If you're in the market for a new mattress, you may have come across the option of financing your purchase with a mattress firm credit card. But what are the chances of actually getting approved for one? The answer is not so straightforward, as approval odds can vary depending on a variety of factors.What Are the Odds of Getting Approved for a Mattress Firm Credit Card?

While there is no guarantee of approval, there are some steps you can take to improve your chances of getting approved for a mattress firm credit card. One of the most important factors is your credit score. A higher credit score will make you a more attractive candidate for credit and could increase your chances of approval.How to Improve Your Chances of Getting Approved for a Mattress Firm Credit Card

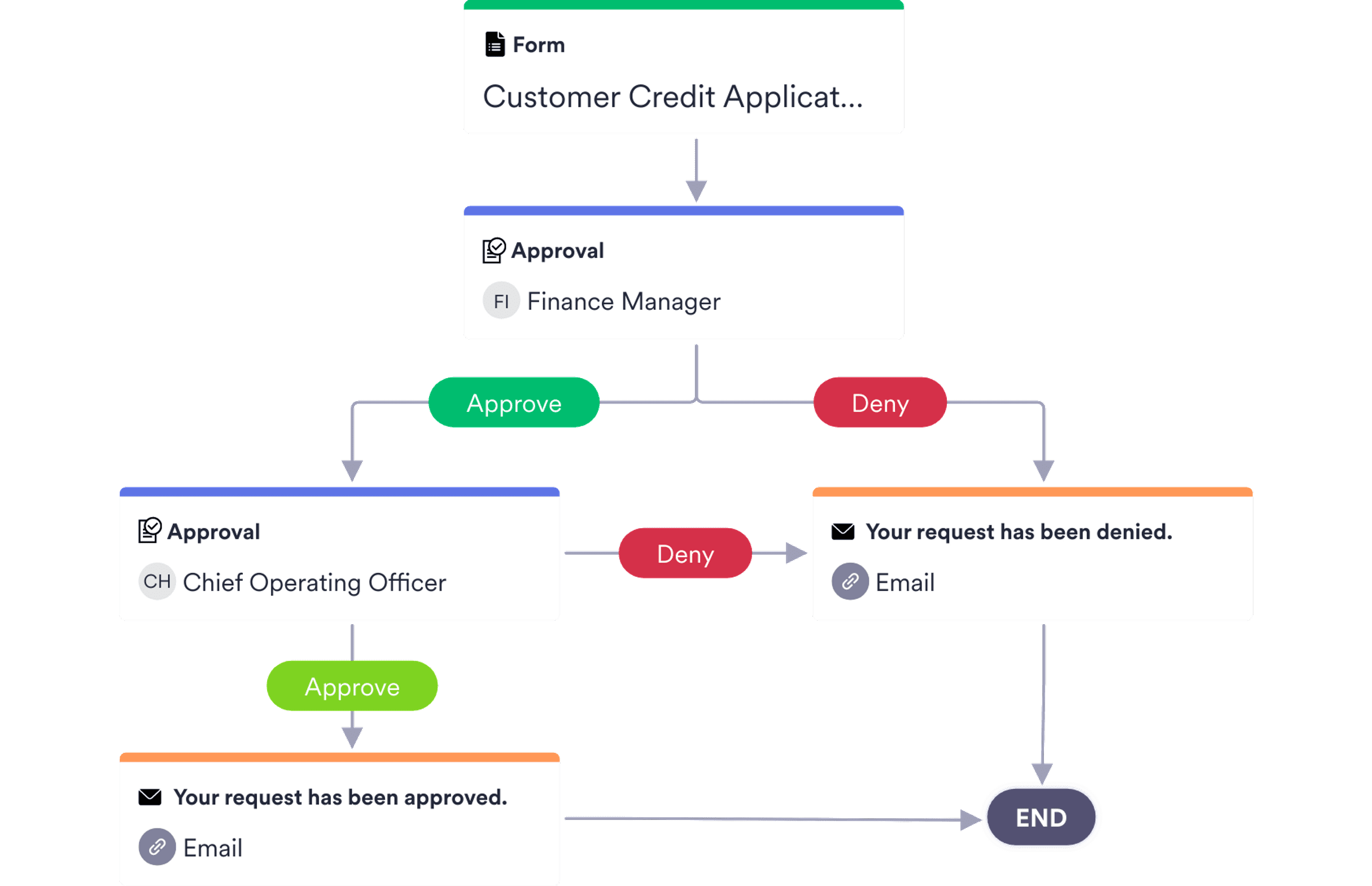

When you apply for a mattress firm credit card, the company will review your credit history, income, and other financial information to determine if you are a responsible borrower. They will also consider factors such as your debt-to-income ratio and any recent credit inquiries. All of these factors will contribute to your overall approval odds.Understanding the Approval Process for a Mattress Firm Credit Card

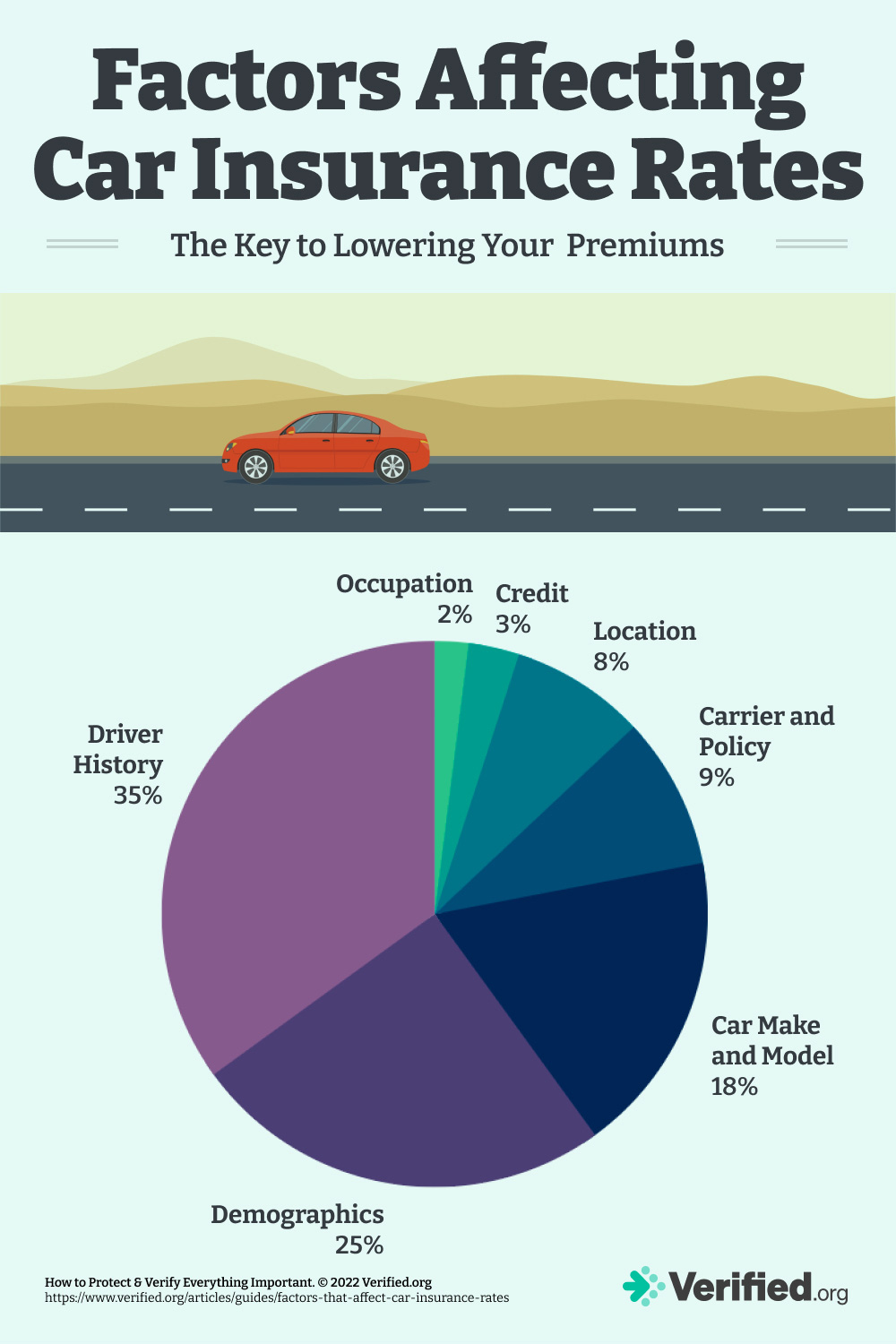

As mentioned, there are several factors that can impact your chances of getting approved for a mattress firm credit card. These include your credit score, income, and debt-to-income ratio. Additionally, having a history of responsible credit card usage and timely payments can also increase your approval odds.Factors That Affect Your Approval Odds for a Mattress Firm Credit Card

If you're determined to get approved for a mattress firm credit card, there are some things you can do to improve your chances. First, make sure you have a good credit score by paying your bills on time, keeping your credit card balances low, and monitoring your credit report for any errors. Also, try to pay off any outstanding debts to lower your debt-to-income ratio.Tips for Getting Approved for a Mattress Firm Credit Card

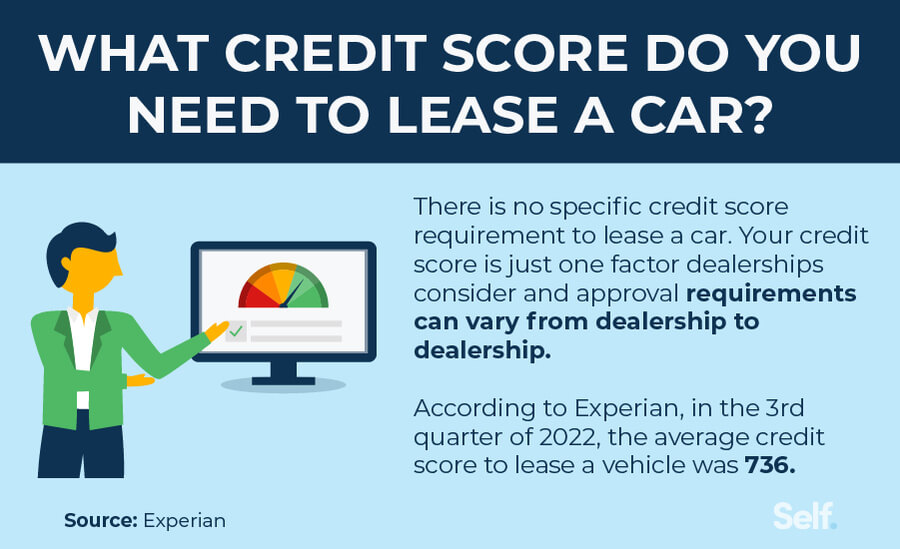

While there is no specific credit score requirement, having a good credit score (typically above 700) can greatly increase your chances of getting approved for a mattress firm credit card. However, even if your score is lower, you may still be able to get approved if you have a strong financial history and responsible credit card usage.What Credit Score Do You Need to Get Approved for a Mattress Firm Credit Card?

The approval process for a mattress firm credit card can vary, but typically you should receive a decision within a few minutes of submitting your application. If you are approved, you should receive your card in the mail within 7-10 business days.How Long Does it Take to Get Approved for a Mattress Firm Credit Card?

If you are not approved for a mattress firm credit card, don't panic. You can start by checking your credit score and reviewing your credit report to see if there are any areas that need improvement. You can also reach out to the credit card company to ask for specific reasons for your denial and work on addressing those factors.What to Do if You're Not Approved for a Mattress Firm Credit Card

If you are not approved for a mattress firm credit card or decide it's not the right option for you, there are other alternatives to consider. Some mattress companies offer their own financing options or you could look into getting a personal loan from a bank or credit union. Just be sure to compare interest rates and terms before making a decision.Alternatives to a Mattress Firm Credit Card

If you are approved for a mattress firm credit card, it's important to use it responsibly to not only finance your purchase, but also to improve your credit score. Be sure to make timely payments and keep your credit card balance low. Avoid overspending and try to pay off your balance in full each month to avoid accruing interest.How to Use a Mattress Firm Credit Card Responsibly to Improve Your Credit Score

The Importance of Choosing the Right Mattress Firm Credit Card

Why Your Mattress Choice Matters

When it comes to designing and creating the perfect home, every detail counts. From the color scheme to the furniture, every element plays a crucial role in creating a space that is both beautiful and functional. However, one aspect that is often overlooked is the quality of our sleep. A good night's rest is essential for our physical and mental well-being, and the right mattress can make all the difference.

When it comes to designing and creating the perfect home, every detail counts. From the color scheme to the furniture, every element plays a crucial role in creating a space that is both beautiful and functional. However, one aspect that is often overlooked is the quality of our sleep. A good night's rest is essential for our physical and mental well-being, and the right mattress can make all the difference.

The Benefits of a Mattress Firm Credit Card

Mattress Firm offers a credit card specifically for those looking to purchase a new mattress. This card provides customers with a range of benefits, including special financing options and exclusive discounts. But before you apply for the card, it's important to understand your chances of approval.

Mattress Firm offers a credit card specifically for those looking to purchase a new mattress. This card provides customers with a range of benefits, including special financing options and exclusive discounts. But before you apply for the card, it's important to understand your chances of approval.

Understanding Your Approval Odds

When it comes to credit cards, our approval odds can depend on a variety of factors such as credit score, income, and credit history. The same applies to the Mattress Firm credit card. However, the good news is that this card is designed to cater to a wide range of credit scores, meaning that even if you have less than perfect credit, you may still have a good chance of approval.

When it comes to credit cards, our approval odds can depend on a variety of factors such as credit score, income, and credit history. The same applies to the Mattress Firm credit card. However, the good news is that this card is designed to cater to a wide range of credit scores, meaning that even if you have less than perfect credit, you may still have a good chance of approval.

Improving Your Approval Odds

If you're concerned about your credit score and want to increase your chances of getting approved for the Mattress Firm credit card, there are a few steps you can take. Firstly, make sure to pay off any outstanding debt and avoid applying for multiple credit cards at once. Additionally, having a stable income and a good credit history can also improve your approval odds.

If you're concerned about your credit score and want to increase your chances of getting approved for the Mattress Firm credit card, there are a few steps you can take. Firstly, make sure to pay off any outstanding debt and avoid applying for multiple credit cards at once. Additionally, having a stable income and a good credit history can also improve your approval odds.

Final Thoughts

Choosing the right mattress is crucial for a good night's sleep, and the Mattress Firm credit card can make that decision easier with its special financing options and discounts. While your approval odds may depend on various factors, understanding them and taking steps to improve them can increase your chances of getting approved for this card. So why wait? Apply for the Mattress Firm credit card today and take the first step towards a better night's sleep.

Choosing the right mattress is crucial for a good night's sleep, and the Mattress Firm credit card can make that decision easier with its special financing options and discounts. While your approval odds may depend on various factors, understanding them and taking steps to improve them can increase your chances of getting approved for this card. So why wait? Apply for the Mattress Firm credit card today and take the first step towards a better night's sleep.