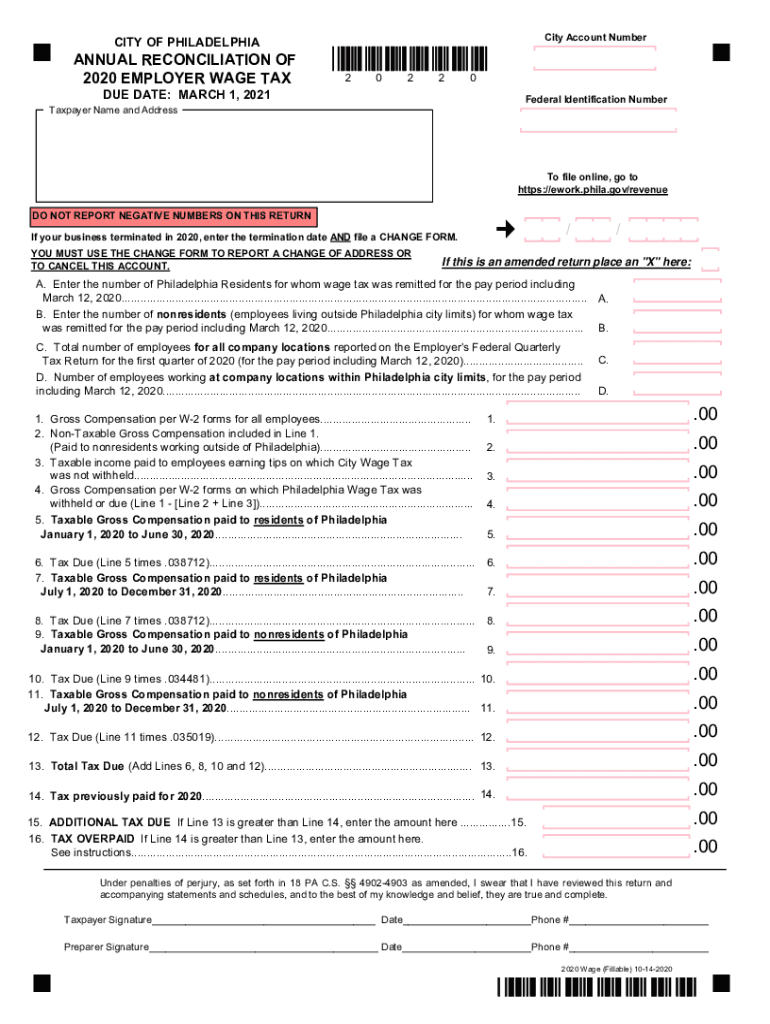

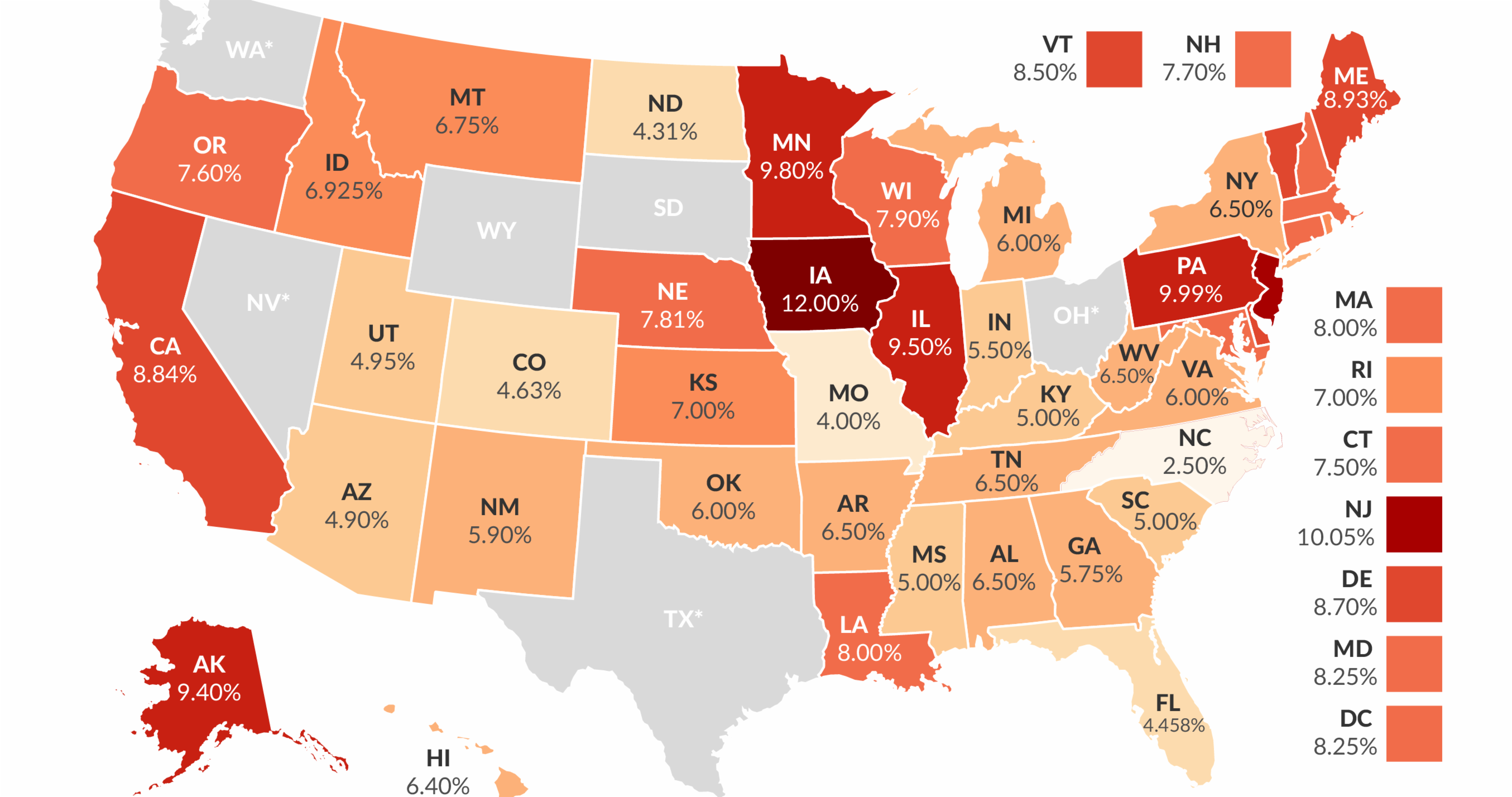

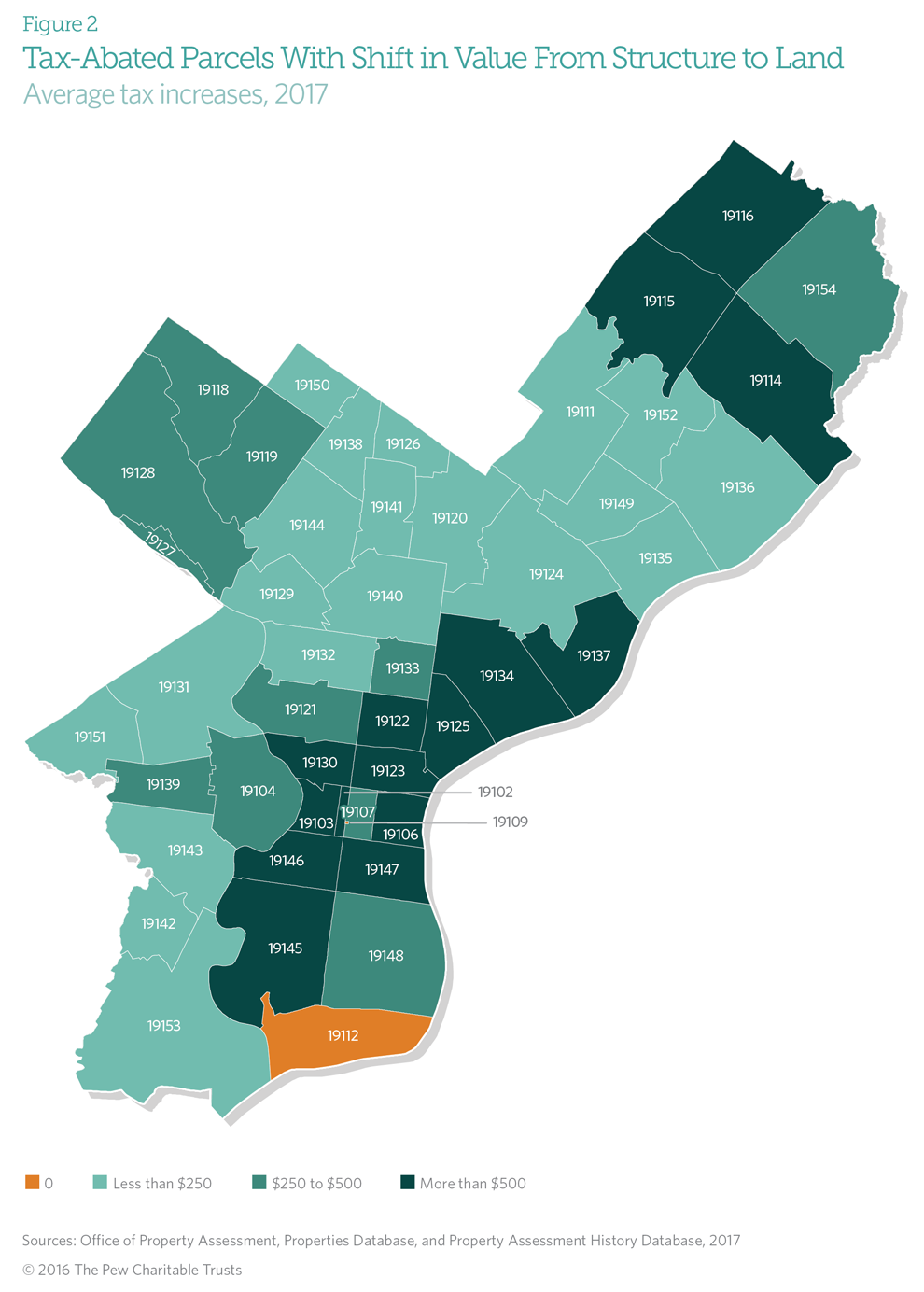

The city of Philadelphia imposes a sales tax on various goods and services, including mattresses. This tax is in addition to the state sales tax and is collected by the Philadelphia Department of Revenue. The current sales tax rate in Philadelphia is 8%, with 7% going to the state and 1% going to the city.Philadelphia Sales Tax

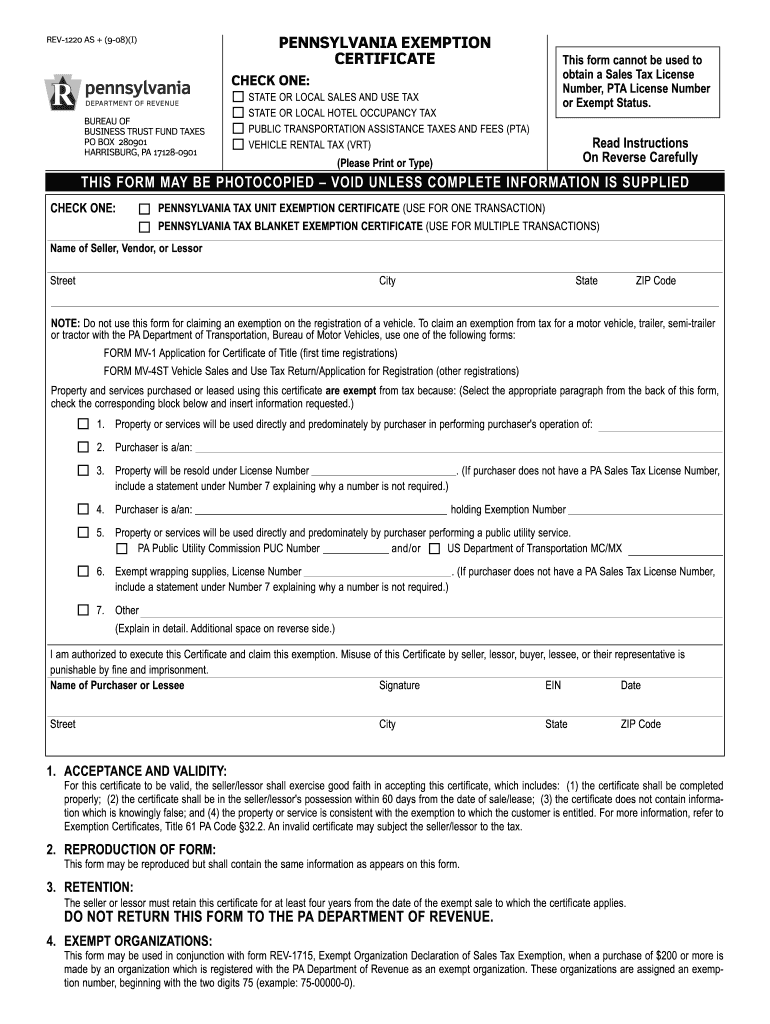

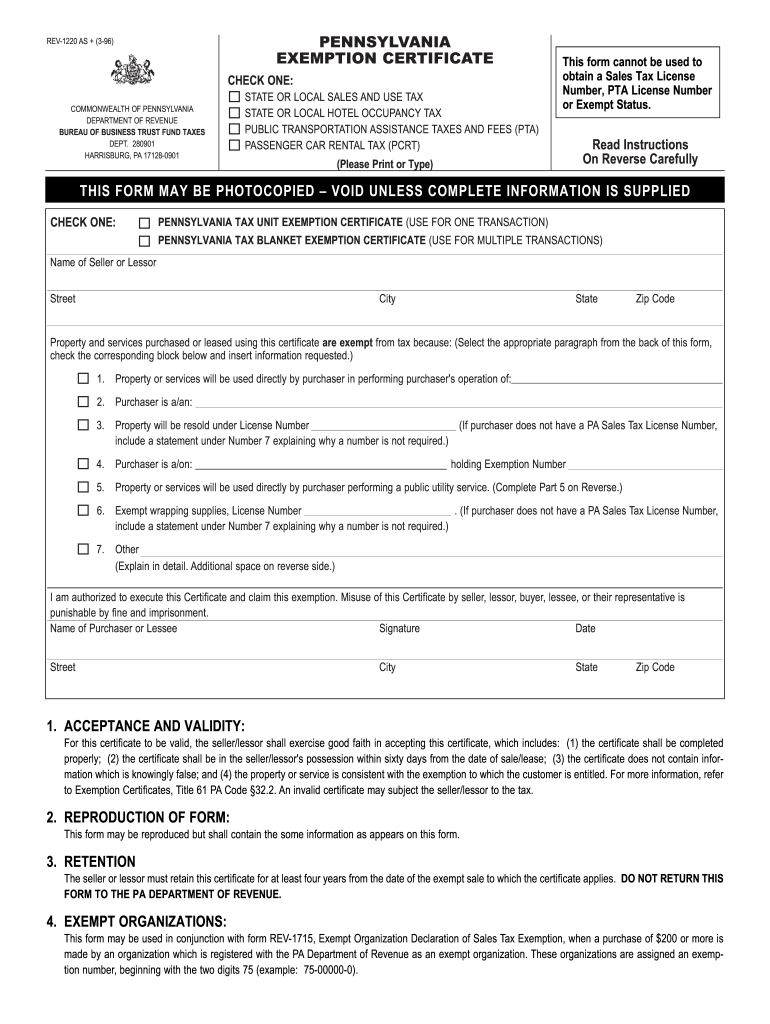

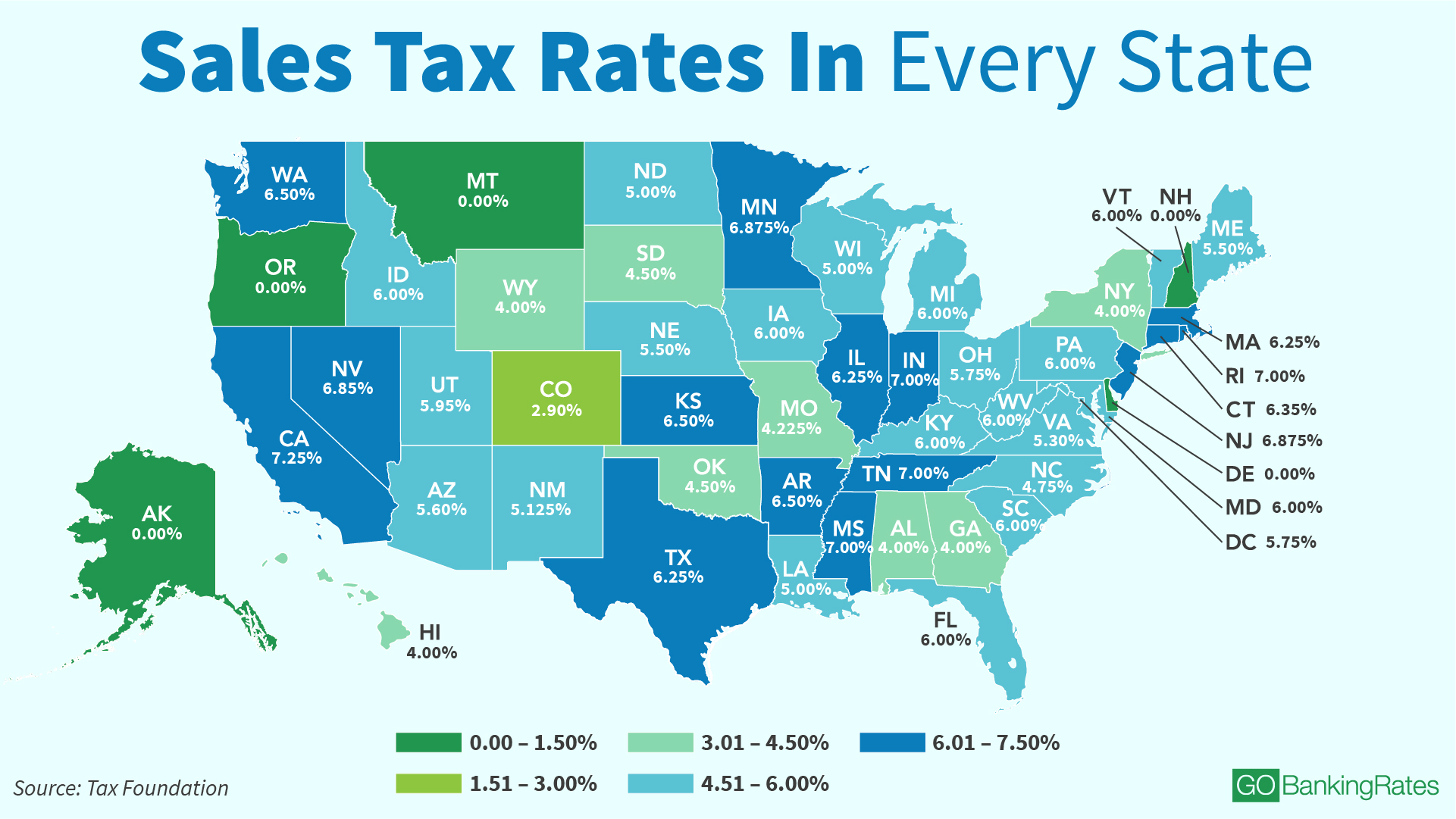

In addition to the Philadelphia sales tax, the state of Pennsylvania also imposes a sales tax on mattresses and other purchases. The state sales tax rate is currently 6%, but some cities and municipalities may have additional local sales taxes. It is important to check with the PA Department of Revenue for the most up-to-date information on tax rates.PA Sales Tax

When purchasing a mattress in Pennsylvania, it is important to be aware of the sales tax that will be added to your total purchase price. This tax applies to all types of mattresses, including innerspring, memory foam, and hybrid mattresses. The sales tax is calculated based on the total amount paid for the mattress, including any delivery or installation fees.Mattress Sales Tax

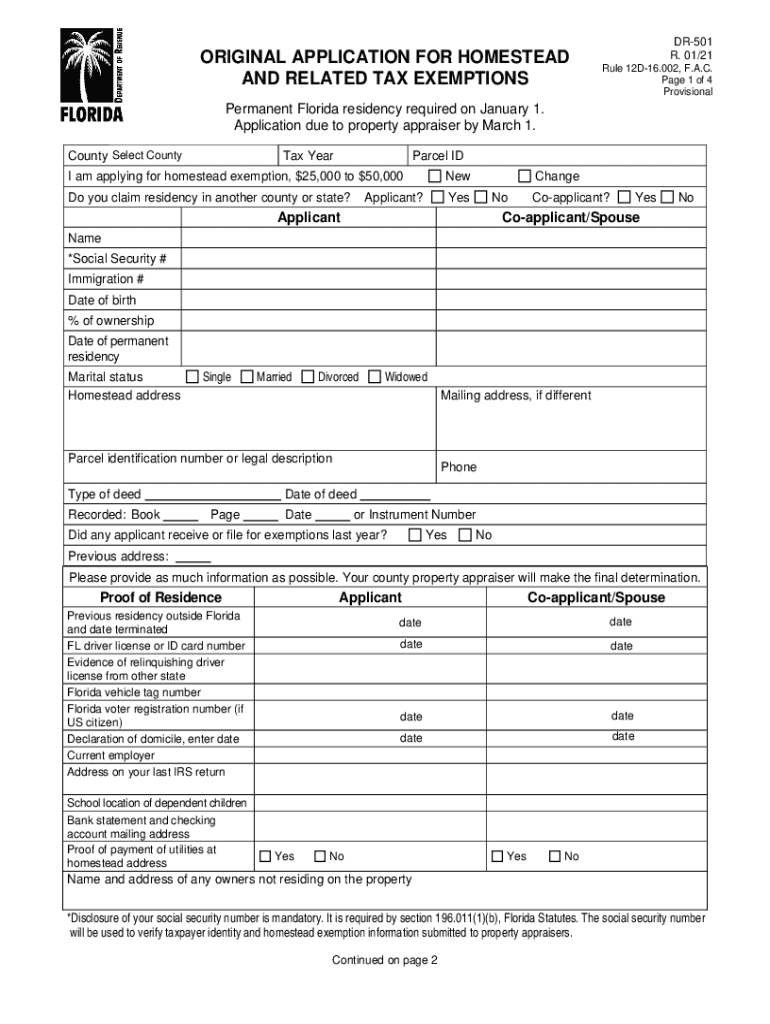

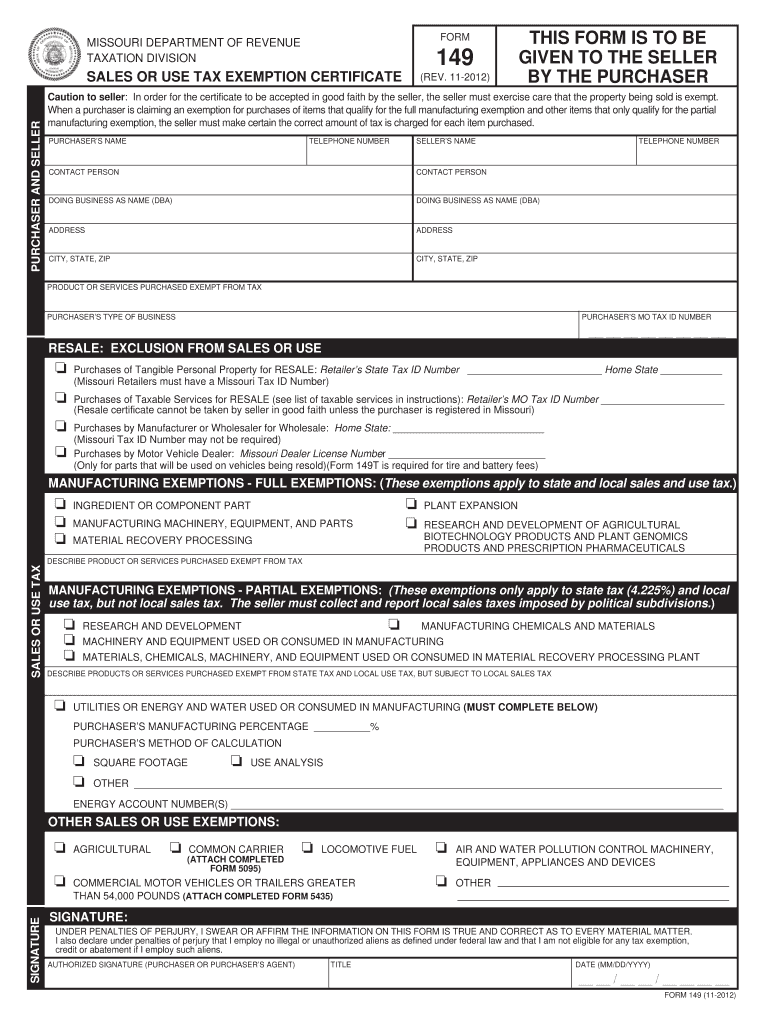

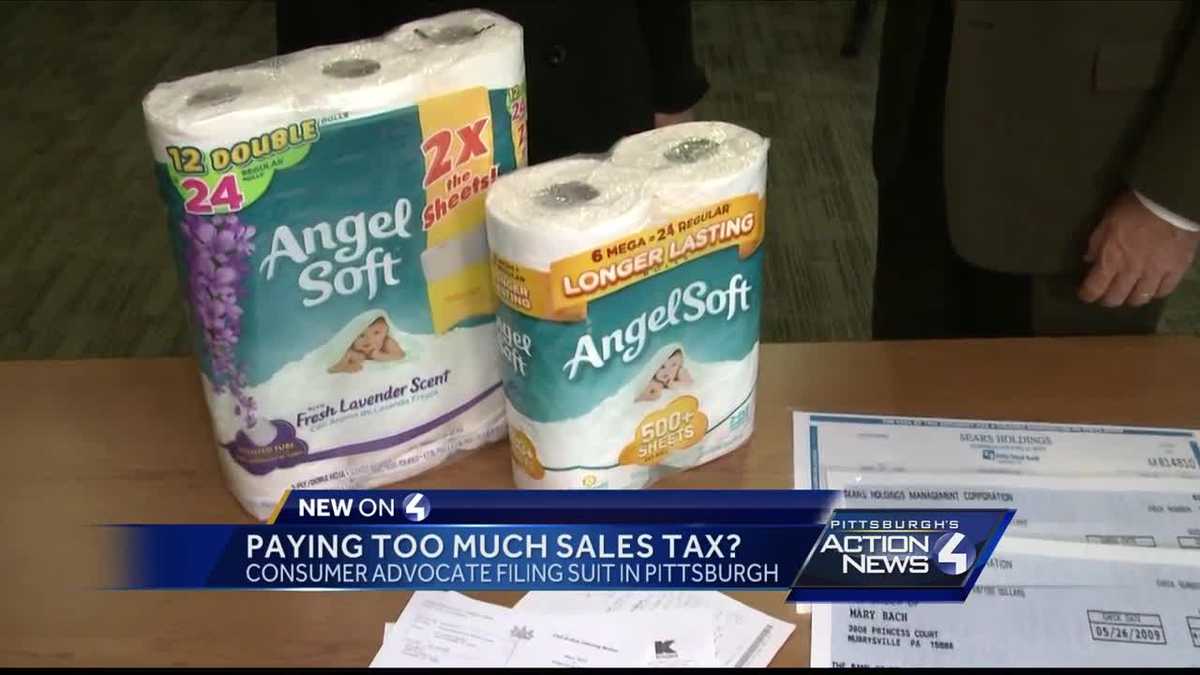

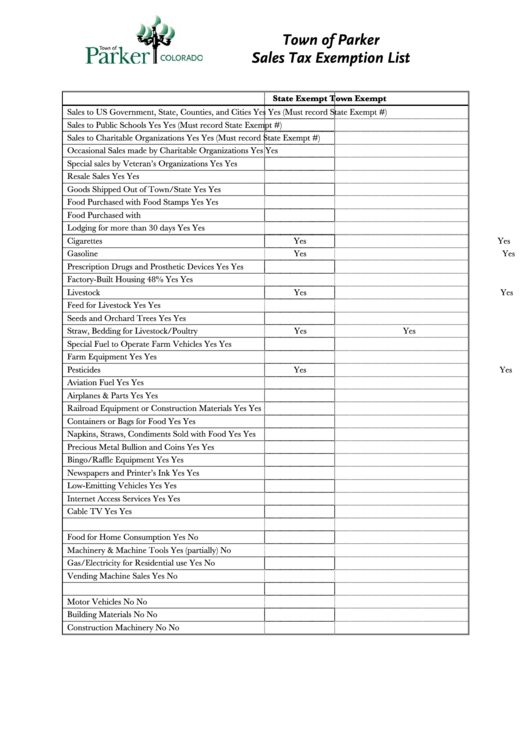

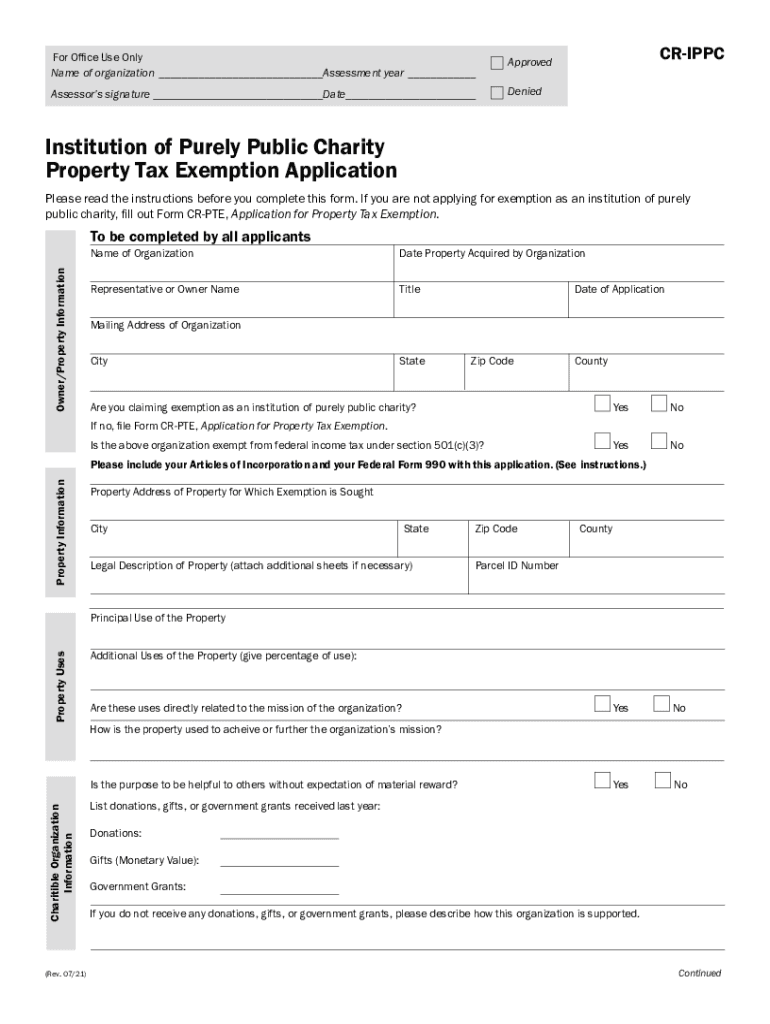

While mattresses are generally subject to sales tax in Pennsylvania, there are some exemptions that may apply. For example, if you are purchasing a mattress for a medical reason, such as to alleviate back pain, you may be able to receive a sales tax exemption with a prescription from your doctor. Additionally, some mattresses may be exempt from sales tax if they are made with certain materials, such as organic or natural materials.Sales Tax Exemptions

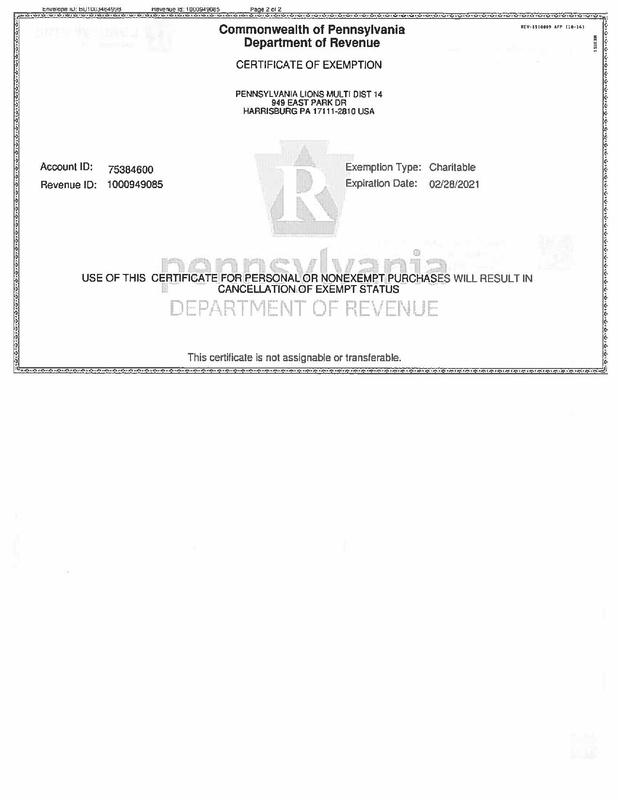

The Pennsylvania Department of Revenue is responsible for collecting and administering the state’s sales tax. They provide resources and information on sales tax rates, exemptions, and other important information for taxpayers. If you have questions about your sales tax obligations in Pennsylvania, the PA Department of Revenue is a valuable resource.PA Department of Revenue

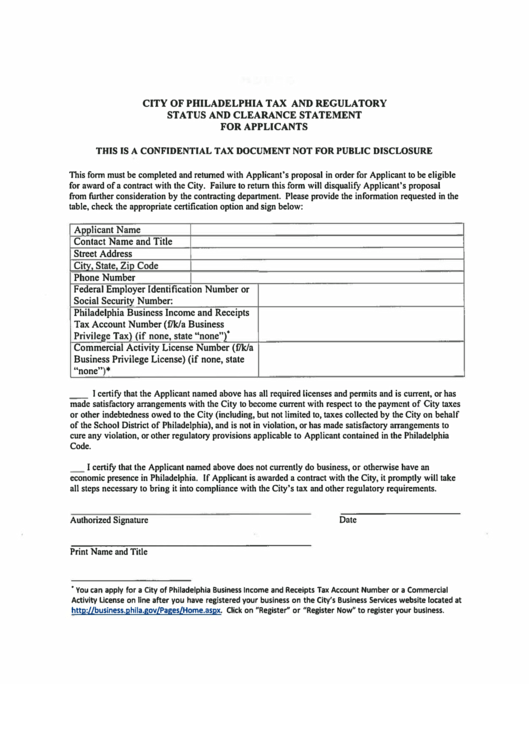

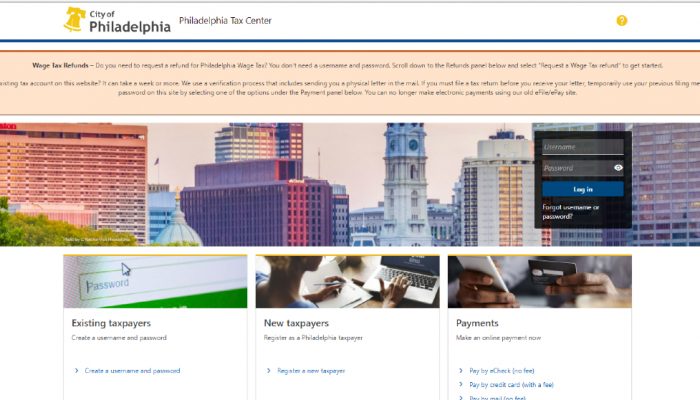

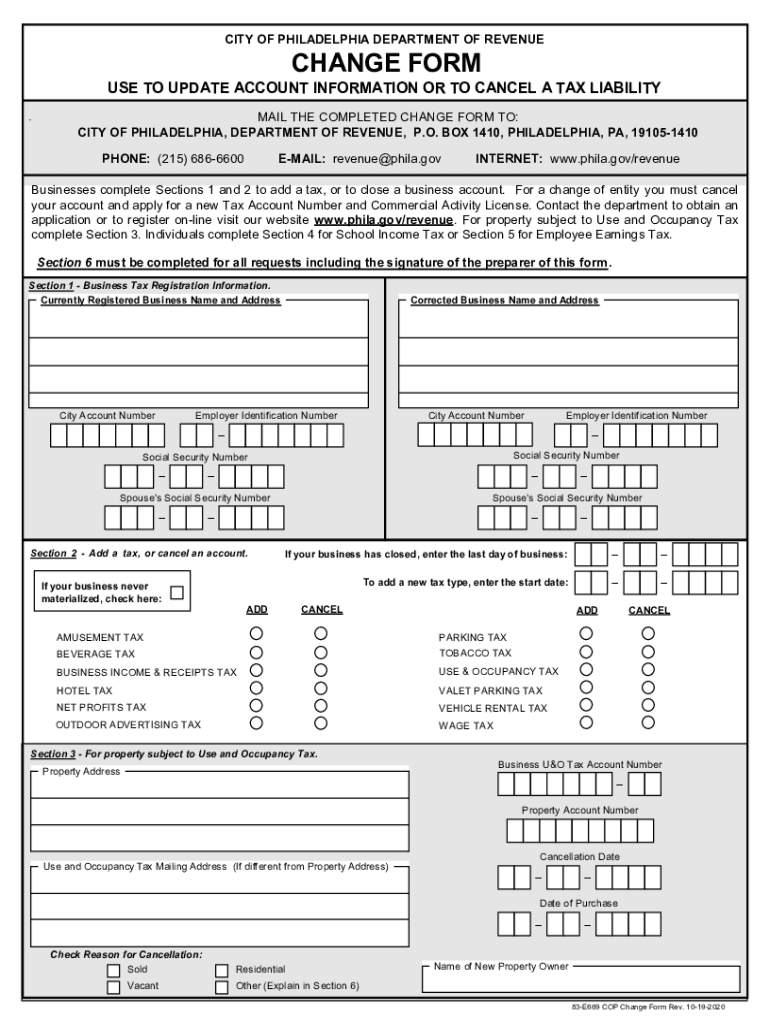

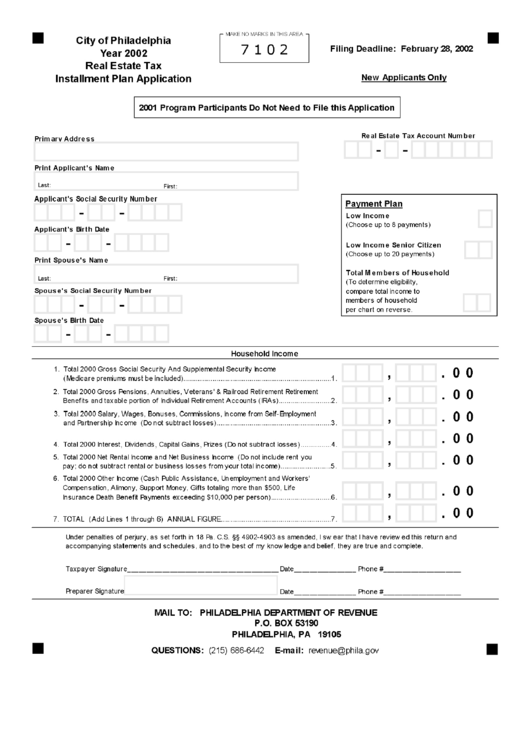

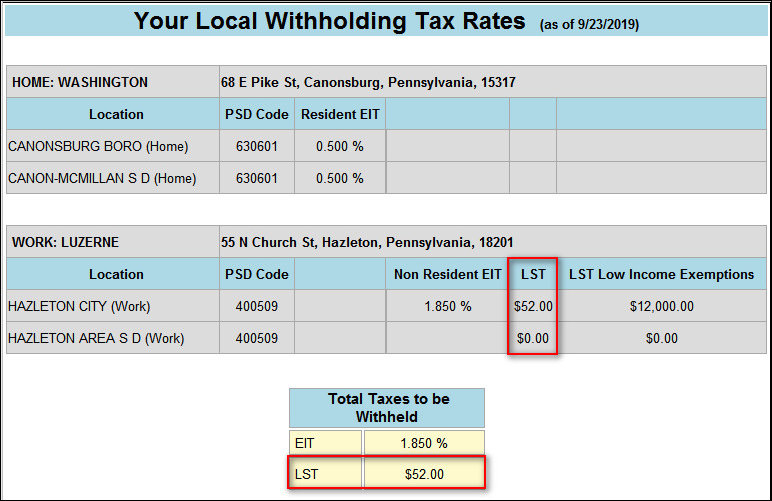

The Philadelphia Department of Revenue is responsible for collecting and administering the city’s sales tax. They provide resources and information on sales tax rates, exemptions, and other important information for taxpayers in Philadelphia. If you have questions about your sales tax obligations in the city, the Philadelphia Department of Revenue is a helpful source of information.Philadelphia Department of Revenue

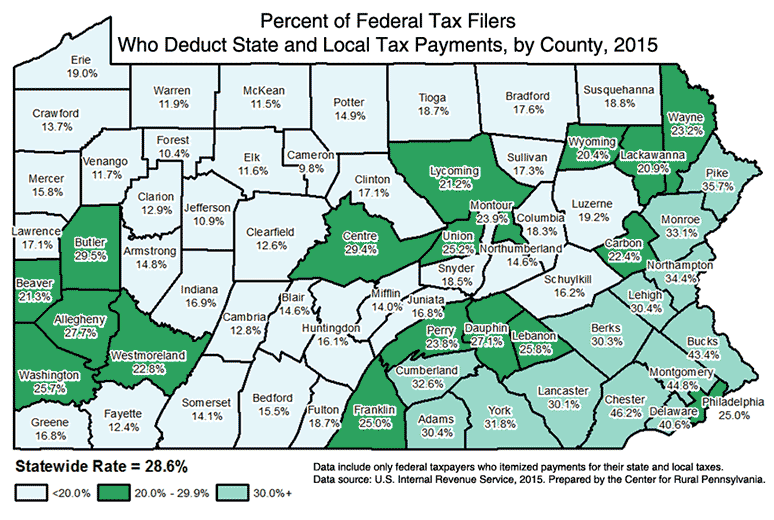

As mentioned earlier, the state sales tax rate in Pennsylvania is currently 6%. However, some cities and municipalities may have additional local sales taxes, so it is important to check with the PA Department of Revenue for the most accurate and up-to-date information on tax rates. It is also worth noting that the sales tax rate in Pennsylvania has not changed since 1968.PA Tax Rates

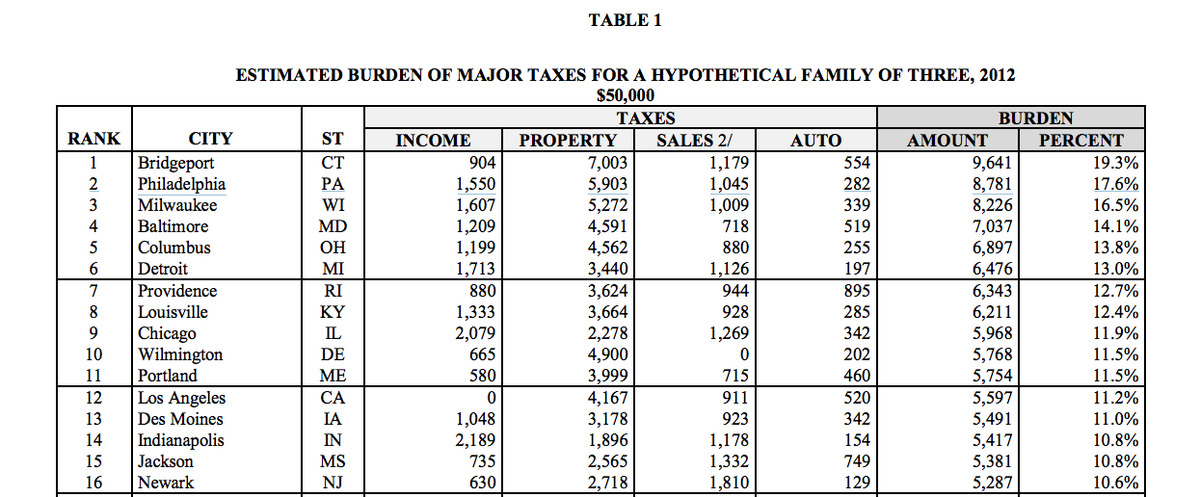

In addition to the state sales tax, the city of Philadelphia also imposes a sales tax at a rate of 1%. This brings the total sales tax rate in the city to 8%, with 7% going to the state and 1% going to the city. It is important to be aware of these tax rates when purchasing a mattress in Philadelphia to ensure you are properly budgeting for your purchase.Philadelphia Tax Rates

Aside from the medical and material exemptions mentioned earlier, there are other exemptions that may apply to certain purchases in Pennsylvania. For example, food and clothing are exempt from sales tax in the state. Additionally, certain organizations, such as charities and religious institutions, may be exempt from paying sales tax on purchases. It is important to consult with the PA Department of Revenue or a tax professional for more information on potential exemptions.PA Tax Exemptions

The city of Philadelphia also has some exemptions that may apply to certain purchases, such as food and clothing. Additionally, there are exemptions for organizations and institutions, such as non-profits and government entities. It is important to check with the Philadelphia Department of Revenue for more information on potential exemptions for your specific purchase.Philadelphia Tax Exemptions

Sales Tax for Mattresses in Pennsylvania Near Philadelphia

The Importance of Considering Sales Tax for Mattresses in Pennsylvania

When it comes to purchasing a new mattress, many factors come into play such as size, material, and comfort level. However, one important factor that is often overlooked is sales tax. In Pennsylvania, sales tax on mattresses can vary depending on your location, and for those living near Philadelphia, it's important to know the specific sales tax rates in order to make an informed purchase.

Sales Tax Rates for Mattresses Near Philadelphia

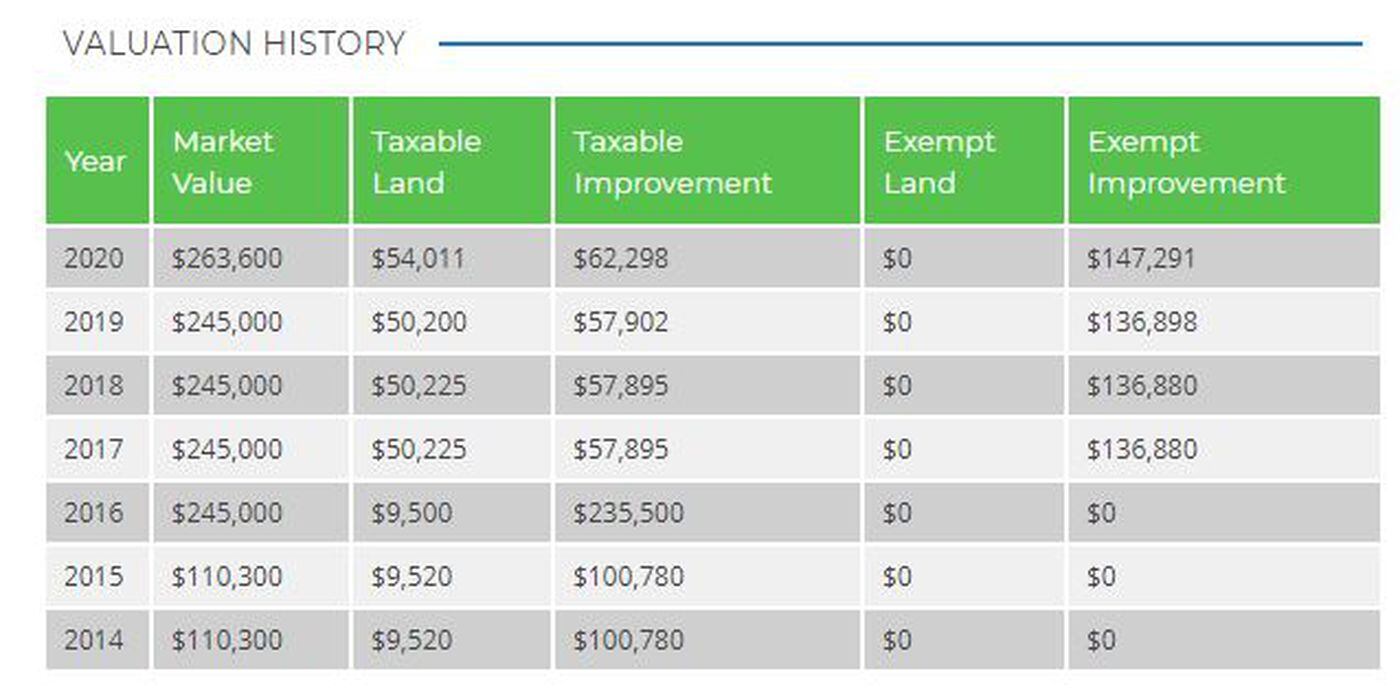

In the state of Pennsylvania, the sales tax rate for mattresses is 6%, but some cities and counties have additional local taxes that can increase the overall rate. For those living near Philadelphia, the sales tax rate can range from 6.6% to 8%, depending on the specific location. This means that for a mattress priced at $1,000, you could be paying an additional $60 to $80 in sales tax.

When it comes to purchasing a new mattress, many factors come into play such as size, material, and comfort level. However, one important factor that is often overlooked is sales tax. In Pennsylvania, sales tax on mattresses can vary depending on your location, and for those living near Philadelphia, it's important to know the specific sales tax rates in order to make an informed purchase.

Sales Tax Rates for Mattresses Near Philadelphia

In the state of Pennsylvania, the sales tax rate for mattresses is 6%, but some cities and counties have additional local taxes that can increase the overall rate. For those living near Philadelphia, the sales tax rate can range from 6.6% to 8%, depending on the specific location. This means that for a mattress priced at $1,000, you could be paying an additional $60 to $80 in sales tax.

How Sales Tax Affects Your Budget and Shopping Experience

The sales tax rate for mattresses can have a significant impact on your budget and overall shopping experience. With a higher sales tax rate, you may end up paying more than you initially budgeted for your new mattress. This can also make it difficult to comparison shop and find the best deal, as the final price may vary depending on the sales tax rate in different locations.

Planning Ahead for Your Mattress Purchase

Knowing the sales tax rates for mattresses near Philadelphia can help you plan ahead and budget accordingly for your purchase. If you have a specific budget in mind, it's important to factor in the sales tax rate to avoid any surprises at the checkout counter. Additionally, you may want to consider shopping in a neighboring city or county with a lower sales tax rate to save some money.

The sales tax rate for mattresses can have a significant impact on your budget and overall shopping experience. With a higher sales tax rate, you may end up paying more than you initially budgeted for your new mattress. This can also make it difficult to comparison shop and find the best deal, as the final price may vary depending on the sales tax rate in different locations.

Planning Ahead for Your Mattress Purchase

Knowing the sales tax rates for mattresses near Philadelphia can help you plan ahead and budget accordingly for your purchase. If you have a specific budget in mind, it's important to factor in the sales tax rate to avoid any surprises at the checkout counter. Additionally, you may want to consider shopping in a neighboring city or county with a lower sales tax rate to save some money.

The Benefits of Shopping for Mattresses in Pennsylvania Near Philadelphia

Despite the sales tax rate, there are many benefits to shopping for mattresses in Pennsylvania near Philadelphia. With a wide range of options available, you can find the perfect mattress to suit your needs and budget. Additionally, many mattress retailers offer sales and promotions throughout the year, allowing you to save even more on your purchase.

Final Thoughts

When it comes to purchasing a new mattress in Pennsylvania near Philadelphia, it's important to consider the sales tax rates in order to make an informed decision and stay within your budget. By planning ahead and being aware of the potential sales tax added to your purchase, you can ensure a smooth and stress-free shopping experience. Happy mattress shopping!

Despite the sales tax rate, there are many benefits to shopping for mattresses in Pennsylvania near Philadelphia. With a wide range of options available, you can find the perfect mattress to suit your needs and budget. Additionally, many mattress retailers offer sales and promotions throughout the year, allowing you to save even more on your purchase.

Final Thoughts

When it comes to purchasing a new mattress in Pennsylvania near Philadelphia, it's important to consider the sales tax rates in order to make an informed decision and stay within your budget. By planning ahead and being aware of the potential sales tax added to your purchase, you can ensure a smooth and stress-free shopping experience. Happy mattress shopping!

-1625833913635.png)