When it comes to tax season, receiving your W-2 form is an important part of the process. This document, provided by your employer, outlines your earnings and tax withholdings for the previous year. As an employee of Mattress Firm, you can expect to receive your W-2 form in a timely and organized manner. Let's take a closer look at the top 10 things you need to know about your W-2 from Mattress Firm.Understanding the W-2 Form from Mattress Firm

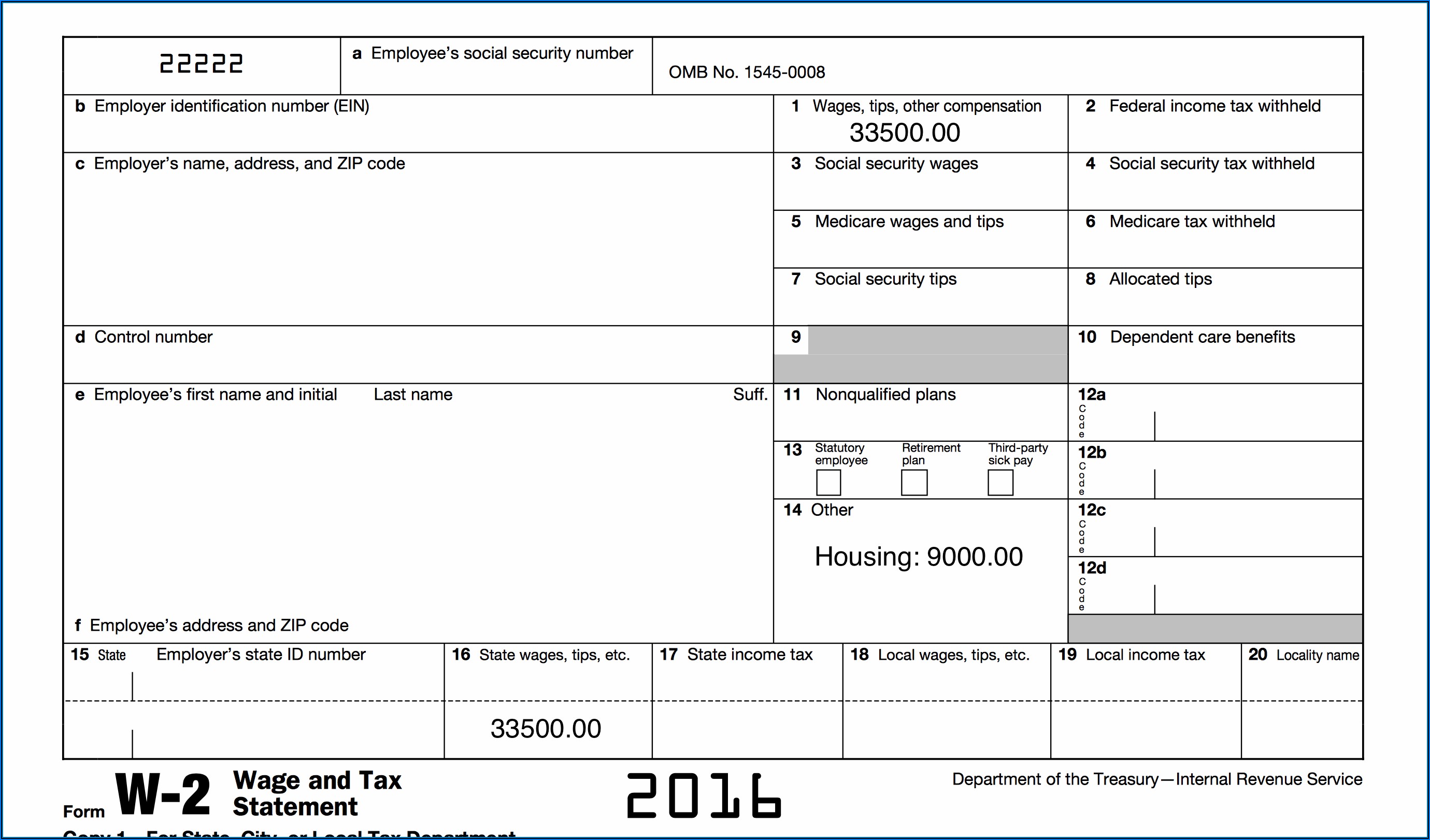

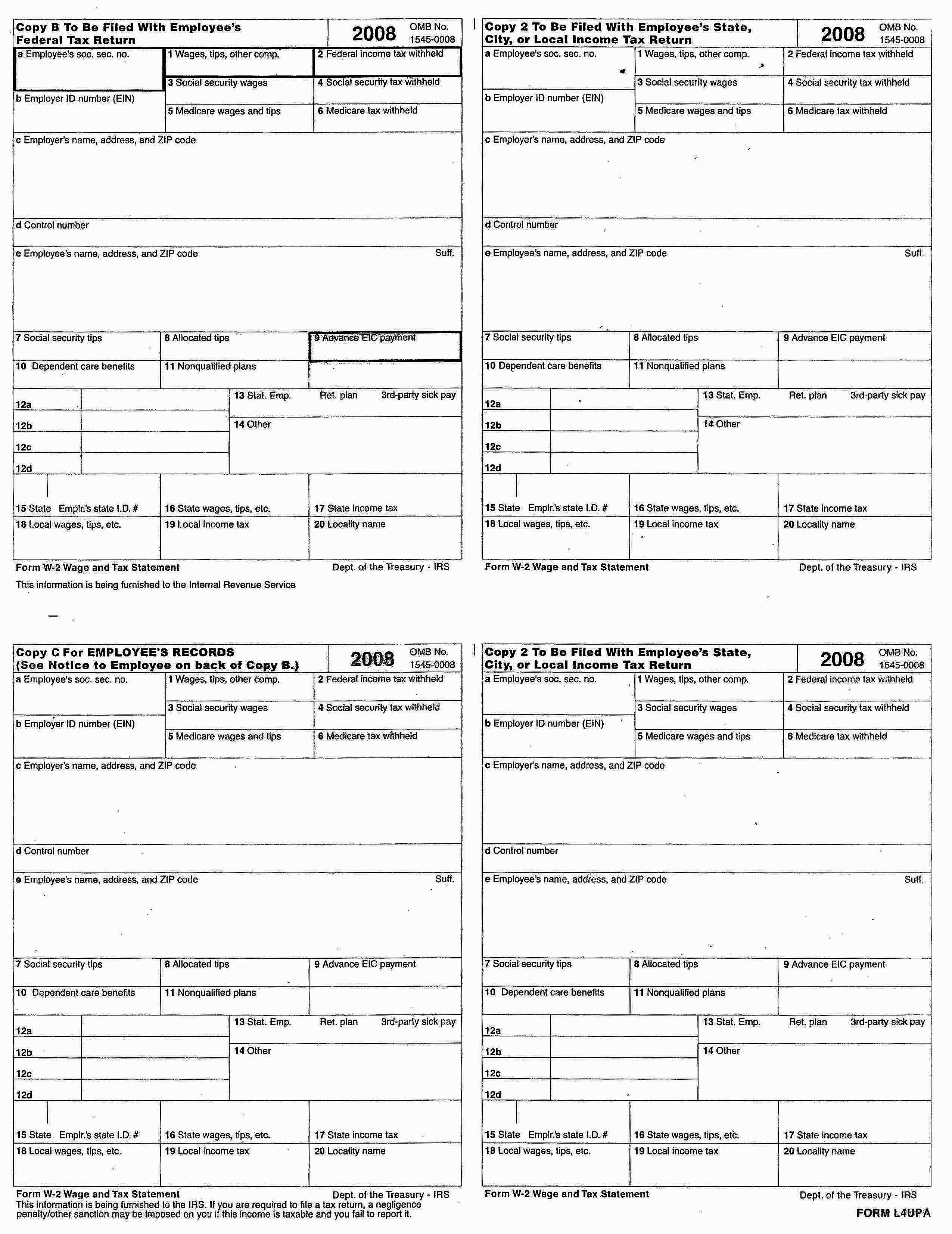

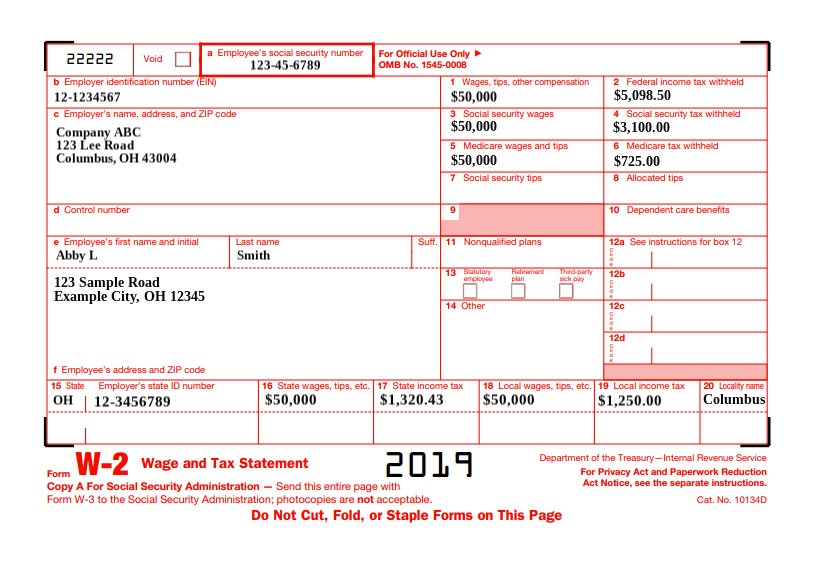

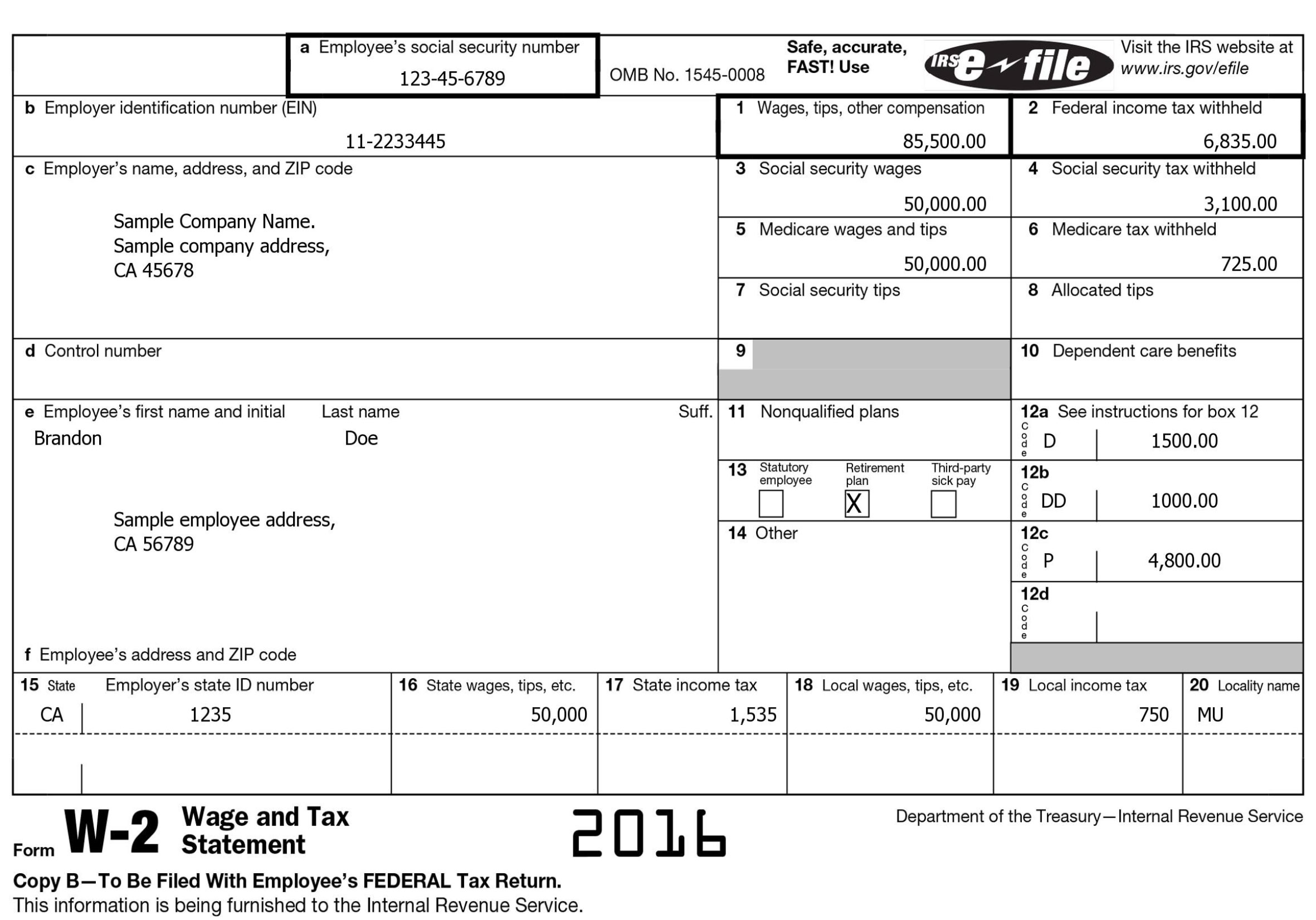

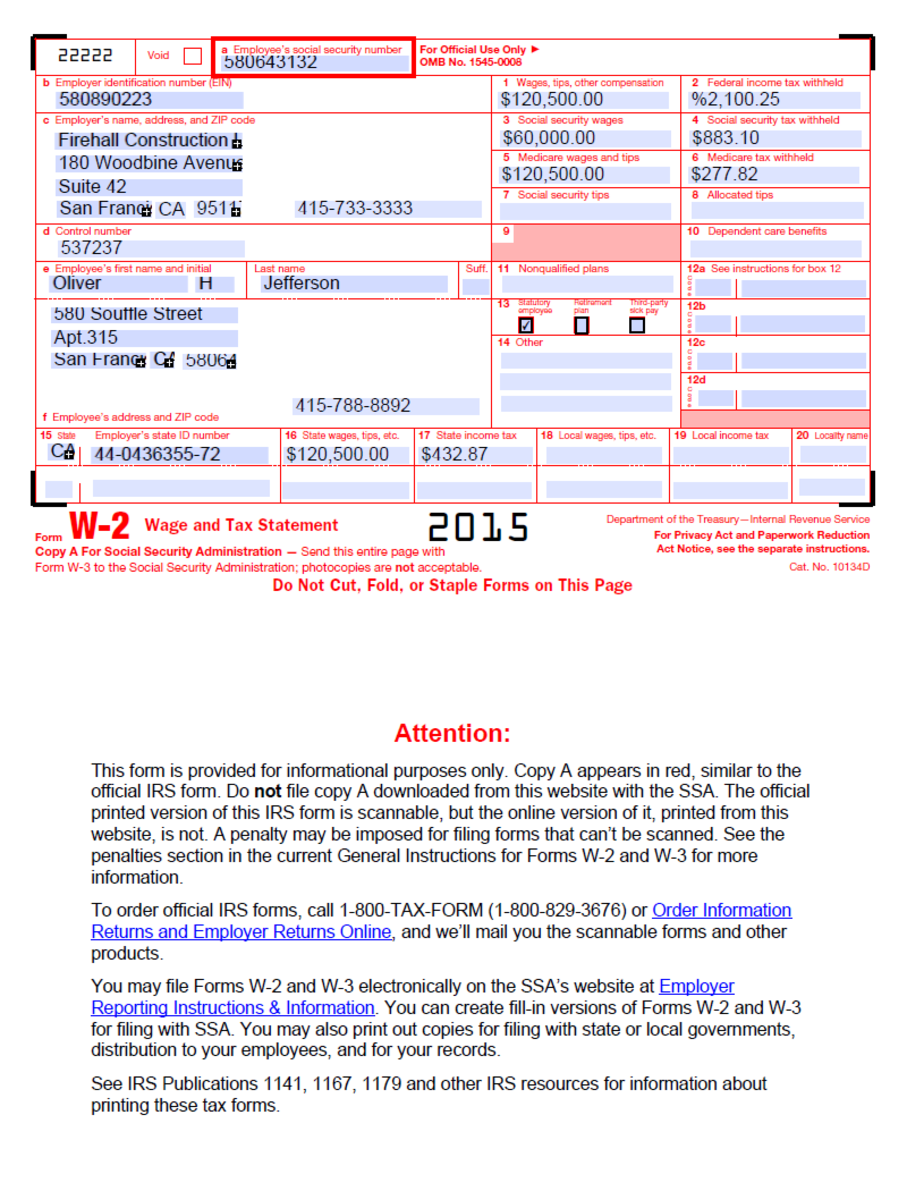

The W-2 form is a tax document that reports your total earnings and tax withholdings for the previous year. It includes important information such as your wages, tips, and other compensation, as well as any taxes that were withheld from your paycheck. The W-2 form is necessary for filing your income tax return.1. What is a W-2 Form?

Mattress Firm strives to provide their employees with their W-2 forms in a timely manner. Typically, you can expect to receive your form by the end of January, as it is required by law to be postmarked by January 31st. However, if you have not received your form by mid-February, it is recommended to reach out to your HR department for assistance.2. When Will I Receive My W-2 Form from Mattress Firm?

Mattress Firm offers two options for accessing your W-2 form: electronically or by mail. If you choose to receive your form electronically, you will receive an email notification once it is available. You can then log into the designated website and access your form. If you prefer to receive a paper copy, it will be mailed to the address on file.3. How Do I Access My W-2 Form?

Your W-2 form from Mattress Firm is divided into several sections. The top portion includes your personal information, such as your name, address, and social security number. The next section outlines your wages and tips for the year, followed by your federal and state income tax withholdings. Finally, the last section includes any other compensation and benefits, such as retirement contributions or health insurance premiums.4. Understanding the Different Sections of Your W-2 Form

If you notice an error on your W-2 form, it is important to contact your HR department at Mattress Firm as soon as possible. They will be able to assist you in correcting the mistake and issuing a corrected form if necessary.5. What Do I Do if There is an Error on My W-2 Form?

While it is recommended to have your W-2 form before filing your taxes, it is possible to file without it. You can use your last pay stub of the year to estimate your earnings and taxes withheld. However, it is important to still request your W-2 form and file an amended return if there are any discrepancies.6. Can I File My Taxes Without My W-2 Form?

Box 12 on your W-2 form may include various codes that correspond to different types of compensation or benefits. For example, code DD represents the cost of employer-sponsored health coverage. It is important to understand these codes when reviewing your form.7. Understanding Box 12 on Your W-2 Form

When filing your tax return, you will need to transfer the information from your W-2 form to the designated sections. Your wages and tips will be reported on line 1 of your tax return, while your federal and state tax withholdings will be reported on line 2. Other compensation and benefits will be reported on different lines depending on the type of income.8. How Do I Report My W-2 Information on My Tax Return?

If you have not received your W-2 form from Mattress Firm by the tax filing deadline, you can request an extension from the IRS. You can also file for an extension if you need more time to gather your tax documents.9. What If I Haven't Received My W-2 Form by Tax Filing Deadline?

It is important to keep your W-2 form in a safe place for future reference. You may need it when applying for loans, filling out financial aid forms, or for other tax-related purposes. If you lose your form, you can request a copy from Mattress Firm or the IRS. In conclusion, understanding your W-2 form from Mattress Firm is essential for filing your taxes accurately and on time. By following these top 10 tips, you can ensure a smooth and successful tax season. If you have any further questions or concerns about your W-2 form, don't hesitate to reach out to your HR department at Mattress Firm for assistance.10. Keeping Your W-2 Form for Future Reference

The Importance of Choosing the Right Mattress for Your Home

Creating the Perfect Bedroom

When designing your dream home, it's easy to get caught up in the aesthetics of the living room or kitchen. However, one of the most important rooms in your house is often overlooked – the bedroom. Your bedroom is your personal sanctuary, a place where you can relax and recharge after a long day. And the key to achieving a comfortable and restful bedroom lies in choosing the right mattress.

Mattress Firm W-2

understands the importance of a good night's sleep and offers a wide variety of high-quality mattresses to suit your needs. With their expertise and experience in the industry, they can help you find the perfect mattress for your home.

When designing your dream home, it's easy to get caught up in the aesthetics of the living room or kitchen. However, one of the most important rooms in your house is often overlooked – the bedroom. Your bedroom is your personal sanctuary, a place where you can relax and recharge after a long day. And the key to achieving a comfortable and restful bedroom lies in choosing the right mattress.

Mattress Firm W-2

understands the importance of a good night's sleep and offers a wide variety of high-quality mattresses to suit your needs. With their expertise and experience in the industry, they can help you find the perfect mattress for your home.

Importance of a Good Mattress

A good mattress is crucial for maintaining good physical and mental health. A

comfortable mattress

provides proper support for your spine, allowing your body to fully relax and recharge during sleep. On the other hand, an uncomfortable mattress can cause back pain, stiffness, and poor sleep quality, ultimately affecting your overall well-being.

Moreover, a quality mattress can also enhance the overall look and feel of your bedroom. It can serve as the centerpiece of your room, creating a cozy and inviting atmosphere. With

Mattress Firm W-2

's range of stylish and customizable options, you can design a bedroom that reflects your unique style and personality.

A good mattress is crucial for maintaining good physical and mental health. A

comfortable mattress

provides proper support for your spine, allowing your body to fully relax and recharge during sleep. On the other hand, an uncomfortable mattress can cause back pain, stiffness, and poor sleep quality, ultimately affecting your overall well-being.

Moreover, a quality mattress can also enhance the overall look and feel of your bedroom. It can serve as the centerpiece of your room, creating a cozy and inviting atmosphere. With

Mattress Firm W-2

's range of stylish and customizable options, you can design a bedroom that reflects your unique style and personality.

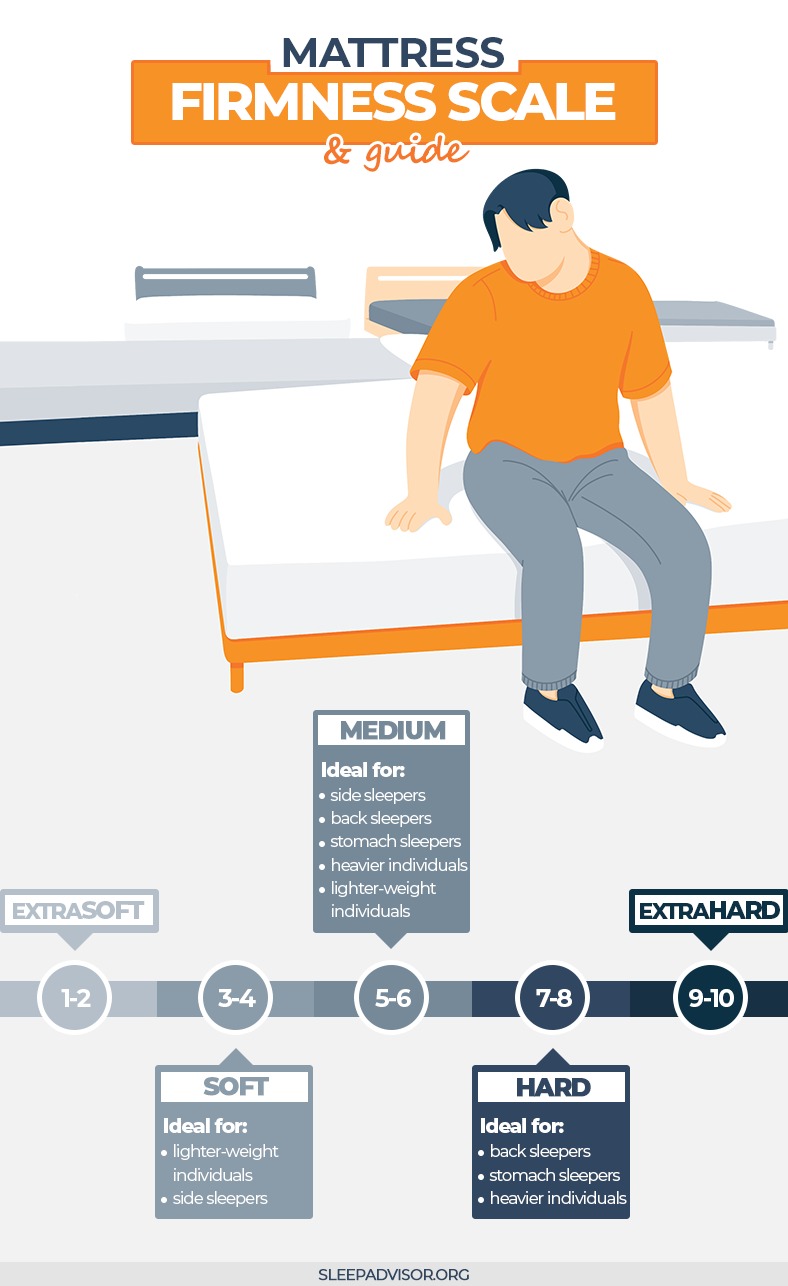

Choosing the Right Mattress

With so many options available in the market, choosing the right mattress can be overwhelming.

Mattress Firm W-2

simplifies this process by offering a wide range of brands, sizes, and types of mattresses to meet your specific needs and preferences. Their knowledgeable staff can guide you through the selection process, taking into consideration your sleeping position, body type, and any specific concerns you may have.

In addition to comfort and support,

Mattress Firm W-2

also prioritizes the safety and health of their customers. All their mattresses are made with high-quality materials and have been tested for durability and safety, giving you peace of mind and ensuring a good night's sleep for years to come.

With so many options available in the market, choosing the right mattress can be overwhelming.

Mattress Firm W-2

simplifies this process by offering a wide range of brands, sizes, and types of mattresses to meet your specific needs and preferences. Their knowledgeable staff can guide you through the selection process, taking into consideration your sleeping position, body type, and any specific concerns you may have.

In addition to comfort and support,

Mattress Firm W-2

also prioritizes the safety and health of their customers. All their mattresses are made with high-quality materials and have been tested for durability and safety, giving you peace of mind and ensuring a good night's sleep for years to come.

In Conclusion

Choosing the right mattress is essential for achieving a comfortable and stylish bedroom. With

Mattress Firm W-2

, you can rest assured that you'll find the perfect mattress for your home. So why wait? Visit their website or store today and start creating your dream bedroom. Your body and mind will thank you for it.

Choosing the right mattress is essential for achieving a comfortable and stylish bedroom. With

Mattress Firm W-2

, you can rest assured that you'll find the perfect mattress for your home. So why wait? Visit their website or store today and start creating your dream bedroom. Your body and mind will thank you for it.

/w2-income-tax-form-186581546-a011e3917c34410d8d39f833127762f6.jpg)

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)