The Mattress Firm credit card is a popular option for those looking to finance their mattress purchases. However, many people are unsure about what credit score is needed to qualify for this card. In this article, we will explore the credit score requirements for the Mattress Firm credit card and provide some tips for improving your credit score to increase your chances of approval. Mattress Firm Credit Card: What Credit Score Do You Need?

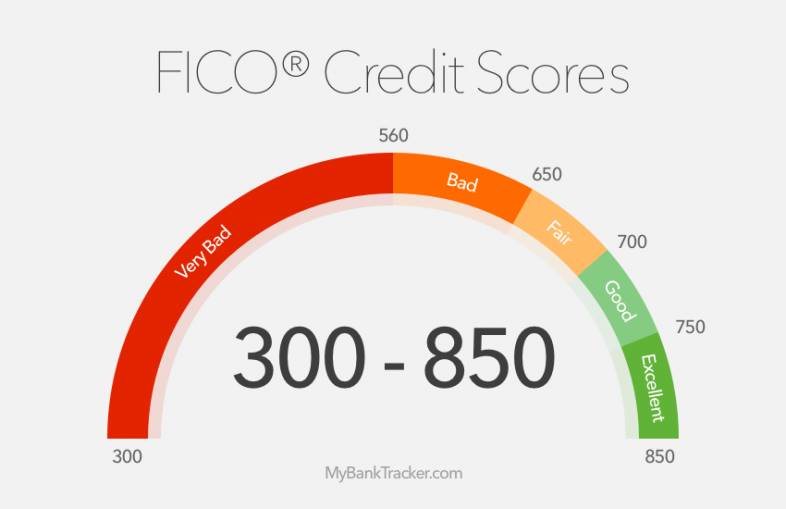

The credit score needed for a Mattress Firm credit card can vary depending on the individual's credit history and the specific card they are applying for. Generally, a credit score of 650 or above is considered good and may increase your chances of approval. What Credit Score is Needed for a Mattress Firm Credit Card?

In addition to a good credit score, there are other factors that may affect your approval for a Mattress Firm credit card. These may include your income, employment history, and debt-to-income ratio. It is also important to have a clean credit report with no recent delinquencies or bankruptcies. Mattress Firm Credit Card Approval Requirements

There is no set minimum credit score for the Mattress Firm credit card, as each application is evaluated on a case-by-case basis. However, as mentioned earlier, a credit score of 650 or above is a good benchmark to aim for. Minimum Credit Score for Mattress Firm Credit Card

In order to improve your chances of qualifying for a Mattress Firm credit card, there are some steps you can take to improve your credit score and financial standing. These include paying off any outstanding debts, keeping your credit utilization low, and making all of your monthly payments on time. How to Qualify for a Mattress Firm Credit Card

While a credit score of 650 or above is generally considered good for qualifying for a Mattress Firm credit card, having a higher score may increase your chances of getting approved. It is also important to have a stable income and a clean credit report with no major red flags. Credit Score Needed for Mattress Firm Credit Card

The application process for a Mattress Firm credit card is fairly straightforward. You can apply online or in-store, and you will need to provide personal information such as your name, address, and social security number. The credit card issuer will then review your application and credit history to determine your eligibility. Mattress Firm Credit Card Application Process

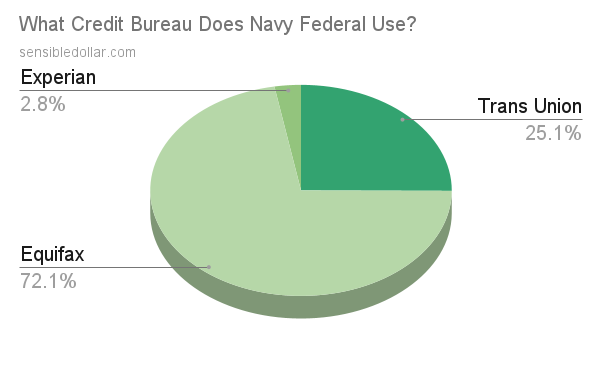

When you apply for a Mattress Firm credit card, the issuer will likely pull your credit report from one of the three major credit bureaus: Equifax, Experian, or TransUnion. It is important to regularly check your credit report from all three bureaus and dispute any errors or discrepancies to ensure the most accurate information is being used in your credit evaluation. What Credit Bureau Does Mattress Firm Use?

If you have a lower credit score and are looking to improve your chances of getting approved for a Mattress Firm credit card, there are some steps you can take to improve your credit score. These include paying off outstanding debts, keeping your credit utilization low, and making all of your monthly payments on time. It may also be helpful to work on building a positive credit history by opening a secured credit card or becoming an authorized user on a family member's credit card. Tips for Improving Your Credit Score for Mattress Firm Credit Card Approval

Aside from financing options, the Mattress Firm credit card also offers some benefits and rewards. These may include special financing promotions, no annual fee, and the ability to earn rewards on purchases. It is important to carefully read the terms and conditions of the credit card to understand the rewards and any potential fees. In conclusion, while there is no set credit score needed for a Mattress Firm credit card, having a good credit score and financial standing can greatly increase your chances of approval. It is important to regularly check your credit report and take steps to improve your credit score to qualify for this and other credit cards in the future. By understanding the credit score requirements and taking proactive steps, you can successfully apply for a Mattress Firm credit card and start enjoying the benefits and rewards it has to offer. Mattress Firm Credit Card Benefits and Rewards

Mattress Firm Credit Card: A Convenient Option for Your Household Needs

The Importance of Having a Good Credit Score

In today's society, having a good credit score is crucial for financial stability and success. It directly affects your ability to obtain loans, credit cards, and even job opportunities. Your credit score is a reflection of your financial responsibility and history, and it is an important factor in determining your overall financial health.

When it comes to household expenses, having a good credit score becomes even more important. From paying rent or mortgage to purchasing furniture and appliances, having a strong credit score can make all the difference.

The Benefits of the Mattress Firm Credit Card

One way to build and maintain a good credit score is by responsibly using a credit card. And when it comes to household expenses, the Mattress Firm credit card is an excellent option to consider. With this card, you can easily finance your bedding and furniture purchases from Mattress Firm, one of the leading retailers in the industry.

Aside from the convenience of being able to make smaller monthly payments on your purchases, the Mattress Firm credit card also offers special financing options and rewards for cardholders. This means you can save money on interest and earn rewards for every dollar you spend, making your household purchases more affordable in the long run.

The Required Credit Score for Approval

Now, you may be wondering what credit score is required to be approved for the Mattress Firm credit card. While each lender may have slightly different criteria, typically a score of around 650 or higher is needed to be considered for approval. Of course, having a higher score will increase your chances of being approved and potentially qualify you for better financing options.

How to Improve Your Credit Score

If your credit score falls below the required range for the Mattress Firm credit card, don't worry. There are steps you can take to improve your credit score and increase your chances of being approved in the future. These include paying your bills on time, keeping your credit card balances low, and monitoring your credit report for any errors that may be negatively affecting your score.

In Conclusion

The Mattress Firm credit card is an excellent option for those looking to build or maintain a good credit score while making essential household purchases. With its convenient financing options and rewards, it is a smart choice for responsible credit card users. Remember to check your credit score and take steps to improve it if necessary before applying for the card. With a little effort and financial responsibility, you can enjoy the benefits of the Mattress Firm credit card and improve your overall financial health.