If you're in the market for a new mattress, you've probably come across the option of financing your purchase through Affirm. But is it worth it? Let's take a closer look at what Affirm financing has to offer. With Affirm, you have the option to pay for your mattress purchase in installments, rather than all at once. This can be a great option for those who may not have the funds upfront, but still want to invest in a high-quality mattress. One of the main benefits of using Affirm financing is the flexibility it offers. Instead of being tied down to one lump sum payment, you can choose to spread out your payments over a period of time that works for you. This can help make a larger purchase more manageable and budget-friendly. However, it's important to keep in mind that financing does come with interest rates and fees. So, while it may seem like a more affordable option at first, you may end up paying more in the long run. Ultimately, whether or not Affirm financing is worth it depends on your personal financial situation and priorities. If you value flexibility and don't mind paying a little extra in interest, then Affirm financing may be a good option for you.1. Affirm Financing Reviews: Is It Worth It?

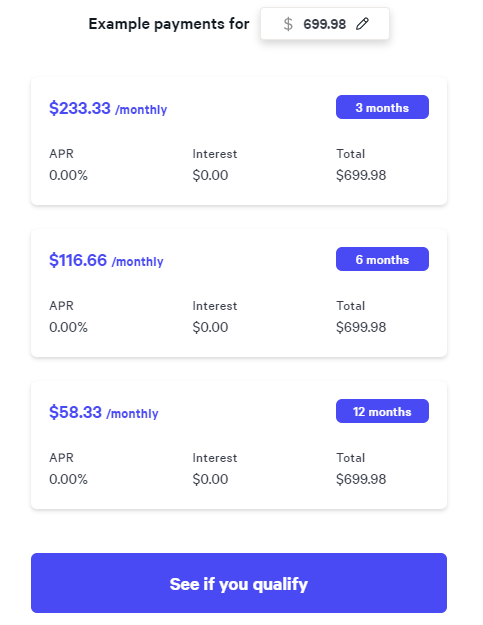

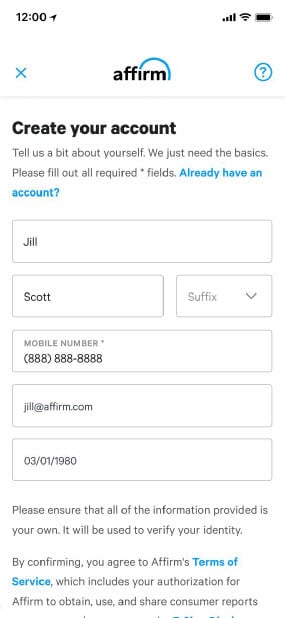

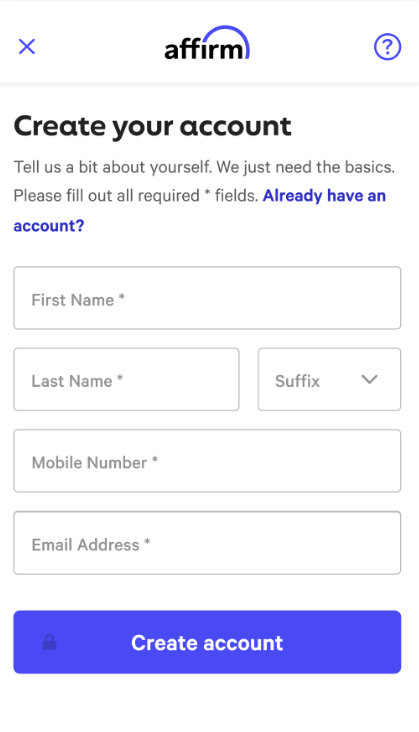

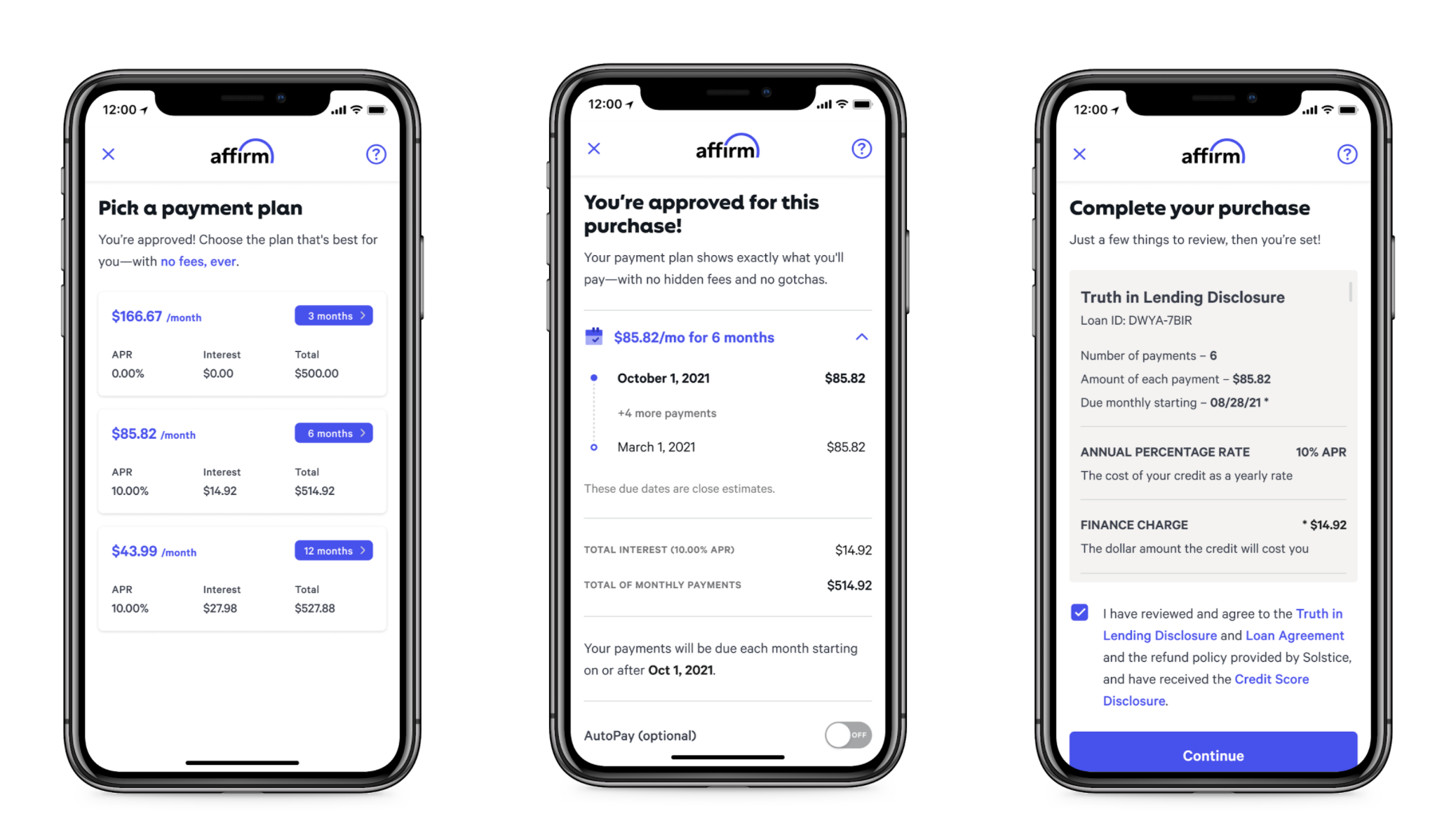

Before diving into Affirm financing, it's important to understand how it works and what you need to know before making a purchase. Affirm offers loans for online purchases, with the option to pay in fixed monthly installments. These loans typically have a term of 3, 6, or 12 months, with interest rates ranging from 10% to 30% APR. This means that if you choose to finance your mattress purchase through Affirm, you will end up paying more than the original purchase price due to interest. To apply for Affirm financing, you will need to provide personal information such as your name, address, and social security number. You will also need to link a bank account or credit/debit card for payments. It's important to carefully review the terms and conditions of your loan, including the interest rate and fees, before committing to Affirm financing. Make sure you are comfortable with the added cost and that you have a clear understanding of how much you will be paying each month.2. Affirm Financing: What You Need to Know

Like any financing option, there are both pros and cons to using Affirm for your mattress purchase. On the pro side, Affirm offers flexibility in payment options and can make a large purchase more manageable. It also doesn't require a hard credit check, so it won't negatively impact your credit score. However, as mentioned before, there are interest rates and fees associated with Affirm financing, so you will end up paying more for your purchase in the long run. Additionally, not all mattress retailers offer Affirm as a financing option, so your selection may be limited. Ultimately, it's important to weigh the pros and cons and consider your personal financial situation before deciding if Affirm financing is the right choice for you.3. Affirm Financing: Pros and Cons

One of the best ways to gauge the effectiveness of a financing option is to look at customer reviews. So, what are people saying about Affirm financing? Many customers appreciate the flexibility and convenience of Affirm, especially when making large purchases. However, some have expressed frustration with the interest rates and fees, and have found the repayment process to be confusing. It's important to keep in mind that customer experiences may vary and it's always a good idea to read through reviews and do your own research before making a decision.4. Affirm Financing: Customer Reviews

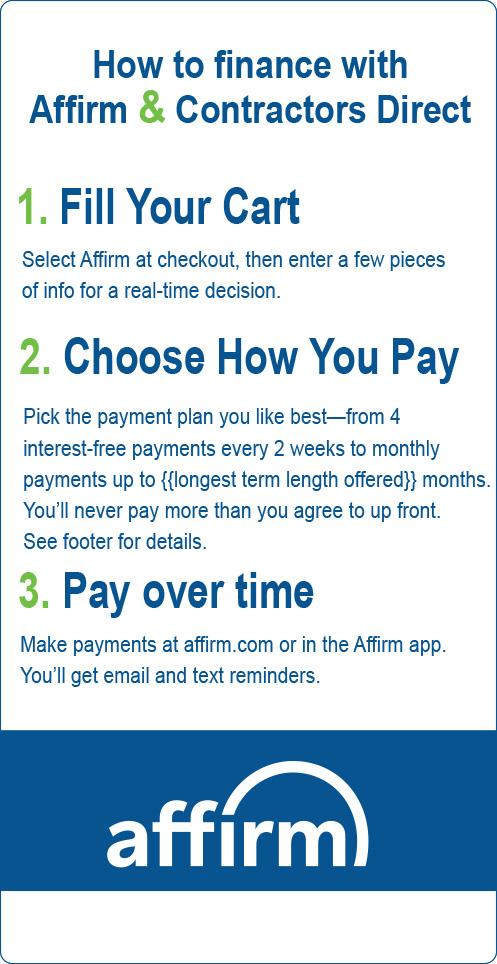

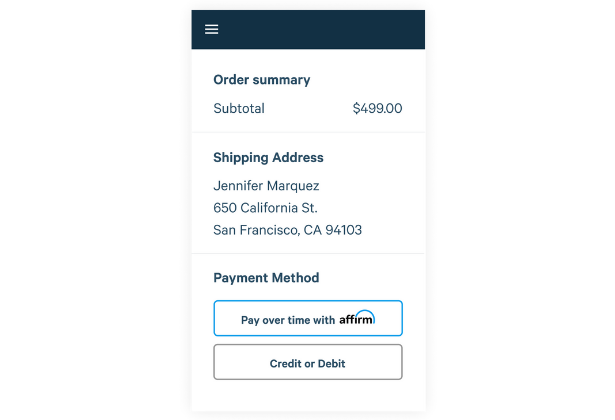

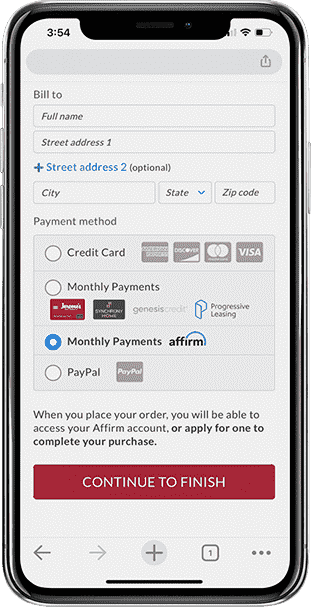

So, how exactly does Affirm financing work? First, you will need to select Affirm as your payment option at checkout when making a mattress purchase. You will then be prompted to enter your personal information and link a bank account or credit/debit card for payments. If approved, you will receive a loan offer with the terms and conditions. If you agree to the offer, the loan will be processed and you can start making payments according to the agreed-upon schedule. It's important to make your payments on time to avoid late fees and potentially negatively impacting your credit score.5. Affirm Financing: How It Works

With any type of financing, safety and security are important factors to consider. So, is Affirm financing safe? Affirm uses industry-standard encryption and security measures to protect your personal information. They also offer a zero fraud liability policy, meaning you won't be held responsible for unauthorized charges on your account. However, it's always a good idea to monitor your account and report any suspicious activity immediately.6. Affirm Financing: Is It Safe?

If you've decided that Affirm financing is the right choice for you, the application process is simple. First, make sure the mattress retailer you are purchasing from offers Affirm as a financing option. Then, select Affirm as your payment option at checkout and follow the prompts to enter your personal information and link a bank account or credit/debit card. You will receive an instant decision on your loan application and if approved, you can start making payments according to the agreed-upon schedule.7. Affirm Financing: How to Apply

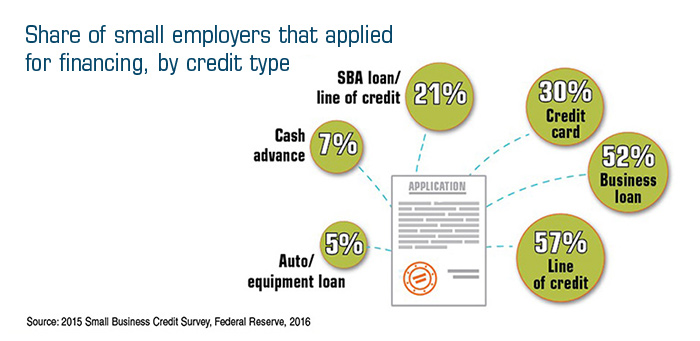

While Affirm financing may be a popular option, it's not the only one available. There are several alternatives to consider when it comes to financing your mattress purchase. One option is to look for retailers that offer in-house financing. These typically have lower interest rates and fees, but may require a credit check and have stricter approval requirements. You could also consider using a credit card with a 0% introductory APR offer. This can be a great option if you are able to pay off the balance within the promotional period, otherwise, you may end up paying high interest rates. It's important to carefully research and compare all of your options before making a decision.8. Affirm Financing: Alternatives to Consider

Still have questions about Affirm financing? Here are some frequently asked questions to help clear things up. Q: Does Affirm financing require a credit check? A: No, Affirm does not require a hard credit check, but they may perform a soft credit check which does not impact your credit score. Q: What happens if I miss a payment? A: If you miss a payment, you may be subject to late fees and your credit score may be impacted. Q: Can I pay off my loan early? A: Yes, you can pay off your loan early without any prepayment fees. Q: Can I use Affirm financing for any mattress purchase? A: No, not all retailers accept Affirm as a financing option.9. Affirm Financing: Frequently Asked Questions

If you've decided to use Affirm financing for your mattress purchase, here are some tips to help you use it wisely. First, make sure you understand the terms and conditions of your loan before agreeing to it. This includes the interest rate, fees, and payment schedule. Next, make sure you can afford the monthly payments and budget accordingly. Missing payments can result in fees and may negatively impact your credit score. It's also a good idea to compare the total cost of financing with the cost of paying upfront. If the added interest is significantly higher, you may want to consider alternative financing options or saving up for the purchase.10. Affirm Financing: Tips for Using It Wisely

Affirm Mattress Financing Reviews: The Perfect Solution for Your Dream Bedroom

Introduction

Creating the perfect bedroom is a dream for many homeowners. From the color scheme to the furniture, every detail matters in achieving the perfect balance of comfort and style. However, this can often come at a hefty price, especially when it comes to investing in a high-quality mattress. That's where Affirm mattress financing comes in - offering a flexible and affordable solution for those looking to upgrade their sleep experience. In this article, we will delve into the benefits of using Affirm for mattress financing and why it's the perfect solution for your dream bedroom.

Creating the perfect bedroom is a dream for many homeowners. From the color scheme to the furniture, every detail matters in achieving the perfect balance of comfort and style. However, this can often come at a hefty price, especially when it comes to investing in a high-quality mattress. That's where Affirm mattress financing comes in - offering a flexible and affordable solution for those looking to upgrade their sleep experience. In this article, we will delve into the benefits of using Affirm for mattress financing and why it's the perfect solution for your dream bedroom.

What is Affirm?

Affirm is a financing company that offers consumers a way to pay for their purchases over time, rather than all at once. It allows customers to split their purchase into fixed monthly payments, making it easier to afford big-ticket items such as a new mattress. With Affirm, you can get approved for a loan instantly, with no hidden fees or compounding interest rates. This transparent and straightforward financing option has gained popularity in recent years, especially in the home design and furniture industry.

Affirm is a financing company that offers consumers a way to pay for their purchases over time, rather than all at once. It allows customers to split their purchase into fixed monthly payments, making it easier to afford big-ticket items such as a new mattress. With Affirm, you can get approved for a loan instantly, with no hidden fees or compounding interest rates. This transparent and straightforward financing option has gained popularity in recent years, especially in the home design and furniture industry.

The Benefits of Using Affirm for Mattress Financing

Affordable Monthly Payments:

With Affirm, you can choose the monthly payment plan that fits your budget. This means you can enjoy a high-quality mattress without breaking the bank.

No Hidden Fees:

Unlike traditional financing options, Affirm does not charge any hidden fees or compounding interest rates. This means you can rest easy knowing exactly how much you will be paying each month.

Flexible Repayment Options:

Affirm offers flexible repayment options, with terms ranging from 3 to 36 months. This allows you to choose a plan that works best for your financial situation.

Instant Approval:

Say goodbye to long and complicated loan applications. With Affirm, you can get approved for a loan instantly, making it a hassle-free and convenient process.

Affordable Monthly Payments:

With Affirm, you can choose the monthly payment plan that fits your budget. This means you can enjoy a high-quality mattress without breaking the bank.

No Hidden Fees:

Unlike traditional financing options, Affirm does not charge any hidden fees or compounding interest rates. This means you can rest easy knowing exactly how much you will be paying each month.

Flexible Repayment Options:

Affirm offers flexible repayment options, with terms ranging from 3 to 36 months. This allows you to choose a plan that works best for your financial situation.

Instant Approval:

Say goodbye to long and complicated loan applications. With Affirm, you can get approved for a loan instantly, making it a hassle-free and convenient process.

Why Affirm is the Perfect Solution for Your Dream Bedroom

Investing in a new mattress is a crucial step in creating your dream bedroom. However, it can often be a significant financial burden. With Affirm, you can achieve your dream bedroom without compromising on the quality of your mattress. With affordable monthly payments, no hidden fees, and flexible repayment options, Affirm takes the stress out of financing a mattress. Plus, with its instant approval process, you can start enjoying your new mattress in no time.

In conclusion, Affirm mattress financing offers a convenient, transparent, and affordable solution for homeowners looking to upgrade their sleep experience. With its flexible repayment options and instant approval, it's the perfect choice for creating your dream bedroom. Don't let budget constraints hold you back from achieving the bedroom of your dreams - choose Affirm for your mattress financing needs.

Investing in a new mattress is a crucial step in creating your dream bedroom. However, it can often be a significant financial burden. With Affirm, you can achieve your dream bedroom without compromising on the quality of your mattress. With affordable monthly payments, no hidden fees, and flexible repayment options, Affirm takes the stress out of financing a mattress. Plus, with its instant approval process, you can start enjoying your new mattress in no time.

In conclusion, Affirm mattress financing offers a convenient, transparent, and affordable solution for homeowners looking to upgrade their sleep experience. With its flexible repayment options and instant approval, it's the perfect choice for creating your dream bedroom. Don't let budget constraints hold you back from achieving the bedroom of your dreams - choose Affirm for your mattress financing needs.

:max_bytes(150000):strip_icc()/affirm-c2bdb39dd86749118ef29b47195ac006.jpg)

.jpg)