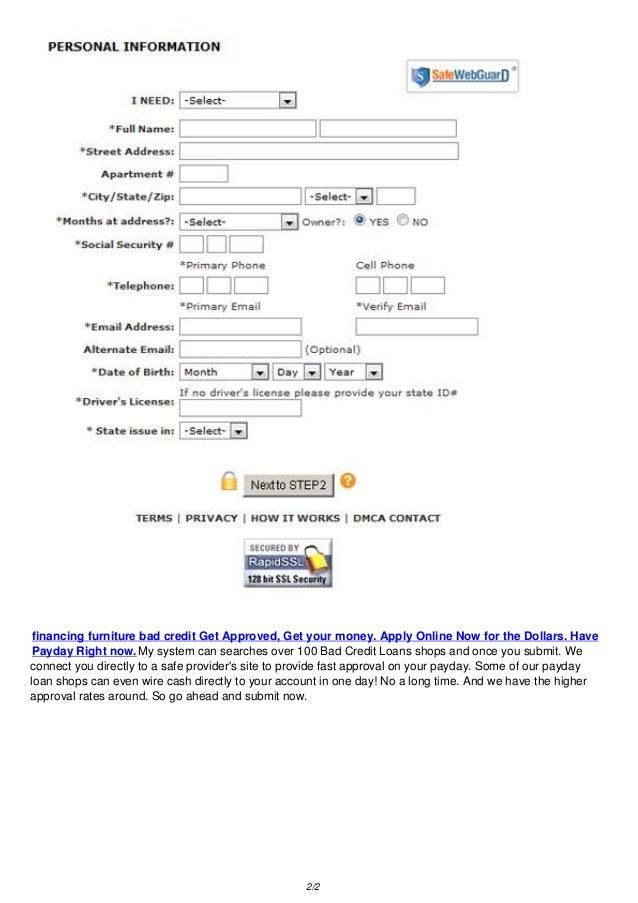

When it comes to furnishing your living room, it can be overwhelming to find the perfect pieces that fit your style and budget. And if you have bad credit or no credit, it can be even more challenging. But don't worry, there are plenty of options for living room furniture financing that can help you get the pieces you need without breaking the bank. In this article, we'll explore the top 10 MAIN_living room furniture credit options that are available for those with less than perfect credit.Living Room Furniture Financing | Bad Credit Furniture Financing | No Credit Check Furniture Financing

One of the most common ways to finance your living room furniture is through furniture credit cards or in-store financing. These options allow you to make monthly payments on your purchases, often with low or no interest. While these options are typically available to those with good credit, there are also options for those with bad credit or no credit. Some furniture stores offer their own financing programs for those with less than perfect credit, so it's worth exploring these options before ruling them out.Living Room Furniture Credit Options | Furniture Credit Cards | Furniture Store Financing

If you have bad credit or no credit, you may assume that financing options are out of reach for you. However, there are many lenders and retailers that specialize in financing options for those with less than perfect credit. These options often come with low monthly payments, making it easier for you to afford the furniture you need without breaking the bank.Living Room Furniture Financing with Low Monthly Payments | Furniture Financing for Bad Credit | Furniture Financing for No Credit

Another option for those with bad credit or no credit is instant approval financing. This type of financing doesn't require a credit check and can provide you with immediate approval for your purchase. While these options may come with higher interest rates, they can be a good option for those who need furniture quickly and have limited credit options.Living Room Furniture Financing with Instant Approval | Furniture Financing for Low Credit Score | Furniture Financing for Poor Credit

For those with low income or credit, finding furniture financing with 0% APR may seem like a dream. However, there are options available that can help you get the furniture you need without paying any interest. Some stores offer 0% APR financing for a limited time, so be sure to shop around and take advantage of these deals when they are available.Living Room Furniture Financing with 0% APR | Furniture Financing for Low Income | Furniture Financing for Low Credit

If you have a low credit rating or limited credit history, it can be challenging to get approved for financing. However, there are lenders and retailers that offer easy approval options for those with less than perfect credit. These options often have higher interest rates, but they can be a great way to build your credit and get the furniture you need.Living Room Furniture Financing with Easy Approval | Furniture Financing for Low Credit Rating | Furniture Financing for Low Credit History

One of the biggest barriers to financing furniture is the down payment. For those with bad credit or no credit, it can be challenging to come up with a significant down payment. However, there are options available that require no down payment, making it easier for you to get the furniture you need without breaking the bank.Living Room Furniture Financing with No Down Payment | Furniture Financing for Low Credit Limit | Furniture Financing for Low Credit Utilization

When it comes to financing your living room furniture, it's essential to find a payment plan that works for your budget. Some lenders and retailers offer flexible payment plans that allow you to make smaller payments over a more extended period. This can be a great option for those with a low credit balance or a high credit utilization ratio.Living Room Furniture Financing with Flexible Payment Plans | Furniture Financing for Low Credit Balance | Furniture Financing for Low Credit Utilization Ratio

If you're looking to finance your living room furniture without paying any interest, there are options available. Some lenders and retailers offer no-interest financing for those with limited credit. This can be a great option if you have a low credit score or credit limit and want to avoid paying any additional fees.Living Room Furniture Financing with No Interest Options | Furniture Financing for Low Credit Score | Furniture Financing for Low Credit Limit

Finally, if you have bad credit or no credit, you may want to consider furniture financing options that don't require a credit check. These options can be a great way to get the furniture you need without worrying about your credit score. However, keep in mind that these options may come with higher interest rates, so be sure to consider all your options before making a decision. In conclusion, when it comes to living room furniture financing, there are plenty of options available for those with bad credit or no credit. Whether you choose to finance through a furniture store, a credit card, or a lender, be sure to carefully consider your options and choose a plan that works for your budget and credit situation. With the right financing, you can create the living room of your dreams without breaking the bank.Living Room Furniture Financing with No Credit Check | Furniture Financing for Low Credit Rating | Furniture Financing for Low Credit History

The Importance of Choosing the Right Living Room Furniture for Your House Design

Creating a Cozy and Functional Space

When it comes to house design, the living room is often considered the heart of the home. It's where we gather with family and friends to relax, entertain, and make memories. That's why it's crucial to choose the right furniture for this space. Not only does it need to be visually appealing, but it also needs to be functional and comfortable.

Living room furniture credit

gives you the opportunity to bring your vision to life and create a cozy and functional space for your home.

When it comes to house design, the living room is often considered the heart of the home. It's where we gather with family and friends to relax, entertain, and make memories. That's why it's crucial to choose the right furniture for this space. Not only does it need to be visually appealing, but it also needs to be functional and comfortable.

Living room furniture credit

gives you the opportunity to bring your vision to life and create a cozy and functional space for your home.

Setting the Tone for Your Home

The living room is typically the first room that guests see when they enter your home, so it sets the tone for the rest of the house.

Choosing the right furniture

can help create a welcoming and inviting atmosphere, making a great first impression. Whether your style is modern, traditional, or somewhere in between, there are countless options for

living room furniture

that can complement your house design and showcase your personal taste.

The living room is typically the first room that guests see when they enter your home, so it sets the tone for the rest of the house.

Choosing the right furniture

can help create a welcoming and inviting atmosphere, making a great first impression. Whether your style is modern, traditional, or somewhere in between, there are countless options for

living room furniture

that can complement your house design and showcase your personal taste.

Maximizing Space and Storage

One of the key factors to consider when choosing

living room furniture

is the size and layout of the room. With limited space, it's essential to maximize every inch and choose pieces that serve multiple purposes. For example, a sofa with built-in storage or a coffee table with hidden compartments can help keep your living room clutter-free.

Living room furniture credit

can help you find the perfect pieces that fit your space and meet your storage needs.

One of the key factors to consider when choosing

living room furniture

is the size and layout of the room. With limited space, it's essential to maximize every inch and choose pieces that serve multiple purposes. For example, a sofa with built-in storage or a coffee table with hidden compartments can help keep your living room clutter-free.

Living room furniture credit

can help you find the perfect pieces that fit your space and meet your storage needs.

Creating a Functional and Stylish Focal Point

In most living rooms, the sofa is the focal point, but it's not the only piece of furniture that can make a statement.

Adding a unique accent chair

or a

bold statement piece

like a colorful rug or a stunning wall art can elevate the overall design of your living room. With

living room furniture credit

, you have the flexibility to mix and match different pieces and create a functional and stylish focal point that reflects your personal style.

In conclusion, choosing the right

living room furniture

is crucial in creating a warm and inviting space that complements your house design. With

living room furniture credit

, you have the opportunity to turn your vision into reality and create a functional and stylish living room that you and your loved ones can enjoy for years to come. So, start exploring your options and bring your dream living room to life!

In most living rooms, the sofa is the focal point, but it's not the only piece of furniture that can make a statement.

Adding a unique accent chair

or a

bold statement piece

like a colorful rug or a stunning wall art can elevate the overall design of your living room. With

living room furniture credit

, you have the flexibility to mix and match different pieces and create a functional and stylish focal point that reflects your personal style.

In conclusion, choosing the right

living room furniture

is crucial in creating a warm and inviting space that complements your house design. With

living room furniture credit

, you have the opportunity to turn your vision into reality and create a functional and stylish living room that you and your loved ones can enjoy for years to come. So, start exploring your options and bring your dream living room to life!