Mattress Firm Credit Approval: What You Need to Know

If you're in the market for a new mattress, you may have considered financing options to help make the purchase more affordable. One option that may have caught your eye is the Mattress Firm credit card. But before you apply, there are a few things you should know about the Mattress Firm credit approval process.

How to Get Approved for Mattress Firm Credit

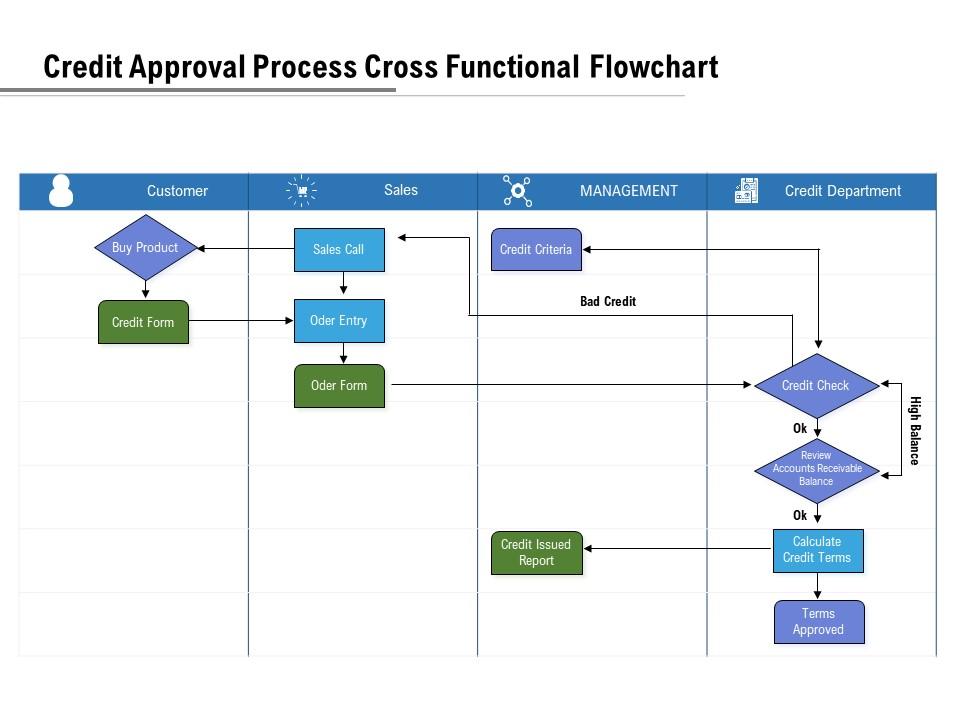

Getting approved for Mattress Firm credit is a relatively simple process, but there are a few key factors that will determine your eligibility. The first and most important factor is your credit score. This is a numerical representation of your creditworthiness, and it is used by lenders to determine your likelihood of paying back the money you borrow. To increase your chances of getting approved for Mattress Firm credit, it is recommended to have a credit score of at least 700 or higher.

Aside from your credit score, lenders will also look at your income and employment history. They want to make sure that you have a stable source of income and are able to make your monthly payments. If you have a steady job and a good income, this will work in your favor when applying for Mattress Firm credit.

Mattress Firm Credit Card: Benefits and How to Apply

The Mattress Firm credit card offers several benefits for those who are approved. Some of these benefits include special financing offers, exclusive discounts, and convenient online account management. To apply for the Mattress Firm credit card, you can either visit your local Mattress Firm store or apply online through their website. When applying, be sure to have your personal and financial information ready, as well as your credit score.

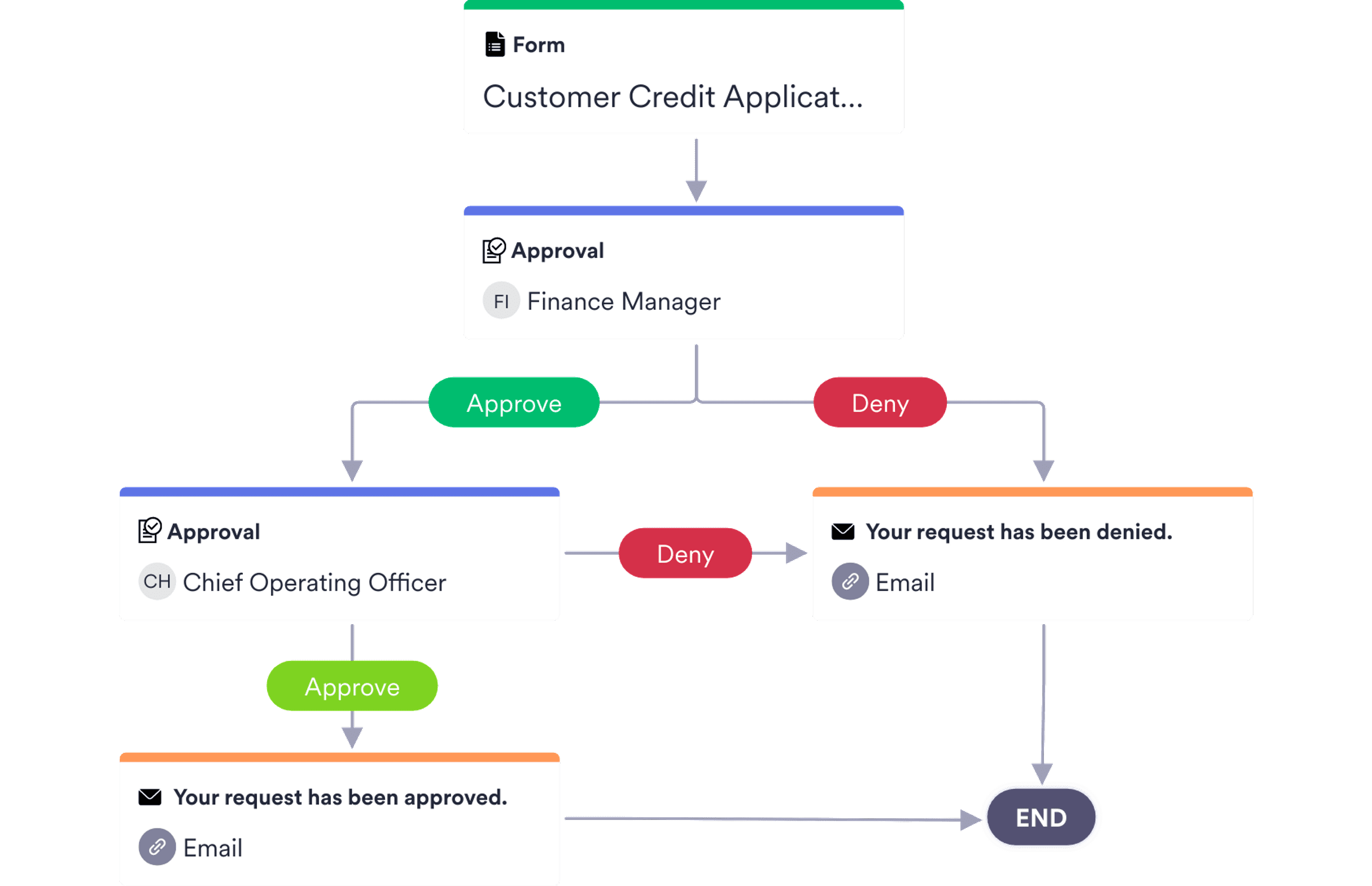

Understanding the Mattress Firm Credit Approval Process

The Mattress Firm credit approval process is relatively quick and straightforward. Once you have submitted your application, it will be reviewed by the lender and a decision will be made within a few minutes. If you are approved, you will receive your credit card in the mail within 7-10 business days.

If you are not approved, you will receive a letter in the mail explaining the reasons for the denial. Some common reasons for denial include a low credit score, insufficient income, or a high debt-to-income ratio. If you are denied, don't fret. There are still other options available to you.

Tips for Improving Your Chances of Mattress Firm Credit Approval

If you are concerned about your credit score or want to improve your chances of getting approved for Mattress Firm credit, there are a few things you can do. First, make sure to keep your credit card balances low and make all of your payments on time. This will help improve your credit score and show lenders that you are responsible with credit.

You can also consider applying with a co-signer who has a higher credit score or income than you. This can help strengthen your application and increase your chances of approval.

Mattress Firm Credit Approval Requirements

In order to be approved for Mattress Firm credit, there are a few basic requirements that you must meet. These include being at least 18 years of age, having a valid Social Security number, and having a steady source of income. You will also need to have a credit score of at least 700 and a good credit history.

How to Check Your Mattress Firm Credit Approval Status

If you have already applied for Mattress Firm credit, you can check the status of your application by logging into your online account or by contacting the lender directly. Keep in mind that it can take up to a week to receive a decision on your application.

If you have been approved, you can start using your credit card right away. If you have been denied, you can consider improving your credit score or exploring alternative financing options.

Mattress Firm Credit Approval: Frequently Asked Questions

Here are some commonly asked questions about Mattress Firm credit approval:

Q: Are there any annual fees for the Mattress Firm credit card?

A: No, there are no annual fees associated with the Mattress Firm credit card.

Q: Is there a penalty for paying off my balance early?

A: No, there is no penalty for paying off your balance early.

Q: How long does it take to receive a decision on my application?

A: You should receive a decision within a few minutes of submitting your application.

Alternatives to Mattress Firm Credit for Financing Your Mattress

If you are not approved for Mattress Firm credit or are looking for alternative financing options, there are a few options you can consider. Some mattress retailers offer their own financing options, which may have different eligibility requirements. You can also look into personal loans or credit cards with low interest rates to finance your mattress purchase.

Mattress Firm Credit Approval: What to Do if You're Denied

If you are denied for Mattress Firm credit, don't worry. There are still other options available to help you finance your mattress purchase. You can work on improving your credit score and reapply in the future, or explore alternative financing options. Just remember to always borrow responsibly and make sure you can afford the monthly payments before taking on any new credit.

Overall, the Mattress Firm credit approval process is relatively straightforward and can provide many benefits for those who are approved. By understanding the requirements and taking steps to improve your creditworthiness, you can increase your chances of getting approved for Mattress Firm credit and making your dream mattress a reality.

Why Mattress Firm Credit Approval is the Best Choice for Your Mattress Purchase

The Importance of a Good Mattress

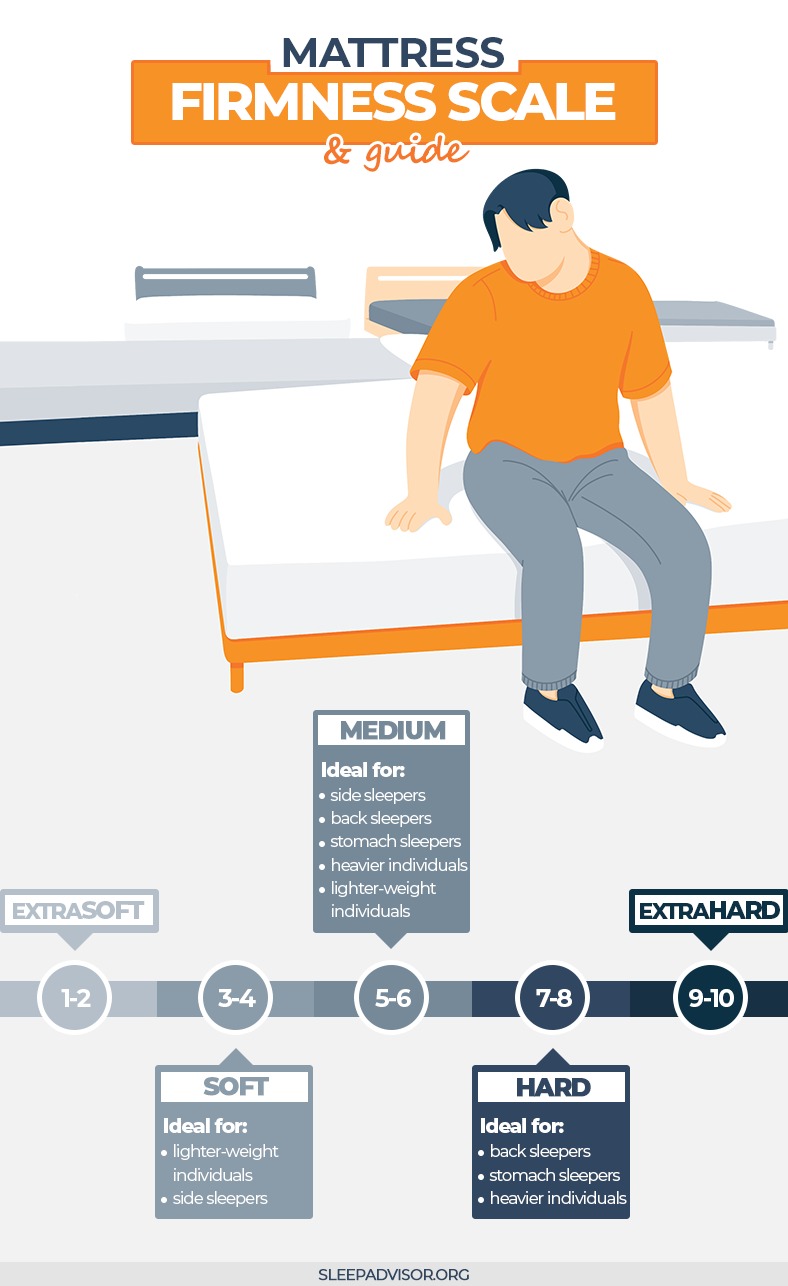

A good mattress is essential for a good night's sleep, as it provides the necessary support and comfort for your body to rest and rejuvenate. Without a quality mattress, you may experience restless nights, body aches, and fatigue the next day. That's why it's important to invest in a good mattress that suits your body and sleeping preferences.

A good mattress is essential for a good night's sleep, as it provides the necessary support and comfort for your body to rest and rejuvenate. Without a quality mattress, you may experience restless nights, body aches, and fatigue the next day. That's why it's important to invest in a good mattress that suits your body and sleeping preferences.

Introducing Mattress Firm Credit Approval

When it comes to purchasing a new mattress, the options can be overwhelming. But with Mattress Firm Credit Approval, the process becomes much simpler and less stressful. With this convenient financing option, you can easily purchase the mattress of your dreams without breaking the bank.

When it comes to purchasing a new mattress, the options can be overwhelming. But with Mattress Firm Credit Approval, the process becomes much simpler and less stressful. With this convenient financing option, you can easily purchase the mattress of your dreams without breaking the bank.

Flexible Payment Plans

Mattress Firm Credit Approval offers flexible payment plans to suit your budget and needs. With low monthly payments and 0% interest for a certain period, you can comfortably afford to upgrade to a better, more comfortable mattress. Plus, with no hidden fees or charges, you can rest assured that you are getting the best deal for your money.

Mattress Firm Credit Approval offers flexible payment plans to suit your budget and needs. With low monthly payments and 0% interest for a certain period, you can comfortably afford to upgrade to a better, more comfortable mattress. Plus, with no hidden fees or charges, you can rest assured that you are getting the best deal for your money.

Instant Approval Process

One of the best things about Mattress Firm Credit Approval is the hassle-free and quick approval process. You can easily apply online or in-store and get an instant decision within minutes. This means you can start enjoying your new mattress sooner rather than later.

One of the best things about Mattress Firm Credit Approval is the hassle-free and quick approval process. You can easily apply online or in-store and get an instant decision within minutes. This means you can start enjoying your new mattress sooner rather than later.

Build Your Credit Score

If you are looking to improve your credit score, Mattress Firm Credit Approval can help. With responsible use and timely payments, you can boost your credit score and establish a positive credit history. This can come in handy for future purchases and financial endeavors.

If you are looking to improve your credit score, Mattress Firm Credit Approval can help. With responsible use and timely payments, you can boost your credit score and establish a positive credit history. This can come in handy for future purchases and financial endeavors.

Conclusion

Investing in a good mattress is investing in your overall health and well-being. With Mattress Firm Credit Approval, you can easily and affordably upgrade to a better mattress without any stress or financial burden. Don't compromise on your sleep quality any longer, take advantage of this convenient financing option and wake up feeling refreshed and rejuvenated every morning.

Investing in a good mattress is investing in your overall health and well-being. With Mattress Firm Credit Approval, you can easily and affordably upgrade to a better mattress without any stress or financial burden. Don't compromise on your sleep quality any longer, take advantage of this convenient financing option and wake up feeling refreshed and rejuvenated every morning.