How to Determine the Tax Write-Off Value of a Mattress and Box Spring

If you're looking to get rid of your old mattress and box spring, you may be wondering if you can get a tax write-off for donating them. The answer is yes, but determining the value of your donation can be a bit tricky. Here's how to determine the tax write-off value of a mattress and box spring:

1. Check the Condition of Your Mattress and Box Spring

The first step in determining the tax write-off value of your mattress and box spring is to assess their condition. If they are in good condition with minimal wear and tear, they will have a higher value than if they are stained or damaged.

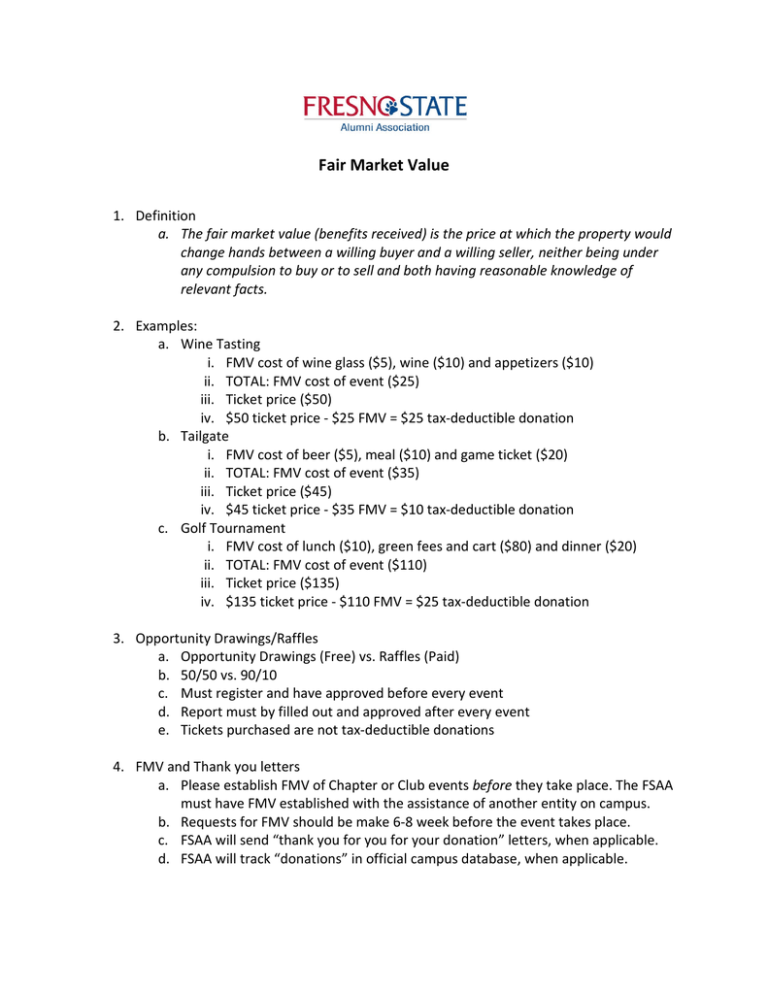

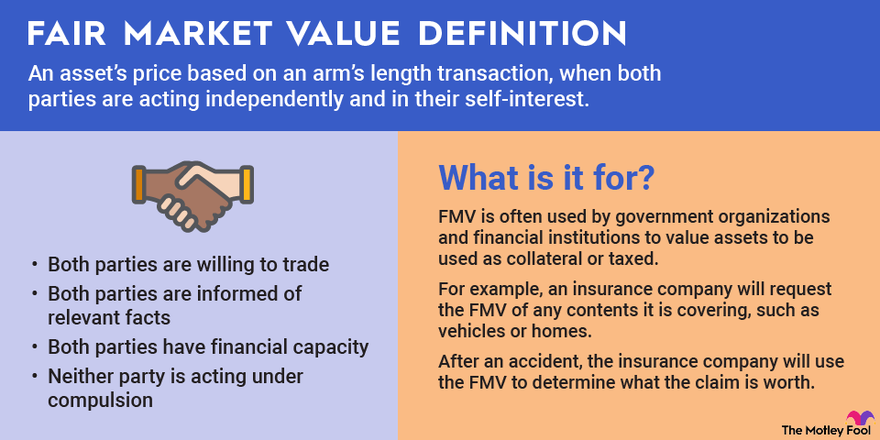

2. Research the Fair Market Value

The fair market value (FMV) is the price that a willing buyer would pay and a willing seller would accept for the mattress and box spring. You can research the FMV by checking the prices of similar mattresses and box springs on websites like eBay or Craigslist.

3. Consider the Age of Your Mattress and Box Spring

The age of your mattress and box spring also plays a role in determining their value for tax purposes. The IRS considers items to have a useful life of 5 years, so if your mattress and box spring are older than 5 years, their value may be lower.

4. Calculate the Depreciation

Since the IRS considers items to have a useful life of 5 years, you can calculate the depreciation of your mattress and box spring by dividing the original purchase price by 5. For example, if your mattress and box spring cost $1,000, the depreciation would be $200 per year.

5. Determine the Donation Value

Once you have all the information, you can calculate the donation value of your mattress and box spring. Subtract the depreciation from the FMV and you will have the tax write-off value of your donation.

How to Calculate the Tax Deduction for Donated Mattresses and Box Springs

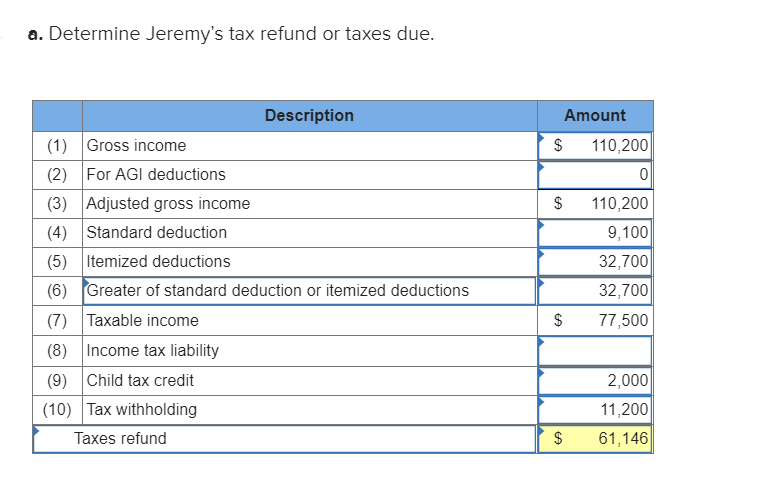

Now that you know how to determine the value of your donated mattress and box spring, you can calculate the tax deduction you can claim on your tax return. Here's how:

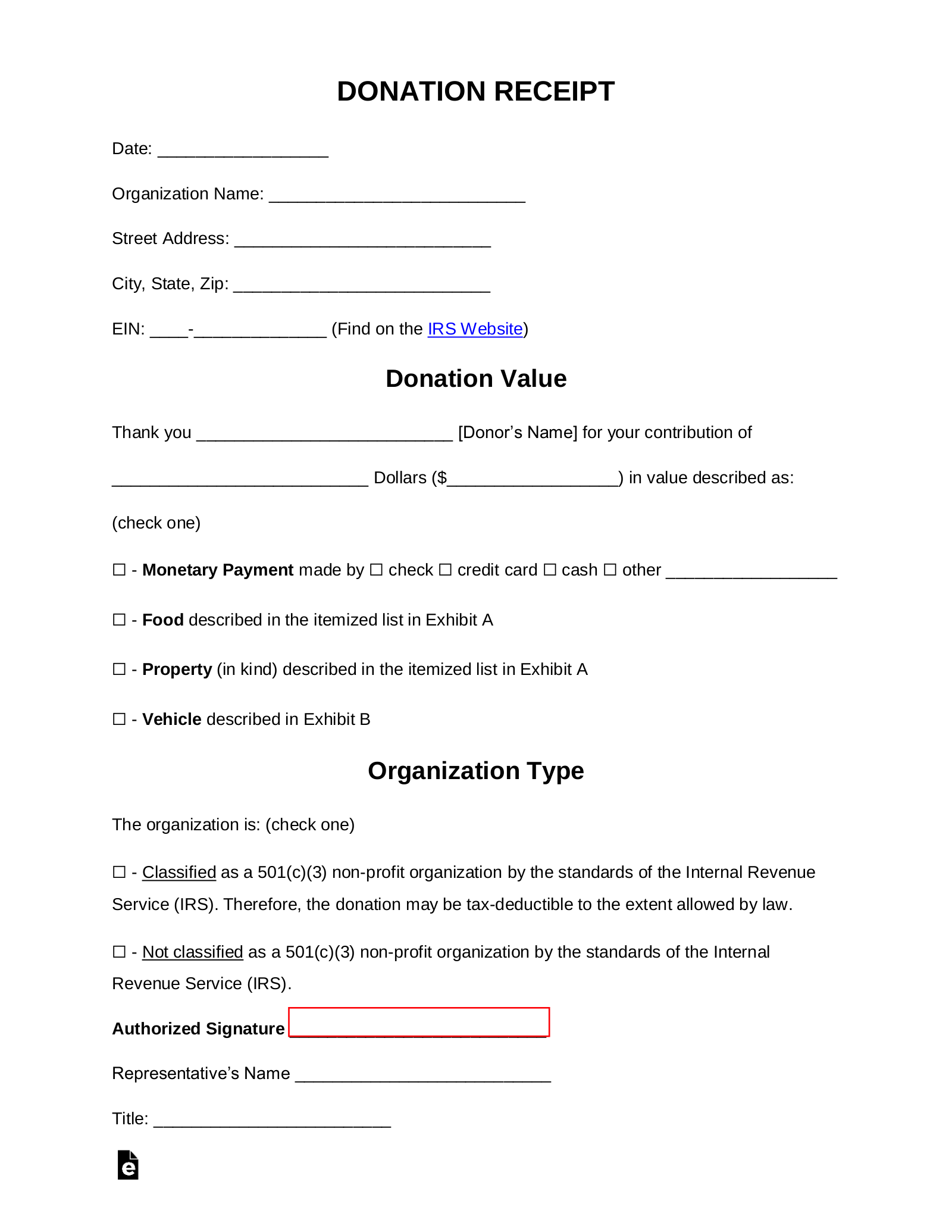

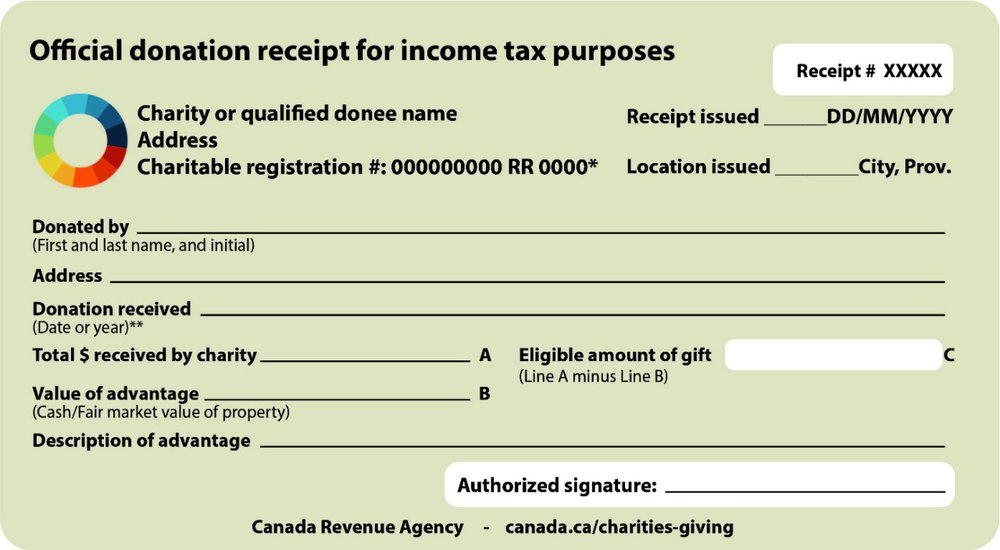

1. Keep Detailed Records

It's important to keep detailed records of your donation, including the date, the name and address of the charitable organization, and a description of the items donated. This information will be needed when filing your taxes.

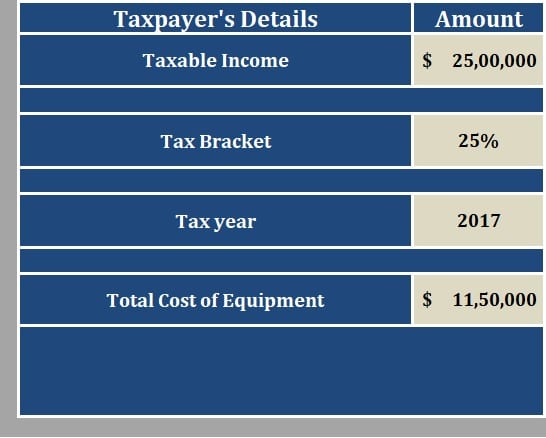

2. Determine Your Tax Bracket

Your tax bracket will determine the percentage of your donation that you can deduct from your taxes. For example, if you are in the 25% tax bracket and your donation is valued at $500, you can deduct $125 from your taxes.

3. Keep in Mind the Donation Limit

The IRS has a limit on the amount you can deduct for charitable donations. For most individuals, this limit is 50% of your adjusted gross income. However, it is always best to consult with a tax professional to ensure you are following the correct guidelines.

IRS Guidelines for Donating a Mattress and Box Spring for a Tax Write-Off

Donating a mattress and box spring for a tax write-off may seem like a simple process, but it's important to follow the IRS guidelines to ensure you are claiming the correct amount on your taxes. Here are a few guidelines to keep in mind:

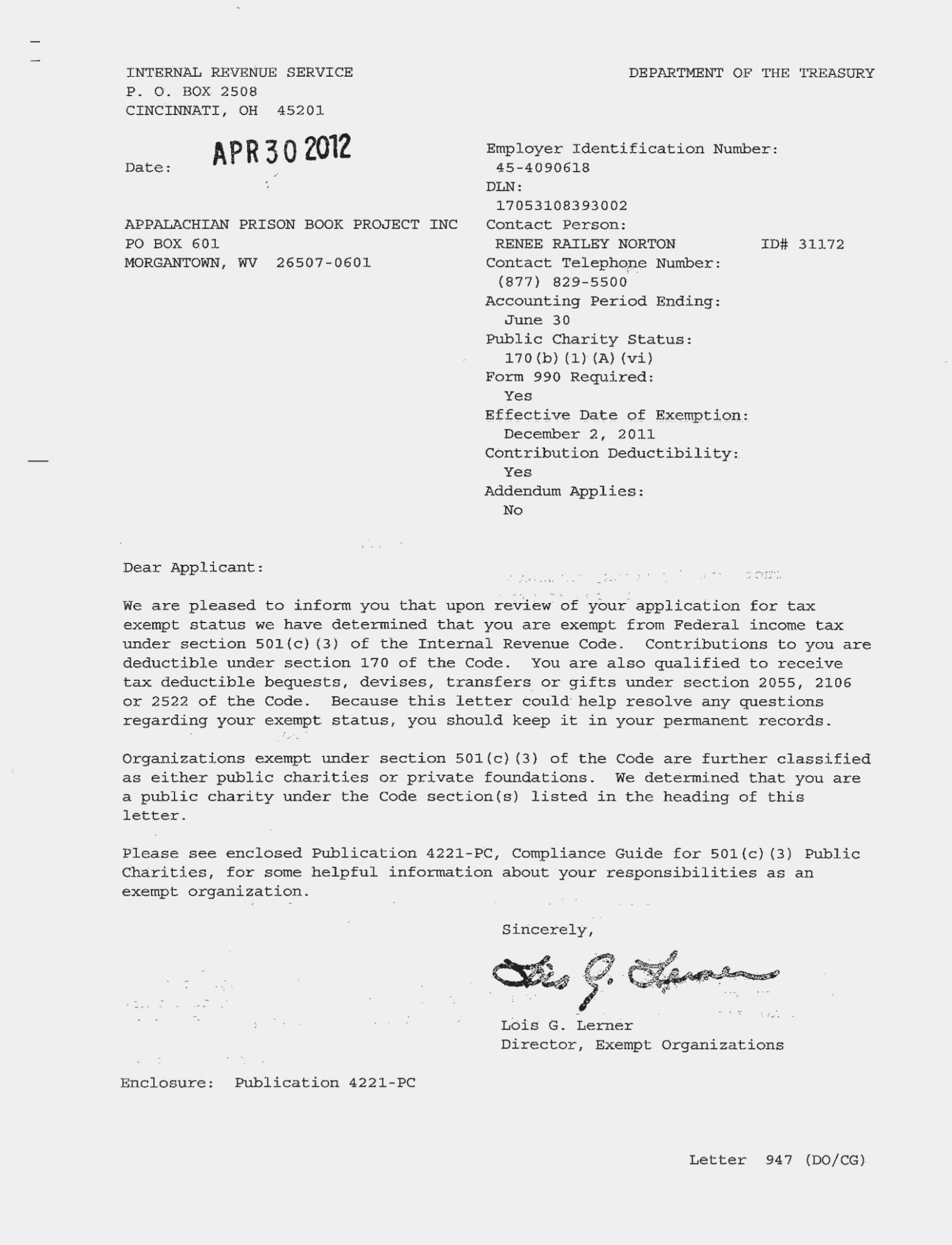

1. Donate to a Qualified Charitable Organization

In order to claim a tax write-off for your donation, the charitable organization must be qualified by the IRS. You can check the IRS website to ensure the organization is eligible.

2. Get an Appraisal for High-Value Items

If your mattress and box spring are valued at more than $5,000, you will need to get an appraisal from a qualified appraiser. This is to ensure that the value of your donation is accurate.

3. File the Correct Tax Forms

You will need to file Form 8283 with your tax return if your donation is valued at more than $500. This form will list all the details of your donation and is required by the IRS.

Maximizing Your Tax Write-Off for Donating a Mattress and Box Spring

If you want to maximize your tax write-off for donating a mattress and box spring, there are a few things you can do:

1. Donate to Multiple Charitable Organizations

If you have multiple mattresses and box springs to donate, consider splitting them up and donating to different charitable organizations. This will allow you to claim a tax write-off for each donation.

2. Donate During High-Tax Years

If you know you will have a higher income in a particular year, consider donating your mattress and box spring during that year to maximize your tax write-off.

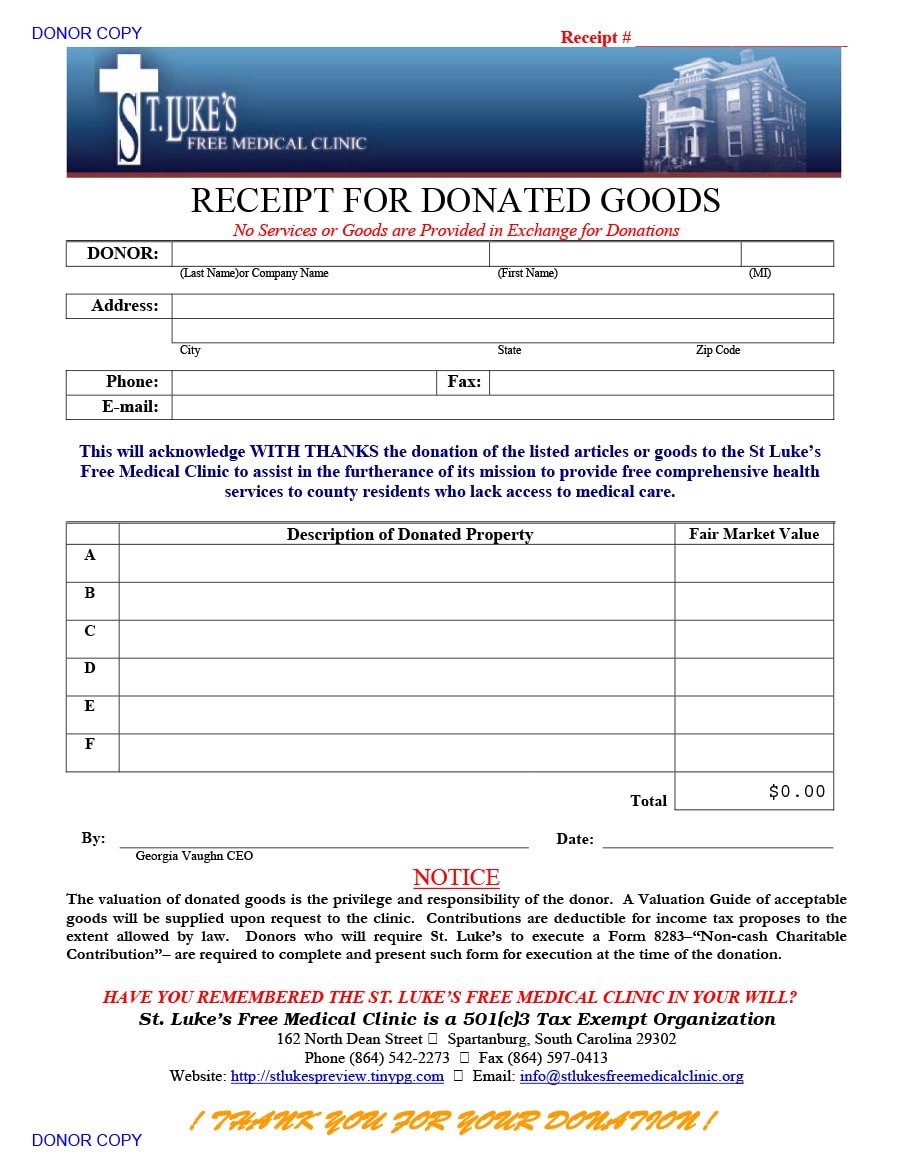

3. Get a Receipt for Your Donation

Make sure to get a receipt from the charitable organization for your donation. This will serve as proof of your donation and the value of your items.

Understanding the Fair Market Value of a Mattress and Box Spring for Tax Purposes

The fair market value of your mattress and box spring is crucial when determining the tax write-off value of your donation. Here are a few things to keep in mind when understanding the FMV:

1. It May Not Be the Original Purchase Price

The fair market value of your mattress and box spring may not be the same as the price you originally paid for it. It is based on what a willing buyer would pay and a willing seller would accept.

2. Consider the Condition and Age

As mentioned earlier, the condition and age of your mattress and box spring will also factor into the FMV. Be sure to take these into account when determining the value of your donation.

3. Keep Documentation of Your Research

If the IRS ever questions the value of your donation, it's important to have documentation of your research and how you determined the FMV. This will help support your claim for a tax write-off.

Tips for Donating a Mattress and Box Spring for a Tax Write-Off

Here are a few tips to keep in mind when donating a mattress and box spring for a tax write-off:

1. Donate to a Charitable Organization That Accepts Mattresses and Box Springs

Not all charitable organizations accept mattresses and box springs, so be sure to do your research and find one that does. Some may even offer free pickup services.

2. Donate in Good Condition

To maximize the value of your donation, make sure your mattress and box spring are in good condition. This will also make it easier for the charitable organization to resell or donate to someone in need.

3. Keep Records of Your Donation

As mentioned earlier, it's important to keep detailed records of your donation for tax purposes. This includes a receipt from the charitable organization and any other documentation of the value of your donation.

How to Document Your Donation of a Mattress and Box Spring for Tax Purposes

When it comes to documenting your donation of a mattress and box spring for tax purposes, here are a few things to keep in mind:

1. Get a Receipt from the Charitable Organization

Make sure to get a receipt from the charitable organization for your donation. This should include the date, the name and address of the organization, and a description of the items donated.

2. Take Photos of Your Donation

Taking photos of your donated mattress and box spring can serve as additional proof of your donation, especially if they are in good condition.

3. Keep Any Appraisal Documents

If you had your mattress and box spring appraised, be sure to keep those documents as well. This will help support the value of your donation in case of an IRS audit.

Common Mistakes to Avoid When Claiming a Tax Write-Off for Donating a Mattress and Box Spring

When donating a mattress and box spring for a tax write-off, here are a few common mistakes to avoid:

1. Overvaluing Your Donation

It's important to be honest when determining the value of your donation. Overvaluing your donation can result in penalties and fees if the IRS determines that the value you claimed was inaccurate.

2. Not Keeping Detailed Records

We can't stress this enough - keeping detailed records of your donation is crucial. Without proper documentation, you may not be able to claim a tax write-off or may face challenges if the IRS questions the value of your donation.

3. Not Consulting a Tax Professional

If you're unsure about the tax rules and regulations surrounding donations, it's always best to consult a tax professional. They can help ensure you are following the correct guidelines and maximizing your tax write-off.

Charitable Organizations That Accept Donated Mattresses and Box Springs for Tax Write-Offs

If you're ready to donate your mattress and box spring for a tax write-off, here are a few charitable organizations that accept these donations:

1. Goodwill

2. Habitat for Humanity ReStore

3. The Salvation Army

4. Furniture Bank Association of North America

5. Local homeless shelters and charities

Consulting a Tax Professional for Advice on Donating a Mattress and Box Spring for a Write-Off

If you're still unsure about the tax implications of donating a mattress and box spring, it's best to consult a tax professional. They can provide guidance and advice specific to your situation and ensure you are following all the necessary guidelines for claiming a tax write-off.

The Tax Writeoff Value of Mattress and Springs in House Design

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/4EDPAOM55BBXVAU3DQWVAXNYUM)

Maximizing Your Tax Savings with Mattress and Springs

When it comes to furnishing your house,

mattresses and springs

may not be the first things that come to mind. However, these essential items not only provide comfort and support for your sleep, but they can also have a

tax writeoff value

in house design.

Generally, homeowners are entitled to

tax deductions

for expenses related to improving or maintaining their homes. This includes

mattresses and springs

as these items fall under the category of

home furnishings

. The Internal Revenue Service (IRS) defines home furnishings as items that are used to decorate, maintain, or improve the home. This can include furniture, appliances, and even bedding.

But how exactly do you go about

claiming a tax writeoff

for your

mattress and springs

? First, you need to determine if you qualify for deductions. This depends on whether your home is considered your primary residence or a rental property. If you are a homeowner, you can claim deductions for

mattress and springs

used in bedrooms, guest rooms, or even your home office. However, if you rent out your property, you can only claim deductions for

mattress and springs

used in the rental unit.

Next, you need to keep track of your expenses. This means keeping receipts for the

mattress and springs

you purchase, as well as any other home furnishings that you plan on claiming as deductions. It is important to note that you can only claim deductions for the

fair market value

of these items, which is the cost of the item in its current condition.

Another important factor to consider is the timeframe for claiming these deductions. Typically,

tax writeoffs

can only be claimed in the year that the expense was incurred. This means that you cannot claim deductions for items that you purchased in previous years. However, there are some exceptions to this rule, so it is always best to consult a tax professional for advice.

In conclusion,

mattresses and springs

can have a significant

tax writeoff value

in house design. As long as you meet the eligibility criteria and keep proper documentation, you can save money on your taxes while also investing in the comfort and style of your home. So, the next time you are in the market for a new mattress or springs, remember to keep track of your expenses and take advantage of potential tax deductions. Your wallet and your sleep will thank you.

When it comes to furnishing your house,

mattresses and springs

may not be the first things that come to mind. However, these essential items not only provide comfort and support for your sleep, but they can also have a

tax writeoff value

in house design.

Generally, homeowners are entitled to

tax deductions

for expenses related to improving or maintaining their homes. This includes

mattresses and springs

as these items fall under the category of

home furnishings

. The Internal Revenue Service (IRS) defines home furnishings as items that are used to decorate, maintain, or improve the home. This can include furniture, appliances, and even bedding.

But how exactly do you go about

claiming a tax writeoff

for your

mattress and springs

? First, you need to determine if you qualify for deductions. This depends on whether your home is considered your primary residence or a rental property. If you are a homeowner, you can claim deductions for

mattress and springs

used in bedrooms, guest rooms, or even your home office. However, if you rent out your property, you can only claim deductions for

mattress and springs

used in the rental unit.

Next, you need to keep track of your expenses. This means keeping receipts for the

mattress and springs

you purchase, as well as any other home furnishings that you plan on claiming as deductions. It is important to note that you can only claim deductions for the

fair market value

of these items, which is the cost of the item in its current condition.

Another important factor to consider is the timeframe for claiming these deductions. Typically,

tax writeoffs

can only be claimed in the year that the expense was incurred. This means that you cannot claim deductions for items that you purchased in previous years. However, there are some exceptions to this rule, so it is always best to consult a tax professional for advice.

In conclusion,

mattresses and springs

can have a significant

tax writeoff value

in house design. As long as you meet the eligibility criteria and keep proper documentation, you can save money on your taxes while also investing in the comfort and style of your home. So, the next time you are in the market for a new mattress or springs, remember to keep track of your expenses and take advantage of potential tax deductions. Your wallet and your sleep will thank you.