Purple Mattress Goes Public: 10 Things to Know About the IPO

The popular mattress company, Purple, has announced that it will be going public with an initial public offering (IPO). This news has sparked the interest of investors and consumers alike. If you're considering investing in Purple or are simply curious about the IPO, here are 10 things you need to know.

1. What is an IPO?

An IPO is when a private company decides to offer shares of its stock to the public for the first time. This allows the company to raise capital and expand its business.

2. Why is Purple going public?

Purple has experienced significant growth since its launch in 2015, and the company believes that going public will help accelerate its expansion plans. The IPO will also provide funds for research and development, marketing, and potential acquisitions.

3. How much is Purple looking to raise?

The company has not disclosed the exact amount it is looking to raise, but experts predict it could be in the range of $150-200 million.

4. What will happen to current shareholders?

Current shareholders, including founders Tony and Terry Pearce, will retain control of the company after the IPO. They will also have the opportunity to sell some of their shares.

5. What is the expected IPO date?

The official date has not been announced yet, but Purple is expected to go public in the second half of 2021.

6. How will the IPO affect the company's valuation?

Purple's estimated valuation after the IPO is around $2 billion, which is a significant increase from its previous valuation of $1 billion.

7. How will the company use the funds raised?

Purple plans to use the funds raised from the IPO for various purposes, including expanding its manufacturing capabilities, investing in new products, and expanding its retail and online presence.

8. What are the potential risks and challenges for investors?

As with any investment, there are risks involved. In Purple's case, some potential risks include competition from other mattress companies, fluctuations in the economy, and supply chain disruptions.

9. What impact will the IPO have on the mattress industry?

The mattress industry has seen significant growth in recent years, and Purple's IPO could further disrupt the market. With the influx of capital, Purple may be able to expand its market share and introduce new products, leading to increased competition for other mattress companies.

10. What are experts saying about the IPO?

Experts are generally positive about Purple's IPO, citing the company's strong financials and potential for growth. However, some caution that the mattress industry is highly competitive, and investors should carefully consider the risks before investing.

Purple Mattress Goes Public: What Investors Need to Know

Investing in an IPO can be both exciting and nerve-wracking, especially when it comes to a popular company like Purple. If you're considering investing in the Purple IPO, here are a few things you need to know before making a decision.

1. Do your research.

Before investing in any IPO, it's essential to do your due diligence and research the company thoroughly. Look into their financials, growth strategy, and potential risks. It's also a good idea to consult with a financial advisor to determine if the investment aligns with your financial goals.

2. Consider the company's potential for growth.

Purple has seen impressive growth since its launch, and the company's expansion plans after the IPO could lead to even more growth. However, it's important to carefully evaluate the potential for growth in the mattress industry and how Purple plans to stand out among competitors.

3. Be aware of the risks.

As mentioned earlier, there are risks involved with any investment, and the Purple IPO is no exception. It's important to be aware of these risks and consider them before making any investment decisions.

4. Keep an eye on the IPO date.

As the official IPO date has not been announced yet, it's crucial to stay updated and monitor the company's news and announcements. This will help you make an informed decision when the IPO opens.

5. Consider the company's long-term potential.

While it's tempting to jump on the IPO hype train, it's essential to consider the company's long-term potential and not just its initial public offering. Look into the company's future plans and how they plan to continue growing and generating profits.

Purple Mattress Goes Public: What to Expect from the IPO

The Purple IPO is a highly anticipated event, and investors are eager to see how it will unfold. Here's what you can expect from the IPO process and the company's future plans.

1. The IPO process.

The IPO process typically involves several steps, including registering with the Securities and Exchange Commission (SEC), setting a price range, and offering shares to investors. Once the IPO opens, investors can purchase shares through their preferred broker or through the company's underwriters.

2. The company's valuation.

As mentioned earlier, Purple's estimated valuation after the IPO is around $2 billion, which is a significant increase from its previous valuation of $1 billion. However, the actual valuation may vary depending on market conditions and investor demand.

3. The impact on the company's financials.

The IPO will provide a significant influx of capital to Purple, which will impact the company's financials. Investors can expect to see an increase in revenue and potentially profitability as the company uses the funds to expand and improve its operations.

4. Expansion plans.

Purple has already announced plans to expand its manufacturing capabilities and invest in new products after the IPO. Investors can expect to see this expansion continue as the company looks to increase its market share and stay ahead of competitors.

5. Potential acquisitions.

Purple may also use some of the funds raised from the IPO for potential acquisitions. This could lead to further growth and diversification for the company in the future.

Purple Mattress Goes Public: How the Company Plans to Use the Funds

The Purple IPO is expected to raise significant funds for the company, and investors are curious about how the company plans to use this capital. Here's a breakdown of how Purple plans to use the funds raised from the IPO.

1. Expanding manufacturing capabilities.

Purple plans to invest in expanding its manufacturing capabilities to keep up with the growing demand for its products. This will allow the company to increase production and potentially reduce costs, leading to improved profitability.

2. Investing in new products.

The company has also stated that it will use some of the funds to invest in new products. This could include developing new mattress models, expanding into new categories, or improving existing products.

3. Expanding retail and online presence.

Purple has a strong online presence, but the company is also looking to expand its retail presence with the funds raised from the IPO. This could lead to more retail partnerships and increased visibility for the brand.

4. Potential acquisitions.

As mentioned earlier, Purple may use some of the funds to acquire other companies in the mattress industry or related industries. This could lead to further growth and diversification for the company.

5. Other potential uses.

Purple has not disclosed all the potential uses for the funds raised from the IPO, but the company has stated that it will use the capital for general corporate purposes, which could include marketing, research and development, and debt repayment.

Purple Mattress Goes Public: A Look at the Company's Financials

As with any investment, it's essential to consider a company's financials before making a decision. Here's a breakdown of Purple's financials and how they have performed in recent years.

1. Revenue growth.

Purple has seen significant revenue growth since its launch in 2015, with revenue increasing from $18.4 million in 2016 to $186.7 million in 2020.

2. Net income.

Purple has also seen a positive trend in its net income, with a net loss of $4.3 million in 2016 turning into a net income of $17.1 million in 2020.

3. Earnings before interest, taxes, depreciation, and amortization (EBITDA).

The company's EBITDA has also shown growth, with an EBITDA loss of $3.7 million in 2016 turning into a positive EBITDA of $25.8 million in 2020.

4. Gross margin.

Purple's gross margin has also improved over the years, increasing from 44.3% in 2016 to 46.6% in 2020.

5. Cash flow from operations.

The company's cash flow from operations has also been positive in recent years, indicating a strong financial position and potential for growth.

Purple Mattress Goes Public: Potential Risks and Challenges

While Purple's IPO may seem like a promising investment opportunity, there are potential risks and challenges that investors should be aware of before making a decision.

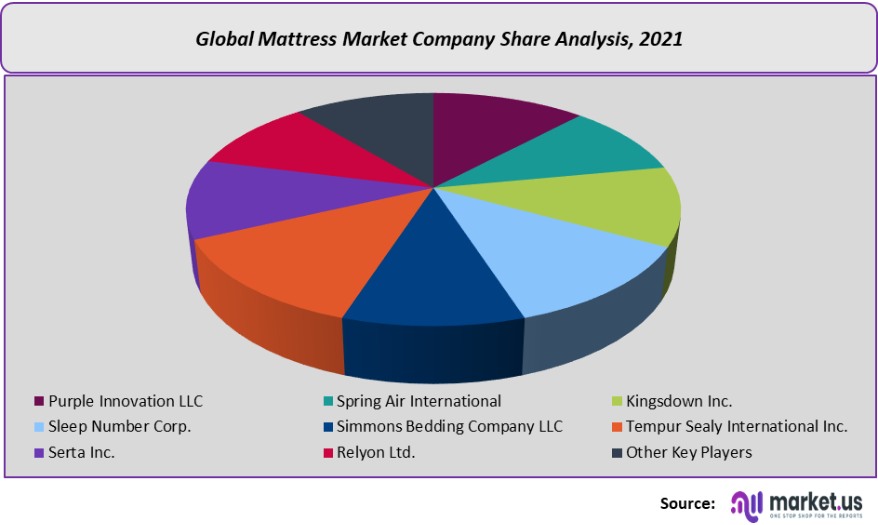

1. Competition from other mattress companies.

The mattress industry is highly competitive, and Purple faces competition from both traditional and online mattress companies. As the company expands, it may face increased competition, which could affect its market share and profitability.

2. Fluctuations in the economy.

The mattress industry is also affected by fluctuations in the economy, and a downturn could impact Purple's sales and profitability. However, the company's strong financials may help mitigate this risk to some extent.

3. Supply chain disruptions.

Like many other businesses, Purple is vulnerable to supply chain disruptions, which could affect its production and product availability. This could lead to decreased revenue and increased costs for the company.

4. Potential operational challenges.

As the company expands and introduces new products, it may face operational challenges that could affect its financials and reputation. However, with proper planning and management, these challenges can be overcome.

5. Regulatory changes.

Changes in regulations or laws could also affect Purple's operations and profitability, especially if they impact the company's ability to sell and distribute its products.

Purple Mattress Goes Public: Impact on the Mattress Industry

The mattress industry has seen significant growth in recent years, and Purple's IPO could have a significant impact on the market. Here's a look at how the company's public offering could affect the mattress industry.

1. Increased competition.

Purple's expansion plans and potential for growth could lead to increased competition in the mattress industry. This could potentially benefit consumers by providing more options and competitive pricing.

2. Disruption in the market.

Purple has already disrupted the mattress industry with its innovative products and marketing tactics. The company's IPO could further disrupt the market and potentially change the way consumers think about buying mattresses.

3. Potential for more IPOs.

Purple's IPO could also pave the way for other mattress companies to go public, as investors and consumers show interest in the industry. This could lead to more growth and competition in the market.

4. Increased focus on online sales.

Purple's success with online sales has shown the potential for growth in the e-commerce mattress market. Other companies may follow suit and focus more on their online presence, potentially shifting the industry's traditional retail model.

5. Potential for industry consolidation.

As companies look to stay competitive and expand, there could be potential for mergers and acquisitions in the mattress industry. This could lead to a consolidation of the market and potentially affect competition and pricing.

Purple Mattress Goes Public: Analysis of the Company's Growth Strategy

One of the key factors investors will consider when deciding whether to invest in the Purple IPO is the company's growth strategy. Here's an analysis of Purple's growth strategy and how it could lead to increased profitability and market share.

1. Product innovation.

Purple has been successful in the mattress market due to its unique and innovative products. The company's continued focus on research and development and introducing new products could lead to increased consumer interest and sales.

2. Expansion into new markets.

Purple has already expanded beyond just mattresses, with products like pillows, sheets, and even pet beds. The company's IPO could provide the capital needed to further expand into new markets, diversifying its revenue streams and potentially increasing profitability.

The Evolution of Purple Mattress: From Innovative Product to Public Company

The Journey to Success

When Purple Mattress first entered the market in 2015, it caused a stir with its revolutionary design and comfort technology. The company quickly gained popularity and became a household name in the mattress industry. In just six years, Purple Mattress has gone from a small startup to a major player in the market, with a valuation of over $1 billion. And now, the company is taking its success to the next level by going public.

When Purple Mattress first entered the market in 2015, it caused a stir with its revolutionary design and comfort technology. The company quickly gained popularity and became a household name in the mattress industry. In just six years, Purple Mattress has gone from a small startup to a major player in the market, with a valuation of over $1 billion. And now, the company is taking its success to the next level by going public.

Going Public: What Does It Mean?

For those unfamiliar with the term, going public means that a company is offering its shares to the general public for the first time. This is a significant step for a company and can have major implications on its future growth and success. By going public, Purple Mattress is essentially opening its doors to a larger pool of investors, which can provide the company with the necessary funds to expand its operations and continue its growth trajectory.

For those unfamiliar with the term, going public means that a company is offering its shares to the general public for the first time. This is a significant step for a company and can have major implications on its future growth and success. By going public, Purple Mattress is essentially opening its doors to a larger pool of investors, which can provide the company with the necessary funds to expand its operations and continue its growth trajectory.

What's Driving This Decision?

Purple Mattress' decision to go public is a strategic move to solidify its position as a leader in the mattress industry. With the increased funding and resources from being a public company, Purple Mattress can continue to innovate and improve its products. This will not only benefit the company but also its customers, who can expect even better and more advanced products in the future.

Purple Mattress' decision to go public is a strategic move to solidify its position as a leader in the mattress industry. With the increased funding and resources from being a public company, Purple Mattress can continue to innovate and improve its products. This will not only benefit the company but also its customers, who can expect even better and more advanced products in the future.

The Benefits for Investors

Going public also presents a unique opportunity for investors to get on board with a company that has a proven track record of success and a promising future. Purple Mattress has already established itself as a top player in the market, and with its plans for expansion and growth, it is expected to continue its upward trajectory. This makes it an attractive investment opportunity for both new and seasoned investors.

Going public also presents a unique opportunity for investors to get on board with a company that has a proven track record of success and a promising future. Purple Mattress has already established itself as a top player in the market, and with its plans for expansion and growth, it is expected to continue its upward trajectory. This makes it an attractive investment opportunity for both new and seasoned investors.

A Bright Future for Purple Mattress

In conclusion, Purple Mattress' decision to go public is a testament to its success and a promising sign for its future. With its innovative products, strong brand reputation, and now, the backing of public investors, the company is poised to reach new heights in the mattress industry. As the company continues to grow and evolve, customers can expect to see even more exciting and comfortable products from Purple Mattress.

In conclusion, Purple Mattress' decision to go public is a testament to its success and a promising sign for its future. With its innovative products, strong brand reputation, and now, the backing of public investors, the company is poised to reach new heights in the mattress industry. As the company continues to grow and evolve, customers can expect to see even more exciting and comfortable products from Purple Mattress.