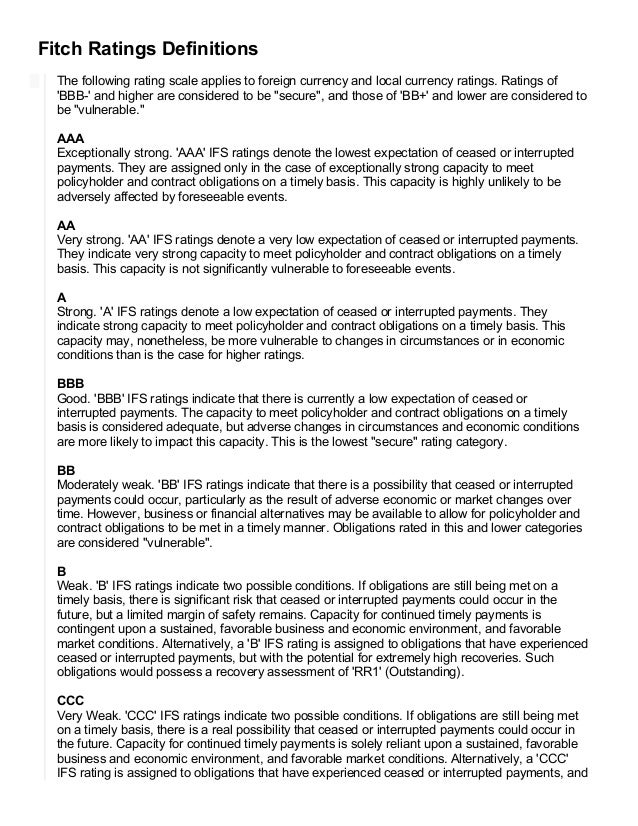

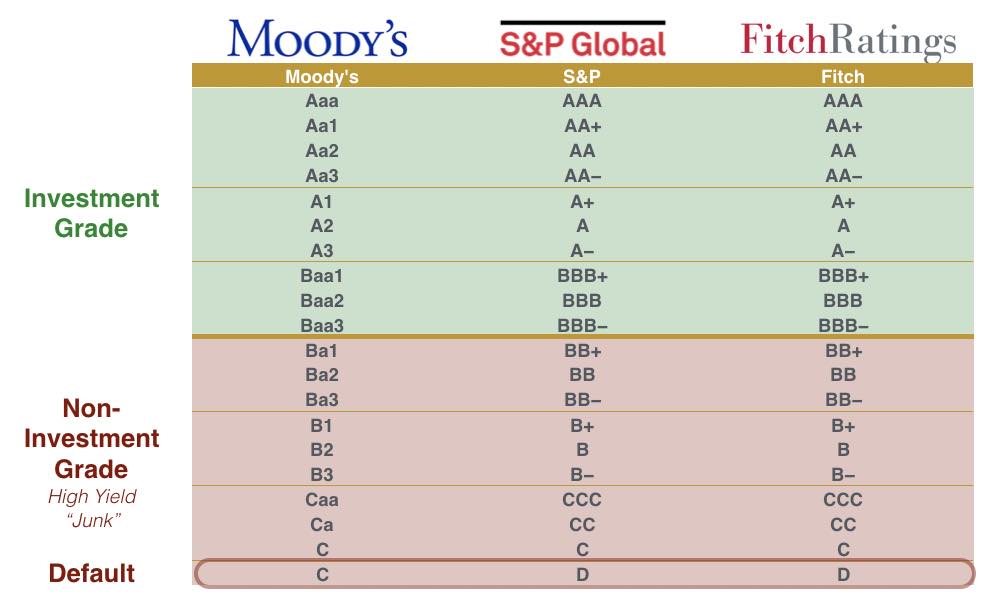

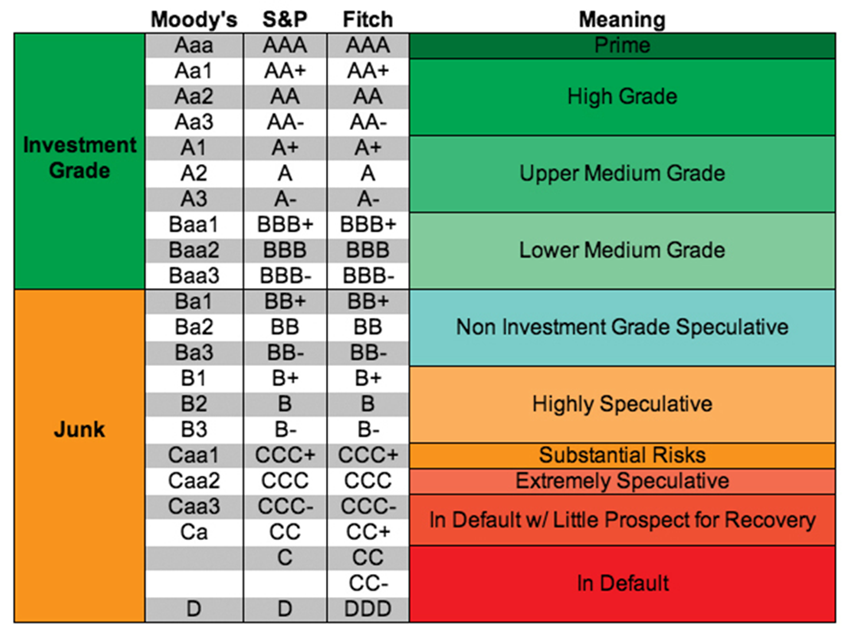

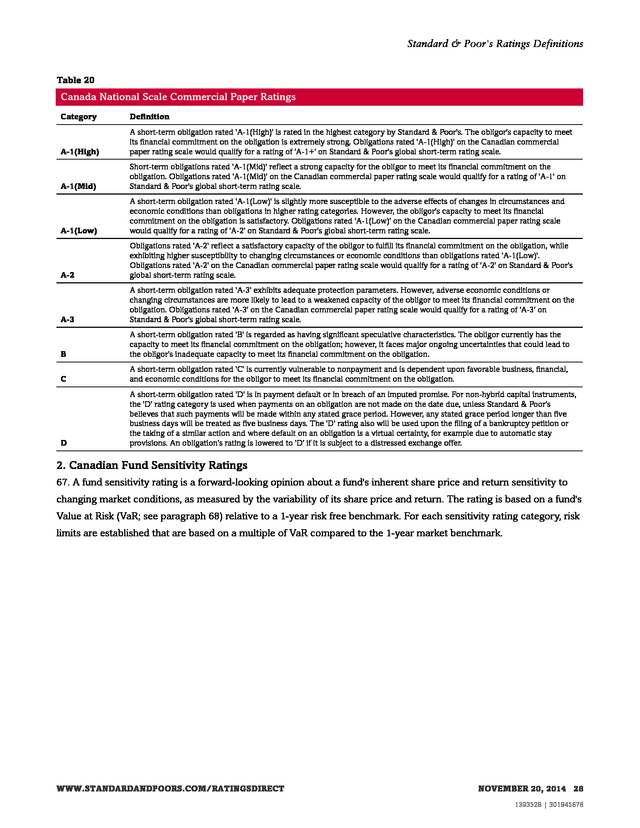

Moody's downgrades Mattress Firm's credit rating to Caa3

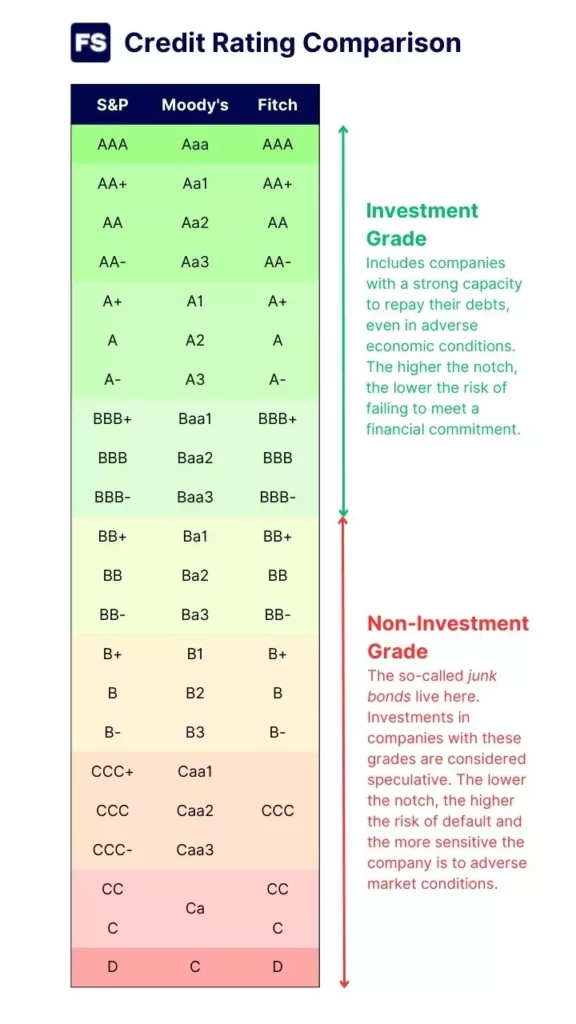

Moody's Investors Service, one of the top credit rating agencies, has recently downgraded Mattress Firm's credit rating to Caa3. This move comes as a surprise to many in the industry, as Mattress Firm has been a leading player in the mattress market for years. The downgrade is a result of the company's declining sales and mounting debt, which have been a cause for concern among investors.

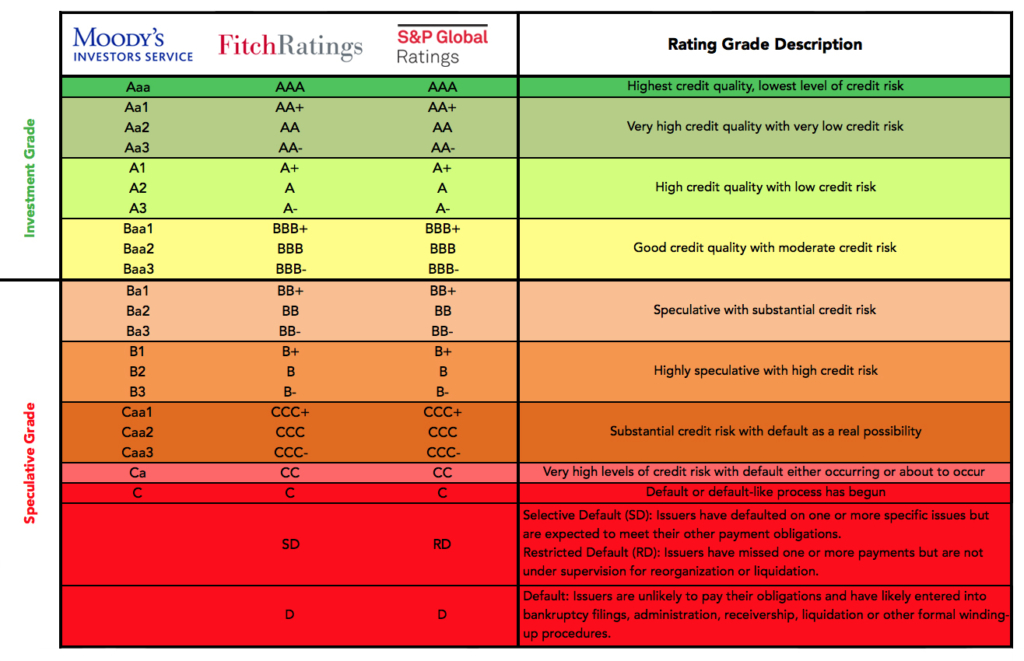

This downgrade is a significant blow to Mattress Firm, as it could potentially impact their ability to secure loans and attract new investors. The Caa3 rating, which is considered to be speculative grade, is a clear indication that the company is facing financial difficulties and may struggle to meet its financial obligations in the near future.

Moody's has also placed a negative outlook on Mattress Firm, which means that there is a possibility of further downgrades in the future if the company's financial situation does not improve. This news has sent shockwaves through the industry, with many wondering what the future holds for the once-dominant mattress retailer.

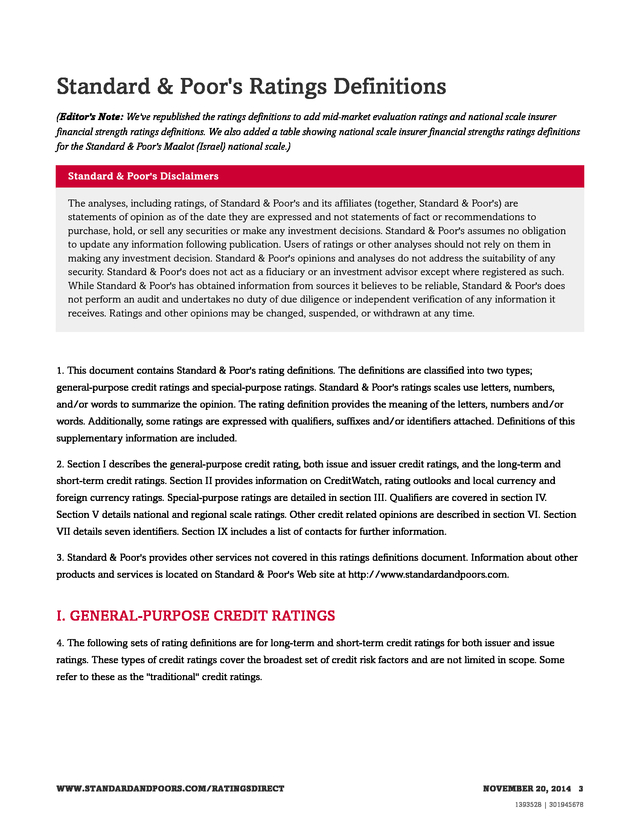

Mattress Firm's credit rating cut to B3 by S&P

Standard & Poor's, another major credit rating agency, has also downgraded Mattress Firm's credit rating. The company's rating has been lowered to B3, which is considered to be highly speculative and carries a significant risk of default. This downgrade comes as no surprise, as the company has been struggling to turn its declining sales around.

S&P has cited concerns about Mattress Firm's debt and its ability to generate enough cash flow to cover its obligations as the main reasons for the downgrade. This news has further added to the company's woes, as a lower credit rating could make it more challenging for Mattress Firm to secure financing and attract new investors.

This downgrade is a clear indication that Mattress Firm's financial situation is precarious, and the company needs to take immediate action to improve its performance and restore investor confidence.

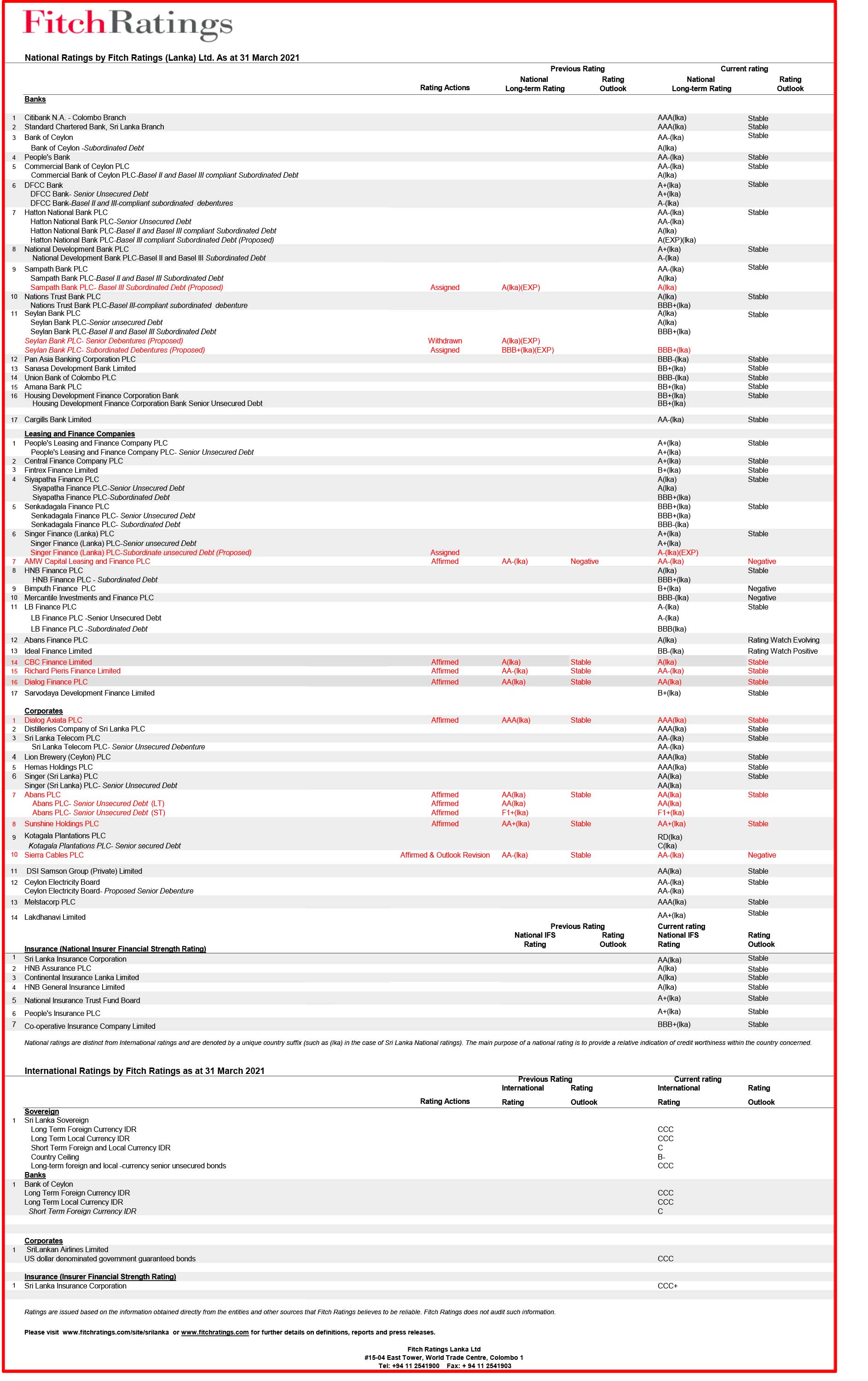

Fitch Ratings downgrades Mattress Firm's credit rating to CCC

Adding to the list of credit rating downgrades, Fitch Ratings has also lowered Mattress Firm's credit rating to CCC. This downgrade puts the company's credit rating firmly in the junk category and highlights the serious financial challenges it is facing.

Fitch has pointed to Mattress Firm's high debt levels and weak operating performance as the primary reasons for the downgrade. The agency has also expressed concerns about the company's ability to repay its debt and meet its financial obligations in the long term.

The CCC rating is a significant blow to Mattress Firm's reputation and could have severe consequences for the company's future. It is now more crucial than ever for Mattress Firm to take decisive action to improve its financial health and regain the trust of investors.

Mattress Firm's credit rating lowered to Caa2 by Moody's

Moody's has once again downgraded Mattress Firm's credit rating, this time to Caa2. This downgrade comes just a few months after the company's initial downgrade to Caa3 and is a clear indication that the company's financial situation is not improving.

Moody's has cited concerns about Mattress Firm's declining sales and weak cash flow as the main reasons for the downgrade. The agency has also placed a negative outlook on the company, which means that further downgrades could be on the horizon if the company's performance does not improve.

The Caa2 rating is considered to be highly speculative and carries a high risk of default. This news is sure to further shake investors' confidence in Mattress Firm and could potentially have a significant impact on the company's operations and future prospects.

Standard & Poor's downgrades Mattress Firm's credit rating to CCC+

In yet another blow to Mattress Firm's financial health, Standard & Poor's has downgraded the company's credit rating to CCC+. This downgrade is a result of the company's continued decline in sales and mounting debt, which have put significant strain on its financial stability.

S&P has highlighted Mattress Firm's weak liquidity and limited financial flexibility as the main concerns that led to the downgrade. The agency has also expressed doubts about the company's ability to turn its operations around and restore profitability in the near future.

The CCC+ rating is a clear sign that Mattress Firm is in a precarious financial position and needs to take immediate action to address its issues and improve its creditworthiness.

Moody's places Mattress Firm's credit rating on review for downgrade

Moody's has placed Mattress Firm's credit rating on review for downgrade, which means that the company's rating could be lowered in the near future. This move comes as the company continues to struggle with declining sales and mounting debt, which have put significant strain on its financial situation.

Moody's has expressed concerns about the company's ability to generate enough cash flow to meet its financial obligations and has cited weak liquidity as a major issue. This news has further added to the uncertainty surrounding Mattress Firm's future and has raised questions about its long-term viability.

Investors are closely watching this situation, as any further downgrade could have a significant impact on the company's operations and could potentially lead to bankruptcy.

Mattress Firm's credit rating downgraded to C by Fitch Ratings

Adding to the list of credit rating downgrades, Fitch Ratings has downgraded Mattress Firm's credit rating to C, which is considered to be highly speculative and carries a high risk of default. This downgrade is a result of the company's continued struggles with declining sales and mounting debt.

Fitch has cited concerns about Mattress Firm's weak liquidity and limited financial flexibility as the main factors that led to the downgrade. The agency has also expressed doubts about the company's ability to turn its operations around and regain its financial footing.

This downgrade is a significant blow to Mattress Firm's reputation and could have severe consequences for the company's future. The company needs to act fast to address its financial issues and regain the trust of investors.

S&P lowers Mattress Firm's credit rating to CC

Standard & Poor's has downgraded Mattress Firm's credit rating once again, this time to CC. This downgrade is a result of the company's continued struggles with declining sales and mounting debt, which have put significant strain on its financial stability.

S&P has highlighted Mattress Firm's weak liquidity and limited financial flexibility as the main concerns that led to the downgrade. The agency has also expressed doubts about the company's ability to turn its operations around and restore profitability in the near future.

The CC rating is a clear sign that Mattress Firm is in a dire financial situation and needs to take immediate action to address its issues and improve its creditworthiness.

Moody's downgrades Mattress Firm's credit rating to Ca

Moody's has downgraded Mattress Firm's credit rating to Ca, which is considered to be highly speculative and carries a very high risk of default. This downgrade is a result of the company's continued struggles with declining sales and mounting debt, which have put significant strain on its financial situation.

Moody's has expressed concerns about Mattress Firm's weak liquidity and limited financial flexibility as the main factors that led to the downgrade. The agency has also cited doubts about the company's ability to turn its operations around and regain its financial footing.

This downgrade is a major setback for Mattress Firm, as it could potentially make it even more challenging for the company to secure financing and attract new investors. The company needs to take immediate and decisive action to address its financial issues and restore investor confidence.

Fitch Ratings downgrades Mattress Firm's credit rating to C

In the final blow to Mattress Firm's credit rating, Fitch Ratings has downgraded the company's credit rating to C, which is considered to be highly speculative and carries a high risk of default. This downgrade is a result of the company's continued struggles with declining sales and mounting debt.

Fitch has cited concerns about Mattress Firm's weak liquidity and limited financial flexibility as the main factors that led to the downgrade. The agency has also expressed doubts about the company's ability to turn its operations around and regain its financial footing.

This downgrade is a significant setback for Mattress Firm, as it could further damage the company's reputation and make it even more challenging to secure financing and attract new investors. The company needs to take immediate and decisive action to address its financial issues and restore investor confidence.

Improving Your Credit Rating with Mattress Firm

Why Your Credit Rating Matters

Your credit rating is an essential aspect of your financial health. It is a numerical representation of your creditworthiness, and it plays a significant role in determining your ability to obtain loans and credit cards. A high credit rating can help you secure better interest rates and loan terms, while a low credit rating can limit your options and cost you more money in the long run. That's why it's crucial to monitor and improve your credit rating regularly. One way to do this is by working with

Mattress Firm

when purchasing a new mattress.

Your credit rating is an essential aspect of your financial health. It is a numerical representation of your creditworthiness, and it plays a significant role in determining your ability to obtain loans and credit cards. A high credit rating can help you secure better interest rates and loan terms, while a low credit rating can limit your options and cost you more money in the long run. That's why it's crucial to monitor and improve your credit rating regularly. One way to do this is by working with

Mattress Firm

when purchasing a new mattress.

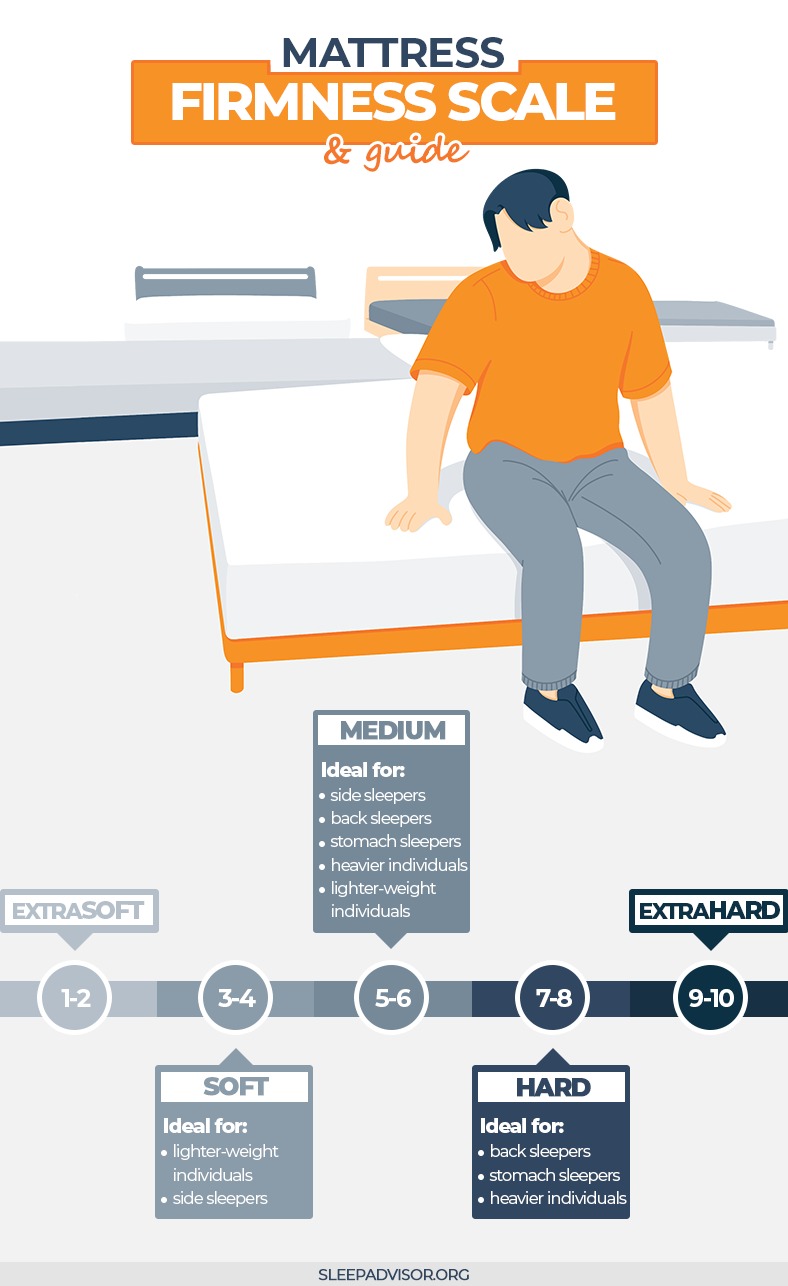

How Mattress Firm Can Help

Many people are surprised to learn that purchasing a mattress can impact their credit rating. But when you finance a mattress through Mattress Firm, they report your payments to credit bureaus, which can positively impact your credit score. This is because having a mix of different types of credit, such as installment loans, can demonstrate responsible financial management. When you make your payments on time and in full, it shows that you are a reliable borrower.

Many people are surprised to learn that purchasing a mattress can impact their credit rating. But when you finance a mattress through Mattress Firm, they report your payments to credit bureaus, which can positively impact your credit score. This is because having a mix of different types of credit, such as installment loans, can demonstrate responsible financial management. When you make your payments on time and in full, it shows that you are a reliable borrower.

Additional Benefits of Financing with Mattress Firm

In addition to improving your credit rating, financing your mattress through Mattress Firm also offers other benefits. Their financing options often come with low or no interest rates, making it easier to afford a high-quality mattress without breaking the bank. It also allows you to make smaller, more manageable payments, rather than paying for the mattress upfront. This can be especially helpful for those on a tight budget or looking to build their credit.

In addition to improving your credit rating, financing your mattress through Mattress Firm also offers other benefits. Their financing options often come with low or no interest rates, making it easier to afford a high-quality mattress without breaking the bank. It also allows you to make smaller, more manageable payments, rather than paying for the mattress upfront. This can be especially helpful for those on a tight budget or looking to build their credit.

The Importance of Good Credit in the House Design Process

When it comes to designing and decorating your home, having good credit is crucial. Many home improvement projects, such as renovations and furniture purchases, require financing. With a high credit rating, you can secure lower interest rates and better loan terms, making these projects more affordable. Additionally, your credit rating can impact your ability to rent or buy a home, as landlords and lenders often check credit scores before approving applications.

When it comes to designing and decorating your home, having good credit is crucial. Many home improvement projects, such as renovations and furniture purchases, require financing. With a high credit rating, you can secure lower interest rates and better loan terms, making these projects more affordable. Additionally, your credit rating can impact your ability to rent or buy a home, as landlords and lenders often check credit scores before approving applications.

Conclusion

In conclusion, your credit rating is an essential aspect of your financial health, and it's vital to work towards improving it regularly. By financing your mattress purchase through Mattress Firm, you not only get a high-quality mattress but also have the opportunity to improve your credit rating. This can have a positive impact on your overall financial well-being and make the house design process more manageable. So why wait? Visit Mattress Firm today and find the perfect mattress for your home.

In conclusion, your credit rating is an essential aspect of your financial health, and it's vital to work towards improving it regularly. By financing your mattress purchase through Mattress Firm, you not only get a high-quality mattress but also have the opportunity to improve your credit rating. This can have a positive impact on your overall financial well-being and make the house design process more manageable. So why wait? Visit Mattress Firm today and find the perfect mattress for your home.

:format(jpeg)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/ZEDBQGMOCVEOZFSW2DQZHUYPBE.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Ba3-BB-_Jan_2021-01-4dd68057e7a241629de924cee6005773.jpg)