What Credit Score Do You Need for a Mattress Firm Credit Card?

If you're in the market for a new mattress, you may have heard about the benefits of a Mattress Firm credit card. With this card, you can finance your purchase and pay it off gradually, making it easier to afford the perfect mattress for your needs. But before you start filling out an application, you may be wondering: what credit score do you need for a Mattress Firm credit card?

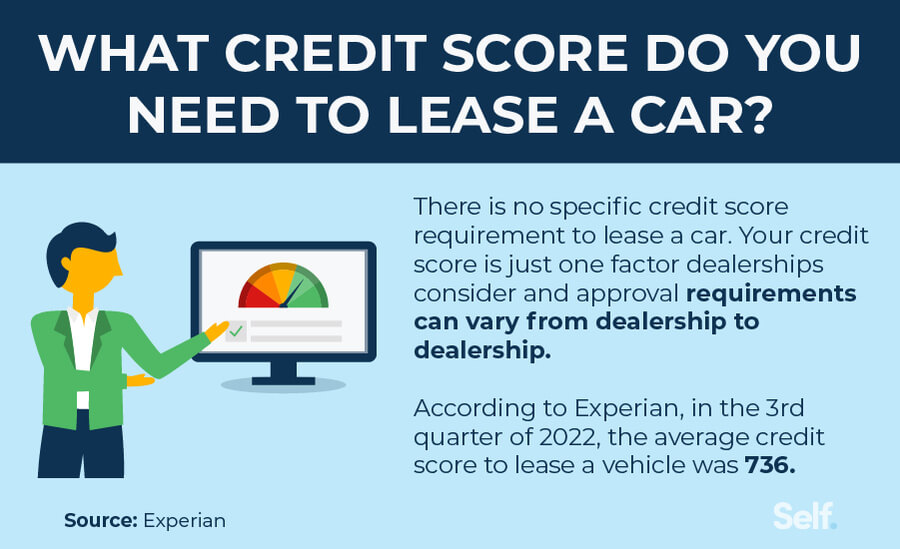

The answer is not a one-size-fits-all number. The credit score requirement for a Mattress Firm credit card may vary depending on a few factors. Let's take a closer look at what those factors are and what credit score you'll need to qualify.

How to Qualify for a Mattress Firm Credit Card

Before we dive into the specific credit score needed for a Mattress Firm credit card, let's first go over the general requirements for getting approved. Like with any credit card, there are a few key factors that will determine whether or not you qualify for a Mattress Firm credit card.

The first and most obvious factor is your credit score. However, as mentioned earlier, there is no set number that will automatically guarantee approval. Other factors that may be taken into consideration include your income, employment status, and credit history.

It's also important to note that Mattress Firm may perform a credit check as part of the application process. This means that if you have a low credit score, it may show up on your credit report and potentially lower your score even further.

Minimum Credit Score Requirements for Mattress Firm Credit Card

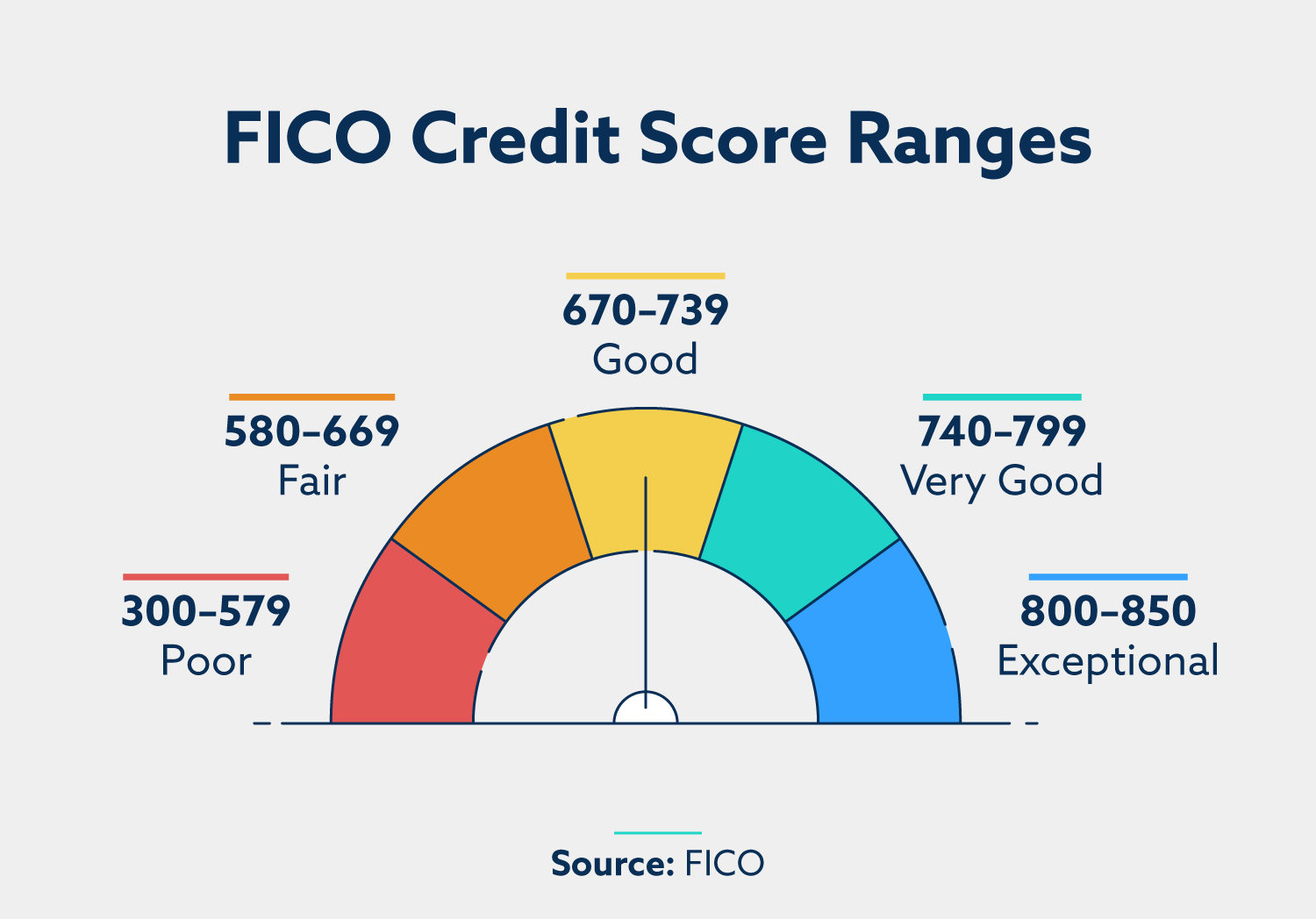

Although there is no specific credit score requirement for a Mattress Firm credit card, it's safe to assume that you'll need at least a fair credit score (between 580-669) to have a good chance at approval. Keep in mind, however, that even if you have a higher credit score, you may still be denied if you have a high debt-to-income ratio or a history of missed payments on your credit report.

On the other hand, if your credit score falls below the fair range, you may still be able to get approved for a Mattress Firm credit card, but you may be offered a higher interest rate or a lower credit limit.

Is a Mattress Firm Credit Card Worth It?

Now that you have an idea of the credit score needed for a Mattress Firm credit card, you may be wondering if it's worth applying for one. The answer to this question depends on your individual financial situation and spending habits.

If you have a good credit score and are able to pay off your balance in full each month, a Mattress Firm credit card can be a great way to finance a large purchase without accruing interest. However, if you struggle with credit card debt or have a low credit score, it may not be the best option for you.

How to Improve Your Credit Score for a Mattress Firm Credit Card

If you're determined to get a Mattress Firm credit card but your credit score is holding you back, don't worry. There are a few steps you can take to improve your credit score and increase your chances of approval.

First, make sure you're paying all of your bills on time and in full each month. Late payments can have a major negative impact on your credit score. You may also want to consider paying down any existing credit card debt to lower your overall credit utilization ratio.

Additionally, you can try becoming an authorized user on a family member or friend's credit card to help build your credit history. Just make sure they have a good payment history and low credit utilization before asking to be added to their account.

What Are the Benefits of a Mattress Firm Credit Card?

Aside from being able to finance your mattress purchase, there are a few other perks that come with owning a Mattress Firm credit card. For example, cardholders may have access to special financing offers and discounts throughout the year.

Additionally, you can earn rewards points on every purchase made with the card, which can be redeemed for future discounts or even free products from Mattress Firm. Just be sure to read the fine print and understand the terms and conditions before signing up.

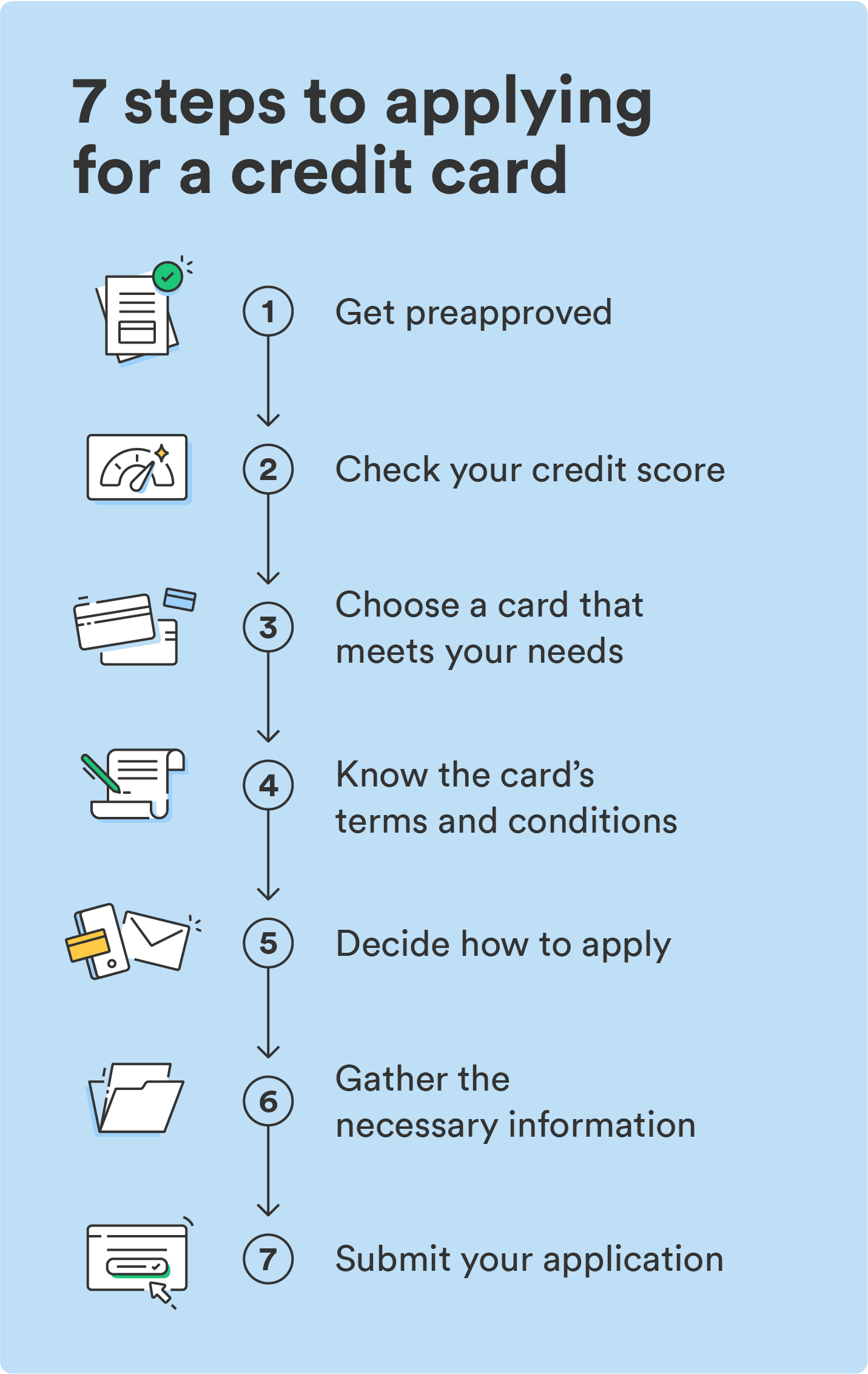

How to Apply for a Mattress Firm Credit Card

If you've decided that a Mattress Firm credit card is the right choice for you, the application process is fairly straightforward. You can apply in-store or online by providing your personal information, income, and employment status. You may also be asked to provide your social security number for a credit check.

If you're approved, you should receive your card in the mail within a few weeks. If you're denied, don't get discouraged. Remember to work on improving your credit score and try again in the future.

What Are the Credit Score Ranges for a Mattress Firm Credit Card?

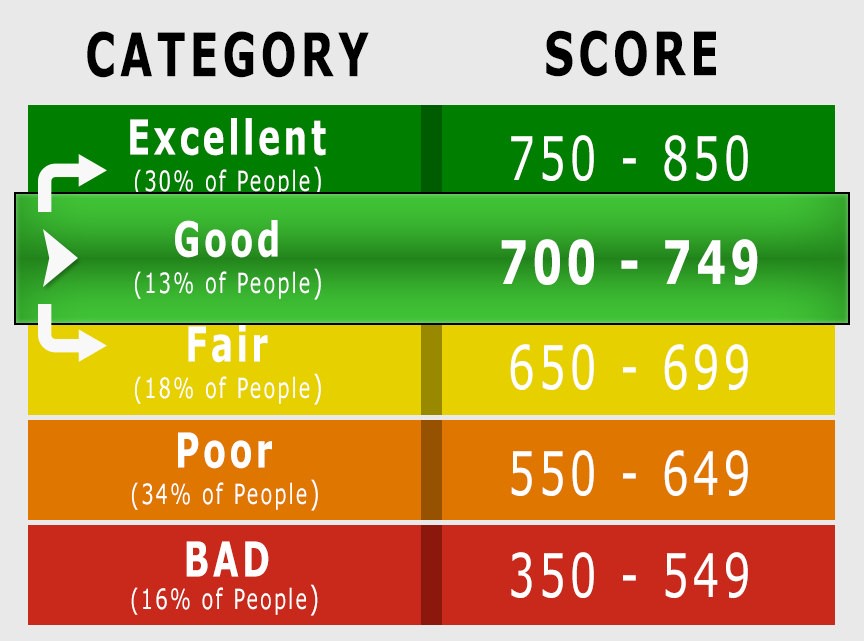

While there is no specific credit score requirement for a Mattress Firm credit card, it's helpful to understand the credit score ranges that lenders typically use when determining approval. These ranges are as follows:

Can You Get Approved for a Mattress Firm Credit Card with Bad Credit?

As mentioned earlier, having a low credit score doesn't necessarily mean you won't be approved for a Mattress Firm credit card. However, if your credit score is in the poor range, you may have a harder time getting approved or may be offered less favorable terms.

If you have bad credit, it may be a good idea to work on improving your credit score before applying for a Mattress Firm credit card to increase your chances of approval.

What Are the Alternatives to a Mattress Firm Credit Card?

If you're not able to get approved for a Mattress Firm credit card or decide it's not the right choice for you, there are a few alternatives you can consider. One option is to look into financing options through the mattress manufacturer or retailer. Another option is to use a regular credit card with a low interest rate to finance your purchase.

Just remember to carefully consider your options and make a decision that is best for your individual financial situation.

The Importance of Having a Good Credit Score for Mattress Firm Credit Card

What is a Credit Score and Why is it Important?

Before we dive into what credit score is needed for a Mattress Firm credit card, let's first understand what a credit score is and why it is important. Your credit score is a three-digit number that represents your creditworthiness, or how likely you are to pay back your debts. It is a crucial factor that lenders consider when deciding whether to give you credit or not. A higher credit score means you are a low risk borrower, and you are more likely to be approved for credit cards, loans, or mortgages with better interest rates and terms.

Before we dive into what credit score is needed for a Mattress Firm credit card, let's first understand what a credit score is and why it is important. Your credit score is a three-digit number that represents your creditworthiness, or how likely you are to pay back your debts. It is a crucial factor that lenders consider when deciding whether to give you credit or not. A higher credit score means you are a low risk borrower, and you are more likely to be approved for credit cards, loans, or mortgages with better interest rates and terms.

The Credit Score Needed for a Mattress Firm Credit Card

Now that we understand the importance of having a good credit score, let's focus on the credit score needed for a Mattress Firm credit card. The Mattress Firm credit card is issued by Synchrony Bank, and like most store credit cards, it requires a fair to excellent credit score to be approved. According to Synchrony Bank, a fair credit score is typically in the range of 580-669, while an excellent credit score is considered to be 720 or above. However, keep in mind that credit score is not the only factor that lenders consider when approving credit applications. Your income, debt-to-income ratio, and credit history are also important factors.

Now that we understand the importance of having a good credit score, let's focus on the credit score needed for a Mattress Firm credit card. The Mattress Firm credit card is issued by Synchrony Bank, and like most store credit cards, it requires a fair to excellent credit score to be approved. According to Synchrony Bank, a fair credit score is typically in the range of 580-669, while an excellent credit score is considered to be 720 or above. However, keep in mind that credit score is not the only factor that lenders consider when approving credit applications. Your income, debt-to-income ratio, and credit history are also important factors.

Why Having a Good Credit Score is Beneficial for Mattress Firm Credit Card Holders

Having a good credit score not only increases your chances of being approved for a Mattress Firm credit card, but it also comes with several benefits. First and foremost, a higher credit score means you can get a higher credit limit, which allows you to make larger purchases and take advantage of special financing offers. Additionally, a good credit score can also qualify you for a lower interest rate, which can save you money in the long run. Moreover, having a good credit score shows that you are responsible with managing credit, which can lead to better credit opportunities in the future.

In conclusion,

while the exact credit score needed for a Mattress Firm credit card may vary, it is important to strive for a good credit score to increase your chances of being approved and to reap the benefits that come with it. Make sure to pay your bills on time, keep your credit card balances low, and maintain a healthy credit mix to improve your credit score. With a good credit score, you can not only enjoy a comfortable mattress from Mattress Firm, but also pave the way for a brighter financial future.

Having a good credit score not only increases your chances of being approved for a Mattress Firm credit card, but it also comes with several benefits. First and foremost, a higher credit score means you can get a higher credit limit, which allows you to make larger purchases and take advantage of special financing offers. Additionally, a good credit score can also qualify you for a lower interest rate, which can save you money in the long run. Moreover, having a good credit score shows that you are responsible with managing credit, which can lead to better credit opportunities in the future.

In conclusion,

while the exact credit score needed for a Mattress Firm credit card may vary, it is important to strive for a good credit score to increase your chances of being approved and to reap the benefits that come with it. Make sure to pay your bills on time, keep your credit card balances low, and maintain a healthy credit mix to improve your credit score. With a good credit score, you can not only enjoy a comfortable mattress from Mattress Firm, but also pave the way for a brighter financial future.

/cdn.vox-cdn.com/uploads/chorus_image/image/63999823/DSC_5108_FM_Kitchen___Bar_Houston_TX_Image_Credit_Ellie_Sharp.0.jpg)