Introduction

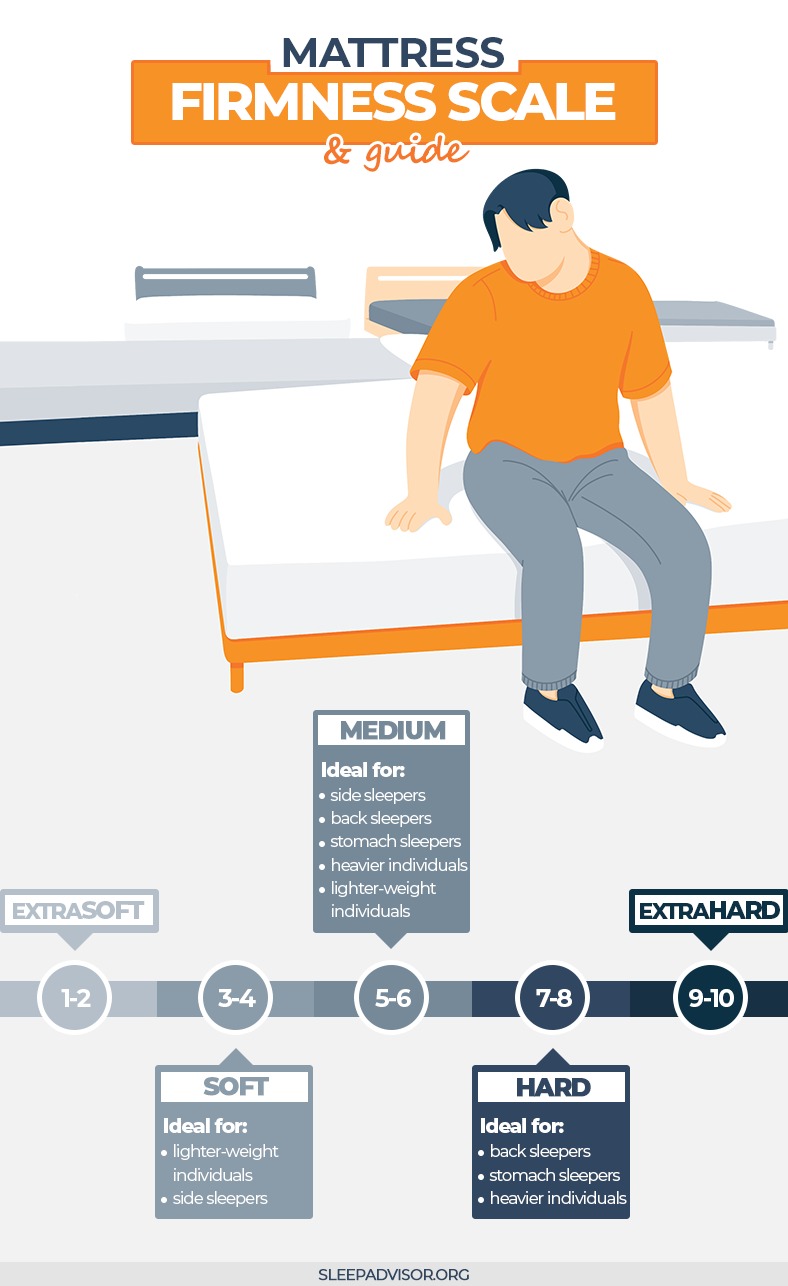

Are you a big fan of Mattress Firm and looking to finance your new mattress purchase? If so, you may have come across the Mattress Firm Credit Card. This card allows customers to make purchases at Mattress Firm and finance them over time. However, like with any credit card, it's important to understand the minimum payment requirements to avoid any potential issues. In this article, we'll discuss the top 10 things you need to know about the Mattress Firm Credit Card minimum payment.

1. What is the Mattress Firm Credit Card?

The Mattress Firm Credit Card is a store credit card that can only be used at Mattress Firm locations. It offers special financing options for purchases made at Mattress Firm, allowing customers to pay for their new mattress over time.

2. What is the Minimum Payment?

The minimum payment is the smallest amount you are required to pay each month on your Mattress Firm Credit Card balance. This amount is determined by the credit card issuer and is typically a percentage of your total balance.

3. How is the Minimum Payment Calculated?

The minimum payment is usually calculated as a percentage of your total balance, typically around 2-3%. However, this can vary depending on your creditworthiness and the terms of your specific credit card agreement.

4. When is the Minimum Payment Due?

The minimum payment is typically due on the same day each month, known as the due date. This date can be found on your credit card statement and may also be available online or through the credit card issuer's mobile app. It's important to make your minimum payment on time to avoid late fees and potential damage to your credit score.

5. What Happens if You Don't Make the Minimum Payment?

If you don't make the minimum payment or only make a partial payment, you may be charged a late fee and your credit score may be negatively impacted. Additionally, you may also be subject to higher interest rates and potential penalties from the credit card issuer.

6. Can You Pay More Than the Minimum Payment?

Absolutely! In fact, it's recommended to pay more than the minimum payment to avoid accruing interest and paying off your balance faster. However, be sure to check with the credit card issuer to ensure there are no penalties for paying off your balance early.

7. How Can You Make Your Minimum Payment?

There are several ways to make your Mattress Firm Credit Card minimum payment. You can do so online through the credit card issuer's website or mobile app, by phone, or by mail. It's important to make your payment on time and in full to avoid any potential penalties.

8. What Happens if You Miss a Payment?

If you miss a payment, you may be charged a late fee and your credit score may be negatively impacted. Additionally, the credit card issuer may also increase your interest rate, making it more expensive to pay off your balance over time.

9. What is the APR for the Mattress Firm Credit Card?

The APR (annual percentage rate) for the Mattress Firm Credit Card varies depending on your creditworthiness and the terms of your specific credit card agreement. It's important to check the APR before applying for a credit card to ensure you're getting the best deal possible.

10. Where Can You Find More Information?

For more information on the Mattress Firm Credit Card, you can visit the credit card issuer's website or speak with a customer service representative. It's important to fully understand the terms and conditions of your credit card agreement to avoid any potential issues in the future.

Conclusion

The Mattress Firm Credit Card can be a great option for financing your new mattress purchase. However, it's important to understand the minimum payment requirements to avoid any potential issues. By making your payments on time and in full, you can enjoy your new mattress without any added stress.

Why a Higher Minimum Payment on Your Mattress Firm Credit Card May Benefit You

The Importance of Making Timely Payments on Your Mattress Firm Credit Card

As a mattress is an essential piece of furniture that you will use every day, it's important to invest in a quality one that promotes a good night's sleep. However, purchasing a mattress can be expensive, which is why many people turn to financing options such as the Mattress Firm credit card. This card allows you to make monthly payments on your mattress purchase, but it's important to understand the minimum payment requirement.

The minimum payment on your Mattress Firm credit card is the minimum amount you are required to pay each month to keep your account in good standing.

This amount is typically a percentage of your total balance and is determined by the credit card issuer. While it may be tempting to only make the minimum payment, it's important to consider the benefits of paying more each month.

As a mattress is an essential piece of furniture that you will use every day, it's important to invest in a quality one that promotes a good night's sleep. However, purchasing a mattress can be expensive, which is why many people turn to financing options such as the Mattress Firm credit card. This card allows you to make monthly payments on your mattress purchase, but it's important to understand the minimum payment requirement.

The minimum payment on your Mattress Firm credit card is the minimum amount you are required to pay each month to keep your account in good standing.

This amount is typically a percentage of your total balance and is determined by the credit card issuer. While it may be tempting to only make the minimum payment, it's important to consider the benefits of paying more each month.

The Advantages of Paying More Than the Minimum

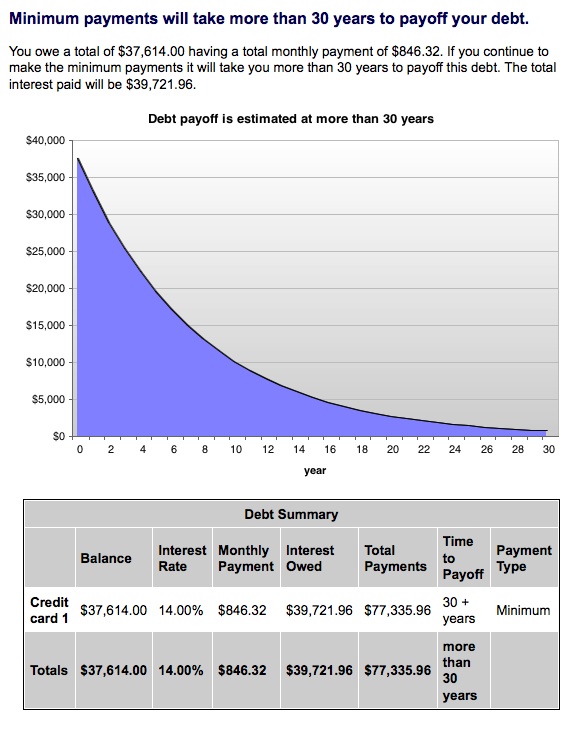

Making only the minimum payment on your Mattress Firm credit card may seem like a budget-friendly option, but it can end up costing you more in the long run. This is because credit card companies charge interest on your balance, and the higher your balance, the more interest you will accrue. By paying more than the minimum each month, you can reduce your balance and ultimately save money on interest charges.

Paying more than the minimum can also help you pay off your debt faster and improve your credit score.

As you make timely and consistent payments, your credit score will improve, making you more eligible for other credit opportunities in the future. Additionally, paying off your debt faster can free up your budget for other expenses and reduce financial stress.

Making only the minimum payment on your Mattress Firm credit card may seem like a budget-friendly option, but it can end up costing you more in the long run. This is because credit card companies charge interest on your balance, and the higher your balance, the more interest you will accrue. By paying more than the minimum each month, you can reduce your balance and ultimately save money on interest charges.

Paying more than the minimum can also help you pay off your debt faster and improve your credit score.

As you make timely and consistent payments, your credit score will improve, making you more eligible for other credit opportunities in the future. Additionally, paying off your debt faster can free up your budget for other expenses and reduce financial stress.

How to Determine Your Ideal Minimum Payment

While it's important to pay more than the minimum on your Mattress Firm credit card, it's also crucial to determine an amount that fits within your budget. A good rule of thumb is to aim for at least double the minimum payment. This will not only help you pay off your balance faster but also save you money on interest charges.

It's important to also consider your current financial situation and prioritize your payments accordingly.

If you have other debts with higher interest rates, it may be more beneficial to allocate more funds towards those payments. However,

if your Mattress Firm credit card balance is your only debt, it's wise to make larger payments to pay it off as soon as possible.

While it's important to pay more than the minimum on your Mattress Firm credit card, it's also crucial to determine an amount that fits within your budget. A good rule of thumb is to aim for at least double the minimum payment. This will not only help you pay off your balance faster but also save you money on interest charges.

It's important to also consider your current financial situation and prioritize your payments accordingly.

If you have other debts with higher interest rates, it may be more beneficial to allocate more funds towards those payments. However,

if your Mattress Firm credit card balance is your only debt, it's wise to make larger payments to pay it off as soon as possible.

In Conclusion

While the minimum payment on your Mattress Firm credit card may seem like a manageable option, it's important to consider the long-term benefits of paying more each month. By paying more, you can save money on interest charges, pay off your debt faster, and improve your credit score. It's essential to find a balance between your budget and paying off your debt to ultimately achieve financial stability.

While the minimum payment on your Mattress Firm credit card may seem like a manageable option, it's important to consider the long-term benefits of paying more each month. By paying more, you can save money on interest charges, pay off your debt faster, and improve your credit score. It's essential to find a balance between your budget and paying off your debt to ultimately achieve financial stability.