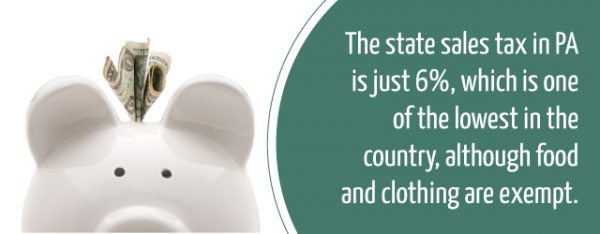

Pennsylvania has a state sales tax rate of 6%, which is applied to most goods and services sold within the state. This includes mattresses, making it important for buyers in Erie, PA to understand the sales tax laws and rates that apply to their purchases.Pennsylvania Sales and Use Tax Rates

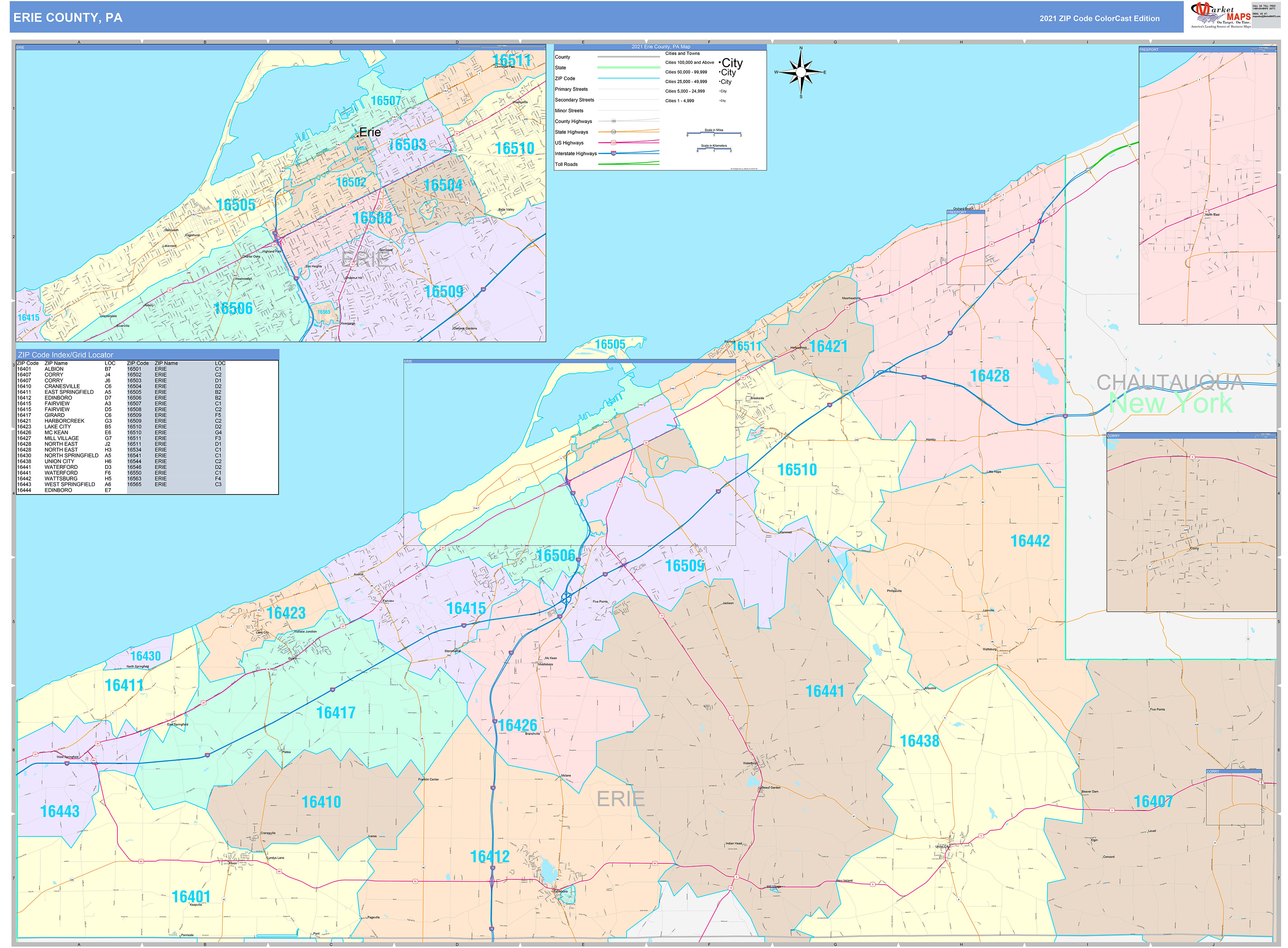

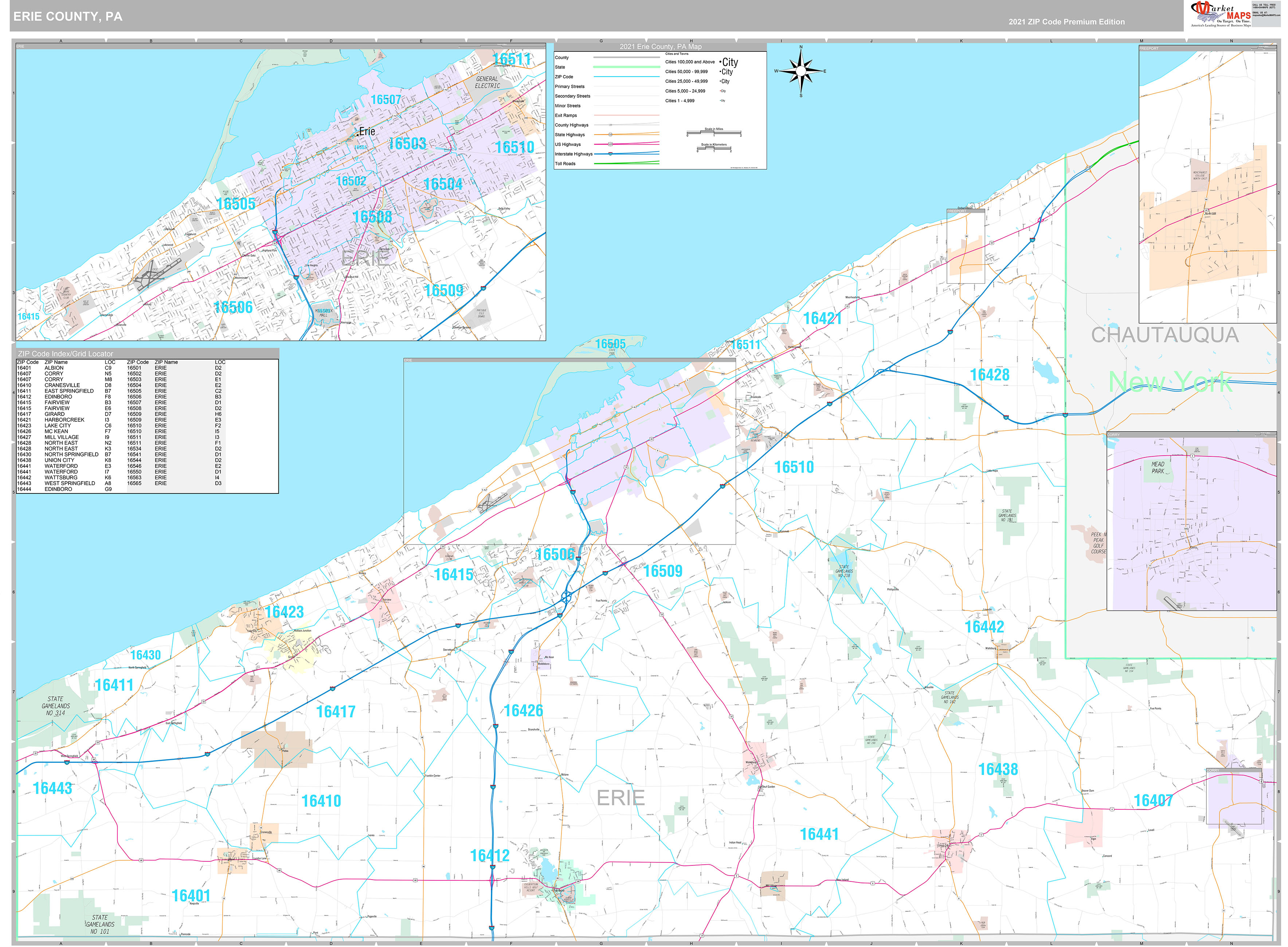

In addition to the state sales tax, Erie County also has a local sales tax rate of 1%, bringing the total sales tax rate for mattresses in Erie, PA to 7%. This means that for every $100 spent on a mattress, an additional $7 will be added on for sales tax.Erie County, PA Sales Tax Rate

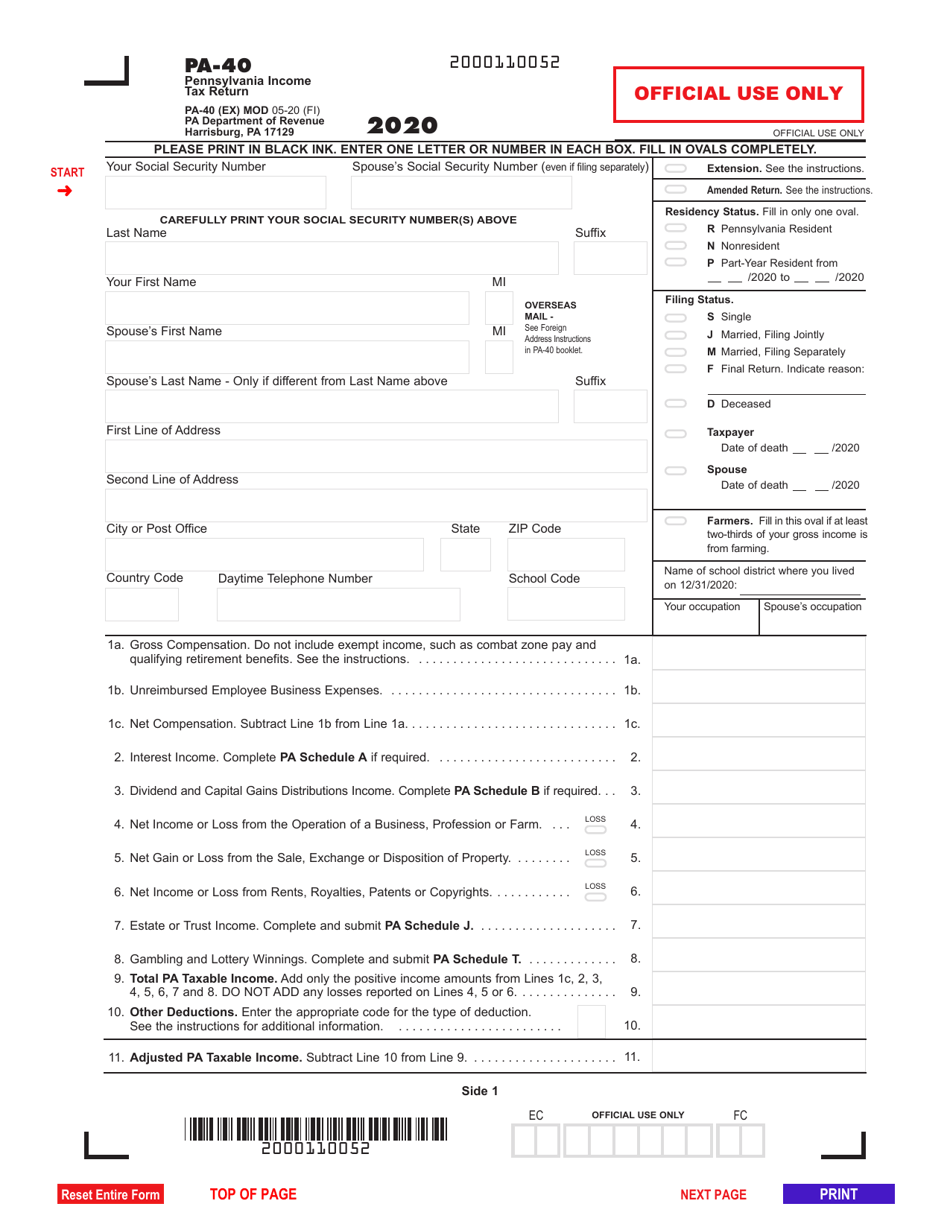

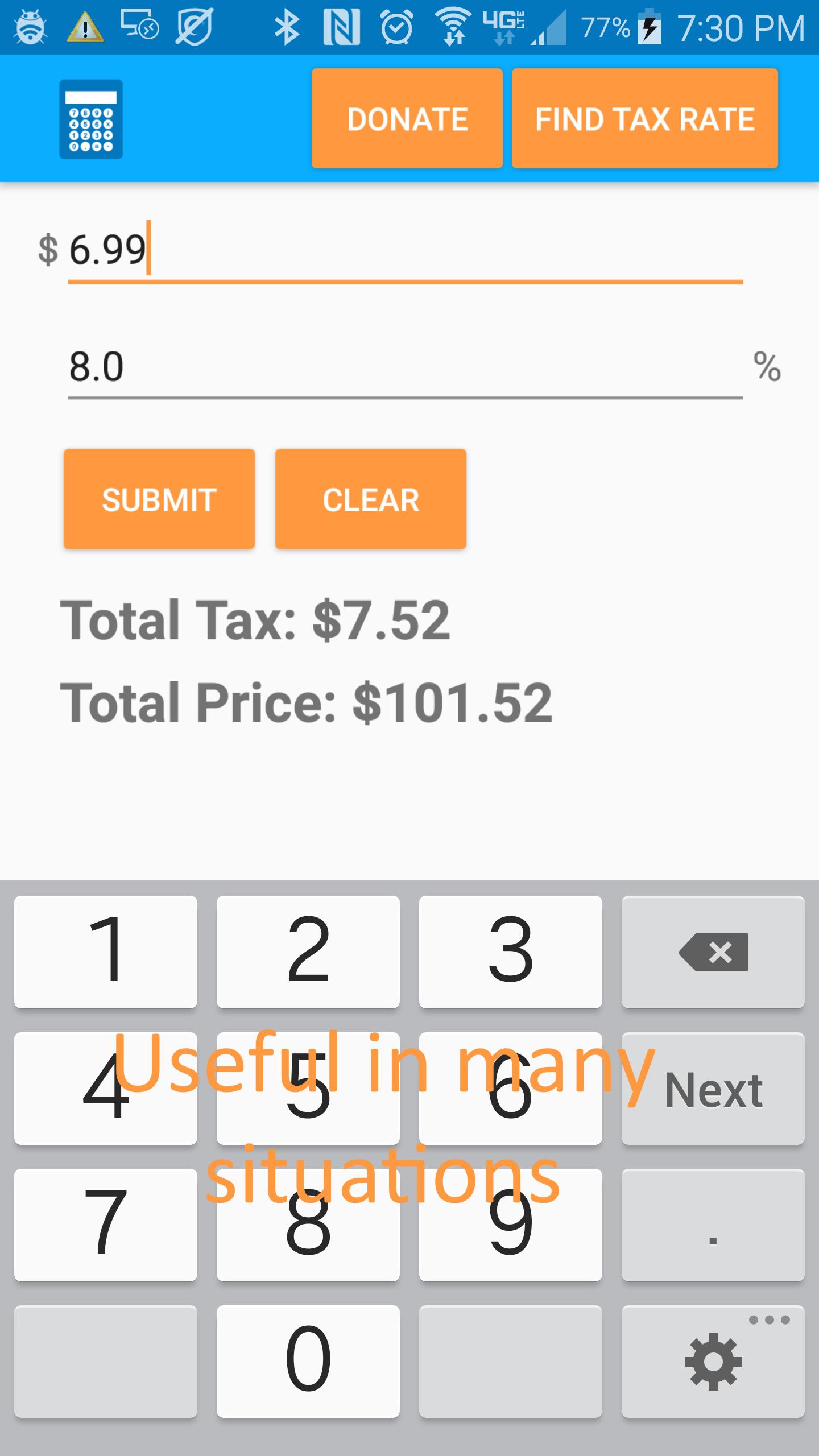

Calculating sales tax in Pennsylvania is fairly simple. To find the sales tax amount, multiply the purchase price by the total sales tax rate. For example, if you purchase a mattress for $500 in Erie, PA, the sales tax would be $35 (500 x 7% = $35).How to Calculate Sales Tax in Pennsylvania

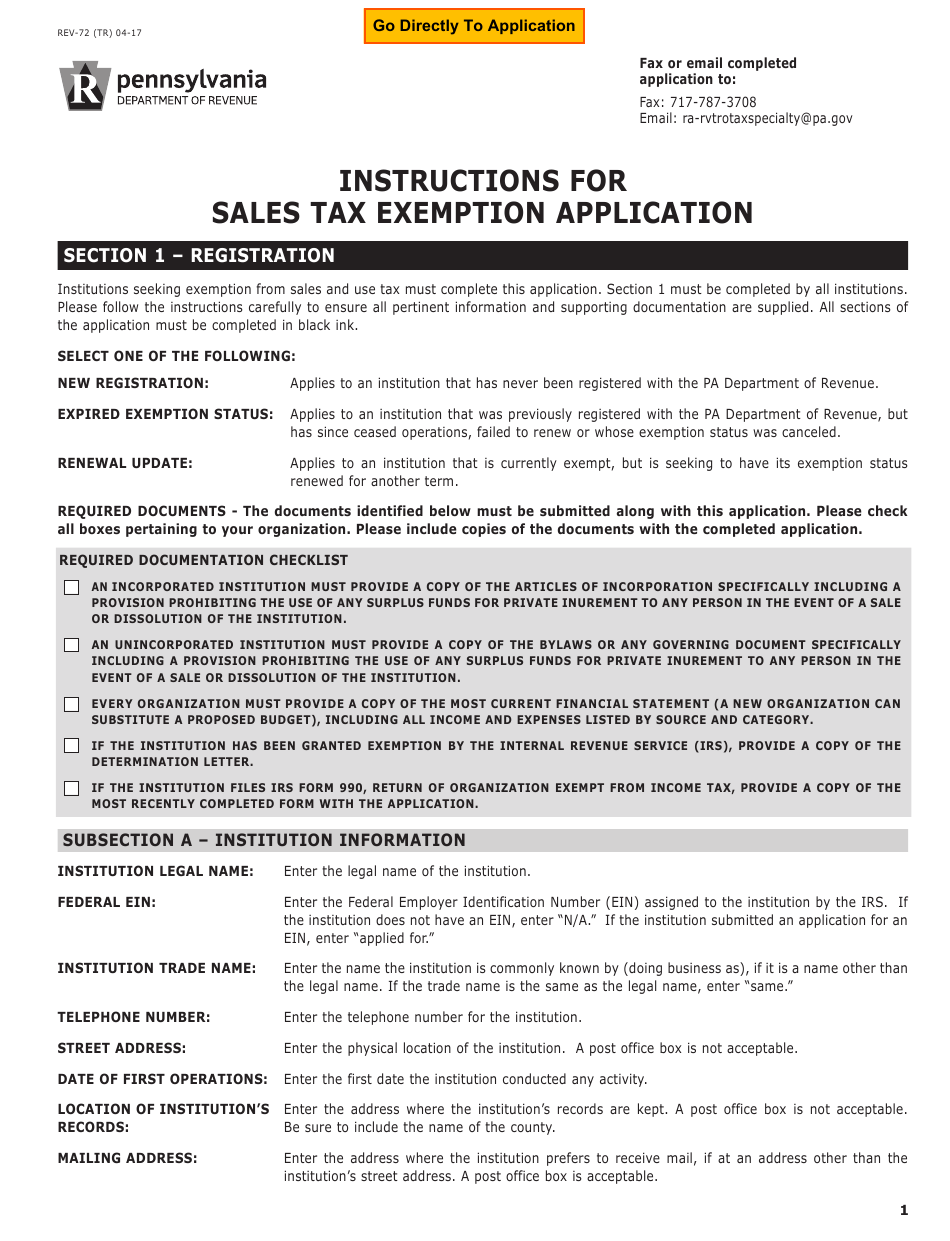

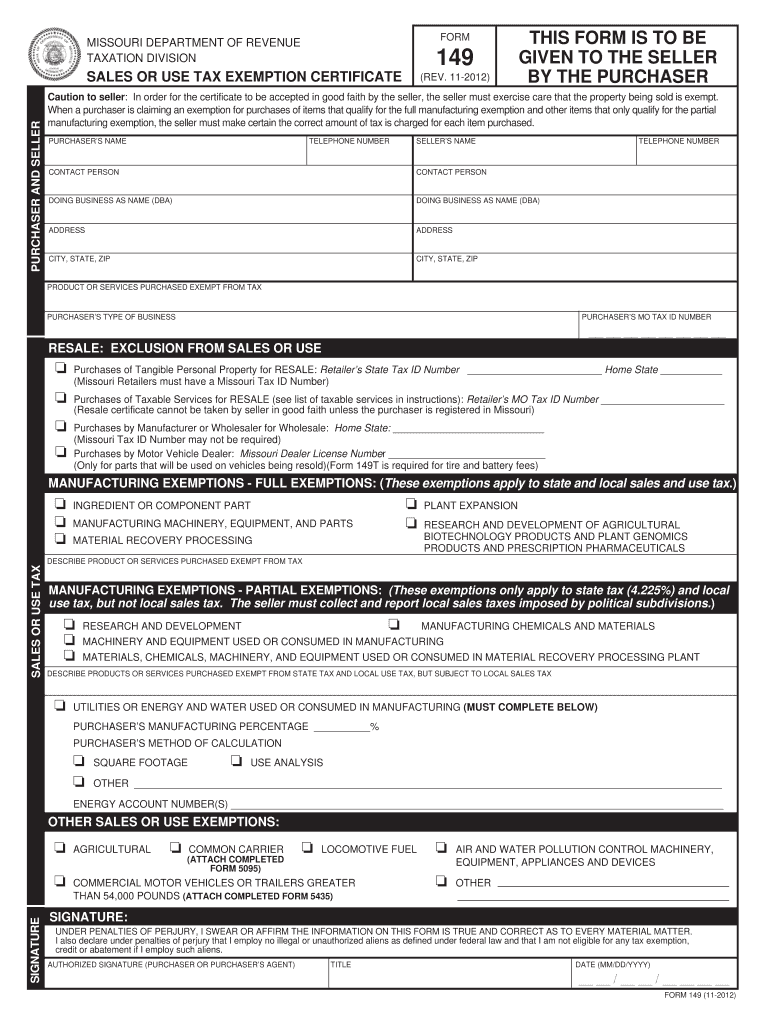

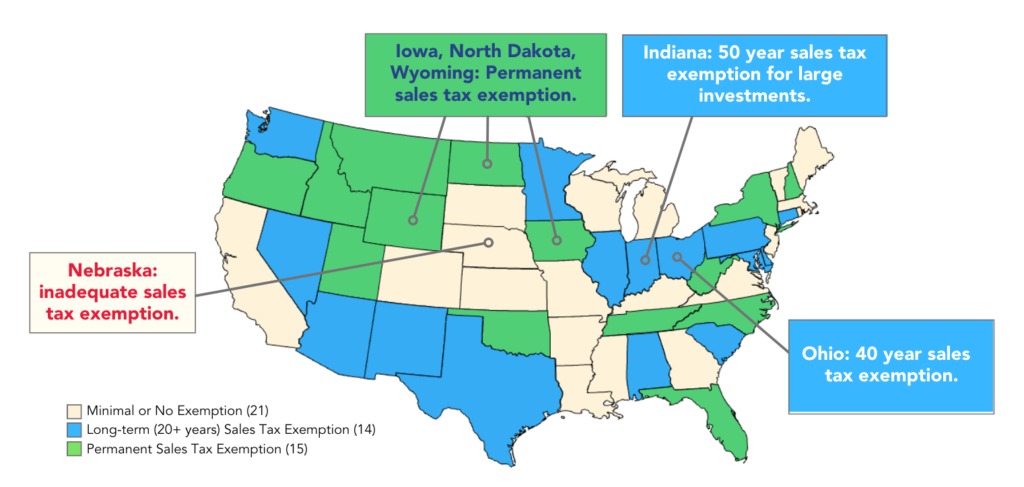

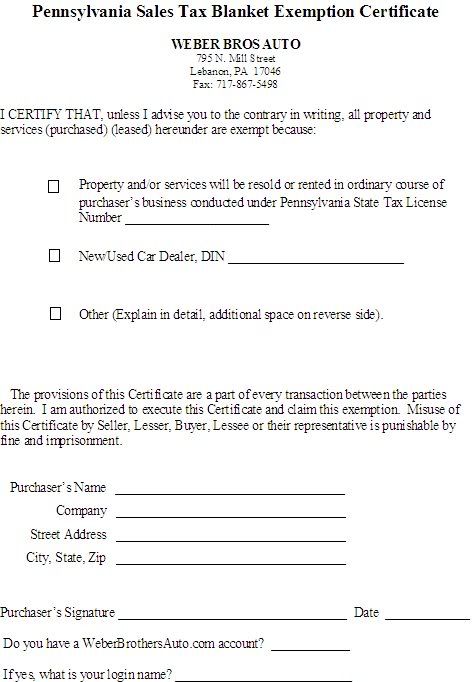

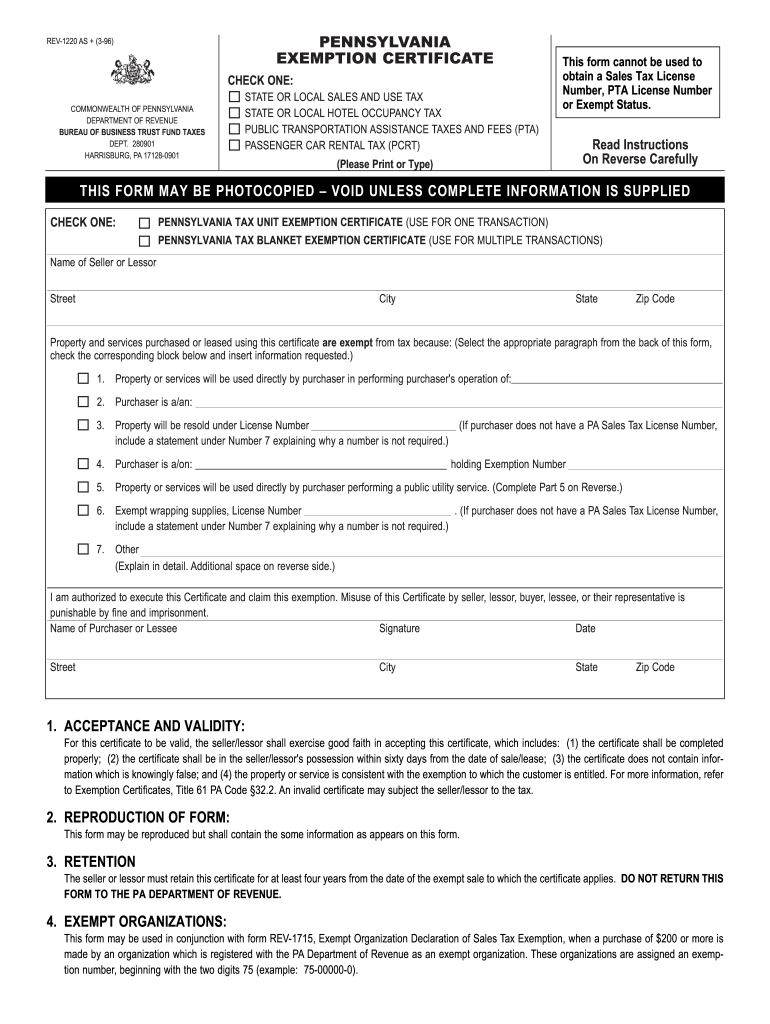

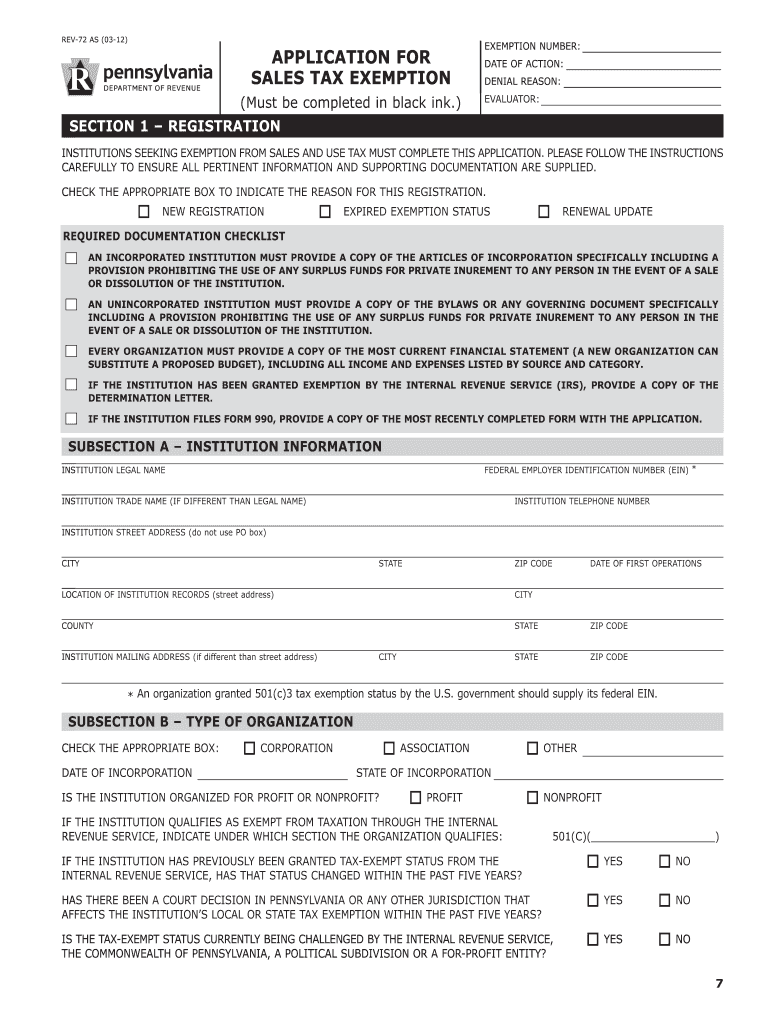

While most purchases in Pennsylvania are subject to the state sales tax, there are a few exemptions. One of these exemptions is for purchases made by organizations and institutions that are exempt from federal income tax. This includes purchases made by non-profit organizations, schools, and government agencies.Mattress Sales Tax Exemption in Pennsylvania

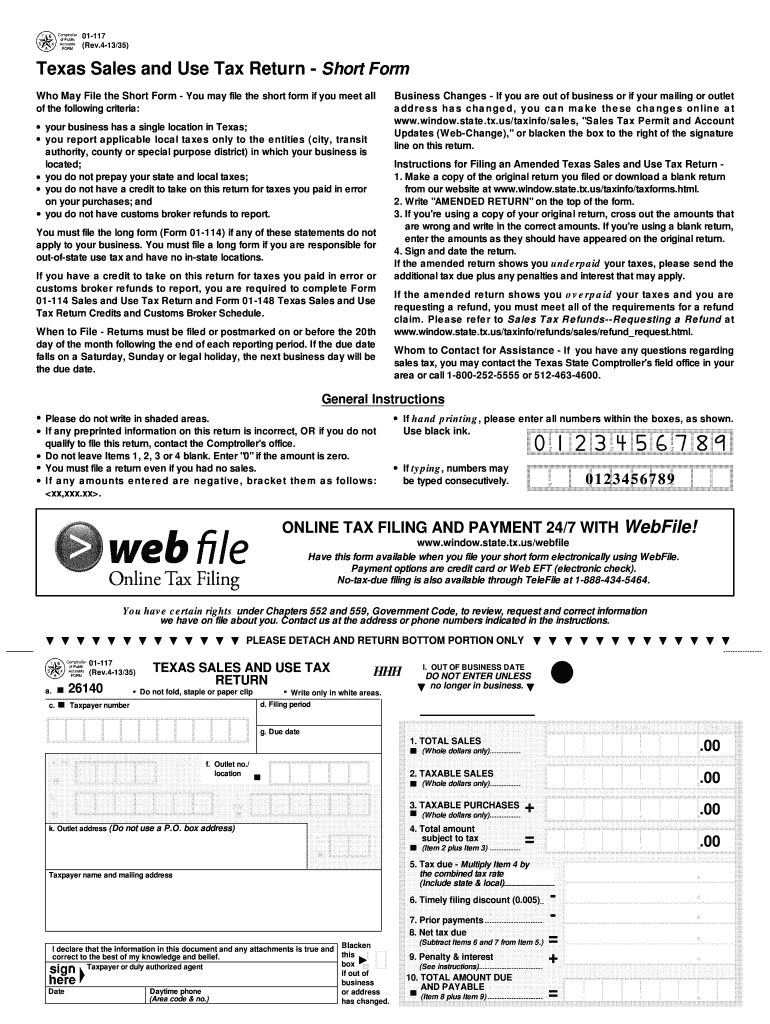

Online purchases made from retailers located in Pennsylvania are subject to the same sales tax rates as in-store purchases. However, if you purchase a mattress from an out-of-state retailer and have it shipped to Pennsylvania, you may be responsible for paying a use tax, which is equivalent to the state sales tax rate of 6%.Online Sales Tax in Pennsylvania

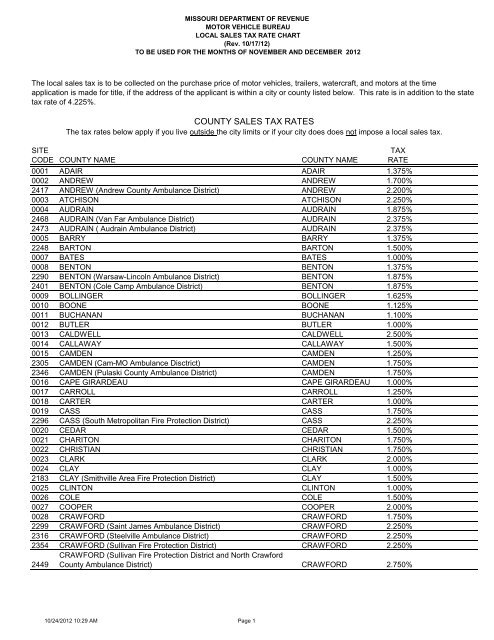

In addition to the state and county sales tax rates, there may also be local sales tax rates in certain cities or municipalities within Erie County. It is important to check with your local government to determine if there are any additional sales tax rates that apply to your purchases.Local Sales Tax Rates in Erie, PA

While there are no specific exemptions for mattresses in Pennsylvania, there are some general exemptions for certain types of purchases. For example, prescription drugs, groceries, and clothing are exempt from the state sales tax. However, this does not apply to mattresses.PA Sales Tax Exemption for Mattresses

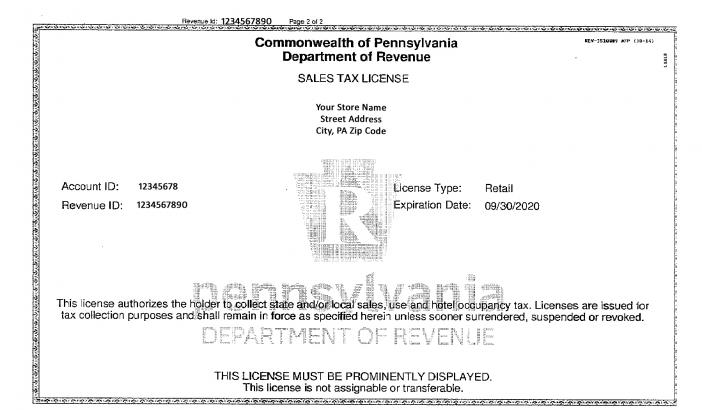

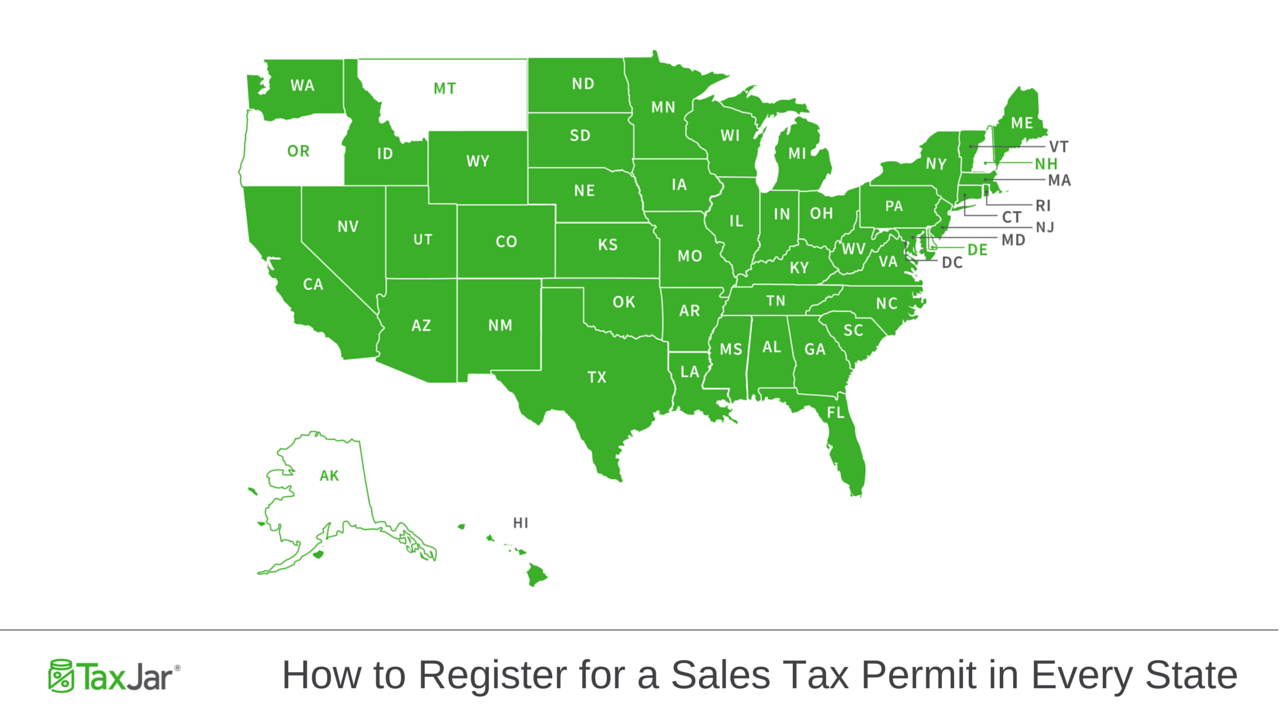

If you are a retailer selling mattresses in Pennsylvania, you are required to collect and remit sales tax to the state. To do this, you must register for a sales tax license with the Pennsylvania Department of Revenue. This can be done online through their website.How to Register for Sales Tax in Pennsylvania

If you purchase a mattress in Pennsylvania and have it delivered to your home, the sales tax will be applied to the total cost of the mattress, including delivery charges. This is because delivery charges are considered part of the sales transaction and are subject to the same sales tax rate as the purchase price of the mattress.PA Sales Tax on Mattress Delivery

Pennsylvania occasionally offers sales tax holidays, during which certain items are exempt from the state sales tax. However, mattresses are not typically included in these tax-free periods. It is important to stay updated on any upcoming sales tax holidays in case there are any changes to the items included in the exemption.Sales Tax Holidays in Pennsylvania

The Impact of Sales Tax in Erie, PA on Mattress Purchases

Mattresses are an essential part of any household and finding the perfect one can be a daunting task. Not only do you have to consider the size, comfort, and support of the mattress, but you also have to factor in the cost. In the city of Erie, Pennsylvania, this cost can be affected by the sales tax rate imposed on mattresses.

The Current Sales Tax Rate for Mattresses in Erie, PA

As of 2021, the sales tax rate for mattresses in Erie, PA is 6%. This means that for every $100 you spend on a mattress, you will have to pay an additional $6 in sales tax. This may not seem like a significant amount, but when you consider that mattresses can range from a few hundred dollars to a few thousand dollars, that extra 6% can add up quickly.

The Impact on Local Businesses

The sales tax rate in Erie, PA not only affects the consumers but also has an impact on local businesses. With the rise of online shopping and the ability to compare prices and taxes, consumers may choose to purchase their mattresses from retailers located outside of Erie. This can result in a loss of sales for local businesses and ultimately have a negative impact on the local economy.

Strategies for Consumers

With the sales tax rate in mind, there are a few strategies that consumers can use to save money on their mattress purchases in Erie, PA. One option is to wait for sales or promotions that offer discounts on mattresses. Another strategy is to purchase from a retailer that offers price matching, where they will match the price of a competitor's mattress. By doing this, consumers can potentially save on the sales tax, as well as the overall cost of the mattress.

Conclusion

When it comes to purchasing a mattress in Erie, PA, it's important to consider the impact of the sales tax rate. By understanding the current rate and utilizing strategies to save money, consumers can make a more informed decision and potentially save on their mattress purchase. Local businesses can also benefit from promoting sales and price-matching options to attract and retain customers. With all of these factors in mind, consumers can find the perfect mattress for their home without breaking the bank.

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/EL2WEKGRXBBMFKWFXYYGLRBVEA.jpg)