One of the main concerns when purchasing a new mattress is whether or not it is covered by insurance. Unfortunately, the answer is not a simple yes or no. There are several factors that can affect whether or not your insurance will cover your mattress, including the type of insurance you have and the reason for needing a new mattress. In this article, we will explore the different types of insurance and whether or not they cover mattresses.Does insurance cover mattress?

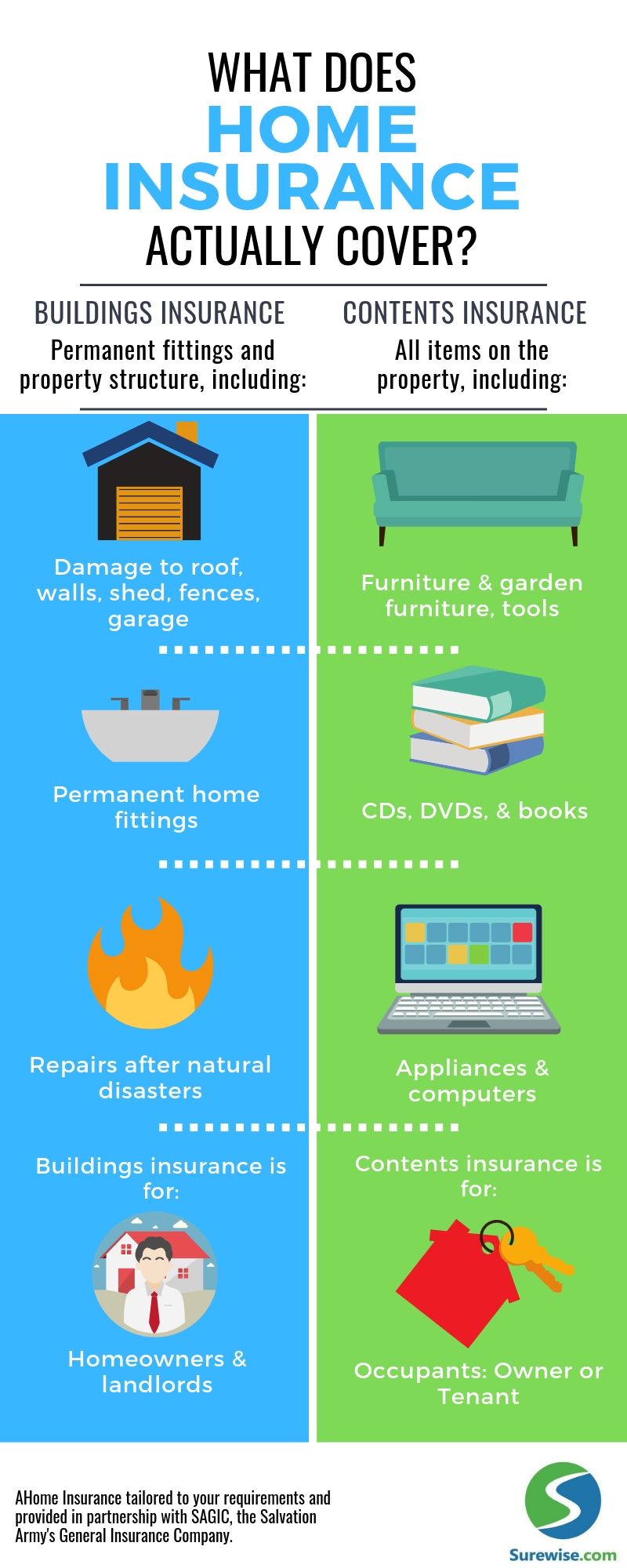

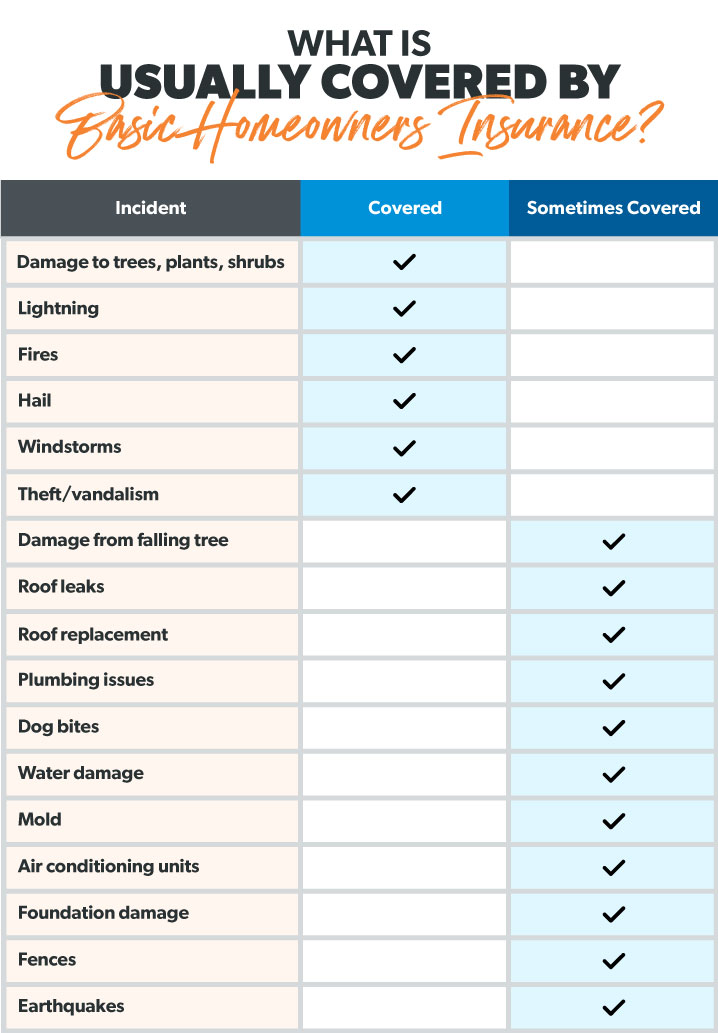

Homeowners insurance is designed to protect your home and personal property from unexpected events, such as fire, theft, or natural disasters. While it does cover your personal property, including furniture and appliances, it may not cover your mattress for everyday wear and tear. If your mattress is damaged due to a covered event, such as a fire, then your homeowners insurance may cover the cost of a new one. However, if your mattress is simply old and worn out, you may need to purchase a new one out of pocket.Does homeowners insurance cover mattress?

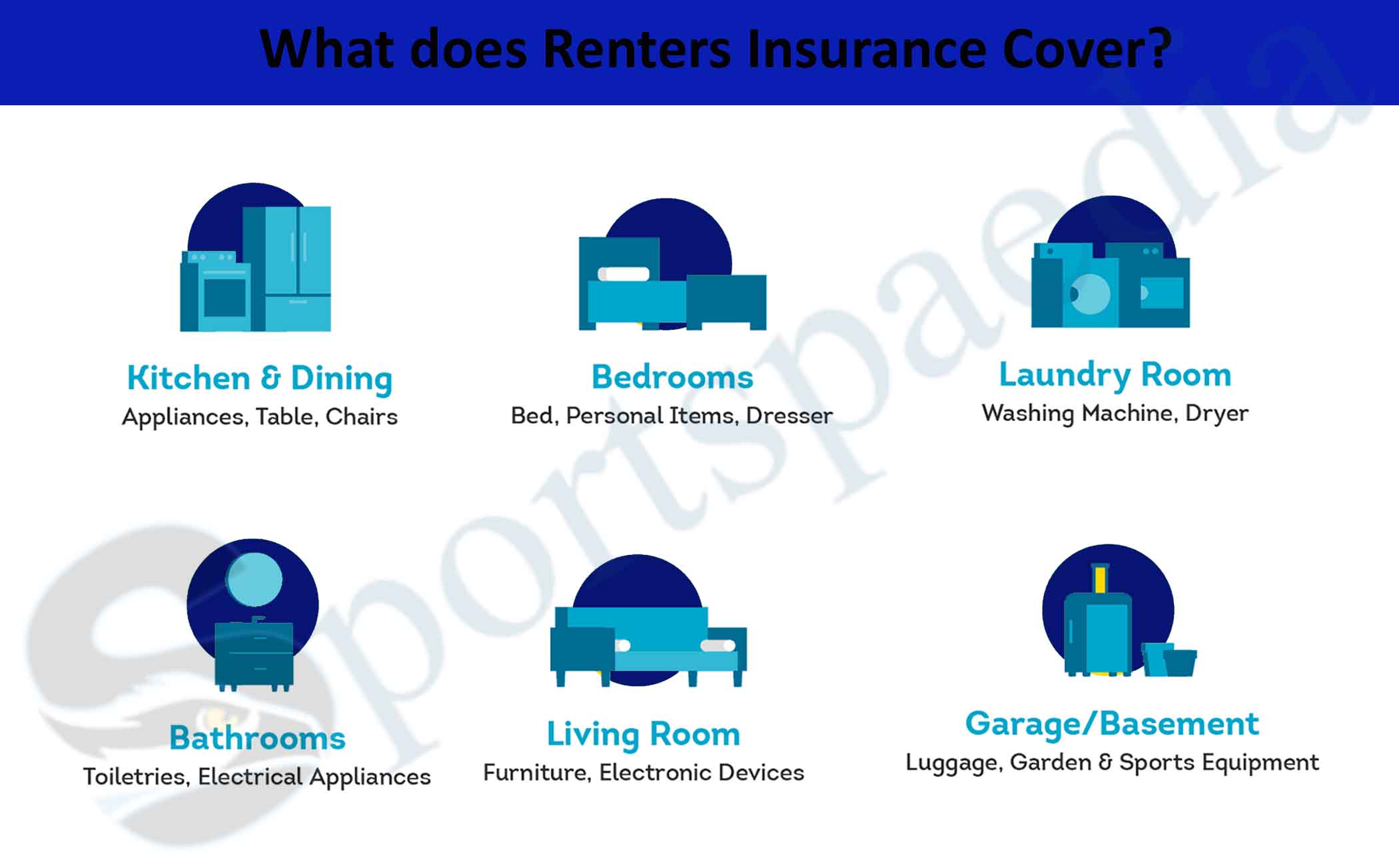

Similar to homeowners insurance, renters insurance also covers personal property from unexpected events. However, since renters do not own the property they live in, they are not responsible for insuring the building itself. Renters insurance may cover your mattress if it is damaged due to a covered event, but again, it may not cover everyday wear and tear. It is important to review your policy and speak with your insurance provider to fully understand what is covered.Does renters insurance cover mattress?

Health insurance is designed to cover medical expenses, including durable medical equipment. While a mattress may be considered a medical device for individuals with certain health conditions, it is not typically covered by health insurance. However, if you have a medical condition that requires a specific type of mattress, your health insurance may cover it with a doctor's prescription and documentation of medical necessity.Does health insurance cover mattress?

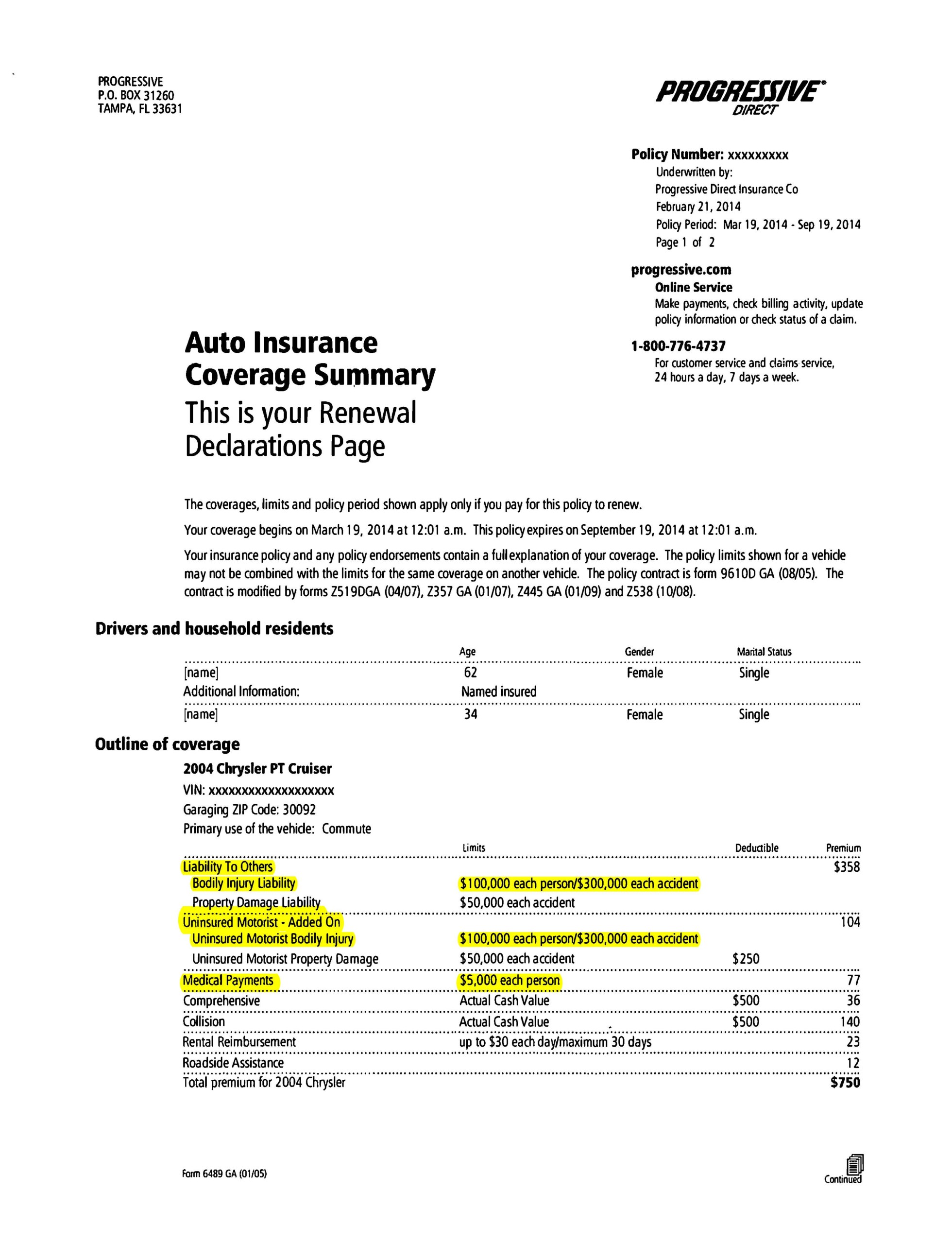

Car insurance is meant to cover damages to your vehicle in the event of an accident. It does not typically cover personal property, such as a mattress, that may be damaged in a car accident. However, if your mattress is damaged while in transit, such as during a move, your car insurance may cover it under the personal property coverage of your policy. Again, it is important to review your policy and speak with your insurance provider to fully understand what is covered.Does car insurance cover mattress?

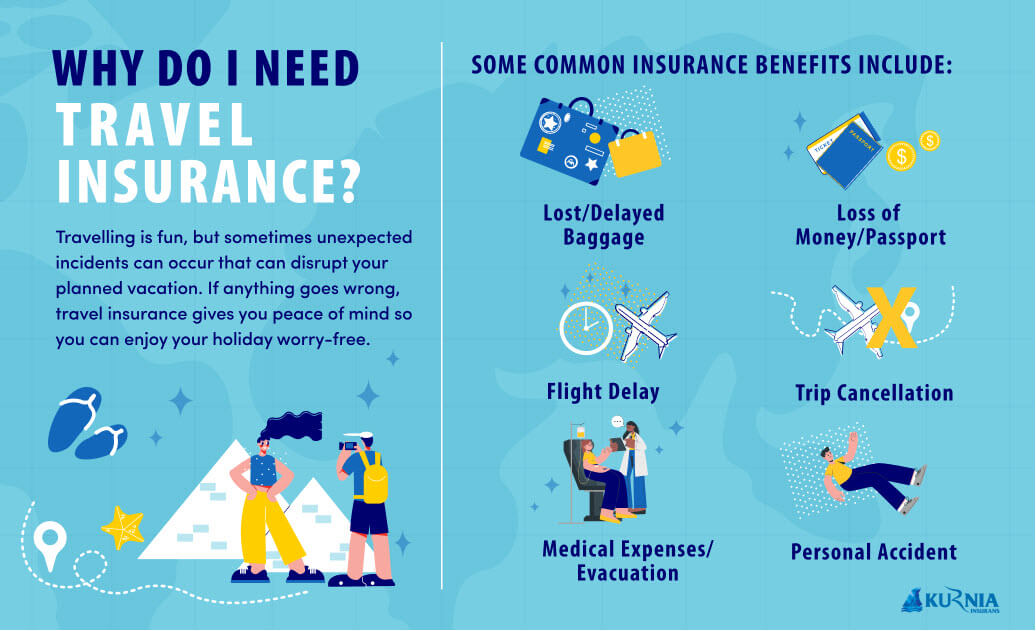

Travel insurance is meant to protect you from unforeseen events while traveling, such as trip cancellations, lost luggage, or medical emergencies. While some travel insurance policies may cover personal belongings, including a mattress, it is not a common coverage. Additionally, travel insurance typically only covers items that are lost, stolen, or damaged during travel, not everyday wear and tear or old mattresses.Does travel insurance cover mattress?

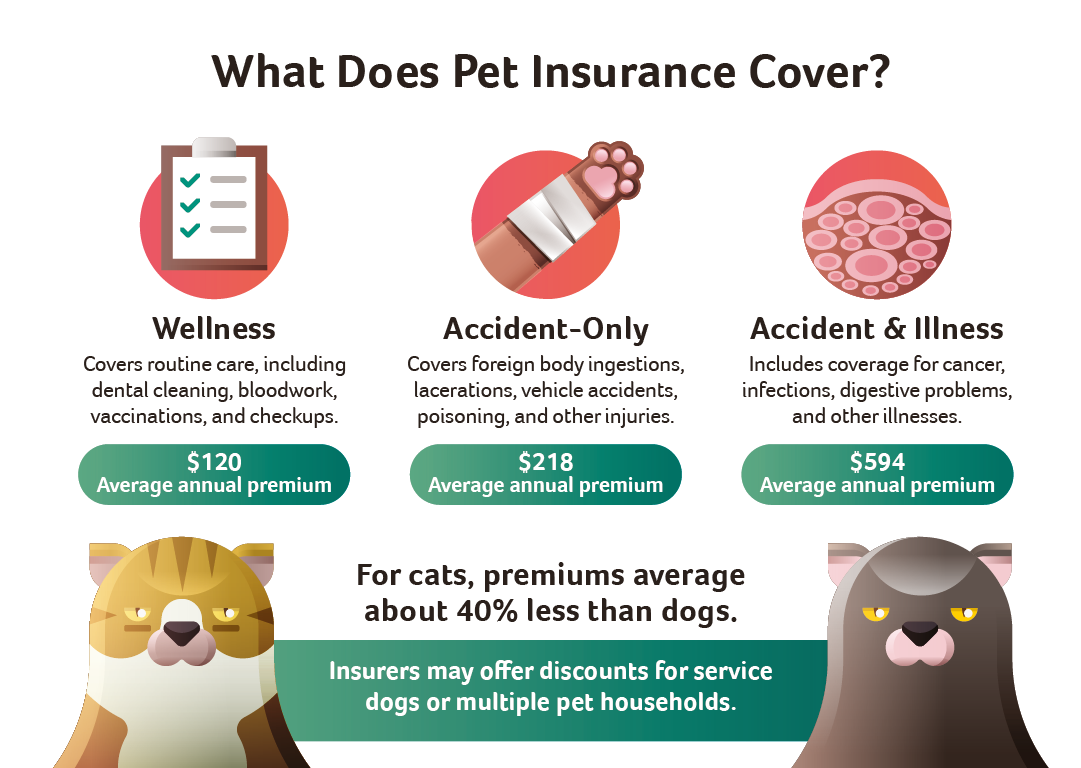

Pet insurance is designed to cover medical expenses for your furry friends. It does not typically cover personal property, such as a mattress, that may be damaged by your pets. However, if your pet damages your mattress and it requires medical treatment, your pet insurance may cover the cost of the treatment. Again, it is important to review your policy and speak with your insurance provider to fully understand what is covered.Does pet insurance cover mattress?

Business insurance is meant to protect your business from unexpected events, such as property damage or liability claims. If your business owns a mattress that is used for business purposes, such as in a hotel or rental property, it may be covered under your business insurance. However, if the mattress is for personal use, it will not be covered under business insurance.Does business insurance cover mattress?

Flood insurance is a separate policy from homeowners insurance and is meant to cover damages to your property and personal belongings in the event of a flood. If your mattress is damaged due to a flood, it may be covered under your flood insurance policy. However, like with other types of insurance, everyday wear and tear or old mattresses are not typically covered.Does flood insurance cover mattress?

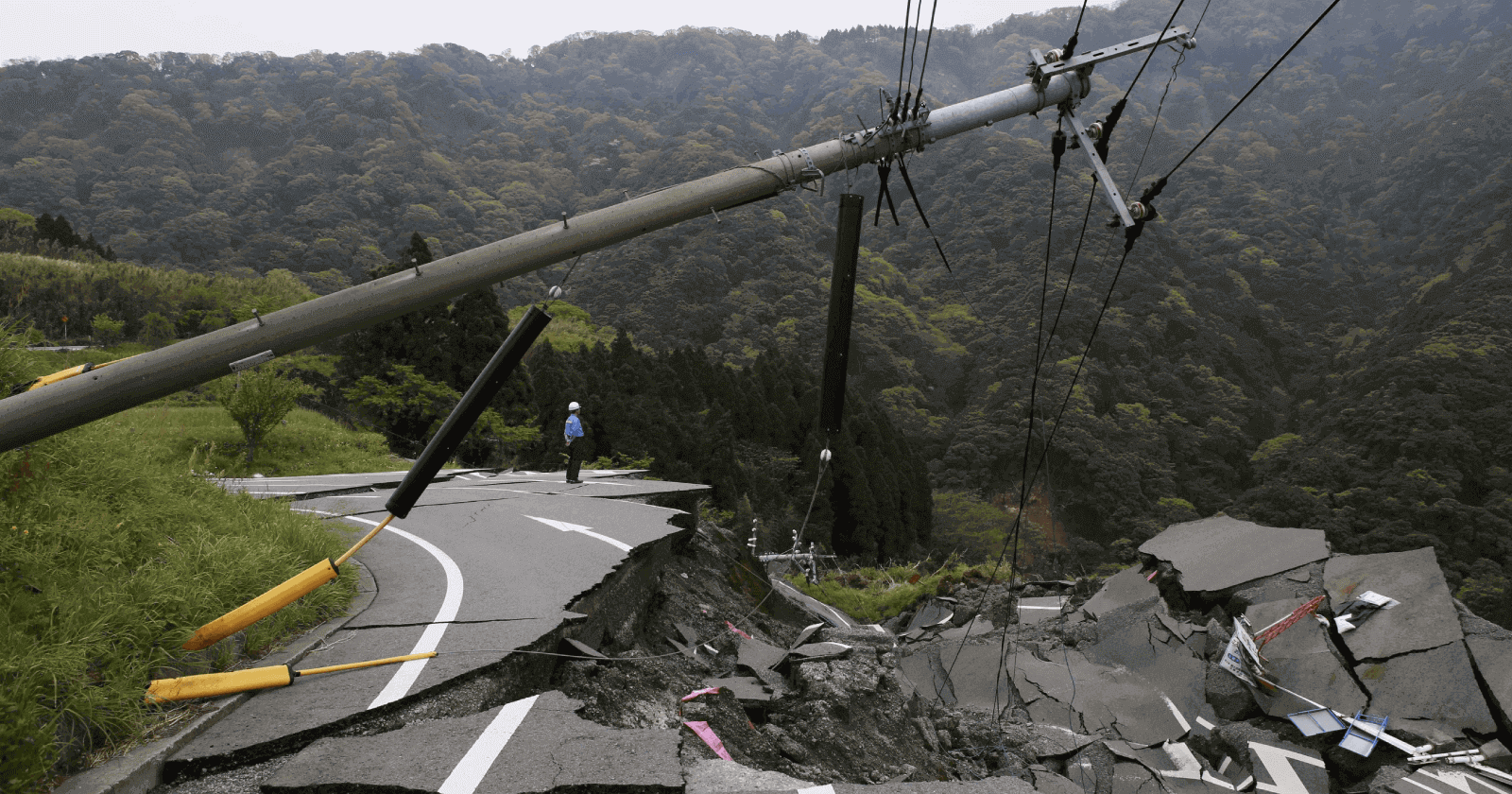

Similar to flood insurance, earthquake insurance is a separate policy from homeowners insurance and is meant to cover damages to your property and personal belongings in the event of an earthquake. If your mattress is damaged due to an earthquake, it may be covered under your earthquake insurance policy. Again, it is important to review your policy and speak with your insurance provider to fully understand what is covered.Does earthquake insurance cover mattress?

Does Insurance Cover Mattresses?

Exploring the Ins and Outs of Mattress Insurance Coverage

When it comes to purchasing a new mattress, many people are concerned about the cost and whether or not their insurance will cover it. While most insurance policies do not cover the cost of a new mattress, there are certain circumstances where it may be covered. Let's take a closer look at what you need to know about mattress insurance coverage.

What is Covered?

Typically, insurance policies do not cover the cost of a new mattress unless it is deemed medically necessary. This means that if you have a medical condition that requires a specific type of mattress, your insurance may cover the cost. However, this will depend on your specific insurance policy and what is deemed necessary by your doctor.

Homeowner's Insurance

Homeowner's insurance typically covers damage to personal property, including your mattress, in the event of a covered disaster such as a fire or natural disaster. However, this coverage may be limited and may not cover the full cost of a new mattress. It is important to review your policy and speak with your insurance provider to understand what is covered and what is not.

Renter's Insurance

Similar to homeowner's insurance, renter's insurance may cover damage to personal property, including your mattress, in the event of a covered disaster. However, it is important to note that if you are renting a home or apartment, your landlord's insurance may cover the cost of repairs or replacements for damage caused by natural disasters or other covered events.

Extended Warranties

Many mattress companies offer extended warranties for an additional cost. These warranties typically cover damage to the mattress, such as sagging or defects, for a certain period of time. However, these warranties may not cover accidental damage or normal wear and tear.

What to Consider

Before purchasing a new mattress, it is important to review your insurance policy and understand what is covered. If you have a medical condition that requires a specific type of mattress, you may be able to get coverage through your insurance. Additionally, it is important to consider purchasing an extended warranty for added protection.

In conclusion, while most insurance policies do not cover the cost of a new mattress, it is important to review your policy and understand what is covered in the event of damage or loss. If you are in need of a new mattress due to a medical condition, speak with your insurance provider to see if you can get coverage. And as always, be sure to research and consider purchasing an extended warranty for added peace of mind.

When it comes to purchasing a new mattress, many people are concerned about the cost and whether or not their insurance will cover it. While most insurance policies do not cover the cost of a new mattress, there are certain circumstances where it may be covered. Let's take a closer look at what you need to know about mattress insurance coverage.

What is Covered?

Typically, insurance policies do not cover the cost of a new mattress unless it is deemed medically necessary. This means that if you have a medical condition that requires a specific type of mattress, your insurance may cover the cost. However, this will depend on your specific insurance policy and what is deemed necessary by your doctor.

Homeowner's Insurance

Homeowner's insurance typically covers damage to personal property, including your mattress, in the event of a covered disaster such as a fire or natural disaster. However, this coverage may be limited and may not cover the full cost of a new mattress. It is important to review your policy and speak with your insurance provider to understand what is covered and what is not.

Renter's Insurance

Similar to homeowner's insurance, renter's insurance may cover damage to personal property, including your mattress, in the event of a covered disaster. However, it is important to note that if you are renting a home or apartment, your landlord's insurance may cover the cost of repairs or replacements for damage caused by natural disasters or other covered events.

Extended Warranties

Many mattress companies offer extended warranties for an additional cost. These warranties typically cover damage to the mattress, such as sagging or defects, for a certain period of time. However, these warranties may not cover accidental damage or normal wear and tear.

What to Consider

Before purchasing a new mattress, it is important to review your insurance policy and understand what is covered. If you have a medical condition that requires a specific type of mattress, you may be able to get coverage through your insurance. Additionally, it is important to consider purchasing an extended warranty for added protection.

In conclusion, while most insurance policies do not cover the cost of a new mattress, it is important to review your policy and understand what is covered in the event of damage or loss. If you are in need of a new mattress due to a medical condition, speak with your insurance provider to see if you can get coverage. And as always, be sure to research and consider purchasing an extended warranty for added peace of mind.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

/filters:quality(60)/2022-11-02-Does-Homeowners-Insurance-Cover-AC.jpg)

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)