Are you a business owner looking to upgrade your kitchen with a new sink? You may be in luck. Under Section 179 of the Internal Revenue Code, businesses can deduct the full cost of certain types of property, including kitchen sinks, in the year they are placed in service. This can provide significant tax savings for small businesses. Let’s dive into the details of how the Section 179 deduction works and how it can benefit your business.1. Section 179 Deduction for Business Property | Internal Revenue Service

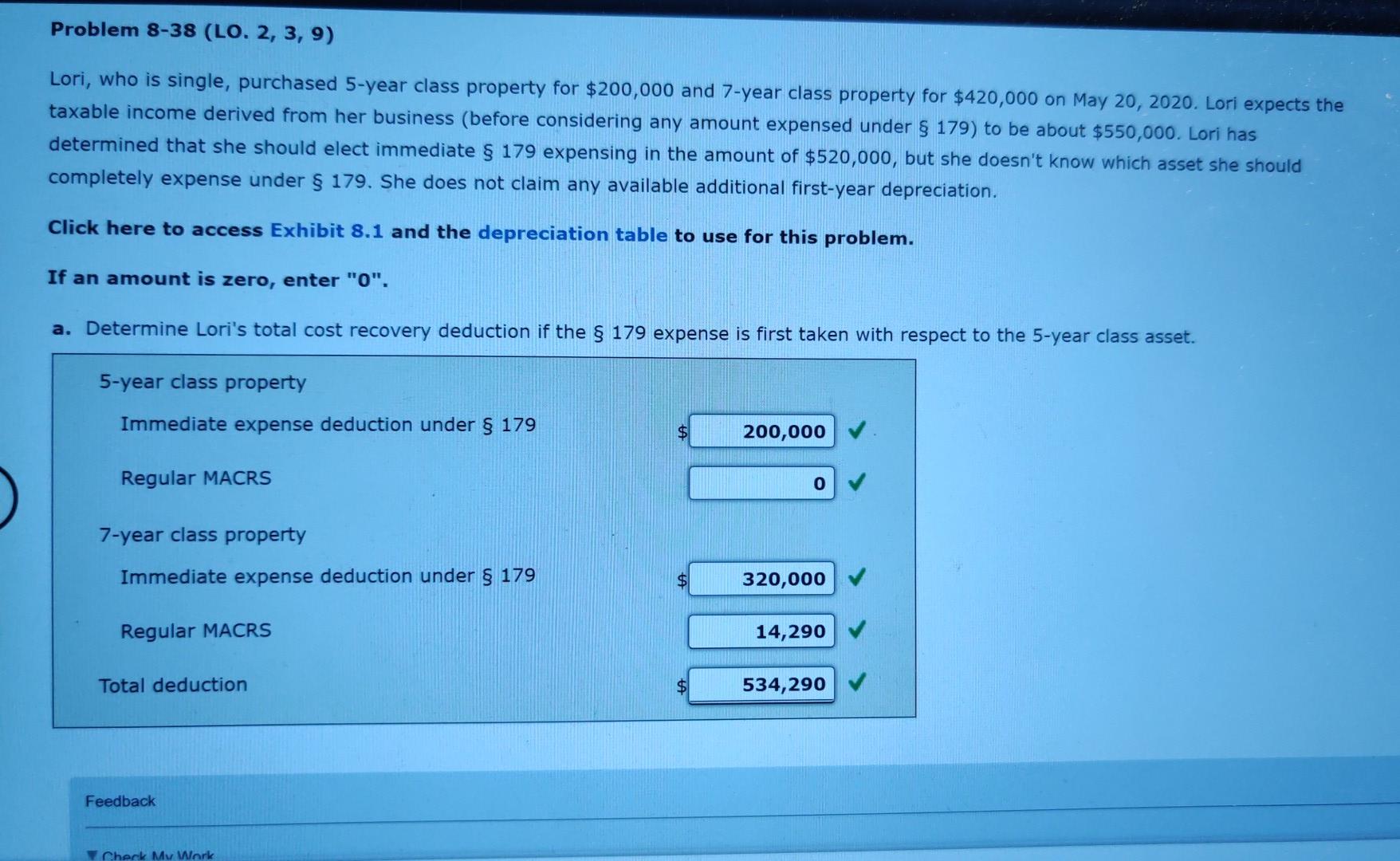

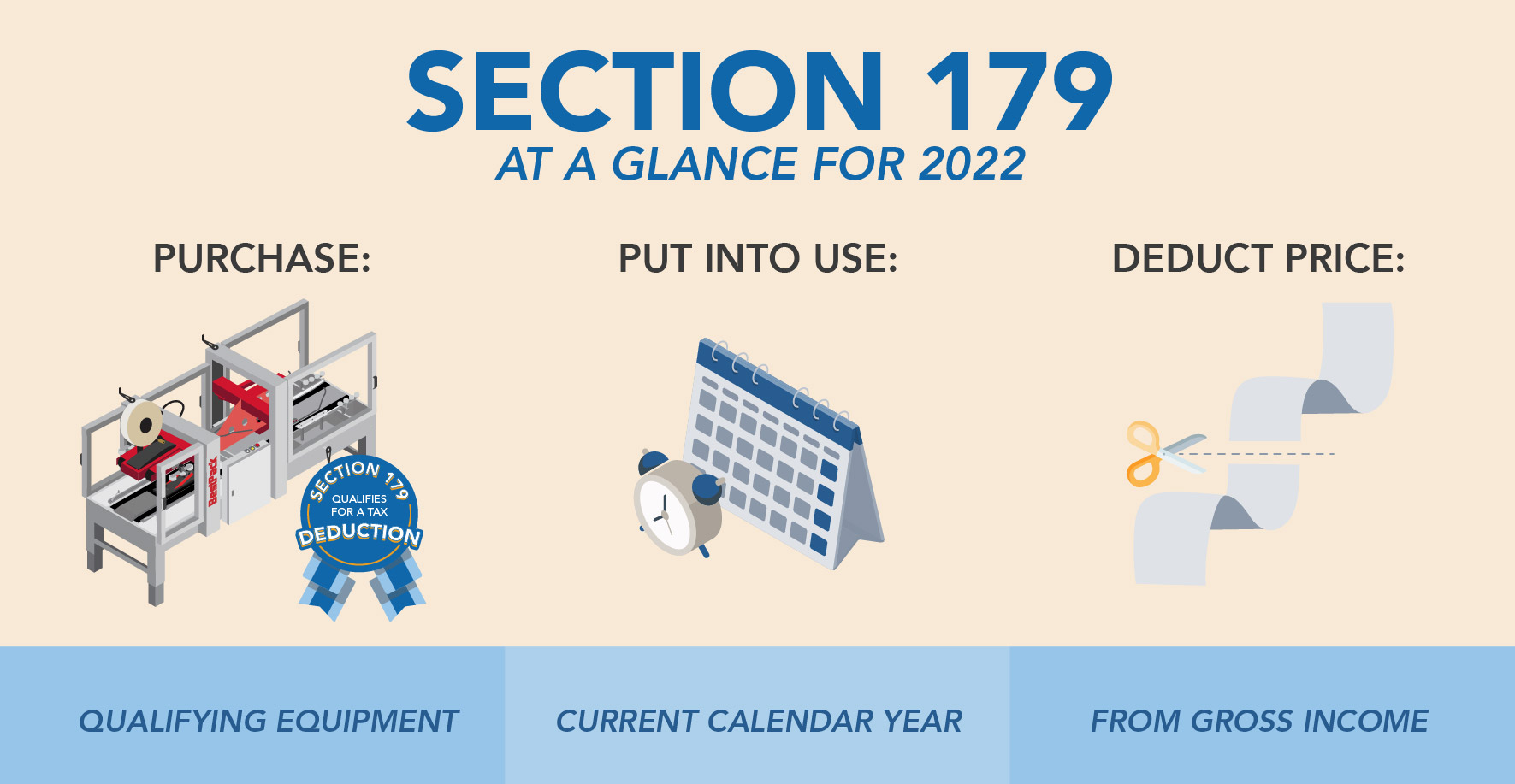

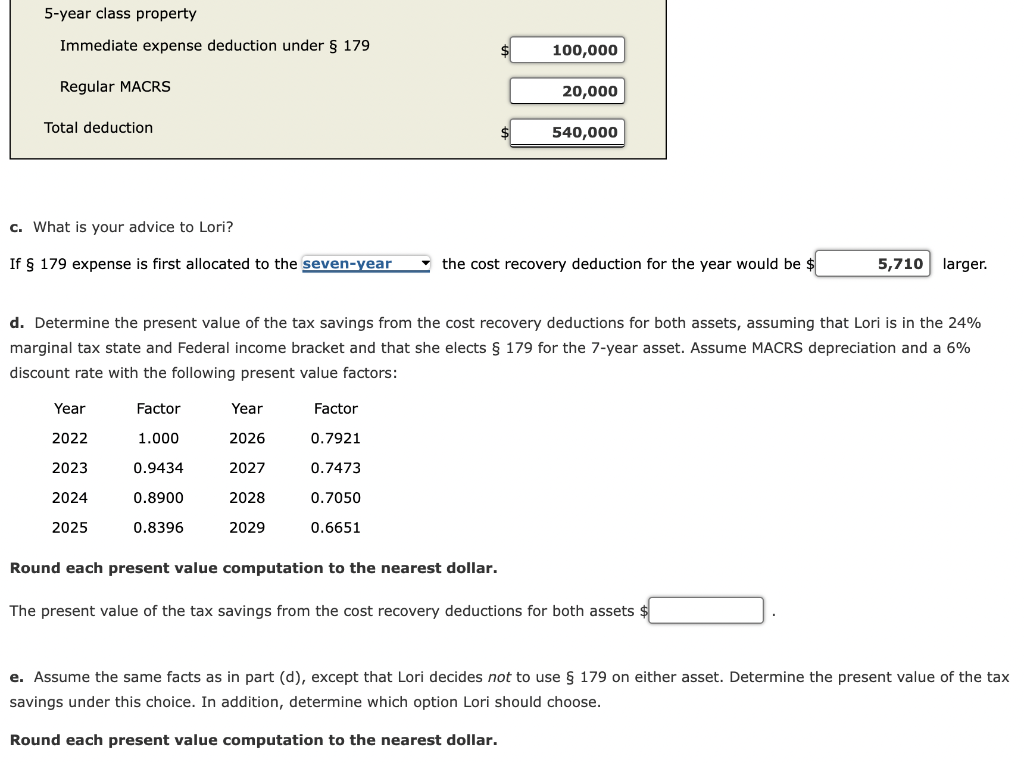

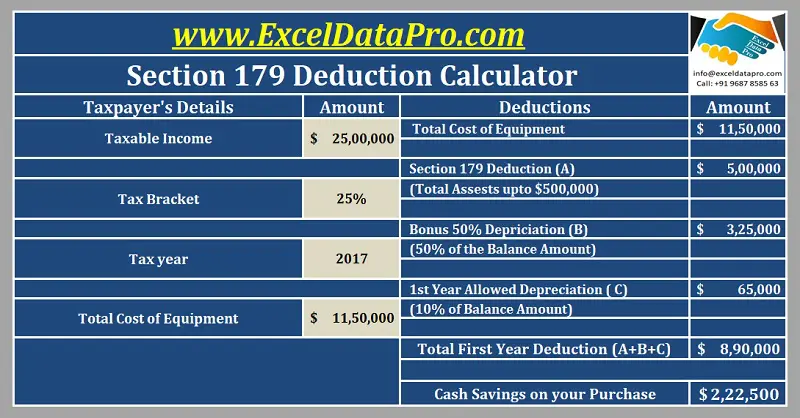

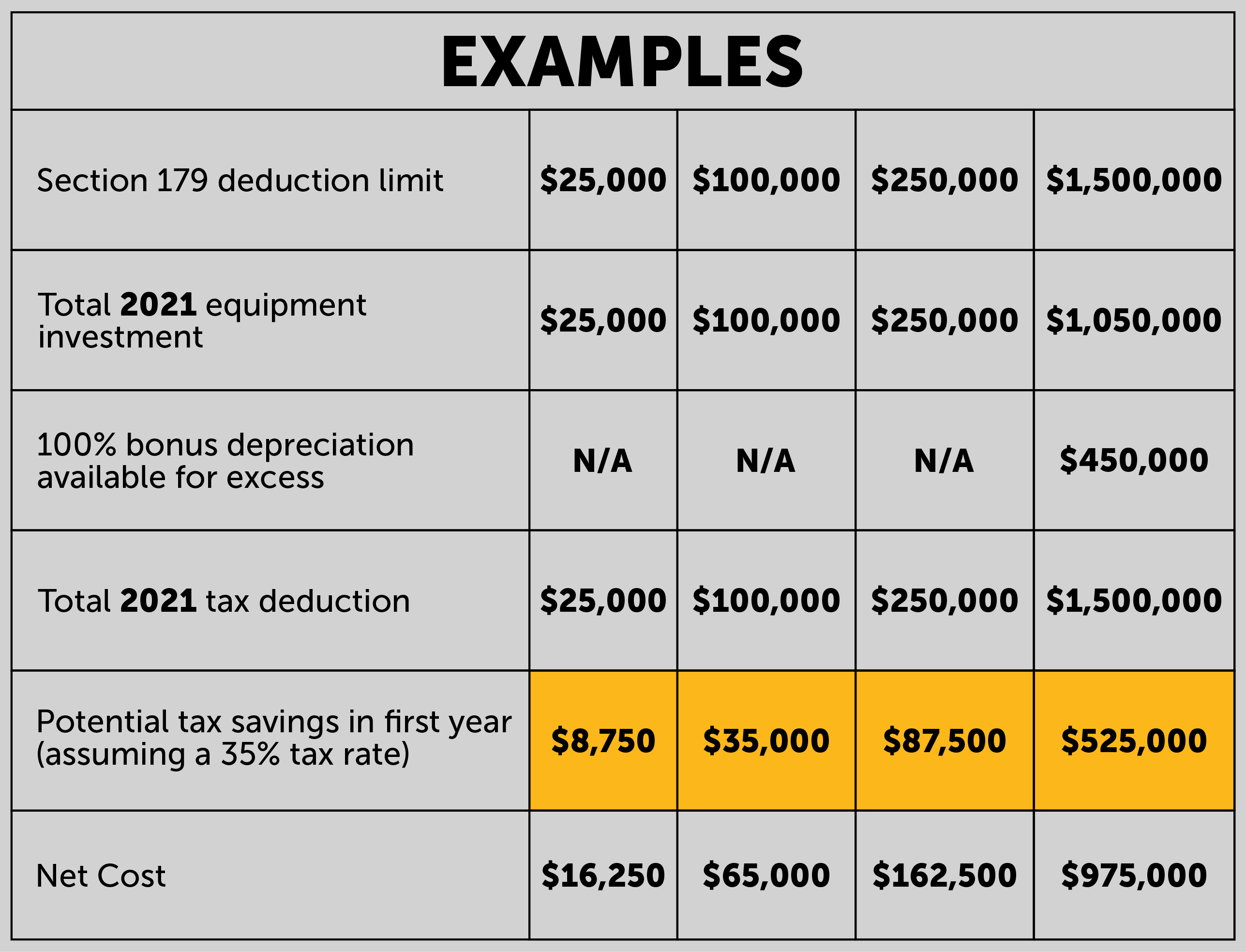

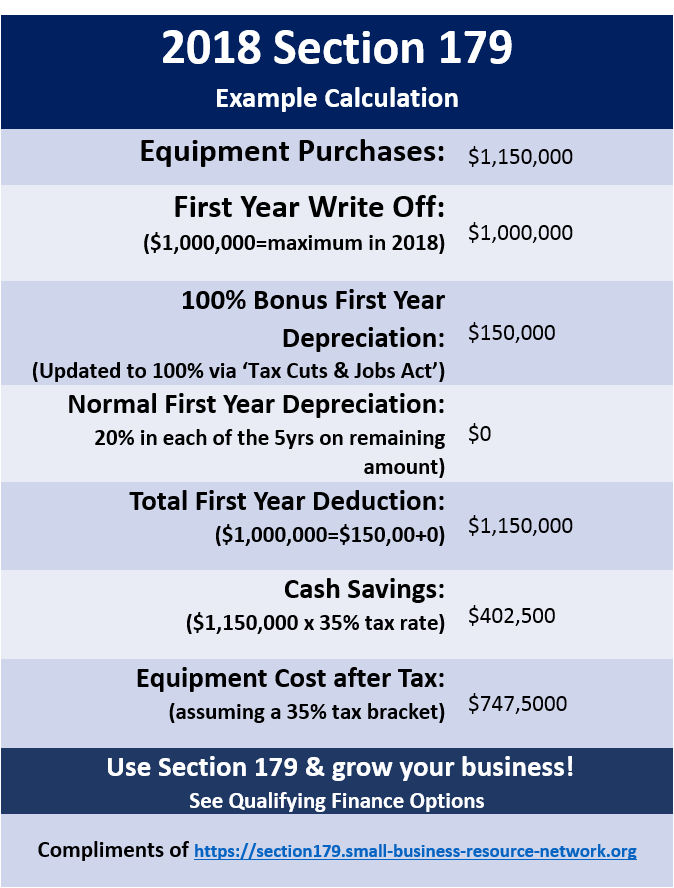

The Section 179 deduction is a tax benefit that allows businesses to deduct the full cost of certain types of property in the year they are purchased and placed in service, rather than having to depreciate the cost over several years. This deduction was created to incentivize businesses to invest in equipment and other assets, stimulating economic growth. Kitchen sinks are considered eligible property under Section 179, making them a valuable deduction for businesses.2. What is the Section 179 Deduction? | Section179.Org

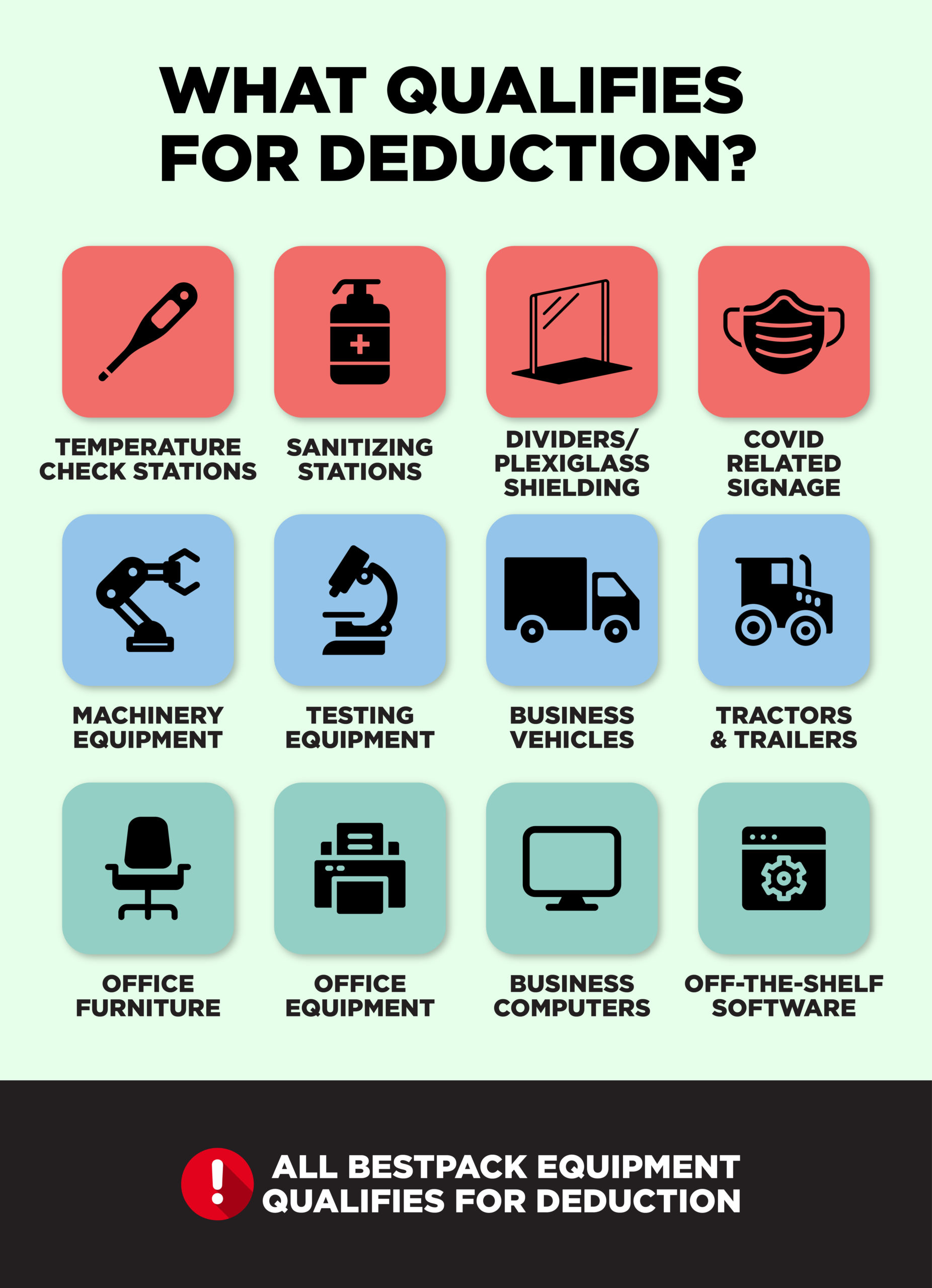

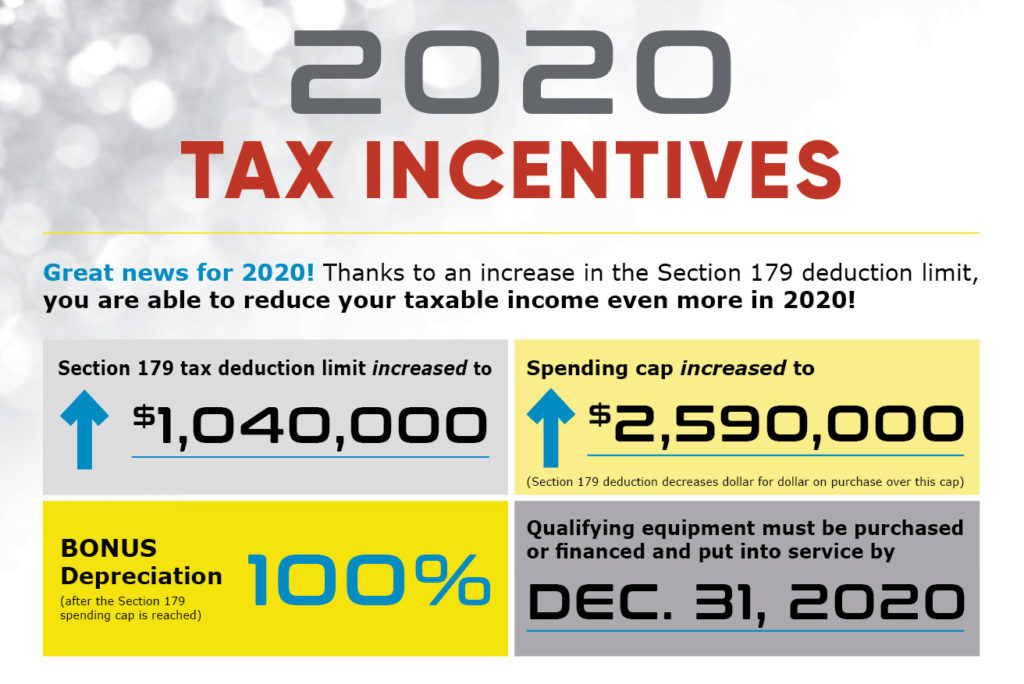

Under Section 179, businesses can deduct up to $1 million in qualifying property in a given tax year. This includes tangible personal property, such as machinery, equipment, and furniture, as well as certain improvements to nonresidential real property, such as roofs, heating and cooling systems, and, you guessed it, kitchen sinks. The deduction is limited to the amount of income from the business, so it cannot create a tax loss.3. Section 179 Tax Deduction for Business Property | Nolo

One of the main benefits of the Section 179 deduction is the ability to deduct the full cost of the property in the year it is purchased, rather than having to spread out the deduction over several years. This can provide significant tax savings for businesses, especially those with high equipment costs. For example, if a business purchases a new sink for their kitchen for $10,000, they can deduct the full $10,000 in that tax year, rather than having to depreciate it over several years.4. Section 179 Deduction: What You Need to Know | Bench

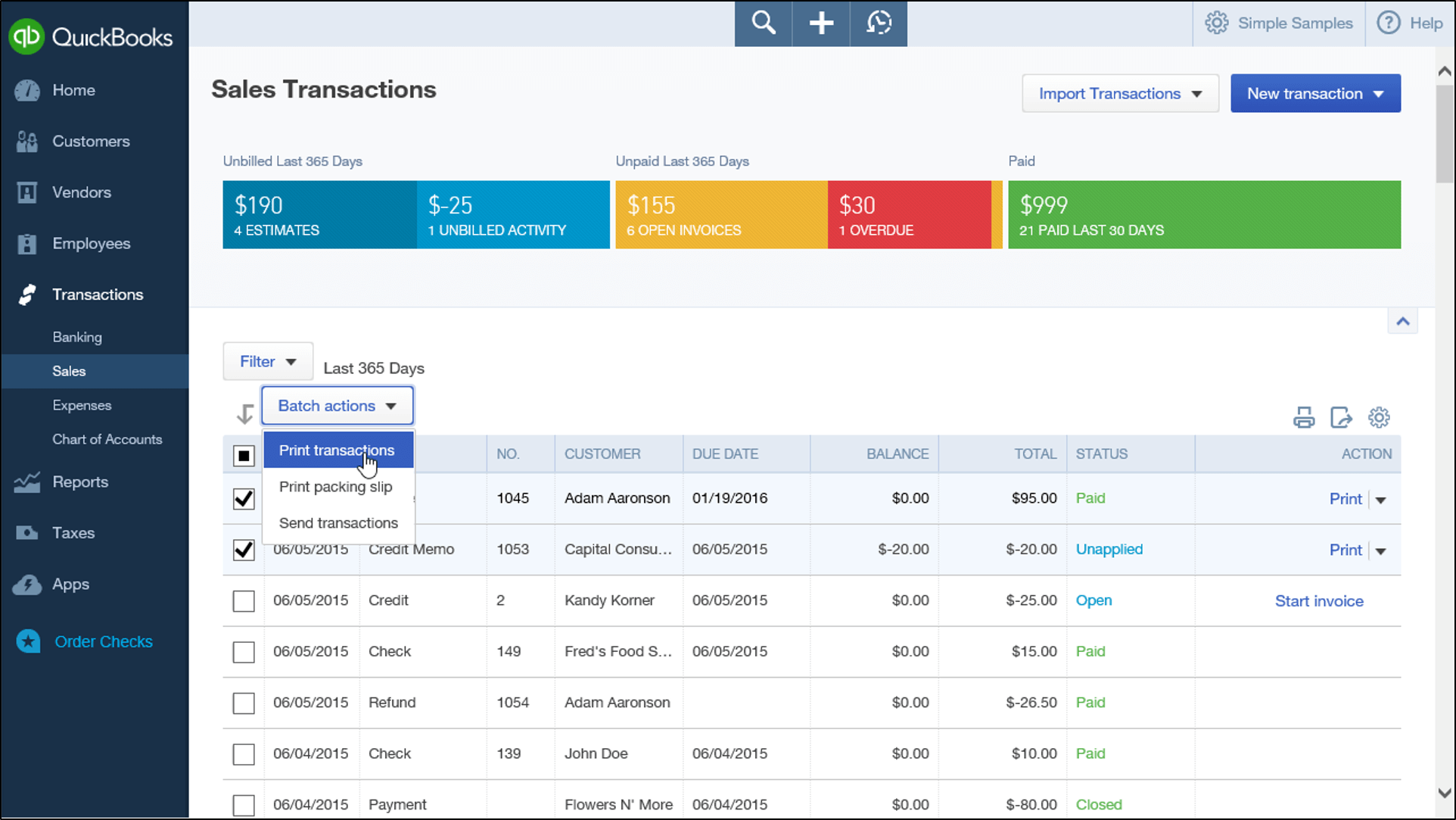

It’s important to note that not all property is eligible for the Section 179 deduction. There are specific rules and limitations that must be followed in order for a property to qualify. For example, the property must be used for business purposes at least 50% of the time, and it must be purchased and placed in service in the same tax year. It’s important to consult with a tax professional to ensure your business is eligible for the deduction and to properly claim it on your tax return.5. Section 179 Deduction: Everything You Need to Know | QuickBooks

In addition to the $1 million limit on the deduction, there is also a phase-out threshold of $2.5 million. This means that if a business purchases more than $2.5 million in qualifying property in a given tax year, the deduction will be reduced dollar for dollar for every dollar over the threshold. For example, if a business purchases $3 million in qualifying property, the Section 179 deduction would be reduced by $500,000, resulting in a deduction of $500,000 instead of $1 million.6. Section 179 Deduction: What It Is and How It Works | The Balance Small Business

Another important aspect to keep in mind is that the Section 179 deduction cannot create a tax loss for the business. If the deduction would result in a loss, it must be carried forward to future tax years. Additionally, the property must be used for business purposes for the entire deduction period. If the property is no longer used for business purposes, the deduction must be recaptured and added back to the business’s taxable income.7. Section 179 Deduction: A Complete Guide for Small Businesses | Fundera

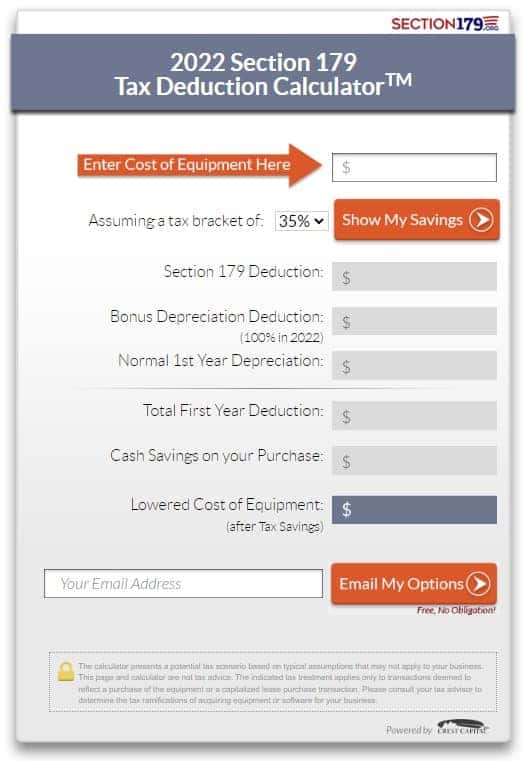

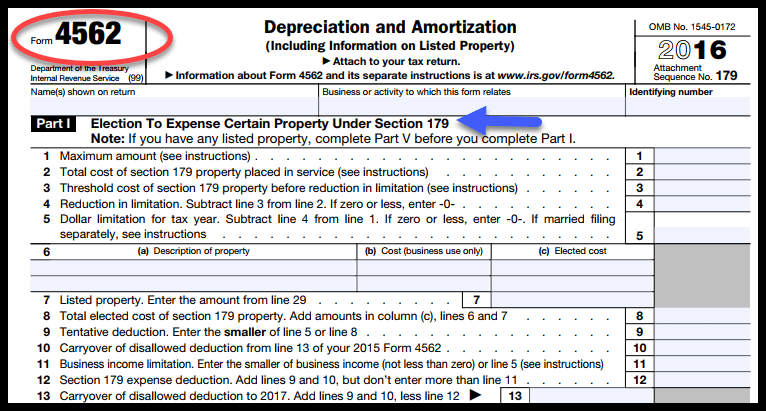

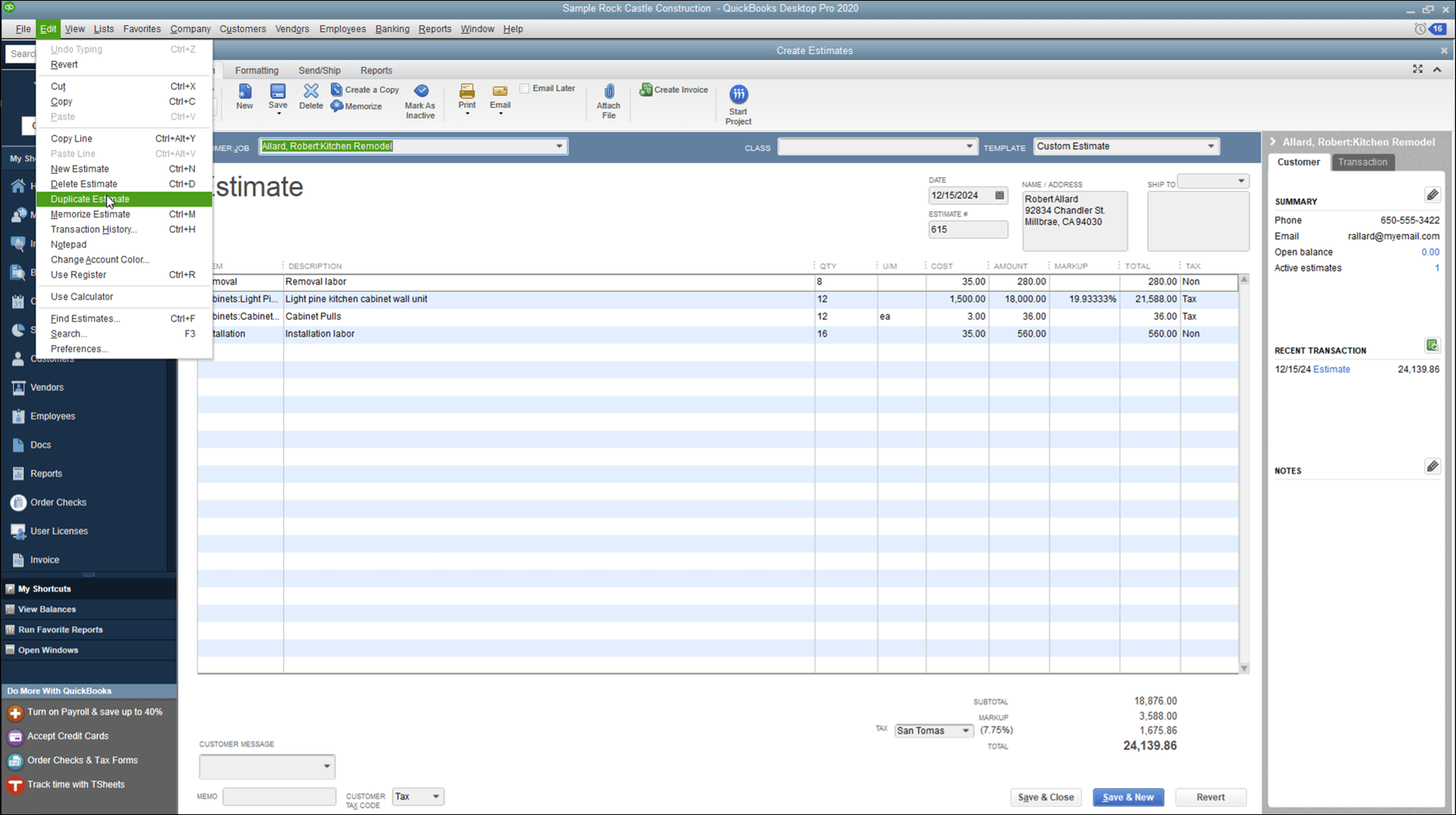

To claim the Section 179 deduction, businesses must file Form 4562 with their tax return. This form details the property purchased and placed in service during the tax year and calculates the deduction. It’s important to keep accurate records of any eligible property purchased and the date it was placed in service to properly claim the deduction.8. Section 179 Deduction: How to Qualify and Claim It | Nav

In addition to the Section 179 deduction, businesses may also be eligible for bonus depreciation, which allows them to deduct 100% of the cost of qualified property in the first year it is placed in service. Bonus depreciation is only available for new property, while the Section 179 deduction can be claimed for new or used property. Businesses can choose which deduction to take, or they may be required to take bonus depreciation if they have a tax loss.9. Section 179 Deduction: What You Need to Know for Your Business Taxes | Forbes

In conclusion, the Section 179 deduction can provide significant tax savings for businesses looking to upgrade their kitchen with a new sink. By allowing businesses to deduct the full cost of certain types of property in the year they are placed in service, the deduction incentivizes businesses to invest in equipment and assets, stimulating economic growth. If you’re a business owner looking to take advantage of this deduction, be sure to consult with a tax professional to ensure you qualify and properly claim it on your tax return.10. Section 179 Deduction: What It Is and How to Use It | Investopedia

Maximizing Your Kitchen Design: The Importance of Including a New Sink Under Section 179

Why a New Sink is Crucial in Kitchen Design

When it comes to designing your dream kitchen, it's important to consider all aspects of functionality and aesthetics. While many homeowners focus on elements such as countertops, cabinets, and appliances, one often overlooked but crucial component is the sink. Not only is the sink a central point for food preparation and clean-up in the kitchen, but it also plays a significant role in the overall design and flow of the space. That's why it's essential to consider including a new sink in your kitchen design, and taking advantage of the available tax benefits under Section 179.

When it comes to designing your dream kitchen, it's important to consider all aspects of functionality and aesthetics. While many homeowners focus on elements such as countertops, cabinets, and appliances, one often overlooked but crucial component is the sink. Not only is the sink a central point for food preparation and clean-up in the kitchen, but it also plays a significant role in the overall design and flow of the space. That's why it's essential to consider including a new sink in your kitchen design, and taking advantage of the available tax benefits under Section 179.

The Benefits of Adding a New Sink Under Section 179

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19495086/drain_0.jpg) Section 179 of the tax code allows businesses to deduct the full cost of qualifying equipment or software from their taxes, up to a certain limit. This also applies to homeowners who are making improvements to their primary residence. This means that if you are considering adding a new sink to your kitchen design, you may be able to deduct the full cost from your taxes, making it a more affordable and realistic option.

Additionally, adding a new sink to your kitchen design can provide a variety of benefits. For one, it can greatly improve the functionality and efficiency of your kitchen. With a larger or more strategically placed sink, you can make food preparation and clean-up easier and more streamlined. A new sink can also enhance the overall design of your kitchen, adding a modern and updated look that can increase the value of your home.

Section 179 of the tax code allows businesses to deduct the full cost of qualifying equipment or software from their taxes, up to a certain limit. This also applies to homeowners who are making improvements to their primary residence. This means that if you are considering adding a new sink to your kitchen design, you may be able to deduct the full cost from your taxes, making it a more affordable and realistic option.

Additionally, adding a new sink to your kitchen design can provide a variety of benefits. For one, it can greatly improve the functionality and efficiency of your kitchen. With a larger or more strategically placed sink, you can make food preparation and clean-up easier and more streamlined. A new sink can also enhance the overall design of your kitchen, adding a modern and updated look that can increase the value of your home.

Considerations for Choosing the Right Sink

When it comes to choosing a new sink for your kitchen design, there are a few important factors to consider. First, think about the size and shape of your kitchen and how the sink will fit into the space. You'll also want to consider the material and style of the sink, as well as any additional features such as a built-in cutting board or garbage disposal. It's also important to ensure that the sink you choose is compatible with your plumbing system.

In conclusion, while it may not be the most glamorous aspect of kitchen design, the sink is an essential component that should not be overlooked. By taking advantage of the tax benefits under Section 179, you can make adding a new sink to your kitchen more affordable and beneficial. So when planning your dream kitchen, be sure to include a new sink in your design for maximum functionality and aesthetic appeal.

When it comes to choosing a new sink for your kitchen design, there are a few important factors to consider. First, think about the size and shape of your kitchen and how the sink will fit into the space. You'll also want to consider the material and style of the sink, as well as any additional features such as a built-in cutting board or garbage disposal. It's also important to ensure that the sink you choose is compatible with your plumbing system.

In conclusion, while it may not be the most glamorous aspect of kitchen design, the sink is an essential component that should not be overlooked. By taking advantage of the tax benefits under Section 179, you can make adding a new sink to your kitchen more affordable and beneficial. So when planning your dream kitchen, be sure to include a new sink in your design for maximum functionality and aesthetic appeal.