If you're looking to get a Mattress Firm credit card, you may be wondering how your credit score will affect your chances of approval. Your credit score plays a major role in determining your eligibility for credit cards and other types of loans. A higher credit score can also mean lower interest rates and more favorable terms. So, if you're concerned about your credit score, here are four tips to help you improve it fast: 1. Pay Your Bills on Time One of the best ways to improve your credit score is to make sure you pay your bills on time. Late payments can have a negative impact on your credit score, so it's important to pay your bills by their due dates. If you struggle to remember when your bills are due, consider setting up automatic payments or creating a calendar reminder. 2. Keep Your Credit Utilization Low Your credit utilization is the percentage of your available credit that you're currently using. For example, if you have a credit card with a $10,000 limit and a balance of $2,000, your credit utilization is 20%. It's generally recommended to keep your credit utilization below 30% to maintain a good credit score. If you have a high credit utilization, consider paying down your balances or requesting a credit limit increase. 3. Check Your Credit Report Regularly It's important to regularly check your credit report for any errors or fraudulent activity. You can get a free credit report from each of the three major credit bureaus once a year. If you find any errors, be sure to dispute them with the credit bureau to have them corrected. This can help improve your credit score if the errors were negatively impacting it. 4. Consider a Secured Credit Card If you have no credit history or a low credit score, you may have a hard time getting approved for a traditional credit card. In this case, you may want to consider a secured credit card. With a secured credit card, you'll need to make a deposit that will serve as your credit limit. By using a secured credit card responsibly, you can establish a positive credit history and improve your credit score.How to Improve Your Credit Score: 4 Tips to Help You Raise Your Score Fast

If you're in the market for a new mattress, you may be considering applying for a Mattress Firm credit card. This store credit card offers special financing options and rewards for purchases made at Mattress Firm. So, how can you get a Mattress Firm credit card? Here are the steps to take: 1. Check Your Credit Score Before applying for a Mattress Firm credit card, it's important to know where your credit stands. This will give you an idea of your chances of approval and what interest rate you may receive. If your credit score needs some work, consider taking steps to improve it before applying. 2. Visit the Mattress Firm Website You can apply for a Mattress Firm credit card online by visiting their website. Click on the "Apply Now" button and you'll be taken to the application page. 3. Fill Out the Application The application will ask for personal information such as your name, address, and annual income. You may also be asked for your social security number and date of birth for a credit check. Make sure to fill out the application accurately and completely. 4. Submit Your Application Once you've completed the application, review it for any errors and then submit it. You should receive a decision on your application within a few minutes. If approved, you'll receive your new Mattress Firm credit card in the mail within a few weeks.How to Get a Mattress Firm Credit Card

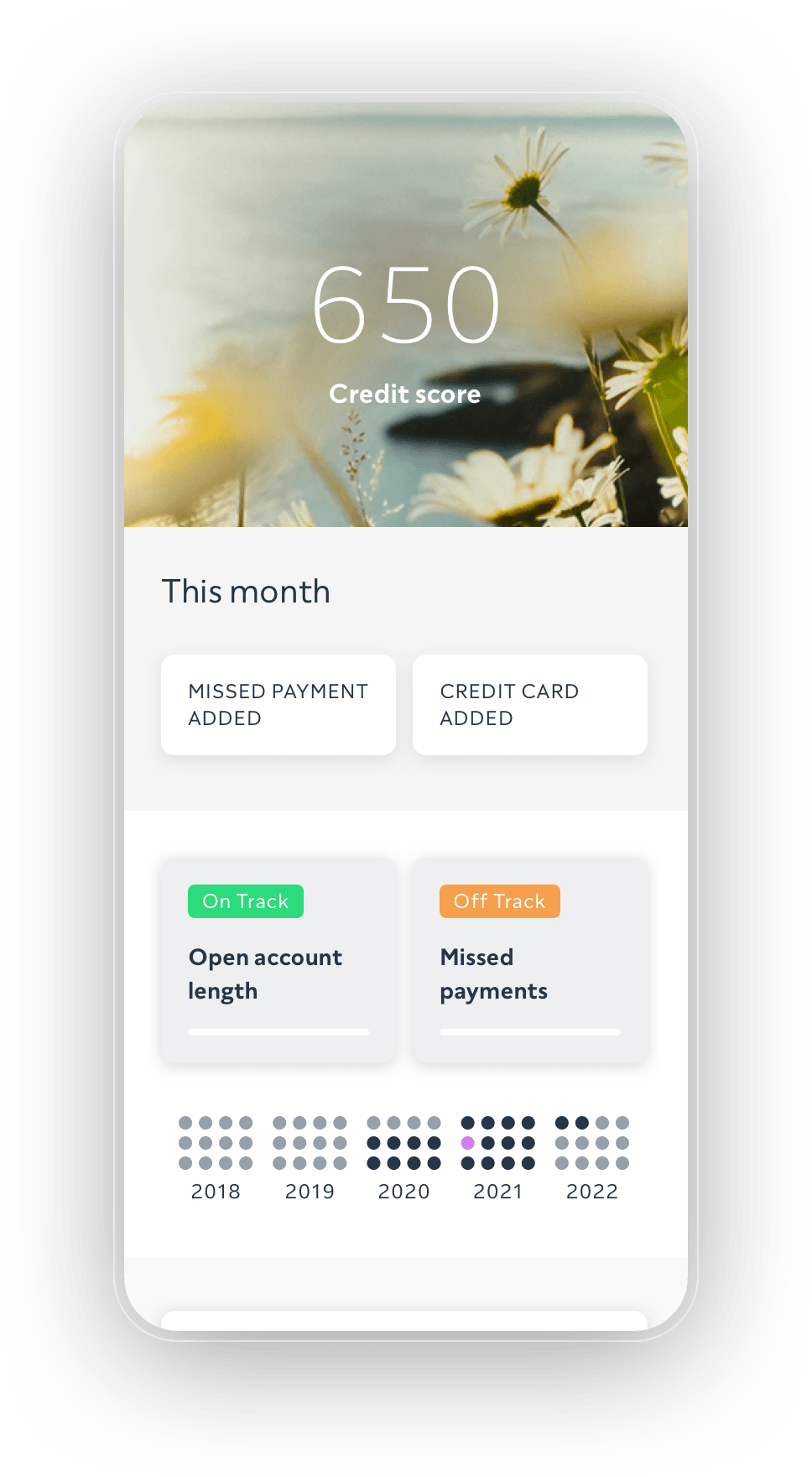

Knowing your credit score is important for maintaining good credit and making informed financial decisions. Luckily, there are several ways to check your credit score for free: 1. Use a Credit Monitoring Service Many credit card companies and banks offer free credit score monitoring to their customers. You can also sign up for a free account with companies like Credit Karma or Credit Sesame to access your credit score at any time. 2. Request Your Credit Report You're entitled to a free credit report from each of the three major credit bureaus once a year. You can request your credit report online, by phone, or by mail. Review your credit report for any errors or fraudulent activity that may be affecting your score. 3. Check Your Credit Card Statements Some credit card companies now include your credit score on your monthly statements. This can be a quick and easy way to keep track of your score without having to log into a separate account.How to Check Your Credit Score for Free

If you're just starting to build your credit, it can be difficult to get approved for a traditional credit card. But there are still options for getting a credit card with no credit history: 1. Apply for a Student Credit Card Student credit cards are designed for college students who may not have a credit history yet. These cards often have lower credit limits and may require a co-signer, but they can be a good way to start building credit. 2. Consider a Secured Credit Card As mentioned earlier, a secured credit card requires a deposit that will serve as your credit limit. This can be a good option for those with no credit history, as the deposit acts as collateral for the card issuer. 3. Become an Authorized User If you have a family member or friend with good credit, you can ask them to add you as an authorized user on their credit card. This will allow you to use the card and build credit history, but the primary cardholder will still be responsible for making payments.How to Get a Credit Card With No Credit History

If you're looking to improve your credit score quickly, here are seven strategies that can help: 1. Become an Authorized User As mentioned earlier, becoming an authorized user on someone else's credit card can help you build credit quickly. Just make sure the primary cardholder has a good payment history and low credit utilization. 2. Get a Credit Builder Loan Credit builder loans are designed specifically to help people build credit. You'll make small monthly payments towards the loan and once it's paid off, you'll receive the money as a lump sum. 3. Use a Secured Credit Card Using a secured credit card responsibly can also help you build credit fast. Make sure to make all payments on time and keep your credit utilization low. 4. Keep Old Accounts Open The length of your credit history is an important factor in your credit score. So, even if you don't use an old credit card, it's best to keep the account open to maintain a longer credit history. 5. Make More Than the Minimum Payment If you have credit card debt, try to pay more than the minimum payment each month. This will help you pay off the debt faster and improve your credit utilization. 6. Diversify Your Credit Having a mix of different types of credit (such as credit cards, loans, and mortgages) can help improve your credit score. Just make sure to only take on credit that you can manage responsibly. 7. Monitor Your Credit Score Lastly, make sure to regularly check your credit score and report for any changes or errors. This will help you track your progress and catch any issues that may be negatively impacting your score.How to Build Credit Fast: 7 Strategies That Work

If you have a low credit score, it may be more challenging to get approved for a credit card. But there are still options available: 1. Look for Secured Credit Cards Secured credit cards are often easier to get approved for with bad credit. Just make sure to use the card responsibly to improve your credit score over time. 2. Consider a Credit-Builder Loan As mentioned earlier, credit-builder loans can help you build credit. But they can also be a good option for those with bad credit, as the lender may be more willing to approve you since you'll be putting down a deposit. 3. Apply for a Store Credit Card Some store credit cards have less strict approval requirements and may be more likely to approve you with bad credit. Just be aware that these cards may have higher interest rates and lower credit limits.How to Get a Credit Card With Bad Credit

If you have no credit history at all, you may have a hard time getting approved for a credit card. But there are still options available: 1. Apply for a Secured Credit Card As mentioned earlier, a secured credit card can be a good option for those with no credit history. By using the card responsibly, you can establish a positive credit history. 2. Become an Authorized User If you have a family member or friend with good credit, you can ask them to add you as an authorized user on their credit card. This will allow you to start building credit without having to apply for a card on your own. 3. Apply for a Student Credit Card Student credit cards are often more lenient with credit requirements, making them a good option for those with no credit history. Just make sure to use the card responsibly to build credit.How to Get a Credit Card With No Credit

If you're concerned about a credit check affecting your credit score, you may be wondering if it's possible to get a credit card without one. While most credit card applications do require a credit check, there are a few options that don't: 1. Prepaid Debit Cards Prepaid debit cards don't require a credit check because you're using your own money to make purchases. Just be aware that these cards often come with fees and may not help you build credit. 2. Store Credit Cards Some store credit cards may not require a credit check, but they may have lower credit limits and higher interest rates. Make sure to read the terms and conditions carefully before applying. 3. Credit Cards for Bad Credit Some credit cards specifically cater to those with bad credit, and these may have less strict credit check requirements. Just be aware that these cards may also come with high fees and interest rates.How to Get a Credit Card With No Credit Check

If you're looking to avoid annual fees on your credit card, here are some steps you can take: 1. Look for No-Fee Credit Cards There are many credit cards available that don't charge an annual fee. Do your research and compare cards to find one that fits your needs. 2. Negotiate With Your Credit Card Company If you currently have a credit card with an annual fee, you may be able to negotiate with your credit card company to waive the fee. This may be easier if you have a good payment history and have been a customer for a long time. 3. Use a Secured Credit Card Some secured credit cards don't charge an annual fee, making them a good option for those looking to avoid this extra cost.How to Get a Credit Card With No Annual Fee

If you're looking to get a credit card without having to make a deposit, here are some options to consider: 1. Look for No-Deposit Credit Cards Some credit cards don't require a deposit, but they may have stricter credit requirements. Make sure to do your research and compare cards to find one that's right for you. 2. Build Your Credit First If you have no credit or bad credit, it may be beneficial to work on improving your credit score before applying for a credit card. This can increase your chances of getting approved for a credit card with more favorable terms. 3. Consider a Secured Credit Card While a secured credit card does require a deposit, this can be a good option for those with no credit or bad credit. The deposit serves as collateral for the card issuer, making it easier to get approved.How to Get a Credit Card With No Deposit

The Importance of Good Credit Score for Mattress Firm Credit Card

Why Credit Score Matters

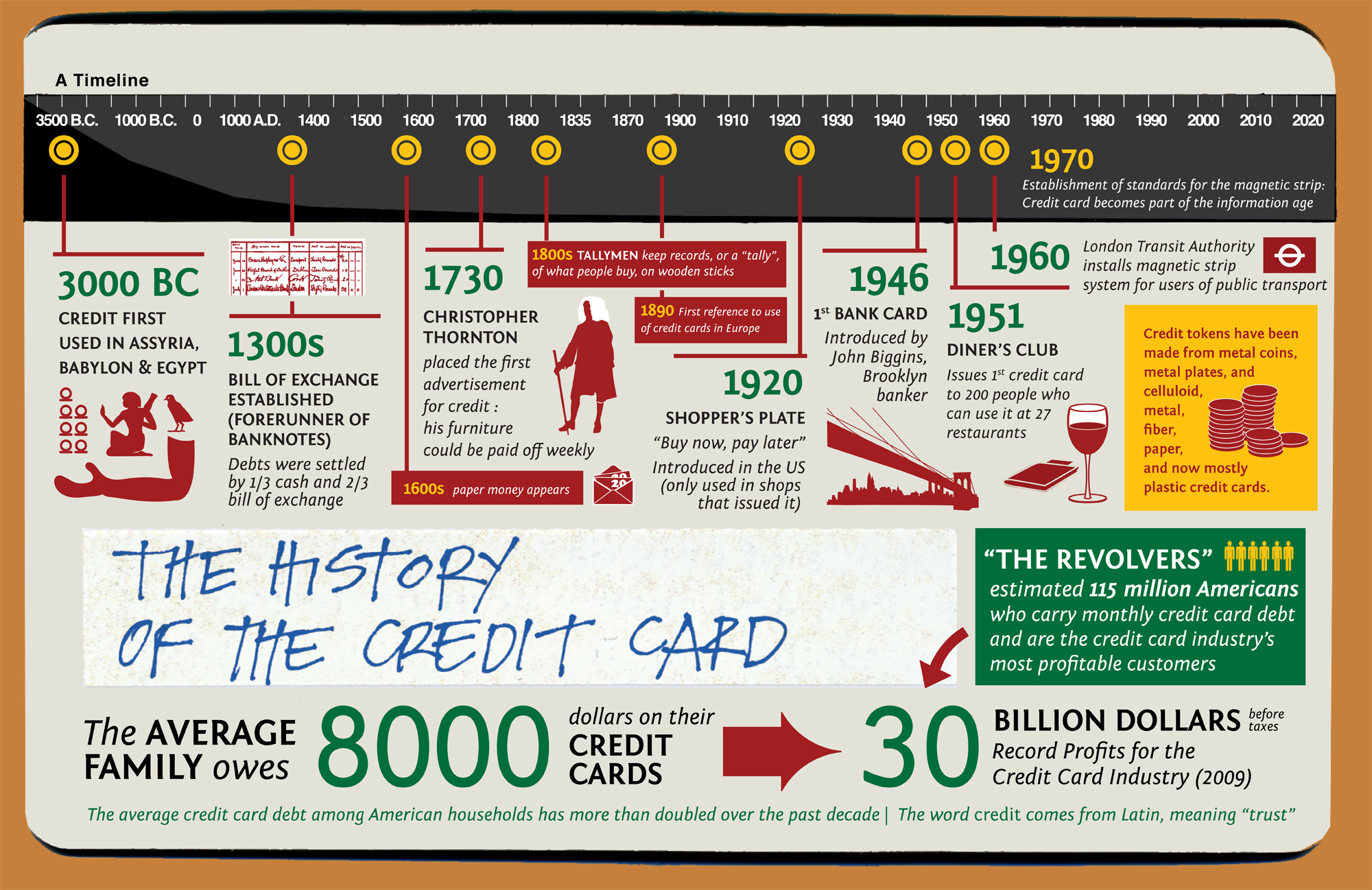

A credit score is a three-digit number that represents an individual's creditworthiness and financial trustworthiness. It is an essential factor in determining whether you qualify for a loan, credit card, or even a mortgage. A good credit score can lead to lower interest rates, better loan terms, and increased chances of approval for credit applications. On the other hand, a poor credit score can make it challenging to obtain credit and may result in higher interest rates and fees. Therefore, maintaining a good credit score is crucial, especially when it comes to applying for a

mattress firm credit card

.

A credit score is a three-digit number that represents an individual's creditworthiness and financial trustworthiness. It is an essential factor in determining whether you qualify for a loan, credit card, or even a mortgage. A good credit score can lead to lower interest rates, better loan terms, and increased chances of approval for credit applications. On the other hand, a poor credit score can make it challenging to obtain credit and may result in higher interest rates and fees. Therefore, maintaining a good credit score is crucial, especially when it comes to applying for a

mattress firm credit card

.

The Impact of Credit Score on Mattress Firm Credit Card Approval

When applying for a

mattress firm credit card

, the issuer will check your credit score to assess your creditworthiness. A higher credit score indicates that you are a responsible borrower who is likely to repay the credit card debt on time. This makes you a lower risk for the credit card issuer, and they are more likely to approve your application. On the other hand, a lower credit score may make the issuer hesitant to approve your application, as it indicates a higher risk of defaulting on payments.

When applying for a

mattress firm credit card

, the issuer will check your credit score to assess your creditworthiness. A higher credit score indicates that you are a responsible borrower who is likely to repay the credit card debt on time. This makes you a lower risk for the credit card issuer, and they are more likely to approve your application. On the other hand, a lower credit score may make the issuer hesitant to approve your application, as it indicates a higher risk of defaulting on payments.

How to Improve Your Credit Score for Mattress Firm Credit Card Approval

If your credit score is not where you want it to be, there are steps you can take to improve it. The first step is to check your credit report for any errors or discrepancies. If you find any, make sure to dispute them and have them corrected. It is also crucial to make all your payments on time and keep your credit utilization ratio low. Consider paying off any outstanding debts and avoiding opening new credit accounts before applying for a

mattress firm credit card

. These actions can help improve your credit score and increase your chances of getting approved for the card.

If your credit score is not where you want it to be, there are steps you can take to improve it. The first step is to check your credit report for any errors or discrepancies. If you find any, make sure to dispute them and have them corrected. It is also crucial to make all your payments on time and keep your credit utilization ratio low. Consider paying off any outstanding debts and avoiding opening new credit accounts before applying for a

mattress firm credit card

. These actions can help improve your credit score and increase your chances of getting approved for the card.

The Benefits of a Good Credit Score for Mattress Firm Credit Card Holders

Having a good credit score not only increases your chances of getting approved for a

mattress firm credit card

, but it also comes with additional perks. With a higher credit score, you may be eligible for lower interest rates and better rewards programs, such as cashback or travel rewards. You may also have access to higher credit limits, allowing you to make larger purchases and improve your credit utilization ratio. Overall, a good credit score can save you money and provide you with better credit opportunities.

In conclusion, a good credit score is crucial when applying for a

mattress firm credit card

. It not only increases your chances of approval but also comes with additional benefits such as lower interest rates and better rewards programs. Therefore, it is essential to maintain a good credit score by making timely payments and keeping your credit utilization ratio low. With a good credit score, you can enjoy a comfortable night's sleep on a new mattress without worrying about the financial burden.

Having a good credit score not only increases your chances of getting approved for a

mattress firm credit card

, but it also comes with additional perks. With a higher credit score, you may be eligible for lower interest rates and better rewards programs, such as cashback or travel rewards. You may also have access to higher credit limits, allowing you to make larger purchases and improve your credit utilization ratio. Overall, a good credit score can save you money and provide you with better credit opportunities.

In conclusion, a good credit score is crucial when applying for a

mattress firm credit card

. It not only increases your chances of approval but also comes with additional benefits such as lower interest rates and better rewards programs. Therefore, it is essential to maintain a good credit score by making timely payments and keeping your credit utilization ratio low. With a good credit score, you can enjoy a comfortable night's sleep on a new mattress without worrying about the financial burden.