The kitchen sink is an essential part of any kitchen, providing a place to clean dishes, wash hands, and prepare food. However, like any other asset, a kitchen sink has a limited lifespan and will eventually need to be replaced. Understanding the depreciation life of a kitchen sink is important for proper budgeting and financial planning. In this article, we will discuss the depreciation life of a kitchen sink and how to calculate it.Depreciation Life of Kitchen Sink

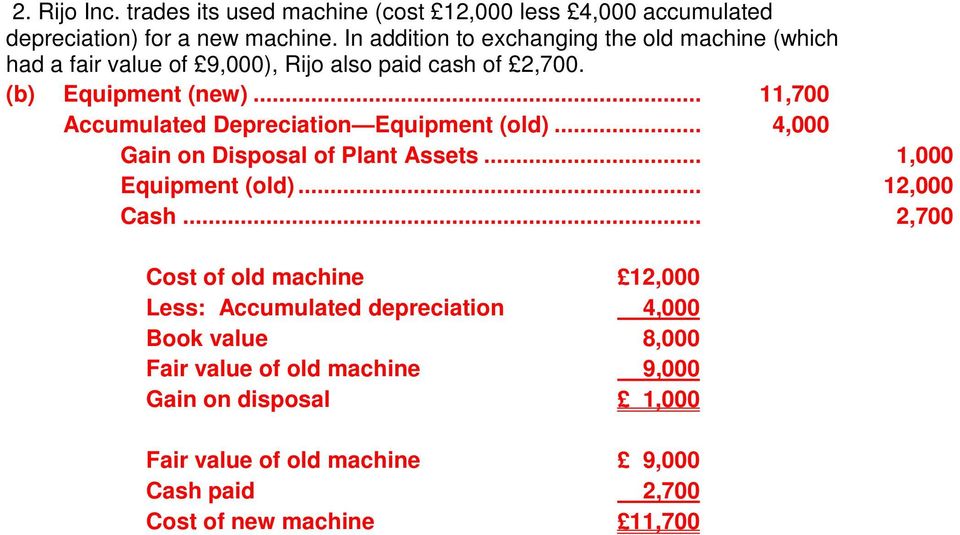

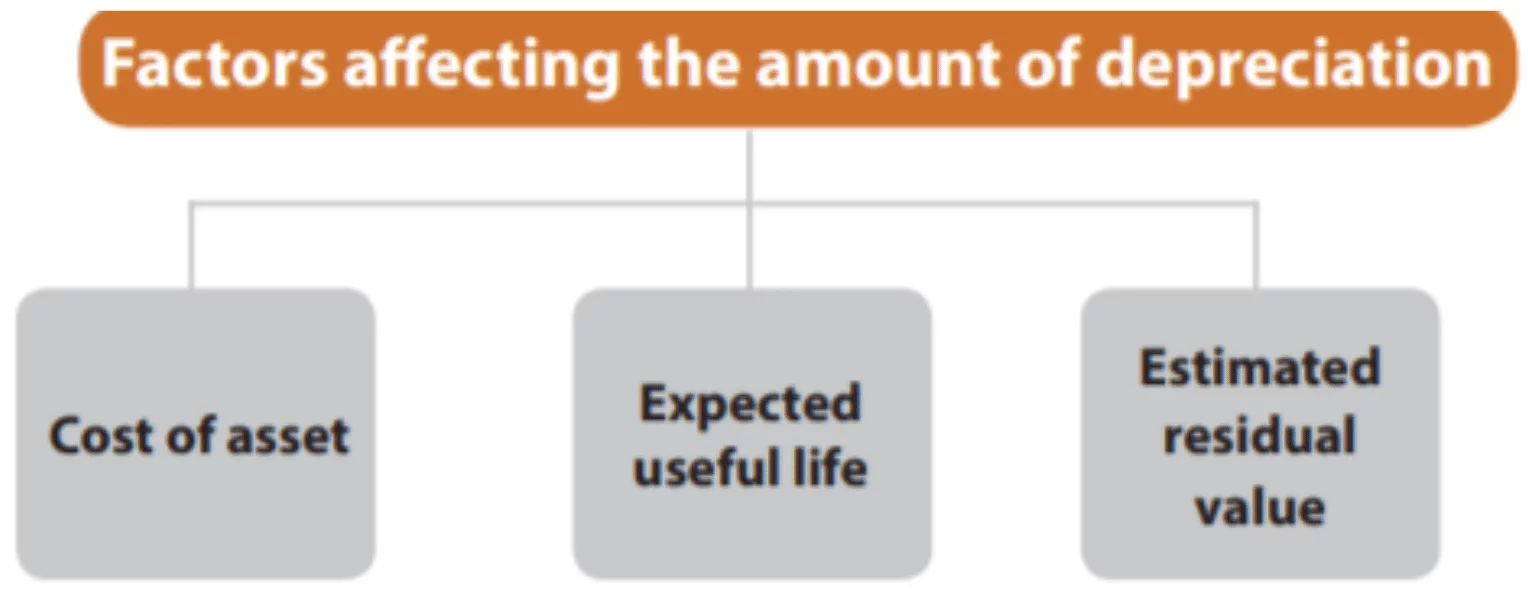

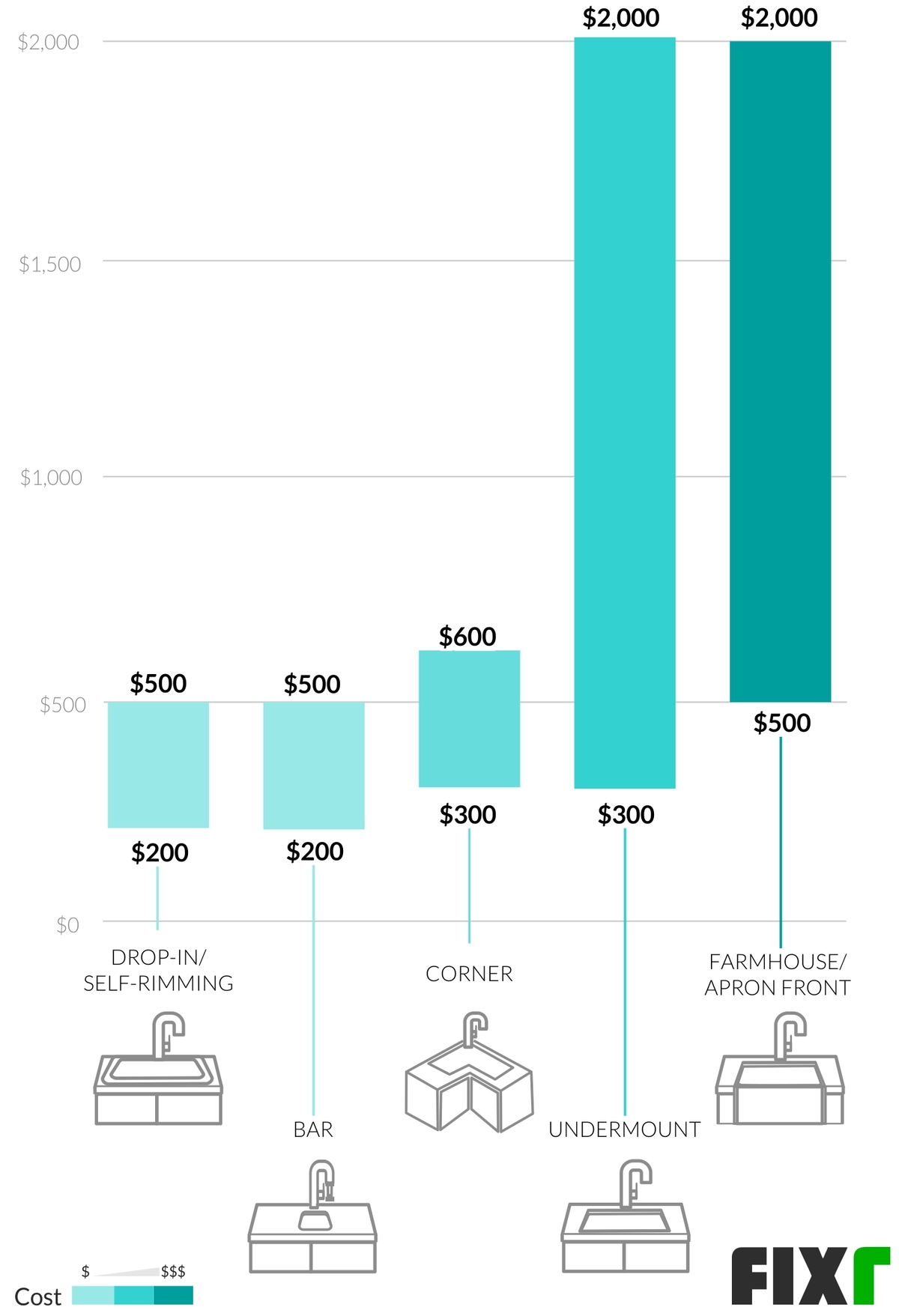

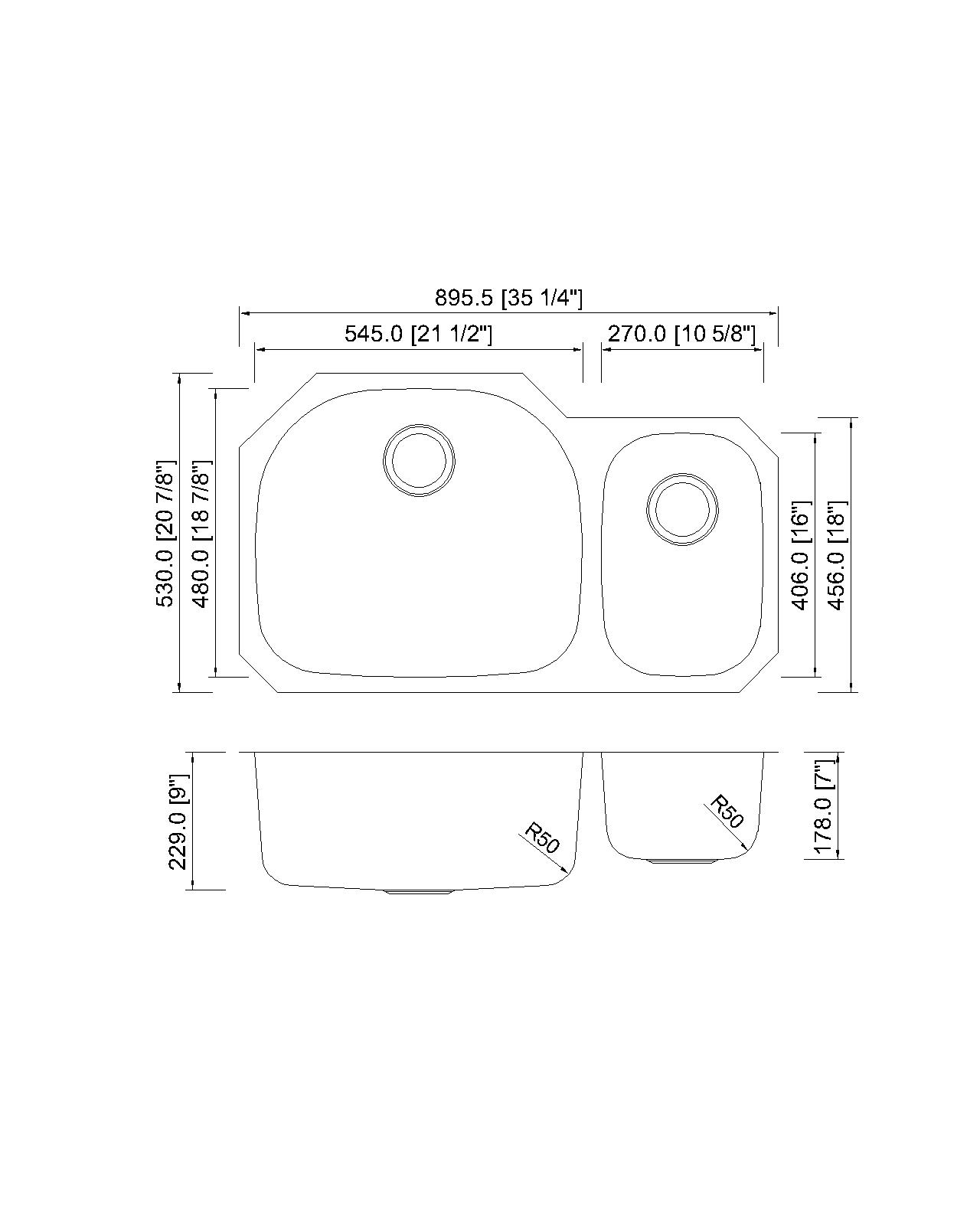

The depreciation life of a kitchen sink refers to the estimated time period in which the sink will lose its value and need to be replaced. To calculate the depreciation life of your kitchen sink, you will need to know the initial cost of the sink, the expected salvage value, and the estimated useful life of the sink. First, determine the initial cost of the sink, which includes the purchase price and installation costs. Then, estimate the expected salvage value, which is the estimated amount you will receive if you were to sell the sink at the end of its useful life. Finally, determine the estimated useful life of the sink, which can vary depending on the material and quality of the sink. Once you have these values, you can use the straight-line depreciation method to calculate the depreciation life of your kitchen sink. This method divides the initial cost of the sink by the estimated useful life to determine the annual depreciation expense.How to Calculate Depreciation Life of Kitchen Sink

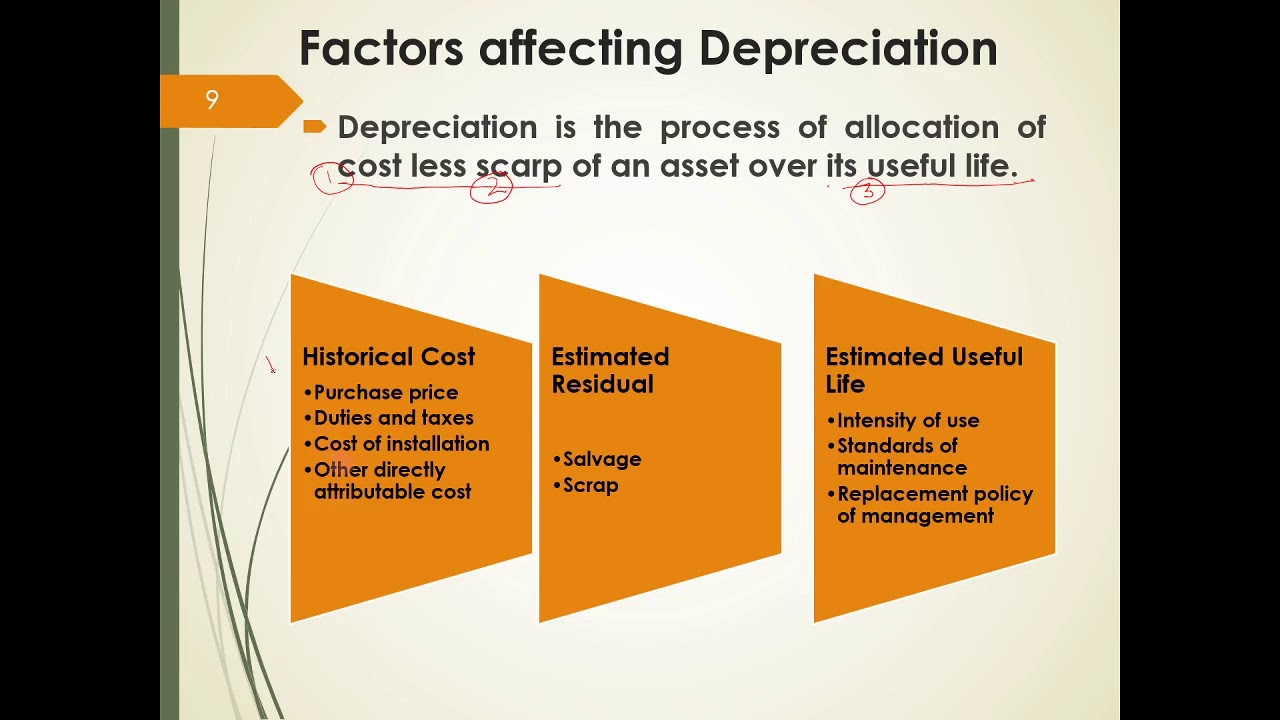

Several factors can affect the depreciation life of a kitchen sink, including the material, quality, and usage. For example, a stainless steel sink may have a longer depreciation life compared to a porcelain sink due to its durability. Similarly, a high-quality sink may last longer than a lower quality one, resulting in a longer depreciation life. Usage also plays a significant role in the depreciation life of a kitchen sink. A sink that is frequently used and exposed to harsh chemicals or hot water may wear out quicker than a sink that is lightly used and well-maintained. Therefore, it is essential to consider these factors when calculating the depreciation life of your sink.Factors Affecting Depreciation Life of Kitchen Sink

Depreciation life is a crucial concept in accounting and finance and is used to determine the value of an asset over time. In the case of a kitchen sink, the depreciation life is used to determine the amount of money that should be set aside each year for its eventual replacement. Understanding the depreciation life of your kitchen sink can help you make informed decisions about budgeting and financial planning.Understanding Depreciation Life for Kitchen Sink

There are several methods for calculating the depreciation of an asset, including the straight-line method, declining balance method, and sum-of-the-years'-digits method. The straight-line method, as mentioned earlier, divides the initial cost of the sink by the estimated useful life to determine the annual depreciation expense. The declining balance method uses a fixed rate to calculate depreciation, where the depreciation expense decreases each year as the asset's value decreases. The sum-of-the-years'-digits method also uses a fixed rate, but the depreciation expense is higher in the earlier years and decreases gradually over time.Depreciation Methods for Kitchen Sink

A depreciation schedule is a document that outlines the depreciation expense for an asset over its estimated useful life. It includes information such as the initial cost, salvage value, estimated useful life, and annual depreciation expense. A depreciation schedule for a kitchen sink can help you track the depreciation of your asset and plan for its eventual replacement.Depreciation Schedule for Kitchen Sink

The depreciation expense for a kitchen sink is the amount that is deducted each year from the asset's value. This expense is recorded in the company's financial statements and reduces the value of the sink over time. It is essential to accurately calculate and record the depreciation expense to ensure proper financial reporting.Depreciation Expense for Kitchen Sink

The depreciation rate for a kitchen sink is the percentage of the initial cost that is deducted each year as the depreciation expense. This rate is determined by dividing the annual depreciation expense by the initial cost of the sink. It is important to note that the depreciation rate may vary depending on the depreciation method used.Depreciation Rate for Kitchen Sink

To calculate the depreciation expense for your kitchen sink, you can use the straight-line method or any other depreciation method that is suitable for your business. It is recommended to consult with an accountant or financial expert to ensure accurate calculations and proper financial reporting.Depreciation Calculation for Kitchen Sink

The formula for calculating the depreciation expense for a kitchen sink using the straight-line method is as follows: Depreciation Expense = (Initial Cost - Salvage Value) / Estimated Useful Life Using this formula, you can determine the annual depreciation expense for your kitchen sink, which can then be used to create a depreciation schedule for proper budgeting and financial planning.Depreciation Formula for Kitchen Sink

The Importance of Understanding Kitchen Sink Depreciation Life in House Design

When it comes to designing a house, every aspect needs to be carefully considered, especially when it comes to the kitchen. The kitchen is often referred to as the heart of the home, where families gather to cook and share meals. One of the key components of a kitchen is the sink, and understanding its depreciation life is crucial in creating a functional and long-lasting kitchen design.

Kitchen Sink Depreciation Life Explained

Depreciation life refers to the estimated time that an asset, such as a kitchen sink, will last before needing to be replaced. This is an important factor to consider when designing a kitchen because it affects not only the functionality of the space but also the overall cost and value of the house. A kitchen sink with a longer depreciation life will save homeowners money in the long run, as they will not need to replace it as frequently.

Affordability and Durability

One of the main benefits of understanding kitchen sink depreciation life is being able to find a balance between affordability and durability. While it may be tempting to opt for a cheaper sink, it may have a shorter depreciation life and end up costing more in the long run. On the other hand, investing in a high-quality sink with a longer depreciation life may be more expensive upfront, but it will save money and hassle in the future.

Design and Functionality

The kitchen sink is not only a functional element, but it also plays a significant role in the overall design and aesthetic of the kitchen. Therefore, it is important to choose a sink that not only fits within the budget and has a long depreciation life but also complements the design of the kitchen. For example, a farmhouse sink may have a longer depreciation life due to its sturdy construction, but it may not suit a modern kitchen design.

Maintenance and Care

Understanding the depreciation life of a kitchen sink can also help homeowners in properly maintaining and caring for it. Different materials and designs may have different maintenance requirements, which can affect the sink's depreciation life. For instance, a stainless steel sink may require regular cleaning and polishing to maintain its shine and prevent rust, while a porcelain sink may be more prone to chipping and cracking if not handled carefully.

Conclusion

In conclusion, kitchen sink depreciation life is a crucial factor to consider in house design. It affects not only the functionality and cost but also the overall look and maintenance of the kitchen. By understanding the depreciation life of different sink materials and designs, homeowners can make informed decisions and create a long-lasting and functional kitchen design.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)