Are you in the market for a new mattress in Florida? Did you know that there are sales tax exemptions available for certain types of mattresses? This can help save you money on your purchase and make buying a new mattress more affordable. Let's take a look at the top 10 Florida sales tax exemptions for mattresses to help you make a more informed decision.Florida Sales Tax Exemption for Mattress

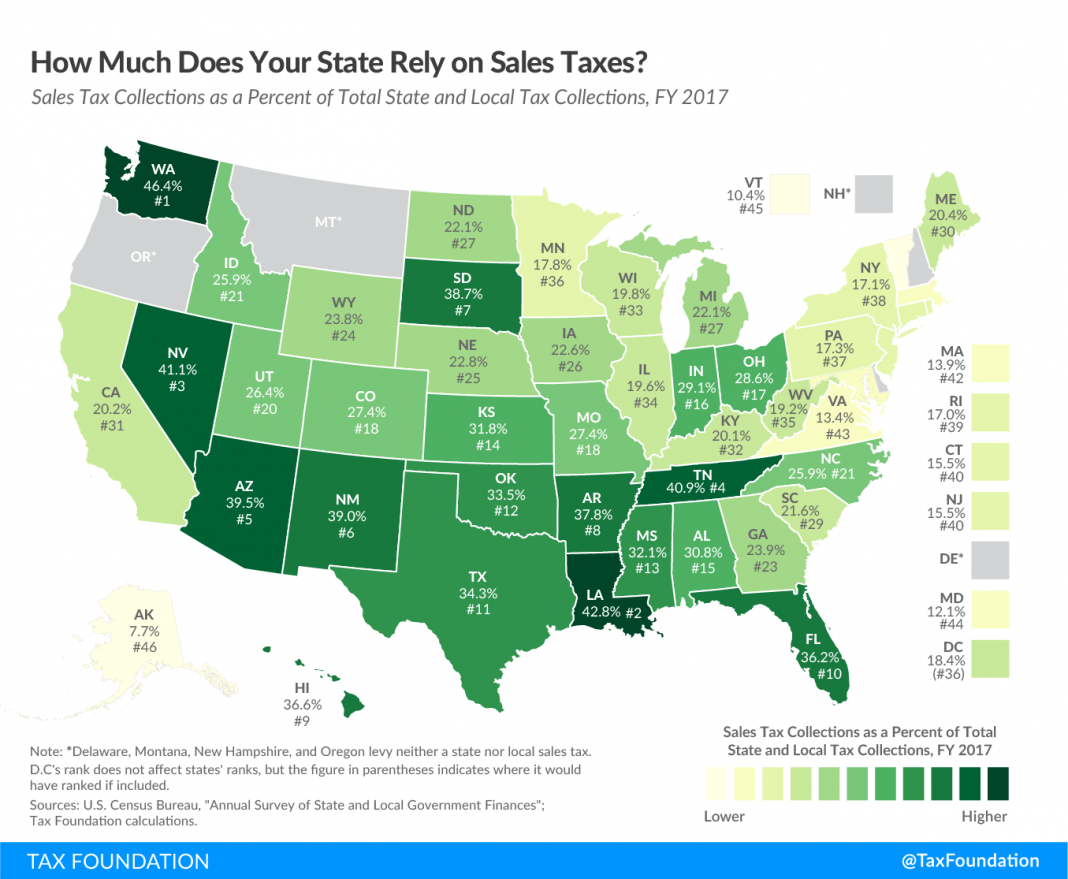

Before we dive into the different types of mattress sales tax exemptions, let's first understand what a sales tax exemption is. In simple terms, it means that certain products or services are exempt from the standard sales tax rate. This can vary from state to state, but in Florida, there are several exemptions available for mattresses and bedding products.Florida Sales Tax Exemption

One of the most common sales tax exemptions in Florida is for mattresses. As long as the mattress is purchased for personal use and not for resale, it is exempt from sales tax. This includes traditional mattresses, as well as adjustable beds and sleep number beds.Florida Mattress Sales Tax Exemption

In addition to the exemption for mattresses, Florida also offers a tax exemption for certain types of bedding. This includes items such as pillows, mattress pads, and linens. However, it's important to note that this exemption only applies to bedding products that are sold as part of a mattress purchase. If you were to purchase these items separately, they would still be subject to sales tax.Florida Tax Exemption for Mattress

Another tax exemption available in Florida is for mattress disposal. If you are purchasing a new mattress and need to dispose of your old one, you can do so without being charged sales tax. This can be a significant savings, as some retailers may charge a fee for mattress disposal services.Florida Mattress Tax Exemption

As mentioned earlier, Florida offers a sales tax exemption for certain types of bedding products when purchased as part of a mattress. This includes bed sheets, comforters, and blankets. It's important to note that this exemption only applies to bedding products that are intended for use with a mattress, not for standalone purchases.Florida Sales Tax Exemption for Bedding

In addition to the sales tax exemption for bedding products when purchased with a mattress, Florida also offers a tax exemption for bedding items that are sold as part of a furniture package. This means that if you purchase a bedroom set or a sofa set that includes bedding items, you will not be charged sales tax on those specific items.Florida Tax Exemption for Bedding

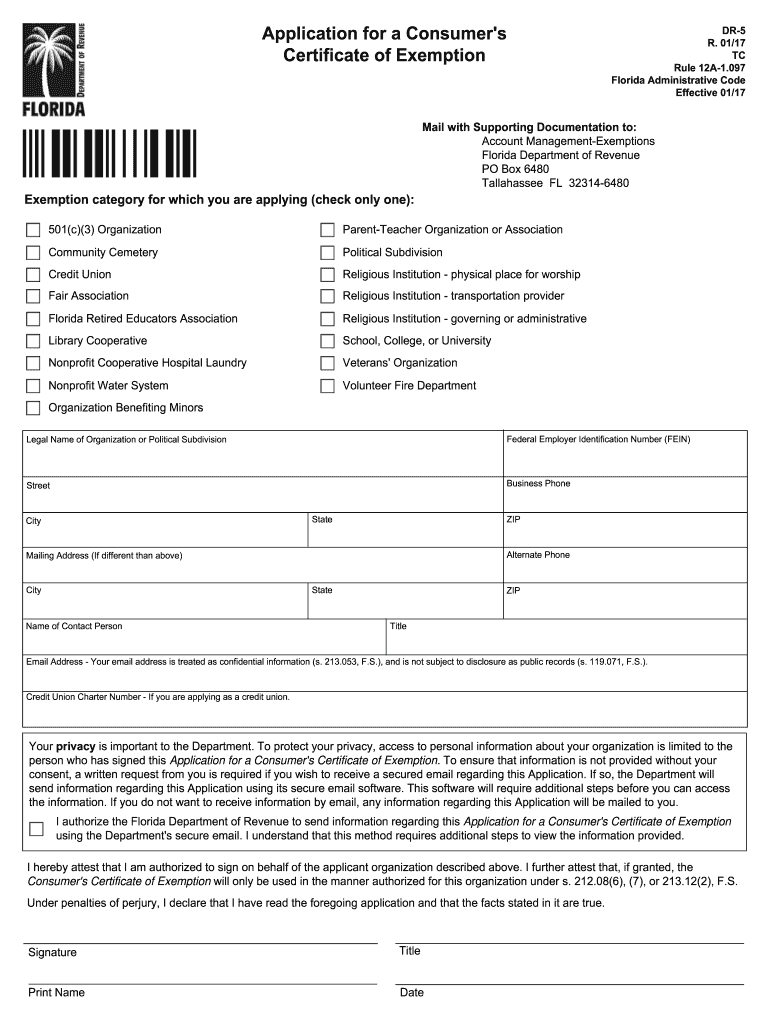

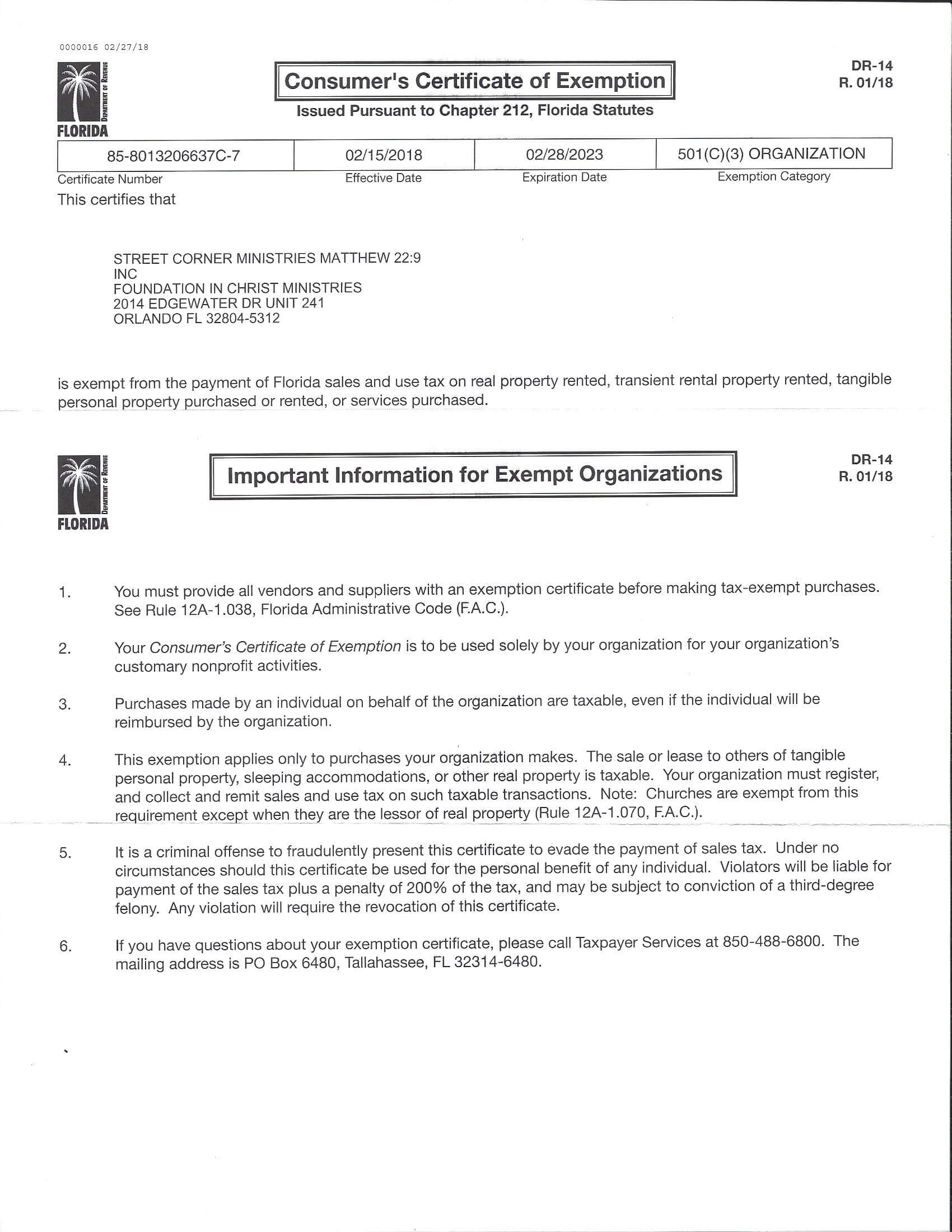

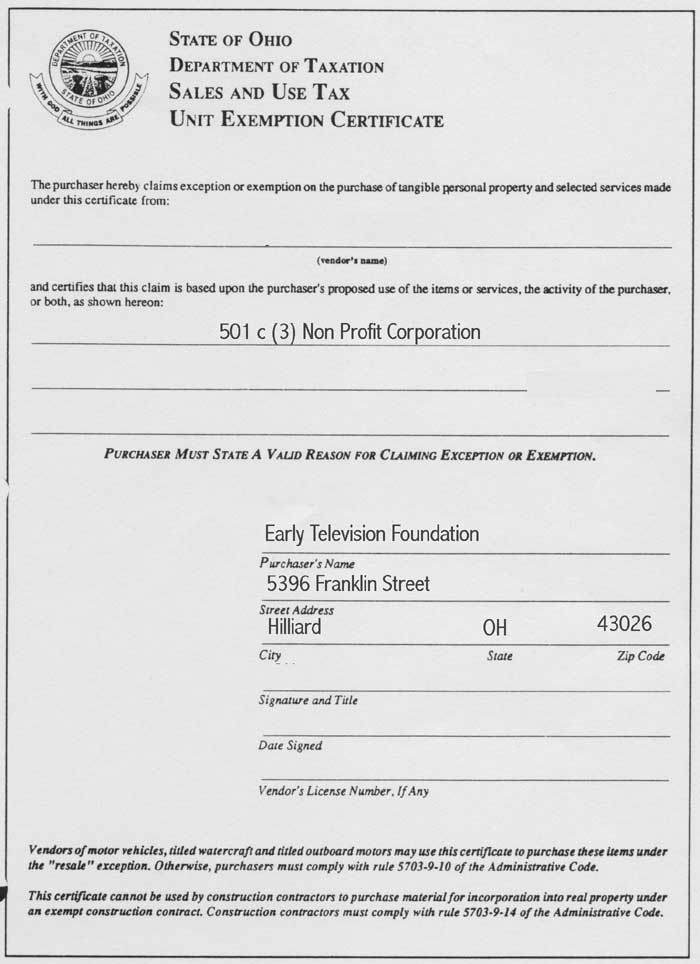

Another tax exemption available in Florida is for bedding products that are sold to non-profit organizations. This means that if a charity or non-profit organization is purchasing bedding products for their use, they are exempt from sales tax. This can be a helpful savings for organizations that rely on donations and fundraising.Florida Bedding Sales Tax Exemption

While not specifically for mattresses, Florida offers a tax exemption for certain types of furniture. This includes items such as chairs, tables, and bed frames. If you are purchasing a mattress as part of a furniture set, this exemption can also apply to the mattress portion of the purchase.Florida Tax Exemption for Furniture

Similar to the tax exemption for bedding products sold as part of a furniture package, Florida also offers a sales tax exemption for mattresses sold as part of a furniture set. This can be a helpful savings for those purchasing a complete bedroom set or a living room set.Florida Furniture Sales Tax Exemption

The Benefits of Purchasing a Mattress in Florida

The Florida Sales Tax Exemption for Mattresses

If you are in the market for a new mattress, you may be pleasantly surprised to find out that Florida offers a sales tax exemption specifically for mattresses. This means that when you purchase a mattress in Florida, you will not have to pay the usual 6% sales tax on your purchase. This can result in significant savings, especially when buying high-end mattresses. But why does Florida have this exemption and how can you take advantage of it?

If you are in the market for a new mattress, you may be pleasantly surprised to find out that Florida offers a sales tax exemption specifically for mattresses. This means that when you purchase a mattress in Florida, you will not have to pay the usual 6% sales tax on your purchase. This can result in significant savings, especially when buying high-end mattresses. But why does Florida have this exemption and how can you take advantage of it?

Why Does Florida Have a Sales Tax Exemption for Mattresses?

The Florida sales tax exemption for mattresses was implemented to help make purchasing essential household items more affordable for its residents. A good mattress is essential for a good night's sleep and the state recognizes the importance of investing in a quality mattress. By offering a sales tax exemption, Florida is making it easier for its residents to access comfortable and supportive mattresses without breaking the bank.

The Florida sales tax exemption for mattresses was implemented to help make purchasing essential household items more affordable for its residents. A good mattress is essential for a good night's sleep and the state recognizes the importance of investing in a quality mattress. By offering a sales tax exemption, Florida is making it easier for its residents to access comfortable and supportive mattresses without breaking the bank.

How Can You Take Advantage of the Sales Tax Exemption?

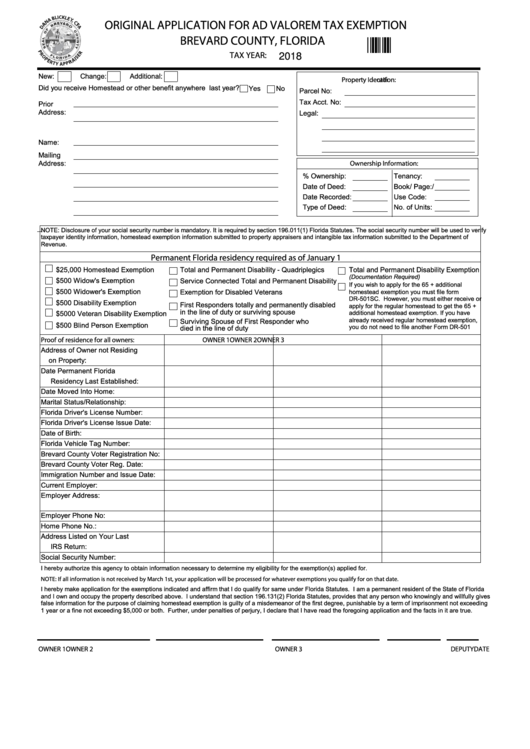

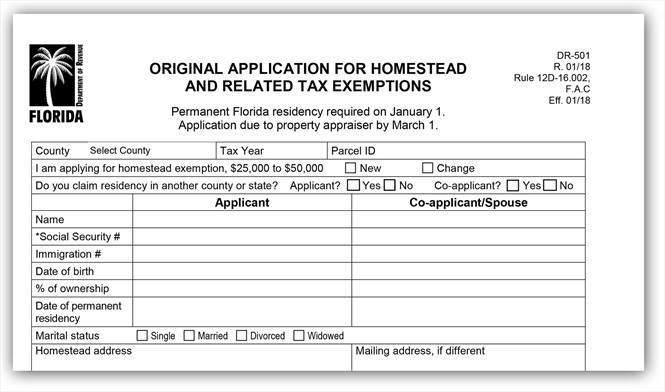

To take advantage of the sales tax exemption for mattresses in Florida, you must be a resident of the state and provide proof of residency at the time of purchase. This can be in the form of a valid Florida driver's license or state-issued ID. You can also take advantage of the exemption if you are a Florida resident who is purchasing a mattress for your primary residence, even if the purchase is made out of state.

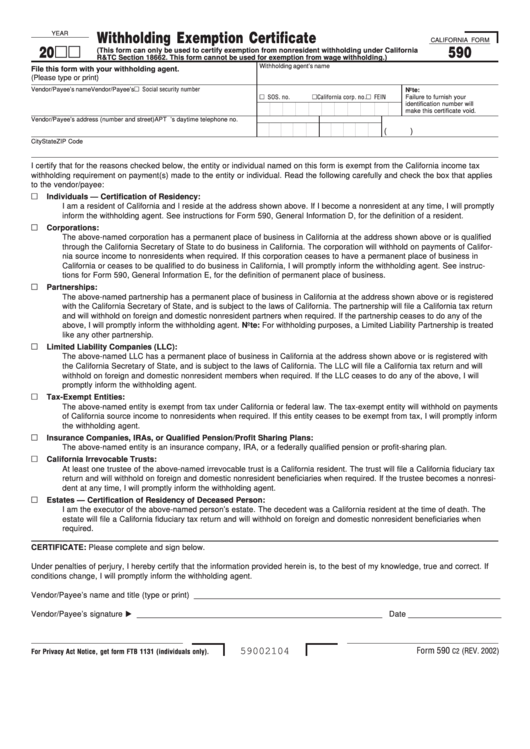

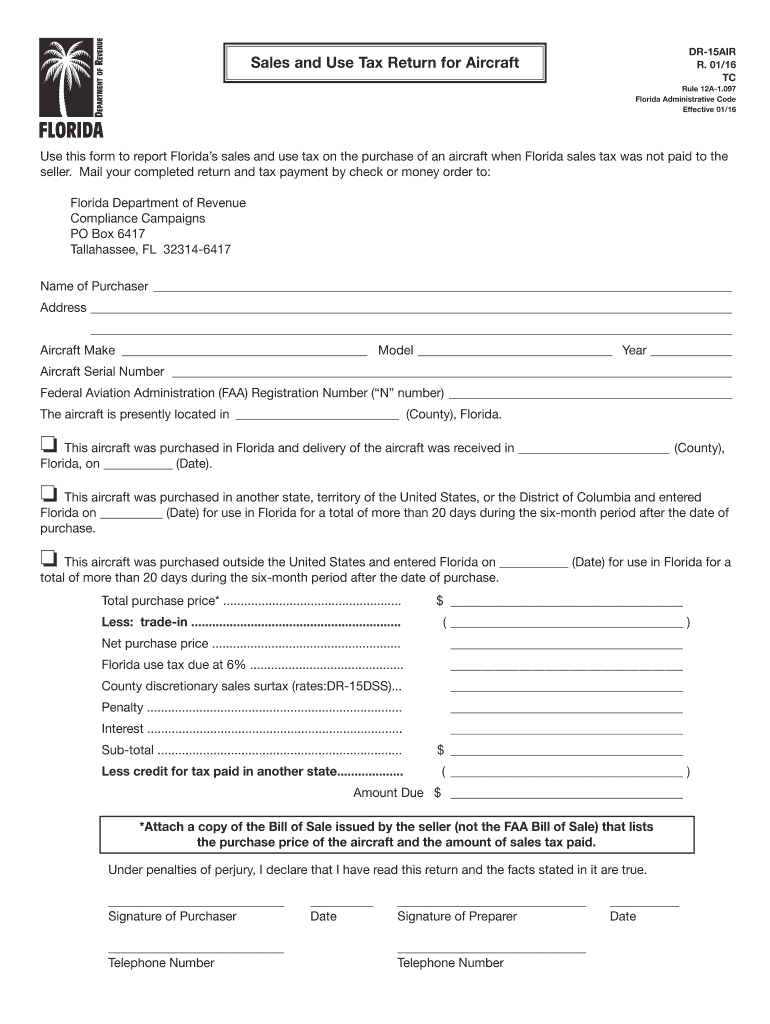

It is important to note that the sales tax exemption only applies to mattresses purchased for personal use and not for resale.

This means that if you are buying a mattress for your rental property or for a business, you will still need to pay the sales tax.

To take advantage of the sales tax exemption for mattresses in Florida, you must be a resident of the state and provide proof of residency at the time of purchase. This can be in the form of a valid Florida driver's license or state-issued ID. You can also take advantage of the exemption if you are a Florida resident who is purchasing a mattress for your primary residence, even if the purchase is made out of state.

It is important to note that the sales tax exemption only applies to mattresses purchased for personal use and not for resale.

This means that if you are buying a mattress for your rental property or for a business, you will still need to pay the sales tax.

Other Tax Benefits of Purchasing a Mattress in Florida

Aside from the sales tax exemption, there are other tax benefits to purchasing a mattress in Florida. For example, the state also offers a homestead exemption on property taxes for primary residences. This means that if you own a home in Florida and use it as your primary residence, you may be eligible for a reduction in your property taxes. This can help offset the cost of purchasing a new mattress for your home.

In addition, Florida does not have an income tax, which means you can save even more money by purchasing a mattress in the state compared to other states that do have income tax.

Overall, the sales tax exemption for mattresses in Florida is just one of the many benefits of living in the Sunshine State.

Not only can you enjoy beautiful weather and scenic beaches, but you can also save money on essential household items like mattresses. So if you are in need of a new mattress, consider taking advantage of the sales tax exemption and purchasing one in Florida. It's a win-win situation for both your wallet and your sleep quality.

Aside from the sales tax exemption, there are other tax benefits to purchasing a mattress in Florida. For example, the state also offers a homestead exemption on property taxes for primary residences. This means that if you own a home in Florida and use it as your primary residence, you may be eligible for a reduction in your property taxes. This can help offset the cost of purchasing a new mattress for your home.

In addition, Florida does not have an income tax, which means you can save even more money by purchasing a mattress in the state compared to other states that do have income tax.

Overall, the sales tax exemption for mattresses in Florida is just one of the many benefits of living in the Sunshine State.

Not only can you enjoy beautiful weather and scenic beaches, but you can also save money on essential household items like mattresses. So if you are in need of a new mattress, consider taking advantage of the sales tax exemption and purchasing one in Florida. It's a win-win situation for both your wallet and your sleep quality.

-1920w.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/JB55YLQWQ5DLTL3ZBVZZ2FWXDY.png)