If you're looking to cancel your Mattress Firm credit card, you're not alone. Whether you're trying to simplify your finances or you've found a better credit card offer, there are many reasons why you may want to cancel your card. In this article, we'll guide you through the steps to cancel your Mattress Firm credit card and provide some helpful tips and alternatives to consider.Cancel Mattress Firm Credit Card

Cancelling your Mattress Firm credit card is a straightforward process, but it's important to follow the proper steps to ensure a smooth cancellation. Here's how to cancel your Mattress Firm credit card:How to Cancel Your Mattress Firm Credit Card

Step 1: Pay off any remaining balance on your card. It's important to make sure your balance is completely paid off before cancelling your credit card. Step 2: Contact Mattress Firm customer service. You can do this by phone or through their online chat feature. Let them know that you want to cancel your credit card. Step 3: Follow any additional instructions from customer service. They may ask you to return your physical card or provide additional information. Step 4: Confirm the cancellation. After following the steps above, make sure to confirm with customer service that your credit card has been cancelled.Steps to Cancel Your Mattress Firm Credit Card

Now, let's take a closer look at each step in the cancellation process to ensure a smooth and successful cancellation. Step 1: Pay off any remaining balance on your card. Before cancelling your credit card, it's important to make sure you have paid off any remaining balance. This will prevent any potential issues with your account or credit score in the future. Step 2: Contact Mattress Firm customer service. You can reach Mattress Firm customer service by phone or through their online chat feature. Make sure to have your credit card information handy when you contact them. Step 3: Follow any additional instructions from customer service. Depending on the specific policies of Mattress Firm, they may have additional steps or requirements for cancelling your credit card. Make sure to follow these instructions carefully to ensure a smooth cancellation. Step 4: Confirm the cancellation. After following the steps above, make sure to confirm with customer service that your credit card has been cancelled. This will ensure that your account is closed and you will no longer be responsible for any charges.Canceling Your Mattress Firm Credit Card: A Step-by-Step Guide

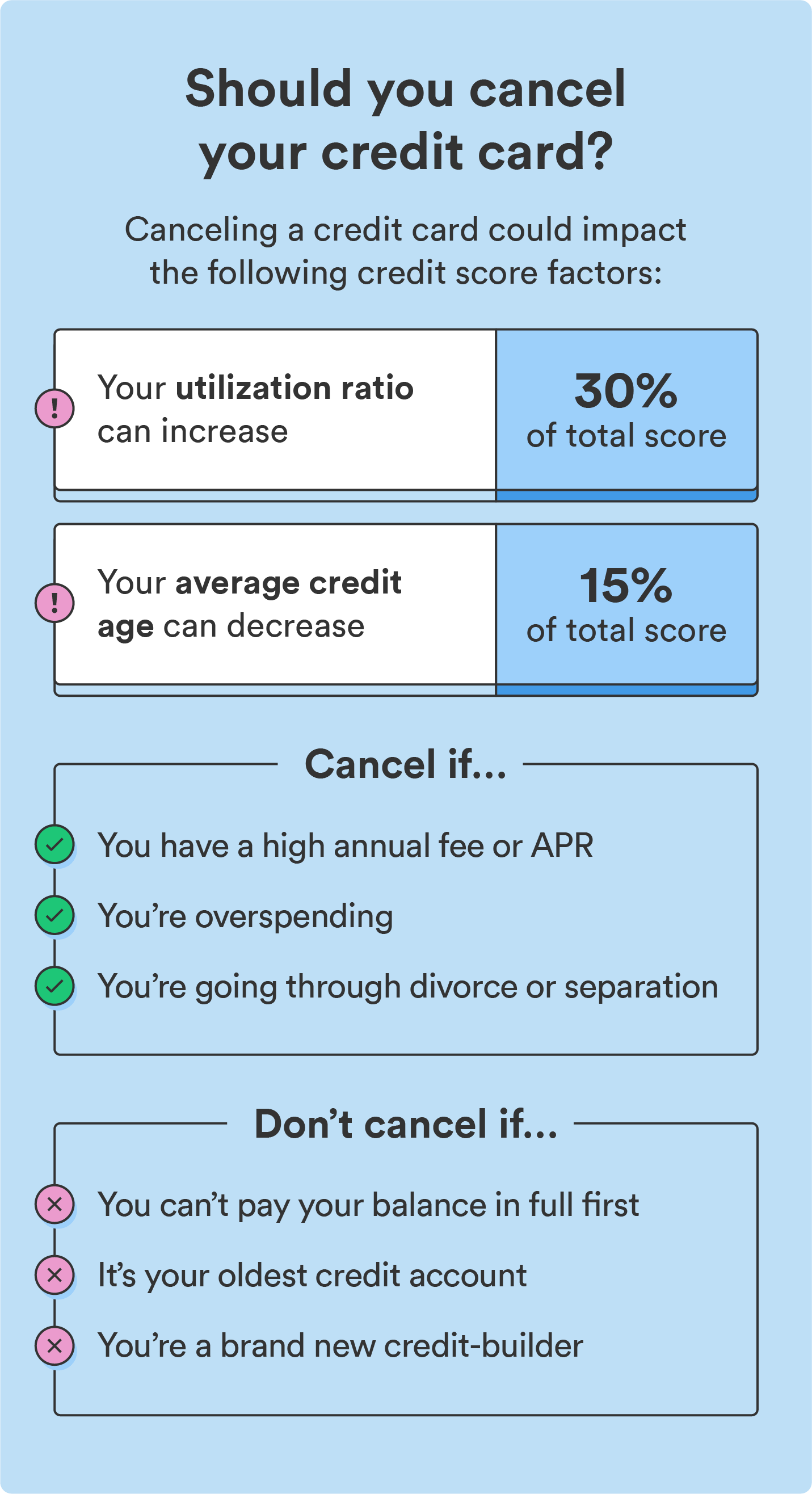

Cancelling a credit card can have an impact on your credit score. When you close a credit card, your credit limit decreases and your credit utilization ratio may increase. This could potentially lower your credit score. However, if you have other credit cards and maintain a low credit utilization ratio, the impact on your credit score should be minimal. It's also important to note that cancelling your Mattress Firm credit card will not affect your purchases or rewards. You will still be able to use your card and redeem any rewards until the cancellation is processed.Canceling Your Mattress Firm Credit Card: What You Need to Know

If you're considering cancelling your Mattress Firm credit card, here are a few tips and tricks to keep in mind: Tip 1: Consider transferring your balance. If you have a remaining balance on your Mattress Firm credit card, you may want to consider transferring it to another credit card with a lower interest rate. This can save you money on interest and help you pay off your balance faster. Tip 2: Keep your credit utilization low. As mentioned earlier, closing a credit card can potentially lower your credit score. To minimize this impact, make sure to keep your credit utilization low on your other credit cards. Tip 3: Consider alternative payment methods. If you're cancelling your Mattress Firm credit card because you no longer want to use a credit card for purchases, consider alternative payment methods such as debit cards or cash.Canceling Your Mattress Firm Credit Card: Tips and Tricks

Here are some common questions and answers related to cancelling your Mattress Firm credit card: Q: Will cancelling my Mattress Firm credit card affect my credit score? A: Cancelling a credit card can potentially lower your credit score, but the impact should be minimal if you have other credit cards and maintain a low credit utilization ratio. Q: Can I still use my Mattress Firm credit card after cancelling it? A: No, your credit card will be closed and you will no longer be able to use it for purchases. Q: Can I still redeem rewards from my Mattress Firm credit card after cancelling it? A: Yes, you will still be able to redeem any rewards you have earned on your credit card until the cancellation is processed.Canceling Your Mattress Firm Credit Card: Common Questions and Answers

Before cancelling your Mattress Firm credit card, make sure to consider the following important factors: Consideration 1: Your credit score may be affected. Consideration 2: You may have other credit cards with better rewards or benefits. Consideration 3: You may have a remaining balance on your credit card.Canceling Your Mattress Firm Credit Card: Important Considerations

If you're not sure if cancelling your Mattress Firm credit card is the right decision for you, here are some alternatives to consider: Alternative 1: Keep your credit card open. If you're not experiencing any issues with your Mattress Firm credit card, you may want to keep it open and continue using it for purchases. Alternative 2: Transfer your balance. If you have a remaining balance on your credit card, you may want to transfer it to another credit card with a lower interest rate. Alternative 3: Consider a different credit card. If you're looking for a credit card with better rewards or benefits, you may want to consider applying for a different credit card instead of cancelling your Mattress Firm credit card.Canceling Your Mattress Firm Credit Card: Alternatives to Consider

After cancelling your Mattress Firm credit card, make sure to keep an eye on your credit report to ensure that the cancellation is processed correctly. You may also want to consider reviewing your credit card options and finding a new credit card that better suits your needs.Canceling Your Mattress Firm Credit Card: Final Steps and Next Steps

Why You Should Consider Cancelling Your Mattress Firm Credit Card

The Hidden Costs of Credit Cards

In today's society, credit cards have become a common means of making purchases. They offer convenience and flexibility, allowing you to buy now and pay later. However, with this convenience, comes hidden costs that many consumers are not aware of. One such cost is the high interest rates that credit cards carry.

Mattress Firm credit card

is no exception to this. With an average APR of 29.99%, it is easy to see how quickly your balance can multiply, especially if you only make minimum payments. This can lead to a never-ending cycle of debt, making it difficult to achieve your financial goals.

In today's society, credit cards have become a common means of making purchases. They offer convenience and flexibility, allowing you to buy now and pay later. However, with this convenience, comes hidden costs that many consumers are not aware of. One such cost is the high interest rates that credit cards carry.

Mattress Firm credit card

is no exception to this. With an average APR of 29.99%, it is easy to see how quickly your balance can multiply, especially if you only make minimum payments. This can lead to a never-ending cycle of debt, making it difficult to achieve your financial goals.

The Temptation of Retail Credit Cards

Retail credit cards, like the

Mattress Firm credit card

, are often enticing with their special offers and rewards. They may offer a discount on your first purchase or promise cashback on future purchases. While these perks may seem appealing, they often come with strings attached. The terms and conditions of these cards may require you to spend a certain amount or limit when you can use the rewards. This can lead to overspending on items you don't need, just to earn rewards that may not be as valuable as they seem.

Canceling your Mattress Firm credit card

can help you avoid falling into this trap and save you money in the long run.

Retail credit cards, like the

Mattress Firm credit card

, are often enticing with their special offers and rewards. They may offer a discount on your first purchase or promise cashback on future purchases. While these perks may seem appealing, they often come with strings attached. The terms and conditions of these cards may require you to spend a certain amount or limit when you can use the rewards. This can lead to overspending on items you don't need, just to earn rewards that may not be as valuable as they seem.

Canceling your Mattress Firm credit card

can help you avoid falling into this trap and save you money in the long run.

The Impact on Your Credit Score

Many people are hesitant to cancel a credit card because they fear it will negatively impact their credit score. While it is true that closing a credit card account can affect your credit score, the impact may not be as significant as you think.

Canceling your Mattress Firm credit card

will only have a minor effect on your credit score, as long as you have other active credit accounts and continue to make timely payments. In fact, having too many credit cards can also lower your credit score, so it may be beneficial to close the ones you no longer need or use.

Many people are hesitant to cancel a credit card because they fear it will negatively impact their credit score. While it is true that closing a credit card account can affect your credit score, the impact may not be as significant as you think.

Canceling your Mattress Firm credit card

will only have a minor effect on your credit score, as long as you have other active credit accounts and continue to make timely payments. In fact, having too many credit cards can also lower your credit score, so it may be beneficial to close the ones you no longer need or use.

Consider Alternatives

:max_bytes(150000):strip_icc()/cancel-credit-cards-56a6350e3df78cf7728bd67e.jpg) Before making the decision to cancel your

Mattress Firm credit card

, consider alternative options. You can transfer your balance to a credit card with a lower interest rate, or look into personal loans with lower interest rates to pay off your balance. Another option is to create a budget and prioritize paying off your credit card debt to avoid high-interest charges.

Canceling your Mattress Firm credit card

should be a last resort, but it can ultimately save you money and help you achieve financial stability.

Before making the decision to cancel your

Mattress Firm credit card

, consider alternative options. You can transfer your balance to a credit card with a lower interest rate, or look into personal loans with lower interest rates to pay off your balance. Another option is to create a budget and prioritize paying off your credit card debt to avoid high-interest charges.

Canceling your Mattress Firm credit card

should be a last resort, but it can ultimately save you money and help you achieve financial stability.

In Conclusion

While having a Mattress Firm credit card may seem like a good idea at the time, the hidden costs and potential impact on your credit score should not be taken lightly. It is important to carefully consider your financial goals and assess whether keeping this credit card aligns with those goals. If not,

cancelling your Mattress Firm credit card

may be a smart decision in the long run.

While having a Mattress Firm credit card may seem like a good idea at the time, the hidden costs and potential impact on your credit score should not be taken lightly. It is important to carefully consider your financial goals and assess whether keeping this credit card aligns with those goals. If not,

cancelling your Mattress Firm credit card

may be a smart decision in the long run.