Managing household finances can be overwhelming, especially when you have multiple expenses to keep track of. But with the help of kitchen table finance, you can take control of your finances and make smarter decisions for your household. Kitchen table finance is a simple and effective approach that involves sitting down at your kitchen table to plan and manage your finances. In this guide, we will discuss the basics of kitchen table finance and how it can benefit your household.1. Kitchen Table Finance: A Guide to Managing Your Household Finances

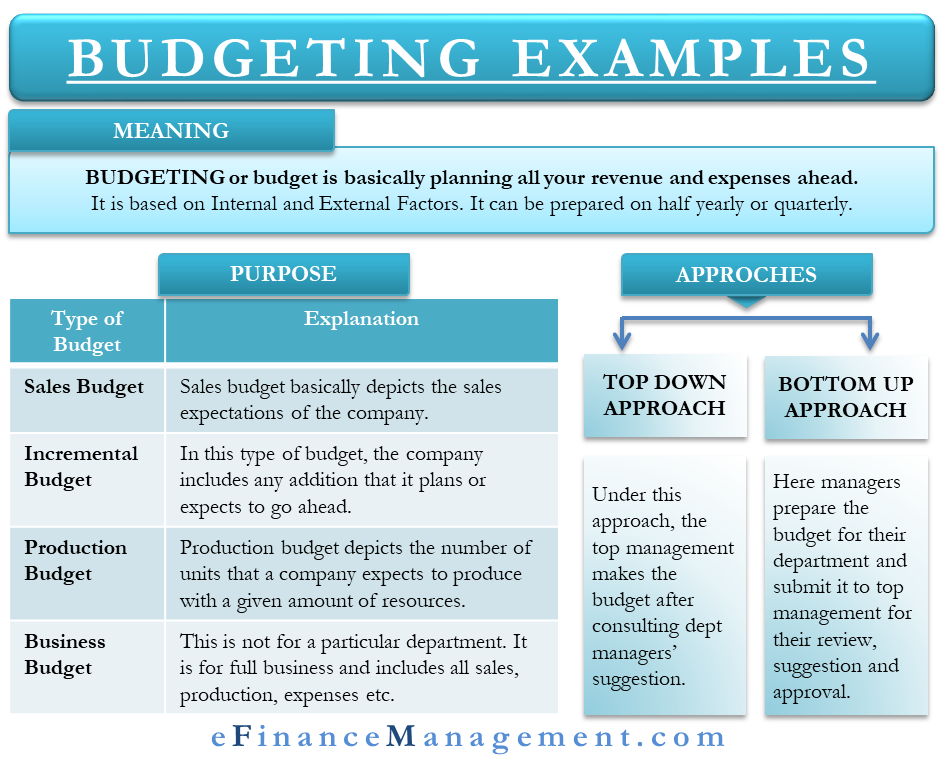

One of the key principles of kitchen table finance is budgeting. It’s important to have a clear understanding of your household income and expenses in order to make informed financial decisions. By creating a budget, you can identify areas where you may be overspending and make adjustments accordingly. Kitchen table finance encourages regular budgeting sessions to ensure that your finances stay on track.2. The Importance of Budgeting: How Kitchen Table Finance Can Help

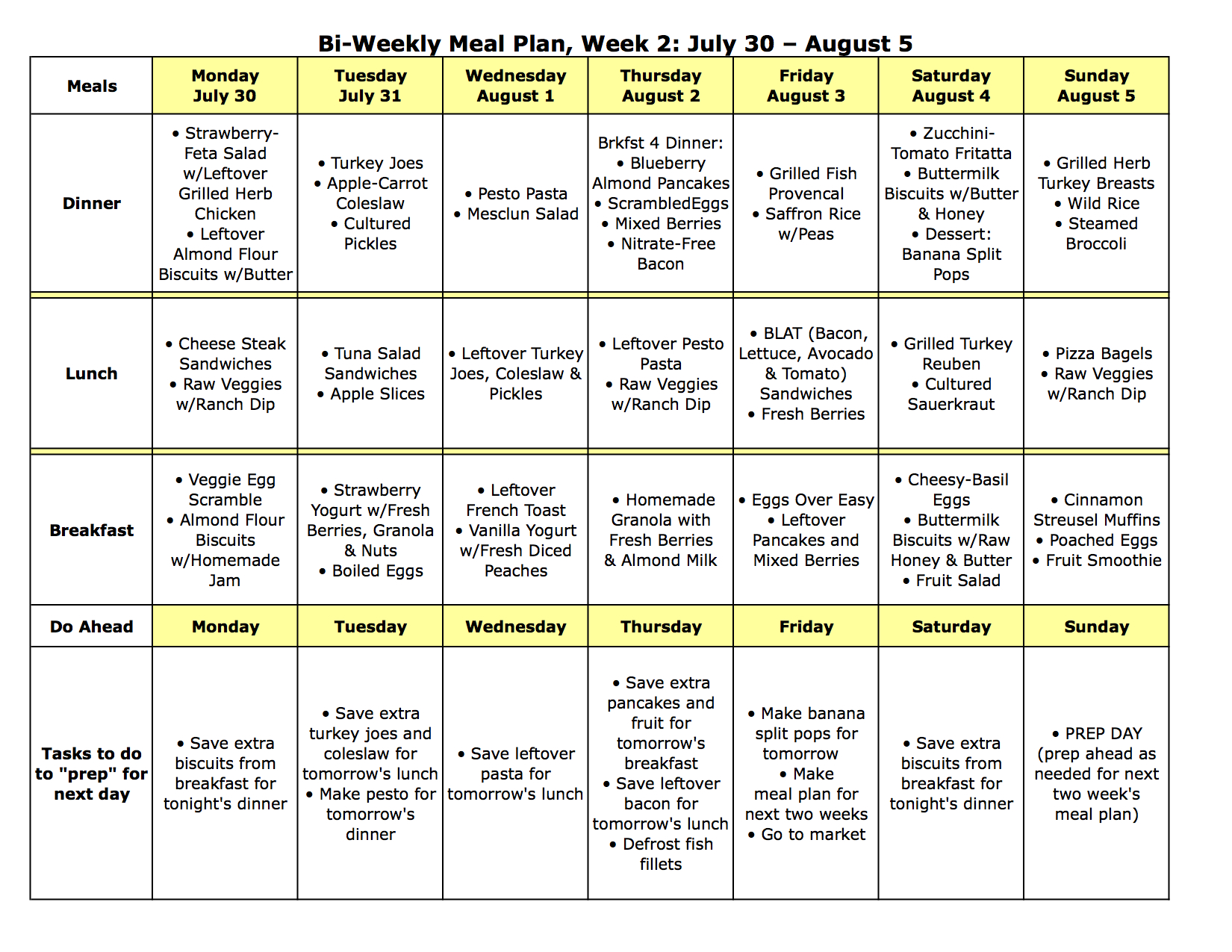

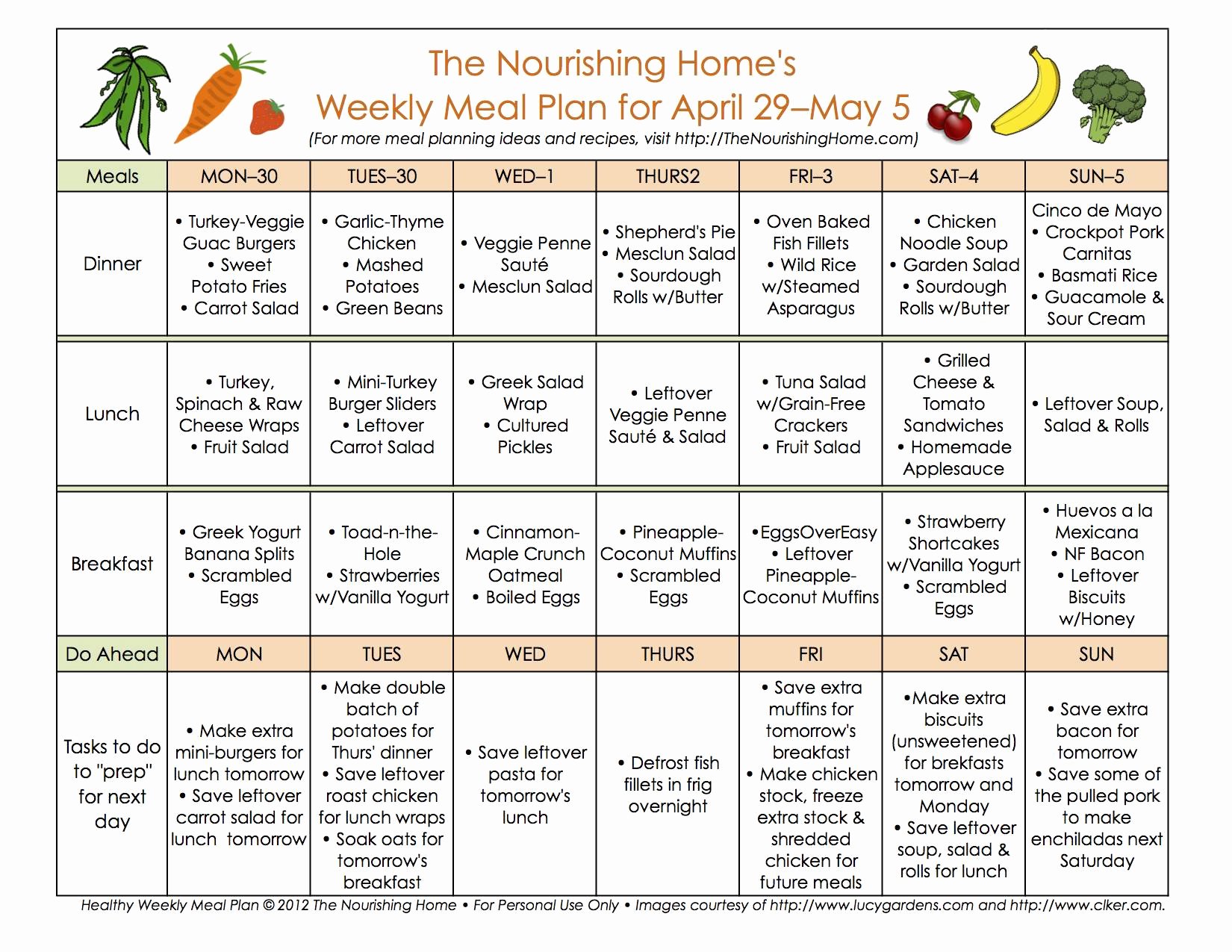

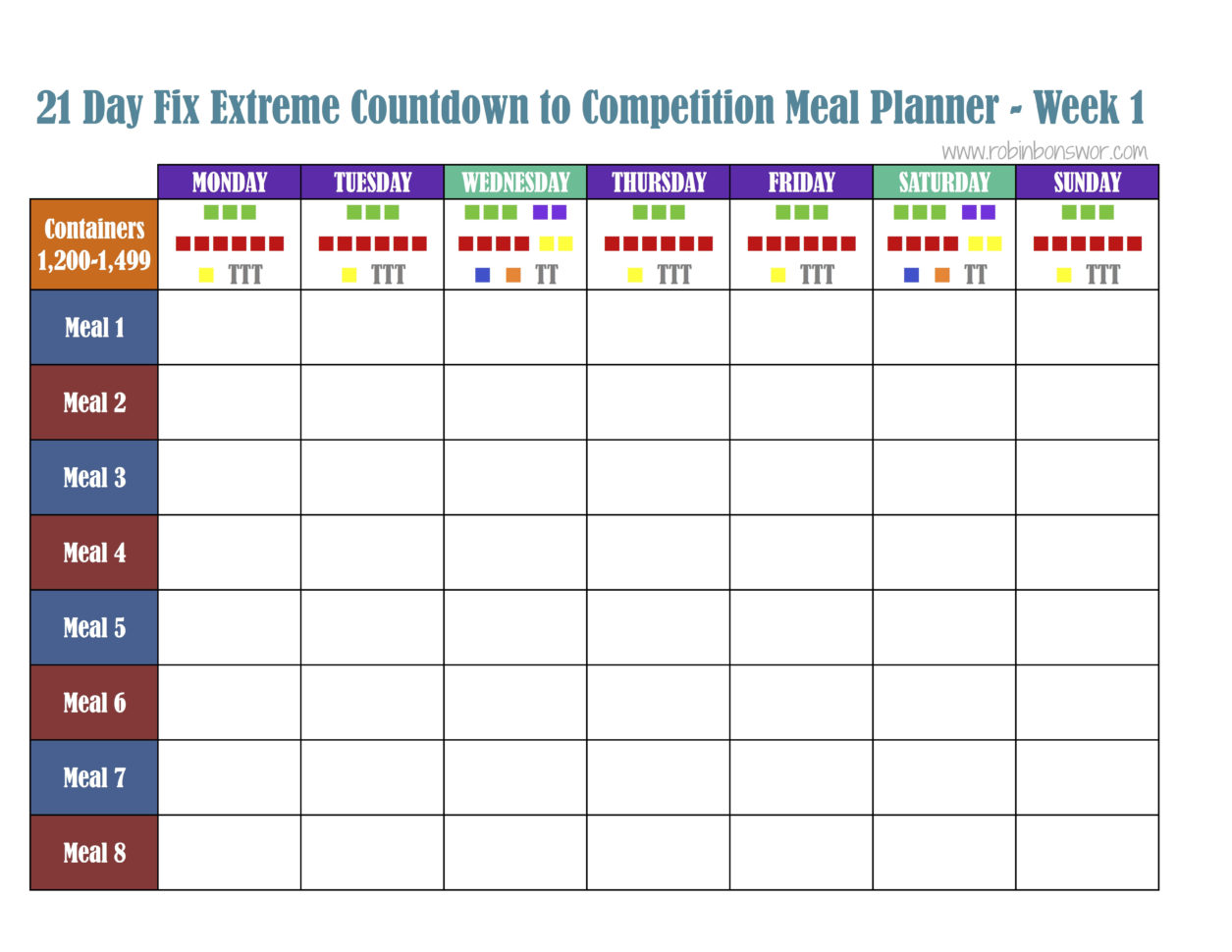

Groceries are a necessary expense for any household, but they can also be a major drain on your finances if not managed properly. With kitchen table finance, you can approach grocery shopping strategically and save money in the long run. This can include meal planning, using coupons, and buying in bulk. By involving your family in the process, you can also teach them the value of money and the importance of budgeting.3. Tips for Saving Money on Groceries: A Kitchen Table Finance Approach

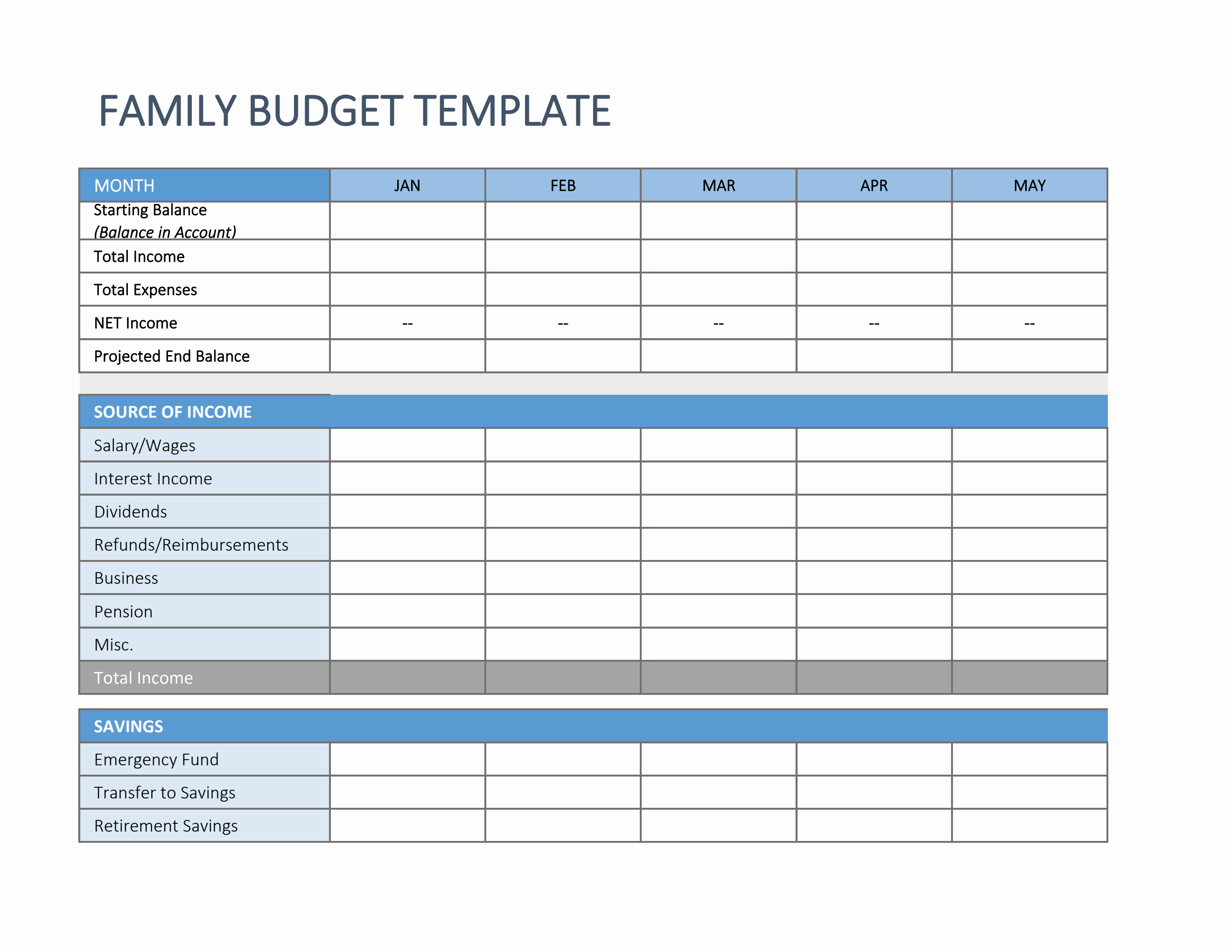

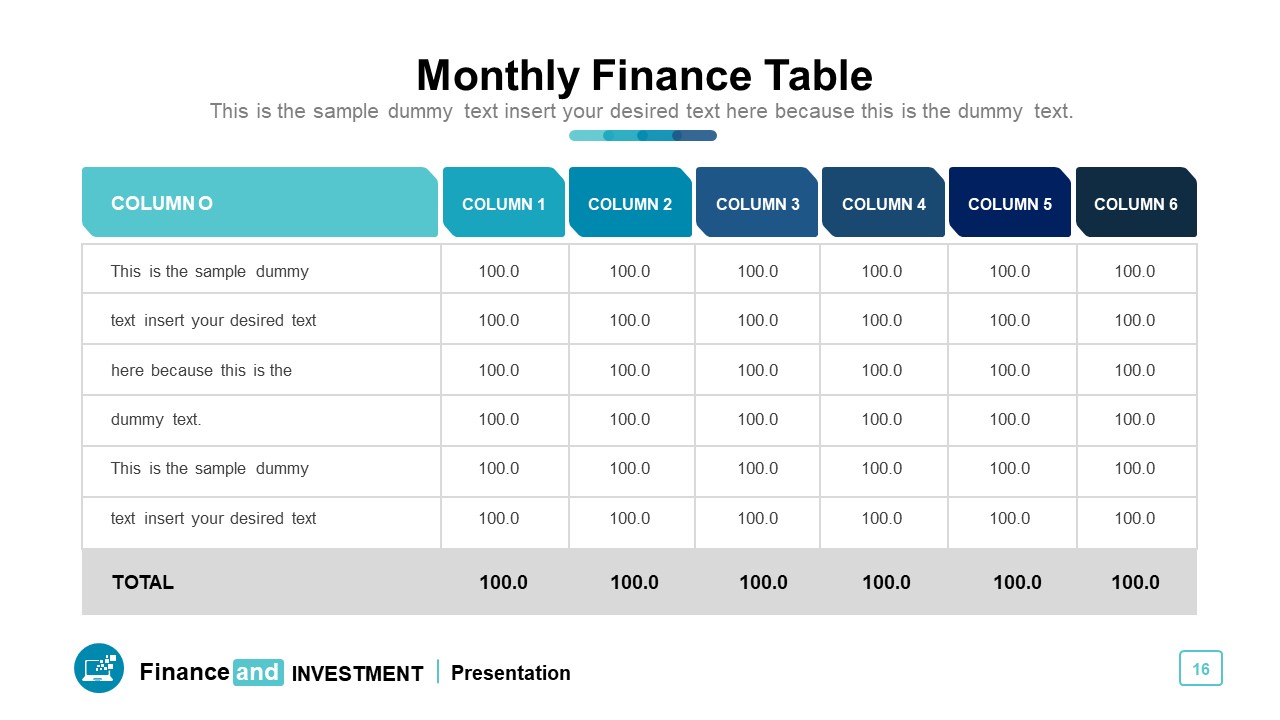

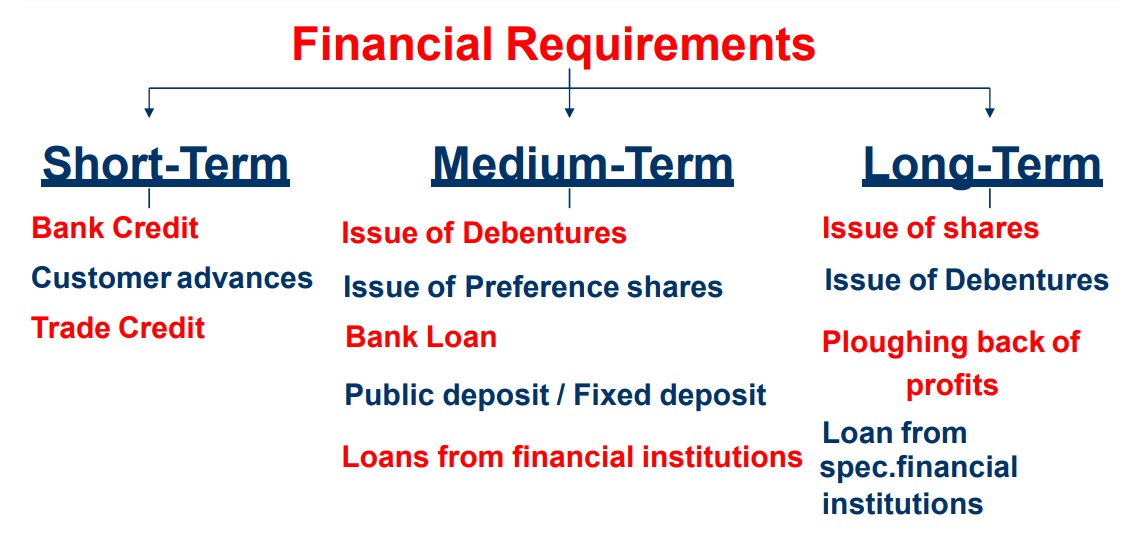

Creating a household budget may seem like a daunting task, but with the help of kitchen table finance principles, it can be a manageable and even enjoyable process. Start by listing all of your income sources and then categorizing your expenses into fixed and variable. This will give you a clear picture of where your money is going and allow you to make necessary adjustments to stay within your budget.4. How to Create a Household Budget with Kitchen Table Finance Principles

One of the popular methods used in kitchen table finance is the cash envelope system. This involves allocating a specific amount of cash to each budget category and using only that cash for purchases. This can help prevent overspending and keep you accountable to your budget. It also allows you to physically see how much money you have left for each category, making it easier to stick to your budget.5. The Benefits of Using Cash Envelopes for Kitchen Table Finance

Kitchen table finance is all about keeping things simple and manageable. By sitting down at your kitchen table with your budget and finances, you can easily stay on top of your expenses and make necessary adjustments. This approach also allows for open communication between family members, making it a collaborative effort to manage household finances.6. Kitchen Table Finance: A Simple and Effective Way to Manage Your Finances

Communication is key in any aspect of life, including household finances. With kitchen table finance, regular budgeting sessions can open up the lines of communication between family members. This can reduce financial stress and ensure that everyone is on the same page when it comes to financial goals and priorities. It also allows for transparency and accountability in managing household finances.7. The Role of Communication in Kitchen Table Finance

Teaching your children about financial responsibility is an important aspect of parenting. With kitchen table finance, you can involve your kids in the budgeting process and teach them valuable lessons about money management. This can include giving them a small budget for their own expenses, involving them in grocery shopping and meal planning, and discussing financial decisions as a family.8. How to Involve Your Kids in Kitchen Table Finance

Meal planning is not only a great way to save money on groceries, but it also aligns with the principles of kitchen table finance. By planning your meals for the week, you can avoid unnecessary trips to the grocery store and reduce food waste. This can also help you stick to a budget and make healthier food choices for your family.9. The Connection Between Meal Planning and Kitchen Table Finance

At its core, kitchen table finance is a collaborative approach to managing household finances. By involving your family in the budgeting process and communicating openly about financial goals and priorities, you can create a sense of teamwork and responsibility. This not only benefits your finances but also strengthens your family dynamic.10. Kitchen Table Finance: A Collaborative Approach to Financial Management

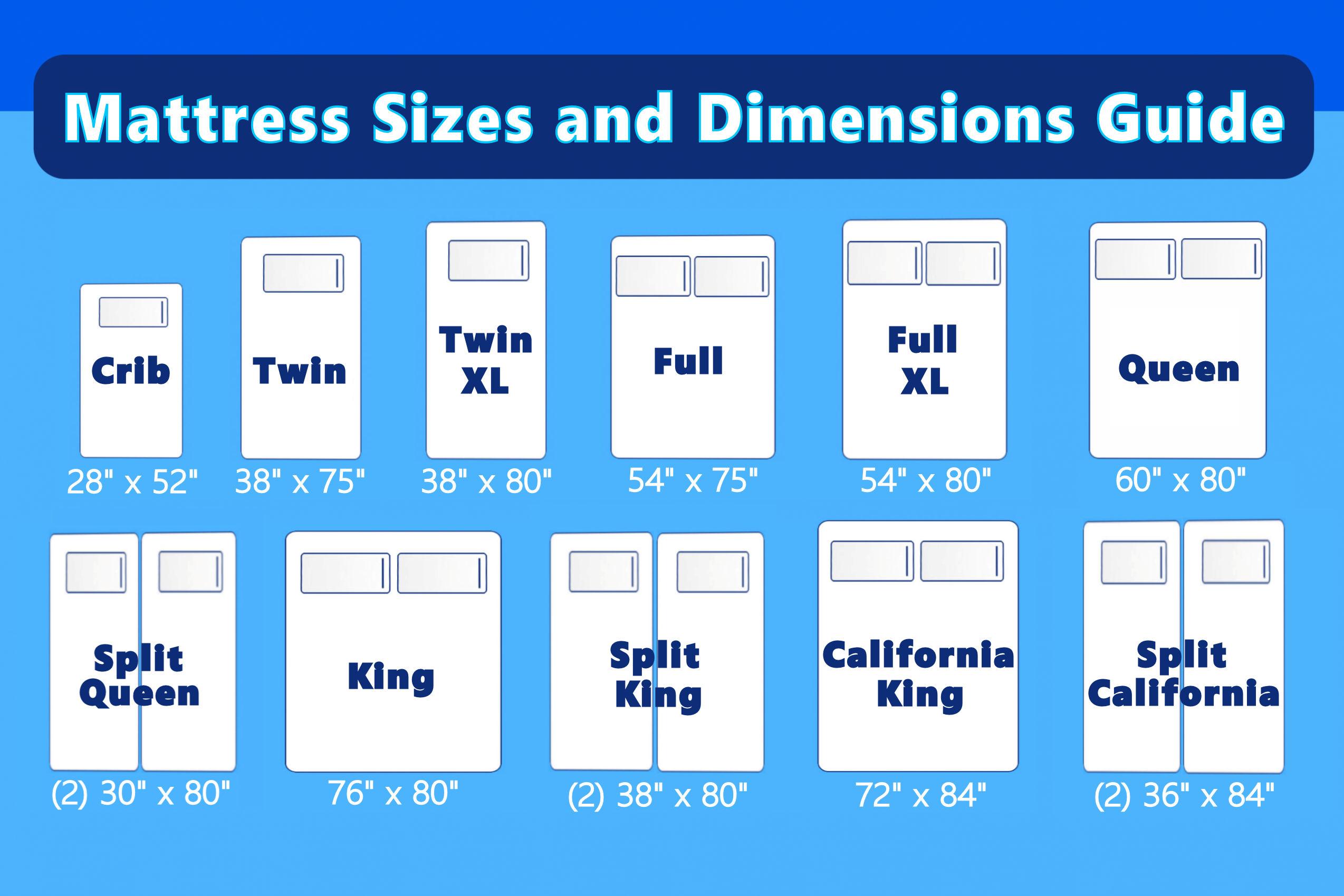

Kitchen Table Finance: The Key to Successful House Design

Transforming Your House with Kitchen Table Finance

When it comes to house design, one of the most important aspects to consider is budget. Without proper financial planning, it can be easy to overspend and end up with a half-finished project or a home that is not up to your standards. This is where

kitchen table finance

comes in – a term that refers to managing your finances and budget from the comfort of your own kitchen table.

Kitchen table finance

allows you to take control of your house design budget and make informed decisions about where to allocate your funds. It involves creating a detailed budget plan, tracking expenses, and finding creative ways to save money without compromising on the overall quality of your home.

When it comes to house design, one of the most important aspects to consider is budget. Without proper financial planning, it can be easy to overspend and end up with a half-finished project or a home that is not up to your standards. This is where

kitchen table finance

comes in – a term that refers to managing your finances and budget from the comfort of your own kitchen table.

Kitchen table finance

allows you to take control of your house design budget and make informed decisions about where to allocate your funds. It involves creating a detailed budget plan, tracking expenses, and finding creative ways to save money without compromising on the overall quality of your home.

The Benefits of Kitchen Table Finance

One of the biggest advantages of

kitchen table finance

is that it puts you in the driver's seat. Instead of relying on a contractor or designer to handle your finances, you have a hands-on approach and can make decisions based on your own priorities and preferences. This not only gives you a sense of control but also helps you stay within your budget and avoid any unexpected costs.

Furthermore,

kitchen table finance

encourages you to be more resourceful and think outside the box. With a limited budget, you may need to get creative and find ways to save money while still achieving your desired design. This could include DIY projects, shopping at discount stores, or repurposing old furniture. By managing your finances at the kitchen table, you are forced to be more involved in the design process and can come up with unique and cost-effective solutions.

One of the biggest advantages of

kitchen table finance

is that it puts you in the driver's seat. Instead of relying on a contractor or designer to handle your finances, you have a hands-on approach and can make decisions based on your own priorities and preferences. This not only gives you a sense of control but also helps you stay within your budget and avoid any unexpected costs.

Furthermore,

kitchen table finance

encourages you to be more resourceful and think outside the box. With a limited budget, you may need to get creative and find ways to save money while still achieving your desired design. This could include DIY projects, shopping at discount stores, or repurposing old furniture. By managing your finances at the kitchen table, you are forced to be more involved in the design process and can come up with unique and cost-effective solutions.

Getting Started with Kitchen Table Finance

To successfully implement

kitchen table finance

, it's important to have a clear understanding of your budget and expenses. Start by creating a detailed budget plan, breaking down your costs into categories such as materials, labor, and furnishings. Keep track of your expenses and constantly reassess your budget to ensure you are staying on track.

Additionally, do your research and explore different options for materials and furnishings. Look for deals and sales, and consider alternative options that may be more budget-friendly. Don't be afraid to negotiate with contractors and suppliers to get the best price for your project.

To successfully implement

kitchen table finance

, it's important to have a clear understanding of your budget and expenses. Start by creating a detailed budget plan, breaking down your costs into categories such as materials, labor, and furnishings. Keep track of your expenses and constantly reassess your budget to ensure you are staying on track.

Additionally, do your research and explore different options for materials and furnishings. Look for deals and sales, and consider alternative options that may be more budget-friendly. Don't be afraid to negotiate with contractors and suppliers to get the best price for your project.

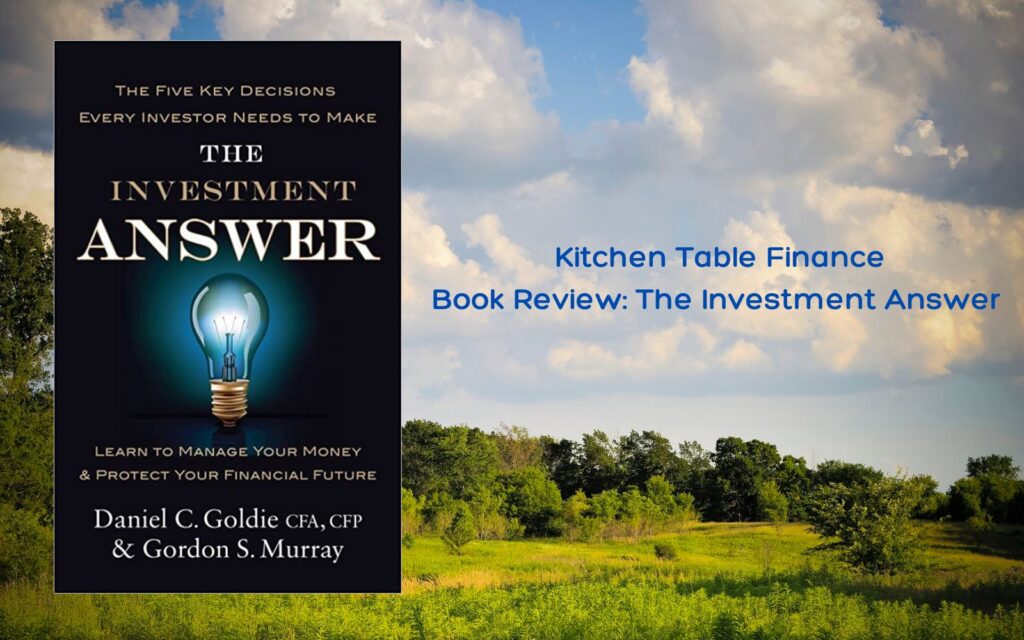

In Conclusion

In the world of house design,

kitchen table finance

is a valuable tool that can help you achieve your dream home within your budget. By taking control of your finances and making informed decisions, you can transform your house into a space that reflects your personal style without breaking the bank. So grab a pen and paper, sit down at your kitchen table, and start planning your next house design project today.

In the world of house design,

kitchen table finance

is a valuable tool that can help you achieve your dream home within your budget. By taking control of your finances and making informed decisions, you can transform your house into a space that reflects your personal style without breaking the bank. So grab a pen and paper, sit down at your kitchen table, and start planning your next house design project today.

.jpg)