As tax season approaches, many people wonder what expenses they can claim on their taxes. One common question is whether or not a mattress can be claimed as a tax deduction. The answer to this question is not a simple yes or no, as it depends on the specific circumstances of the individual. In this article, we will explore the rules and regulations surrounding claiming a mattress on your taxes and provide some helpful tips to ensure you are making the most of your deductions.Can I Claim a Mattress on My Taxes?

First and foremost, it is important to understand that claiming a mattress on your taxes is not a straightforward process. In order for a mattress to be considered a tax-deductible expense, it must be deemed a medical expense. This means that the mattress must be prescribed by a doctor to treat a specific medical condition. Simply buying a new mattress for comfort or to improve your sleep will not qualify for a tax deduction.How to Claim a Mattress on Your Taxes

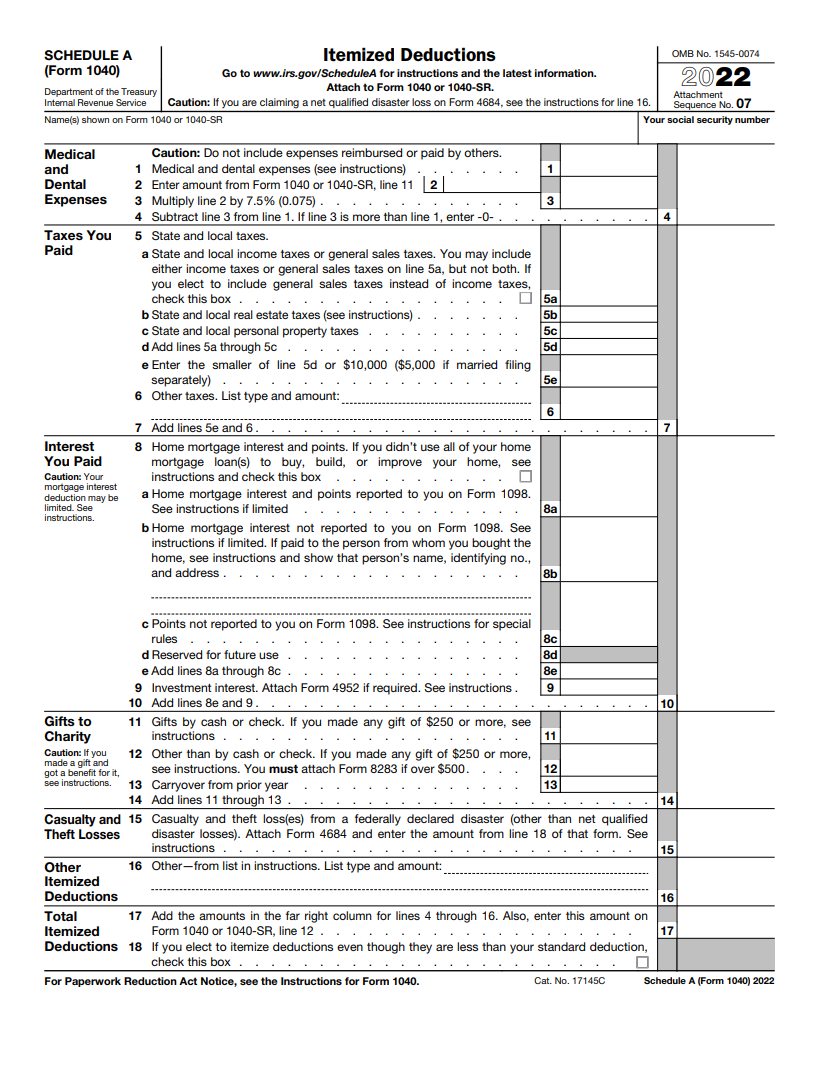

If you have a medical condition that requires a specific type of mattress, you may be able to claim it as a tax deduction. However, there are certain limitations and restrictions to be aware of. According to the Internal Revenue Service (IRS), medical expenses are tax-deductible if they exceed 7.5% of your adjusted gross income. This means that you can only claim the portion of the mattress cost that exceeds 7.5% of your income.Are Mattresses Tax Deductible?

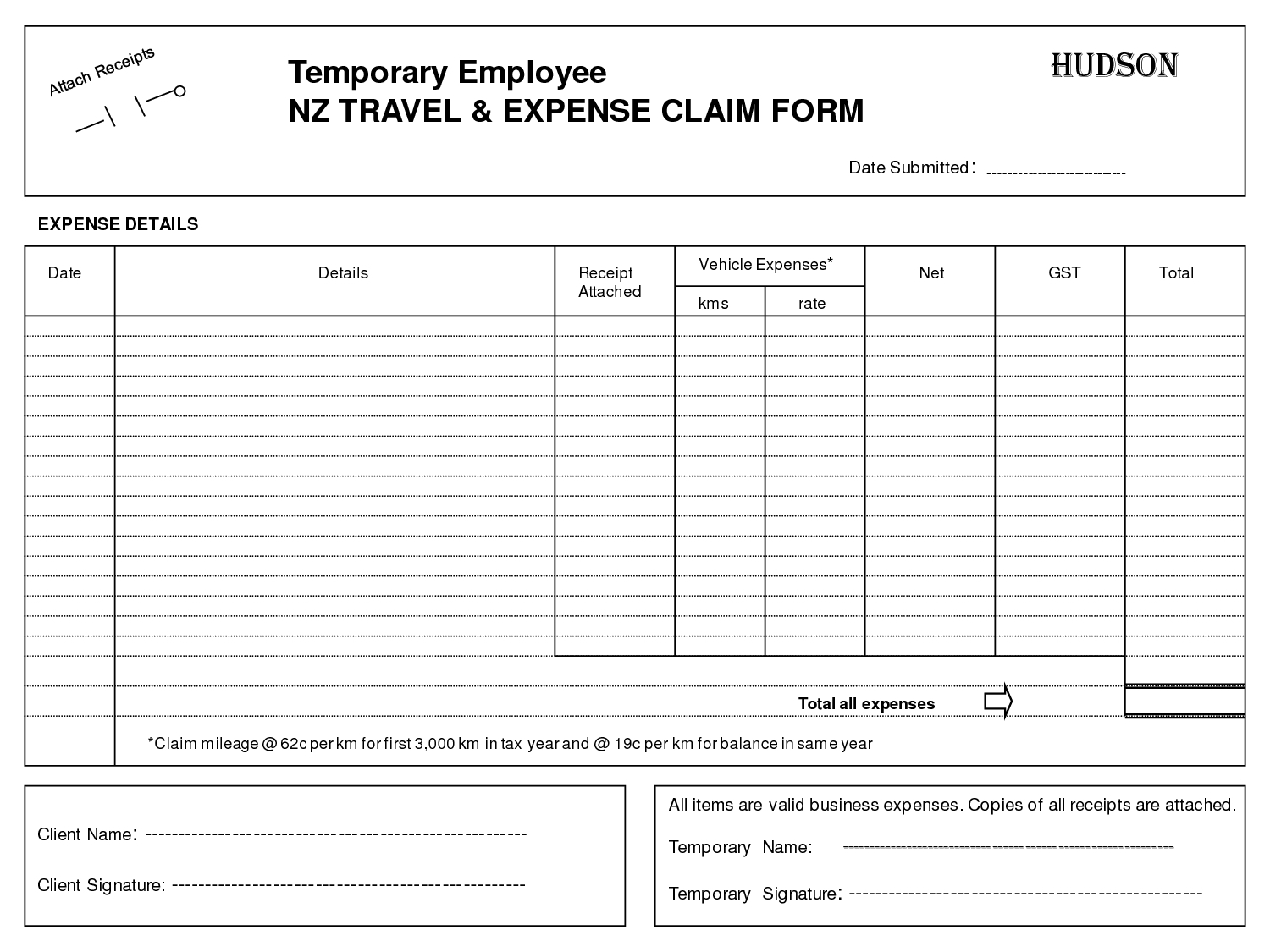

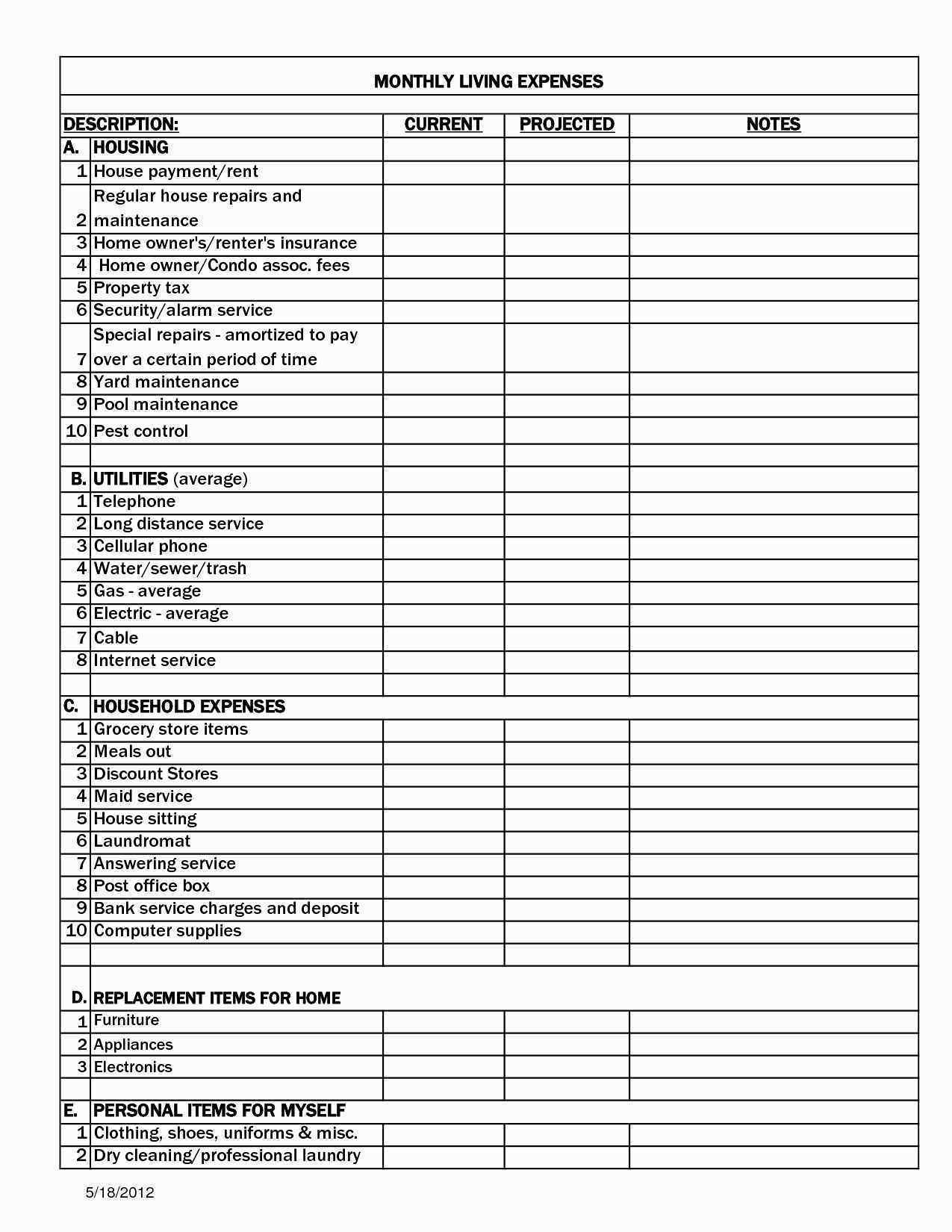

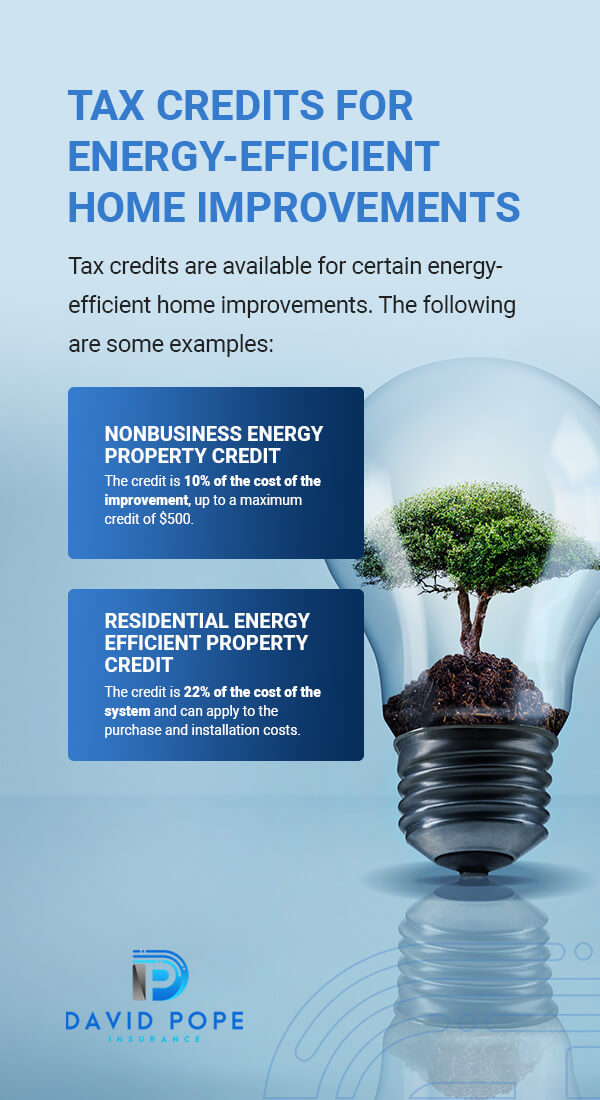

Aside from medical expenses, there are other home-related expenses that you may be able to claim on your taxes. These include home office expenses, moving expenses, and energy-efficient home improvements. However, it is important to note that claiming these expenses also comes with specific guidelines and restrictions. For example, in order to claim home office expenses, the space must be used exclusively for business purposes.What Home Expenses Can I Claim on My Taxes?

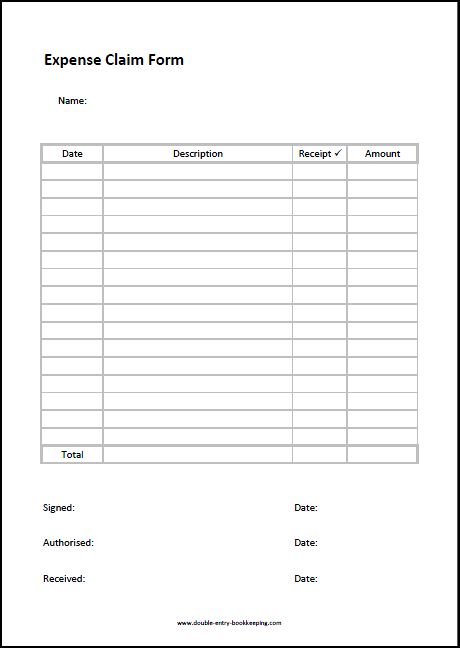

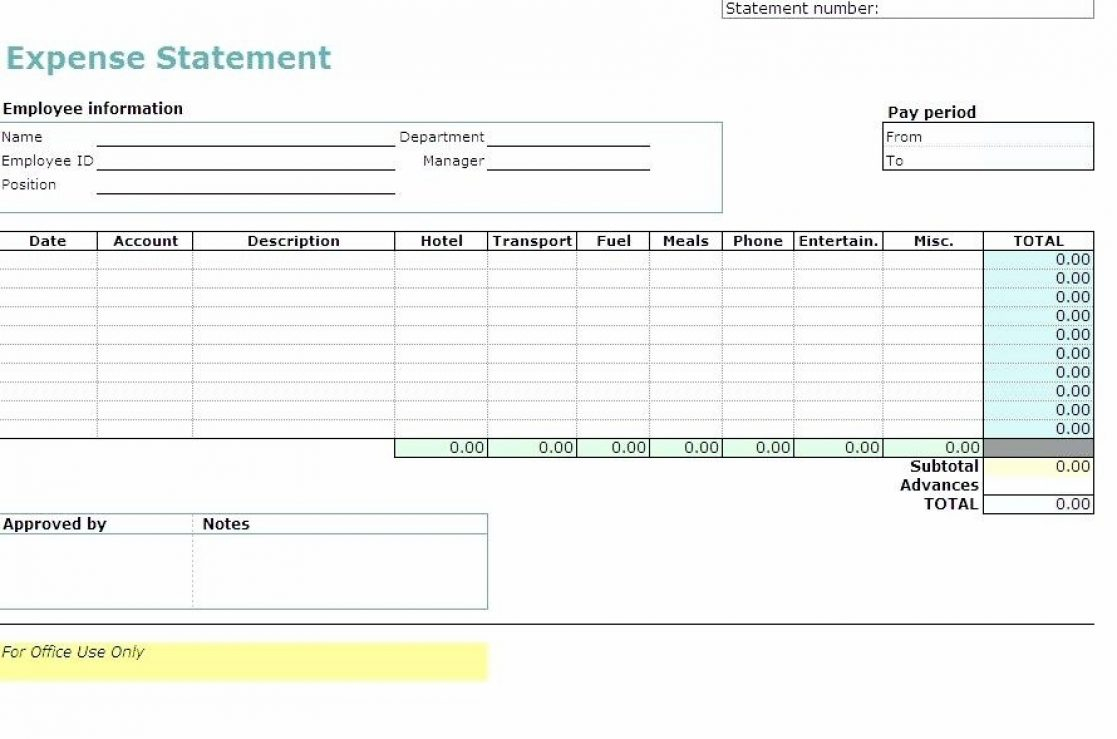

If you have determined that your mattress qualifies as a medical expense, you will need to keep detailed records in order to claim it on your taxes. This includes a written prescription from your doctor, a receipt for the mattress purchase, and any other relevant documents. It is important to keep these records organized and easily accessible for when it comes time to file your taxes.How to Claim Medical Expenses on Your Taxes

As mentioned earlier, simply purchasing a new mattress for comfort or better sleep will not qualify as a medical expense. However, if you have a medical condition such as chronic back pain or arthritis and your doctor has prescribed a specific type of mattress to help alleviate your symptoms, then you may be able to claim it on your taxes. It is always best to consult with a tax professional for specific advice regarding your individual situation.Can I Claim a New Mattress as a Medical Expense?

In addition to mattresses, there are a variety of other medical expenses that may be tax-deductible. These include prescription medication, medical equipment, doctor visits, and hospital stays. It is important to keep track of all of your medical expenses throughout the year and consult with a tax professional to determine which ones can be claimed on your taxes.What Medical Expenses are Tax Deductible?

If you work from home and have a designated home office space, you may be able to claim certain home office expenses on your taxes. This can include a portion of your rent or mortgage, utilities, and office supplies. However, as mentioned earlier, the space must be used exclusively for business purposes in order to claim these expenses.How to Claim Home Office Expenses on Your Taxes

If you are self-employed and use furniture for your business, you may be able to claim it as a business expense. This can include items such as a desk, chair, or filing cabinet. However, the same rules apply as with home office expenses – the furniture must be used exclusively for business purposes in order to be claimed on your taxes.Can I Claim Furniture as a Business Expense?

Another way to potentially save on your taxes is by making energy-efficient home improvements. This can include things like installing solar panels, upgrading to energy-efficient windows, or installing a programmable thermostat. These improvements can not only save you money on your energy bills, but they may also qualify for tax deductions. It is important to keep all receipts and documents related to these improvements in order to claim them on your taxes. In conclusion, while mattresses may not be directly tax-deductible, they can be claimed as a medical expense if prescribed by a doctor. It is important to keep detailed records and consult with a tax professional to ensure you are making the most of your deductions. Additionally, there are other home-related expenses that may be tax-deductible, such as home office expenses and energy-efficient home improvements. By staying organized and knowledgeable about the rules and regulations surrounding tax deductions, you can potentially save money on your taxes and improve your financial well-being. What Home Improvements are Tax Deductible?

Can Mattresses be Claimed on Taxes: A Guide to Tax Deductions for Homeowners

As a homeowner, it's important to take advantage of every tax deduction available to you. After all, owning a home comes with its fair share of expenses, from mortgage payments to maintenance costs. So when it comes to filing your taxes, it's only natural to wonder if your mattress can be included as a deductible expense. The short answer is yes, but there are certain criteria that must be met. In this article, we'll dive into the details and explore whether or not mattresses can be claimed on taxes.

What is a Tax Deduction?

A tax deduction is an expense that can be subtracted from your taxable income, reducing the amount of taxes you owe to the government. This can include expenses related to your home, like mortgage interest, property taxes, and even home improvements. Essentially, a tax deduction helps to decrease your overall tax bill, making it a valuable tool for homeowners.

Can Mattresses be Claimed on Taxes?

The short answer is yes, mattresses can be claimed on taxes, but only under certain circumstances. The Internal Revenue Service (IRS) allows for a tax deduction on medical expenses, including the purchase of a new mattress, if the expense exceeds 7.5% of your adjusted gross income (AGI). This means that if your AGI is $50,000, you can deduct medical expenses that exceed $3,750.

However, there are a few important details to keep in mind. First, the mattress must be deemed medically necessary by a licensed physician. This means that if you have a specific medical condition that requires a special type of mattress, you may be able to claim it on your taxes. Additionally, the mattress cannot be purchased for general comfort or convenience, it must be directly related to a medical condition.

Other Tax Deductions for Homeowners

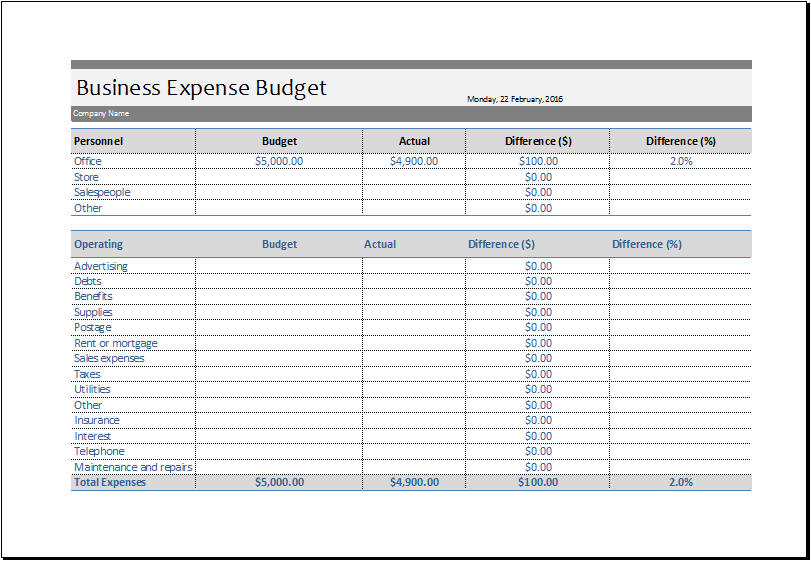

While claiming a mattress as a tax deduction may not be the most common scenario, there are plenty of other deductions that homeowners can take advantage of. Some of the most common include:

- Mortgage Interest Deduction: This allows homeowners to deduct the interest paid on their mortgage loans.

- Property Tax Deduction: Homeowners can deduct their property taxes, up to a certain limit, from their taxable income.

- Energy-Efficient Home Improvement Deductions: If you've made energy-efficient upgrades to your home, such as installing solar panels, you may be eligible for a tax deduction.

In Conclusion

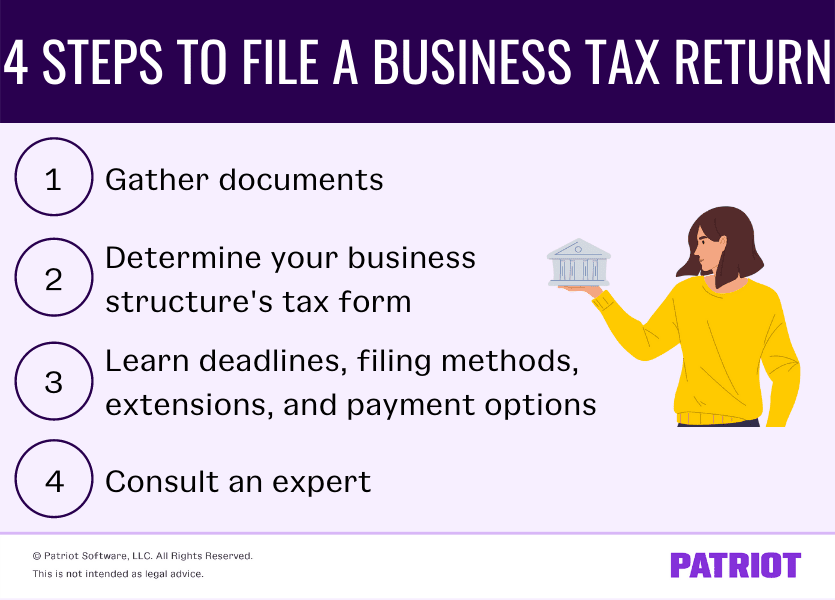

While mattresses can be claimed on taxes under certain circumstances, it's always best to consult with a tax professional before filing your taxes. They can help you determine if your mattress purchase qualifies for a deduction and what other deductions you may be eligible for as a homeowner. By taking advantage of all available deductions, you can potentially save a significant amount of money on your taxes. So don't be afraid to explore your options and make the most of your homeowner status.

HTML Code:

Can Mattresses be Claimed on Taxes: A Guide to Tax Deductions for Homeowners

As a homeowner, it's important to take advantage of every tax deduction available to you. After all, owning a home comes with its fair share of expenses, from mortgage payments to maintenance costs. So when it comes to filing your taxes, it's only natural to wonder if your mattress can be included as a deductible expense. The short answer is yes, but there are certain criteria that must be met. In this article, we'll dive into the details and explore whether or not mattresses can be claimed on taxes.

What is a Tax Deduction?

A tax deduction is an expense that can be subtracted from your taxable income, reducing the amount of taxes you owe to the government. This can include expenses related to your home, like mortgage interest, property taxes, and even home improvements. Essentially, a tax deduction helps to decrease your overall tax bill, making it a valuable tool for homeowners.

Can Mattresses be Claimed on Taxes?

The short answer is yes, mattresses can be claimed on taxes, but only under certain circumstances. The Internal Revenue Service (IRS) allows for a tax deduction on medical expenses, including the purchase of a new mattress , if the expense exceeds 7.5% of

/cloudfront-us-east-1.images.arcpublishing.com/tgam/2WIGDUKVNNHP3L5I7W4VQHT6SE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ORHPAY7LOZFBJL3FMRDCGN4X4A.jpg)

/filters:quality(60)/2020-02-07-Are-Home-Improvements-Tax-Deductible-CDN.png)