HSN Code for Foam Mattress

HSN code, or Harmonized System of Nomenclature, is a code system used to classify goods for taxation purposes. For foam mattresses, the HSN code falls under the category of bedding and mattresses and is used for both domestic and international trade. Here are the top 10 HSN codes for foam mattresses that you need to know.

HSN Code for Foam Mattress in India

In India, the HSN code for foam mattresses is 94042990. This code is used for all types of foam mattresses, including memory foam, latex foam, and polyurethane foam. It is important to note that the HSN code for a product may vary depending on its composition, size, and other factors.

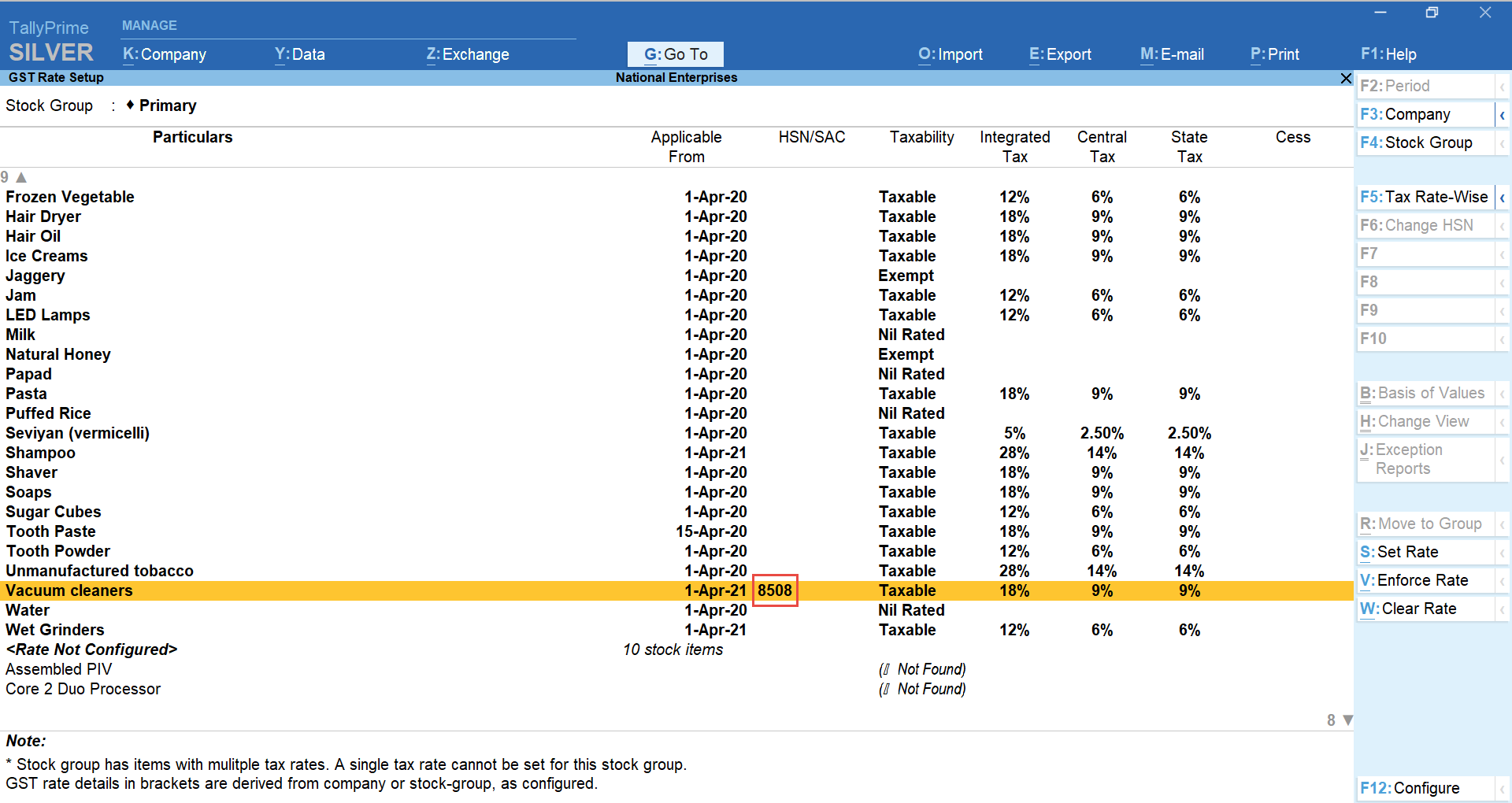

HSN Code for Foam Mattress in GST

With the implementation of the Goods and Services Tax (GST) in India, the HSN code for foam mattresses is now used to determine the applicable tax rate. The GST rate for foam mattresses is 18%, which includes 9% for CGST and 9% for SGST.

HSN Code for Foam Mattress in Export

For exporting foam mattresses from India, the HSN code is important for customs and taxation purposes. The HSN code for foam mattresses in export is the same as the code used for domestic trade, which is 94042990.

HSN Code for Foam Mattress in Import

When importing foam mattresses into India, the HSN code is used to determine the applicable customs duty. The HSN code for foam mattresses in import is also 94042990, but the duty rate may vary depending on the country of origin and other factors.

HSN Code for Foam Mattress in Manufacturing

For manufacturers of foam mattresses, the HSN code is used for invoicing and tax purposes. The HSN code for foam mattresses in manufacturing is 94042990, and it is important to ensure that the correct code is used to avoid any issues with taxation.

HSN Code for Foam Mattress in Retail

Retailers of foam mattresses also need to use the correct HSN code for taxation purposes. The HSN code for foam mattresses in retail is 94042990, and it is important to display this code on invoices and bills to comply with tax regulations.

HSN Code for Foam Mattress in Wholesale

Wholesale traders of foam mattresses also need to use the correct HSN code for taxation purposes. The HSN code for foam mattresses in wholesale is 94042990, and it is important to mention this code in all invoices and documents related to sales and purchases.

HSN Code for Foam Mattress in E-commerce

E-commerce platforms that sell foam mattresses also need to use the correct HSN code for taxation purposes. The HSN code for foam mattresses in e-commerce is 94042990, and it is important to mention this code in product descriptions and invoices.

HSN Code for Foam Mattress in Online Sales

For online sales of foam mattresses, the HSN code is used for taxation purposes. The HSN code for foam mattresses in online sales is 94042990, and it is important to mention this code in product descriptions and invoices to ensure compliance with tax regulations.

In conclusion, the HSN code for foam mattresses is an important factor to consider for taxation and trade purposes. It is crucial to use the correct code to avoid any issues with taxes and customs duties. Make sure to keep these top 10 HSN codes for foam mattresses in mind for all your foam mattress-related transactions.

Understanding the HSN Code for Foam Mattress

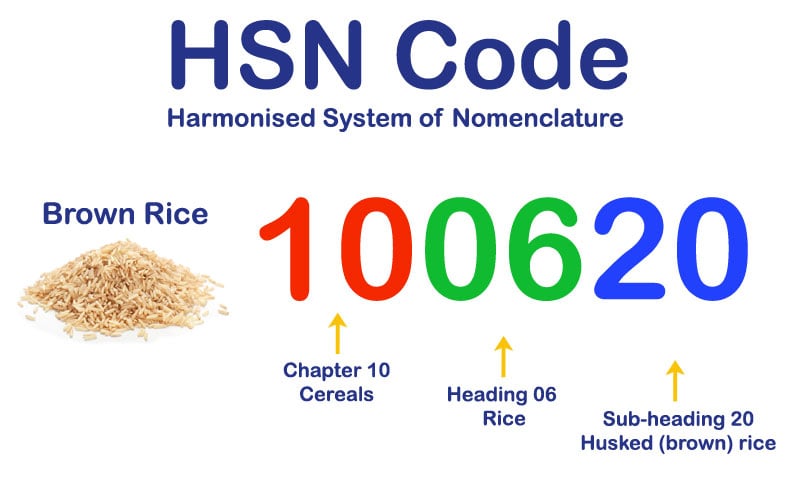

What is HSN Code?

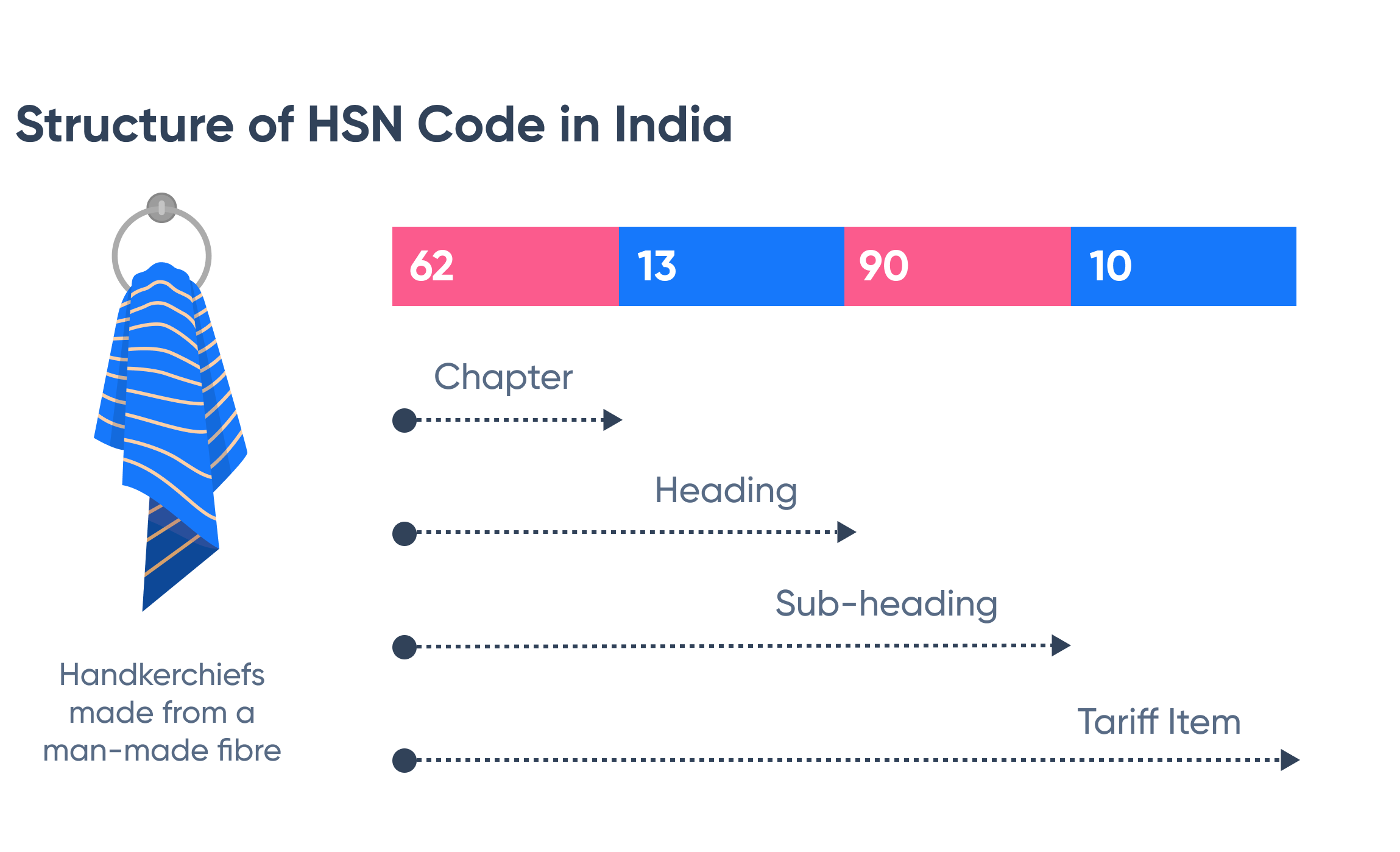

Before we dive into the specific HSN code for foam mattresses, it's important to understand what HSN code actually means. HSN stands for Harmonized System of Nomenclature and is a multi-purpose international product nomenclature developed by the World Customs Organization (WCO). This code is used to classify goods for taxation, customs, and statistical purposes.

Before we dive into the specific HSN code for foam mattresses, it's important to understand what HSN code actually means. HSN stands for Harmonized System of Nomenclature and is a multi-purpose international product nomenclature developed by the World Customs Organization (WCO). This code is used to classify goods for taxation, customs, and statistical purposes.

The Importance of HSN Code for Foam Mattress

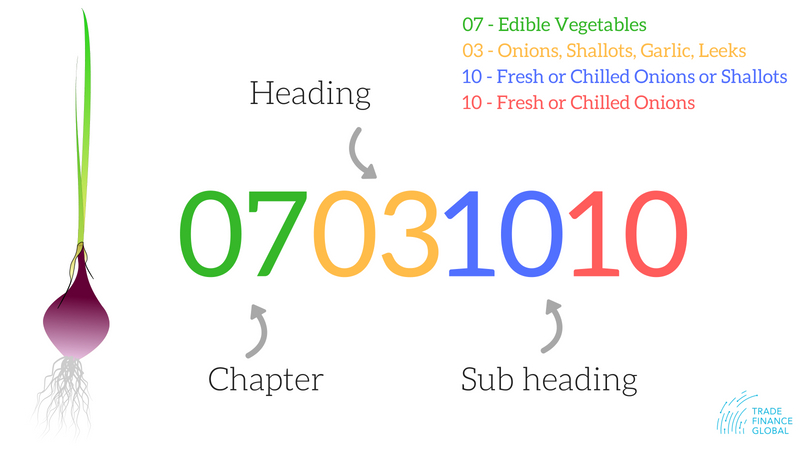

Now that we have a basic understanding of HSN code, let's focus on its significance for foam mattresses. In simple terms, the HSN code for foam mattresses is a unique 8-digit code assigned to this particular product. This code is used by businesses and governments to accurately classify and identify foam mattresses for import and export purposes. It also helps in determining the applicable tax rate and trade policies for these mattresses.

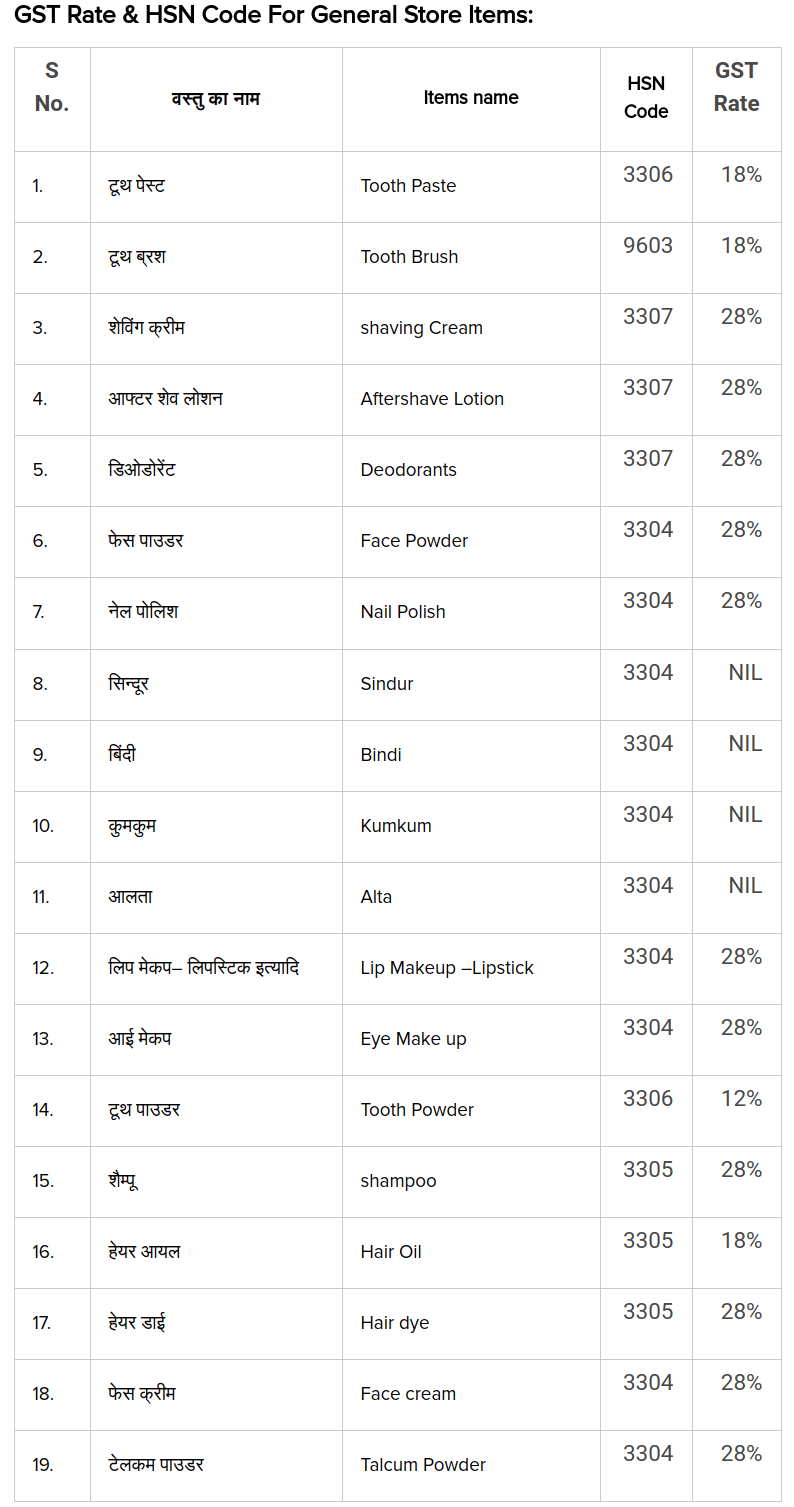

Some common HSN codes for foam mattresses are:

Now that we have a basic understanding of HSN code, let's focus on its significance for foam mattresses. In simple terms, the HSN code for foam mattresses is a unique 8-digit code assigned to this particular product. This code is used by businesses and governments to accurately classify and identify foam mattresses for import and export purposes. It also helps in determining the applicable tax rate and trade policies for these mattresses.

Some common HSN codes for foam mattresses are:

- 94041010 - Innerspring mattresses

- 94042910 - Other mattresses, stuffed or internally filled

- 94042990 - Other mattresses, not stuffed or internally filled

How to Find the Correct HSN Code for Foam Mattresses

Finding the right HSN code for your foam mattress may seem like a daunting task, but it can be easily done with a little bit of research. The first step is to determine the type of foam mattress you have - is it an innerspring, memory foam, or latex foam mattress? Once you have identified the type, you can use the HSN code list provided by the government to find the specific code for your mattress.

Tip:

It's important to double-check the HSN code before using it for any legal or taxation purposes to avoid any discrepancies.

Finding the right HSN code for your foam mattress may seem like a daunting task, but it can be easily done with a little bit of research. The first step is to determine the type of foam mattress you have - is it an innerspring, memory foam, or latex foam mattress? Once you have identified the type, you can use the HSN code list provided by the government to find the specific code for your mattress.

Tip:

It's important to double-check the HSN code before using it for any legal or taxation purposes to avoid any discrepancies.

In Conclusion

Knowing the correct HSN code for foam mattresses is crucial for businesses and individuals involved in the trade of these products. It not only helps in proper taxation and customs procedures but also ensures smooth international trade. So, make sure to do your due diligence and use the correct HSN code for your foam mattress to avoid any complications.

Knowing the correct HSN code for foam mattresses is crucial for businesses and individuals involved in the trade of these products. It not only helps in proper taxation and customs procedures but also ensures smooth international trade. So, make sure to do your due diligence and use the correct HSN code for your foam mattress to avoid any complications.