Sales tax is a form of consumption tax that is imposed on goods and services by the government. When purchasing a mattress, you may have noticed an additional charge on your receipt for sales tax. This tax varies depending on the state and local government, but it is important to understand the sales tax rate for mattresses to avoid any surprises when making a purchase.What is the sales tax on a mattress?

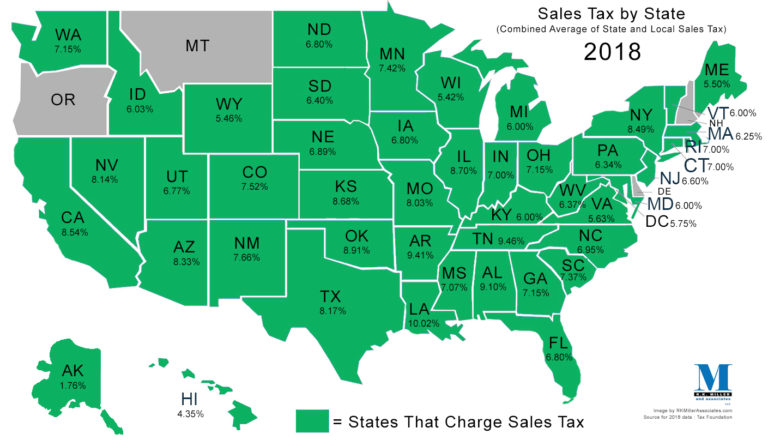

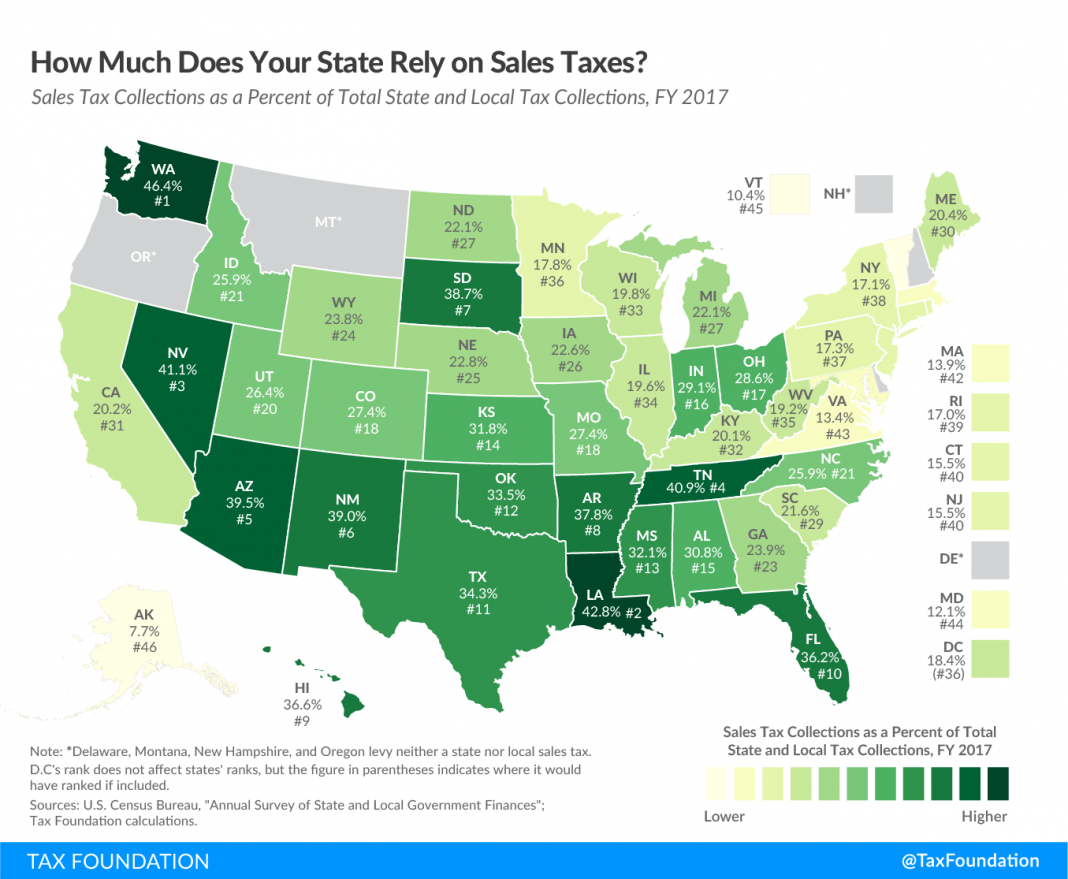

The sales tax on a mattress can range from 0% to over 10%, depending on where you live. The average sales tax rate in the United States is around 6%, but some states have higher or lower rates. For example, the sales tax rate in Alaska is 0%, while the sales tax rate in California is 7.25%.How much is the sales tax on a mattress?

In most cases, yes, you will have to pay sales tax on a mattress purchase. The only exception is if you live in a state that does not charge sales tax, such as Alaska, Delaware, Montana, New Hampshire, and Oregon. However, even if you live in one of these states, you may still have to pay a local sales tax.Do you have to pay sales tax on a mattress?

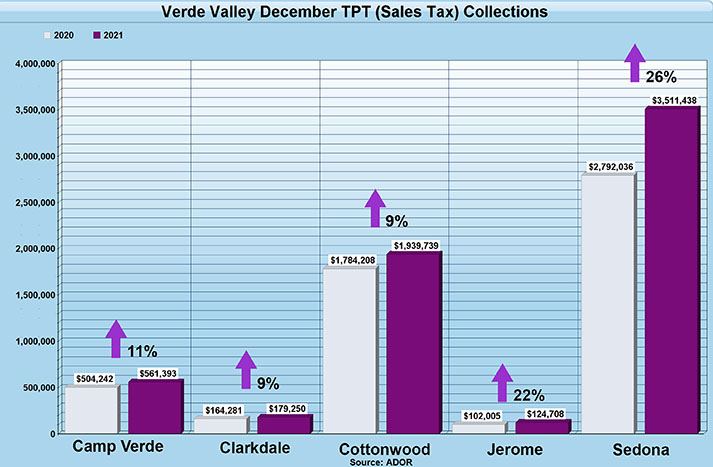

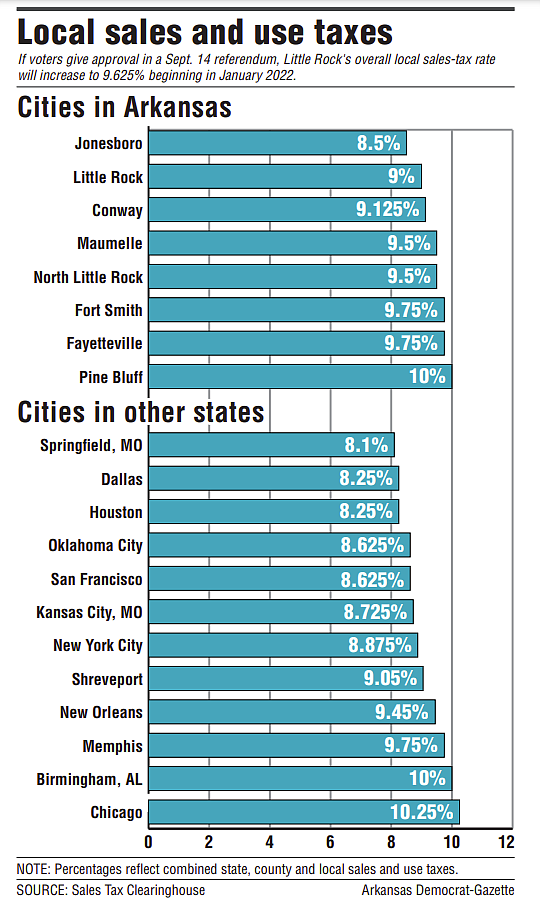

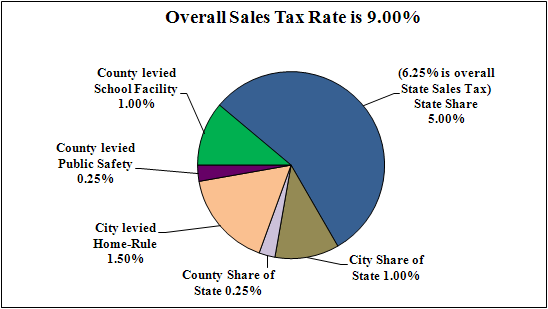

The sales tax rate for mattresses varies by state and can also be affected by local taxes. For example, some cities or counties may have a higher sales tax rate than the state. It is important to research the sales tax rate in your specific location before making a mattress purchase.Sales tax rate for mattresses

As mentioned, the sales tax on mattresses is imposed by the state government. The state sets the sales tax rate, which can vary depending on the type of goods or services. Some states may have different rates for different products, so it is important to check the specific rate for mattresses in your state.State sales tax on mattresses

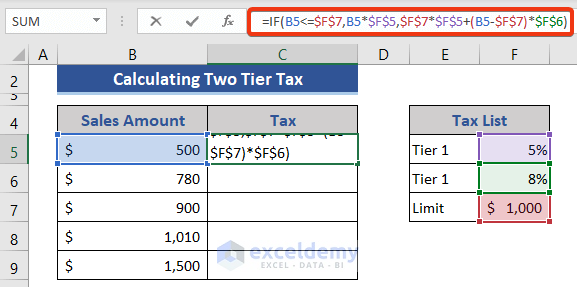

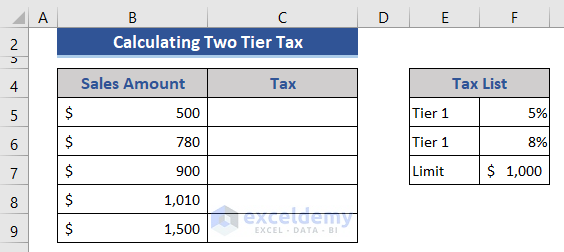

To calculate the sales tax on a mattress, you will need to know the sales tax rate in your state or local area. Once you have this information, you can multiply the cost of the mattress by the sales tax rate. For example, if the sales tax rate is 6% and the mattress costs $1000, the sales tax would be $60.How to calculate sales tax on a mattress

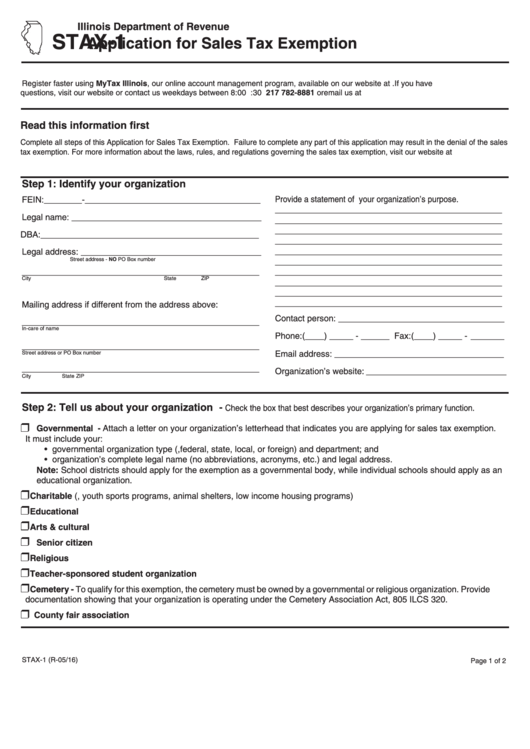

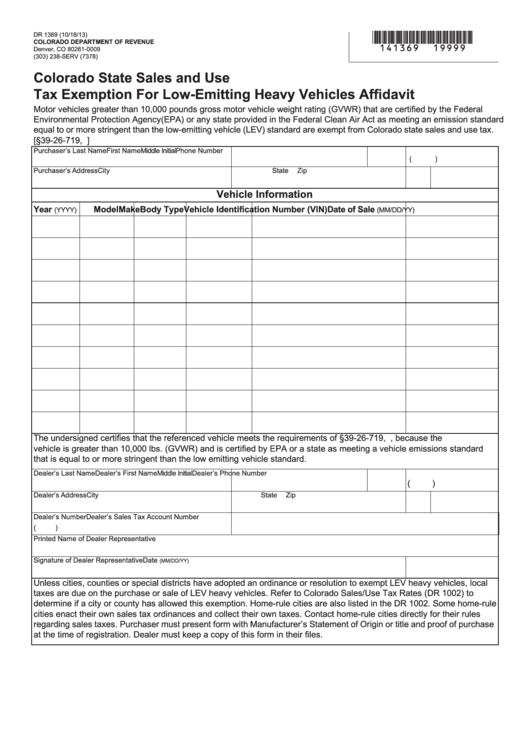

There are some cases where you may be exempt from paying sales tax on a mattress purchase. In some states, certain items are exempt from sales tax, such as medical equipment or items for resale. It is important to check with your state's tax laws to see if you qualify for a sales tax exemption for your mattress purchase.Sales tax exemption for mattresses

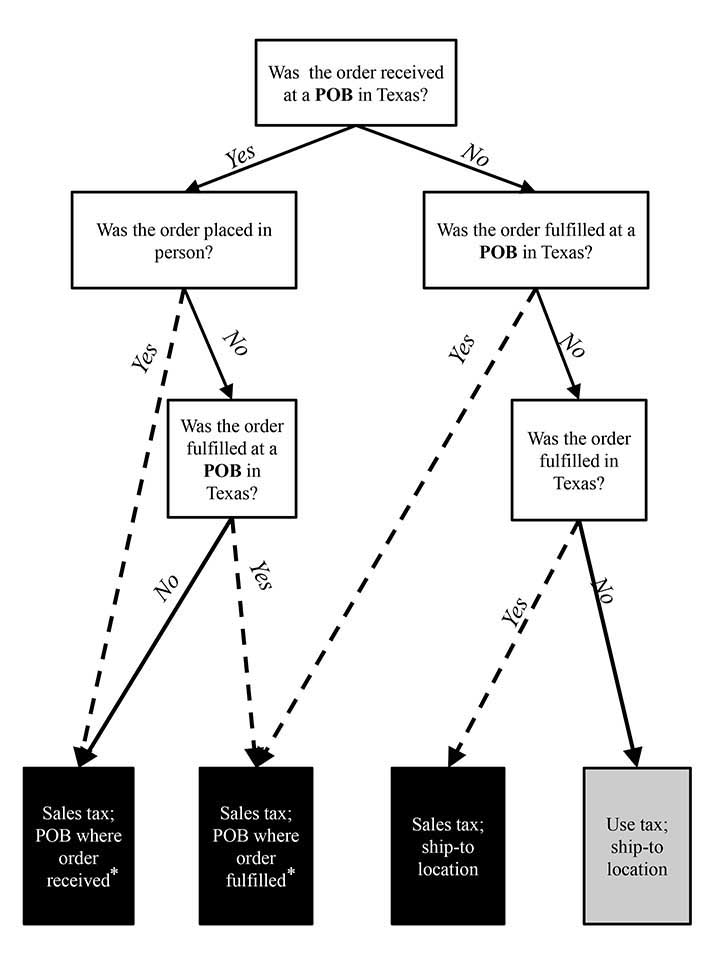

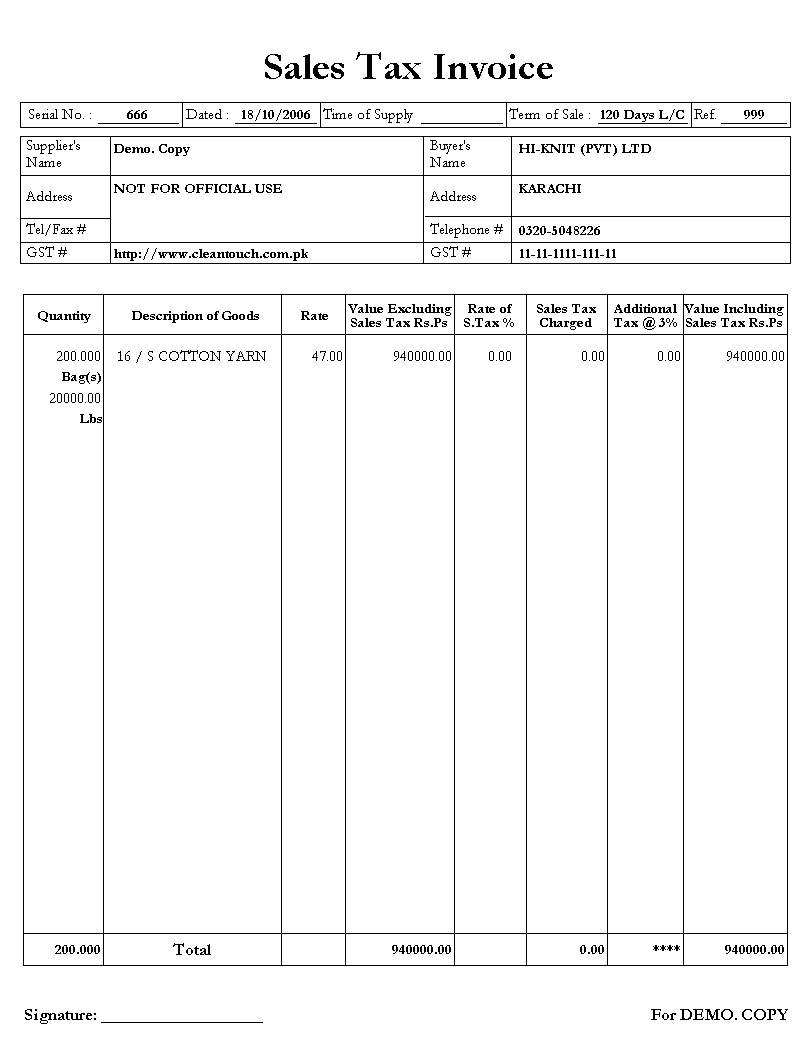

Whether you are purchasing a mattress in-store or online, you will likely have to pay sales tax. Online purchases may have a different sales tax rate depending on where the mattress is being shipped from and where it is being shipped to. Many online retailers will calculate the sales tax for you at checkout, but it is important to double-check to ensure you are being charged the correct amount.Sales tax on mattress purchases

With the rise of online shopping, many states have implemented laws requiring online retailers to collect sales tax from their customers. This means that even if you live in a state with no sales tax, you may still have to pay sales tax when purchasing a mattress online. It is important to check the online retailer's policy on sales tax before making a purchase.Online sales tax for mattresses

In addition to state sales tax, some cities and counties may impose a local sales tax on mattresses. This can vary greatly depending on your location, so it is important to research the local sales tax rate as well. You may be surprised to find that your local sales tax is higher than the state sales tax. In conclusion, sales tax on mattresses is a necessary part of the purchase process. It is important to research the sales tax rate in your state and local area to avoid any unexpected charges. Remember to factor in the sales tax when budgeting for a new mattress, and don't hesitate to ask the retailer for clarification if you have any questions about the tax rate. Happy mattress shopping!Local sales tax on mattresses

The Impact of Sales Tax on Mattress Purchases

Understanding the Cost of a Good Night's Sleep

When it comes to buying a new mattress, there are a lot of factors to consider. Comfort, support, and durability are all important aspects that influence our decision. But there's another factor that often gets overlooked - sales tax. Yes, that's right, the extra percentage added onto the price of our mattress can have a significant impact on our wallet. Let's take a closer look at the effect of sales tax on mattress purchases.

Sales tax

is a percentage of the purchase price that is added on by the government and collected by retailers. The rate of sales tax varies from state to state, with some states having no sales tax at all. However, in most states, mattresses are subject to sales tax, which can range from 4% to 10% of the purchase price. This means that on a $1000 mattress, you could be paying an extra $40 to $100 in sales tax.

So how does sales tax impact our mattress purchase?

For starters, it increases the overall cost of the mattress. This means that we end up paying more for the same product, which can be a burden on our budget. In some cases, the added cost of sales tax can even push us towards choosing a cheaper and potentially less comfortable or supportive mattress.

Additionally, sales tax can also affect the type of mattress we can afford. For example, if we have a budget of $1000 for a new mattress, we may have to settle for a lower quality option in states with a higher sales tax rate. This could mean sacrificing comfort and support, which are crucial for a good night's sleep.

But why are mattresses subject to sales tax in the first place?

The answer lies in the categorization of mattresses as "tangible personal property" by most states. This means that they are classified as tangible items that can be physically touched and owned. As a result, they are subject to sales tax, just like other products we purchase.

In recent years, there have been efforts to exempt mattresses from sales tax, as they are considered a necessity for a good night's sleep and overall health. However, so far, only a few states have implemented this exemption.

In conclusion, the impact of sales tax on mattress purchases should not be overlooked. It not only increases the overall cost of the mattress but also affects the type of mattress we can afford. If you are in the market for a new mattress, it's important to factor in the sales tax and consider your options carefully. After all, a good night's sleep is priceless.

When it comes to buying a new mattress, there are a lot of factors to consider. Comfort, support, and durability are all important aspects that influence our decision. But there's another factor that often gets overlooked - sales tax. Yes, that's right, the extra percentage added onto the price of our mattress can have a significant impact on our wallet. Let's take a closer look at the effect of sales tax on mattress purchases.

Sales tax

is a percentage of the purchase price that is added on by the government and collected by retailers. The rate of sales tax varies from state to state, with some states having no sales tax at all. However, in most states, mattresses are subject to sales tax, which can range from 4% to 10% of the purchase price. This means that on a $1000 mattress, you could be paying an extra $40 to $100 in sales tax.

So how does sales tax impact our mattress purchase?

For starters, it increases the overall cost of the mattress. This means that we end up paying more for the same product, which can be a burden on our budget. In some cases, the added cost of sales tax can even push us towards choosing a cheaper and potentially less comfortable or supportive mattress.

Additionally, sales tax can also affect the type of mattress we can afford. For example, if we have a budget of $1000 for a new mattress, we may have to settle for a lower quality option in states with a higher sales tax rate. This could mean sacrificing comfort and support, which are crucial for a good night's sleep.

But why are mattresses subject to sales tax in the first place?

The answer lies in the categorization of mattresses as "tangible personal property" by most states. This means that they are classified as tangible items that can be physically touched and owned. As a result, they are subject to sales tax, just like other products we purchase.

In recent years, there have been efforts to exempt mattresses from sales tax, as they are considered a necessity for a good night's sleep and overall health. However, so far, only a few states have implemented this exemption.

In conclusion, the impact of sales tax on mattress purchases should not be overlooked. It not only increases the overall cost of the mattress but also affects the type of mattress we can afford. If you are in the market for a new mattress, it's important to factor in the sales tax and consider your options carefully. After all, a good night's sleep is priceless.

-480a.jpg)