Living Room of Satoshi Tax Calculator: A Comprehensive Guide

Are you using Living Room of Satoshi to pay your bills with cryptocurrency? If so, you may be wondering about the tax implications of your transactions. Fortunately, Living Room of Satoshi has a user-friendly tax calculator that can help you determine your tax obligations. In this guide, we'll walk you through the process of using the Living Room of Satoshi tax calculator and provide important information about the tax laws and requirements for using this platform.

Understanding Living Room of Satoshi Tax Laws

When it comes to taxes, cryptocurrency can be a bit of a grey area. However, the Australian Taxation Office (ATO) has provided guidance on how to treat cryptocurrency transactions for tax purposes. According to the ATO, cryptocurrency is considered a form of property and is subject to capital gains tax. This means that any profits made from using Living Room of Satoshi to pay bills may be subject to tax.

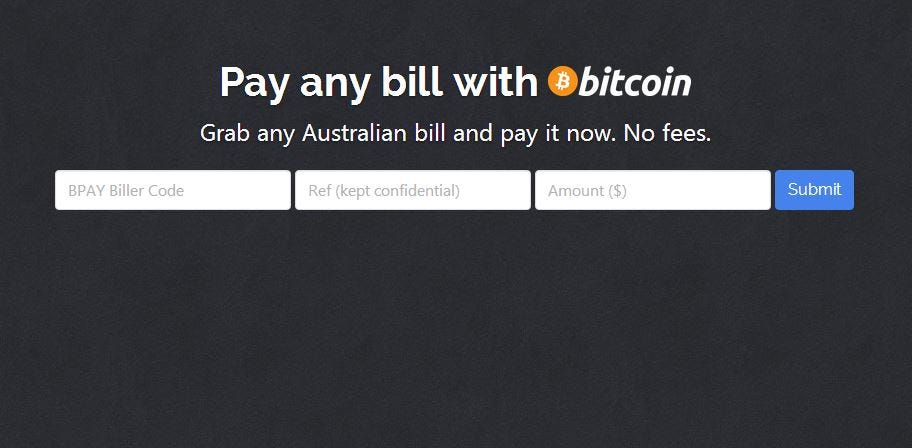

Using the Living Room of Satoshi Tax Calculator

The Living Room of Satoshi tax calculator is a free tool that allows you to easily calculate your tax obligations for cryptocurrency transactions. To use the calculator, you'll need to enter your transaction details, including the date of the transaction, the amount of cryptocurrency used, and the Australian dollar value of the transaction at the time. The calculator will then provide you with an estimate of your tax liability. Keep in mind that this is just an estimate and you should consult with a tax professional for accurate advice.

Reporting Your Living Room of Satoshi Transactions

As with any cryptocurrency transactions, it's important to keep detailed records of your Living Room of Satoshi transactions. This includes the date, amount, and value of each transaction. You'll need this information when filing your taxes. Additionally, Living Room of Satoshi provides a tax summary report that can be downloaded and used for tax reporting purposes. This report can be accessed by logging into your account and clicking on the "Tax" tab.

Meeting Your Tax Obligations

It's important to stay compliant with tax laws when using Living Room of Satoshi. This means accurately reporting your transactions and paying any applicable taxes. If you are unsure about your tax obligations, it's always best to consult with a tax professional. They can provide you with personalized advice and help you stay in compliance with tax laws.

Staying in Compliance with Living Room of Satoshi Tax Requirements

In addition to meeting your tax obligations, it's also important to stay in compliance with Living Room of Satoshi's tax requirements. This includes keeping your account information up to date and ensuring that your transactions are accurate. If you have any questions about the tax requirements for using Living Room of Satoshi, you can contact their customer support team for assistance.

Conclusion: Understanding Living Room of Satoshi Taxation

Paying bills with cryptocurrency through Living Room of Satoshi can be a convenient and innovative way to manage your finances. However, it's important to understand the tax implications and requirements that come with using this platform. By using the Living Room of Satoshi tax calculator, staying up to date with tax laws, and consulting with a tax professional, you can ensure that you are meeting your tax obligations and staying in compliance with Living Room of Satoshi's requirements.

The Living Room of Satoshi: A Revolutionary Way to Pay Taxes

Revolutionizing the Way We Pay Taxes

Taxes are an inevitable part of life. It is a responsibility that every citizen must fulfill to contribute to the development and maintenance of their country. However, the process of paying taxes can often be daunting and tedious, leaving many individuals feeling overwhelmed and frustrated. This is where the living room of satoshi comes in – a revolutionary platform that aims to simplify and streamline the tax payment process for individuals and businesses.

Taxes are an inevitable part of life. It is a responsibility that every citizen must fulfill to contribute to the development and maintenance of their country. However, the process of paying taxes can often be daunting and tedious, leaving many individuals feeling overwhelmed and frustrated. This is where the living room of satoshi comes in – a revolutionary platform that aims to simplify and streamline the tax payment process for individuals and businesses.

The Concept of Living Room of Satoshi

The living room of satoshi is a digital platform that allows individuals and businesses to pay their taxes in a quick, secure, and hassle-free manner. The platform was created in 2014 by a team of innovative individuals who saw the need for a more efficient way of paying taxes. It is named after the pseudonym used by the creator of Bitcoin, Satoshi Nakamoto, in honor of the cryptocurrency's revolutionary impact on the finance industry.

The living room of satoshi is a digital platform that allows individuals and businesses to pay their taxes in a quick, secure, and hassle-free manner. The platform was created in 2014 by a team of innovative individuals who saw the need for a more efficient way of paying taxes. It is named after the pseudonym used by the creator of Bitcoin, Satoshi Nakamoto, in honor of the cryptocurrency's revolutionary impact on the finance industry.

How It Works

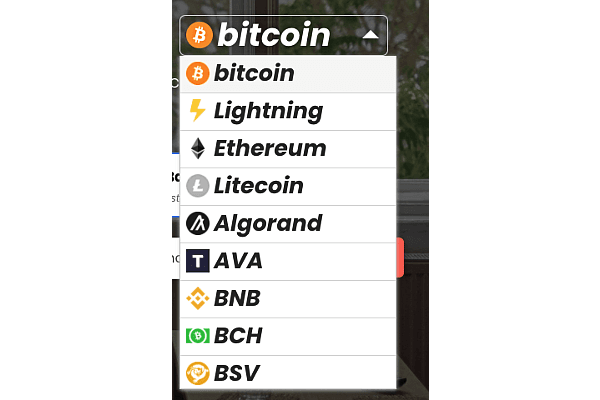

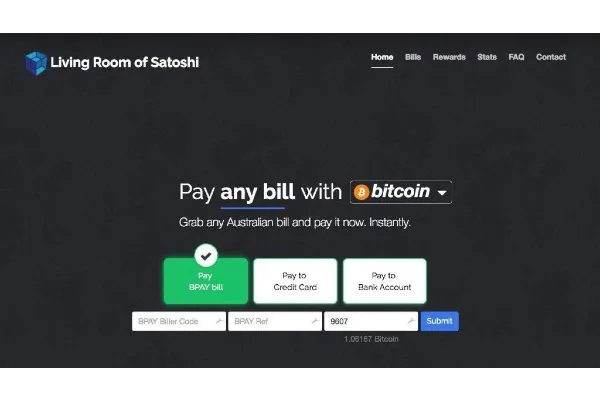

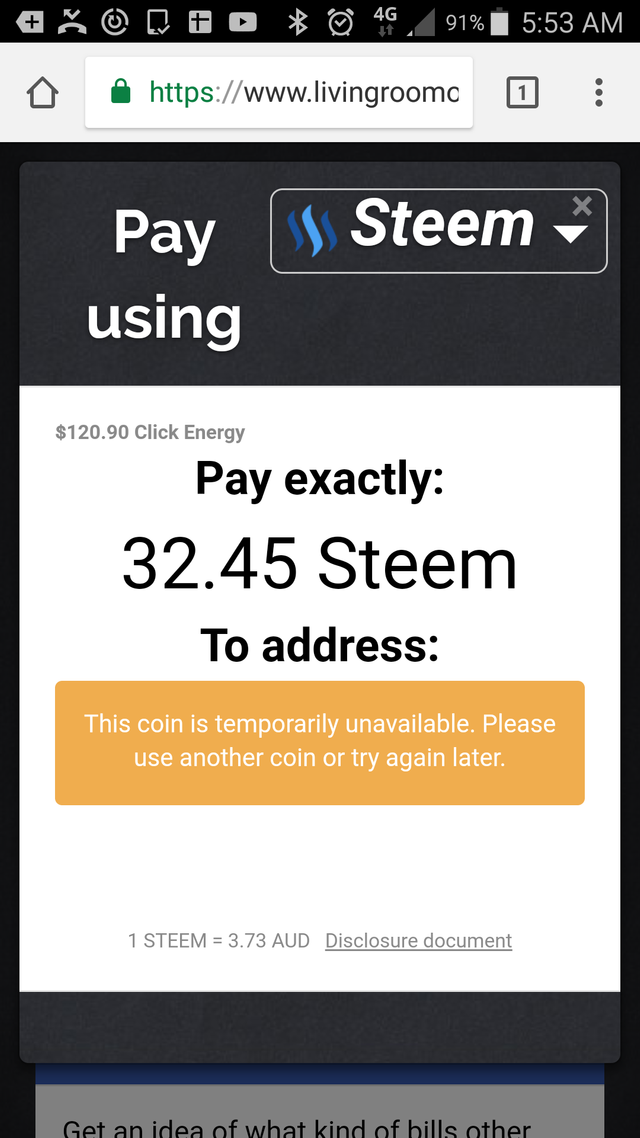

The living room of satoshi works by converting your tax payment into cryptocurrency, mainly Bitcoin, and then transferring it to the Australian Taxation Office (ATO). The process is simple and straightforward – all you need to do is log in to the platform, enter your tax details, and choose the cryptocurrency you want to use for payment. The platform then generates a unique code that you can use to pay your taxes through your preferred cryptocurrency wallet. Once the transaction is confirmed, the ATO receives the payment in Australian dollars, and your tax obligation is fulfilled.

The living room of satoshi works by converting your tax payment into cryptocurrency, mainly Bitcoin, and then transferring it to the Australian Taxation Office (ATO). The process is simple and straightforward – all you need to do is log in to the platform, enter your tax details, and choose the cryptocurrency you want to use for payment. The platform then generates a unique code that you can use to pay your taxes through your preferred cryptocurrency wallet. Once the transaction is confirmed, the ATO receives the payment in Australian dollars, and your tax obligation is fulfilled.

The Benefits of Using Living Room of Satoshi

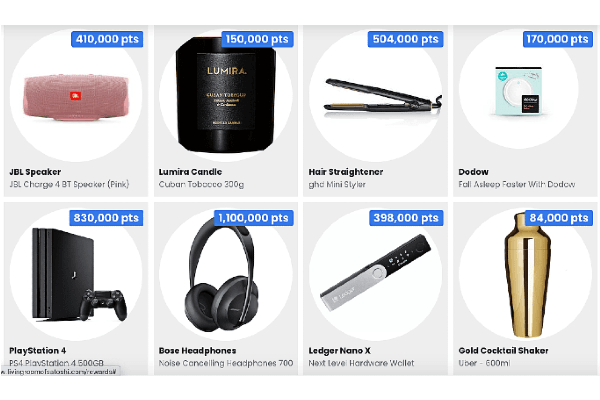

One of the significant benefits of using the living room of satoshi is the convenience it offers. Gone are the days of filling out numerous forms and making trips to the tax office, as everything can now be done online from the comfort of your home or office. Additionally, the platform provides a secure and transparent way of paying taxes, with all transactions recorded on the blockchain for added security. Moreover, the integration of cryptocurrency in the tax payment process also opens up opportunities for individuals and businesses to take advantage of potential gains from the fluctuating market.

In Conclusion

In conclusion, the living room of satoshi is a game-changer in the world of tax payment. It is a modern, efficient, and secure way of fulfilling your tax obligations, making the process less daunting and more accessible for everyone. With its revolutionary approach, the living room of satoshi is paving the way for a more streamlined and convenient future of tax payment. So why not join the thousands of individuals and businesses already using this platform and experience the benefits for yourself?

One of the significant benefits of using the living room of satoshi is the convenience it offers. Gone are the days of filling out numerous forms and making trips to the tax office, as everything can now be done online from the comfort of your home or office. Additionally, the platform provides a secure and transparent way of paying taxes, with all transactions recorded on the blockchain for added security. Moreover, the integration of cryptocurrency in the tax payment process also opens up opportunities for individuals and businesses to take advantage of potential gains from the fluctuating market.

In Conclusion

In conclusion, the living room of satoshi is a game-changer in the world of tax payment. It is a modern, efficient, and secure way of fulfilling your tax obligations, making the process less daunting and more accessible for everyone. With its revolutionary approach, the living room of satoshi is paving the way for a more streamlined and convenient future of tax payment. So why not join the thousands of individuals and businesses already using this platform and experience the benefits for yourself?

:max_bytes(150000):strip_icc()/TermDefinitions_Satoshi-91924de4c94845f6ba22454037bfe209.jpg)