If you're in the market for a new mattress in Pennsylvania, you may be wondering if you'll have to pay sales tax on your purchase. The answer is yes, there is a sales tax on mattresses in Pennsylvania.Is there sales tax on mattresses in Pennsylvania?

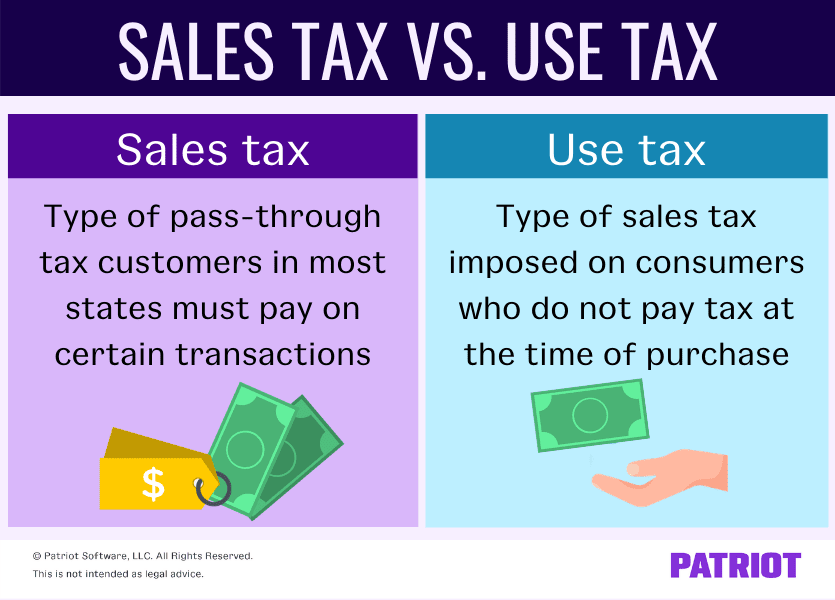

The state of Pennsylvania imposes a sales tax on most tangible personal property, including mattresses. This means that when you make a purchase of a mattress in Pennsylvania, you will be required to pay a sales tax on the total cost of the mattress.Yes, there is a sales tax on mattresses in Pennsylvania.

The sales tax rate for mattresses in Pennsylvania is currently 6%. This rate applies to the total cost of the mattress, including any delivery or installation fees. This sales tax rate is the same for all types and sizes of mattresses, whether you're purchasing a twin or a king size.Pennsylvania sales tax on mattresses

When purchasing a mattress in Pennsylvania, you will see the sales tax added to your total cost at the time of purchase. This tax is collected by the seller and then remitted to the state of Pennsylvania. It is important to note that the sales tax rate for mattresses in Pennsylvania may change, so it's always a good idea to check the current rate before making a purchase.PA mattress sales tax

The sales tax rate for mattresses in Pennsylvania is currently 6%. This rate applies to the total cost of the mattress, including any delivery or installation fees. This means that if you purchase a mattress for $1,000 in Pennsylvania, you will pay a sales tax of $60.How much is the sales tax on mattresses in Pennsylvania?

The sales tax rate for mattresses in Pennsylvania is currently 6%. This rate applies to the total cost of the mattress, including any delivery or installation fees. This tax rate may change in the future, so it's important to stay informed on any updates or changes to the rate.Pennsylvania mattress tax rate

Yes, if you purchase a mattress in Pennsylvania, you will be required to pay sales tax on the total cost of the mattress. This sales tax is collected by the seller and then remitted to the state of Pennsylvania.Do I have to pay sales tax on a mattress in Pennsylvania?

It's important to note that in addition to the sales tax on mattresses in Pennsylvania, there may also be other taxes or fees associated with your purchase. For example, if you are having your old mattress removed and disposed of by the seller, there may be a separate disposal fee that is subject to tax. It's always a good idea to ask the seller about any additional fees or taxes that may apply to your mattress purchase.PA mattress tax laws

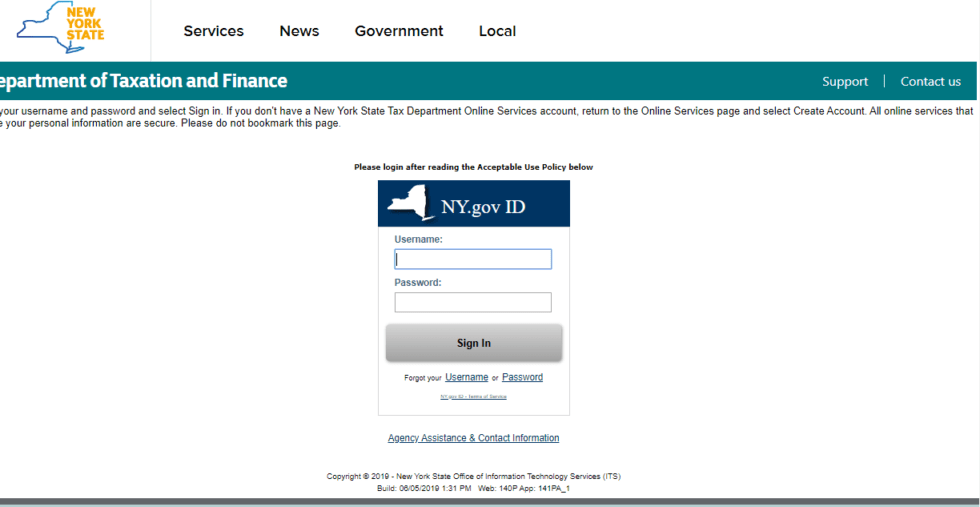

The sales tax on mattresses in Pennsylvania is just one aspect of the state's tax laws. It's important to stay informed on any updates or changes to these laws, as they can affect your mattress purchase and other purchases in the state. If you have any questions about the sales tax on mattresses in Pennsylvania, you can contact the Pennsylvania Department of Revenue for more information.Sales tax on mattresses in PA

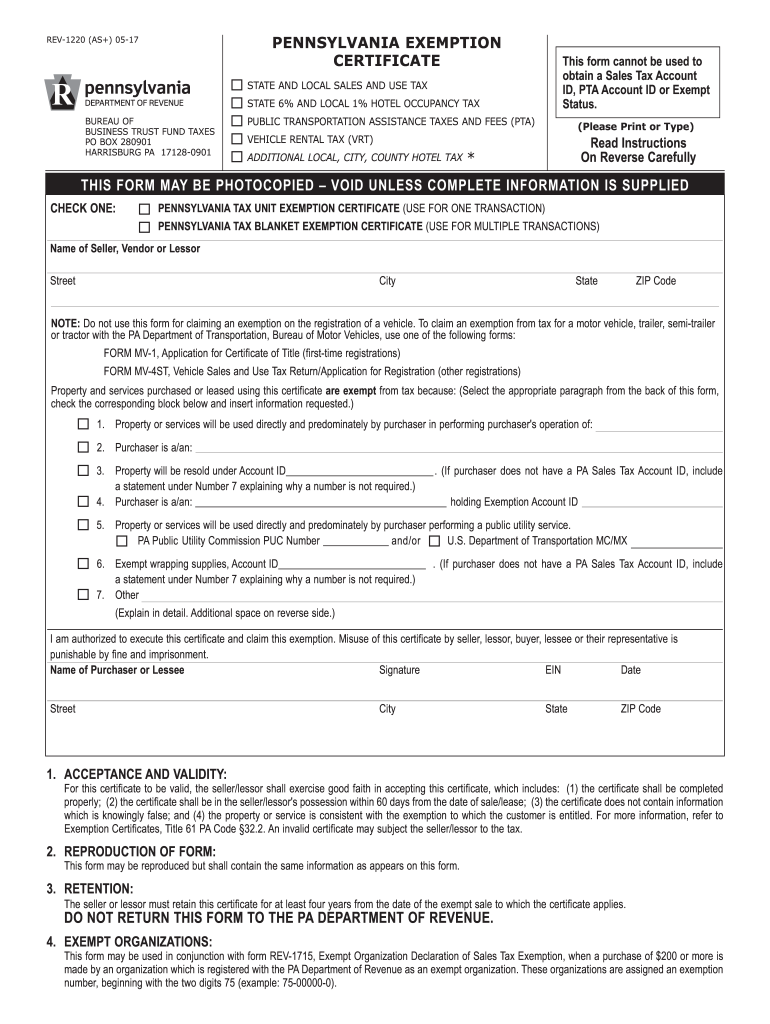

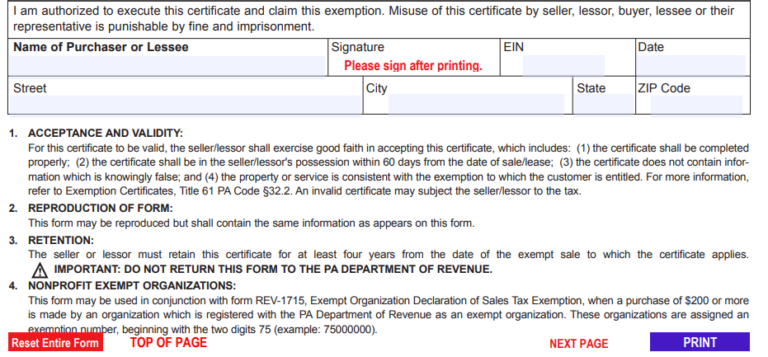

There are some instances in which you may be exempt from paying sales tax on a mattress in Pennsylvania. For example, if you are purchasing a mattress for resale, you may be able to provide a valid resale certificate to the seller and not be charged sales tax. Additionally, certain organizations, such as charities or religious organizations, may also be exempt from paying sales tax on a mattress purchase. It's best to check with the Pennsylvania Department of Revenue for more information on tax exemptions for mattress purchases.Pennsylvania mattress tax exemption

The Impact of Sales Tax on Mattresses in Pennsylvania

.jpg#keepProtocol)