If you're in the market for a new mattress and have some medical issues, you may be wondering if you can claim it as a medical expense. The answer is, it depends. While mattresses are not typically considered a medical expense, there are certain circumstances where you may be able to claim it on your taxes. Let's dive into the details and find out if a new mattress can qualify for medical expenses.Can a New Mattress Qualify for Medical Expenses?

The short answer is, yes. You can claim a new mattress as a medical expense if it is deemed necessary for medical reasons. This means that you must have a medical condition that requires you to have a certain type of mattress for treatment or relief.Can You Claim a New Mattress as a Medical Expense?

Generally, mattresses are not considered a medical expense. However, if you have a medical condition that requires a specific type of mattress for treatment, then it can be classified as a medical expense. This means that you may be able to deduct the cost of the mattress on your taxes.Are Mattresses Considered a Medical Expense?

Yes, if you meet the criteria for claiming a new mattress as a medical expense, then you can write it off on your taxes. This means that you can deduct the cost of the mattress from your taxable income, potentially saving you money on your taxes.Can You Write Off a New Mattress as a Medical Expense?

As mentioned earlier, a new mattress can be tax deductible as a medical expense if it is deemed necessary for medical reasons. This means that you must have a medical condition that requires a specific type of mattress for treatment or relief. The amount you can deduct will depend on your individual circumstances and the cost of the mattress.Is a New Mattress Tax Deductible as a Medical Expense?

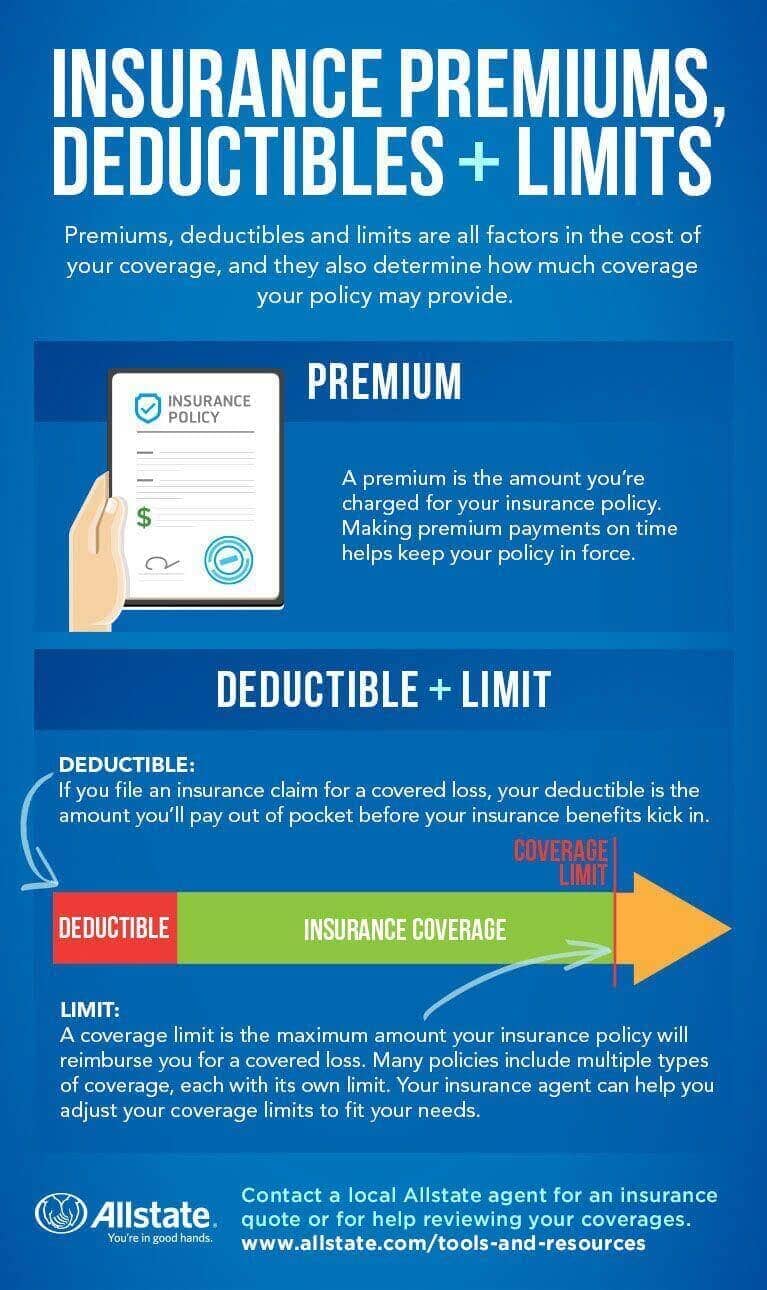

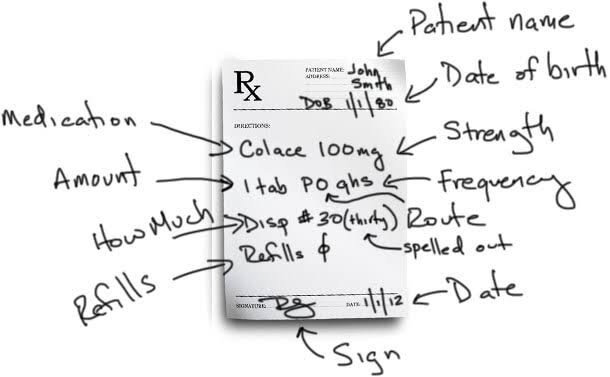

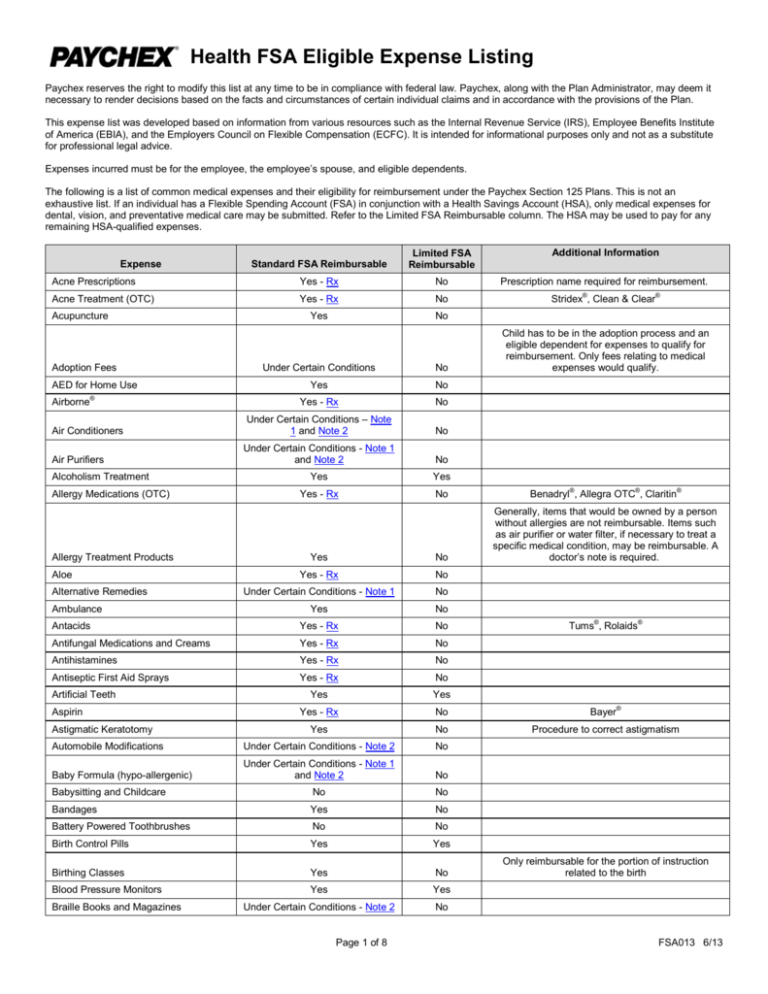

If you have a Health Savings Account (HSA), you may be able to use the funds to purchase a new mattress. HSAs are tax-advantaged accounts that are used to pay for medical expenses. However, you must have a doctor's prescription stating that the mattress is medically necessary in order to use HSA funds for this purpose.Can You Use HSA Funds to Buy a New Mattress?

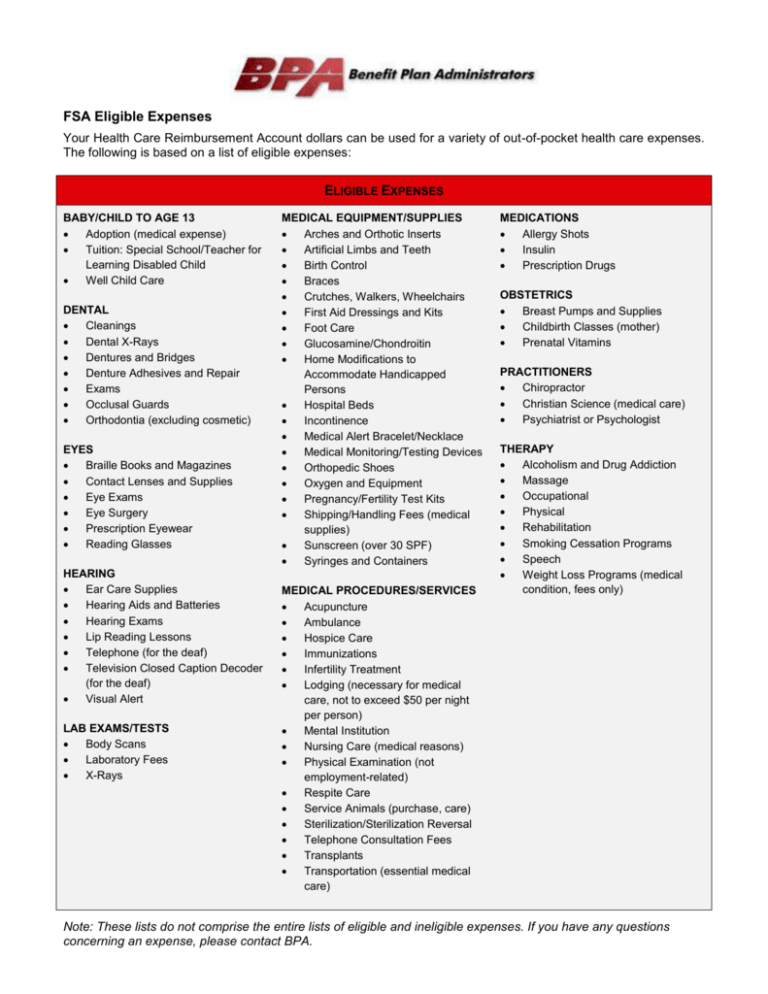

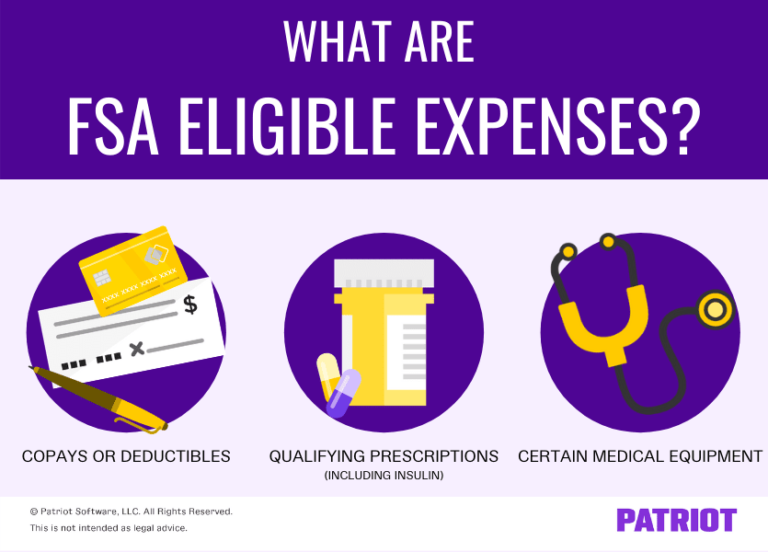

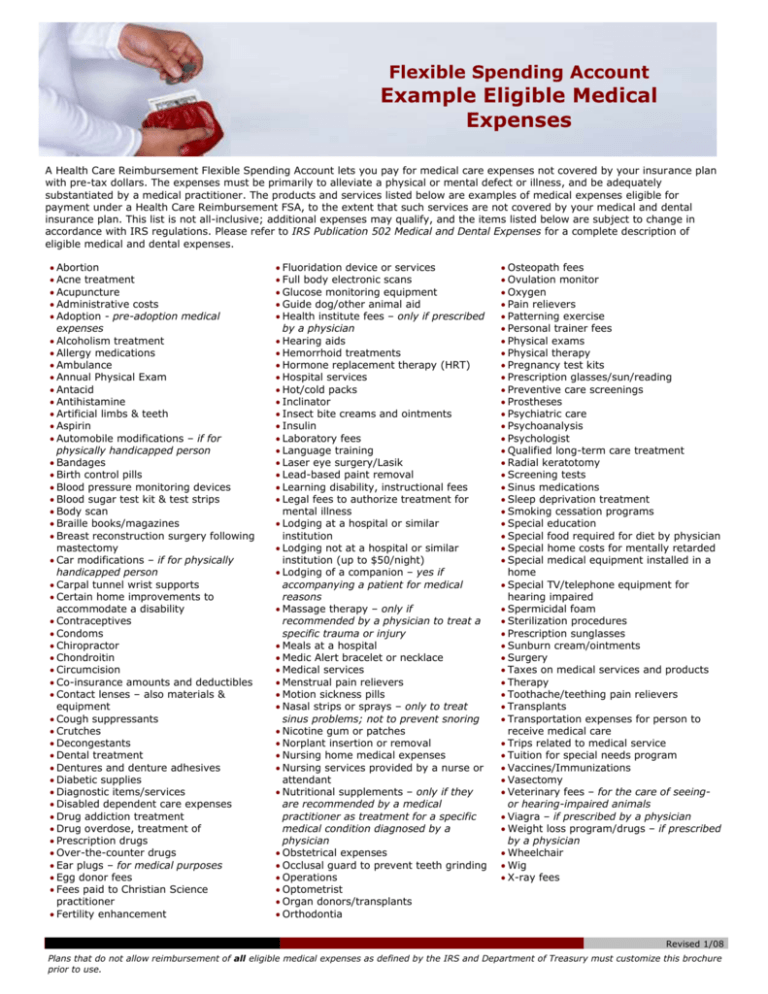

Flexible Spending Accounts (FSAs) are also tax-advantaged accounts that can be used to pay for medical expenses. Similar to HSAs, you will need a doctor's prescription stating that the mattress is medically necessary in order to use FSA funds for this purpose.Are Mattresses Covered by Flexible Spending Accounts?

In order to claim a new mattress as a medical expense, you will need to have a doctor's prescription. This is to ensure that the mattress is deemed medically necessary for your specific condition and not just a personal preference.Can You Get a Doctor's Prescription for a New Mattress?

A new mattress can be used as a medical expense for a variety of conditions, including back pain, arthritis, fibromyalgia, and sleep disorders. If you have a medical condition that affects your sleep or requires a certain type of support, a new mattress may be considered a necessary medical expense.What Types of Medical Expenses Can a New Mattress Be Used For?

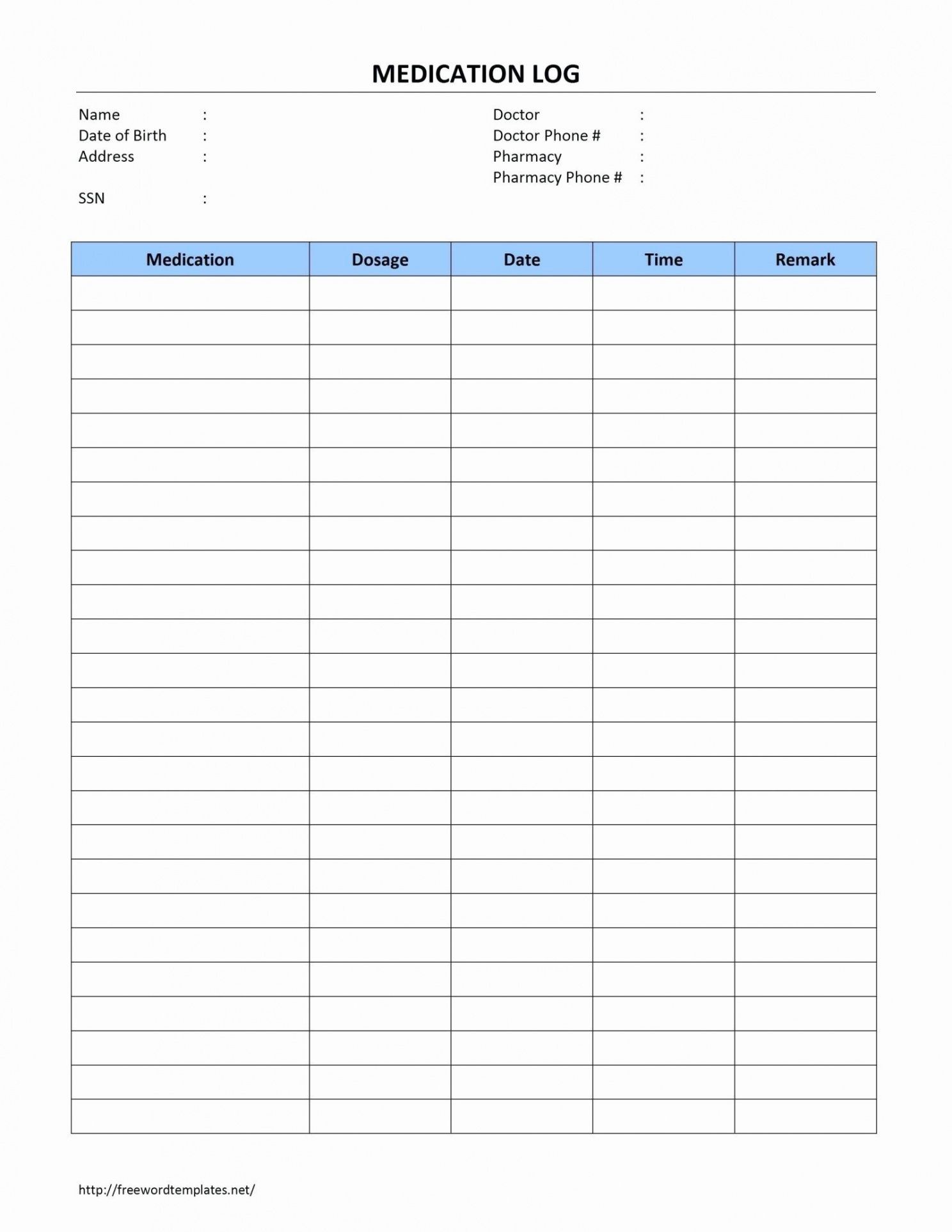

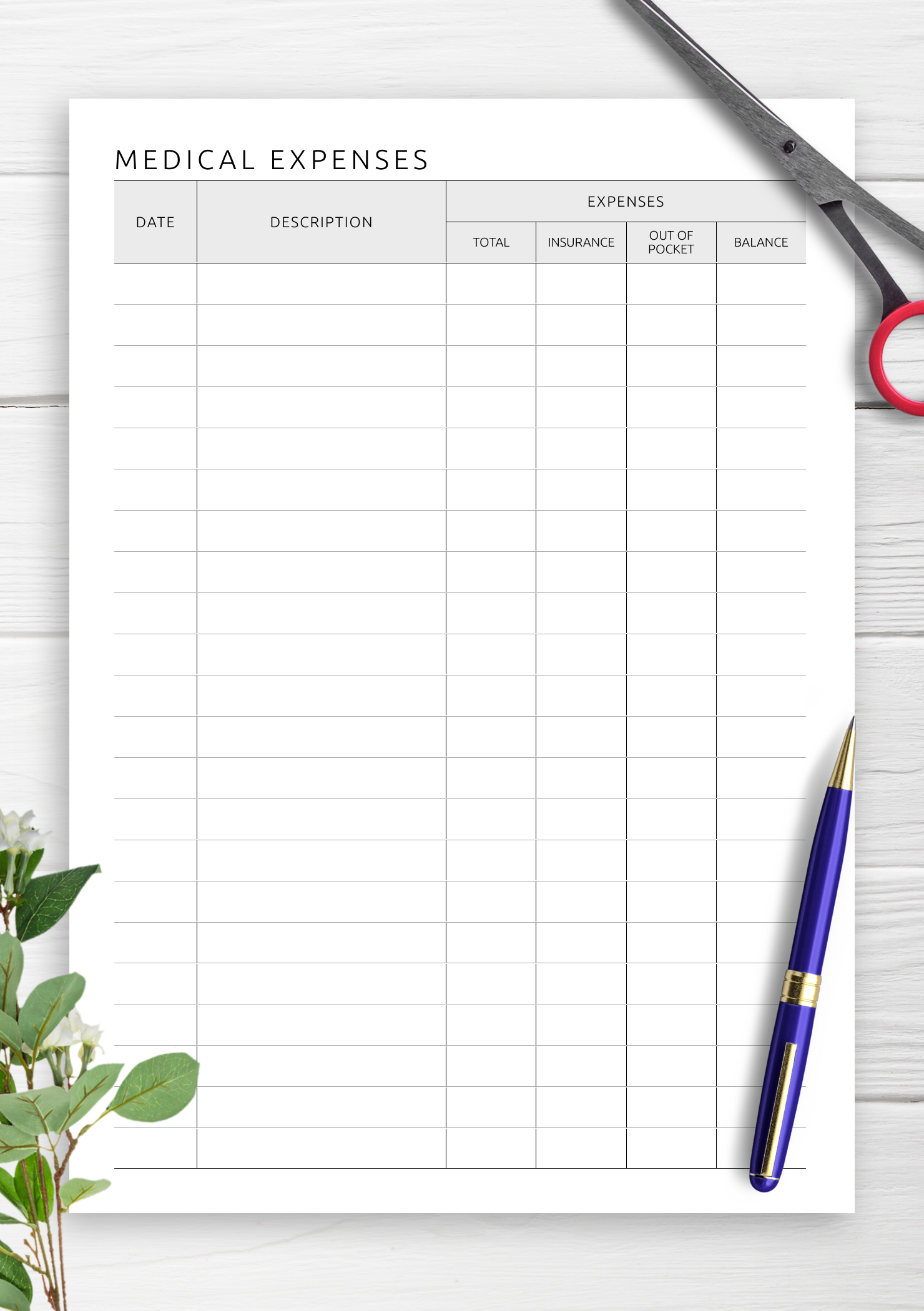

In order to claim a new mattress as a medical expense on your taxes, you will need to itemize your deductions using Schedule A and include the cost of the mattress under the "medical and dental expenses" section. You will also need to keep all receipts and documentation, including a doctor's prescription, to support your claim. In conclusion, a new mattress can qualify as a medical expense if it is deemed necessary for medical reasons. Make sure to consult with a tax professional or the IRS for specific guidelines and requirements before claiming a new mattress as a medical expense on your taxes.How to Claim a New Mattress as a Medical Expense on Your Taxes

The Importance of a Quality Mattress for Medical Expenses

The Connection Between Mattresses and Health

When it comes to our health, we often think about our diet, exercise, and overall lifestyle habits. However, one crucial factor that is often overlooked is our

mattress

. After all, we spend one-third of our lives sleeping, and the quality of our sleep can greatly impact our physical and mental well-being. This is especially important for those with medical conditions that require extra care and support. In fact, investing in a

new mattress

can have a significant impact on

medical expenses

in the long run.

When it comes to our health, we often think about our diet, exercise, and overall lifestyle habits. However, one crucial factor that is often overlooked is our

mattress

. After all, we spend one-third of our lives sleeping, and the quality of our sleep can greatly impact our physical and mental well-being. This is especially important for those with medical conditions that require extra care and support. In fact, investing in a

new mattress

can have a significant impact on

medical expenses

in the long run.

The Benefits of a Properly-Supported Mattress

A common misconception is that a

mattress

is simply a place to sleep, but its role goes far beyond that. A quality mattress can provide the necessary support for our bodies, helping to maintain proper alignment and relieve pressure on our joints. This is particularly important for individuals with medical conditions such as chronic pain, arthritis, or back problems. A

new mattress

with the right firmness and support can alleviate discomfort and improve overall sleep quality, leading to a more restful and restorative night's sleep.

A common misconception is that a

mattress

is simply a place to sleep, but its role goes far beyond that. A quality mattress can provide the necessary support for our bodies, helping to maintain proper alignment and relieve pressure on our joints. This is particularly important for individuals with medical conditions such as chronic pain, arthritis, or back problems. A

new mattress

with the right firmness and support can alleviate discomfort and improve overall sleep quality, leading to a more restful and restorative night's sleep.

The Cost-Saving Benefits of a New Mattress

While the initial cost of a

new mattress

may seem like an unnecessary expense, it can actually save you money in the long run. Medical expenses related to poor sleep, such as doctor visits, medication, and even surgery, can add up quickly. By investing in a high-quality mattress, you can potentially avoid or reduce these expenses, leading to long-term cost savings. Additionally, a

new mattress

can also improve your overall health, reducing the likelihood of other medical issues that may require expensive treatments.

While the initial cost of a

new mattress

may seem like an unnecessary expense, it can actually save you money in the long run. Medical expenses related to poor sleep, such as doctor visits, medication, and even surgery, can add up quickly. By investing in a high-quality mattress, you can potentially avoid or reduce these expenses, leading to long-term cost savings. Additionally, a

new mattress

can also improve your overall health, reducing the likelihood of other medical issues that may require expensive treatments.

Choosing the Right Mattress for Your Needs

When considering a

new mattress

for medical purposes, it is essential to choose one that is specifically designed to support your individual needs. For example, those with back pain may benefit from a firmer mattress, while those with joint pain may prefer a softer option. It is also important to consider factors such as material, size, and brand reputation. Consulting with a healthcare professional or doing thorough research can help you make an informed decision.

In conclusion, a

new mattress

can make a significant difference in

medical expenses

for individuals with specific health conditions. By providing proper support and improving sleep quality, a high-quality mattress can potentially save individuals money in the long run. So, when considering your overall health and well-being, don't underestimate the importance of investing in a

new mattress

.

When considering a

new mattress

for medical purposes, it is essential to choose one that is specifically designed to support your individual needs. For example, those with back pain may benefit from a firmer mattress, while those with joint pain may prefer a softer option. It is also important to consider factors such as material, size, and brand reputation. Consulting with a healthcare professional or doing thorough research can help you make an informed decision.

In conclusion, a

new mattress

can make a significant difference in

medical expenses

for individuals with specific health conditions. By providing proper support and improving sleep quality, a high-quality mattress can potentially save individuals money in the long run. So, when considering your overall health and well-being, don't underestimate the importance of investing in a

new mattress

.

.jpg)

/how-to-install-a-sink-drain-2718789-hero-24e898006ed94c9593a2a268b57989a3.jpg)