If you're in the market for a new mattress, you may have noticed that the price can quickly add up. Not only do you have to consider the cost of the mattress itself, but also any additional fees and taxes. One tax that can significantly impact the price of a mattress is the sales tax. But did you know that there are exemptions and ways to save on sales tax when purchasing a prescription mattress? Here's everything you need to know about sales tax and prescription mattresses.Understanding Sales Tax on Mattresses

For those with medical conditions that require a specialized mattress, the cost can be quite high. However, there are ways to save on sales tax when purchasing a prescription mattress. One option is to take advantage of sales tax holidays, which are specific days or weekends where certain items, including mattresses, are exempt from sales tax. Another option is to apply for a sales tax exemption for medical necessity items, such as prescription mattresses.How to Save on Sales Tax for Prescription Mattresses

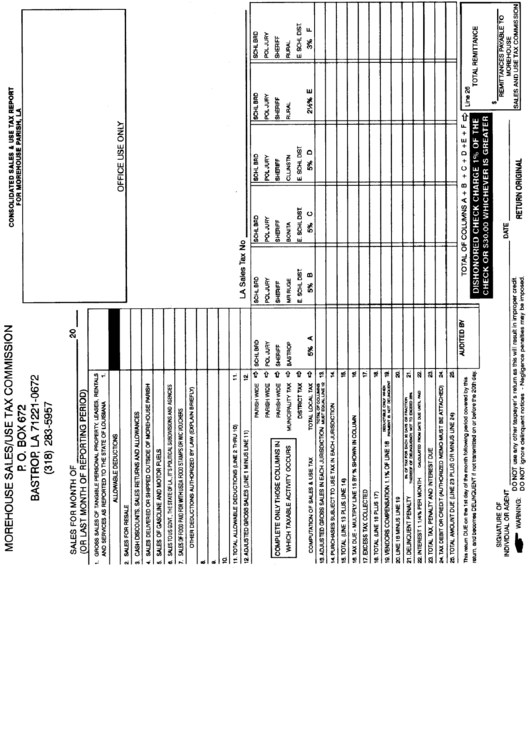

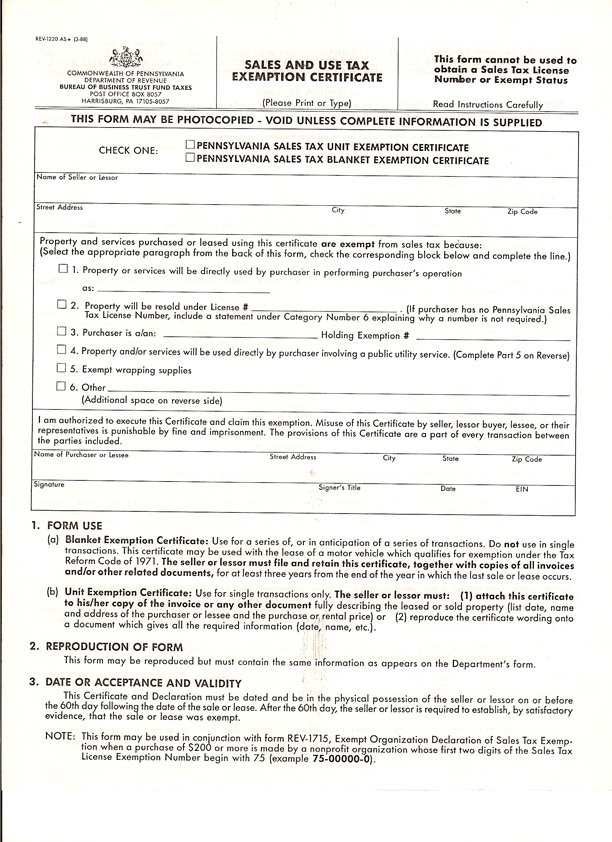

Each state has its own regulations regarding sales tax exemptions for prescription mattresses. Some states may offer a blanket exemption for all medical necessity items, while others may have specific criteria that must be met to qualify for the exemption. It's essential to research your state's laws and regulations or consult with a tax professional to see if you qualify for a sales tax exemption for your prescription mattress purchase.State Sales Tax Exemptions for Prescription Mattresses

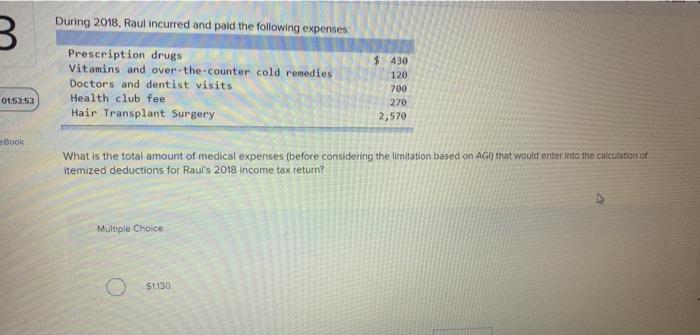

In addition to sales tax exemptions, you may also be able to claim a tax deduction for your prescription mattress purchase. This applies if you itemize deductions on your tax return and your medical expenses exceed a certain threshold. Keep in mind that this deduction only applies to medical expenses that are not covered by insurance, so it's essential to save all receipts and documentation related to your prescription mattress purchase.Prescription Mattresses and Tax Deductions

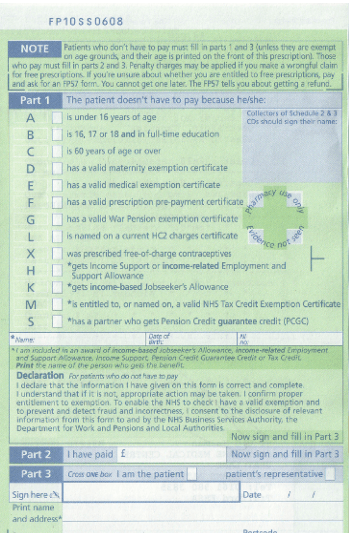

Aside from prescription mattresses, there are also sales tax exemptions for other medical necessity items, such as medical equipment, prescription medications, and prosthetics. These exemptions vary by state, so it's crucial to research your state's laws or consult with a tax professional to see if you qualify for any exemptions.Sales Tax Exemptions for Medical Necessity Items

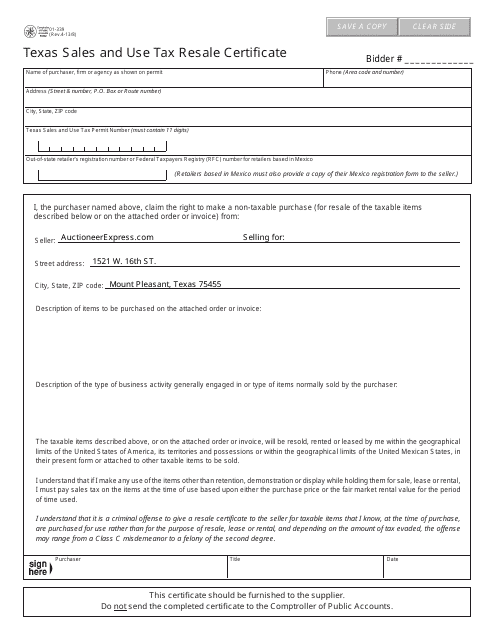

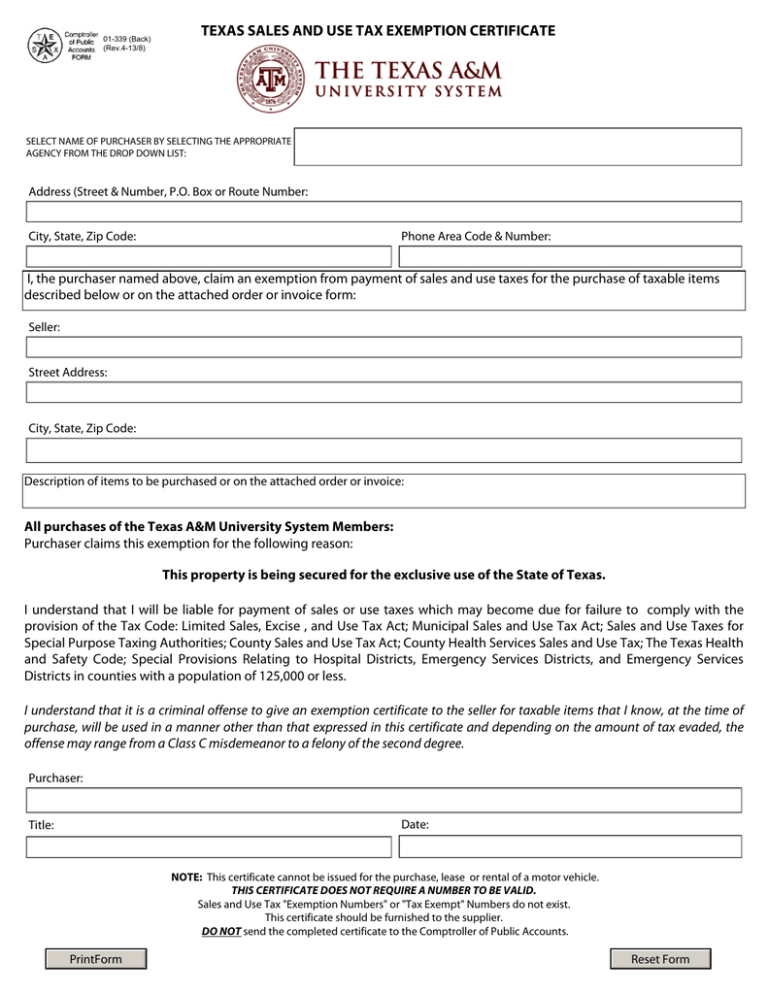

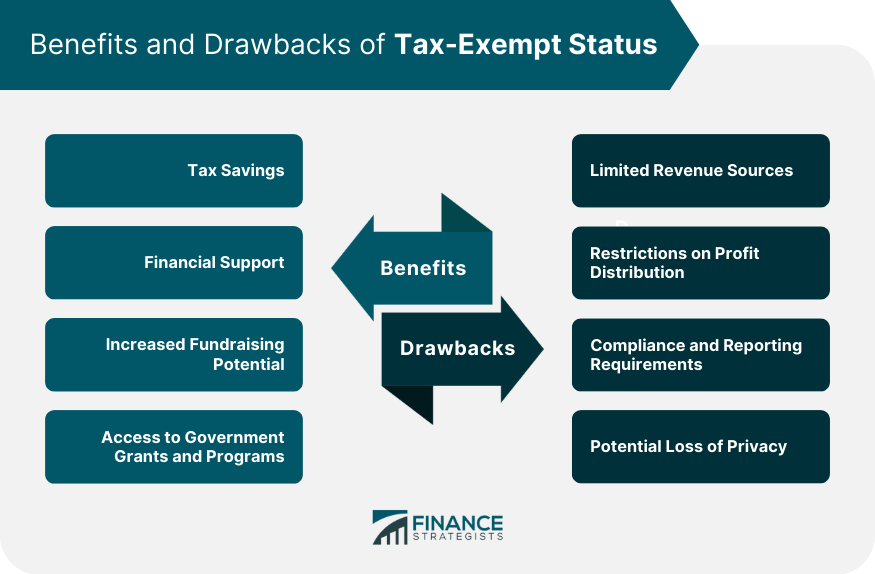

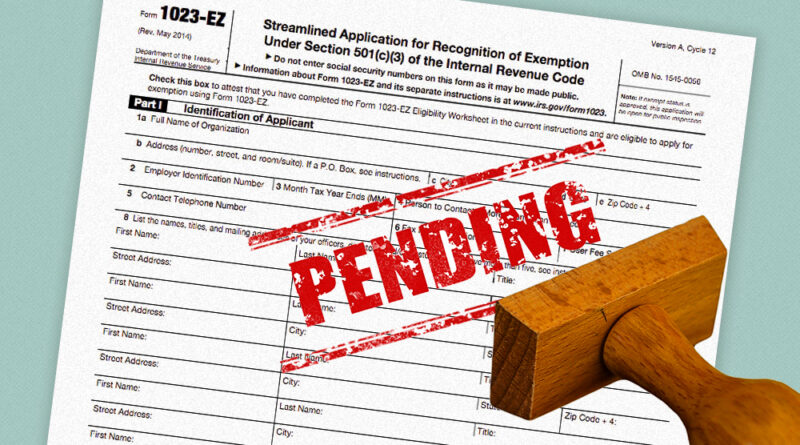

Some organizations, such as hospitals, non-profits, and government agencies, may have tax-exempt status. If you're purchasing a prescription mattress for an organization with tax-exempt status, you may be able to avoid paying sales tax altogether. However, you will need to provide proper documentation and proof of the organization's tax-exempt status.Prescription Mattresses and Tax-Exempt Status

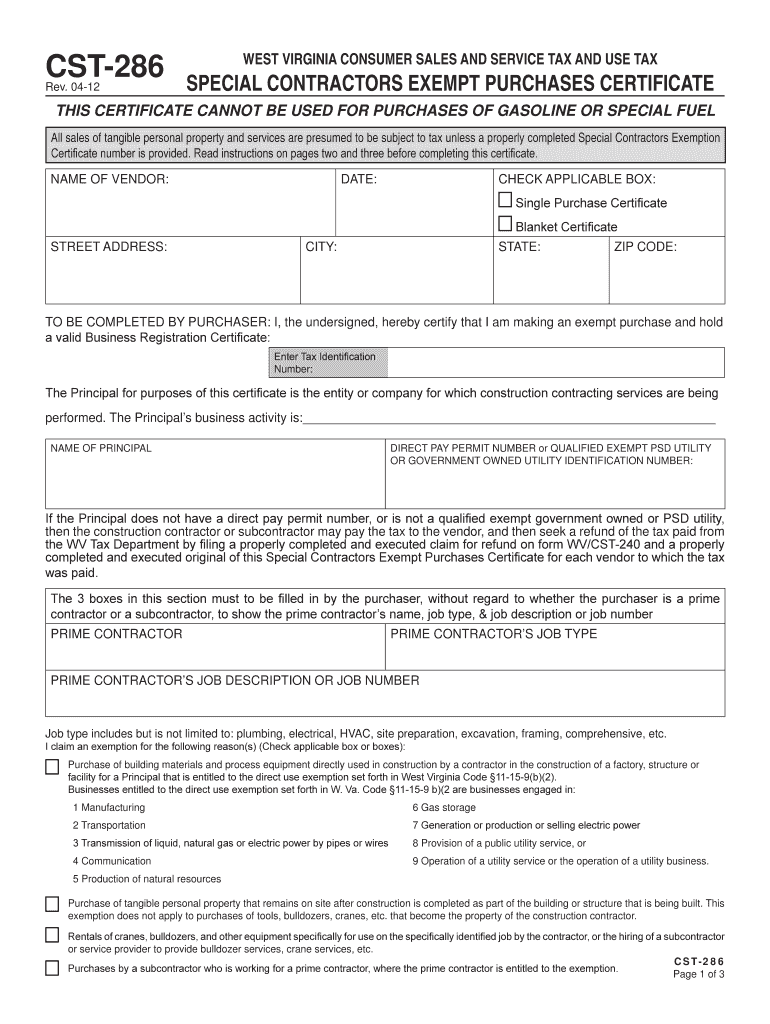

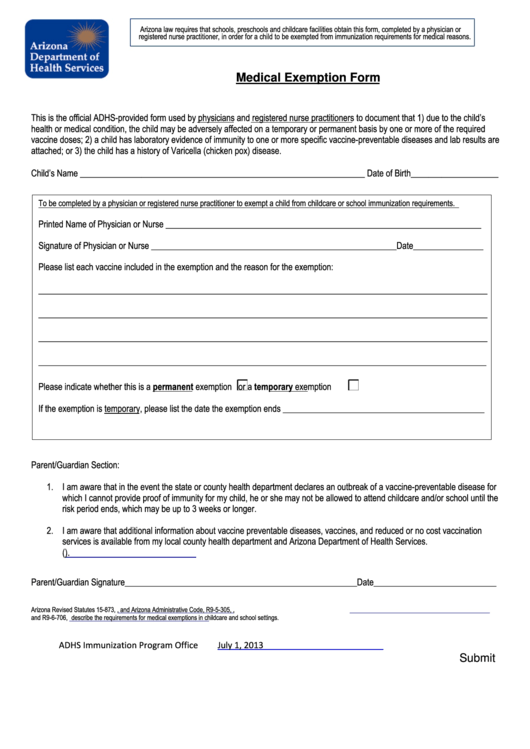

If you believe you qualify for a sales tax exemption for your prescription mattress purchase, you will need to provide proof and documentation to the retailer at the time of purchase. This may include a doctor's note or prescription, medical records, or a tax-exempt certificate. Be sure to research your state's requirements and have all necessary documentation on hand to avoid any issues when making your purchase.How to Claim a Sales Tax Exemption for Prescription Mattresses

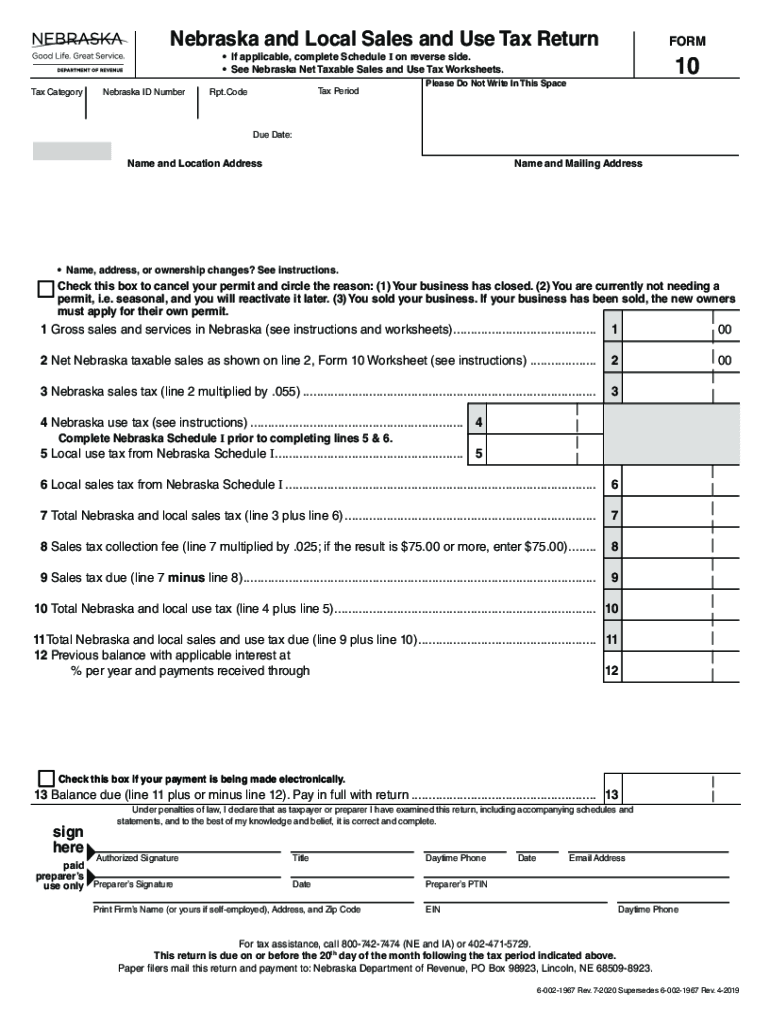

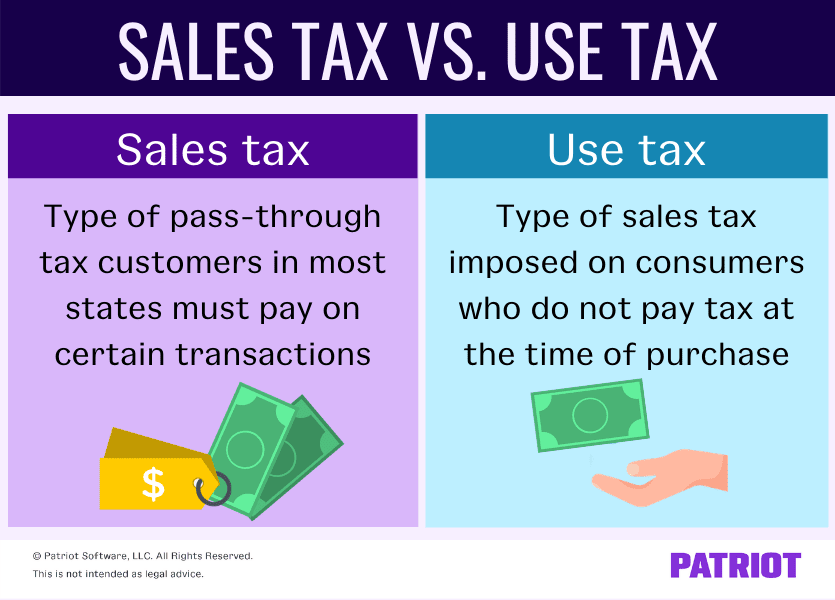

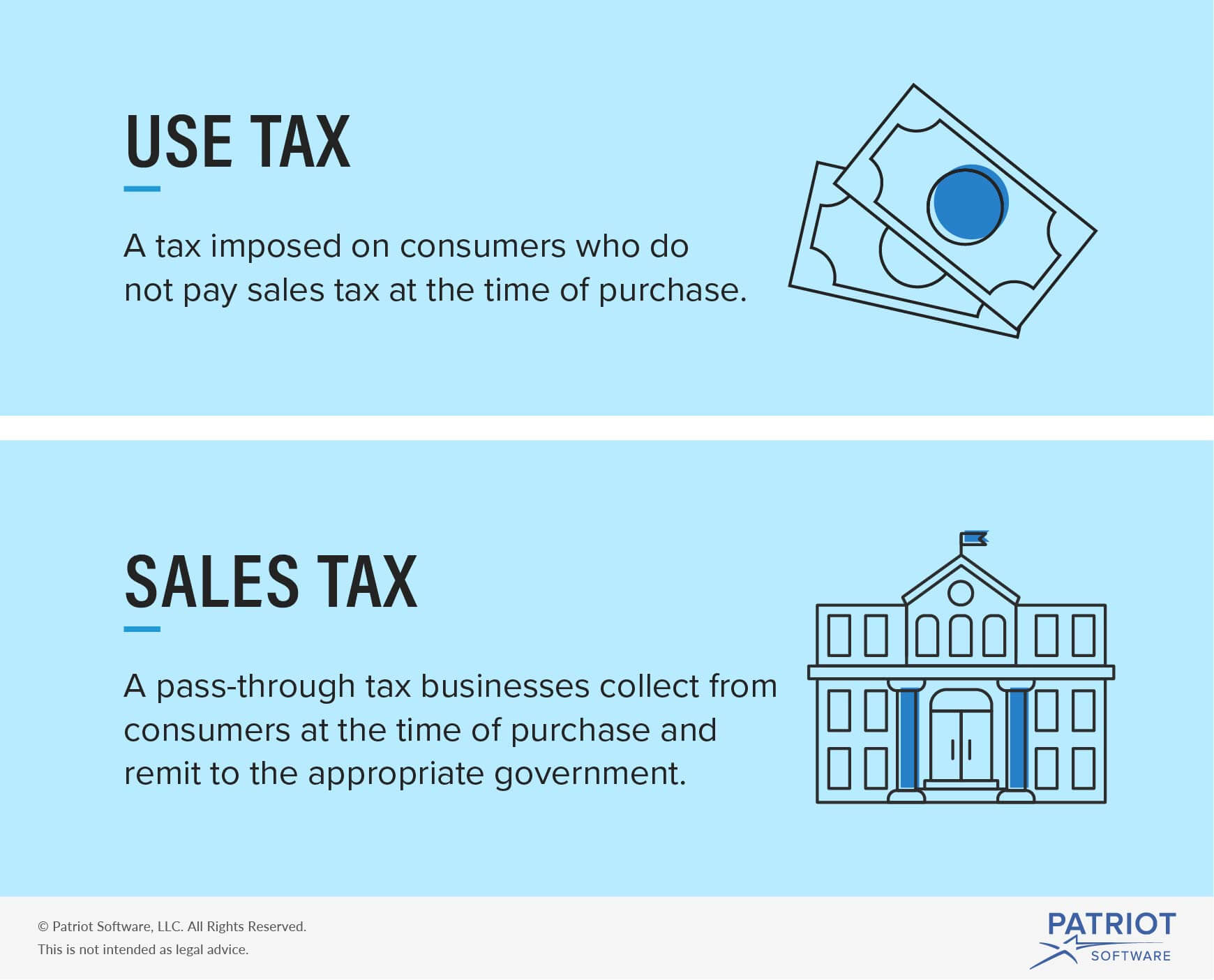

While sales tax is a common term, you may also come across the term "use tax" when purchasing a mattress. The difference between the two is that sales tax is imposed at the time of purchase, while use tax is imposed when an item is used or consumed in a state where sales tax was not paid. This typically applies to online purchases from out-of-state retailers. It's essential to understand the difference between the two and ensure you are paying the correct tax on your prescription mattress purchase.Understanding the Difference Between Sales Tax and Use Tax for Mattresses

If you're purchasing a prescription mattress for an organization with tax-exempt status, you may not have to worry about sales tax. However, it's crucial to research the specific laws and regulations in your state and have proper documentation to prove the organization's tax-exempt status. This can save you a significant amount of money on your mattress purchase.Prescription Mattresses and Tax-Exempt Organizations

Calculating sales tax on a prescription mattress purchase will depend on the state you're making the purchase in and whether you qualify for any exemptions or deductions. If you're unsure how much sales tax you will be charged, it's best to consult with a tax professional or research your state's sales tax rates and regulations. Knowing the sales tax rate and exemptions available in your state can help you plan and budget for your prescription mattress purchase.How to Calculate Sales Tax on a Prescription Mattress Purchase

How a Prescription Mattress Sales Tax May Affect Your House Design

The Importance of a Good Mattress in House Design

When designing a house, many factors are taken into consideration such as layout, color scheme, and furniture. However, one aspect that is often overlooked is the importance of a good mattress. A good mattress not only affects the quality of your sleep but also plays a significant role in the overall design and functionality of your bedroom. With the recent proposal of a prescription mattress sales tax, it is important to understand the potential impact it may have on house design.

When designing a house, many factors are taken into consideration such as layout, color scheme, and furniture. However, one aspect that is often overlooked is the importance of a good mattress. A good mattress not only affects the quality of your sleep but also plays a significant role in the overall design and functionality of your bedroom. With the recent proposal of a prescription mattress sales tax, it is important to understand the potential impact it may have on house design.

The Proposal for a Prescription Mattress Sales Tax

In recent news, there has been a proposal to implement a sales tax on prescription mattresses. This proposal has sparked a debate among lawmakers and consumers alike. The main argument for this tax is that prescription mattresses are considered a luxury item and should be taxed accordingly. However, many argue that a good mattress is essential for a good night's sleep, which is crucial for overall health and well-being.

In recent news, there has been a proposal to implement a sales tax on prescription mattresses. This proposal has sparked a debate among lawmakers and consumers alike. The main argument for this tax is that prescription mattresses are considered a luxury item and should be taxed accordingly. However, many argue that a good mattress is essential for a good night's sleep, which is crucial for overall health and well-being.

The Potential Impact on House Design

If this proposal is approved, it could have a significant impact on house design. For starters, many people may opt for cheaper, non-prescription mattresses to avoid the additional cost. This could lead to a decline in the quality of sleep and ultimately affect the functionality and design of the bedroom. A good mattress not only provides comfort but also adds to the aesthetic appeal of the room. With a limited budget, people may have to compromise on the overall design of their bedroom to accommodate a cheaper mattress.

If this proposal is approved, it could have a significant impact on house design. For starters, many people may opt for cheaper, non-prescription mattresses to avoid the additional cost. This could lead to a decline in the quality of sleep and ultimately affect the functionality and design of the bedroom. A good mattress not only provides comfort but also adds to the aesthetic appeal of the room. With a limited budget, people may have to compromise on the overall design of their bedroom to accommodate a cheaper mattress.

The Importance of Investing in a Good Mattress

With the potential implementation of a prescription mattress sales tax, it is crucial to understand the importance of investing in a good mattress. A good mattress not only provides comfort and support but also contributes to the overall design and functionality of your bedroom. It is a long-term investment that can greatly impact your health and well-being. Furthermore, a good mattress can also increase the value of your home, making it a worthwhile investment.

With the potential implementation of a prescription mattress sales tax, it is crucial to understand the importance of investing in a good mattress. A good mattress not only provides comfort and support but also contributes to the overall design and functionality of your bedroom. It is a long-term investment that can greatly impact your health and well-being. Furthermore, a good mattress can also increase the value of your home, making it a worthwhile investment.

In Conclusion

In conclusion, a prescription mattress sales tax could have a significant impact on house design. It is important to understand the importance of a good mattress and its role in creating a functional and aesthetically pleasing bedroom. With the potential implementation of this tax, it is crucial to consider investing in a good mattress for the overall well-being and design of your home.

In conclusion, a prescription mattress sales tax could have a significant impact on house design. It is important to understand the importance of a good mattress and its role in creating a functional and aesthetically pleasing bedroom. With the potential implementation of this tax, it is crucial to consider investing in a good mattress for the overall well-being and design of your home.

.jpg?v=805bca85)