1. Kitchen Table Finance

Kitchen table finance refers to the concept of managing your household finances from the comfort of your own kitchen table. This approach is popular among families as it allows them to have a central hub where they can discuss and plan their financial goals together.

With the rise of technology and online banking, many families have moved away from traditional methods of managing money. However, there is still value in sitting down at the kitchen table and physically going through bills, budgeting, and financial planning.

Not only does this foster a sense of teamwork and responsibility within the family, but it also allows for better communication and understanding of each family member's financial needs and goals.

2. Money Management for Families

Managing money as a family can be challenging, especially with the many expenses that come with raising children. However, with proper money management techniques, families can ensure that they are financially stable and on track to achieve their financial goals.

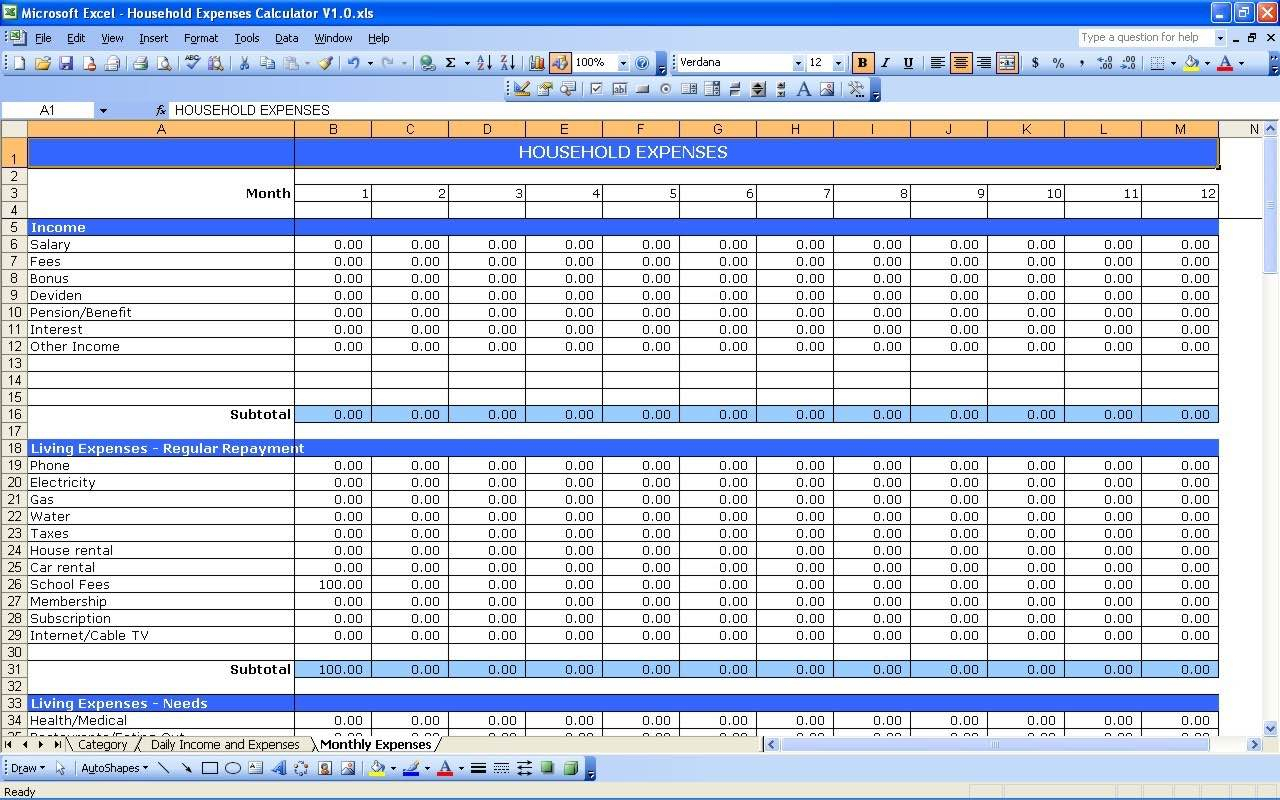

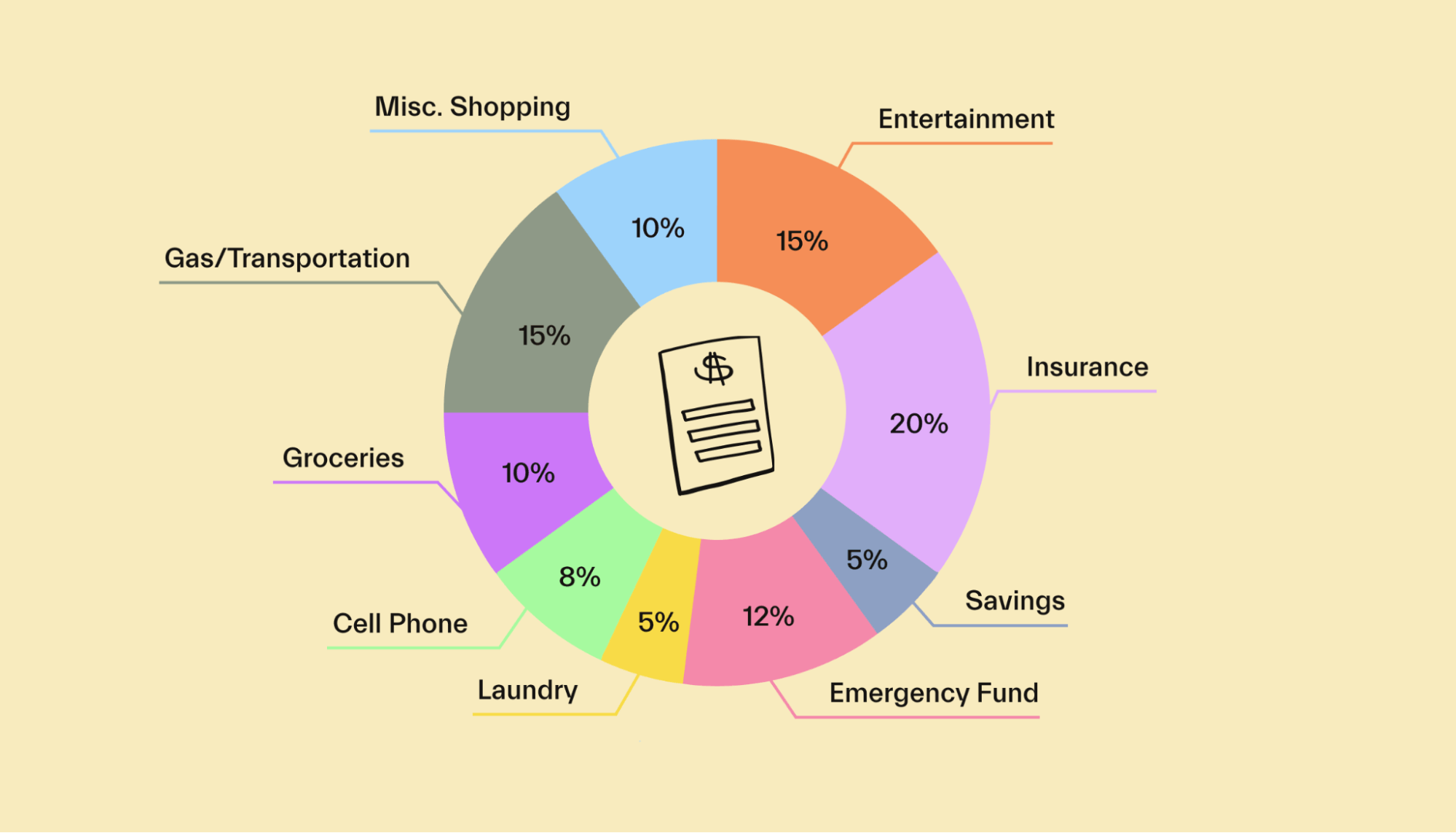

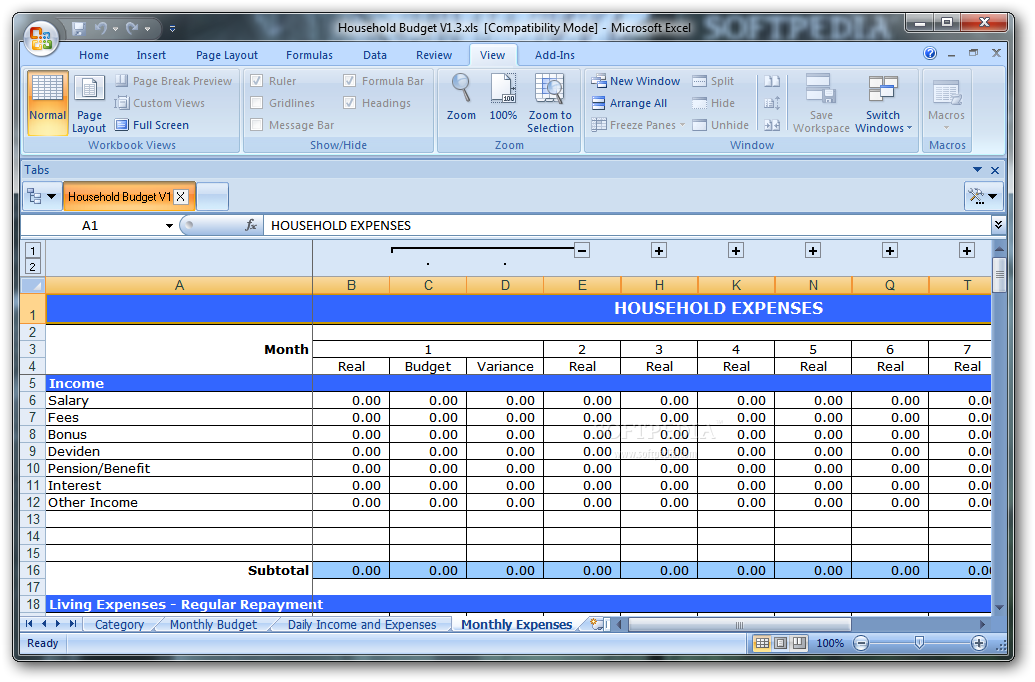

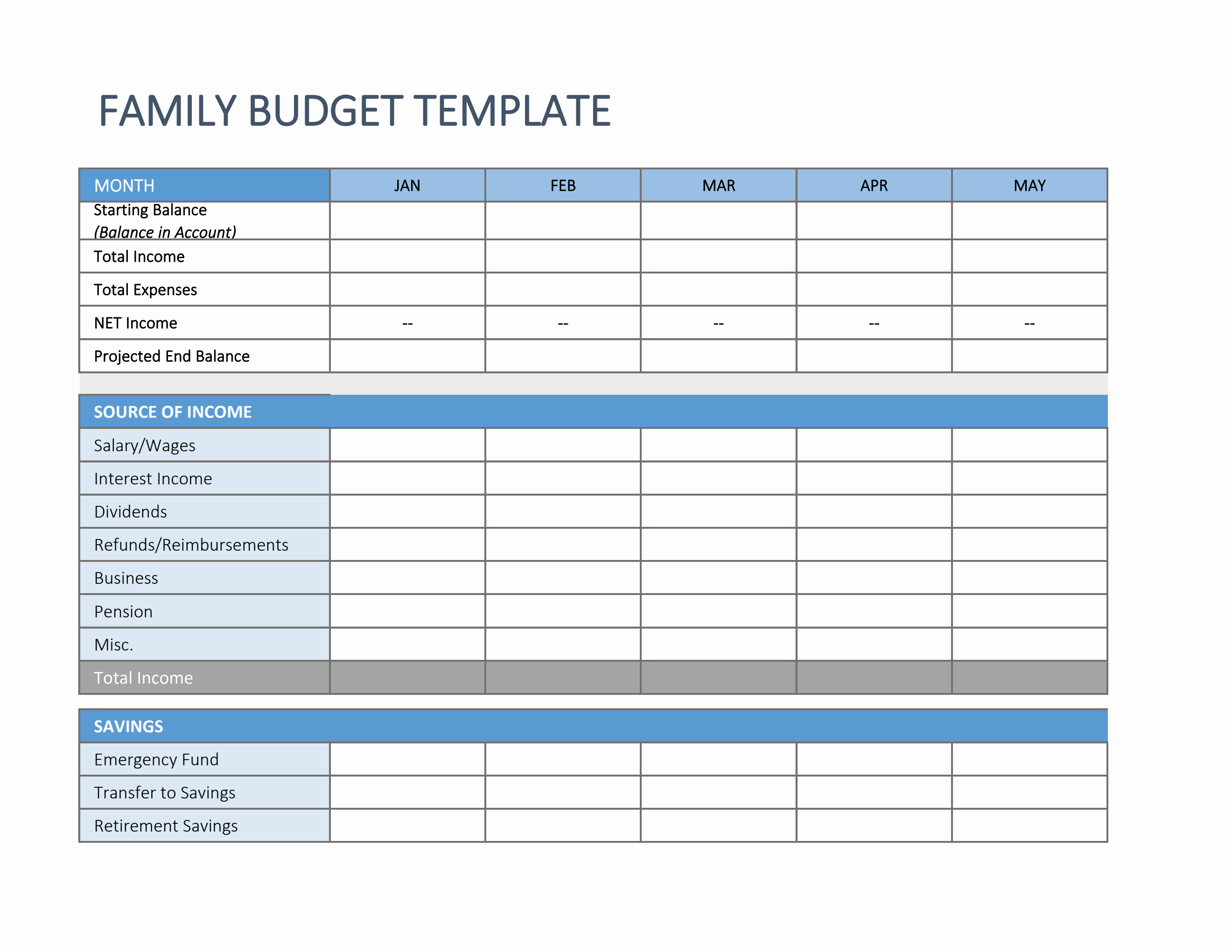

One key aspect of money management for families is budgeting. Creating a budget helps families to track their expenses, identify areas where they can cut back, and allocate their income towards savings and investments.

It is also essential for families to have open and honest communication about money. This includes discussing financial goals, setting priorities, and making joint decisions on major purchases.

3. Budgeting for Household Expenses

Budgeting for household expenses is a crucial component of kitchen table finance. It involves creating a plan for how your family will spend and save money to cover all necessary expenses.

Start by making a list of all your household expenses, including rent or mortgage, utilities, groceries, transportation, and any other recurring bills. Then, allocate a specific amount of money towards each expense category.

It is essential to regularly review and adjust your budget as needed to ensure that you are staying within your means and meeting your financial goals.

4. Saving Money on Groceries

Groceries are a significant expense for most families, but there are ways to save money on this essential expense. One of the best ways is to plan your meals and make a grocery list before heading to the store.

Stick to your list and avoid impulse purchases. Consider buying in bulk and using coupons or taking advantage of sales. You can also save money by buying store-brand items instead of name brands.

Additionally, try to limit the number of times you eat out and instead opt for homemade meals. This not only saves money but also encourages healthier eating habits for the whole family.

5. DIY Kitchen Table

If you are looking to save money on furniture, consider making your own kitchen table. Not only is this a budget-friendly option, but it also allows you to customize the table to fit your specific needs and style.

You can find tutorials and plans online for building a kitchen table using materials such as wood, metal, or even recycled materials. Get the whole family involved in the project for a fun and cost-effective DIY experience.

6. Making Extra Money from Home

For families looking to increase their income, there are many ways to make extra money from the comfort of your own home. This can include freelance work, starting a home-based business, or participating in online surveys or tasks.

Find a side hustle that aligns with your skills and interests, and make sure to set aside dedicated time to work on it. This can provide extra income for your family and help you reach your financial goals faster.

7. Frugal Living Tips

Frugal living is all about being mindful of your spending and finding ways to save money. This doesn't mean living a life of deprivation, but rather finding ways to cut back and prioritize your spending.

A few frugal living tips for families include meal planning, buying second-hand items, and finding free or low-cost activities for entertainment. It also helps to involve the whole family in these practices and make them a fun and creative challenge.

8. Investing in Your Home

Investing in your home is a great way to not only increase its value but also save money in the long run. This can include energy-efficient upgrades, such as installing solar panels or upgrading to energy-efficient appliances.

It can also involve DIY projects, such as painting or landscaping, to improve the aesthetics of your home. These investments can lead to long-term savings on utility bills and potentially increase the value of your home when it comes time to sell.

9. Financial Planning for Couples

When it comes to managing money as a couple, it's essential to be on the same page and work together towards your financial goals. This can involve creating a joint budget, discussing financial priorities, and regularly reviewing your progress.

It's also essential to have open and honest communication about money and to avoid keeping financial secrets from your partner. This can help build trust and strengthen your relationship in the long run.

10. Side Hustles for Stay-at-Home Parents

For stay-at-home parents looking to earn some extra income, there are many side hustles that can be done from home. This can include freelance work, virtual assisting, or starting a home-based business.

It's important to find a side hustle that fits into your schedule and doesn't interfere with your primary responsibilities as a parent. This can be a great way to contribute financially while still being able to stay home with your children.

In conclusion, implementing kitchen table finance into your household can lead to better money management, increased communication and teamwork within the family, and ultimately help you achieve your financial goals. By budgeting, saving money, and finding ways to increase your income, you can create a stable and financially secure future for your family.

The Importance of a Functional Kitchen Table in House Design

Creating a Space for Everyday Life

The kitchen table is often referred to as the heart of the home, and for good reason. It is where families gather to share meals, stories, and make memories. But beyond its sentimental value, the kitchen table also plays a crucial role in the functionality and design of a house. It is not just a piece of furniture, but a space that brings people together and serves a multitude of purposes.

Kitchen table money

, also known as the budget for a kitchen table, is often overlooked in the grand scheme of home design. However, investing in a high-quality kitchen table can have a significant impact on the overall aesthetic and functionality of a house. It is important to allocate a sufficient budget for a kitchen table that meets the needs of your family and complements the design of your home.

The kitchen table is often referred to as the heart of the home, and for good reason. It is where families gather to share meals, stories, and make memories. But beyond its sentimental value, the kitchen table also plays a crucial role in the functionality and design of a house. It is not just a piece of furniture, but a space that brings people together and serves a multitude of purposes.

Kitchen table money

, also known as the budget for a kitchen table, is often overlooked in the grand scheme of home design. However, investing in a high-quality kitchen table can have a significant impact on the overall aesthetic and functionality of a house. It is important to allocate a sufficient budget for a kitchen table that meets the needs of your family and complements the design of your home.

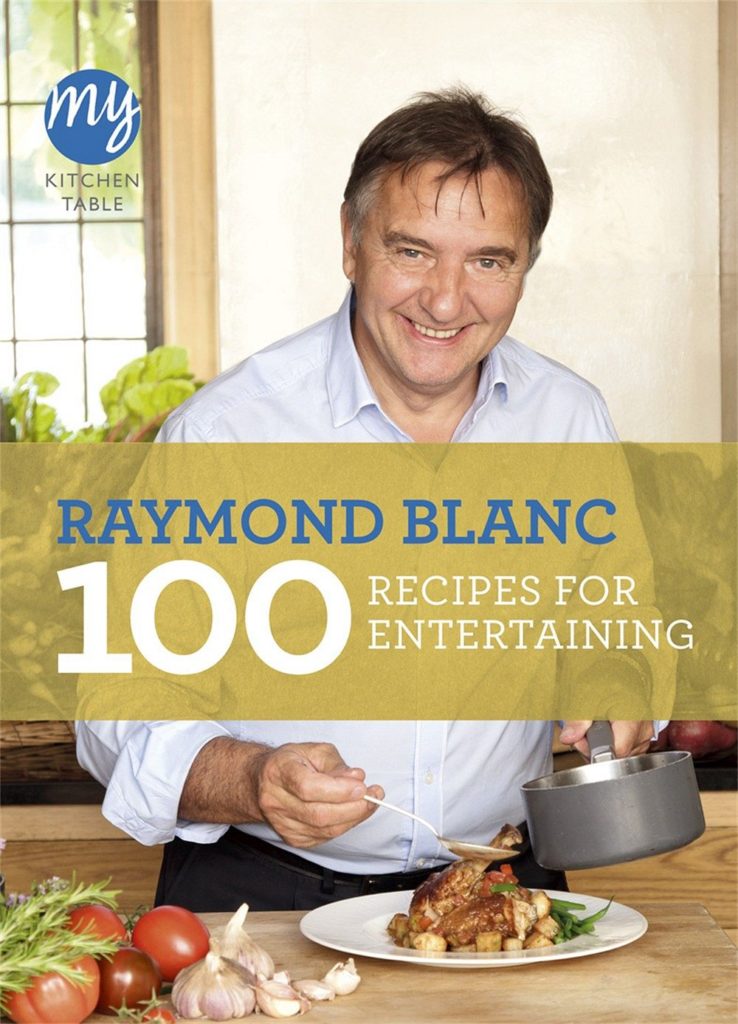

Maximizing Space and Storage

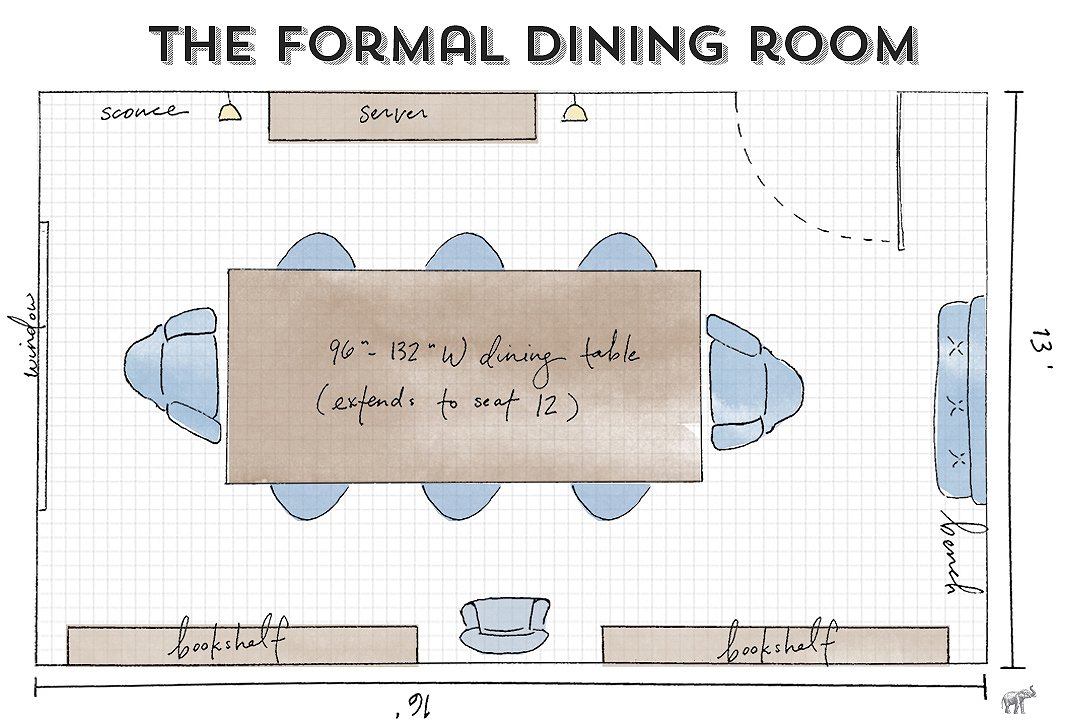

A well-designed kitchen table can serve as more than just a place to eat. It can also provide valuable storage space for kitchen essentials, such as cookbooks, utensils, and linens. This is particularly important for smaller homes or apartments where space is limited. By choosing a kitchen table with built-in storage options, you can maximize the functionality of your space while also keeping it organized and clutter-free.

In addition, the size and shape of the kitchen table can also impact the flow and layout of the kitchen. A round or oval table may be more suitable for smaller spaces, while a rectangular or square table can fit better in larger kitchens. It is important to consider the dimensions of your kitchen and the overall design aesthetic when choosing the right kitchen table for your home.

A well-designed kitchen table can serve as more than just a place to eat. It can also provide valuable storage space for kitchen essentials, such as cookbooks, utensils, and linens. This is particularly important for smaller homes or apartments where space is limited. By choosing a kitchen table with built-in storage options, you can maximize the functionality of your space while also keeping it organized and clutter-free.

In addition, the size and shape of the kitchen table can also impact the flow and layout of the kitchen. A round or oval table may be more suitable for smaller spaces, while a rectangular or square table can fit better in larger kitchens. It is important to consider the dimensions of your kitchen and the overall design aesthetic when choosing the right kitchen table for your home.

Design and Decor

A kitchen table is not just a functional piece of furniture, but also a design element that can tie a room together. The style, material, and color of the table can greatly impact the overall look and feel of the kitchen. Whether you prefer a modern, sleek table or a rustic farmhouse style, the kitchen table can serve as a focal point for the room and add character to the space.

Furthermore,

kitchen table money

can also be allocated towards accessories and decor to enhance the overall design. From statement centerpieces to coordinating placemats and napkins, these small details can make a big difference in creating a cohesive and inviting space.

In conclusion, the kitchen table may seem like a small component of house design, but it plays a vital role in creating a functional and welcoming space. By allocating a sufficient budget and paying attention to its design and purpose, you can create a kitchen table that not only meets your family's needs but also enhances the overall aesthetic of your home.

A kitchen table is not just a functional piece of furniture, but also a design element that can tie a room together. The style, material, and color of the table can greatly impact the overall look and feel of the kitchen. Whether you prefer a modern, sleek table or a rustic farmhouse style, the kitchen table can serve as a focal point for the room and add character to the space.

Furthermore,

kitchen table money

can also be allocated towards accessories and decor to enhance the overall design. From statement centerpieces to coordinating placemats and napkins, these small details can make a big difference in creating a cohesive and inviting space.

In conclusion, the kitchen table may seem like a small component of house design, but it plays a vital role in creating a functional and welcoming space. By allocating a sufficient budget and paying attention to its design and purpose, you can create a kitchen table that not only meets your family's needs but also enhances the overall aesthetic of your home.

.gif?format=1500w)