Business insurance is an essential investment for any mattress store owner. It protects your business from financial losses due to unexpected events and risks. As a mattress store owner, you have invested a significant amount of time, money, and effort into your business, and it's crucial to protect that investment. That's where business insurance comes in. When it comes to getting insurance for your mattress store, you want to make sure you have the right coverage for your specific risks. This is where CoverWallet comes in. They offer customizable insurance policies that can be tailored to fit your business's unique needs. With CoverWallet, you can feel confident knowing that your business is protected.Business Insurance for Mattress Stores | CoverWallet

Mattress store insurance is designed to protect your business from a variety of risks, such as property damage, liability claims, and more. Insureon understands that every mattress store is unique, and they offer customizable insurance policies that can be tailored to fit your business's specific needs. Insureon also offers a range of coverage options, including general liability insurance, property insurance, and business interruption insurance. With Insureon, you can rest easy knowing that your business is protected from unexpected events and risks.Mattress Store Insurance | Insureon

Nationwide offers insurance solutions for mattress stores that can help protect your business from financial losses due to unexpected events and risks. With Nationwide, you can choose from a variety of coverage options, including property insurance, general liability insurance, and business interruption insurance. One of the benefits of choosing Nationwide for your mattress store insurance is their dedicated team of agents who can help you navigate the insurance process and find the right coverage for your business's specific needs.Mattress Store Insurance | Nationwide

The Hartford offers insurance solutions for small businesses, including mattress stores. They understand the unique risks that mattress store owners face and offer customizable insurance policies to fit those risks. The Hartford offers a range of coverage options, including property insurance, general liability insurance, and business income insurance. With their coverage, you can feel confident knowing that your business is protected from unexpected events and risks.Mattress Store Insurance | The Hartford

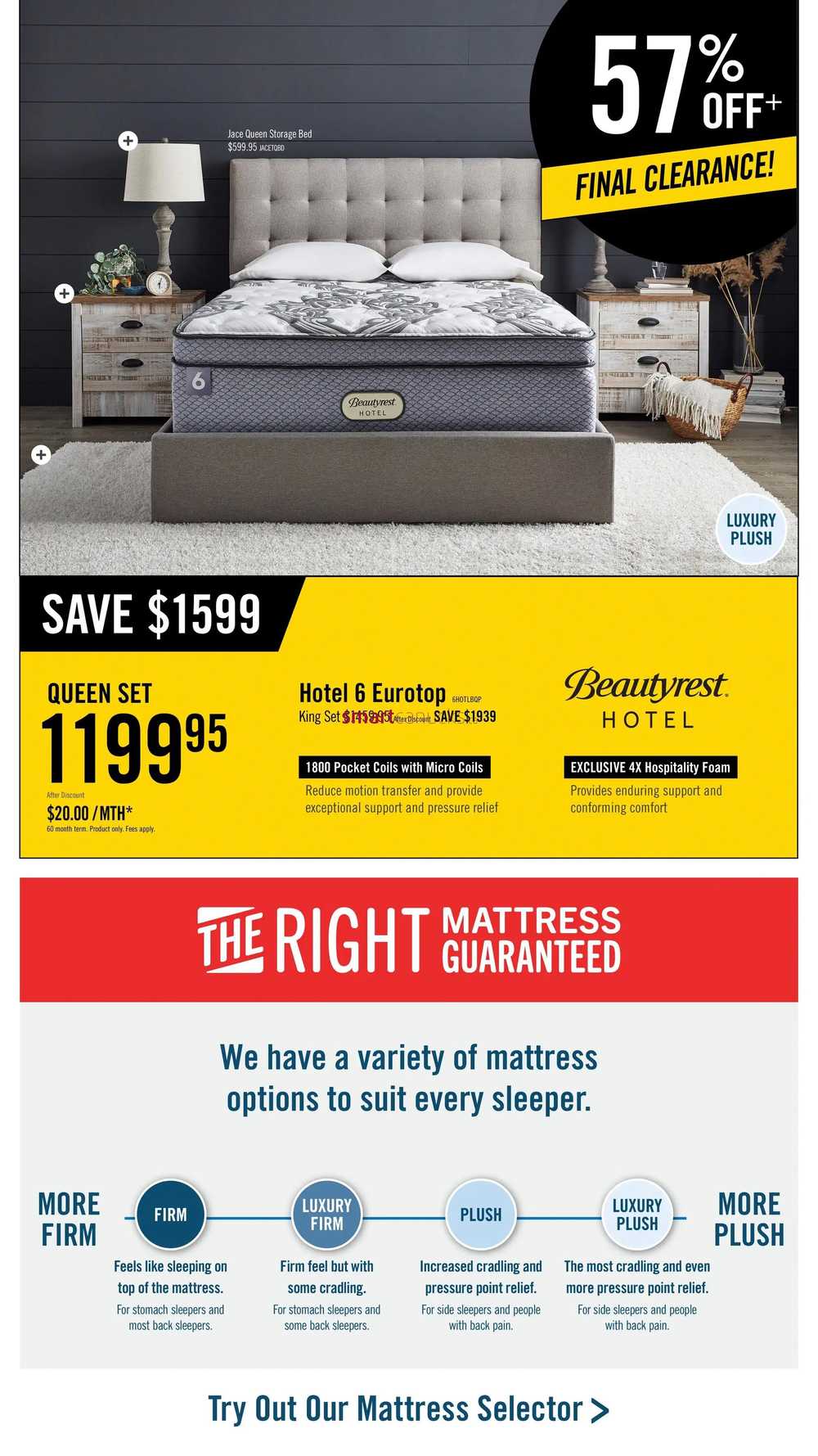

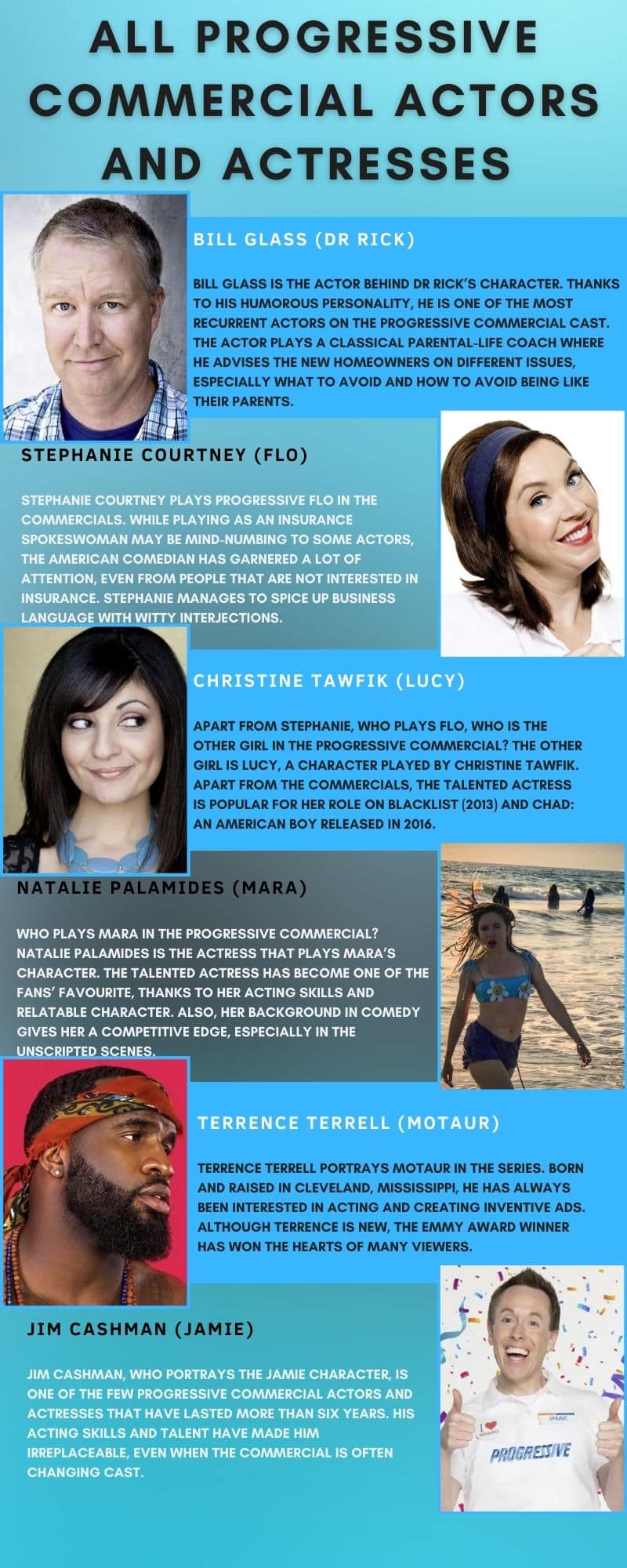

Progressive Commercial offers insurance solutions for small businesses, including mattress stores. Their insurance policies are customizable, allowing you to choose the coverage that best fits your business's specific needs and risks. With Progressive Commercial, you can choose from a range of coverage options, including property insurance, general liability insurance, and workers' compensation insurance. They also offer affordable rates, making it easier for small businesses to get the coverage they need.Mattress Store Insurance | Progressive Commercial

Farmers Insurance offers comprehensive insurance solutions for small businesses, including mattress stores. They understand that every business is unique and offer customizable coverage options to fit your business's specific needs and risks. With Farmers Insurance, you can choose from a variety of coverage options, including property insurance, general liability insurance, and workers' compensation insurance. They also offer 24/7 claims support, so you can get the help you need when you need it.Mattress Store Insurance | Farmers Insurance

Hiscox offers specialized insurance solutions for small businesses, including mattress stores. They understand the unique risks that mattress store owners face and offer customizable coverage options to fit those risks. Hiscox offers a range of coverage options, including general liability insurance, property insurance, and business interruption insurance. They also have a team of dedicated agents who can help you find the right coverage for your business's specific needs.Mattress Store Insurance | Hiscox

Liberty Mutual offers insurance solutions for a variety of small businesses, including mattress stores. They understand the unique risks that small businesses face and offer customizable insurance policies to fit those risks. With Liberty Mutual, you can choose from a range of coverage options, including property insurance, general liability insurance, and business income insurance. They also offer discounts for bundling multiple policies, making it easier for small businesses to get the coverage they need at an affordable rate.Mattress Store Insurance | Liberty Mutual

State Farm offers insurance solutions for small businesses, including mattress stores. With State Farm, you can choose from a variety of coverage options, including property insurance, general liability insurance, and business income insurance. One of the benefits of choosing State Farm for your mattress store insurance is their personalized service. Their agents will work with you to understand your business's unique needs and help you find the right coverage to protect your business and your investment.Mattress Store Insurance | State Farm

Allstate offers insurance solutions for small businesses, including mattress stores. They understand the unique risks that small businesses face and offer customizable insurance policies to fit those risks. With Allstate, you can choose from a variety of coverage options, including property insurance, general liability insurance, and workers' compensation insurance. They also offer a range of resources and tools to help you understand your insurance coverage and manage your policy.Mattress Store Insurance | Allstate

Why Your Mattress Store Needs Insurance

Protecting Your Business from Potential Risks

Running a mattress store can be a fulfilling and profitable venture, but it also comes with its fair share of risks. From natural disasters to customer injuries, unforeseen events can have a significant impact on your business and its finances. This is why having insurance for your mattress store is crucial for protecting your business and giving you peace of mind.

Property Insurance

One of the most significant risks for any business is damage to property. This can happen due to a fire, theft, or severe weather conditions. As a mattress store owner, your inventory is your livelihood, and any damage to it could result in significant financial losses. This is where property insurance comes in. It can cover the cost of repairing or replacing damaged property, including your mattresses, furniture, and equipment.

Liability Insurance

Another essential type of insurance for a mattress store is liability insurance. This protects your business in case a customer or third party suffers an injury or property damage while on your premises. For example, if a customer slips and falls in your store, liability insurance can cover their medical expenses and any legal fees if they decide to sue. It can also cover any damages caused by your products, such as a defective mattress causing damage to a customer's home.

Business Interruption Insurance

In the event of a disaster or unforeseen event, your mattress store may need to close temporarily. This can result in a loss of income and disrupt your business operations. Business interruption insurance can help cover the loss of income and any ongoing expenses, such as rent and employee salaries, while your store is closed. This ensures that your business can continue to operate smoothly, even during challenging times.

Worker's Compensation Insurance

If you have employees working in your mattress store, it is essential to have worker's compensation insurance. This protects your employees in case of work-related injuries or illnesses and covers their medical expenses and lost wages. It also protects your business from potential lawsuits filed by injured employees.

In conclusion, insurance for your mattress store is not just a smart business decision; it is also necessary for protecting your business from potential risks and financial losses. By investing in the right insurance policies, you can rest easy knowing that your business is covered in case of any unfortunate events. Don't wait until it's too late, make sure to get insurance for your mattress store to secure its future and your peace of mind.

Running a mattress store can be a fulfilling and profitable venture, but it also comes with its fair share of risks. From natural disasters to customer injuries, unforeseen events can have a significant impact on your business and its finances. This is why having insurance for your mattress store is crucial for protecting your business and giving you peace of mind.

Property Insurance

One of the most significant risks for any business is damage to property. This can happen due to a fire, theft, or severe weather conditions. As a mattress store owner, your inventory is your livelihood, and any damage to it could result in significant financial losses. This is where property insurance comes in. It can cover the cost of repairing or replacing damaged property, including your mattresses, furniture, and equipment.

Liability Insurance

Another essential type of insurance for a mattress store is liability insurance. This protects your business in case a customer or third party suffers an injury or property damage while on your premises. For example, if a customer slips and falls in your store, liability insurance can cover their medical expenses and any legal fees if they decide to sue. It can also cover any damages caused by your products, such as a defective mattress causing damage to a customer's home.

Business Interruption Insurance

In the event of a disaster or unforeseen event, your mattress store may need to close temporarily. This can result in a loss of income and disrupt your business operations. Business interruption insurance can help cover the loss of income and any ongoing expenses, such as rent and employee salaries, while your store is closed. This ensures that your business can continue to operate smoothly, even during challenging times.

Worker's Compensation Insurance

If you have employees working in your mattress store, it is essential to have worker's compensation insurance. This protects your employees in case of work-related injuries or illnesses and covers their medical expenses and lost wages. It also protects your business from potential lawsuits filed by injured employees.

In conclusion, insurance for your mattress store is not just a smart business decision; it is also necessary for protecting your business from potential risks and financial losses. By investing in the right insurance policies, you can rest easy knowing that your business is covered in case of any unfortunate events. Don't wait until it's too late, make sure to get insurance for your mattress store to secure its future and your peace of mind.

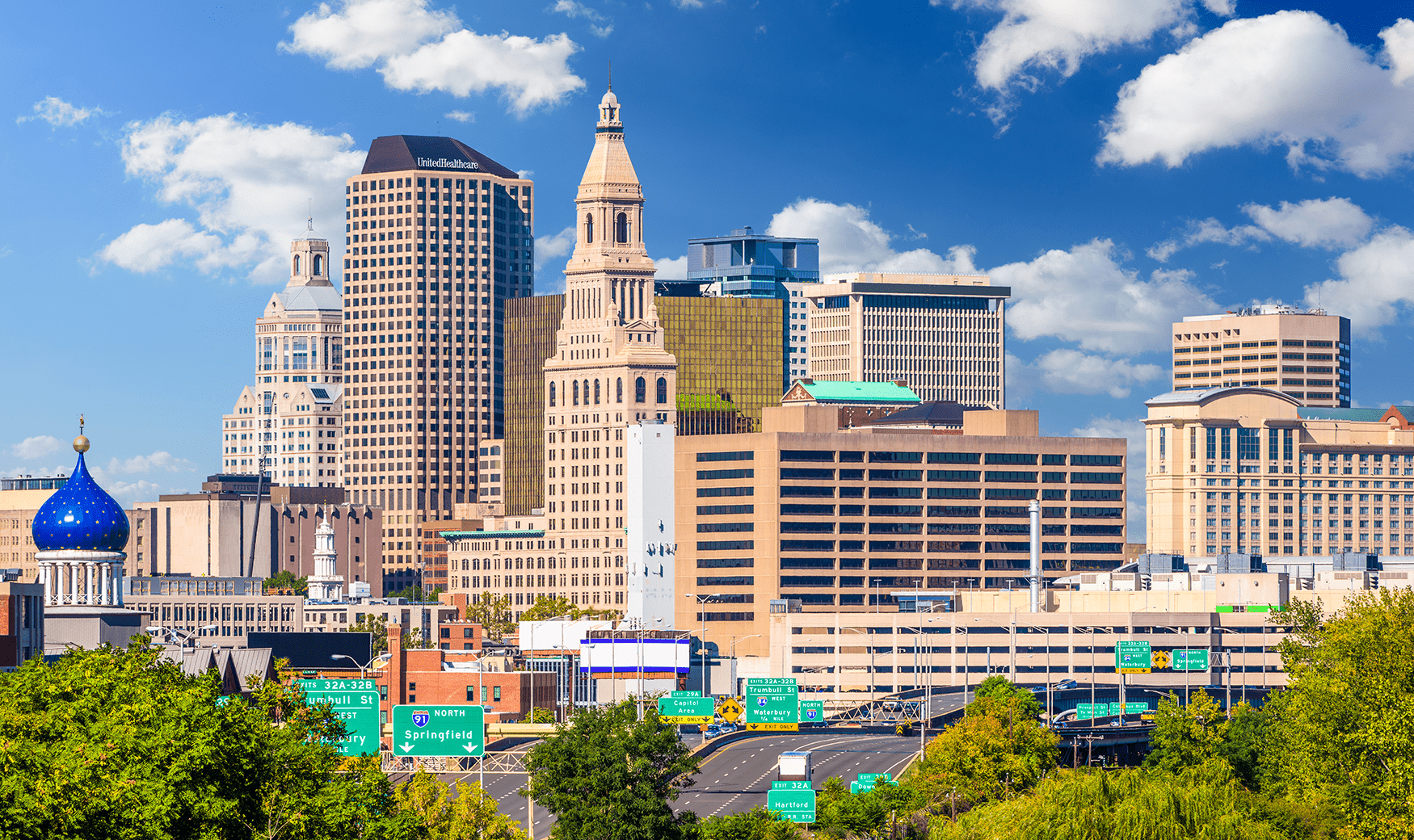

:max_bytes(150000):strip_icc()/Hartford-CT-GettyImages-480236859-4180725015a74001b4a6532398b5d2d1.jpg)

:max_bytes(150000):strip_icc()/Hartford-Skyline-Fall-GettyImages-635865186-17b68463682543d08c7324ae1995b4b8.jpg)