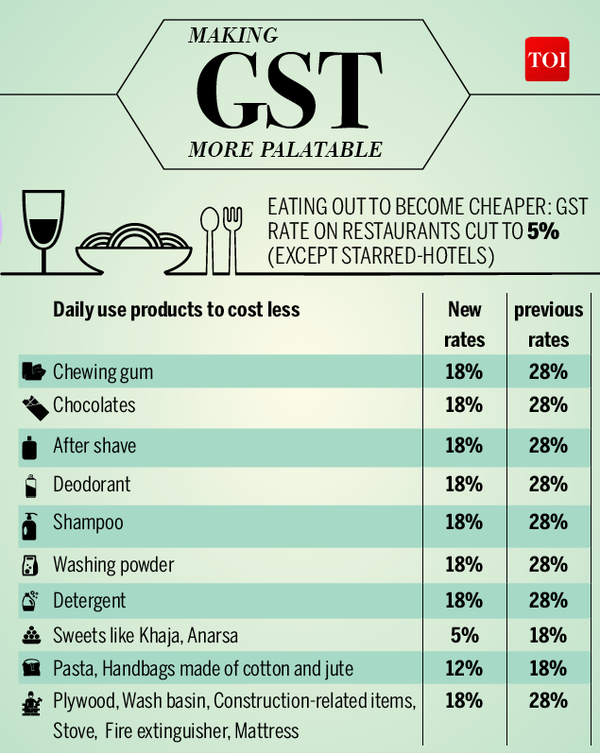

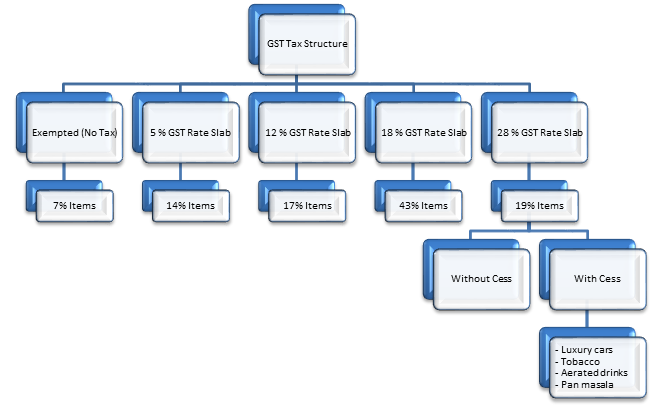

With the implementation of Goods and Services Tax (GST) in India, the tax structure for various products and services has undergone a major change. One such product that has seen a significant impact is kitchen lighters. In this article, we will delve into the details of GST rates for kitchen lighters and how it affects the prices of these essential household items. Featured keyword: GST rates for kitchen lighters1. Understanding GST Rates for Kitchen Lighters

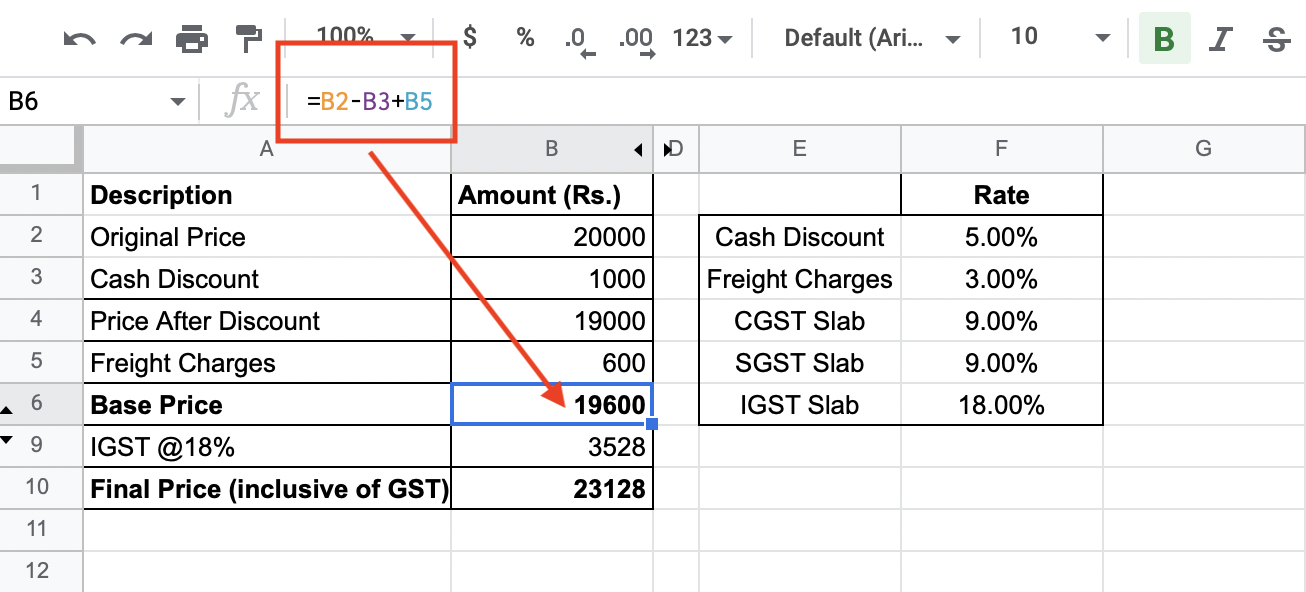

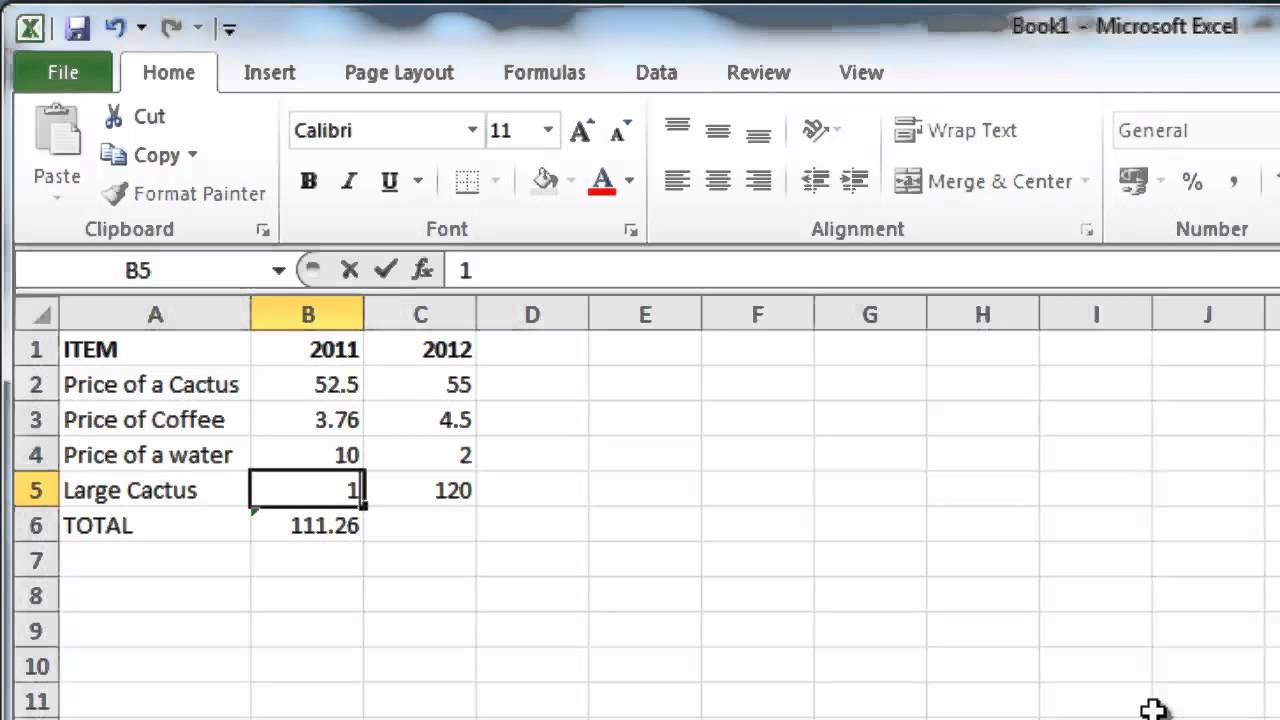

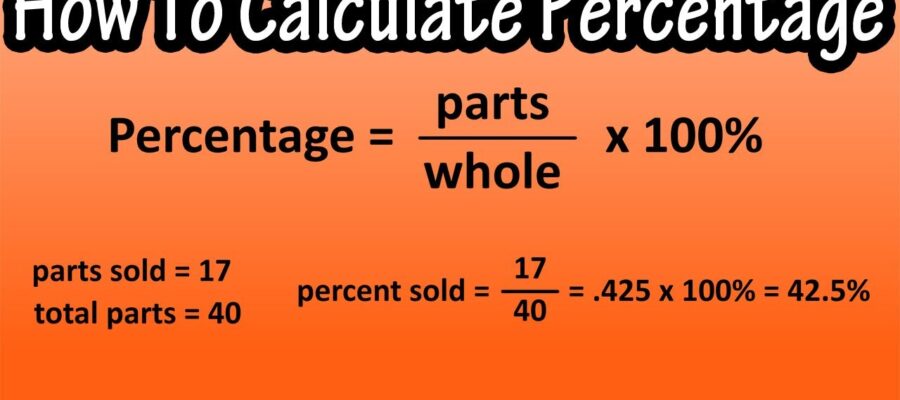

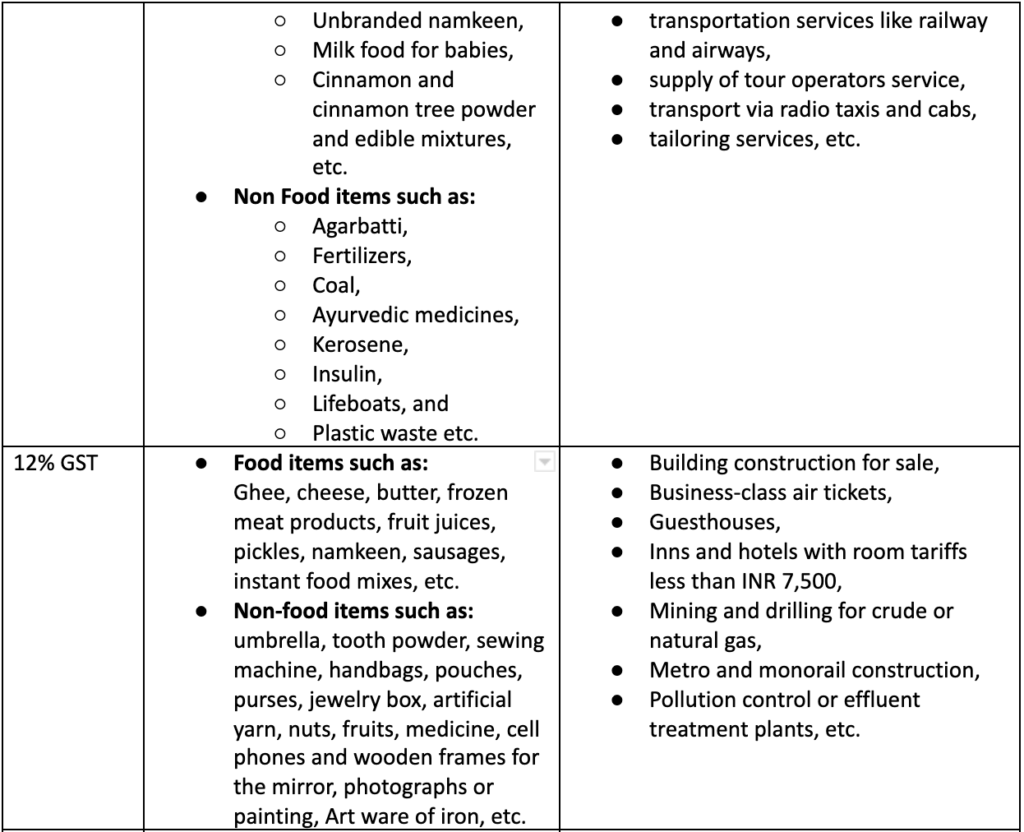

Calculating the GST on kitchen lighters is a simple process. The GST rate for kitchen lighters is 12%, which is the standard rate for most household items. To calculate the GST, you need to multiply the cost of the kitchen lighter by 12% (0.12). The resulting amount is the GST that is added to the price of the product. Featured keyword: Calculate GST on kitchen lighters2. How to Calculate GST on Kitchen Lighters

The implementation of GST has resulted in a significant impact on the prices of kitchen lighters. With a standard rate of 12%, the overall cost of kitchen lighters has increased. However, this increase in price is offset by the elimination of multiple taxes and the introduction of input tax credit, making it a more streamlined and efficient tax structure. Featured keyword: GST impact on kitchen lighter prices3. GST Impact on Kitchen Lighter Prices

The GST rate for kitchen lighters in India is 12%, which falls under the 12-18% tax slab. This rate is applicable to all types of kitchen lighters, including gas lighters, electric lighters, and rechargeable lighters. The GST rate is the same across all states in India, making it a uniform tax structure for kitchen lighters. Featured keyword: GST rate for kitchen lighters in India4. GST Rate for Kitchen Lighters in India

For those looking for a comprehensive guide on GST for kitchen lighters, this article is the perfect resource. From understanding the tax structure to calculating the GST and its impact on prices, we cover all the essential information related to GST on kitchen lighters. So, read on to stay updated on the latest tax regulations for this household item. Featured keyword: GST on kitchen lighters5. GST on Kitchen Lighters: A Complete Guide

As with any tax system, there are bound to be updates and changes over time. To stay informed on the latest news and updates regarding GST on kitchen lighters, make sure to follow our blog regularly. We keep track of all the developments and bring you the most relevant and up-to-date information on GST for kitchen lighters. Featured keyword: Latest GST news on kitchen lighters6. Latest GST News on Kitchen Lighters

While the GST rate for kitchen lighters may seem straightforward, there are a few things you need to know to understand it fully. For instance, the GST rate for kitchen lighters is 12%, but there are different rates for other household items. Knowing these details can help you make informed decisions when purchasing kitchen lighters. Featured keyword: GST rate for kitchen lighters7. GST Rate for Kitchen Lighters: What You Need to Know

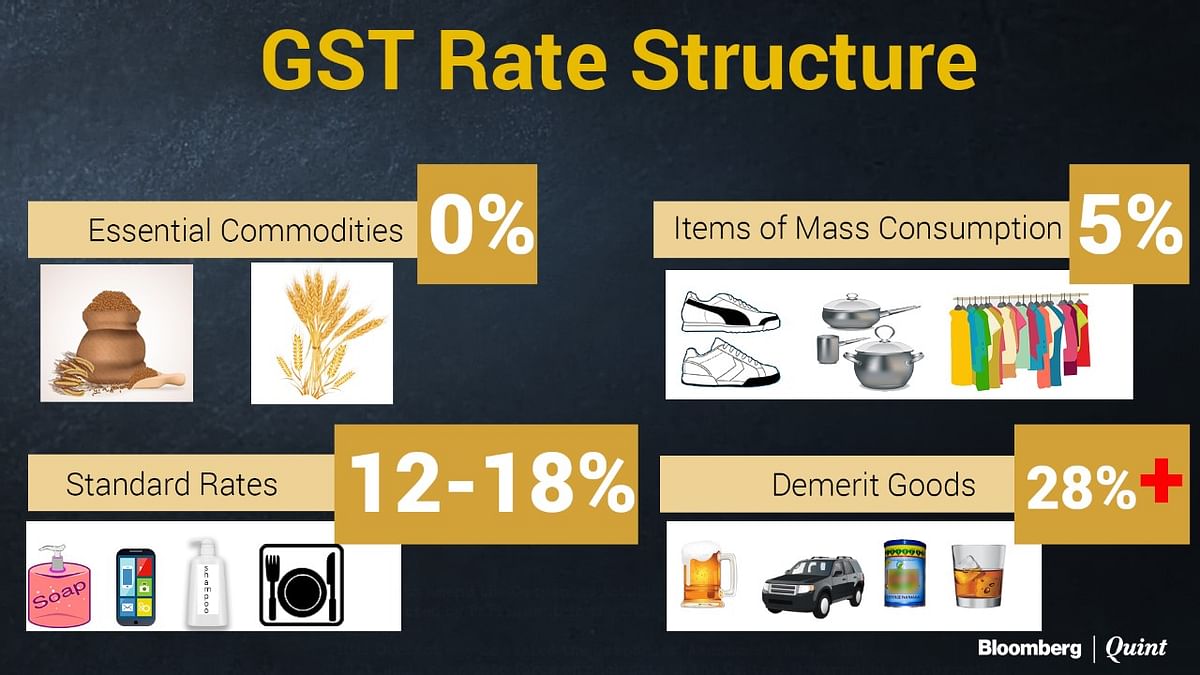

As mentioned earlier, while the GST rate for kitchen lighters is 12%, there are different rates for other household items. For example, the GST rate for LPG stoves and other cooking appliances is 18%. Understanding these different rates can give you a better idea of how GST affects the prices of various household items. Featured keyword: Different GST rates for kitchen lighters8. Understanding the Different GST Rates for Kitchen Lighters

While the GST rate for kitchen lighters is fixed at 12%, there are ways to save on this tax. One way to do so is by purchasing kitchen lighters from retailers who offer discounts or cashback on GST. Additionally, being aware of the input tax credit system can also help you save on GST for kitchen lighters. Featured keyword: Save on GST for kitchen lighters9. How to Save on GST for Kitchen Lighters

Apart from the impact on prices for consumers, GST has also affected the manufacturers and retailers of kitchen lighters. With the elimination of multiple taxes and the introduction of input tax credit, the overall tax burden on manufacturers and retailers has reduced, making it a more favorable tax structure for them. Featured keyword: Impact of GST on kitchen lighter manufacturers and retailers10. Impact of GST on Kitchen Lighter Manufacturers and Retailers

Understanding the Impact of GST on Kitchen Lighters

What is GST?

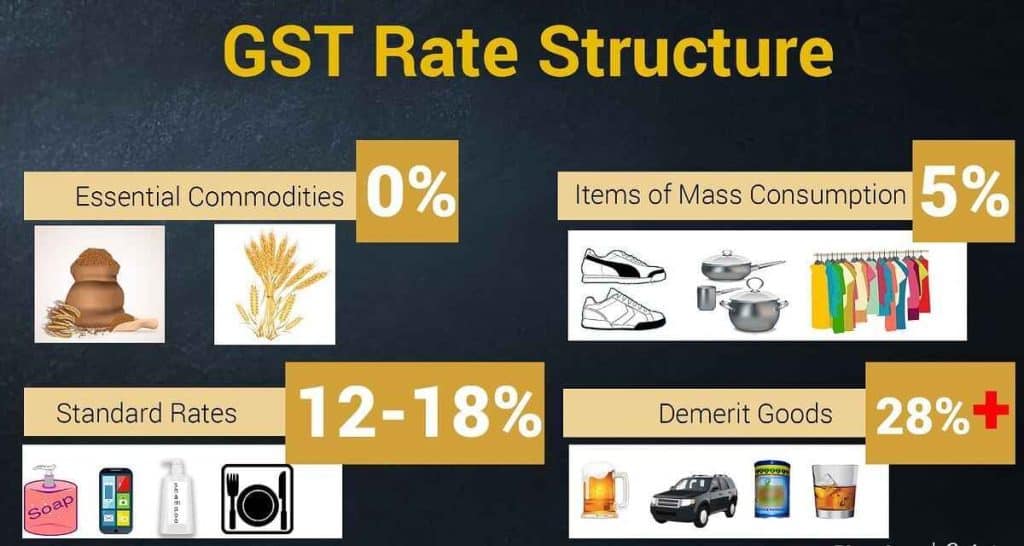

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India. It was implemented on July 1, 2017, replacing multiple indirect taxes such as VAT, service tax, central excise duty, and more. The GST has simplified the tax structure and created a unified market for goods and services across the country. However, its implementation has also brought about changes in the prices of various goods, including kitchen lighters.

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India. It was implemented on July 1, 2017, replacing multiple indirect taxes such as VAT, service tax, central excise duty, and more. The GST has simplified the tax structure and created a unified market for goods and services across the country. However, its implementation has also brought about changes in the prices of various goods, including kitchen lighters.

Impact of GST on Kitchen Lighters

Before the implementation of GST, kitchen lighters were subject to multiple taxes, such as excise duty and VAT, which varied from state to state. This led to a significant difference in prices of kitchen lighters in different regions. With the introduction of GST, all these taxes have been replaced by a single tax that is applicable across the country. This has resulted in a more uniform pricing of kitchen lighters, making it easier for consumers to compare prices and make informed purchases.

Kitchen lighters

are now placed under the 18% GST category, which is higher than the previous tax rate of 14%. This increase in tax may seem like a burden for consumers, but it has also brought certain benefits. Under the previous tax structure, the manufacturers of kitchen lighters were not able to claim input tax credit for the taxes paid on raw materials and other inputs. This resulted in an increase in the overall cost of production, which was then passed on to the consumers. With GST, manufacturers can now claim input tax credit, resulting in a reduction in production costs and ultimately leading to a decrease in the price of kitchen lighters.

Before the implementation of GST, kitchen lighters were subject to multiple taxes, such as excise duty and VAT, which varied from state to state. This led to a significant difference in prices of kitchen lighters in different regions. With the introduction of GST, all these taxes have been replaced by a single tax that is applicable across the country. This has resulted in a more uniform pricing of kitchen lighters, making it easier for consumers to compare prices and make informed purchases.

Kitchen lighters

are now placed under the 18% GST category, which is higher than the previous tax rate of 14%. This increase in tax may seem like a burden for consumers, but it has also brought certain benefits. Under the previous tax structure, the manufacturers of kitchen lighters were not able to claim input tax credit for the taxes paid on raw materials and other inputs. This resulted in an increase in the overall cost of production, which was then passed on to the consumers. With GST, manufacturers can now claim input tax credit, resulting in a reduction in production costs and ultimately leading to a decrease in the price of kitchen lighters.

Conclusion

In conclusion, the implementation of GST has brought about significant changes in the pricing of kitchen lighters. While the tax rate has increased, it has also streamlined the tax structure and reduced the overall cost of production, resulting in more competitive prices for consumers. As the nation moves towards a more unified tax system, it is important for consumers to understand the impact of GST on various products, including kitchen lighters. So, the next time you go to buy a kitchen lighter, keep in mind the impact of GST and make an informed decision.

In conclusion, the implementation of GST has brought about significant changes in the pricing of kitchen lighters. While the tax rate has increased, it has also streamlined the tax structure and reduced the overall cost of production, resulting in more competitive prices for consumers. As the nation moves towards a more unified tax system, it is important for consumers to understand the impact of GST on various products, including kitchen lighters. So, the next time you go to buy a kitchen lighter, keep in mind the impact of GST and make an informed decision.