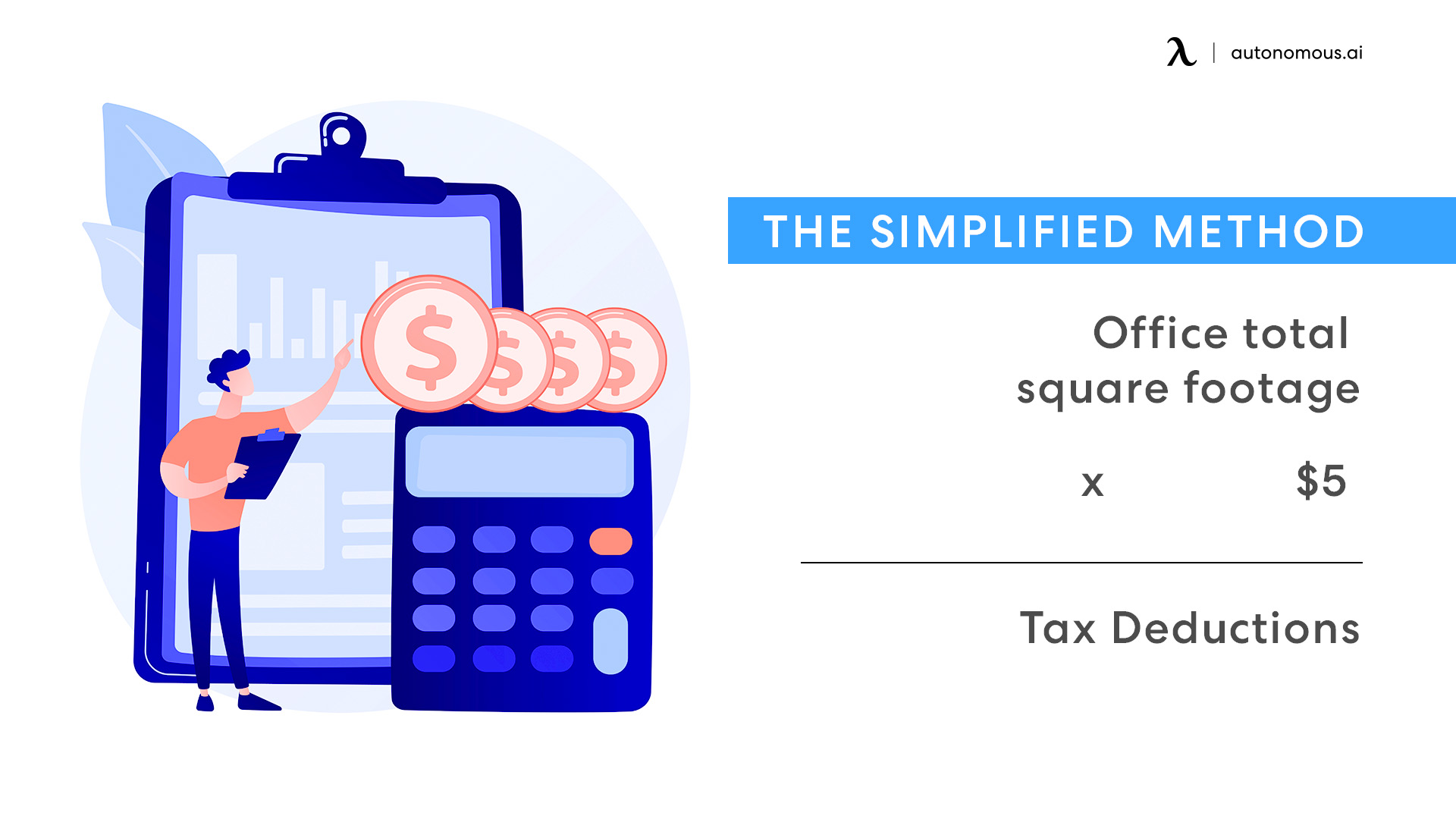

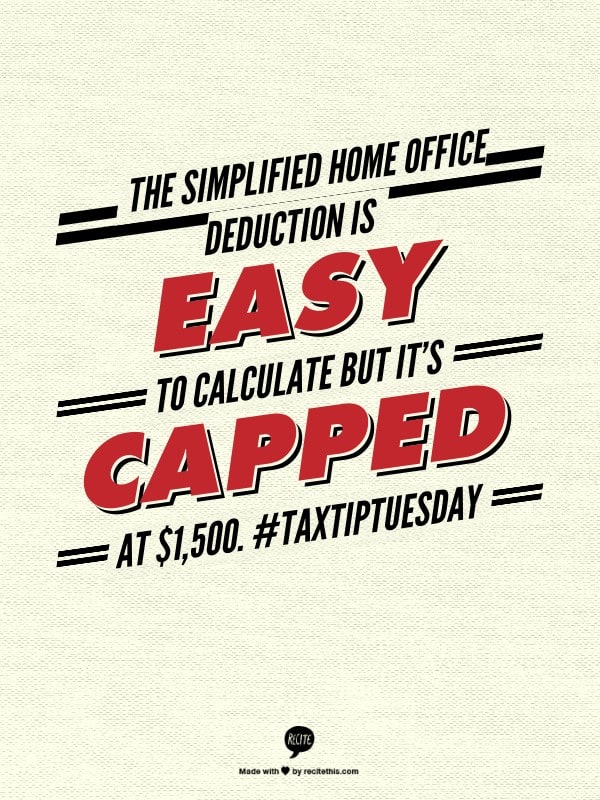

As a freelancer or self-employed individual, you may be eligible for the home office deduction, which allows you to deduct expenses related to the use of a home office on your tax return. However, there are two methods for claiming this deduction: the simplified method and the regular method. Each has its own benefits and requirements, so it's important to understand the differences before deciding which one to use. Main Keyword: Home Office Deduction Related Keywords: Simplified Method, Regular Method, Deduct Expenses, Freelancer, Self-Employed, Tax Return, Benefits, RequirementsHome Office Deduction: Simplified Method vs. Regular Method

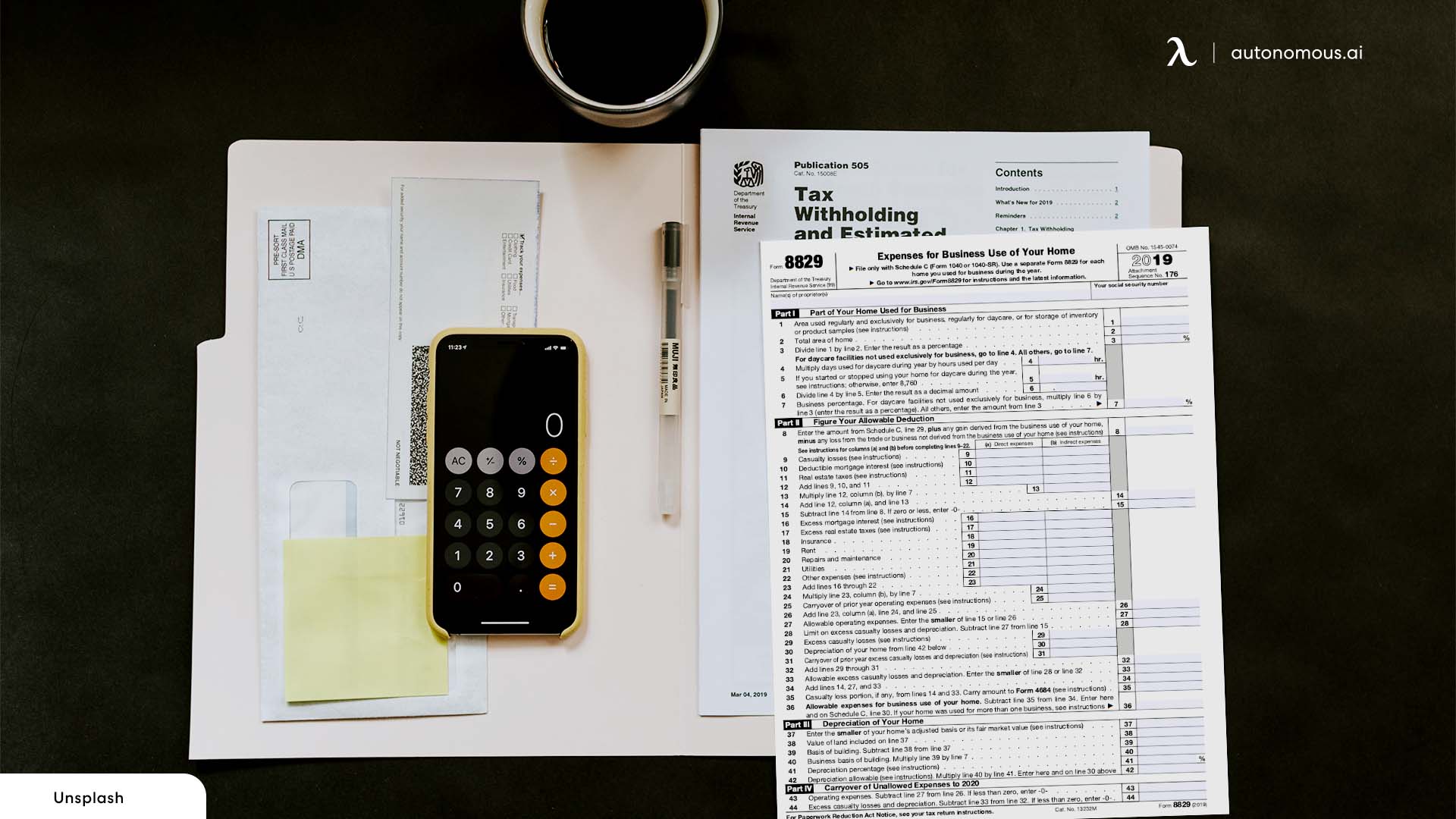

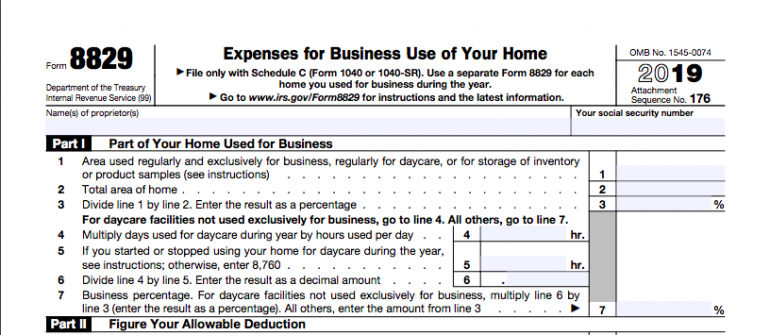

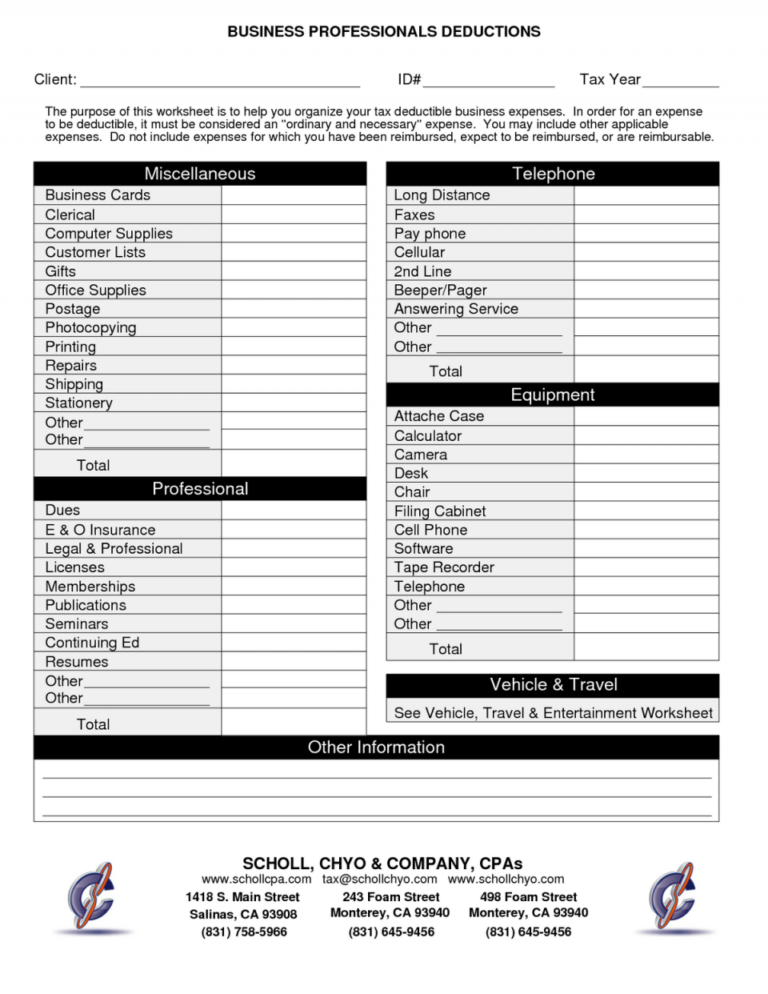

If you are eligible for the home office deduction, you can claim it by filling out Form 8829, Expenses for Business Use of Your Home, and attaching it to your tax return. The amount of your deduction will depend on which method you choose and how much of your home is used as a home office. It's important to keep detailed records of your home office expenses and use them to accurately calculate your deduction. Main Keyword: Claim the Home Office Deduction Related Keywords: Eligible, Form 8829, Business Use, Tax Return, Deduction, Method, Home Office Expenses, CalculateHow to Claim the Home Office Deduction

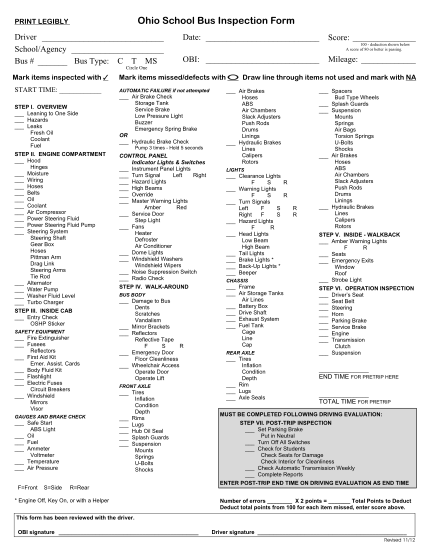

The IRS has specific rules and limits for claiming the home office deduction. These include using the space regularly and exclusively for business purposes, and meeting one of two tests: the regular use test or the principal place of business test. Additionally, there are limits on the amount that can be deducted based on the size of the home office and the income of the taxpayer. Main Keyword: IRS Home Office Deduction Related Keywords: Rules, Limits, Regularly, Exclusively, Business Purposes, Regular Use Test, Principal Place of Business Test, Deducted, Size, IncomeIRS Home Office Deduction: Rules and Limits

If you're considering claiming the home office deduction, there are a few key things you need to know. First, the space must be used regularly and exclusively for business purposes. Second, you must be able to support your deduction with documentation such as receipts and records. And finally, you should consult with a tax professional or use tax software to ensure you are claiming the deduction correctly. Main Keyword: Home Office Deduction Related Keywords: Regularly, Exclusively, Business Purposes, Documentation, Receipts, Records, Tax Professional, Tax Software, Claiming CorrectlyHome Office Deduction: What You Need to Know

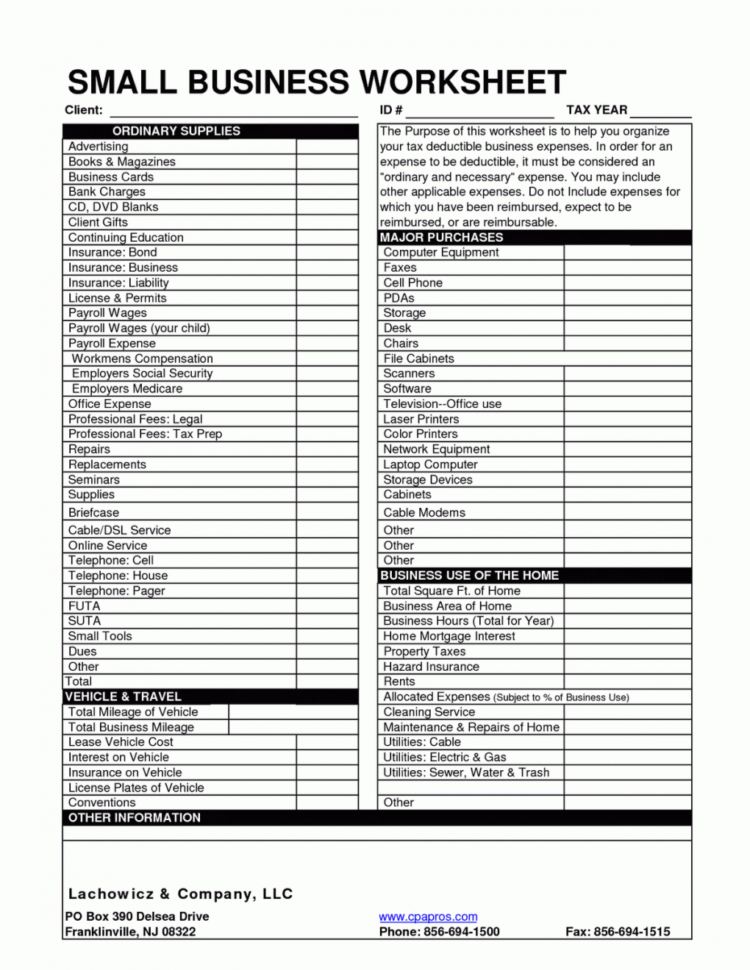

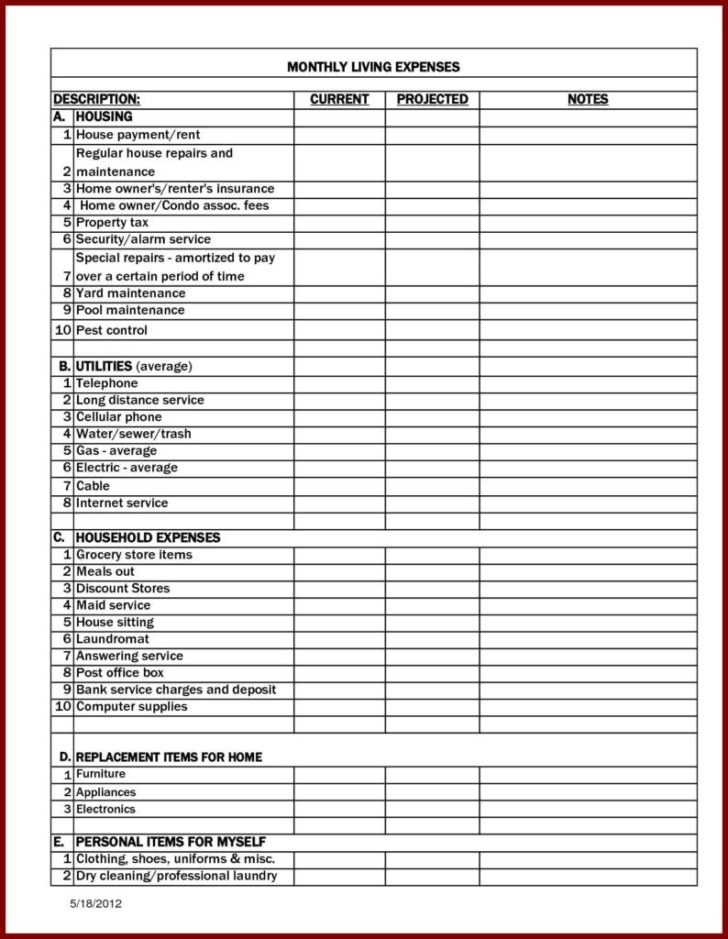

When claiming the home office deduction, it's important to maximize the amount you can deduct. This means keeping detailed records of all home office expenses, including rent or mortgage payments, utilities, and maintenance costs. Additionally, if you use a space in your home for both business and personal purposes, you can still deduct a portion of the expenses as long as the space is used regularly and exclusively for business purposes. Main Keyword: Maximizing Your Home Office Deduction Related Keywords: Detailed Records, Home Office Expenses, Rent, Mortgage Payments, Utilities, Maintenance Costs, Personal Purposes, Regularly, Exclusively, Business PurposesMaximizing Your Home Office Deduction

As a freelancer or self-employed individual, the home office deduction can provide significant tax savings. However, it can also be a complex process to understand and claim correctly. This guide will walk you through the key information you need to know about the deduction, including eligibility requirements, documentation needed, and tips for maximizing your deduction. Main Keyword: Home Office Deduction Related Keywords: Freelancers, Self-Employed, Tax Savings, Complex Process, Eligibility Requirements, Documentation, Tips, MaximizingHome Office Deduction: A Guide for Freelancers and Self-Employed Individuals

Calculating and claiming the home office deduction can be a daunting task, but it doesn't have to be. The key is to keep detailed records of all home office expenses, and use those records to accurately calculate the amount of your deduction. Additionally, make sure to consult with a tax professional or use tax software to ensure you are claiming the deduction correctly. Main Keyword: Calculate and Claim the Home Office Deduction Related Keywords: Daunting Task, Detailed Records, Home Office Expenses, Accurately Calculate, Tax Professional, Tax Software, Claiming CorrectlyHome Office Deduction: How to Calculate and Claim It

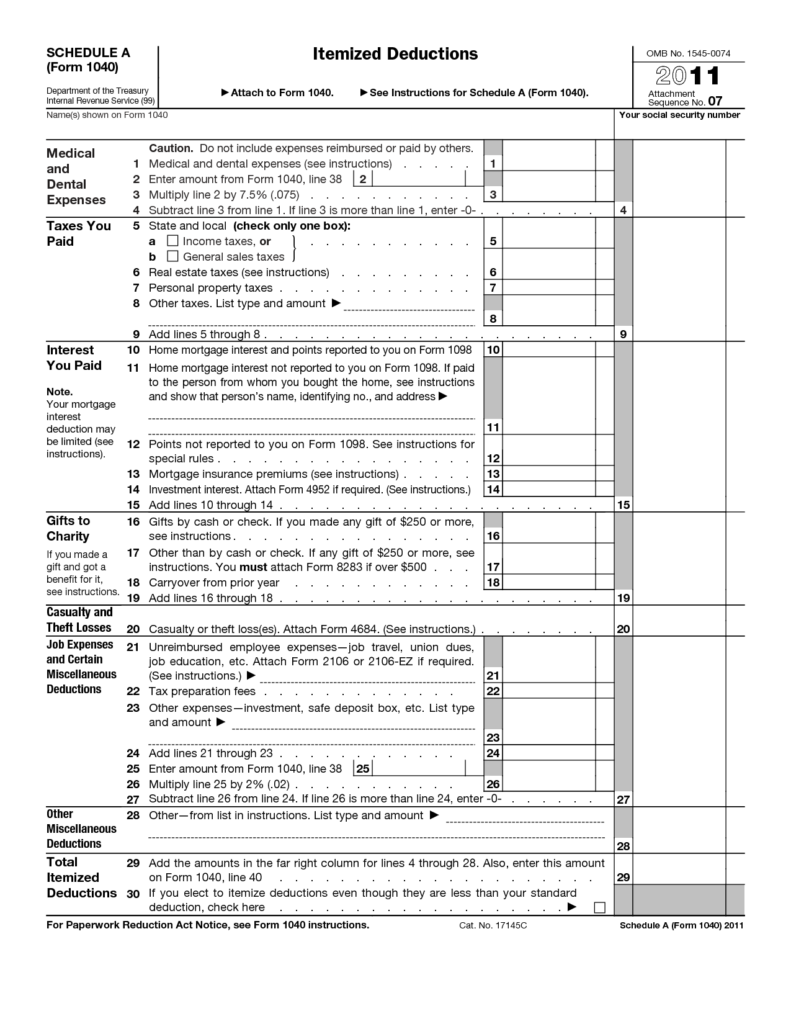

When claiming the home office deduction, it's important to know which expenses you can deduct. These include rent or mortgage payments, utilities, insurance, and maintenance costs. However, certain expenses, such as home improvements and personal expenses, are not deductible. It's important to keep detailed records and only deduct expenses that are directly related to your home office. Main Keyword: Home Office Deduction Expenses Related Keywords: Rent, Mortgage Payments, Utilities, Insurance, Maintenance Costs, Home Improvements, Personal Expenses, Deductible, Related to Home OfficeHome Office Deduction: What Expenses Can You Deduct?

If you're planning on claiming the home office deduction on your taxes, there are a few tips to keep in mind. First, make sure you meet all eligibility requirements and have the necessary documentation. Second, be consistent in your deductions year after year. And finally, consider consulting with a tax professional to ensure you are claiming the deduction correctly and getting the maximum tax benefit. Main Keyword: Tips for Claiming the Home Office Deduction Related Keywords: Planning, Eligibility Requirements, Documentation, Consistent, Deductions, Year after Year, Tax Professional, Claiming Correctly, Maximum Tax BenefitHome Office Deduction: Tips for Claiming It on Your Taxes

When claiming the home office deduction, there are some common mistakes that can result in a denied deduction or even an audit from the IRS. These include not meeting eligibility requirements, not keeping detailed records, and deducting personal expenses. To avoid these mistakes, make sure to thoroughly understand the rules and limits of the deduction and consult with a tax professional if needed. Main Keyword: Common Mistakes to Avoid when Claiming the Home Office Deduction Related Keywords: Denied Deduction, Audit, IRS, Eligibility Requirements, Detailed Records, Personal Expenses, Thoroughly Understand, Rules, Limits, Tax ProfessionalHome Office Deduction: Common Mistakes to Avoid

The Benefits of Creating a Home Office in Your Living Room

For many professionals and remote workers, having a designated space to work from home is essential. With the rise of telecommuting and flexible work arrangements, more and more people are looking to create a functional and comfortable home office. While some may have a spare room or dedicated office space, others may have limited space and need to get creative with their setup. One option that has become increasingly popular is utilizing the living room as a home office. In this article, we will explore the benefits of creating a home office in your living room, specifically focusing on the

home office deduction

and how it can benefit your overall house design.

For many professionals and remote workers, having a designated space to work from home is essential. With the rise of telecommuting and flexible work arrangements, more and more people are looking to create a functional and comfortable home office. While some may have a spare room or dedicated office space, others may have limited space and need to get creative with their setup. One option that has become increasingly popular is utilizing the living room as a home office. In this article, we will explore the benefits of creating a home office in your living room, specifically focusing on the

home office deduction

and how it can benefit your overall house design.

Maximizing Space and Functionality

One of the biggest advantages of having a home office in your living room is the ability to maximize space and functionality. With the use of

multifunctional furniture

and clever design, you can create a workspace that seamlessly blends into your living room without taking up too much space. This is especially useful for those living in smaller homes or apartments where space is limited. By converting a corner or unused area in your living room into a home office, you can create a functional and productive workspace without sacrificing the comfort and style of your living room.

One of the biggest advantages of having a home office in your living room is the ability to maximize space and functionality. With the use of

multifunctional furniture

and clever design, you can create a workspace that seamlessly blends into your living room without taking up too much space. This is especially useful for those living in smaller homes or apartments where space is limited. By converting a corner or unused area in your living room into a home office, you can create a functional and productive workspace without sacrificing the comfort and style of your living room.

Cost-Efficient Option

Another benefit of creating a home office in your living room is the cost-efficiency. Unlike building a separate office or renovating a spare room, utilizing your living room as a home office can save you a significant amount of money. Not only will you save on construction costs, but you can also take advantage of the

home office deduction

on your taxes. This allows you to deduct a portion of your rent or mortgage, utilities, and other home office-related expenses from your taxes. It's important to consult with a tax professional to ensure you qualify for this deduction and to learn about the specific guidelines and requirements.

Another benefit of creating a home office in your living room is the cost-efficiency. Unlike building a separate office or renovating a spare room, utilizing your living room as a home office can save you a significant amount of money. Not only will you save on construction costs, but you can also take advantage of the

home office deduction

on your taxes. This allows you to deduct a portion of your rent or mortgage, utilities, and other home office-related expenses from your taxes. It's important to consult with a tax professional to ensure you qualify for this deduction and to learn about the specific guidelines and requirements.

Aesthetic Appeal

:max_bytes(150000):strip_icc()/89880708-56a492bd5f9b58b7d0d79ce3.jpg) Lastly, creating a home office in your living room can add to the aesthetic appeal of your home. With the right design and decor, your home office can seamlessly blend in with the rest of your living room, creating a cohesive and stylish space. You can choose to incorporate

natural elements

such as plants, or opt for a more modern and minimalist look. The key is to find a design that not only meets your functional needs but also enhances the overall look and feel of your living room.

In conclusion, creating a home office in your living room can provide numerous benefits, from maximizing space and saving money to adding to the aesthetic appeal of your home. With the

home office deduction

available, it's a cost-efficient option that can also benefit your overall house design. So if you're in need of a home office but don't have a spare room, consider utilizing your living room and get creative with your design to create a functional and stylish workspace.

Lastly, creating a home office in your living room can add to the aesthetic appeal of your home. With the right design and decor, your home office can seamlessly blend in with the rest of your living room, creating a cohesive and stylish space. You can choose to incorporate

natural elements

such as plants, or opt for a more modern and minimalist look. The key is to find a design that not only meets your functional needs but also enhances the overall look and feel of your living room.

In conclusion, creating a home office in your living room can provide numerous benefits, from maximizing space and saving money to adding to the aesthetic appeal of your home. With the

home office deduction

available, it's a cost-efficient option that can also benefit your overall house design. So if you're in need of a home office but don't have a spare room, consider utilizing your living room and get creative with your design to create a functional and stylish workspace.

:max_bytes(150000):strip_icc()/200196510-001-56a0a4663df78cafdaa38959.jpg)