Managing household finances can be a daunting task, but it all starts with creating a budget. The kitchen table is the perfect place to sit down with your family and discuss your financial situation. By setting a budget, you can track your expenses and make sure you have enough money for all your kitchen table needs.1. Budgeting for Kitchen Table Finances

The kitchen table is often the hub of the household, where meals are shared, conversations are had, and bills are paid. It's also the perfect place to discuss and manage your family's finances. By setting aside time each week to review your budget, pay bills, and discuss any financial concerns, you can stay on top of your kitchen table finances and avoid any surprises.2. Managing Household Finances at the Kitchen Table

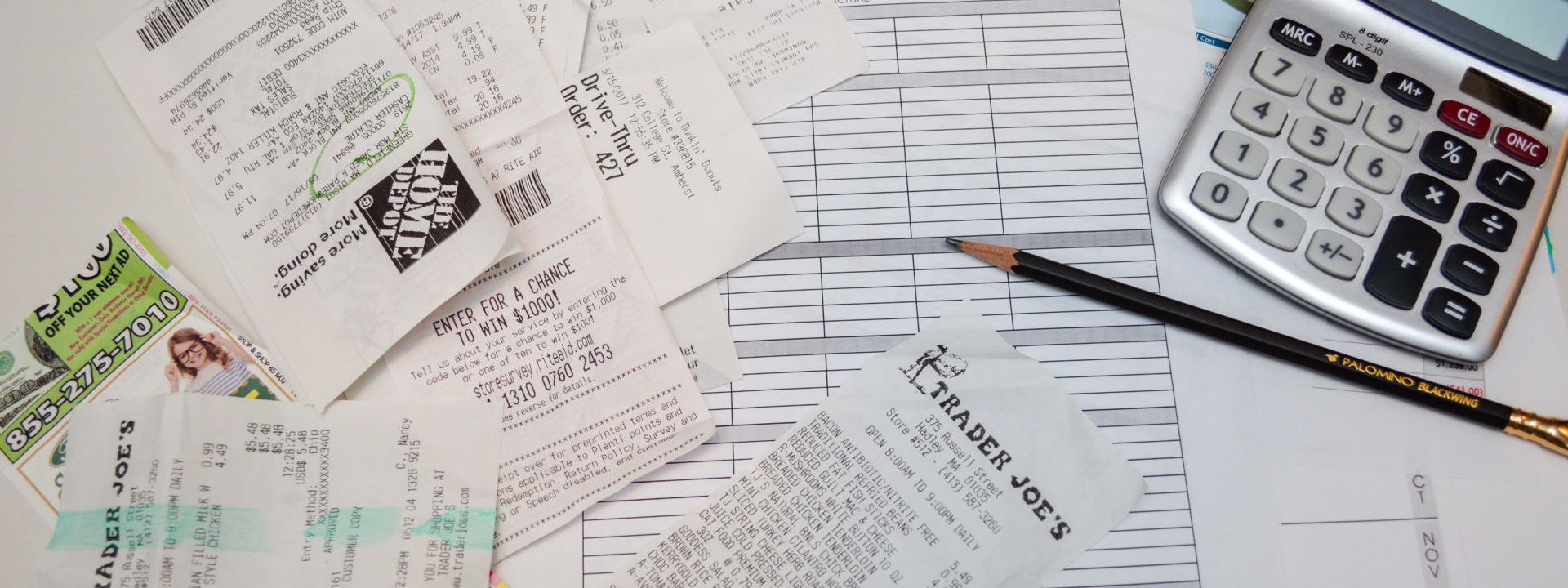

The kitchen table is where we gather to eat, but it's also where we spend a lot of money. From groceries to household items, the expenses can add up quickly. To save money on your kitchen table expenses, try meal planning to reduce food waste, use coupons and shop sales, and consider buying in bulk for common household items.3. Tips for Saving Money on Kitchen Table Expenses

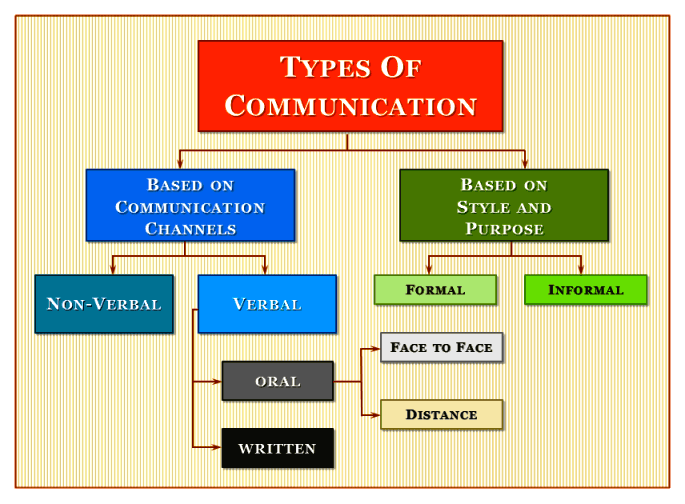

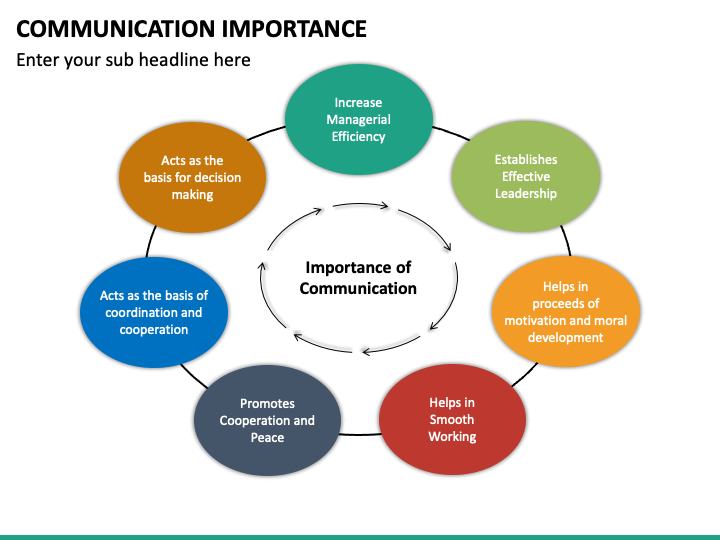

Communication is key when it comes to managing household finances. It's essential to discuss your financial goals and concerns with your family at the kitchen table. By openly communicating and working together, you can make informed decisions and strengthen your financial situation.4. The Importance of Communication in Kitchen Table Finances

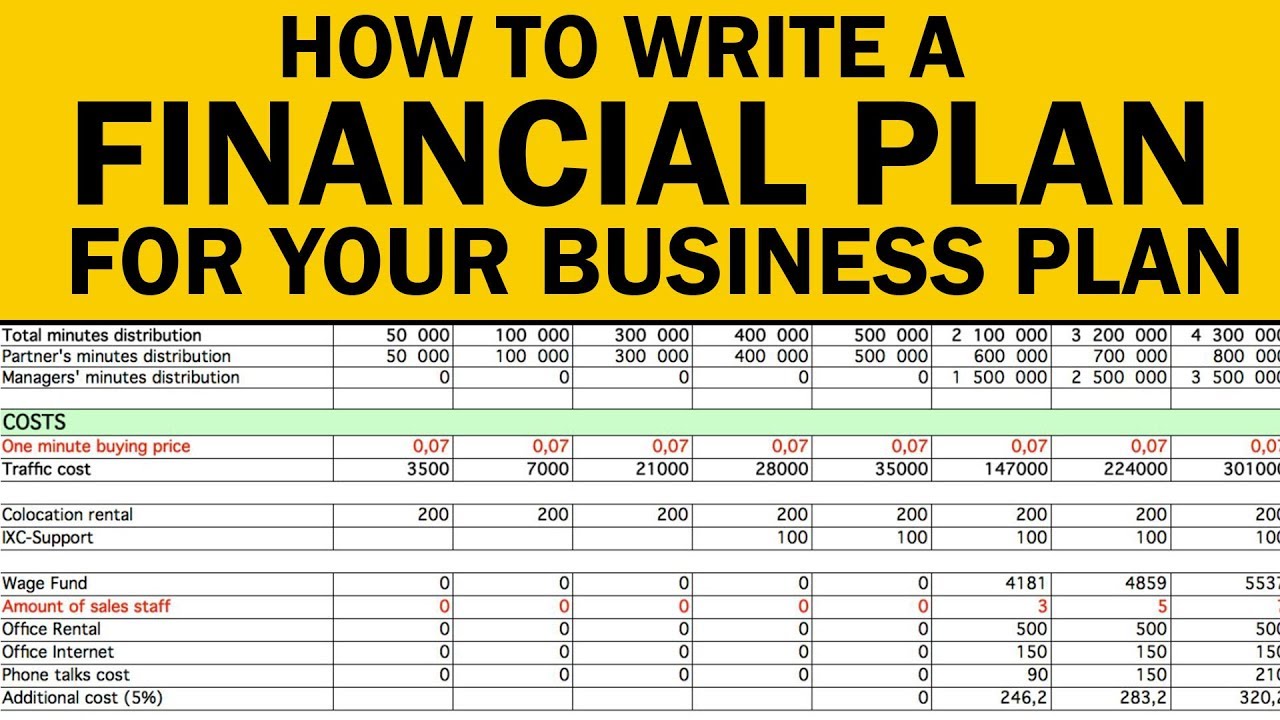

Creating a financial plan for your kitchen table involves setting goals and developing a strategy to achieve them. Start by assessing your current financial situation and identifying areas for improvement. Then, set realistic goals and create a budget to help you reach them. Remember to regularly review and adjust your plan as needed.5. How to Create a Financial Plan for Your Kitchen Table

When creating a budget for your kitchen table, it's essential to make the most of every dollar. Look for ways to reduce expenses, such as cooking meals at home instead of eating out or finding ways to save on household items. Consider using budgeting apps or spreadsheets to track your expenses and stay on top of your budget.6. Maximizing Your Kitchen Table Budget

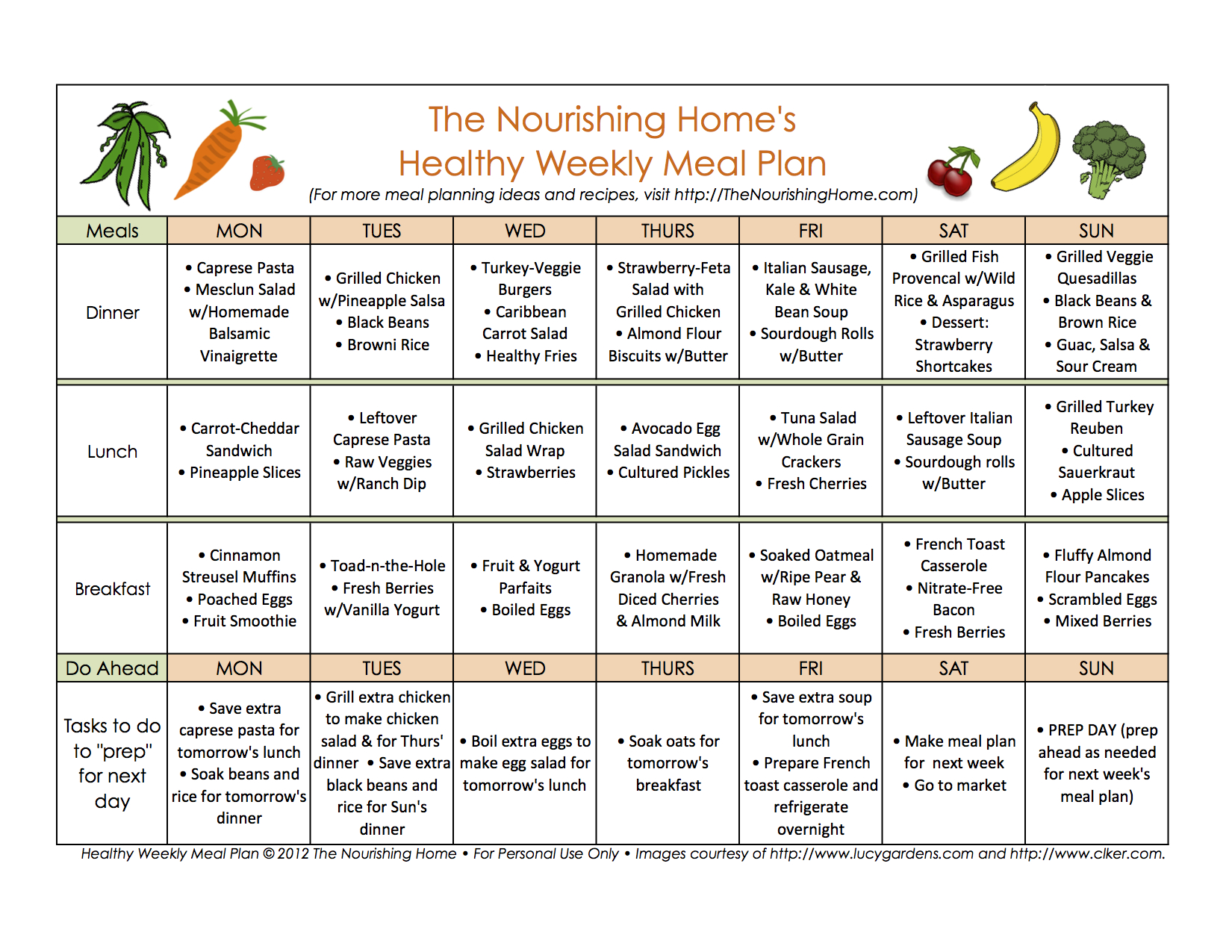

Meal planning is an excellent way to save money on your kitchen table expenses. By planning out your meals for the week, you can create a grocery list and avoid purchasing unnecessary items. Meal planning can also help reduce food waste and save time by having meals prepped in advance. Get the whole family involved in meal planning to make it a fun and collaborative activity.7. The Role of Meal Planning in Kitchen Table Finances

Investing in your kitchen table may seem counterintuitive when trying to save money, but it can actually help you in the long run. Upgrading to energy-efficient appliances can save you money on utility bills, while investing in quality cookware and utensils can save you from constantly replacing cheaper options. Consider these investments as cost-saving measures for your kitchen table finances.8. Investing in Your Kitchen Table: Upgrading Appliances and Saving Money

It's never too early to start teaching children about managing money and household finances. The kitchen table is the perfect place to involve kids in discussions about budgeting, saving, and spending wisely. Consider giving them a small allowance and teaching them about the value of money and how to make responsible choices.9. Teaching Children about Kitchen Table Finances

Managing household finances can be challenging, especially when balancing work and family life. The kitchen table can be a place to find balance and make financial decisions as a family. Set aside time to discuss your financial goals, delegate tasks, and support each other in achieving a healthy work-life balance.10. Balancing Work and Family Finances at the Kitchen Table

Kitchen Table Finances: Managing Your Budget in Style

The Importance of Budgeting in House Design

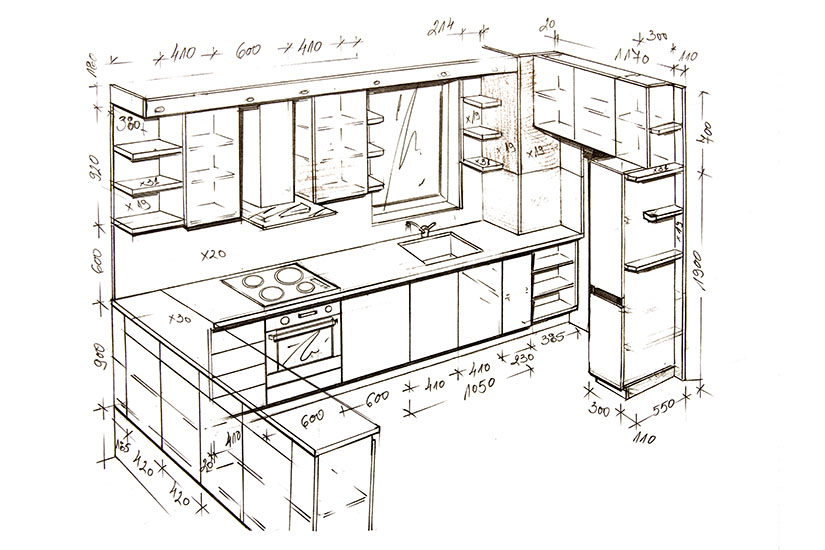

When it comes to designing and decorating your home, the kitchen is often the heart of the house. It's where we gather with family and friends, share meals, and create memories. But have you ever stopped to think about the financial aspect of kitchen design?

Kitchen table finances

refers to the process of managing your budget and expenses while creating the perfect kitchen for your home. It may not be the most glamorous part of house design, but it is crucial to ensure that your dream kitchen doesn't become a financial nightmare.

When it comes to designing and decorating your home, the kitchen is often the heart of the house. It's where we gather with family and friends, share meals, and create memories. But have you ever stopped to think about the financial aspect of kitchen design?

Kitchen table finances

refers to the process of managing your budget and expenses while creating the perfect kitchen for your home. It may not be the most glamorous part of house design, but it is crucial to ensure that your dream kitchen doesn't become a financial nightmare.

Creating a Realistic Budget

The first step in managing your

kitchen table finances

is to set a budget. This will help you determine how much you can afford to spend on your kitchen design. Be realistic and consider all factors, such as the cost of materials, labor, and any additional expenses. It's also important to leave some room for unexpected costs that may arise during the design process. Once you have a budget in place, you can start making decisions about the design and features of your kitchen within your financial means.

The first step in managing your

kitchen table finances

is to set a budget. This will help you determine how much you can afford to spend on your kitchen design. Be realistic and consider all factors, such as the cost of materials, labor, and any additional expenses. It's also important to leave some room for unexpected costs that may arise during the design process. Once you have a budget in place, you can start making decisions about the design and features of your kitchen within your financial means.

Getting Creative with Costs

Creating a budget doesn't mean you have to sacrifice style or functionality in your kitchen design. There are plenty of ways to get creative and save money without compromising on your vision.

Shopping around for deals

on materials and appliances is a great way to cut costs. You can also consider

DIY projects

for certain aspects of your kitchen design, such as painting cabinets or installing backsplash. Another cost-saving tip is to

repurpose

or

upcycle

items you already have in your home. For example, an old dining table can be transformed into a kitchen island, or a vintage dresser can be turned into a unique storage solution.

Creating a budget doesn't mean you have to sacrifice style or functionality in your kitchen design. There are plenty of ways to get creative and save money without compromising on your vision.

Shopping around for deals

on materials and appliances is a great way to cut costs. You can also consider

DIY projects

for certain aspects of your kitchen design, such as painting cabinets or installing backsplash. Another cost-saving tip is to

repurpose

or

upcycle

items you already have in your home. For example, an old dining table can be transformed into a kitchen island, or a vintage dresser can be turned into a unique storage solution.

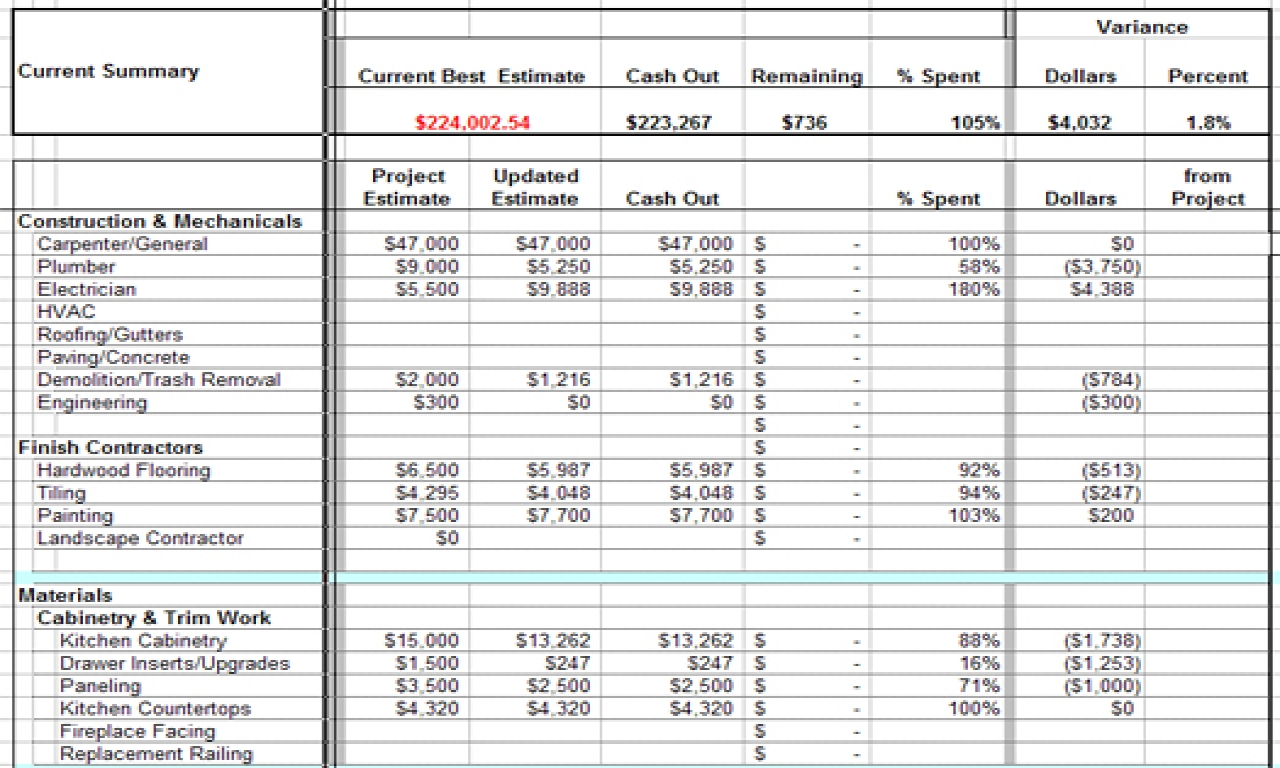

Staying Organized and On Track

Once your kitchen design is underway, it's important to stay organized and keep track of your expenses. This will not only help you stick to your budget but also allow you to make adjustments if necessary. Keep a spreadsheet or use budgeting apps to track your expenses, including any unexpected costs that may arise. Set a timeline for your project and make sure to stick to it.

Procrastination

can lead to rushed decisions and overspending, so it's important to stay on track and make decisions within your budget.

In conclusion,

kitchen table finances

may not be the most exciting part of house design, but it is essential for a successful and stress-free project. By setting a realistic budget, getting creative with costs, and staying organized, you can create the kitchen of your dreams without breaking the bank. So, as you plan your kitchen design, don't forget to also plan your

kitchen table finances

to ensure a beautiful and budget-friendly outcome.

Once your kitchen design is underway, it's important to stay organized and keep track of your expenses. This will not only help you stick to your budget but also allow you to make adjustments if necessary. Keep a spreadsheet or use budgeting apps to track your expenses, including any unexpected costs that may arise. Set a timeline for your project and make sure to stick to it.

Procrastination

can lead to rushed decisions and overspending, so it's important to stay on track and make decisions within your budget.

In conclusion,

kitchen table finances

may not be the most exciting part of house design, but it is essential for a successful and stress-free project. By setting a realistic budget, getting creative with costs, and staying organized, you can create the kitchen of your dreams without breaking the bank. So, as you plan your kitchen design, don't forget to also plan your

kitchen table finances

to ensure a beautiful and budget-friendly outcome.

.jpg)

.jpeg)