GST Rate on Foam Mattress

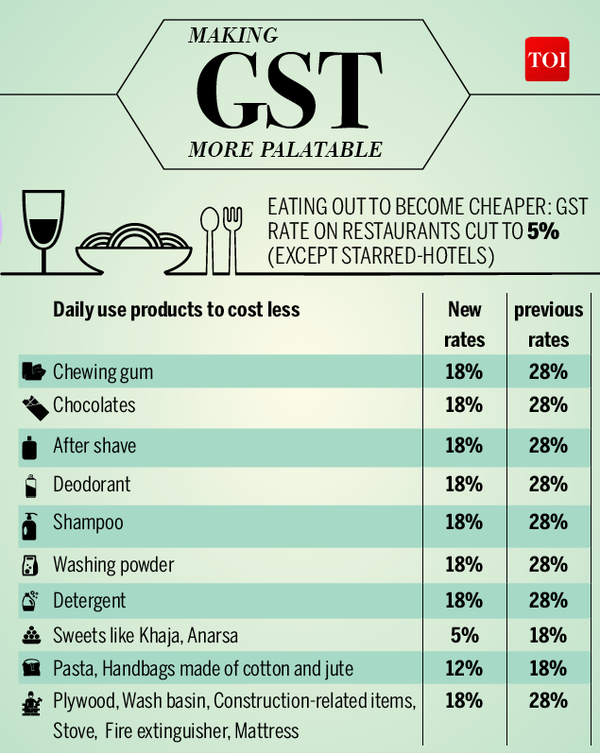

The Goods and Services Tax (GST) rate on foam mattresses is an important factor to consider when purchasing a new mattress for your home. The GST rate on foam mattresses is currently set at 18%, which means that you will have to pay an additional 18% on top of the mattress's base price. This may seem like a significant amount, but it is important to understand the reasons behind this rate and how it affects the final cost of your mattress.

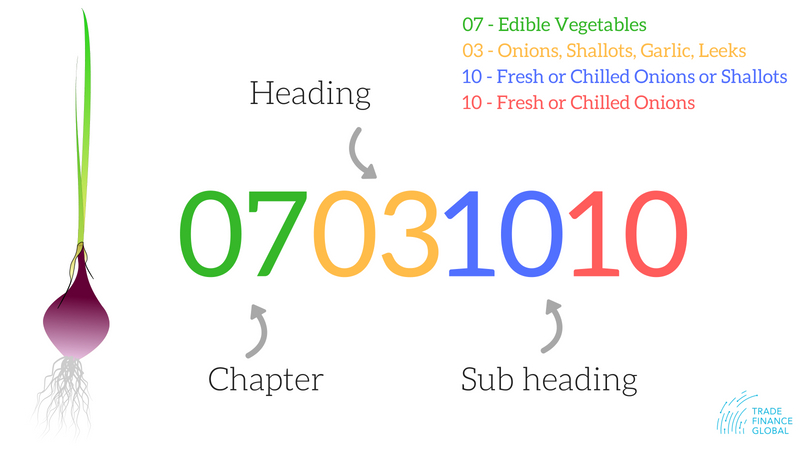

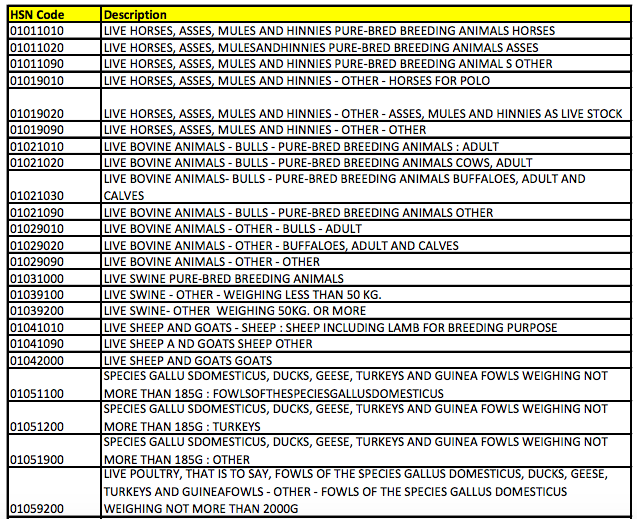

HSN Code for Foam Mattress

In order to understand the GST rate on foam mattresses, it is important to know the Harmonized System of Nomenclature (HSN) code for these products. The HSN code for foam mattresses is 9404, which falls under the category of "Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; lamps and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated buildings." This code is used to classify foam mattresses and determine the applicable GST rate.

GST Rate on Mattresses

The GST rate on mattresses, in general, is 18%, which includes all types of mattresses including foam, coir, spring, and memory foam. This rate was implemented in 2017 when the GST was introduced in India to replace the previous complex tax system. The government decided on a flat rate of 18% for most goods and services, including mattresses, to simplify the tax system and make it more transparent for consumers.

GST Rate on Bedding Products

The GST rate on bedding products, such as pillows, duvets, and mattress protectors, is also 18%. These products are considered essential components of a mattress and are thus subject to the same GST rate. This rate applies to all types of bedding products, including those made from foam, cotton, or other materials.

GST Rate on Furniture

As mentioned earlier, the HSN code for foam mattresses falls under the category of furniture. Therefore, the GST rate on furniture also applies to foam mattresses. The current GST rate on furniture is 18%, which includes all types of furniture, such as sofas, beds, tables, and chairs. This rate is applicable to both wooden and non-wooden furniture.

GST Rate on Home Furnishings

Home furnishings, which include items such as curtains, carpets, and rugs, also fall under the 18% GST rate category. These products are often used in conjunction with foam mattresses to enhance the overall comfort and aesthetic of a bedroom. Therefore, it is important to factor in the GST rate on home furnishings when purchasing a foam mattress.

GST Rate on Bedroom Furniture

Bedroom furniture, which includes beds, wardrobes, and dressers, also falls under the 18% GST rate category. These items are essential for creating a comfortable and functional bedroom, and the GST rate must be considered when purchasing a foam mattress. It is important to note that the GST rate on furniture may vary depending on the material used and the type of furniture.

GST Rate on Household Goods

Household goods, which include items such as kitchenware, utensils, and appliances, also fall under the 18% GST rate category. While these items may not seem directly related to foam mattresses, they are essential for creating a comfortable and functional home, and the GST rate must be taken into account when making a purchase.

GST Rate on Sleeping Products

Products that are specifically designed for sleeping, such as pillows, mattresses, and bed linens, fall under the 18% GST rate category. The government has identified these products as essential for a good night's sleep and has thus kept the GST rate consistent across all types of sleeping products.

GST Rate on Comfort Products

Comfort products, such as cushions, pillows, and mattresses, are designed to provide additional support and comfort while sleeping or sitting. These products fall under the 18% GST rate category, as they are considered essential for maintaining good posture and overall well-being. The GST rate on comfort products, including foam mattresses, is set at 18% to ensure consistency and fairness in the tax system.

In conclusion, the current GST rate on foam mattresses is 18%, which is consistent with the rates for other related products such as furniture, bedding, and home furnishings. As a consumer, it is important to be aware of the GST rate on foam mattresses and how it affects the final cost of your purchase. By understanding the HSN code and the applicable GST rate, you can make an informed decision when buying a foam mattress for your home.

The Impact of GST Rate on Foam Mattress for House Design

Introduction

When it comes to designing a house, every detail matters. From the color of the walls to the type of furniture, each element plays a crucial role in creating a comfortable and aesthetically pleasing living space. One such important element is the mattress. A good mattress not only ensures a good night's sleep but also contributes to the overall design of a house. However, with the implementation of Goods and Services Tax (GST) in India, the prices of various products, including foam mattresses, have been affected. In this article, we will explore the impact of GST rate on foam mattresses for house design.

When it comes to designing a house, every detail matters. From the color of the walls to the type of furniture, each element plays a crucial role in creating a comfortable and aesthetically pleasing living space. One such important element is the mattress. A good mattress not only ensures a good night's sleep but also contributes to the overall design of a house. However, with the implementation of Goods and Services Tax (GST) in India, the prices of various products, including foam mattresses, have been affected. In this article, we will explore the impact of GST rate on foam mattresses for house design.

The Impact of GST on Foam Mattress Prices

Before the implementation of GST, the tax rate on foam mattresses was around 13.5%. However, with the introduction of GST, the tax rate has increased to 18%. This has resulted in an increase in prices of foam mattresses, making them a more expensive choice for house design. The increase in prices is due to the higher tax rate and the additional cost of compliance with GST regulations.

Before the implementation of GST, the tax rate on foam mattresses was around 13.5%. However, with the introduction of GST, the tax rate has increased to 18%. This has resulted in an increase in prices of foam mattresses, making them a more expensive choice for house design. The increase in prices is due to the higher tax rate and the additional cost of compliance with GST regulations.

Effects on House Design

The increase in prices of foam mattresses due to GST has had a significant impact on house design. Many individuals and interior designers are now opting for alternative materials for mattress choices, such as coir or cotton, to avoid the higher prices of foam mattresses. This has led to a shift in the overall design of houses, as mattresses play a crucial role in the comfort and aesthetics of a bedroom.

The increase in prices of foam mattresses due to GST has had a significant impact on house design. Many individuals and interior designers are now opting for alternative materials for mattress choices, such as coir or cotton, to avoid the higher prices of foam mattresses. This has led to a shift in the overall design of houses, as mattresses play a crucial role in the comfort and aesthetics of a bedroom.

Considerations for House Design

With the increase in GST rate on foam mattresses, it is essential to consider the impact on house design. For those who prefer foam mattresses, it is necessary to factor in the higher prices when budgeting for house design. It is also crucial to explore alternative options and choose the most suitable material for both comfort and design.

Conclusion:

In conclusion, the implementation of GST has had a significant impact on the prices of foam mattresses, which ultimately affects house design. It is essential to consider the higher tax rate when making choices for mattress materials and to explore alternative options to ensure both comfort and design are not compromised. As house design continues to evolve, it is crucial to stay informed about the impact of GST on various products, including foam mattresses, to make informed decisions.

With the increase in GST rate on foam mattresses, it is essential to consider the impact on house design. For those who prefer foam mattresses, it is necessary to factor in the higher prices when budgeting for house design. It is also crucial to explore alternative options and choose the most suitable material for both comfort and design.

Conclusion:

In conclusion, the implementation of GST has had a significant impact on the prices of foam mattresses, which ultimately affects house design. It is essential to consider the higher tax rate when making choices for mattress materials and to explore alternative options to ensure both comfort and design are not compromised. As house design continues to evolve, it is crucial to stay informed about the impact of GST on various products, including foam mattresses, to make informed decisions.