Credit Score Needed for Mattress Firm

When it comes to purchasing a new mattress, many people turn to popular retailers like Mattress Firm. However, before you can rest easy on your new bed, you may need to meet certain credit score requirements. In this article, we'll break down the top 10 main credit score needed for Mattress Firm and provide helpful tips for getting approved.

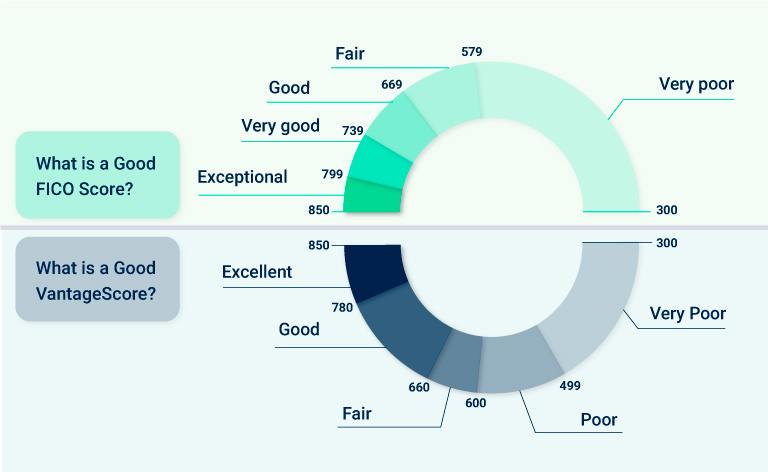

Mattress Firm Credit Score Requirements

Mattress Firm offers financing options to help customers afford their dream bed. However, to qualify for financing, you'll need to meet certain credit score requirements. The specific credit score needed for Mattress Firm may vary depending on the financing option you choose, but typically, a credit score of 640 or higher is required. This is considered a fair credit score and may be achievable for many individuals.

Minimum Credit Score for Mattress Firm

The minimum credit score required for Mattress Firm financing is 640, but keep in mind that this is just a general guideline. Other factors, such as your income and debt-to-income ratio, may also be considered when determining your creditworthiness. If you have a lower credit score, you may still be able to get approved for financing, but you may be offered higher interest rates or a smaller line of credit.

Mattress Firm Financing Credit Score

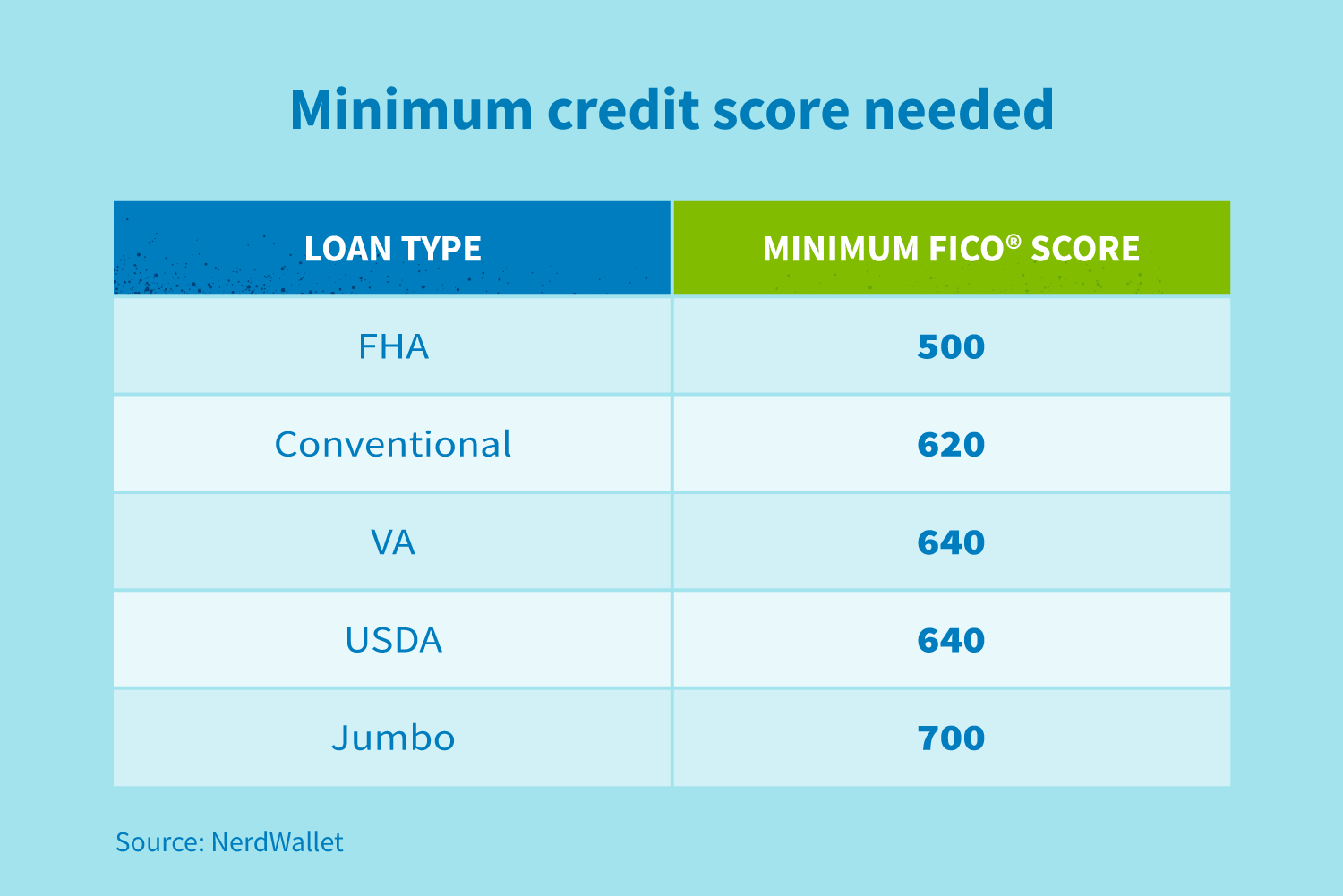

One of the most popular financing options offered by Mattress Firm is their 0% APR for 6 years financing plan. To qualify for this option, you'll need a credit score of 700 or higher. This is considered a good credit score and may be achievable for those who have a history of responsible credit use. However, keep in mind that other factors may also be taken into consideration when determining eligibility for financing.

Mattress Firm Credit Check

When you apply for financing at Mattress Firm, they will likely conduct a credit check to determine your creditworthiness. This means that your credit score and credit history will be reviewed to see if you meet their requirements. It's important to note that a credit check may result in a small dip in your credit score, so it's best to limit the number of credit checks you have done within a short period of time.

Mattress Firm Credit Approval

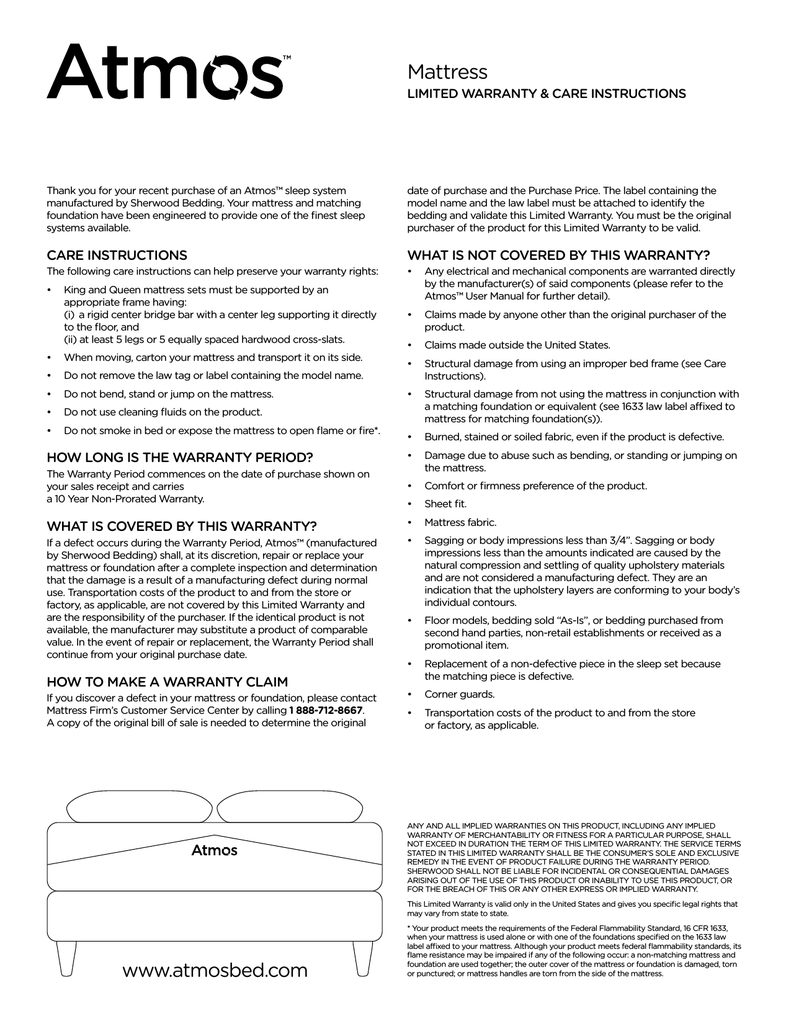

If you meet the credit score requirements and other criteria, you may be approved for financing at Mattress Firm. This means that you'll be able to purchase your new mattress and make payments over time. However, keep in mind that approval is not guaranteed and other factors may also be taken into consideration. If you are not approved, there are other financing options available to help you afford your new mattress.

Mattress Firm Credit Score Range

Now that we've discussed the minimum credit score needed for Mattress Firm, let's take a look at the credit score range that is typically accepted. Mattress Firm generally accepts credit scores ranging from 640 to 850. However, it's important to keep in mind that other factors may also be taken into consideration when determining eligibility for financing.

Mattress Firm Credit Score Criteria

In addition to your credit score, there are other criteria that Mattress Firm may consider when determining your eligibility for financing. These may include your income, employment history, and debt-to-income ratio. It's important to maintain a stable and decent income to increase your chances of being approved for financing.

Mattress Firm Credit Score Qualifications

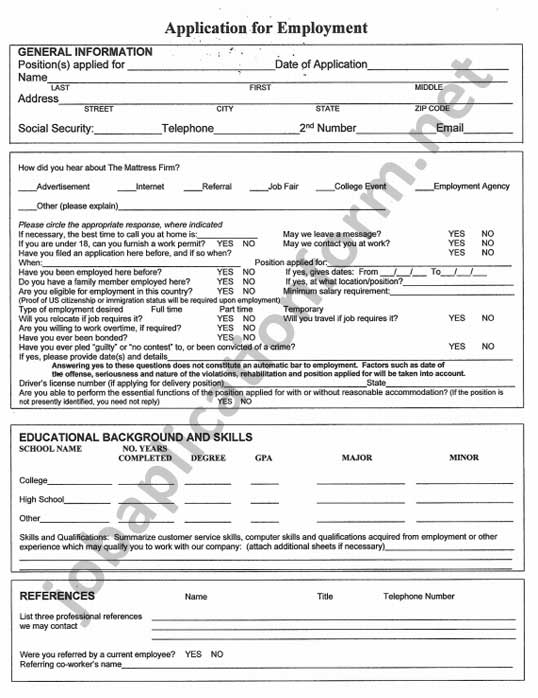

To qualify for financing at Mattress Firm, you'll need to meet the credit score requirements and other qualifications. This may include being at least 18 years old, having a steady source of income, and having a valid ID. It's important to have all necessary documentation ready when applying for financing to ensure a smooth and efficient process.

Mattress Firm Credit Score Guidelines

If you're concerned about your credit score and want to improve it before applying for financing at Mattress Firm, there are a few guidelines you can follow. First, make sure to make all of your credit card and loan payments on time. This will show lenders that you are responsible and can be trusted with credit. Additionally, try to keep your credit card balances low and avoid opening too many new accounts at once. With time and responsible credit use, you may be able to improve your credit score and increase your chances of being approved for financing at Mattress Firm.

The Importance of Having a Good Credit Score for Buying a Mattress from Mattress Firm

Why Your Credit Score Matters

When it comes to purchasing a new mattress, your credit score may not be the first thing that comes to mind. However, having a good credit score is crucial when buying a mattress from Mattress Firm, or any other major retailer. Your credit score is a numerical representation of your creditworthiness, which is used by lenders and retailers to determine your eligibility for loans and financing options. A good credit score not only gives you access to better financing options, but it also reflects your financial responsibility and trustworthiness to repay any debts.

The Credit Score Requirements at Mattress Firm

If you're planning on buying a mattress from Mattress Firm, it's important to know their credit score requirements. Mattress Firm offers financing options through third-party financing companies such as Synchrony and Progressive Leasing. These financing companies may have different credit score requirements, but generally, they look for a credit score of at least 600 for Synchrony and 500 for Progressive Leasing. This is considered a fair credit score, and if you have a higher credit score, you may be eligible for better financing terms and lower interest rates.

How Your Credit Score Affects Your Financing Options

Having a good credit score not only increases your chances of being approved for financing, but it also affects the terms of your financing options. A higher credit score can lead to lower interest rates, which means you'll end up paying less for your mattress in the long run. On the other hand, a lower credit score may result in higher interest rates and stricter payment terms, making it more difficult to afford your dream mattress. It's important to keep in mind that financing a mattress is essentially taking out a loan, and your credit score plays a significant role in determining the terms of that loan.

Improving Your Credit Score for Better Financing Options

If your credit score isn't where you'd like it to be, don't worry. There are steps you can take to improve it before making a mattress purchase at Mattress Firm. Paying your bills on time, keeping your credit card balances low, and avoiding opening too many new credit accounts can all contribute to a better credit score. It's also important to regularly check your credit report for any errors or discrepancies that may be negatively affecting your score.

In conclusion, having a good credit score is crucial when it comes to buying a mattress from Mattress Firm. It not only increases your chances of being approved for financing, but it also affects the terms of your financing options. Keep your credit score in mind when making a mattress purchase and take steps to improve it if necessary. With a good credit score, you'll be one step closer to getting a good night's sleep on your dream mattress from Mattress Firm.