When it comes to buying a new mattress, one of the biggest concerns for many people is the cost. Mattresses can be expensive, and not everyone has the budget to purchase one outright. However, there are options available for those who need a little help with financing their mattress purchase. If you're in the market for a new mattress and wondering if you can finance it, the answer is yes. Many mattress retailers, including Mattress Firm, offer financing options to help make the process more affordable. Let's take a closer look at some of the ways you can finance a mattress and what you need to know before making a decision.1. Financing Options for Mattresses | Mattress Firm

The short answer is yes, you can finance a mattress. In fact, financing a mattress is a common practice for many people. Just like buying a car or a piece of furniture, financing allows you to spread out the cost of your purchase over a period of time instead of paying for it all at once. One of the main benefits of financing a mattress is that it allows you to get the mattress you want without having to wait until you have enough money saved up. This can be especially helpful if you're in need of a new mattress due to discomfort or other issues.2. Can You Finance a Mattress? | Credit Karma

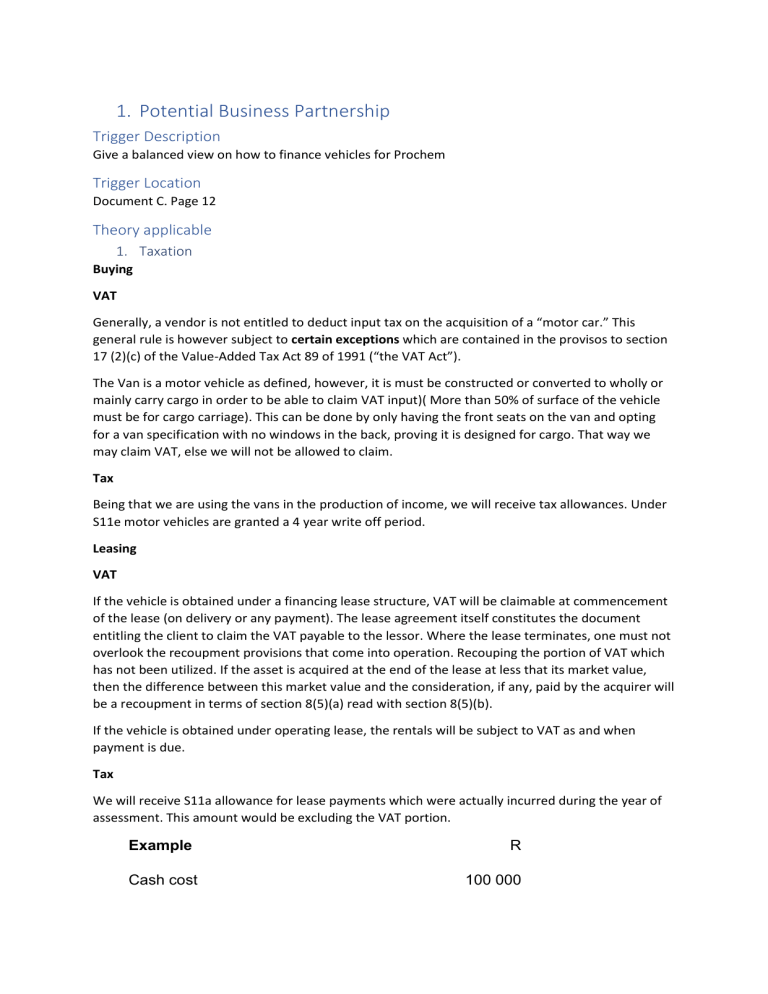

So how does mattress financing work? It's similar to financing other big purchases. You'll typically have the option to finance through the mattress retailer or through a third-party financing company. At Mattress Firm, for example, you can apply for credit through their partner, Synchrony Financial. When you finance a mattress, you'll be required to make monthly payments until the full balance is paid off. The length of your financing term will depend on the agreement you make with the financing company and can range from a few months to a few years.3. Mattress Financing | Mattress Firm

Before you decide to finance a mattress, there are a few things you should consider. First, make sure you understand the terms of your financing agreement. This includes the interest rate, monthly payments, and any additional fees or charges. It's also important to have a solid understanding of your budget and make sure you can comfortably afford the monthly payments. If you have other large expenses or financial obligations, it may not be the best time to take on additional debt.4. Mattress Financing | Mattress Firm

Another important factor to consider is your credit score. Most financing companies will require you to have a certain credit score in order to qualify for financing. If your credit score is low, you may have a harder time getting approved or may be offered a higher interest rate. It's also worth comparing financing options from different retailers to see who offers the most favorable terms. Some may offer 0% interest for a certain period of time or other incentives, so it's important to do your research and make the best decision for your specific situation.5. Mattress Financing | Mattress Firm

If you're unsure about financing a mattress, there are other options available to help make your purchase more affordable. Many mattress retailers offer layaway programs where you can make smaller payments over time until the full balance is paid off. This can be a good option for those who want to avoid taking on debt. You could also consider purchasing a mattress during a sale or promotion period. This can help you save money and make the purchase more manageable without having to finance it.6. Mattress Financing | Mattress Firm

Before you make a decision, it's also a good idea to read reviews and do some research on the mattress you're interested in. This will help ensure that you're making a good investment and getting a mattress that will meet your needs and last for many years to come. Remember, financing a mattress is a big decision and should be approached with caution. Make sure you fully understand the terms and have a plan in place to pay off the balance in a timely manner to avoid any potential issues.7. Mattress Financing | Mattress Firm

In addition to financing, many retailers also offer other payment options such as credit cards or debit cards. These can be good alternatives to traditional financing and may offer rewards or cash back on your purchases. Ultimately, the decision to finance a mattress is a personal one and will depend on your individual circumstances. If you do decide to finance, make sure to read the fine print and have a clear understanding of the terms before signing any agreements.8. Mattress Financing | Mattress Firm

At the end of the day, the most important thing is to find a mattress that will provide you with the comfort and support you need for a good night's sleep. Whether you choose to finance or use another payment option, the most important thing is to make a decision that works for you and your budget. So if you're in the market for a new mattress and wondering if you can finance it, the answer is yes. With some careful consideration and research, financing a mattress can be a great option for those who need a little help making their purchase more affordable.9. Mattress Financing | Mattress Firm

In summary, financing a mattress is a common practice and can be a good option for those who need a little help with affording a new mattress. Just be sure to do your research, understand the terms, and have a plan in place to pay off the balance in a timely manner. With the right approach, you can get the mattress you want without breaking the bank.10. Mattress Financing | Mattress Firm

Financing Options for Your Dream Mattress

Can You Finance a Mattress?

If you're in the market for a new mattress, you may be wondering if you can finance it. After all, mattresses can be a significant investment and it's not always feasible to pay for one upfront. The good news is, yes, you can finance a mattress! Many mattress companies offer financing options to make it easier for customers to afford their dream mattress. Let's take a closer look at the different financing options available and how you can finance a mattress.

If you're in the market for a new mattress, you may be wondering if you can finance it. After all, mattresses can be a significant investment and it's not always feasible to pay for one upfront. The good news is, yes, you can finance a mattress! Many mattress companies offer financing options to make it easier for customers to afford their dream mattress. Let's take a closer look at the different financing options available and how you can finance a mattress.

Types of Financing Options

When it comes to financing a mattress, there are a few different options available. The most common option is through the mattress company itself. Many mattress companies offer financing plans with low or 0% interest rates for a set period of time. This allows you to make monthly payments on your mattress without accruing any interest. Some companies even offer financing with no credit check, making it easier for those with less-than-perfect credit to get approved.

Another option is to finance your mattress through a third-party financing company. These companies specialize in providing financing for large purchases, such as mattresses. They may offer longer financing terms and lower interest rates, but they may also require a credit check and charge additional fees. It's important to carefully read the terms and conditions before choosing this option.

When it comes to financing a mattress, there are a few different options available. The most common option is through the mattress company itself. Many mattress companies offer financing plans with low or 0% interest rates for a set period of time. This allows you to make monthly payments on your mattress without accruing any interest. Some companies even offer financing with no credit check, making it easier for those with less-than-perfect credit to get approved.

Another option is to finance your mattress through a third-party financing company. These companies specialize in providing financing for large purchases, such as mattresses. They may offer longer financing terms and lower interest rates, but they may also require a credit check and charge additional fees. It's important to carefully read the terms and conditions before choosing this option.

Things to Consider

Before you decide to finance a mattress, there are a few things you should consider. First, make sure you understand the terms and conditions of the financing plan. This includes the interest rate, payment schedule, and any additional fees. It's also important to consider your budget and make sure you can comfortably afford the monthly payments.

You should also think about the long-term costs of financing a mattress. While it may seem like an affordable option in the short-term, you may end up paying more in interest over time. It's important to compare the total cost of financing versus paying upfront to determine which option is the best for you.

Before you decide to finance a mattress, there are a few things you should consider. First, make sure you understand the terms and conditions of the financing plan. This includes the interest rate, payment schedule, and any additional fees. It's also important to consider your budget and make sure you can comfortably afford the monthly payments.

You should also think about the long-term costs of financing a mattress. While it may seem like an affordable option in the short-term, you may end up paying more in interest over time. It's important to compare the total cost of financing versus paying upfront to determine which option is the best for you.

In Conclusion

If you're in the market for a new mattress but can't afford to pay for it upfront, financing may be a great option for you. It allows you to spread out the cost of your mattress over time, making it more affordable. Just make sure to carefully consider your options and choose a financing plan that works best for your budget. With the right financing plan, you can finally get the mattress of your dreams without breaking the bank.

If you're in the market for a new mattress but can't afford to pay for it upfront, financing may be a great option for you. It allows you to spread out the cost of your mattress over time, making it more affordable. Just make sure to carefully consider your options and choose a financing plan that works best for your budget. With the right financing plan, you can finally get the mattress of your dreams without breaking the bank.