1. Kickstarter: The Pioneer of Crowdfunding Loans

When it comes to crowdfunding loans, Kickstarter is often the first platform that comes to mind. Launched in 2009, this popular platform has helped countless entrepreneurs and creatives bring their ideas to life through small contributions from a large number of people. With a focus on creative projects such as films, music, and art, Kickstarter has become a go-to option for those looking for funding outside of traditional loans.

2. Indiegogo: Where Innovation Meets Funding

Indiegogo is another major player in the crowdfunding world, offering both loan and equity options for businesses and startups. What sets Indiegogo apart is its dedication to supporting innovative and groundbreaking ideas. From tech gadgets to eco-friendly products, Indiegogo has helped bring many cutting-edge concepts to the market. Plus, its flexible funding option allows users to keep the funds they raise, even if they don't reach their initial goal.

3. GoFundMe: The Ultimate Personal Crowdfunding Platform

While Kickstarter and Indiegogo focus on creative and business ventures, GoFundMe is all about personal crowdfunding. This platform allows individuals to raise money for a variety of causes, from medical expenses to educational pursuits. With a user-friendly interface and a strong sense of community, GoFundMe has become a popular option for those in need of financial assistance.

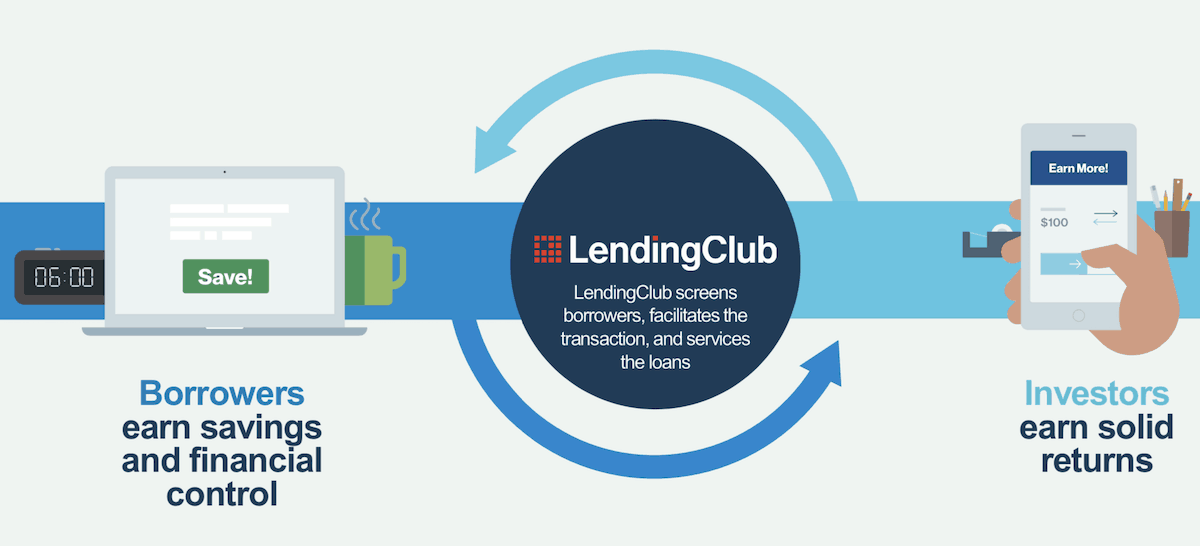

4. LendingClub: Connecting Borrowers and Investors

LendingClub is a peer-to-peer lending platform that allows individuals and businesses to borrow money from investors. This unique approach to crowdfunding loans has made LendingClub a popular choice for both borrowers and investors. Borrowers can receive competitive interest rates and flexible repayment terms, while investors can diversify their portfolio by funding a variety of loans.

5. Prosper: Investing in the Future

Similar to LendingClub, Prosper is a peer-to-peer lending platform that connects investors with borrowers. With a focus on personal loans for things like debt consolidation and home improvement, Prosper has helped many individuals achieve their financial goals. Plus, investors can earn solid returns by funding loans on the platform.

6. Kiva: Empowering Entrepreneurs Worldwide

Kiva is a unique crowdfunding platform that allows users to lend money to entrepreneurs and small businesses in developing countries. By providing microloans, Kiva helps individuals in impoverished communities start or grow their own businesses. With a repayment rate of over 97%, Kiva has proven to be an effective tool for empowering entrepreneurs and reducing poverty.

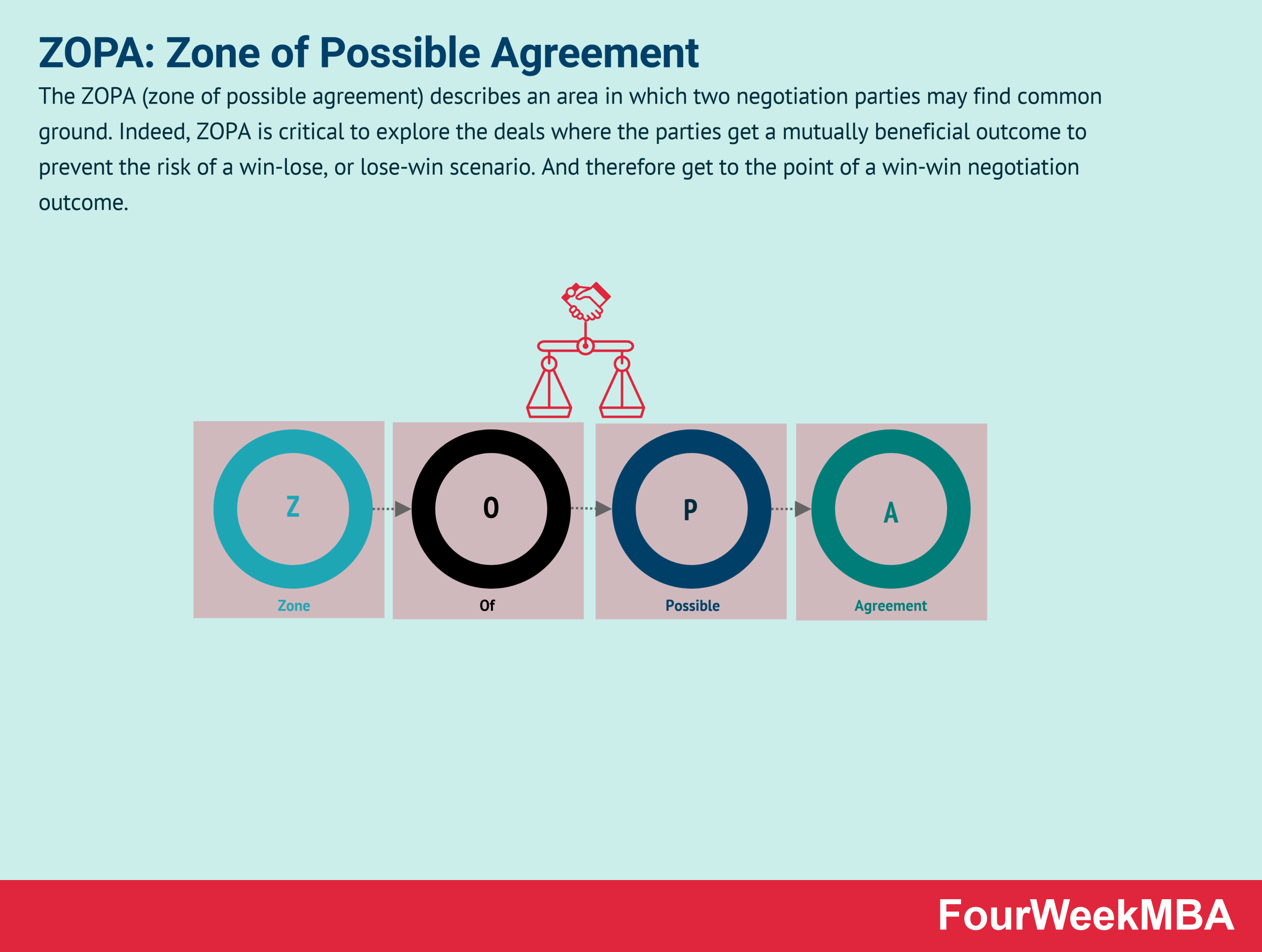

7. Zopa: The UK's Leading Peer-to-Peer Lender

For our friends across the pond, Zopa is the go-to crowdfunding platform for loans. This UK-based company has been connecting borrowers with investors since 2005, offering competitive rates and flexible repayment terms. With over £4 billion in loans funded to date, Zopa has solidified its position as the leading peer-to-peer lender in the UK market.

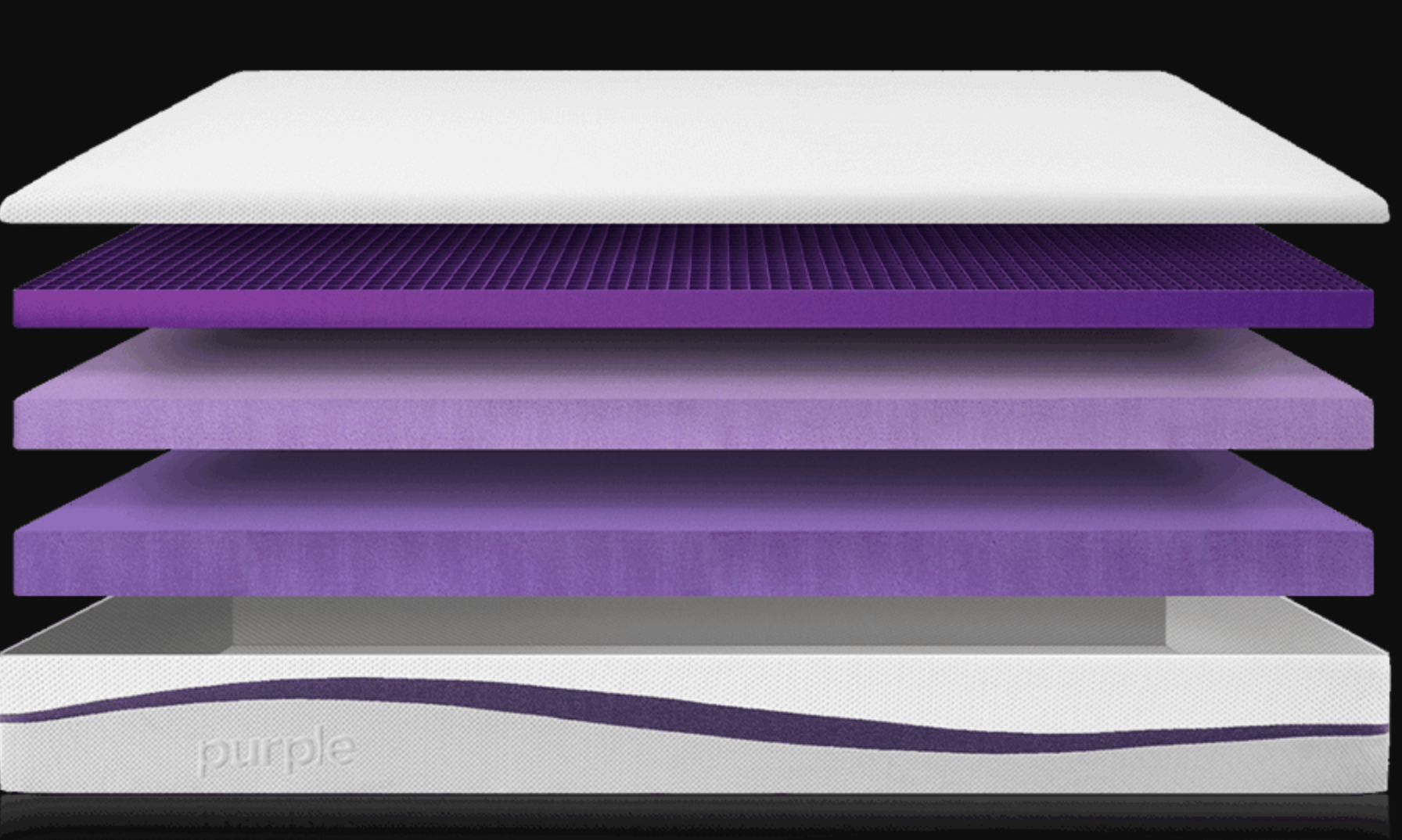

8. Purple Mattress: The Innovative Mattress Company That Used Crowdfunding

Purple Mattress is not a crowdfunding platform, but it's worth mentioning in this list as a success story of using crowdfunding to fund a business. In 2015, Purple Mattress launched a Kickstarter campaign to fund their unique mattress design, which promised to provide the perfect balance of comfort and support. The campaign was a huge success, raising over $2 million and paving the way for the company to become a major player in the mattress industry.

9. Crowdfunder: Connecting Entrepreneurs with Investors

Crowdfunder is a platform that focuses on connecting entrepreneurs and small businesses with investors. With a variety of funding options, including equity and rewards-based crowdfunding, Crowdfunder has helped many startups and businesses secure the funding they need to bring their ideas to life.

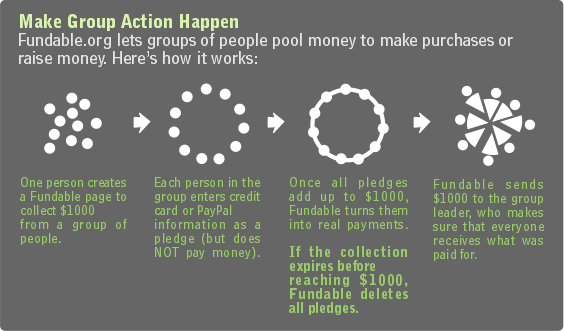

10. Fundable: Simplifying the Investment Process

Fundable is a crowdfunding platform that specializes in equity and rewards-based crowdfunding for startups and small businesses. What sets Fundable apart is its focus on simplifying the investment process for both entrepreneurs and investors. With a user-friendly platform and resources for businesses, Fundable has become a popular option for those looking to raise capital.

The Benefits of Crowdfunding Loans for Purchasing a Purple Mattress

A Revolutionary Way to Finance Your Dream Mattress

Purple mattresses have taken the sleep industry by storm with their innovative design and promise of a better night's sleep. However, with their premium price tag, many people may find it difficult to afford one. This is where crowdfunding loans come in as a game-changing solution.

Crowdfunding loans

are a type of financing where a group of individuals pool their money together to fund a project or purchase. This method has become increasingly popular in recent years, especially for

house design

and home renovation projects. With platforms like Kickstarter and GoFundMe, individuals can easily create campaigns and reach a larger audience to fund their dreams.

But how does this relate to purchasing a

Purple mattress

? Well, crowdfunding loans can provide individuals with the opportunity to acquire the necessary funding to purchase their dream mattress. Instead of having to save up for months or even years, individuals can reach out to a wider community for support and receive the funds they need in a shorter amount of time.

One of the main advantages of crowdfunding loans is that they offer a more flexible and accessible option for financing. Traditional loans from banks or financial institutions often have strict eligibility criteria and can be difficult to obtain, especially for those with lower credit scores. On the other hand, crowdfunding loans are open to a wider range of individuals, making it easier for people to get the funding they need for their

house design

goals.

Moreover, crowdfunding loans also offer a sense of community and support. With traditional loans, individuals often have to deal with large corporations and may feel like just another number. With crowdfunding loans, individuals can connect with a community of like-minded individuals who share their passion for

purple mattresses

and their desire for a better sleep experience. This sense of connection and support can make the financing process feel more personal and less daunting.

In addition, crowdfunding loans also have the potential to provide individuals with access to better interest rates and repayment terms compared to traditional loans. With traditional loans, individuals may have to pay high interest rates and adhere to strict repayment schedules. However, with crowdfunding loans, individuals can negotiate terms with their lenders and potentially secure better rates and more flexible payment plans.

In conclusion, crowdfunding loans provide a revolutionary way to finance the purchase of a

Purple mattress

. Not only does it offer a more accessible and flexible option for financing, but it also fosters a sense of community and support. So why wait to save up for your dream mattress when you can reach out to a wider community and make your dream a reality? Start your crowdfunding campaign today and experience the comfort and luxury of a Purple mattress for yourself.

Purple mattresses have taken the sleep industry by storm with their innovative design and promise of a better night's sleep. However, with their premium price tag, many people may find it difficult to afford one. This is where crowdfunding loans come in as a game-changing solution.

Crowdfunding loans

are a type of financing where a group of individuals pool their money together to fund a project or purchase. This method has become increasingly popular in recent years, especially for

house design

and home renovation projects. With platforms like Kickstarter and GoFundMe, individuals can easily create campaigns and reach a larger audience to fund their dreams.

But how does this relate to purchasing a

Purple mattress

? Well, crowdfunding loans can provide individuals with the opportunity to acquire the necessary funding to purchase their dream mattress. Instead of having to save up for months or even years, individuals can reach out to a wider community for support and receive the funds they need in a shorter amount of time.

One of the main advantages of crowdfunding loans is that they offer a more flexible and accessible option for financing. Traditional loans from banks or financial institutions often have strict eligibility criteria and can be difficult to obtain, especially for those with lower credit scores. On the other hand, crowdfunding loans are open to a wider range of individuals, making it easier for people to get the funding they need for their

house design

goals.

Moreover, crowdfunding loans also offer a sense of community and support. With traditional loans, individuals often have to deal with large corporations and may feel like just another number. With crowdfunding loans, individuals can connect with a community of like-minded individuals who share their passion for

purple mattresses

and their desire for a better sleep experience. This sense of connection and support can make the financing process feel more personal and less daunting.

In addition, crowdfunding loans also have the potential to provide individuals with access to better interest rates and repayment terms compared to traditional loans. With traditional loans, individuals may have to pay high interest rates and adhere to strict repayment schedules. However, with crowdfunding loans, individuals can negotiate terms with their lenders and potentially secure better rates and more flexible payment plans.

In conclusion, crowdfunding loans provide a revolutionary way to finance the purchase of a

Purple mattress

. Not only does it offer a more accessible and flexible option for financing, but it also fosters a sense of community and support. So why wait to save up for your dream mattress when you can reach out to a wider community and make your dream a reality? Start your crowdfunding campaign today and experience the comfort and luxury of a Purple mattress for yourself.

/cdn.vox-cdn.com/uploads/chorus_image/image/56558505/indiegogo.0.0.jpg)