Depreciation of Bathroom Vanity in Rental Property

When it comes to owning a rental property, there are many expenses and deductions that landlords can take advantage of on their tax returns. One of these deductions is the depreciation of assets, such as a bathroom vanity. Depreciation is a tax deduction that allows landlords to recover the cost of an asset over time. In this article, we will discuss the top 10 things you need to know about the depreciation of bathroom vanity in rental property.

Depreciation of Bathroom Vanity in Rental Property Tax

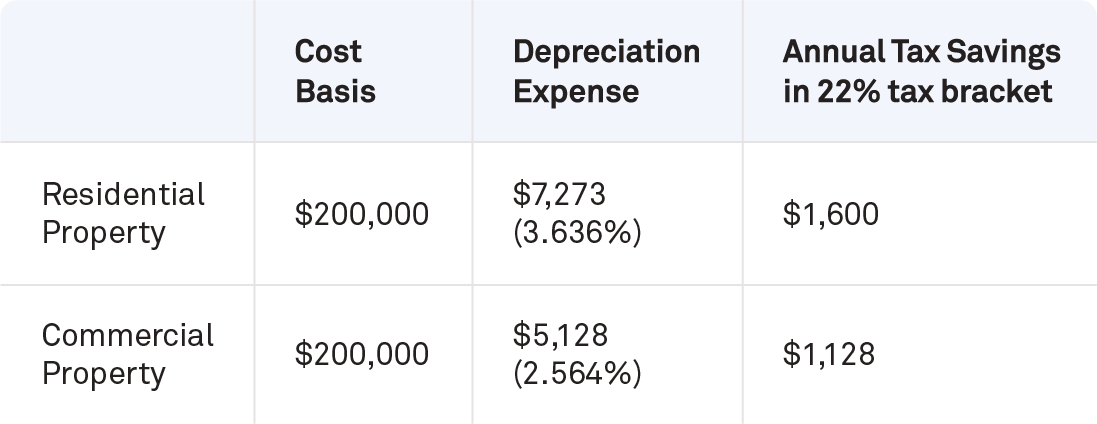

As a landlord, it is important to understand how the depreciation of a bathroom vanity can affect your taxes. The cost of a bathroom vanity can be deducted from your rental income, reducing your taxable income and ultimately lowering your tax liability. This can result in significant tax savings for landlords. However, it is important to note that the amount of depreciation you can claim may vary depending on your tax bracket and other factors. It is always best to consult with a tax professional for personalized advice.

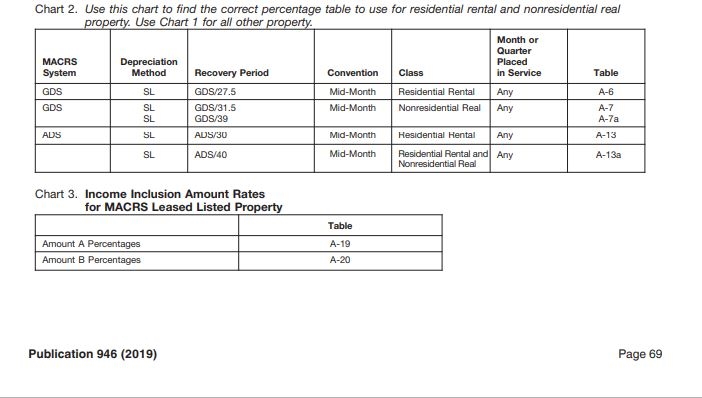

Depreciation of Bathroom Vanity in Rental Property IRS

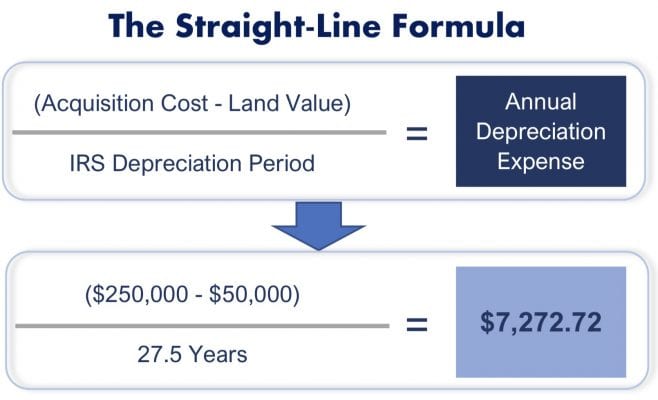

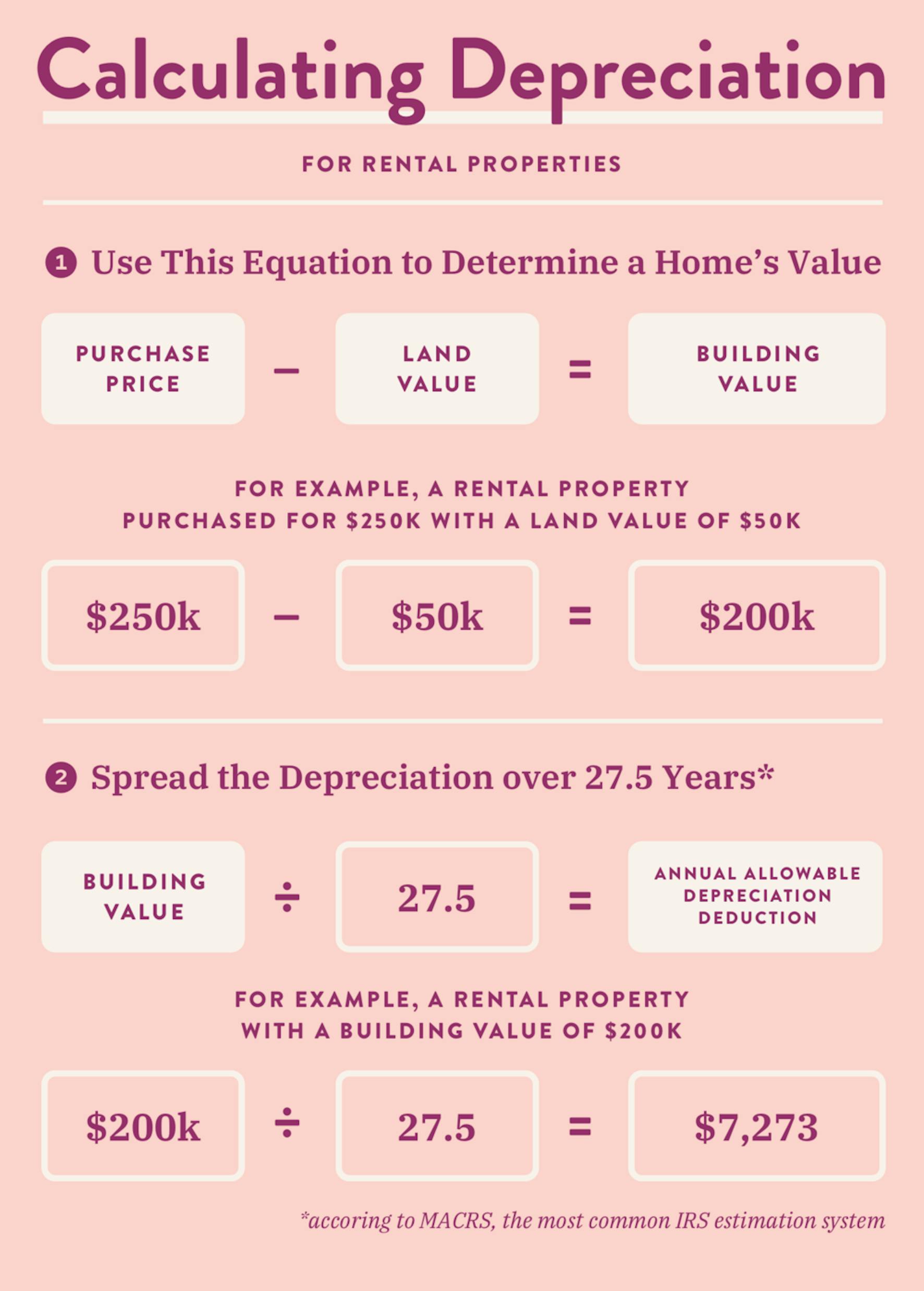

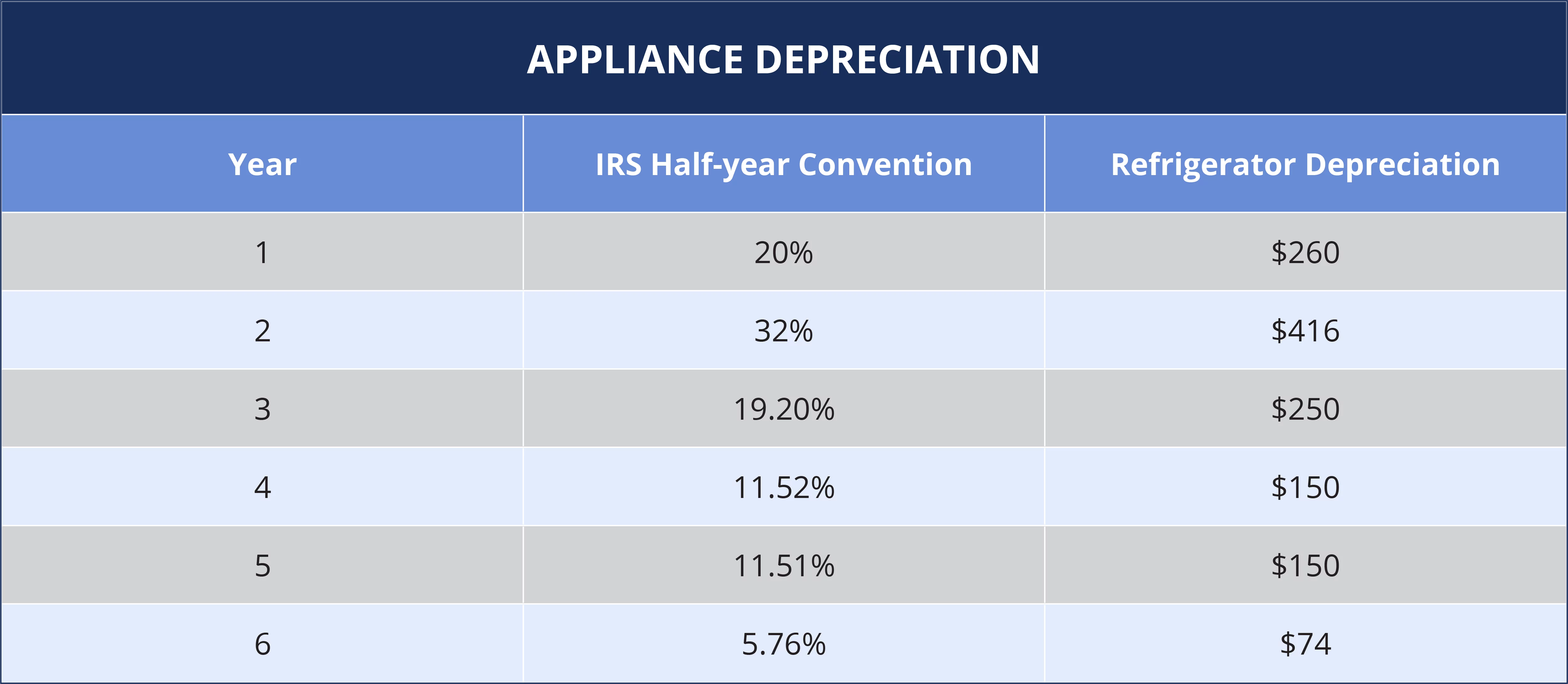

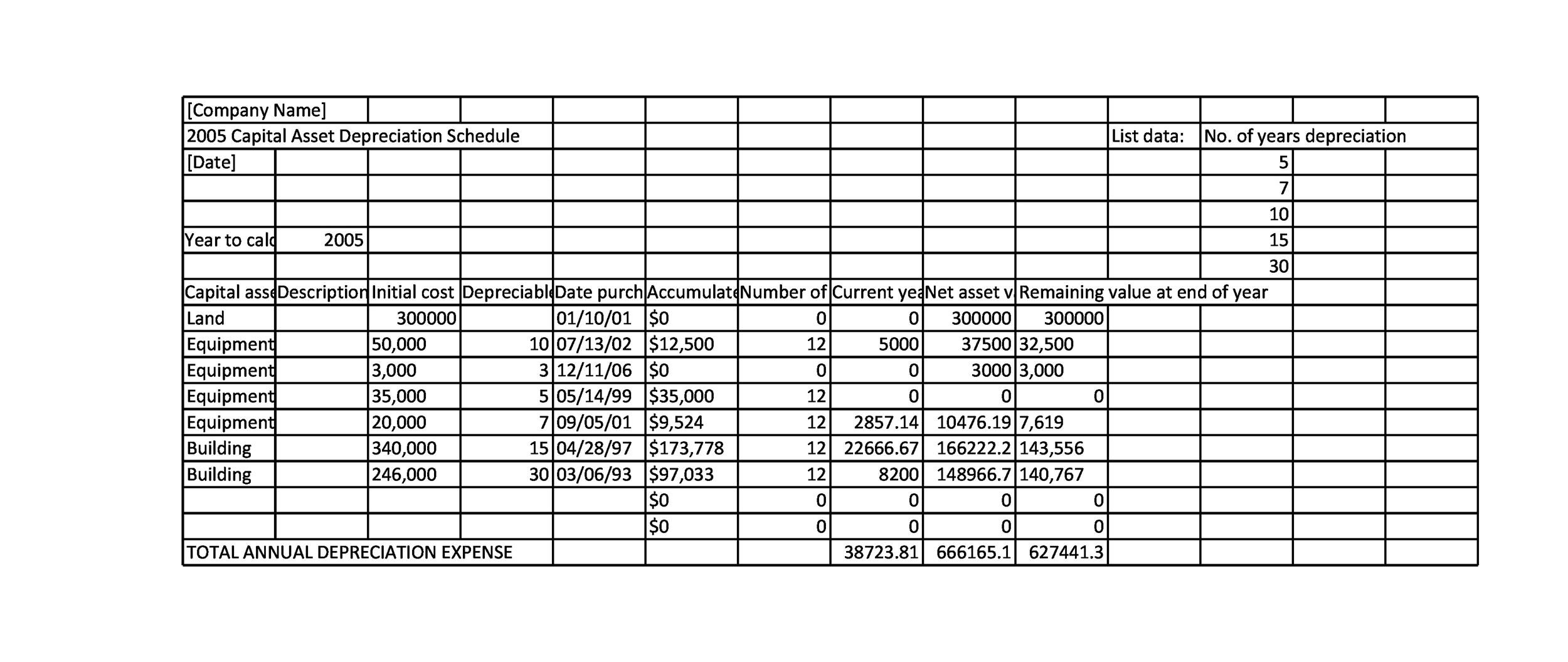

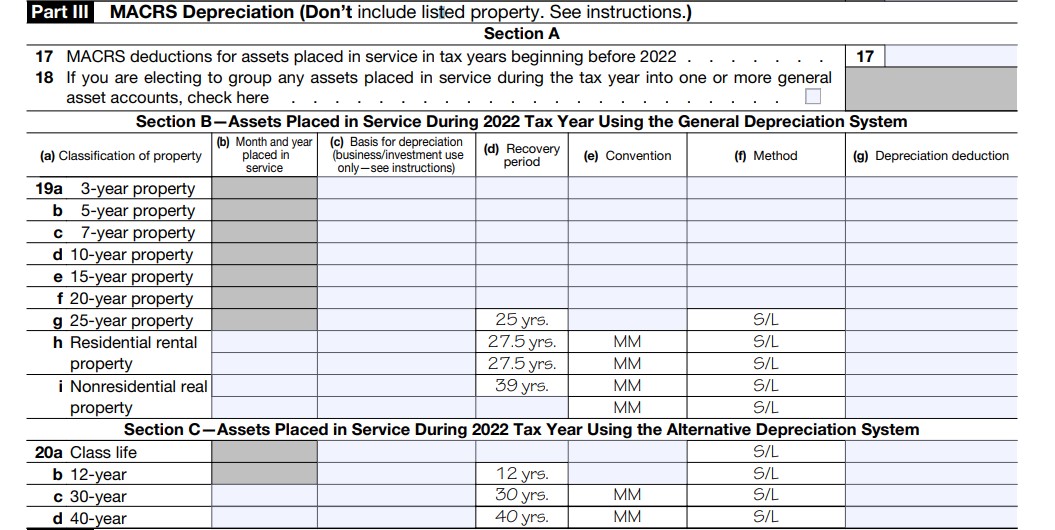

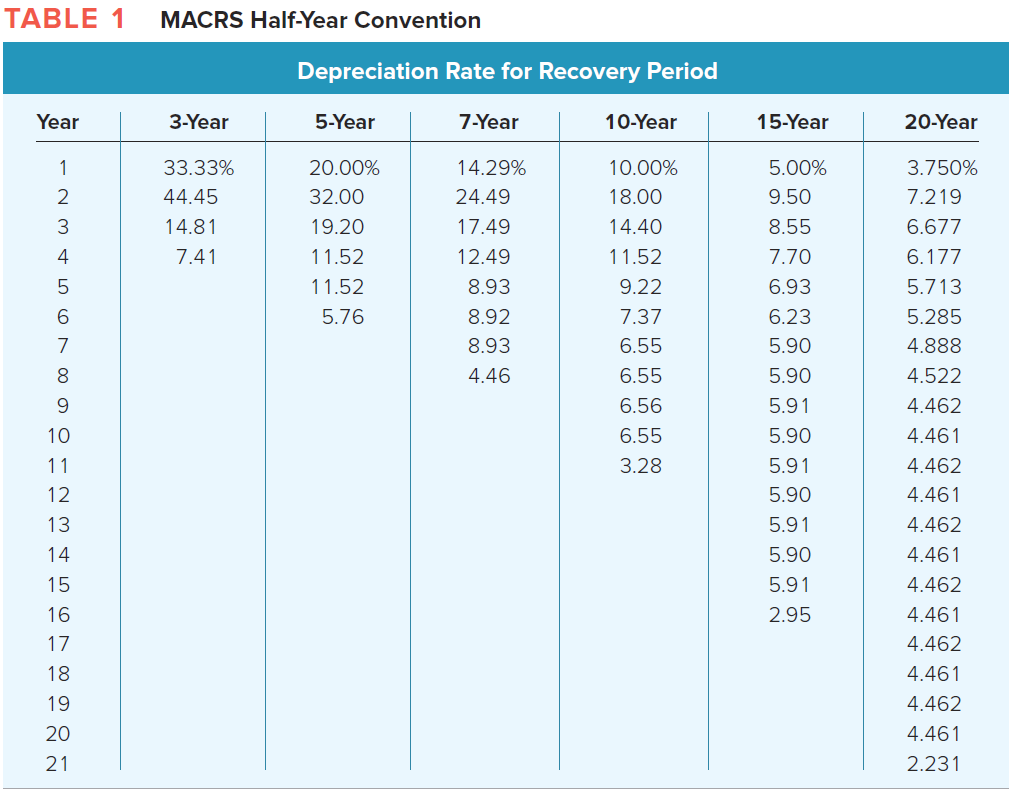

The Internal Revenue Service (IRS) has specific rules and regulations when it comes to claiming depreciation on assets in rental properties. According to the IRS, landlords can claim depreciation on any asset that has a useful life of more than one year and is expected to last for more than one year. This includes a bathroom vanity, which is typically considered a long-term asset. Landlords must use the IRS-approved method of depreciation, such as the Modified Accelerated Cost Recovery System (MACRS), to calculate the depreciation deduction.

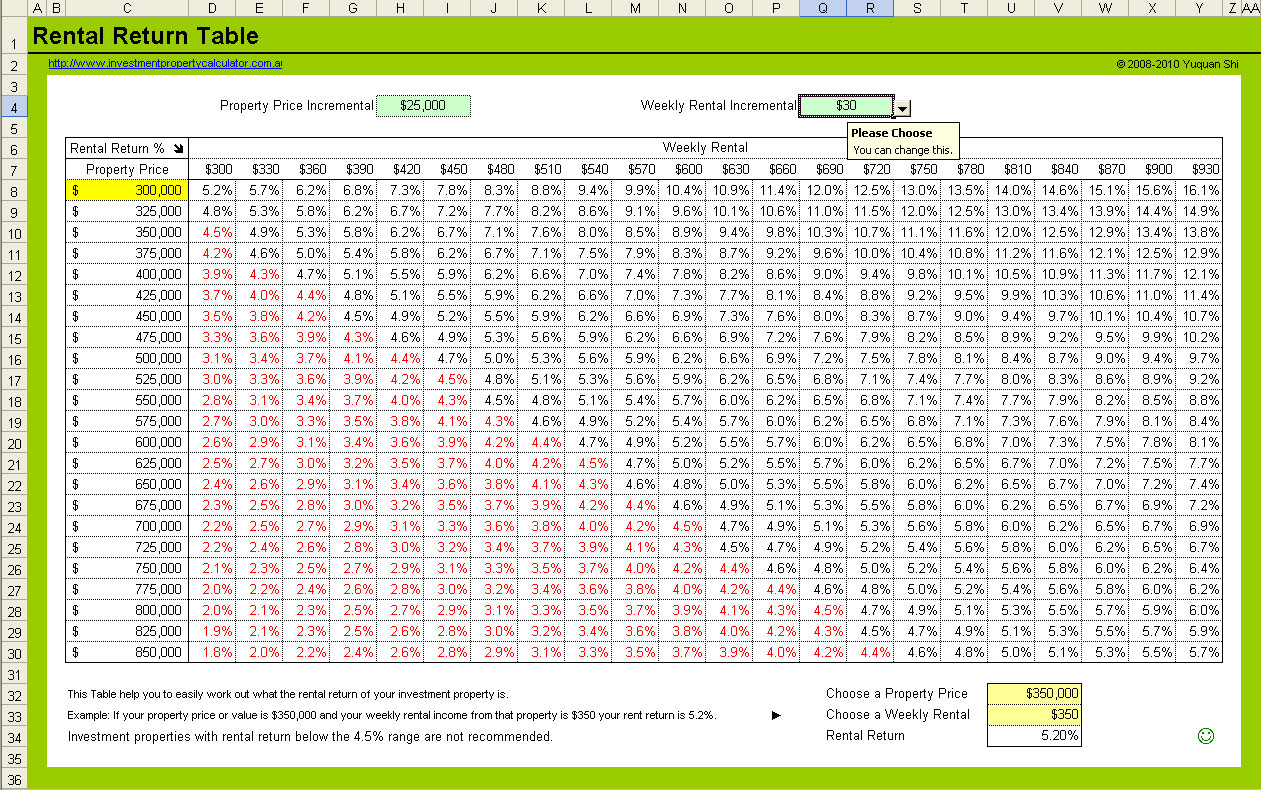

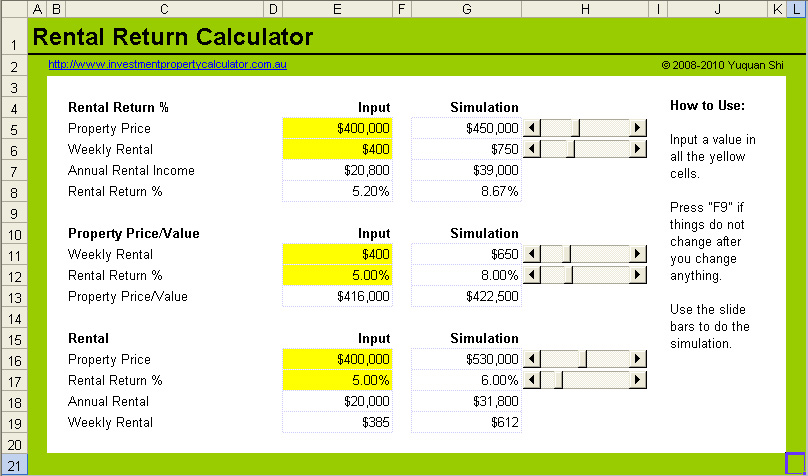

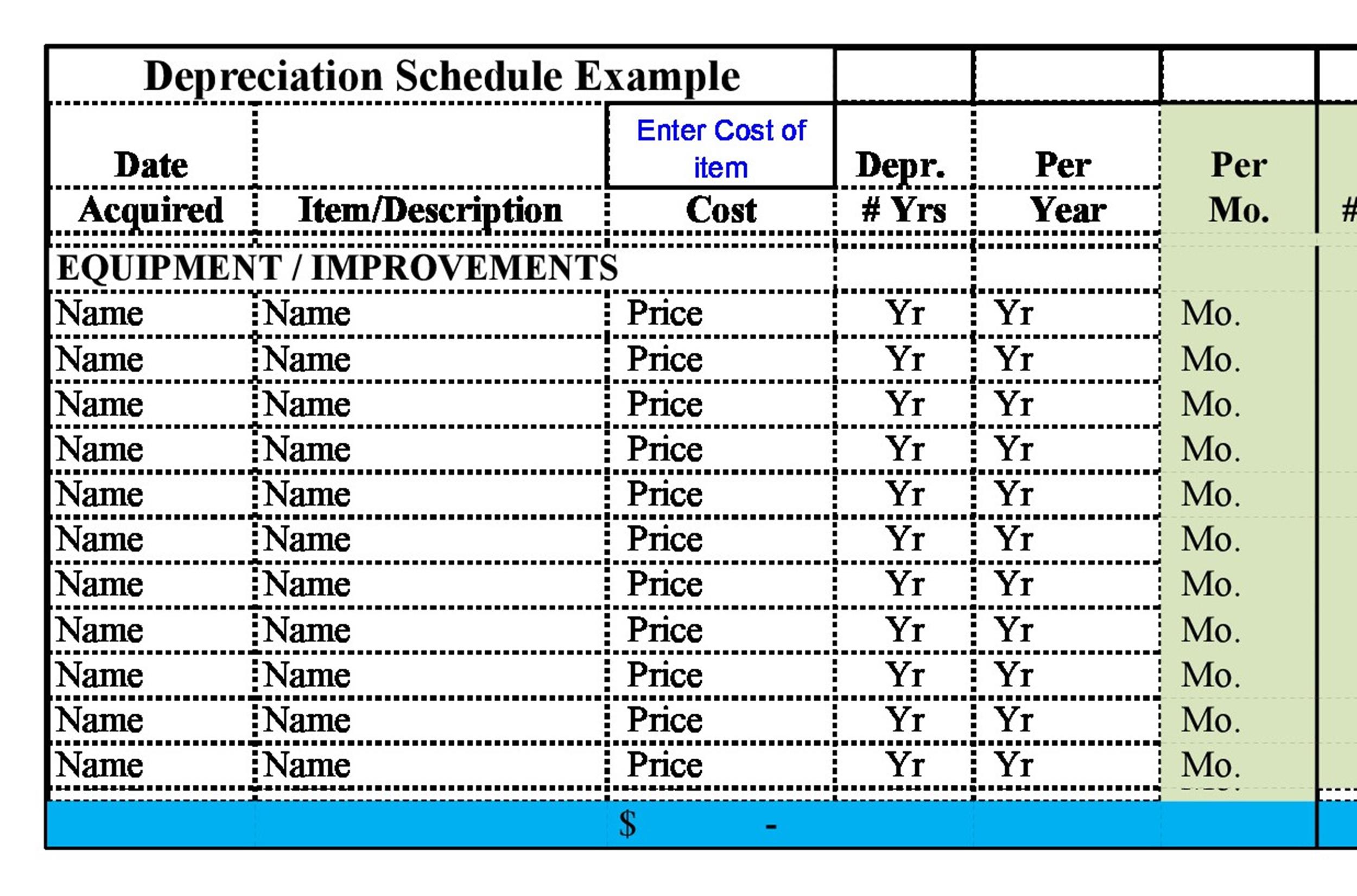

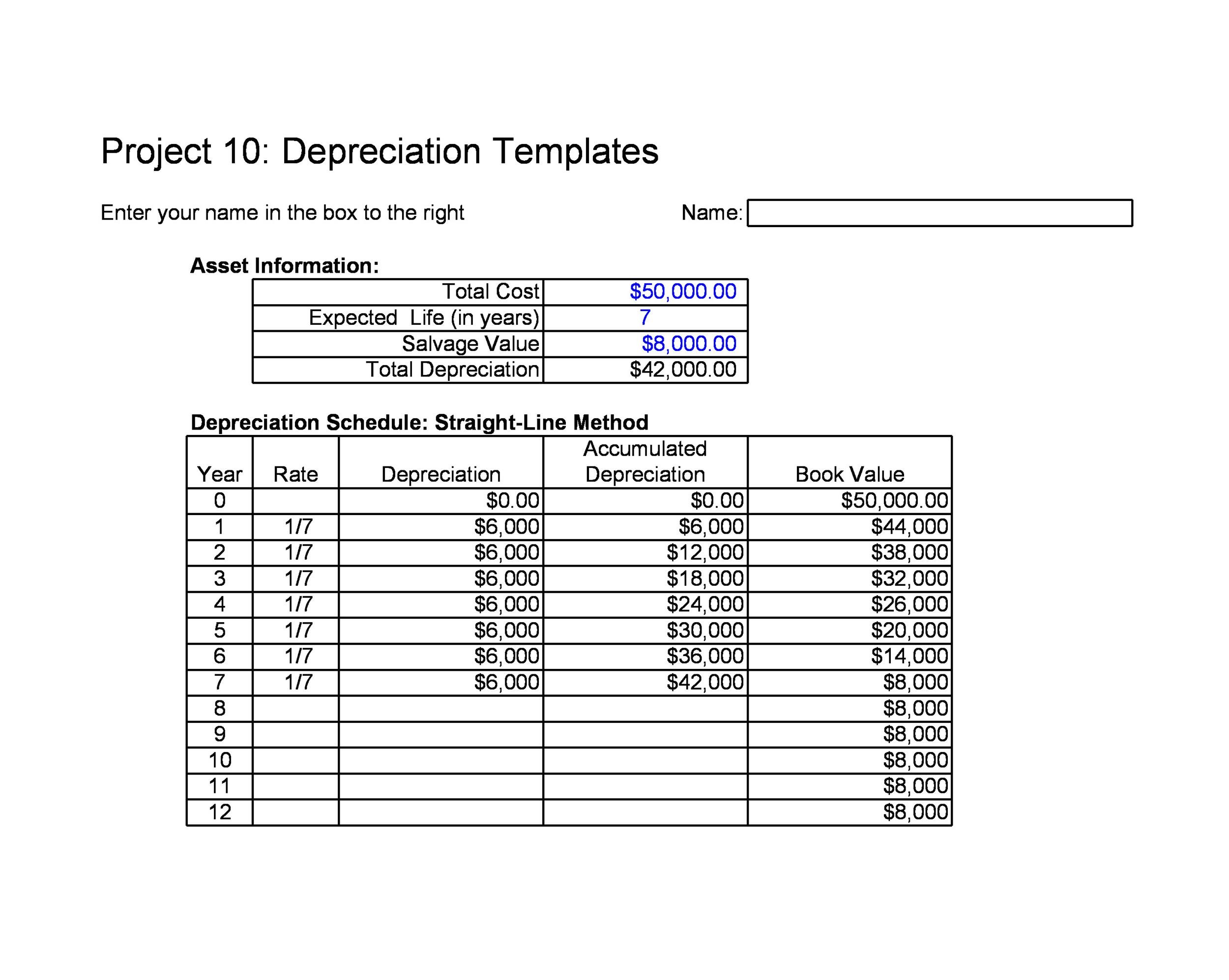

Depreciation of Bathroom Vanity in Rental Property Calculator

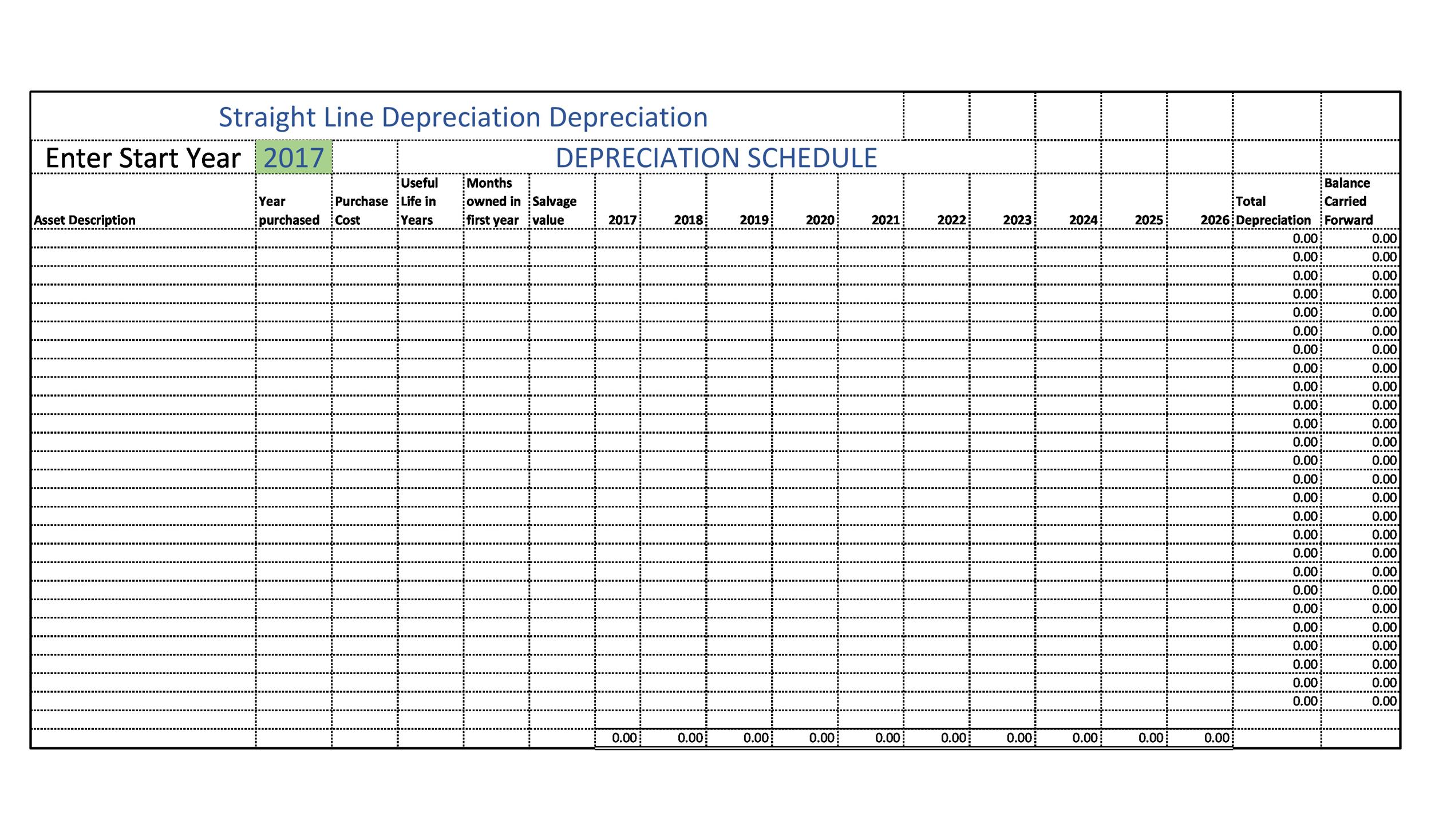

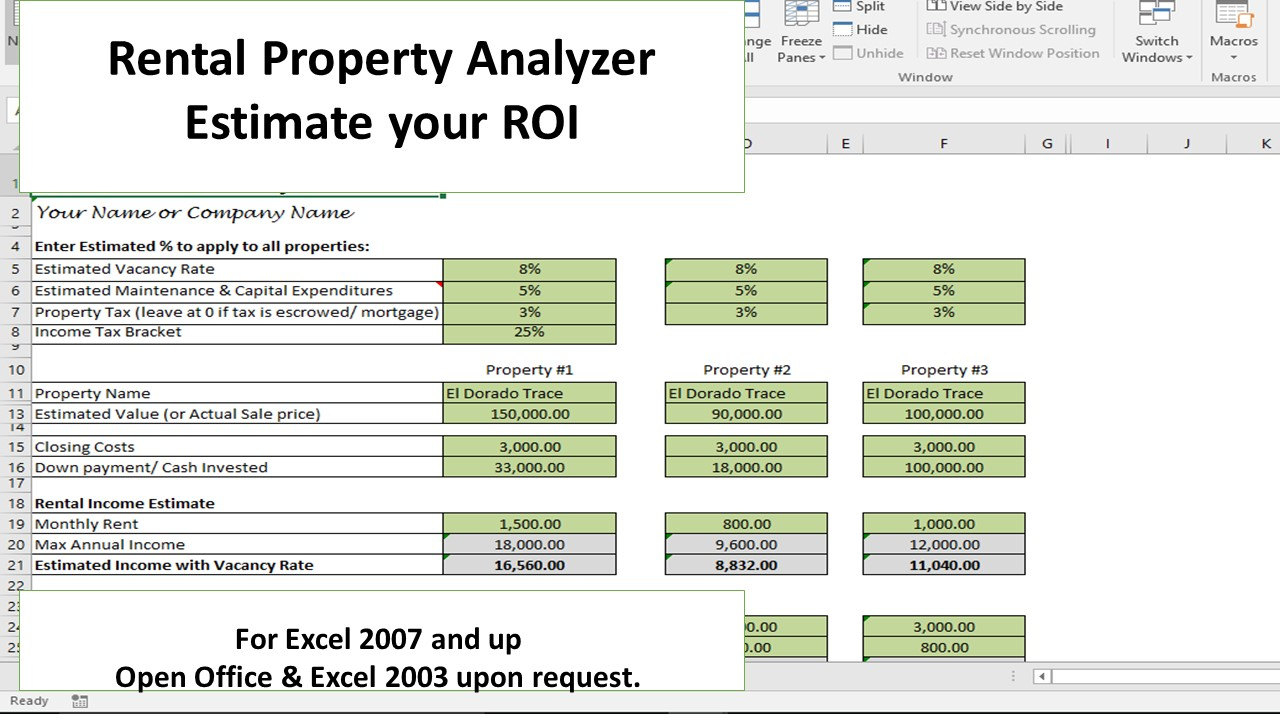

Calculating depreciation can be a complex process, especially for those who are not familiar with tax laws and regulations. Fortunately, there are many online resources and calculators available to help landlords determine the depreciation of their bathroom vanity. These calculators take into account factors such as the cost of the vanity, its useful life, and the depreciation method being used. By using a depreciation calculator, landlords can ensure that they are accurately claiming the depreciation deduction on their tax returns.

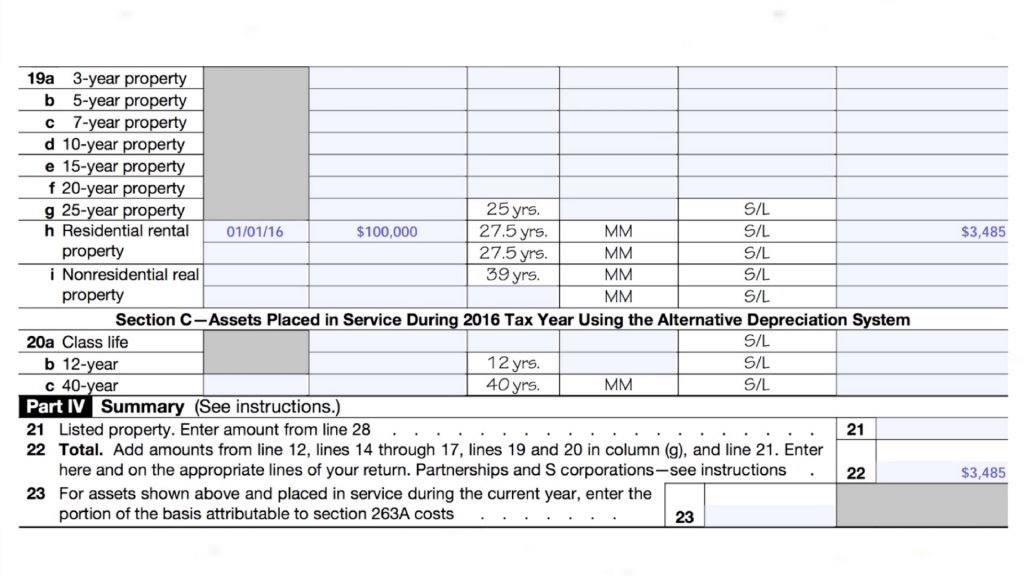

Depreciation of Bathroom Vanity in Rental Property Schedule E

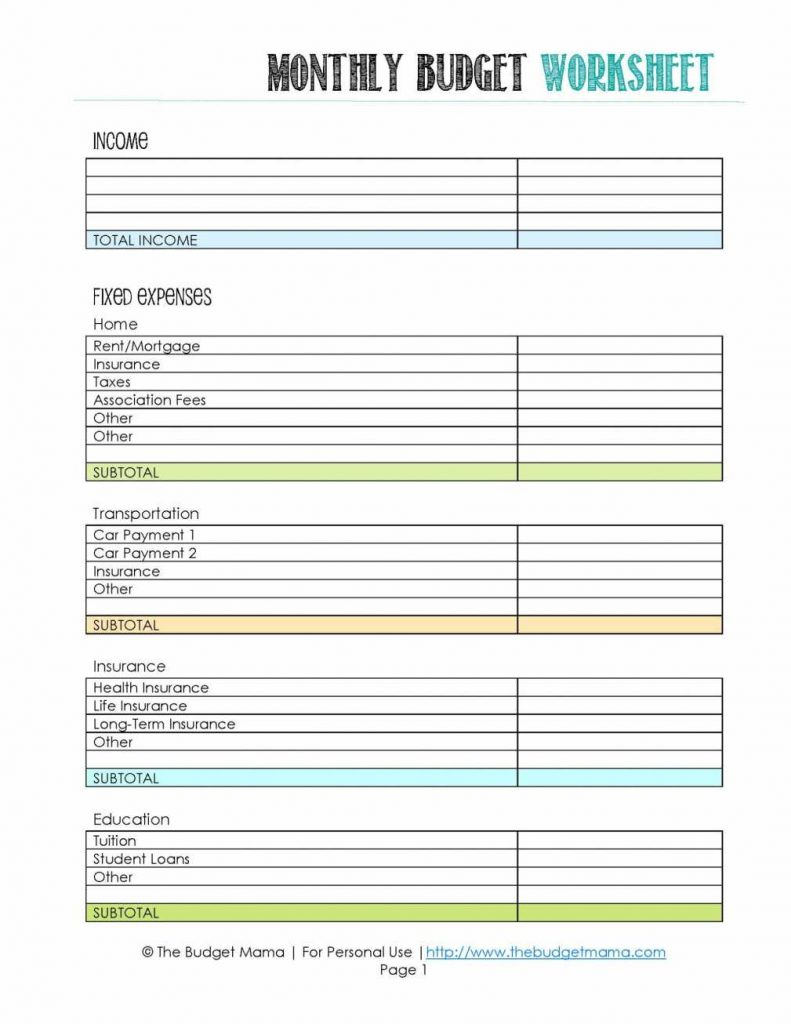

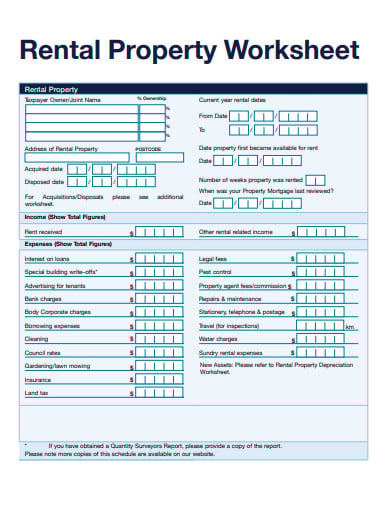

The depreciation of a bathroom vanity is typically reported on Schedule E of the landlord's tax return. This is the form used to report rental income and expenses, including depreciation of assets. On Schedule E, landlords can claim the depreciation deduction for their bathroom vanity, as well as any other assets in their rental property. It is important to keep detailed records of the cost of the vanity, its useful life, and the depreciation being claimed in case of an audit by the IRS.

Depreciation of Bathroom Vanity in Rental Property Capitalization

Landlords have the option to either depreciate their bathroom vanity over several years or to deduct the entire cost of the vanity in the year it was purchased. This is known as capitalization or the Section 179 deduction. The Section 179 deduction allows landlords to deduct the full cost of certain assets, including a bathroom vanity, in the year they were purchased. However, there are limitations and restrictions on this deduction, so it is important to consult with a tax professional before making this decision.

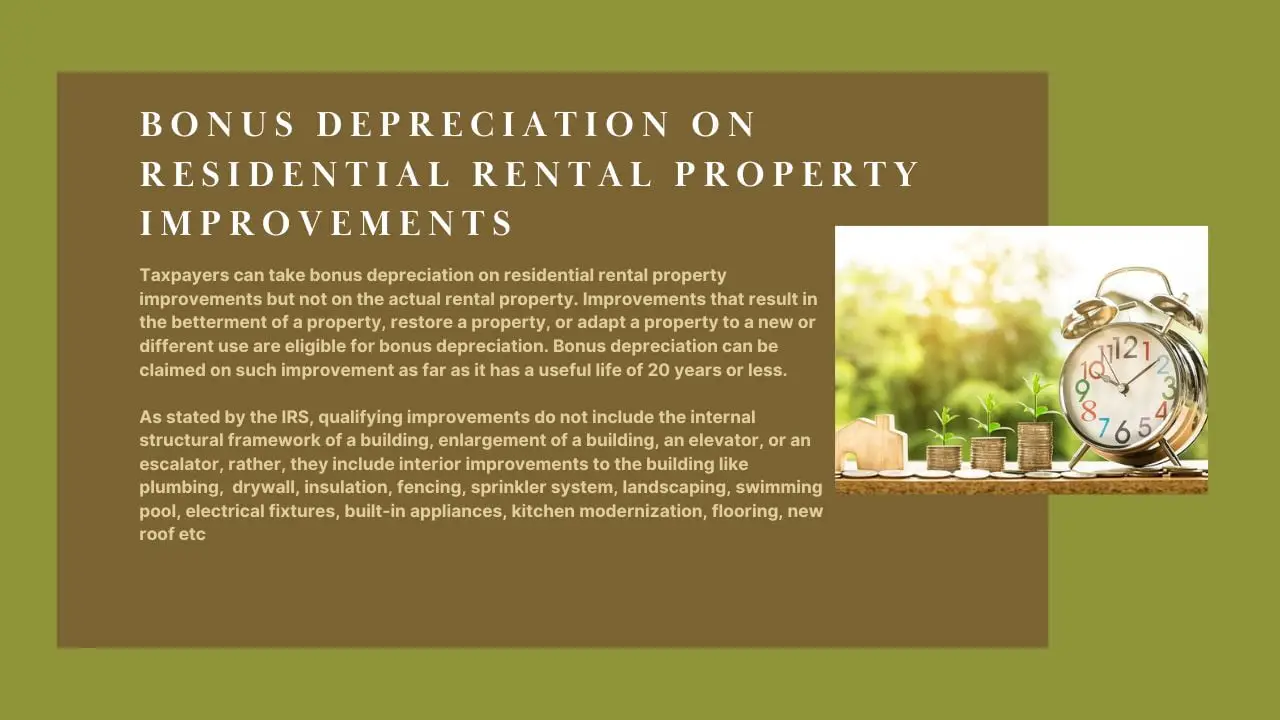

Depreciation of Bathroom Vanity in Rental Property Improvements

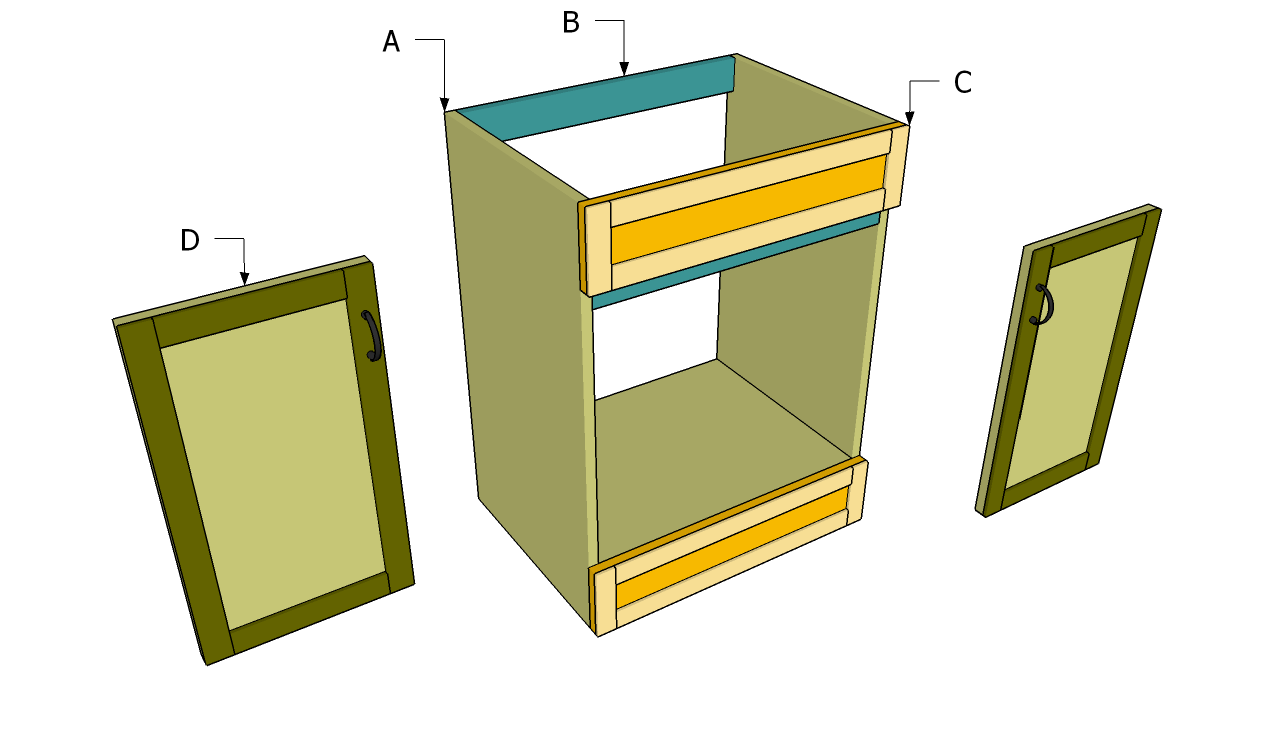

It is important to note that landlords can only claim depreciation on improvements made to their rental property, not on repairs or maintenance. This means that if a bathroom vanity is replaced or upgraded, the cost of the new vanity can be depreciated, but the cost of repairing a leaky faucet or replacing a broken mirror cannot be depreciated. As a landlord, it is important to keep track of which expenses are considered improvements and which are considered repairs.

Depreciation of Bathroom Vanity in Rental Property Deduction

As mentioned earlier, the depreciation of a bathroom vanity is a tax deduction for landlords. This means that it directly reduces the amount of taxable income and can result in significant tax savings. However, it is important to note that the depreciation deduction will eventually need to be recaptured when the property is sold. This means that the amount of depreciation claimed will be added back to the landlord's taxable income in the year the property is sold.

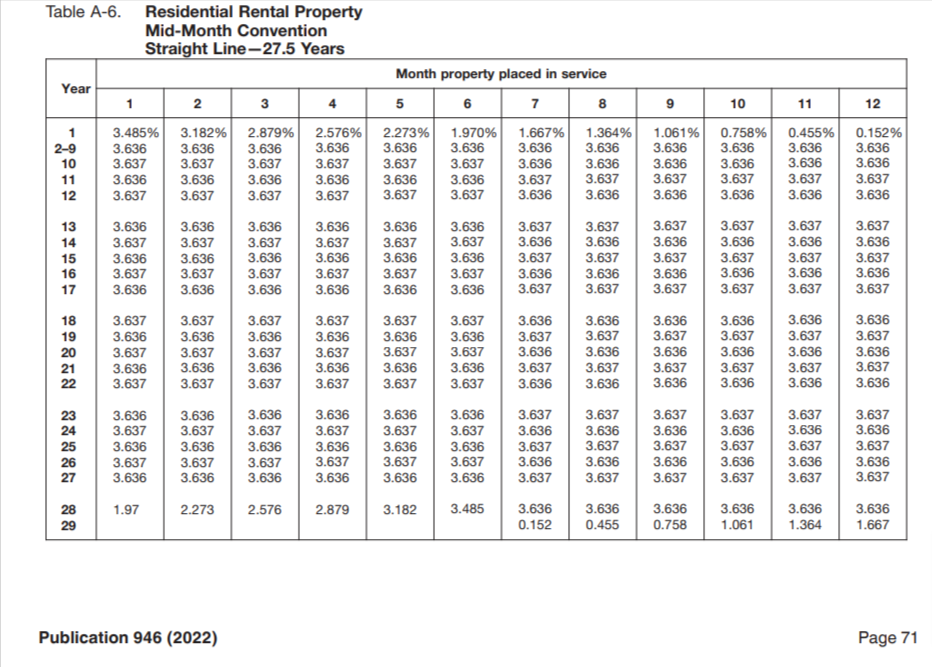

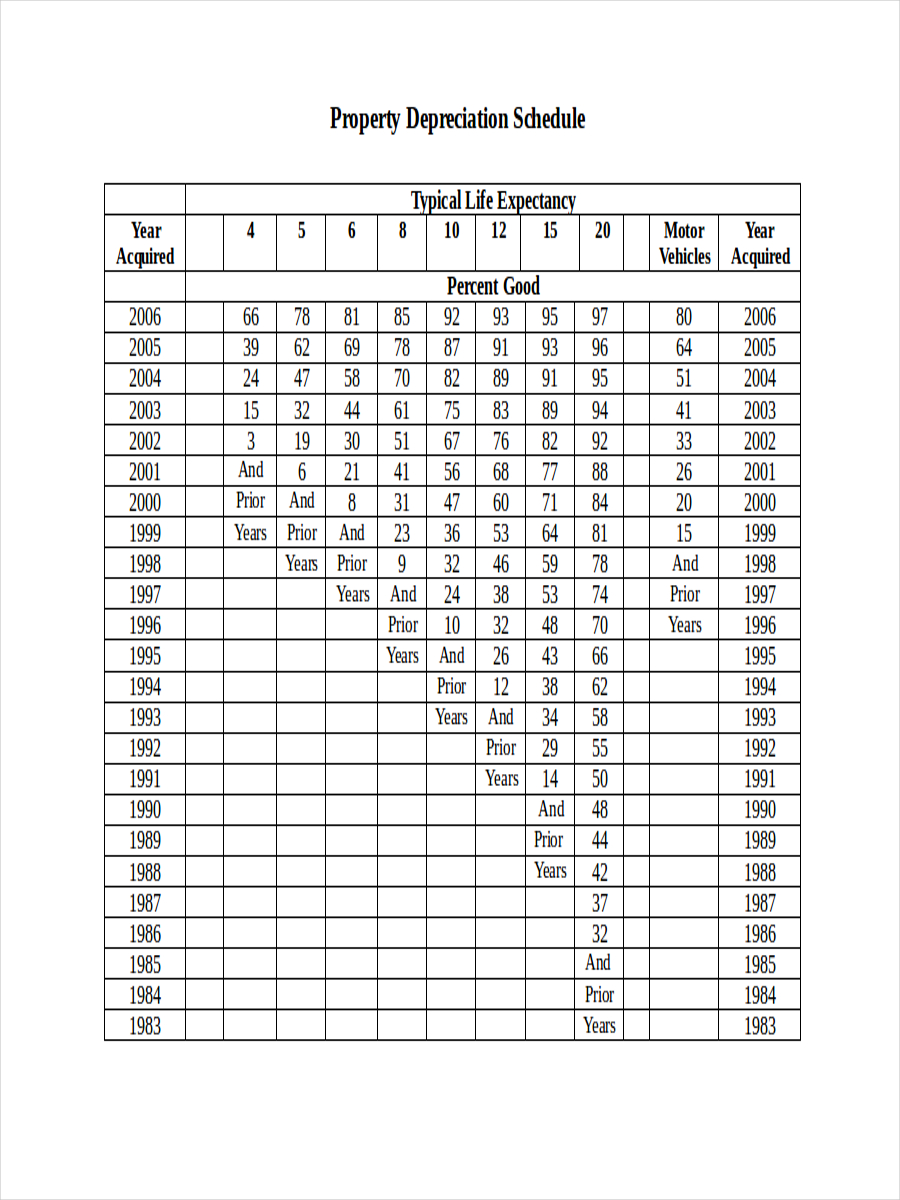

Depreciation of Bathroom Vanity in Rental Property MACRS

The Modified Accelerated Cost Recovery System (MACRS) is the most commonly used method of depreciation for rental properties. Under MACRS, landlords can depreciate their bathroom vanity over a period of 27.5 years, which is the useful life of residential rental property according to the IRS. This means that landlords can claim 1/27.5th of the cost of the bathroom vanity each year on their tax returns. However, it is important to note that the depreciation deduction may vary depending on the method and recovery period used.

Depreciation of Bathroom Vanity in Rental Property Useful Life

The useful life of a bathroom vanity in a rental property is an important factor when it comes to claiming depreciation. The IRS considers a bathroom vanity to have a useful life of more than one year, which means that it can be depreciated over several years. However, the useful life may vary depending on the quality and condition of the vanity, as well as the frequency of use. It is important for landlords to keep track of the useful life of their bathroom vanity to ensure they are accurately claiming depreciation on their taxes.

The Importance of Depreciation for Bathroom Vanities in Rental Properties

Maximizing Property Value

When it comes to renting out a property, the main goal for any landlord is to maximize the value of their investment. One way to do this is by properly managing and maintaining the property, including the bathroom vanity.

Depreciation

plays a crucial role in this process.

As defined by the

Internal Revenue Service (IRS)

, depreciation is the process of deducting the cost of an asset over time as it loses value due to wear and tear, deterioration, or obsolescence. This means that as a landlord, you can use depreciation to deduct a portion of the cost of the bathroom vanity each year from your taxable income. This not only reduces your tax liability but also allows you to recoup some of the initial cost of the vanity.

When it comes to renting out a property, the main goal for any landlord is to maximize the value of their investment. One way to do this is by properly managing and maintaining the property, including the bathroom vanity.

Depreciation

plays a crucial role in this process.

As defined by the

Internal Revenue Service (IRS)

, depreciation is the process of deducting the cost of an asset over time as it loses value due to wear and tear, deterioration, or obsolescence. This means that as a landlord, you can use depreciation to deduct a portion of the cost of the bathroom vanity each year from your taxable income. This not only reduces your tax liability but also allows you to recoup some of the initial cost of the vanity.

Keeping Up with Trends

Another reason why

depreciation

is important for bathroom vanities in rental properties is to keep up with current design trends. As with any other aspect of a rental property, the bathroom vanity needs to be maintained and updated to attract potential tenants. With the help of depreciation, landlords can budget for regular updates and replacements of bathroom vanities to keep their property looking modern and appealing to renters.

Another reason why

depreciation

is important for bathroom vanities in rental properties is to keep up with current design trends. As with any other aspect of a rental property, the bathroom vanity needs to be maintained and updated to attract potential tenants. With the help of depreciation, landlords can budget for regular updates and replacements of bathroom vanities to keep their property looking modern and appealing to renters.

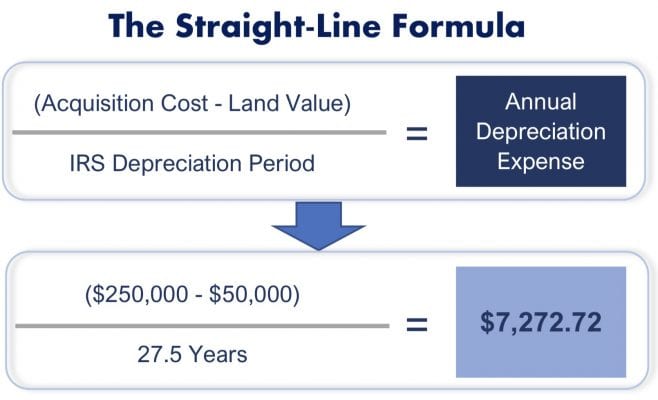

Calculating Depreciation for Bathroom Vanities

Calculating

depreciation

for a bathroom vanity in a rental property can be a bit complex. It involves determining the cost basis of the vanity, its useful life, and the applicable depreciation method. This is where the expertise of a tax professional or accountant comes in handy. They can help landlords accurately calculate and claim depreciation deductions for their bathroom vanities.

Calculating

depreciation

for a bathroom vanity in a rental property can be a bit complex. It involves determining the cost basis of the vanity, its useful life, and the applicable depreciation method. This is where the expertise of a tax professional or accountant comes in handy. They can help landlords accurately calculate and claim depreciation deductions for their bathroom vanities.

Conclusion

/bathroom-vanity-design-ideas-4135228-hero-26243a156f8744f7b86659ddc9299362.jpeg) In conclusion,

depreciation

is a crucial factor to consider for bathroom vanities in rental properties. It not only helps landlords maximize the value of their investment but also allows them to keep up with current design trends and attract potential tenants. With the help of depreciation, landlords can properly manage and maintain their bathroom vanities, ultimately increasing the overall value of their rental property.

In conclusion,

depreciation

is a crucial factor to consider for bathroom vanities in rental properties. It not only helps landlords maximize the value of their investment but also allows them to keep up with current design trends and attract potential tenants. With the help of depreciation, landlords can properly manage and maintain their bathroom vanities, ultimately increasing the overall value of their rental property.