Steinhoff International Holdings

Steinhoff International Holdings is a global retail giant based in South Africa. The company operates in over 30 countries and has a diverse portfolio of retail brands, including Mattress Firm.

Mattress Firm

Mattress Firm is one of the largest mattress retailers in the United States, with over 2,500 stores nationwide. The company offers a wide range of mattresses, bedding accessories, and furniture.

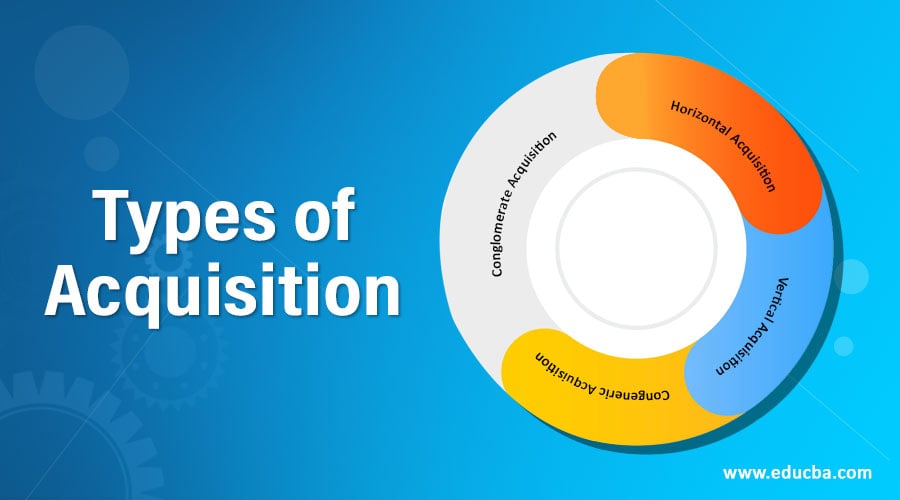

Acquisition

In 2016, Steinhoff International Holdings announced its acquisition of Mattress Firm in a deal worth $3.8 billion. This was a significant move for both companies, as it allowed Steinhoff to enter the US market and gave Mattress Firm access to Steinhoff's international resources.

Retail

The acquisition of Mattress Firm was a strategic move for Steinhoff, as it allowed the company to expand its retail presence in the US. With the addition of Mattress Firm's stores, Steinhoff's retail footprint grew to over 9,000 stores worldwide.

Furniture

While Mattress Firm is known for its mattresses, the company also offers a wide range of furniture and bedding accessories. This was an attractive aspect for Steinhoff, as it diversified its product offerings and allowed the company to tap into the growing furniture market in the US.

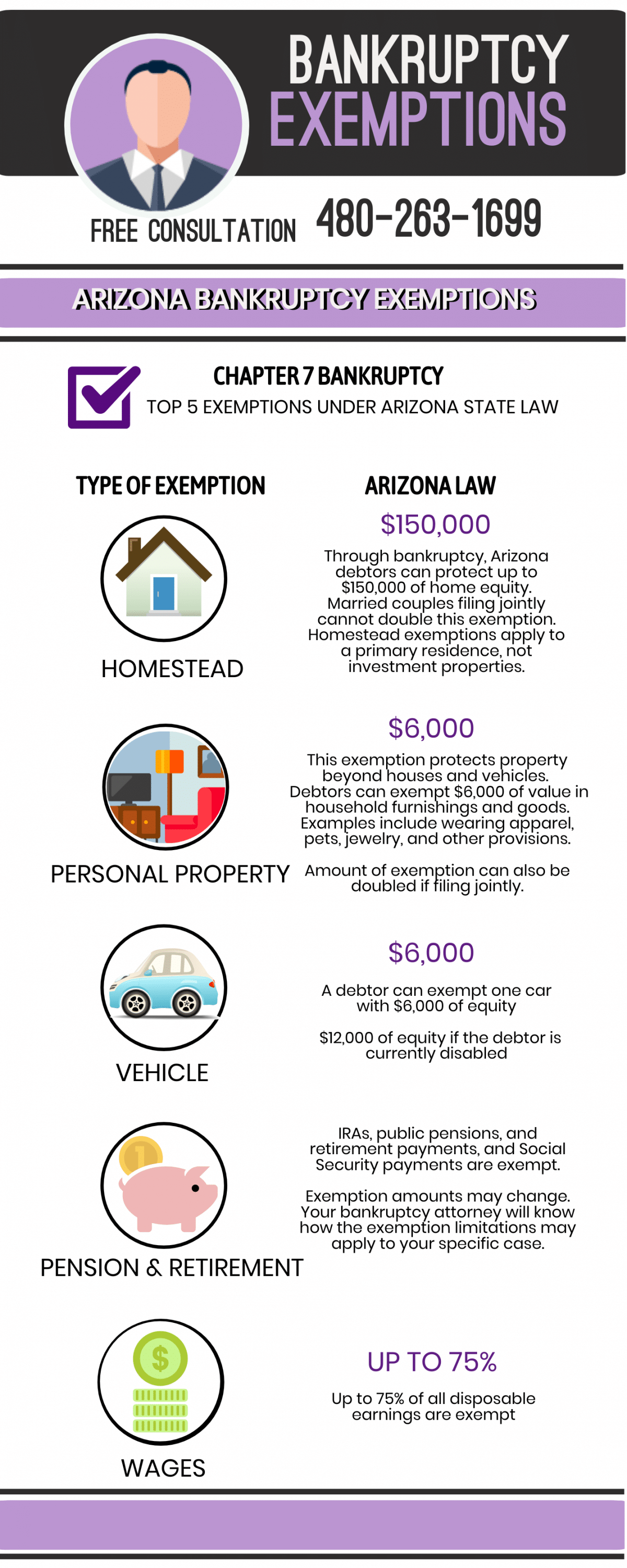

Bankruptcy

In 2018, just two years after the acquisition, Mattress Firm filed for Chapter 11 bankruptcy. This was a surprising turn of events, as the company had been struggling financially for some time. This move caused some concern for Steinhoff, as it had invested a significant amount of money in the acquisition.

Financial Troubles

The bankruptcy of Mattress Firm was not the only financial trouble that Steinhoff faced. In 2017, the company's CEO resigned amid an accounting scandal that revealed irregularities in the company's financial statements. This caused a significant drop in Steinhoff's stock price and led to further investigations and lawsuits.

Expansion

Despite the financial troubles, Steinhoff continued to expand its presence in the US market. In 2019, the company launched a new furniture brand, Harveys Furniture, in the US. This move was seen as a way for Steinhoff to diversify its US portfolio and recover from the bankruptcy of Mattress Firm.

Consolidation

In 2020, Steinhoff announced its plans to consolidate its US retail brands, including Mattress Firm, into one unified brand, Sleep Outfitters. This move was aimed at streamlining operations and reducing costs for the company.

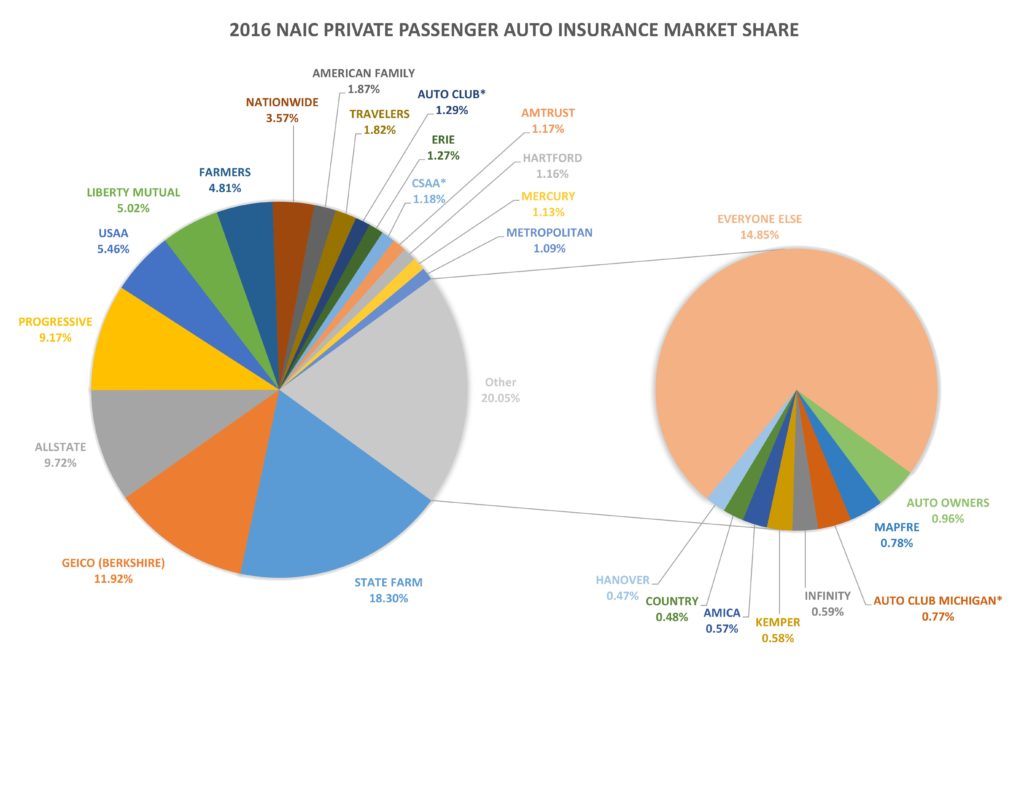

Market Share

The Steinhoff acquisition of Mattress Firm has had a significant impact on the US retail market. With the consolidation of Sleep Outfitters and the continued expansion of other Steinhoff brands, the company has become a major player in the US furniture and bedding industry, with a significant market share and strong competition for other retailers.

The Benefits of Steinhoff's Acquisition of Mattress Firm

Expansion of Market Reach

The recent acquisition of Mattress Firm by the global retail conglomerate, Steinhoff, has created a buzz in the business world. While some may view this acquisition as just another business deal, there are actually numerous benefits that this merger brings to the table. One of the most significant advantages of this acquisition is the expansion of market reach for both companies.

Mattress Firm, being the largest mattress retailer in the United States, has a strong presence in the American market. However, with Steinoff's international presence in over 30 countries, this acquisition opens up new opportunities for Mattress Firm to expand its reach globally. This means that Mattress Firm now has the potential to tap into new markets, increase its customer base, and ultimately boost its sales.

The recent acquisition of Mattress Firm by the global retail conglomerate, Steinhoff, has created a buzz in the business world. While some may view this acquisition as just another business deal, there are actually numerous benefits that this merger brings to the table. One of the most significant advantages of this acquisition is the expansion of market reach for both companies.

Mattress Firm, being the largest mattress retailer in the United States, has a strong presence in the American market. However, with Steinoff's international presence in over 30 countries, this acquisition opens up new opportunities for Mattress Firm to expand its reach globally. This means that Mattress Firm now has the potential to tap into new markets, increase its customer base, and ultimately boost its sales.

Diversification of Product Offerings

Another advantage of this merger is the diversification of product offerings. Steinhoff is known for its diverse portfolio of retail brands, including furniture, household goods, and electronics. By acquiring Mattress Firm, Steinhoff can now add mattresses to its list of products, further expanding its offerings to customers. This diversification not only benefits Steinhoff but also provides Mattress Firm with the opportunity to offer a wider range of products to its customers, catering to their diverse needs and preferences.

Another advantage of this merger is the diversification of product offerings. Steinhoff is known for its diverse portfolio of retail brands, including furniture, household goods, and electronics. By acquiring Mattress Firm, Steinhoff can now add mattresses to its list of products, further expanding its offerings to customers. This diversification not only benefits Steinhoff but also provides Mattress Firm with the opportunity to offer a wider range of products to its customers, catering to their diverse needs and preferences.

Increased Efficiency and Cost Savings

With this acquisition, there is also the potential for increased efficiency and cost savings for both companies. As a result of the merger, Mattress Firm will now have access to Steinhoff's global supply chain and logistics network. This means that Mattress Firm can now leverage Steinhoff's resources and expertise to streamline its operations, reduce costs, and improve its overall efficiency. Moreover, with the economies of scale that come with a larger market presence, both companies can benefit from cost savings in terms of bulk purchasing and production.

In conclusion, the acquisition of Mattress Firm by Steinhoff brings many benefits to both companies, including the expansion of market reach, diversification of product offerings, and increased efficiency and cost savings. This merger not only strengthens the position of both companies in the market but also presents new opportunities for growth and success.

With this acquisition, there is also the potential for increased efficiency and cost savings for both companies. As a result of the merger, Mattress Firm will now have access to Steinhoff's global supply chain and logistics network. This means that Mattress Firm can now leverage Steinhoff's resources and expertise to streamline its operations, reduce costs, and improve its overall efficiency. Moreover, with the economies of scale that come with a larger market presence, both companies can benefit from cost savings in terms of bulk purchasing and production.

In conclusion, the acquisition of Mattress Firm by Steinhoff brings many benefits to both companies, including the expansion of market reach, diversification of product offerings, and increased efficiency and cost savings. This merger not only strengthens the position of both companies in the market but also presents new opportunities for growth and success.

.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Consolidate_colorv1-a3c1be00e6344ca7b265869d516bb4c3.png)

/CourtneyKeating-EPlus-GettyImages-565c83113df78c6ddf626dda.jpg)

/https://blogs-images.forbes.com/louiscolumbus/files/2016/05/CRM-Market-Share-2015.jpg)