Steinhoff International Holdings NV (SNHJ.J) is one of the leading mattress firms in the world. It has gained a lot of attention in recent years, especially after the scandal that rocked the company in 2017. With the company's finances being closely scrutinized, one important financial metric that stands out is the EBITDA. In this article, we will delve into the top 10 reasons why EBITDA is a crucial factor for Steinhoff International Holdings NV (SNHJ.J).The Importance of EBITDA for Steinhoff International Holdings NV (SNHJ.J)

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It is a financial metric that is used to measure a company's profitability before taking into account non-cash expenses such as interest and depreciation. EBITDA is important because it provides a clear picture of a company's operating performance without the influence of accounting and financing decisions.1. Understanding EBITDA

As a mattress firm, Steinhoff's main source of revenue comes from selling mattresses and other related products. By looking at the company's EBITDA, investors can get a clear understanding of how well the company's core business is performing. This is important because it helps in making informed investment decisions.2. EBITDA Reflects Steinhoff's Core Business Performance

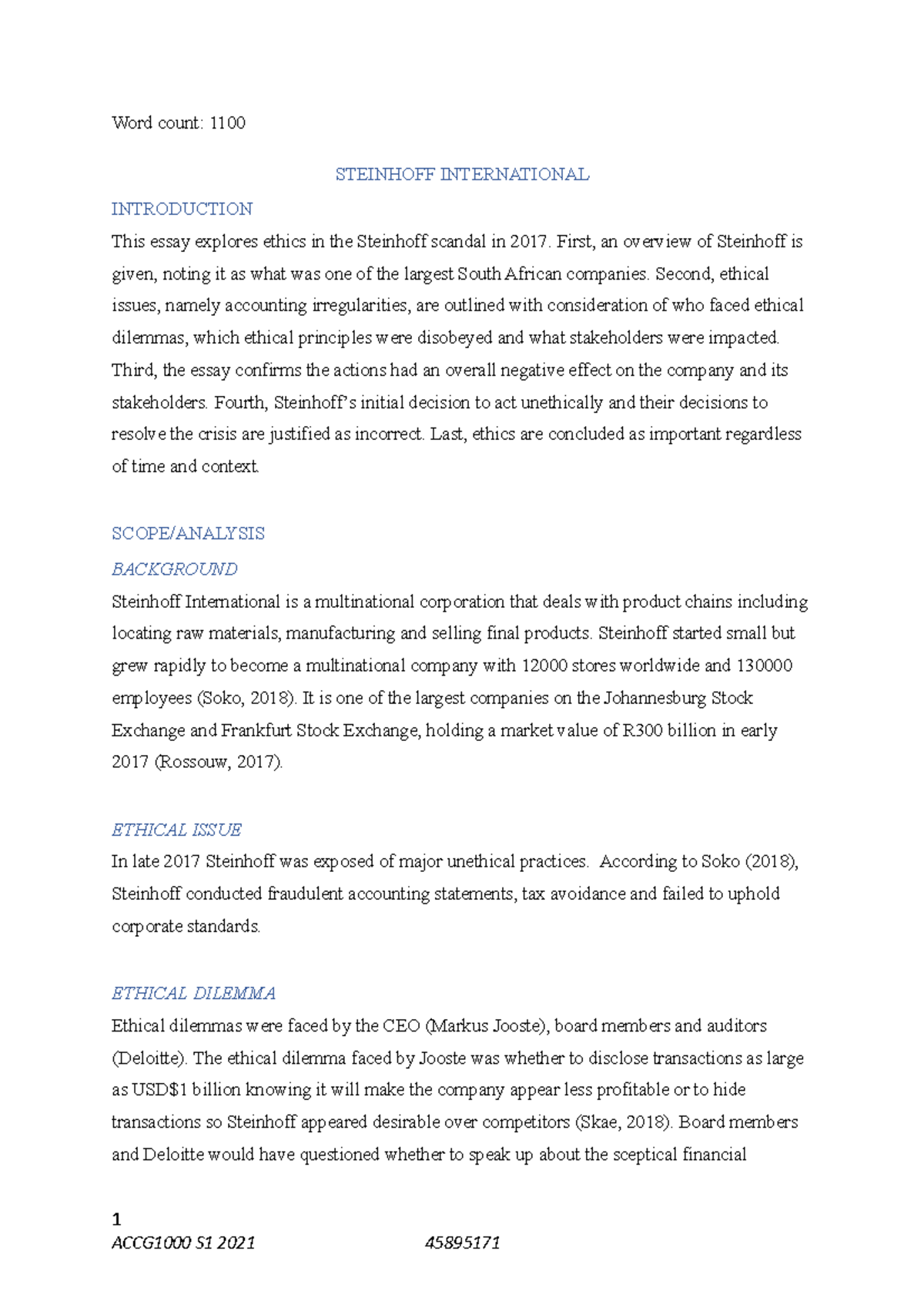

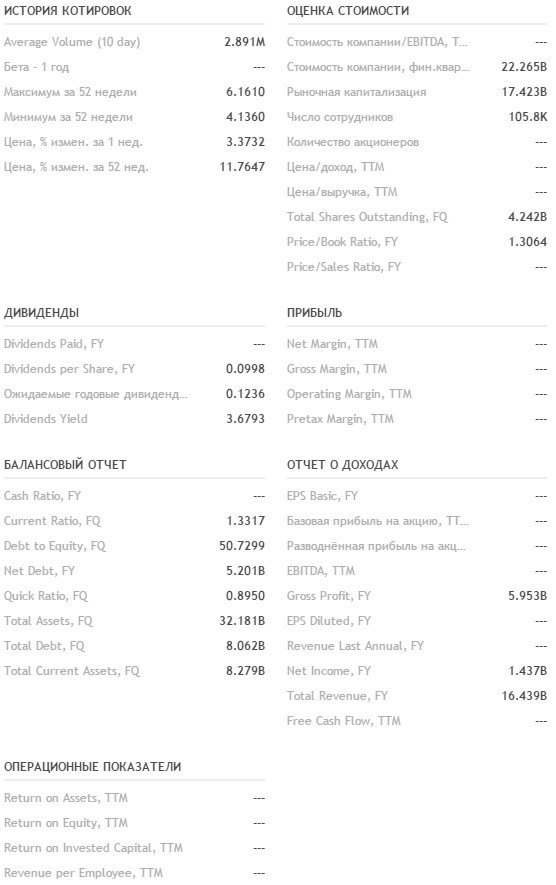

Steinhoff's EBITDA is a crucial factor in assessing the company's financial health. By comparing the company's EBITDA to its debt, investors can get a sense of how easily Steinhoff can repay its debts. A higher EBITDA indicates that the company is generating enough cash to cover its financial obligations, while a lower EBITDA may raise concerns about the company's ability to meet its debt obligations.3. EBITDA is a Key Indicator of Steinhoff's Financial Health

EBITDA is a commonly used financial metric, making it easier for investors to compare Steinhoff's performance with other companies in the same industry. This can provide valuable insights into how Steinhoff is doing compared to its competitors and whether it is outperforming or underperforming in terms of profitability.4. EBITDA Helps in Comparing Steinhoff with Other Companies

EBITDA is a measure of a company's operating efficiency. A high EBITDA indicates that Steinhoff is generating strong profits from its core operations, while a low EBITDA may suggest that the company is struggling to control its costs or facing challenges with its operations.5. EBITDA Reflects Steinhoff's Efficiency

EBITDA is less susceptible to manipulation compared to other financial metrics such as net income. This is because it excludes non-cash expenses, which can be easily manipulated by companies. As a result, EBITDA provides a more accurate representation of Steinhoff's profitability and financial health.6. EBITDA is Less Manipulated Than Other Financial Metrics

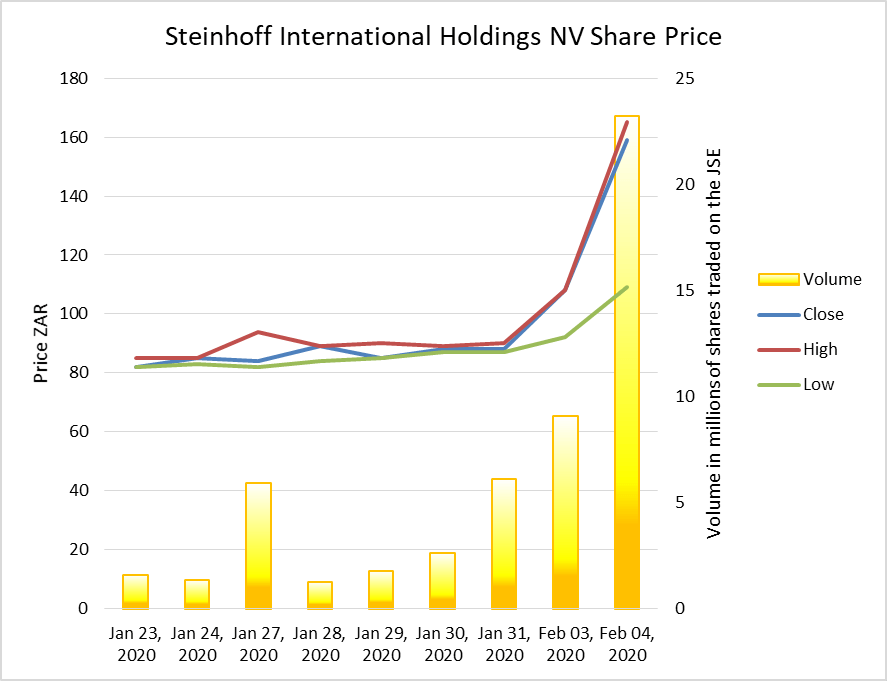

EBITDA is a key factor in valuing a company's stock. A higher EBITDA indicates that the company is generating strong profits, which can translate into higher stock prices. Investors often use EBITDA multiples to determine whether a stock is undervalued or overvalued.7. EBITDA is Important for Valuing Steinhoff's Stock

By looking at Steinhoff's EBITDA over a period of time, investors can get a sense of the company's growth potential. A consistent increase in EBITDA indicates that the company is growing and becoming more profitable, while a decreasing trend may raise concerns about the company's future prospects.8. EBITDA Helps in Assessing Steinhoff's Growth Potential

EBITDA is not a standard accounting measure, but it provides a clearer view of a company's financial performance. By excluding non-cash expenses, EBITDA helps in understanding the company's true profitability and financial situation.9. EBITDA Provides Clarity in Steinhoff's Financial Statements

The Significance of EBITDA in the Mattress Firm Steinhoff Merger

What is EBITDA?

EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization, is a financial metric used to evaluate a company's profitability and financial health. It is often referred to as a proxy for a company's cash flow and is used by investors and analysts to assess a company's performance.

EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization, is a financial metric used to evaluate a company's profitability and financial health. It is often referred to as a proxy for a company's cash flow and is used by investors and analysts to assess a company's performance.

The Role of EBITDA in the Mattress Firm Steinhoff Merger

The recent merger between Mattress Firm and Steinhoff has been making headlines in the business world. As two major players in the mattress industry, their merger has sparked interest and speculation among investors and industry experts. One important factor to consider in this merger is the EBITDA of both companies.

Mattress Firm

, as one of the largest specialty mattress retailers in the United States, has been experiencing declining sales and profits in recent years. However, their EBITDA has remained relatively stable, indicating their ability to generate consistent cash flow. This could be a favorable factor for Steinhoff, as it shows Mattress Firm's financial strength and stability.

On the other hand, Steinhoff, a global retail conglomerate based in South Africa, has a high EBITDA margin and a strong track record of acquisitions and mergers. This could be seen as a positive sign for the success of the merger, as Steinhoff's experience in integrating companies could help improve Mattress Firm's financial performance.

The recent merger between Mattress Firm and Steinhoff has been making headlines in the business world. As two major players in the mattress industry, their merger has sparked interest and speculation among investors and industry experts. One important factor to consider in this merger is the EBITDA of both companies.

Mattress Firm

, as one of the largest specialty mattress retailers in the United States, has been experiencing declining sales and profits in recent years. However, their EBITDA has remained relatively stable, indicating their ability to generate consistent cash flow. This could be a favorable factor for Steinhoff, as it shows Mattress Firm's financial strength and stability.

On the other hand, Steinhoff, a global retail conglomerate based in South Africa, has a high EBITDA margin and a strong track record of acquisitions and mergers. This could be seen as a positive sign for the success of the merger, as Steinhoff's experience in integrating companies could help improve Mattress Firm's financial performance.

The Importance of EBITDA in Assessing Merger Success

EBITDA is a crucial metric in evaluating the success of a merger. It provides insight into the financial health of the companies involved and their ability to generate cash flow. A high EBITDA margin can indicate a strong and profitable company, making it an attractive partner for a merger.

In the case of the Mattress Firm Steinhoff merger, the EBITDA of both companies can give investors and analysts confidence in the potential success of the merger. It also highlights the complementary strengths of both companies, with Mattress Firm's stable cash flow and Steinhoff's experience in acquisitions and mergers.

In conclusion

, EBITDA plays a significant role in the Mattress Firm Steinhoff merger and is a crucial metric in evaluating the success of any merger. It provides valuable insights into the financial health and potential growth of a company, making it an important consideration for investors and industry experts.

EBITDA is a crucial metric in evaluating the success of a merger. It provides insight into the financial health of the companies involved and their ability to generate cash flow. A high EBITDA margin can indicate a strong and profitable company, making it an attractive partner for a merger.

In the case of the Mattress Firm Steinhoff merger, the EBITDA of both companies can give investors and analysts confidence in the potential success of the merger. It also highlights the complementary strengths of both companies, with Mattress Firm's stable cash flow and Steinhoff's experience in acquisitions and mergers.

In conclusion

, EBITDA plays a significant role in the Mattress Firm Steinhoff merger and is a crucial metric in evaluating the success of any merger. It provides valuable insights into the financial health and potential growth of a company, making it an important consideration for investors and industry experts.