1. What is Dip Financing and How Does it Work?

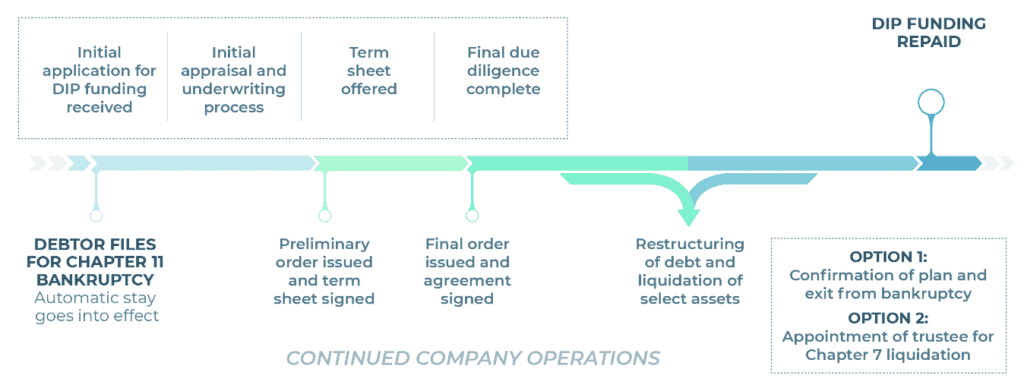

In the world of corporate bankruptcy and financial restructuring, dip financing has become an increasingly common term. But what exactly is dip financing and how does it work? Dip financing, also known as debtor-in-possession financing, is a type of financing that provides a company with the necessary funds to continue operating while going through a bankruptcy process. This type of financing is typically provided by a lender who is willing to take on the risk of lending to a company in bankruptcy proceedings.

2. Understanding the Basics of Dip Financing

The main purpose of dip financing is to provide a company with the necessary funds to continue operating during a bankruptcy process. This type of financing is considered a priority debt, meaning it will be paid back before any other creditors in the bankruptcy process. Dip financing is often secured by the company's assets, which serves as collateral for the lender. This provides the lender with some assurance that they will recoup their investment if the company is unable to repay the loan.

3. The Role of Dip Financing in the Mattress Firm Bankruptcy

In 2018, the popular mattress retailer Mattress Firm filed for Chapter 11 bankruptcy. As part of their restructuring plan, they secured $525 million in dip financing from a group of lenders. This financing allowed the company to continue operating while they closed underperforming stores and restructured their business. Without this financing, it is likely that Mattress Firm would have been forced to liquidate and close all of their stores.

4. How Dip Financing Saved Mattress Firm from Bankruptcy

Thanks to the dip financing provided by their lenders, Mattress Firm was able to emerge from bankruptcy in 2018 with a stronger financial position. The funds allowed them to pay off their existing debt, close underperforming stores, and invest in new marketing and store strategies. This successful use of dip financing ultimately saved the company from bankruptcy and allowed them to continue operating as a profitable business.

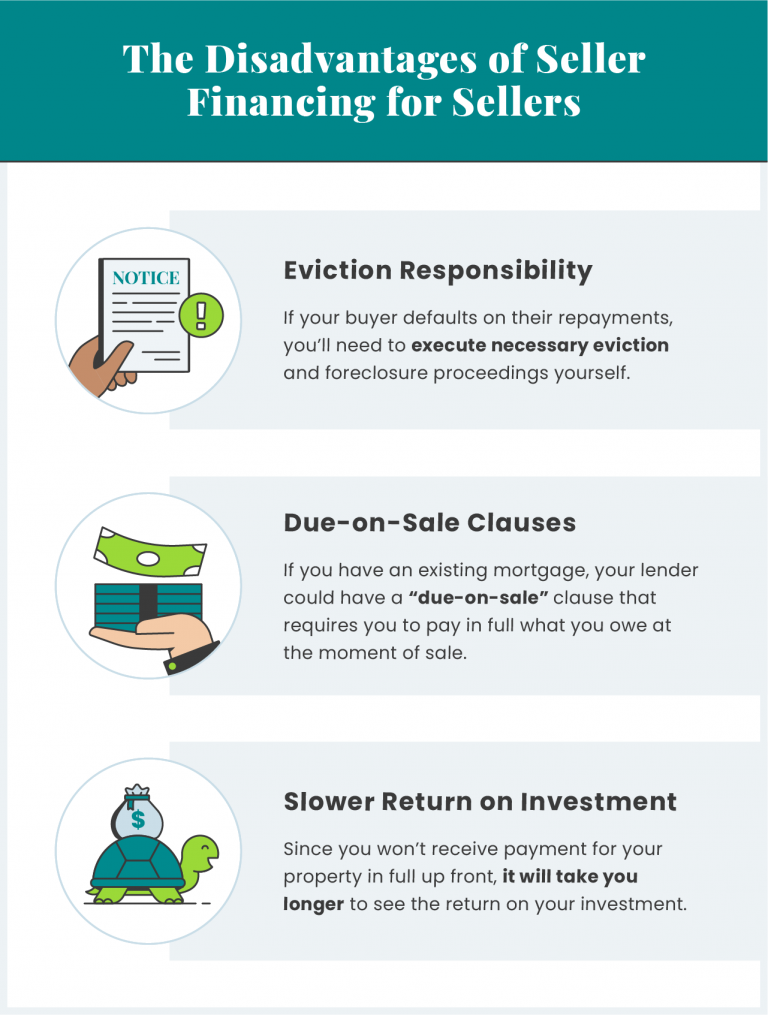

5. The Benefits and Risks of Dip Financing for Companies

Dip financing can provide struggling companies with the necessary funds to continue operating and restructure their business, which can ultimately save them from bankruptcy. However, there are also risks involved for both the company and the lender. For the company, dip financing can come with high interest rates and fees, and failure to repay the loan can result in the loss of assets. For the lender, there is always the risk that the company will not be able to repay the loan, resulting in a loss of their investment.

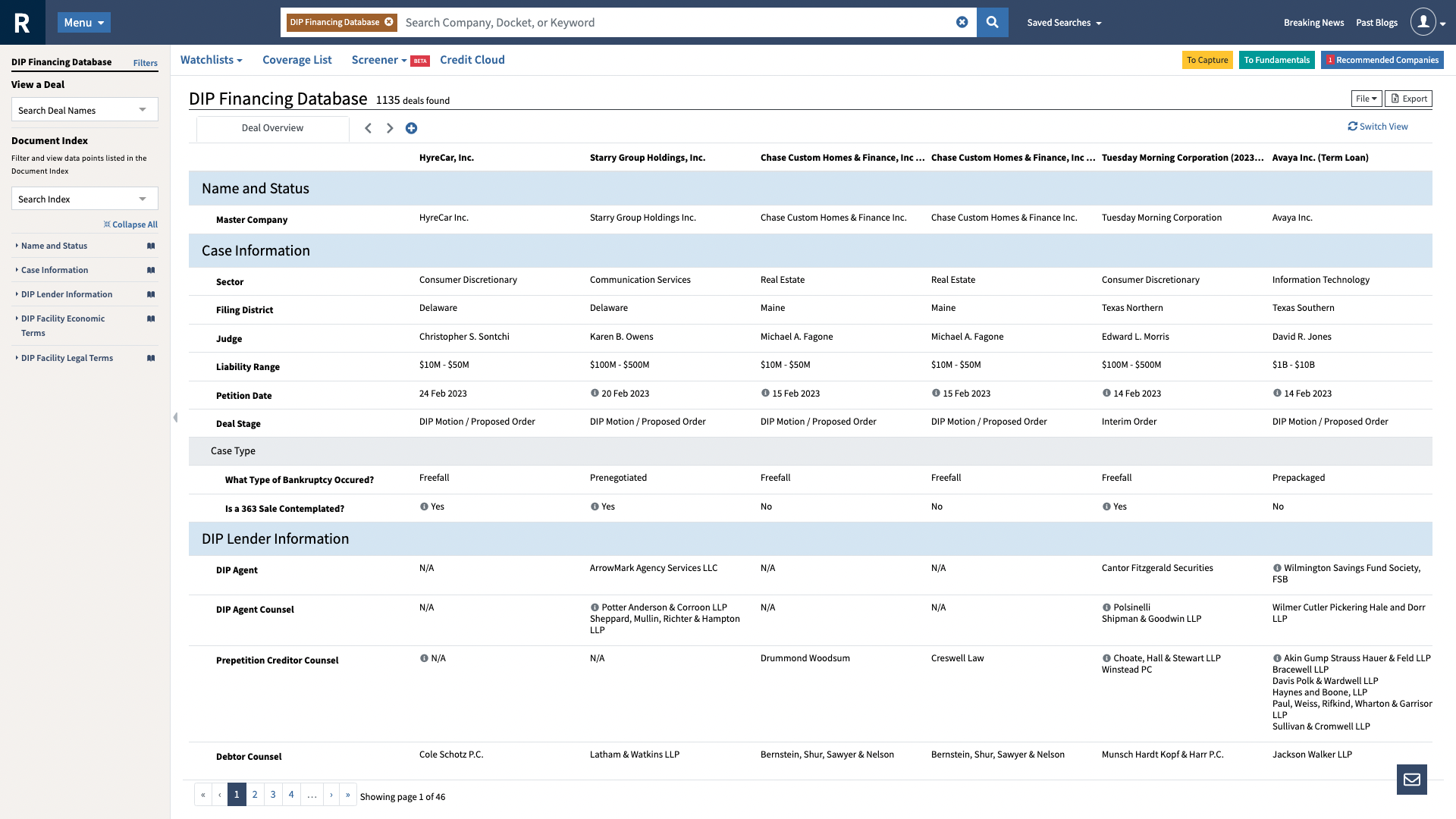

6. Exploring the Different Types of Dip Financing

There are several different types of dip financing, each with its own set of terms and conditions. Some common types of dip financing include asset-based lending, term loans, and revolving credit facilities. These types of financing can vary in terms of interest rates, collateral requirements, and repayment schedules. Companies in need of dip financing should carefully consider their options and choose the type that best suits their needs and financial situation.

7. The Process of Obtaining Dip Financing for a Company

The process of obtaining dip financing can be complex and time-consuming. Companies must present a detailed restructuring plan to potential lenders, along with financial projections and a plan for repaying the loan. Lenders will also conduct thorough due diligence to assess the company's financial health and likelihood of success. It is important for companies to have a strong and convincing plan in order to secure dip financing from lenders.

8. The Impact of Dip Financing on Creditors and Shareholders

For creditors and shareholders of a company in bankruptcy, dip financing can have both positive and negative impacts. On one hand, dip financing can provide the necessary funds for the company to restructure and potentially save the business, thus protecting the interests of creditors and shareholders. However, dip financing can also result in the loss of assets and decreased value for existing shareholders. Creditors may also face delays in receiving repayment, as dip financing is considered a priority debt.

9. Case Study: Mattress Firm's Successful Use of Dip Financing

The case of Mattress Firm's dip financing is a prime example of how this type of financing can be used successfully to save a struggling company. By securing a large amount of dip financing, Mattress Firm was able to restructure their business and emerge from bankruptcy as a stronger and more profitable company. This success story serves as a testament to the power and potential of dip financing for companies in financial distress.

10. The Future of Dip Financing in Corporate Restructuring

As more and more companies face financial difficulties and bankruptcy, dip financing is likely to continue playing a significant role in corporate restructuring. However, it is important for both companies and lenders to carefully consider the risks and benefits involved in dip financing and utilize it responsibly. As the economy and market conditions change, the use of dip financing may also evolve, making it important for companies to stay informed and adapt to new practices and regulations.

Dip Financing: A Lifeline for Mattress Firm during Financial Crisis

What is Dip Financing?

Dip financing, or debtor-in-possession financing, is a type of financing that allows a company to access funds while undergoing a bankruptcy process. It is a crucial lifeline for struggling businesses, providing them with the necessary cash flow to continue operations and restructure their finances.

Dip financing, or debtor-in-possession financing, is a type of financing that allows a company to access funds while undergoing a bankruptcy process. It is a crucial lifeline for struggling businesses, providing them with the necessary cash flow to continue operations and restructure their finances.

The Plight of Mattress Firm

Mattress Firm, one of the largest mattress retailers in the United States, found itself in dire financial straits in 2018. The company was burdened with a massive debt load and faced intense competition from online mattress retailers. As a result, Mattress Firm filed for Chapter 11 bankruptcy, with plans to close hundreds of stores and restructure its operations.

Mattress Firm, one of the largest mattress retailers in the United States, found itself in dire financial straits in 2018. The company was burdened with a massive debt load and faced intense competition from online mattress retailers. As a result, Mattress Firm filed for Chapter 11 bankruptcy, with plans to close hundreds of stores and restructure its operations.

The Role of Dip Financing

During the bankruptcy process, Mattress Firm received $250 million in dip financing from its existing lenders. This infusion of capital allowed the company to continue operating and pay its suppliers, employees, and other creditors. Without dip financing, Mattress Firm may have been forced to liquidate its assets and close its doors, leaving thousands of employees without jobs and customers without access to their products.

During the bankruptcy process, Mattress Firm received $250 million in dip financing from its existing lenders. This infusion of capital allowed the company to continue operating and pay its suppliers, employees, and other creditors. Without dip financing, Mattress Firm may have been forced to liquidate its assets and close its doors, leaving thousands of employees without jobs and customers without access to their products.

The Benefits of Dip Financing for Mattress Firm

Dip financing not only provided Mattress Firm with the necessary funds to continue operations, but it also gave the company the time and resources to restructure its finances and improve its business model. This allowed Mattress Firm to emerge from bankruptcy in 2018 with a significantly reduced debt load and a more sustainable business plan.

Dip financing not only provided Mattress Firm with the necessary funds to continue operations, but it also gave the company the time and resources to restructure its finances and improve its business model. This allowed Mattress Firm to emerge from bankruptcy in 2018 with a significantly reduced debt load and a more sustainable business plan.

The Importance of Dip Financing for Struggling Businesses

Mattress Firm's successful dip financing experience highlights the importance of this type of financing for struggling businesses. Without access to funds during a bankruptcy process, many companies may not be able to survive and reorganize. Dip financing serves as a crucial lifeline, providing businesses with the opportunity to turn their financial situation around and emerge stronger in the long run.

Mattress Firm's successful dip financing experience highlights the importance of this type of financing for struggling businesses. Without access to funds during a bankruptcy process, many companies may not be able to survive and reorganize. Dip financing serves as a crucial lifeline, providing businesses with the opportunity to turn their financial situation around and emerge stronger in the long run.

Conclusion

In conclusion, dip financing played a crucial role in helping Mattress Firm weather the storm of bankruptcy and emerge as a stronger and more sustainable business. It serves as a lifeline for struggling companies, providing them with the necessary funds and time to restructure and improve their operations. Dip financing is an essential tool in the world of finance, ensuring that even during times of financial crisis, businesses have a chance to bounce back and thrive.

In conclusion, dip financing played a crucial role in helping Mattress Firm weather the storm of bankruptcy and emerge as a stronger and more sustainable business. It serves as a lifeline for struggling companies, providing them with the necessary funds and time to restructure and improve their operations. Dip financing is an essential tool in the world of finance, ensuring that even during times of financial crisis, businesses have a chance to bounce back and thrive.