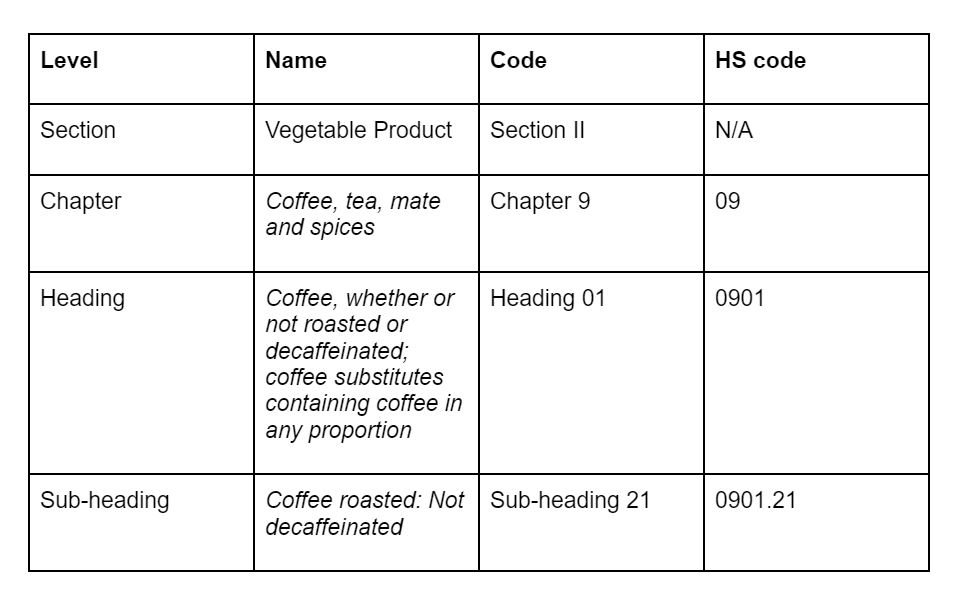

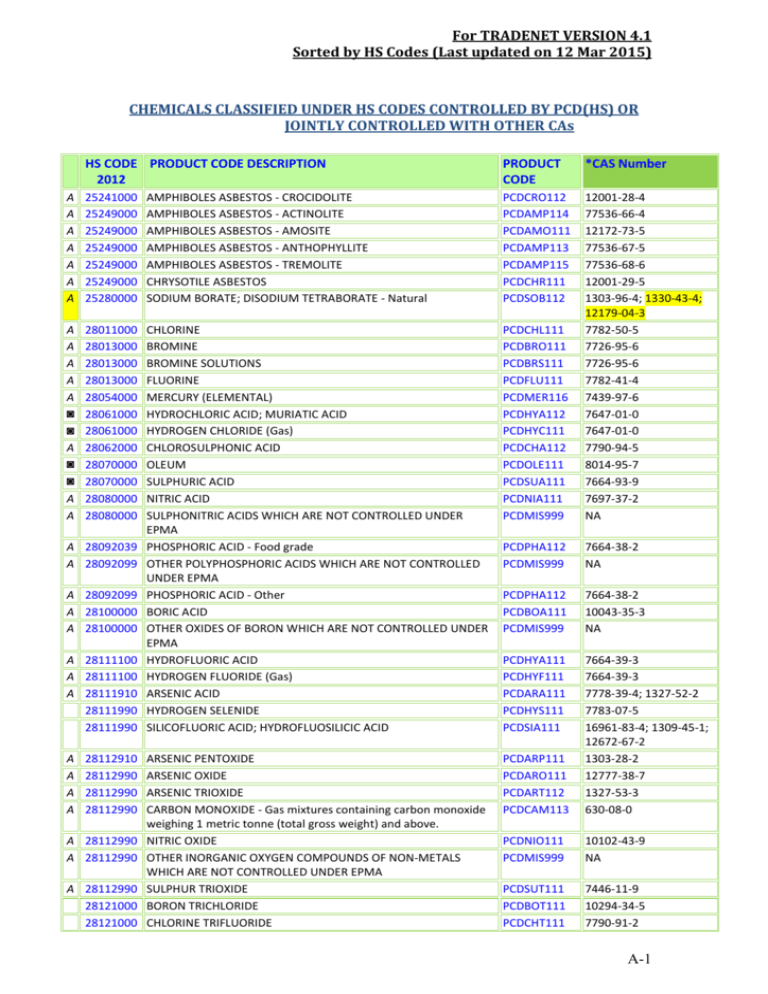

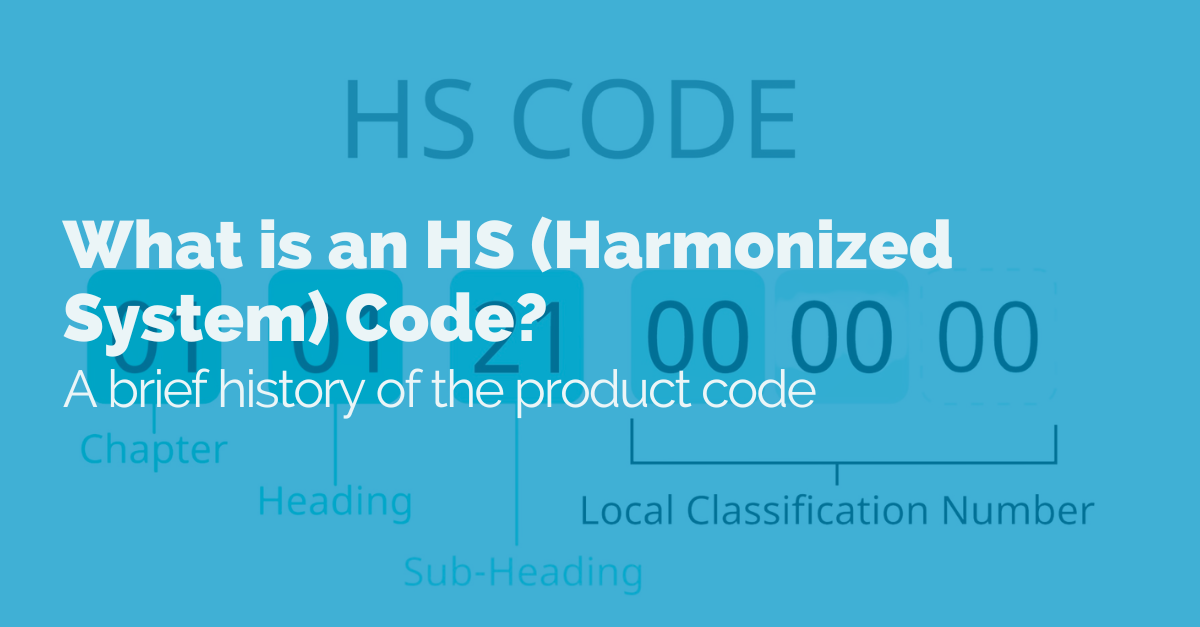

If you're in the business of importing or exporting kitchen gas lighters, one of the most important things to know is the HS code for your product. HS code, or Harmonized System code, is an internationally recognized system for classifying goods based on their nature, type, and use. It is used by customs authorities and international trade organizations to facilitate the trade of goods and ensure consistency in tariff classification. In this article, we'll take a closer look at the HS code for kitchen gas lighters and its implications for your business.1. HS Code for Kitchen Gas Lighter - Understanding the Basics

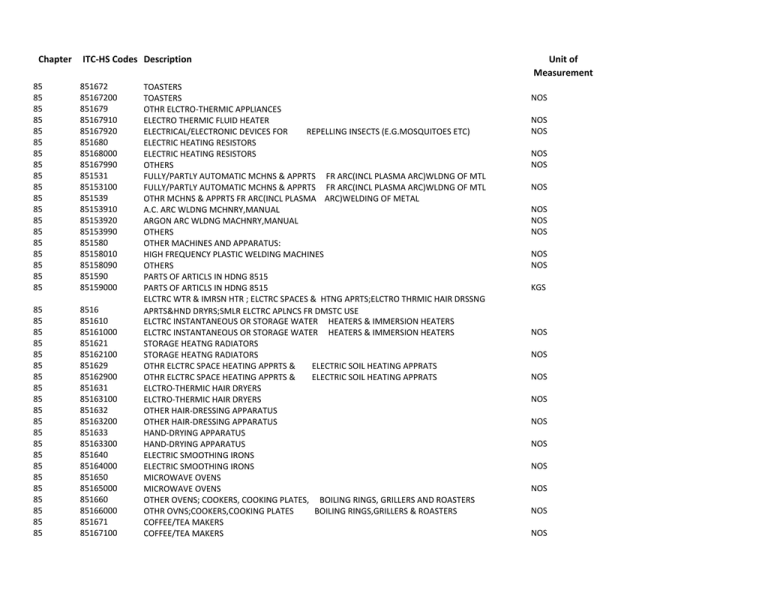

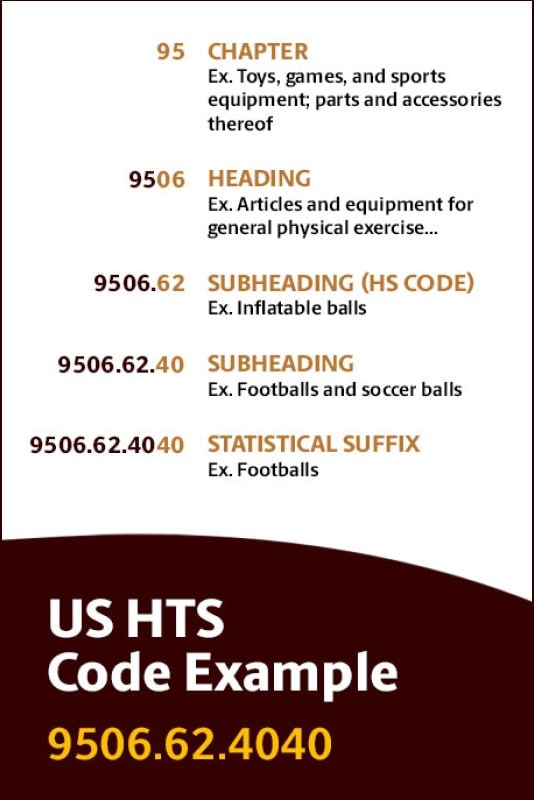

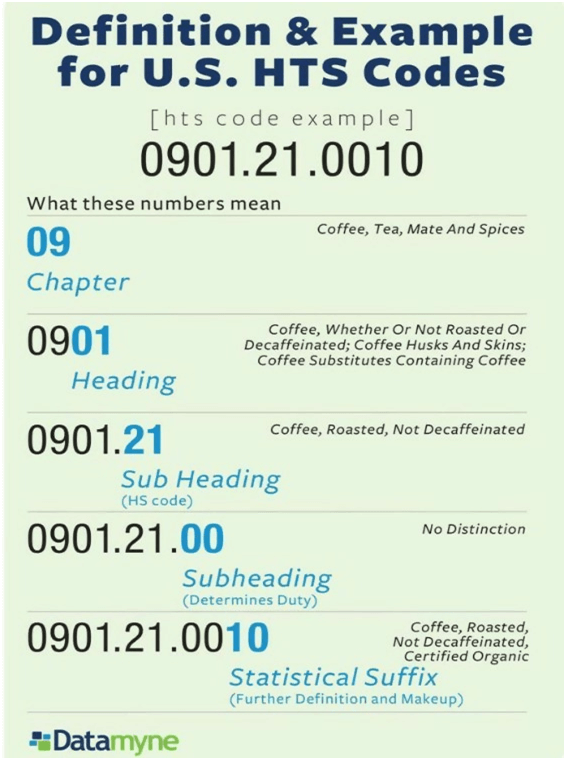

The HS code for gas lighters falls under the category of 9613, which is specifically for lighters and other similar devices. The first two digits, 96, represent the chapter for miscellaneous manufactured articles, while the third digit, 1, identifies the heading for lighters. The fourth digit, 3, is the subheading for gas lighters specifically. This code is internationally recognized and used by more than 200 countries, making it an essential code to know for international trade.2. HS Code for Gas Lighter - A Closer Look at the Numbers

One of the key factors in determining the HS code for a kitchen gas lighter is its intended use. The HS code for kitchen lighters is 9613.10, which is the subheading for gas lighters designed for use in the kitchen. This code is important to note as it may have different tariff rates compared to other types of lighters, such as cigarette lighters, which fall under a different subheading.3. HS Code for Kitchen Lighter - Classifying by Use

Knowing the HS code for your kitchen gas lighter is crucial when it comes to importing or exporting the product. The HS code will determine the tariff rates that will be applied to your product, as well as any restrictions or regulations that may apply. It is important to consult with your local customs authority or a trade specialist to ensure that you have the correct HS code for your product.4. Gas Lighter HS Code - Implications for Import and Export

When importing or exporting your kitchen gas lighter, you will need to include the HS code on all shipping and customs documents. This will ensure that your product is properly classified and that the correct tariff rates are applied. Failure to provide the correct HS code may result in delays, penalties, or even rejection of your shipment.5. Kitchen Gas Lighter Code - Importing and Exporting Made Easy

The HS code for kitchen gas lighters will also be used during the import process. When your product arrives in the destination country, customs officials will refer to the HS code to determine the appropriate taxes and duties that will be applied to your shipment. It is important to provide accurate and up-to-date information to avoid any issues or delays.6. HS Code for Kitchen Gas Lighter Import - Navigating the Process

If you are exporting your kitchen gas lighter, the HS code will also be used by customs officials in the destination country. They will use the code to classify your product and determine any tariff rates or restrictions that may apply. It is important to research and understand the HS code requirements for the country you are exporting to.7. HS Code for Kitchen Gas Lighter Export - Understanding the Requirements

As a business owner, it is your responsibility to ensure that your kitchen gas lighters are properly classified and have the correct HS code when going through customs. Failure to do so may result in penalties or delays, which can have a negative impact on your business. It is important to stay informed and up-to-date on any changes or updates to HS codes and customs regulations.8. HS Code for Kitchen Gas Lighter Customs - Knowing Your Obligations

The HS code for your kitchen gas lighter will also determine the tariff rates that will be applied to your product. Tariffs are taxes on imported goods and can vary depending on the HS code, country of origin, and other factors. By knowing the HS code for your product, you can accurately calculate the costs of importing or exporting your kitchen gas lighter.9. HS Code for Kitchen Gas Lighter Tariff - Calculating the Costs

In addition to tariffs, the HS code for your kitchen gas lighter may also determine if any other fees or duties will be applied to your product. These fees may include anti-dumping duties, countervailing duties, or other types of taxes. It is important to research and understand the implications of the HS code for your product to avoid any unexpected costs.10. HS Code for Kitchen Gas Lighter Duty - Understanding the Fees

The Importance of Kitchen Gas Lighters in House Design

Efficiency and Convenience

In the world of modern house design, practicality and efficiency are key factors. This is where the use of

kitchen gas lighters

comes in. Gone are the days of struggling with matches or traditional lighters to ignite your gas stove. With a simple click, a gas lighter provides an instant and steady flame, making cooking a hassle-free experience. This not only saves time but also ensures safety as there is no need to keep flammable items like matches or lighters in the kitchen.

In the world of modern house design, practicality and efficiency are key factors. This is where the use of

kitchen gas lighters

comes in. Gone are the days of struggling with matches or traditional lighters to ignite your gas stove. With a simple click, a gas lighter provides an instant and steady flame, making cooking a hassle-free experience. This not only saves time but also ensures safety as there is no need to keep flammable items like matches or lighters in the kitchen.

Design and Aesthetics

Apart from functionality, the design and aesthetics of a house also play a crucial role.

Kitchen gas lighters

come in a variety of styles and designs, making them a perfect addition to any modern kitchen. They are sleek, compact, and can easily blend in with any kitchen decor. With their clean and sophisticated look, they add a touch of elegance to the overall design of the kitchen.

Apart from functionality, the design and aesthetics of a house also play a crucial role.

Kitchen gas lighters

come in a variety of styles and designs, making them a perfect addition to any modern kitchen. They are sleek, compact, and can easily blend in with any kitchen decor. With their clean and sophisticated look, they add a touch of elegance to the overall design of the kitchen.

A Cost-Effective Option

In today's world, where every penny counts, opting for

kitchen gas lighters

can save you money in the long run. They are a cost-effective option compared to traditional methods of lighting a gas stove. With their durability and long lifespan, they eliminate the need for constantly buying matches or refillable lighters, making them a more budget-friendly choice.

In today's world, where every penny counts, opting for

kitchen gas lighters

can save you money in the long run. They are a cost-effective option compared to traditional methods of lighting a gas stove. With their durability and long lifespan, they eliminate the need for constantly buying matches or refillable lighters, making them a more budget-friendly choice.

Safe and Durable

Safety is always a top priority when it comes to house design.

Kitchen gas lighters

are designed to be safe and reliable. They come with child-lock features, ensuring that they cannot be accidentally lit by children. Moreover, they are also durable and can withstand daily wear and tear, making them a practical choice for any household.

In conclusion,

kitchen gas lighters

are an essential and practical addition to any modern house design. They offer efficiency, convenience, and safety, while also adding to the overall aesthetics of the kitchen. With their cost-effectiveness and durability, they are a smart choice for any household. So why wait? Upgrade your kitchen design with a stylish and functional gas lighter today.

Safety is always a top priority when it comes to house design.

Kitchen gas lighters

are designed to be safe and reliable. They come with child-lock features, ensuring that they cannot be accidentally lit by children. Moreover, they are also durable and can withstand daily wear and tear, making them a practical choice for any household.

In conclusion,

kitchen gas lighters

are an essential and practical addition to any modern house design. They offer efficiency, convenience, and safety, while also adding to the overall aesthetics of the kitchen. With their cost-effectiveness and durability, they are a smart choice for any household. So why wait? Upgrade your kitchen design with a stylish and functional gas lighter today.