If you're a homeowner, you know the importance of having insurance to protect your property and belongings. But have you ever considered whether your bathroom vanity is covered under your homeowners insurance policy? In this article, we'll dive into the details of what is and isn't covered when it comes to your bathroom vanity, and what you can do to ensure you have the right coverage in place.Insuring Your Bathroom Vanity with Homeowners Insurance: What You Need to Know

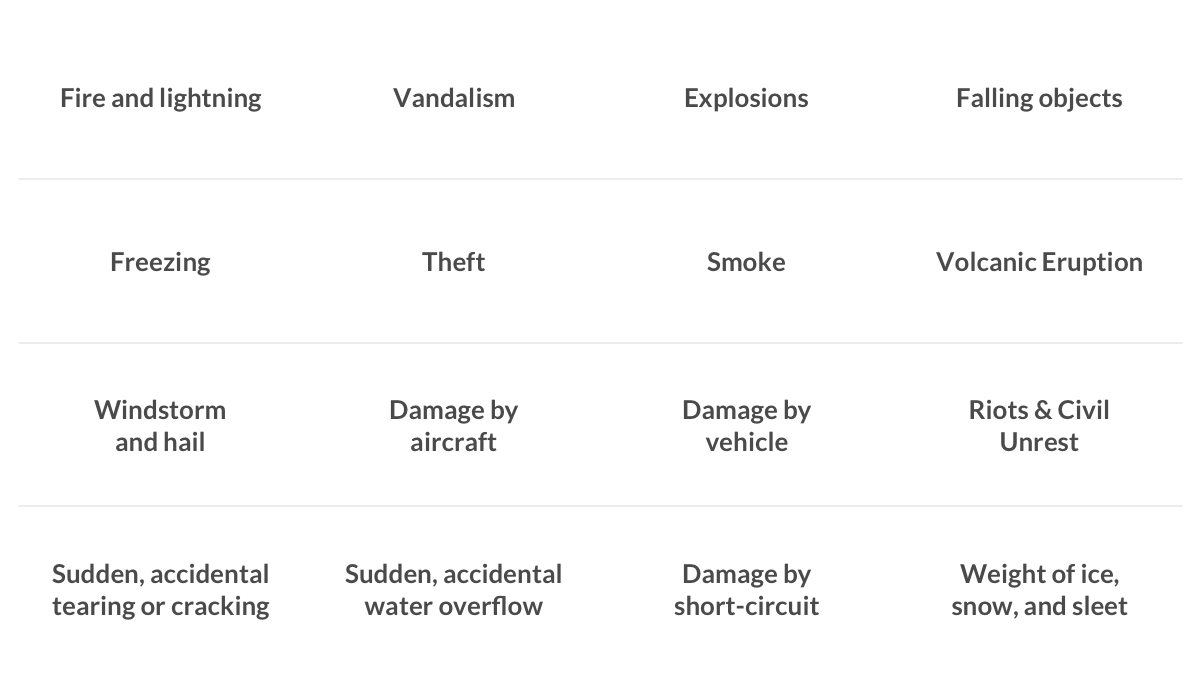

When it comes to your bathroom vanity, there are two main types of coverage to consider: damage and replacement. Damage coverage will protect your vanity in case of accidental damage, such as a leaky pipe causing water damage or a careless guest causing a crack. Replacement coverage, on the other hand, will cover the cost of replacing your vanity if it is damaged beyond repair or stolen.Understanding Homeowners Insurance Bathroom Vanity Coverage

If you do experience damage to your bathroom vanity, the first step is to file a claim with your homeowners insurance. This usually involves contacting your insurance company and providing them with details of the damage, including photos and a description of the incident. It's important to act quickly, as most insurance companies have a time limit for filing a claim.Filing a Bathroom Vanity Claim with Your Homeowners Insurance

When it comes to homeowners insurance, there are a few factors that could affect your coverage for your bathroom vanity. These include the age of your vanity, the material it is made of, and any previous claims you have made. If your vanity is older or made of a more expensive material, you may need to purchase additional coverage to ensure it is fully protected.Factors That Could Affect Your Coverage

If you do have an older or more expensive bathroom vanity, you may want to consider adding additional coverage to your homeowners insurance policy. This could include a rider or endorsement specifically for your vanity, or increasing your overall coverage for personal property. Be sure to speak with your insurance provider to determine the best option for your specific needs.Adding Additional Coverage for Your Bathroom Vanity

While insurance coverage is important, it's also crucial to take good care of your bathroom vanity in order to prevent damage in the first place. This includes regular maintenance, such as fixing leaks and cleaning up spills, as well as being cautious with heavy objects and using proper cleaning products. Taking these precautions can help prevent costly damage to your vanity and keep your insurance premiums low.The Importance of Regular Maintenance and Care

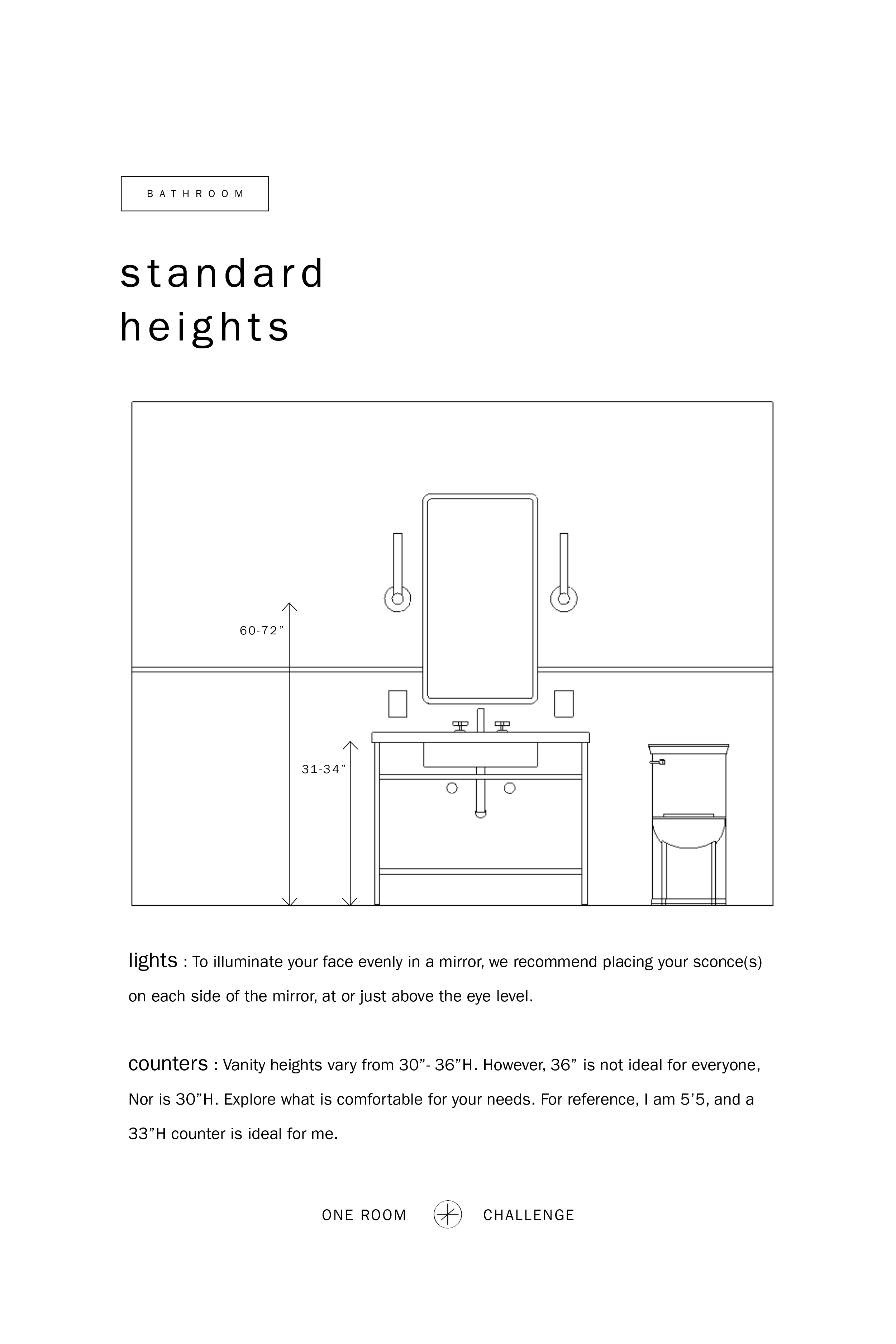

If you're planning on renovating your bathroom and installing a new vanity, it's important to update your homeowners insurance policy to ensure it is properly covered. This may require additional coverage or a rider specifically for the new vanity, depending on its value and material. Be sure to speak with your insurance provider before beginning any renovations to ensure you have the right coverage in place.Updating Your Homeowners Insurance Policy for Bathroom Renovations

When shopping for homeowners insurance, it's important to consider the coverage for your bathroom vanity. Look for policies that offer comprehensive damage and replacement coverage, as well as options for additional coverage if needed. It's also a good idea to compare quotes from multiple insurance providers to ensure you're getting the best coverage for the best price.Choosing the Right Homeowners Insurance for Your Bathroom Vanity

Your bathroom vanity may seem like a small aspect of your home, but it's important to have proper insurance coverage in case of damage or theft. Be sure to review your homeowners insurance policy and consider adding additional coverage if needed. And don't forget to take good care of your vanity to prevent any unnecessary claims and keep your insurance premiums low.The Bottom Line on Homeowners Insurance for Your Bathroom Vanity

By understanding the coverage options for your bathroom vanity and taking the necessary precautions, you can rest easy knowing that it is protected under your homeowners insurance policy. Remember to update your policy as needed, and always shop around for the best coverage and price. With the right insurance in place, you can enjoy your beautiful bathroom vanity without worrying about what could go wrong.In Conclusion

The Importance of Properly Insuring Your Bathroom Vanity

Why Homeowners Insurance Should Include Bathroom Vanities

When it comes to protecting your home, homeowners insurance is a crucial investment. It provides coverage for damages and losses to your property, including your bathroom vanity. Many homeowners may overlook the importance of insuring their bathroom vanity, but it is an essential aspect of protecting your home and its contents.

Bathroom vanities

are considered

content

by homeowners insurance policies, which means they are items that can easily be moved and are not permanently attached to the structure of your home. This can include fixtures such as sinks, faucets, and cabinets, as well as any personal items stored within the vanity, such as toiletries and cosmetics.

When it comes to protecting your home, homeowners insurance is a crucial investment. It provides coverage for damages and losses to your property, including your bathroom vanity. Many homeowners may overlook the importance of insuring their bathroom vanity, but it is an essential aspect of protecting your home and its contents.

Bathroom vanities

are considered

content

by homeowners insurance policies, which means they are items that can easily be moved and are not permanently attached to the structure of your home. This can include fixtures such as sinks, faucets, and cabinets, as well as any personal items stored within the vanity, such as toiletries and cosmetics.

The Risks Faced by Bathroom Vanities

Bathroom vanities are constantly exposed to moisture and humidity, making them vulnerable to damage. Water leaks from pipes or fixtures can cause rotting and warping of the vanity's wooden components, while excess moisture can lead to mold growth. In addition, accidents can happen in the bathroom, such as dropping a heavy object on the vanity or spilling chemicals that can cause damage.

Properly insuring your bathroom vanity can protect you from these risks and provide coverage for repairs or replacements in the event of damage or loss.

Bathroom vanities are constantly exposed to moisture and humidity, making them vulnerable to damage. Water leaks from pipes or fixtures can cause rotting and warping of the vanity's wooden components, while excess moisture can lead to mold growth. In addition, accidents can happen in the bathroom, such as dropping a heavy object on the vanity or spilling chemicals that can cause damage.

Properly insuring your bathroom vanity can protect you from these risks and provide coverage for repairs or replacements in the event of damage or loss.

What to Consider When Insuring Your Bathroom Vanity

When choosing an insurance policy for your bathroom vanity, it is essential to consider the value of the vanity and its contents. This can include the cost of the vanity itself, as well as any personal items stored within it. It is also important to read and understand the coverage provided by your policy, as some may have limitations or exclusions for bathroom vanities.

In addition, it is crucial to regularly review and update your insurance policy to ensure that it adequately covers the value of your bathroom vanity and its contents. As you make changes or upgrades to your vanity, such as installing a new sink or countertop, it is essential to inform your insurance provider and adjust your coverage accordingly.

When choosing an insurance policy for your bathroom vanity, it is essential to consider the value of the vanity and its contents. This can include the cost of the vanity itself, as well as any personal items stored within it. It is also important to read and understand the coverage provided by your policy, as some may have limitations or exclusions for bathroom vanities.

In addition, it is crucial to regularly review and update your insurance policy to ensure that it adequately covers the value of your bathroom vanity and its contents. As you make changes or upgrades to your vanity, such as installing a new sink or countertop, it is essential to inform your insurance provider and adjust your coverage accordingly.

In Conclusion

In conclusion, insuring your bathroom vanity is a crucial aspect of protecting your home and its contents. By understanding the risks faced by bathroom vanities and choosing a comprehensive insurance policy, you can have peace of mind knowing that your vanity and its contents are covered in the event of damage or loss. Don't overlook the importance of properly insuring your bathroom vanity and make sure it is included in your homeowners insurance coverage.

In conclusion, insuring your bathroom vanity is a crucial aspect of protecting your home and its contents. By understanding the risks faced by bathroom vanities and choosing a comprehensive insurance policy, you can have peace of mind knowing that your vanity and its contents are covered in the event of damage or loss. Don't overlook the importance of properly insuring your bathroom vanity and make sure it is included in your homeowners insurance coverage.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)