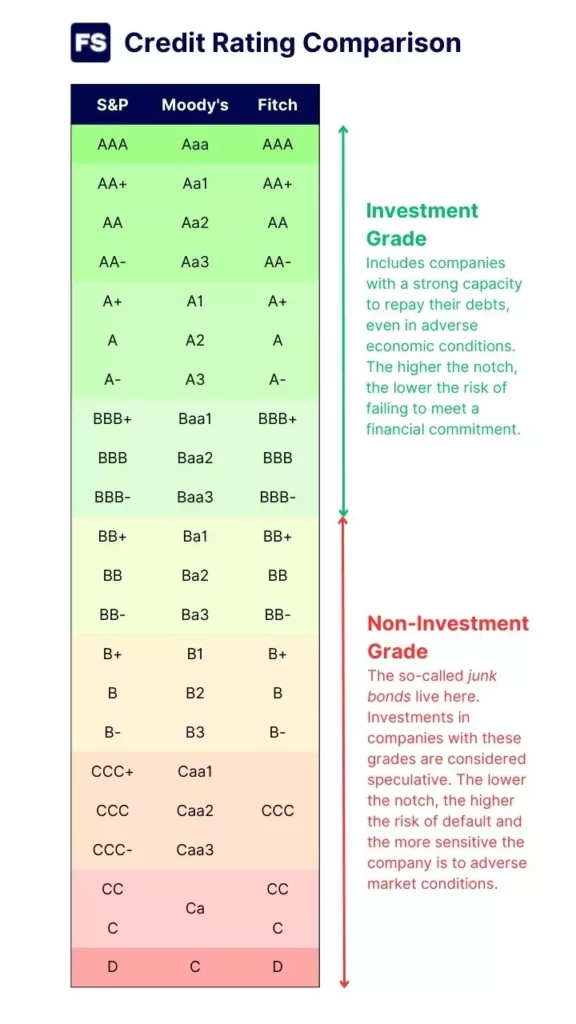

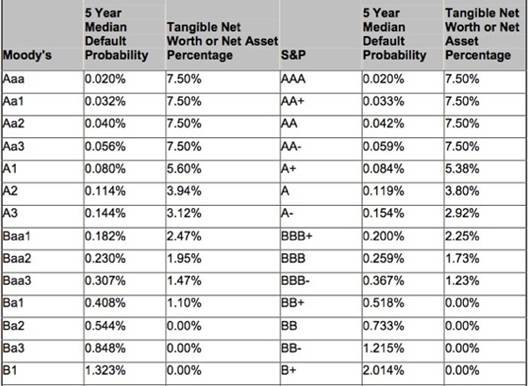

Mattress Firm has recently announced their plans to issue senior secured notes, and credit rating agency Moody's has assigned a B3 rating to these notes. This rating reflects the agency's belief that the company's financial performance and credit profile may improve in the near future. However, it also highlights the risks associated with the notes, such as the company's high leverage and competitive market conditions.Moody's assigns B3 rating to Mattress Firm's proposed senior secured notes

In a recent development, credit rating agency S&P has downgraded Mattress Firm's bond rating to a lower grade. The agency has cited the company's weak operating performance and declining sales as reasons for the downgrade. This move may make it more difficult for Mattress Firm to raise capital in the future, as investors may view the company as a higher risk.Mattress Firm's bond rating downgraded by S&P

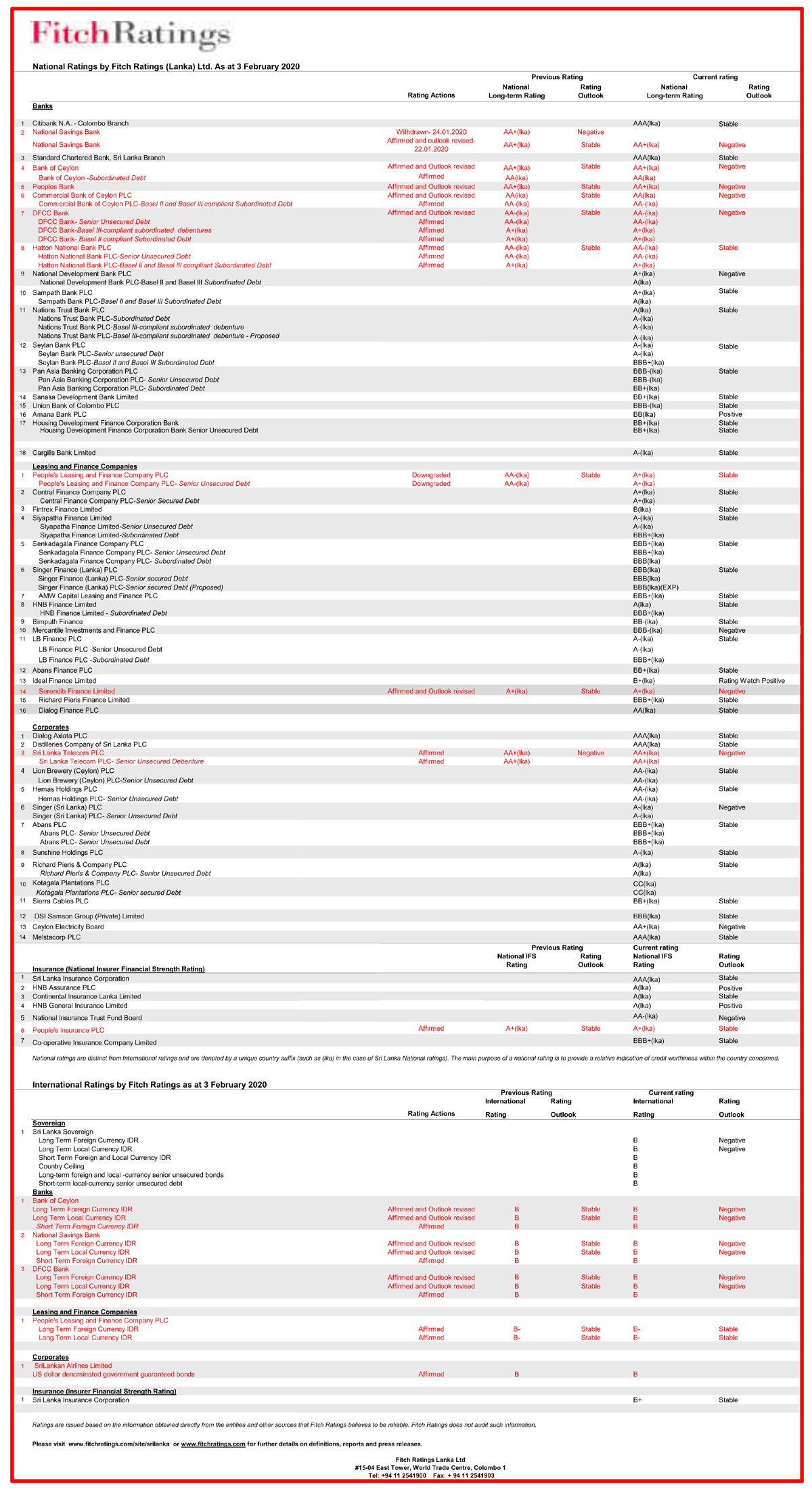

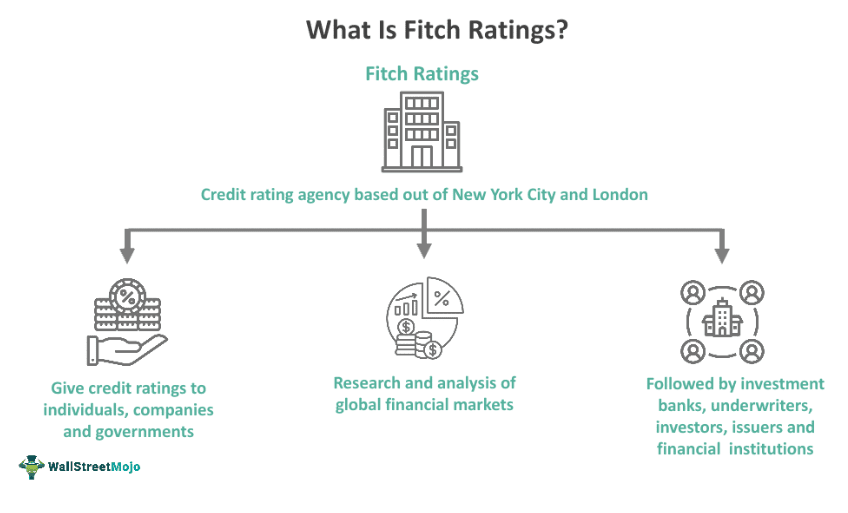

Fitch Ratings has assigned a 'CCC' rating to Mattress Firm's proposed senior secured notes. This rating reflects the agency's belief that there is a high risk of default on these notes. It also highlights the company's high debt levels and competitive market conditions as reasons for concern.Fitch Ratings assigns 'CCC' rating to Mattress Firm's proposed senior secured notes

S&P has recently downgraded Mattress Firm's bond rating to a 'C' grade. This is the lowest rating given by the agency and indicates a high risk of default for investors. Mattress Firm has been facing financial challenges due to declining sales and increasing competition in the mattress industry, which has led to this downgrade.Mattress Firm's bond rating lowered to 'C' by S&P

Another credit rating agency, Moody's, has downgraded Mattress Firm's corporate family rating to Caa3. This rating reflects the agency's belief that the company's financial performance may continue to deteriorate in the near future. It also highlights the challenges Mattress Firm faces in terms of managing their debt levels and competing in the market.Moody's downgrades Mattress Firm's corporate family rating to Caa3

In a recent move, S&P has placed Mattress Firm's bond rating on CreditWatch Negative. This means that the agency is considering downgrading the company's rating in the near future, based on their financial performance and credit profile. This could have a negative impact on Mattress Firm's ability to raise capital and attract investors.Mattress Firm's bond rating placed on CreditWatch Negative by S&P

As Mattress Firm continues to face financial challenges, Fitch Ratings has downgraded the company's Issuer Default Rating (IDR) to 'CC'. This rating reflects the agency's belief that there is a high risk of default for the company, and it may struggle to meet its financial obligations. This downgrade could make it more difficult for Mattress Firm to secure financing and manage their debt levels.Fitch Ratings downgrades Mattress Firm's IDR to 'CC'

In addition to downgrading Mattress Firm's corporate family rating, Moody's has also downgraded the company's probability of default rating (PDR) to Caa3-PD. This rating reflects the agency's belief that there is a high likelihood of Mattress Firm defaulting on its financial obligations in the near future. This further highlights the challenges the company is facing in terms of managing its debt and competing in the market.Moody's downgrades Mattress Firm's probability of default rating to Caa3-PD

With Mattress Firm's financial performance showing no signs of improvement, S&P has revised the company's bond rating outlook to negative. This means that the agency believes there is a higher chance of the company's bond rating being downgraded in the future. This could make it more difficult for Mattress Firm to raise capital and manage its debt levels, as investors may view the company as a higher risk.Mattress Firm's bond rating outlook revised to negative by S&P

In their latest move, Fitch Ratings has downgraded Mattress Firm's senior secured notes to 'C/RR6'. This rating reflects the agency's belief that there is a high risk of default for these notes, and investors may not receive their full principal amount back in the event of default. This downgrade highlights the challenges Mattress Firm is facing in terms of managing its debt levels and financial performance.Fitch Ratings downgrades Mattress Firm's senior secured notes to 'C/RR6'

The Importance of Mattress Firm Bond Ratings for a Good Night's Sleep

Understanding the Role of Mattress Firm Bond Ratings

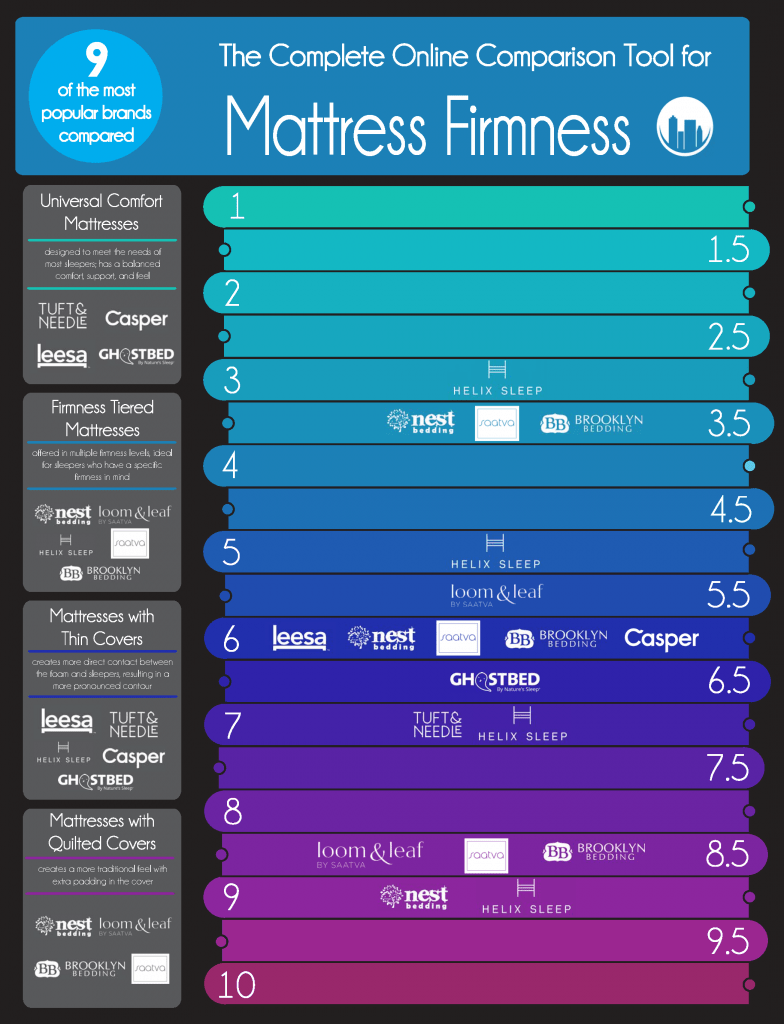

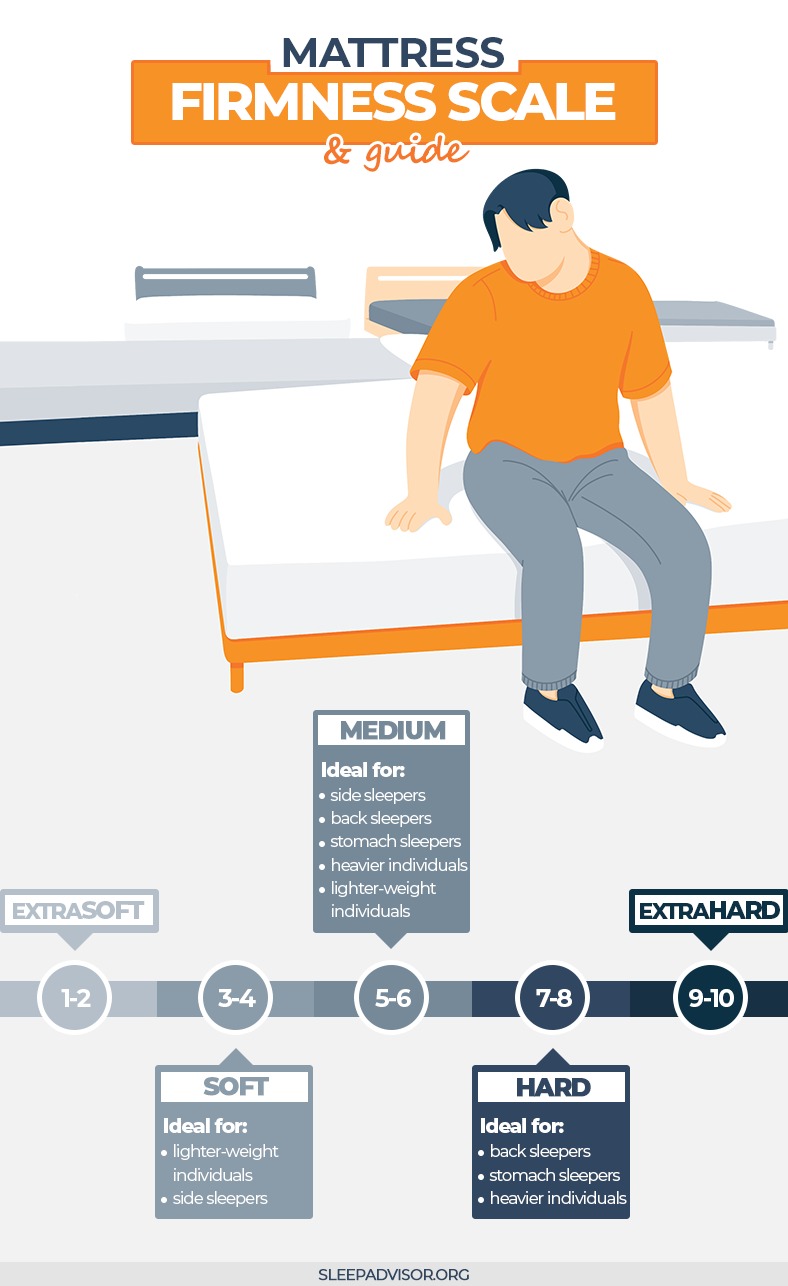

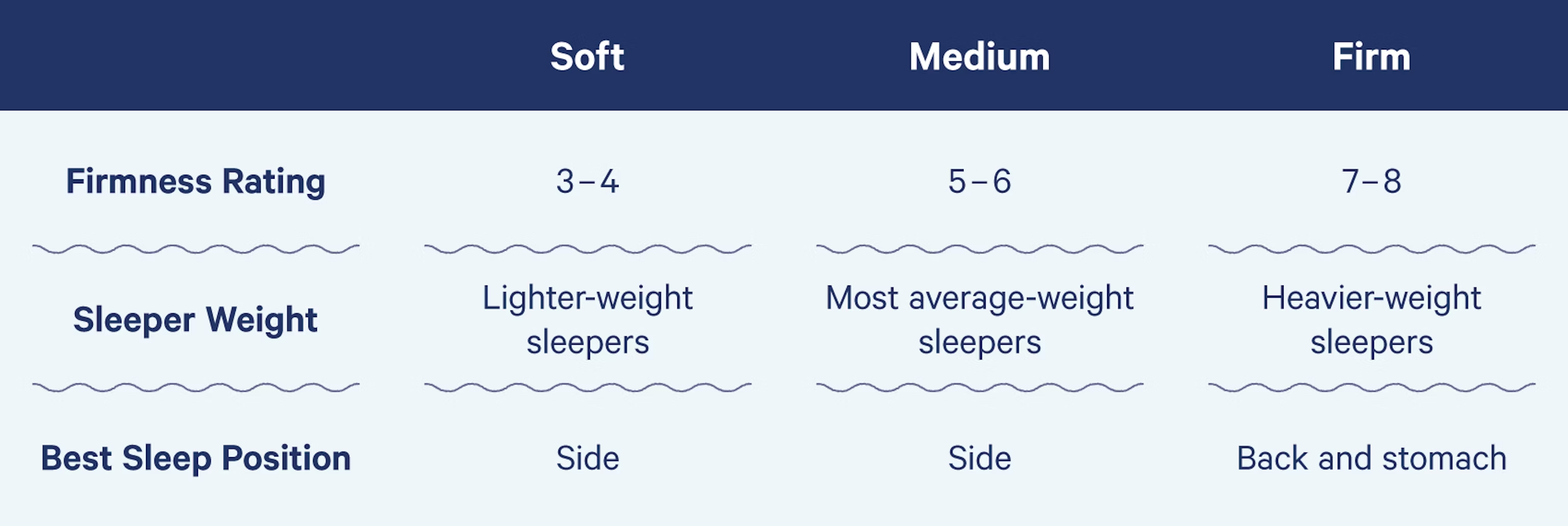

When it comes to designing and decorating your home, one of the most important factors to consider is your mattress. After all, a good night's sleep is essential for our overall health and well-being. However, many people overlook the importance of mattress firm bond ratings when purchasing a new mattress.

Mattress firm bond ratings

are used to measure the financial stability and creditworthiness of a mattress company. This rating system is essential because it reflects the company's ability to meet its financial obligations and continue providing quality products to its customers. A high bond rating means that the company is financially stable and has a solid track record of success.

When it comes to designing and decorating your home, one of the most important factors to consider is your mattress. After all, a good night's sleep is essential for our overall health and well-being. However, many people overlook the importance of mattress firm bond ratings when purchasing a new mattress.

Mattress firm bond ratings

are used to measure the financial stability and creditworthiness of a mattress company. This rating system is essential because it reflects the company's ability to meet its financial obligations and continue providing quality products to its customers. A high bond rating means that the company is financially stable and has a solid track record of success.

The Impact of Mattress Firm Bond Ratings on Your Sleep

So why should you care about a mattress firm's bond rating when all you want is a comfortable bed to sleep on? The truth is, a company with a low bond rating may have difficulties sourcing high-quality materials, maintaining production standards, and investing in research and development for new and improved mattresses. This can lead to a decline in the overall quality of their products.

On the other hand, a company with a high bond rating can assure you that they have the financial resources to invest in the best materials and technology for their mattresses. This means that you can trust in the quality and durability of their products, which ultimately translates to a better night's sleep for you.

Additionally, a high mattress firm bond rating also indicates that the company is financially stable and has a lower risk of going bankrupt or closing down.

This is important because if a company goes out of business, it may be challenging to find replacement parts or get a refund for a faulty mattress. By choosing a company with a high bond rating, you can have peace of mind knowing that your investment in a quality mattress is secure.

So why should you care about a mattress firm's bond rating when all you want is a comfortable bed to sleep on? The truth is, a company with a low bond rating may have difficulties sourcing high-quality materials, maintaining production standards, and investing in research and development for new and improved mattresses. This can lead to a decline in the overall quality of their products.

On the other hand, a company with a high bond rating can assure you that they have the financial resources to invest in the best materials and technology for their mattresses. This means that you can trust in the quality and durability of their products, which ultimately translates to a better night's sleep for you.

Additionally, a high mattress firm bond rating also indicates that the company is financially stable and has a lower risk of going bankrupt or closing down.

This is important because if a company goes out of business, it may be challenging to find replacement parts or get a refund for a faulty mattress. By choosing a company with a high bond rating, you can have peace of mind knowing that your investment in a quality mattress is secure.

Consider Mattress Firm Bond Ratings When Making Your Next Purchase

When shopping for a new mattress, it's essential to consider not just the price and comfort level but also the company's bond rating. Investing in a high-quality mattress from a financially stable company can ensure that you get the best sleep possible and protect your investment in the long run.

In conclusion,

mattress firm bond ratings play a crucial role in the overall quality and reliability of a mattress company.

By understanding their significance and considering them in your purchasing decision, you can ensure that you get a good night's sleep on a high-quality mattress that will last for years to come.

When shopping for a new mattress, it's essential to consider not just the price and comfort level but also the company's bond rating. Investing in a high-quality mattress from a financially stable company can ensure that you get the best sleep possible and protect your investment in the long run.

In conclusion,

mattress firm bond ratings play a crucial role in the overall quality and reliability of a mattress company.

By understanding their significance and considering them in your purchasing decision, you can ensure that you get a good night's sleep on a high-quality mattress that will last for years to come.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/IPHVUUX4ZWM6VRRPOXAEDWZGVQ.jpg)