Tax Deductions for Exclusive Business Dining Rooms

As a business owner, you are always looking for ways to save money and maximize your profits. One often overlooked area for potential tax savings is your exclusive business dining room. This dedicated space for hosting business meals can actually offer several tax deductions that can significantly reduce your tax bill. Let's take a look at the top 10 tax deductions for exclusive business dining rooms.

Tax Benefits for Business Dining Rooms

Having a separate dining room exclusively for business purposes can bring several benefits when it comes to tax time. Not only can you deduct the expenses associated with maintaining and operating the dining room, but you can also reap the benefits of increased productivity and better business relationships that come from having a dedicated space for business meals.

Tax Write-Offs for Exclusive Business Dining Rooms

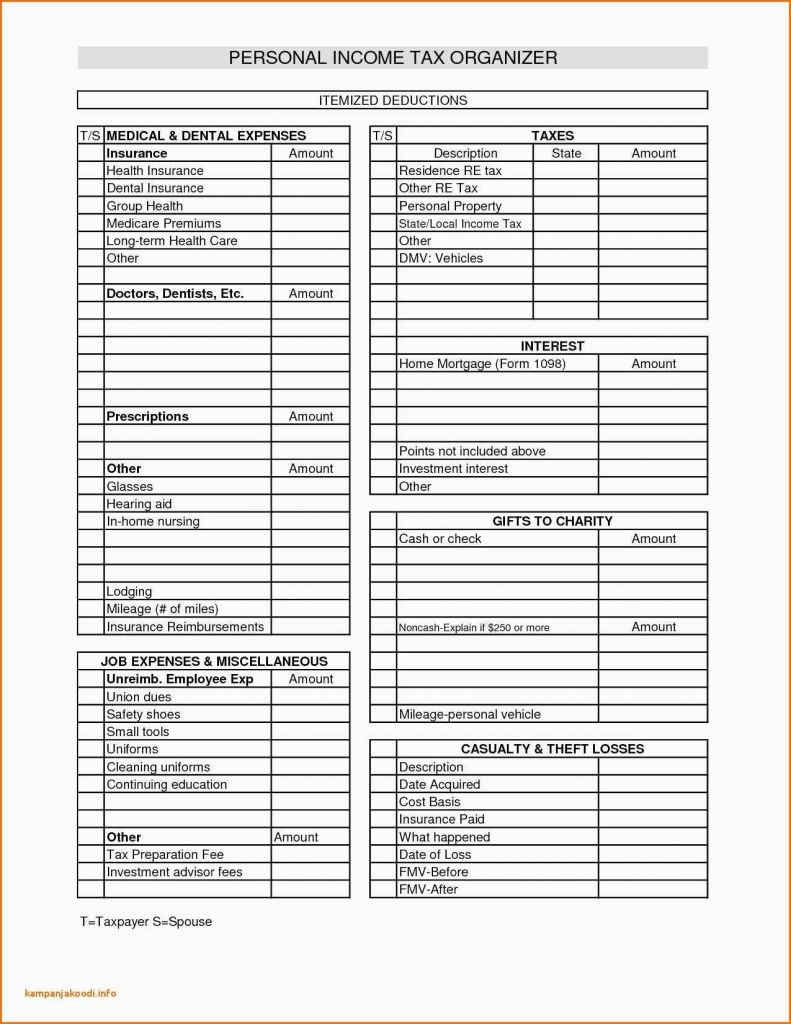

One of the main tax benefits of having an exclusive business dining room is the ability to write off certain expenses related to its operation. This includes the cost of furniture, decor, and any renovations or repairs necessary to maintain the space. You can also deduct the cost of utilities, insurance, and maintenance for the dining room.

Tax Savings for Business Dining Rooms

By taking advantage of the various tax write-offs for your exclusive business dining room, you can save a significant amount of money on your taxes. These savings can add up quickly, especially if you have a high volume of business meals and events in your dining room throughout the year.

Tax Breaks for Exclusive Business Dining Rooms

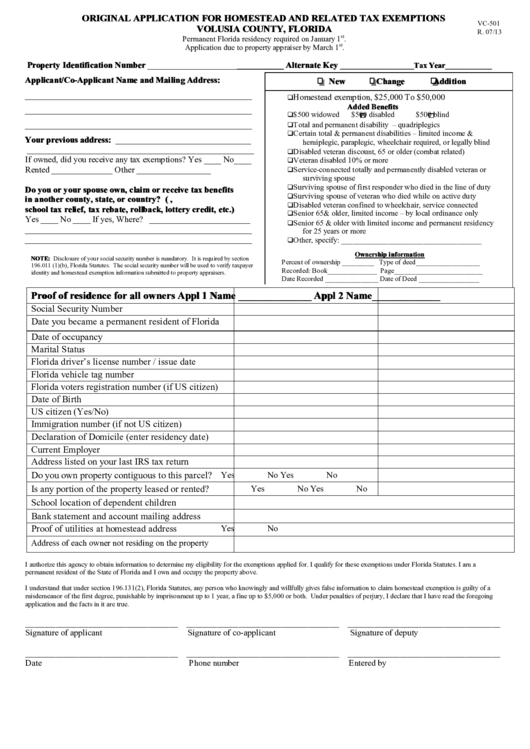

In addition to tax deductions, there are also various tax breaks available for business dining rooms. For example, you may be able to deduct a portion of your property taxes and mortgage interest if your dining room is located in your home. You may also be able to claim a portion of your home office expenses if your dining room is used as a workspace as well.

Tax Incentives for Business Dining Rooms

Some local and state governments offer tax incentives for businesses that have dedicated dining rooms. These incentives may include tax credits, reductions, or even exemptions for certain types of business dining expenses. It's worth checking with your local government to see if you qualify for any tax incentives for your exclusive business dining room.

Tax Advantages for Exclusive Business Dining Rooms

Having a dedicated dining room for your business also offers various tax advantages. For example, you can deduct the cost of meals and entertainment for clients or potential business partners when they are hosted in your exclusive dining room. This can help reduce your overall tax liability and make business meals more affordable.

Tax Exemptions for Business Dining Rooms

In some cases, your exclusive business dining room may qualify for tax exemptions. For example, if you use your dining room to host charitable events or fundraisers, you may be exempt from paying certain taxes on those events. This can provide additional savings and incentives for using your dining room for business purposes.

Tax Relief for Exclusive Business Dining Rooms

For businesses that are struggling financially, having a dedicated dining room for business purposes can offer some tax relief. By deducting the expenses associated with the dining room, you can reduce your taxable income and potentially lower your tax bill. This can provide some much-needed relief for businesses that are facing financial difficulties.

Tax Credits for Business Dining Rooms

In some cases, your exclusive business dining room may be eligible for tax credits. For example, if you make energy-efficient upgrades to your dining room, you may be able to claim a tax credit for those expenses. This can provide additional savings and incentives for investing in your dining room and making it more eco-friendly.

The Benefits of Having a Dedicated Dining Room for Exclusive Business Deduction Taxes

Maximizing Your Tax Deductions

As a business owner, it is important to take advantage of every possible tax deduction to minimize your tax burden. One often overlooked deduction is for a dedicated dining room in your home. According to the

IRS

, a dining room can be considered a

deductible

business expense if it is used exclusively for business purposes. This means that if you regularly use your dining room for business meetings, conferences, or entertaining clients, you can claim a portion of your home expenses as a tax deduction.

As a business owner, it is important to take advantage of every possible tax deduction to minimize your tax burden. One often overlooked deduction is for a dedicated dining room in your home. According to the

IRS

, a dining room can be considered a

deductible

business expense if it is used exclusively for business purposes. This means that if you regularly use your dining room for business meetings, conferences, or entertaining clients, you can claim a portion of your home expenses as a tax deduction.

Creating a Professional Atmosphere

Having a dedicated dining room for business purposes can also help create a more professional atmosphere for your meetings and events. Instead of having to meet in a crowded coffee shop or noisy restaurant, you can host your clients in a private and quiet setting. This can also help to impress potential clients and give them a sense of your professionalism and attention to detail.

Having a dedicated dining room for business purposes can also help create a more professional atmosphere for your meetings and events. Instead of having to meet in a crowded coffee shop or noisy restaurant, you can host your clients in a private and quiet setting. This can also help to impress potential clients and give them a sense of your professionalism and attention to detail.

Enhancing Your Home's Value

Not only does a dedicated dining room have tax benefits, but it can also enhance the overall value of your home. A well-designed and functional dining room can add to the aesthetic appeal of your home, making it more attractive to potential buyers in the future. It can also add to the overall square footage of your home, increasing its value even more.

Not only does a dedicated dining room have tax benefits, but it can also enhance the overall value of your home. A well-designed and functional dining room can add to the aesthetic appeal of your home, making it more attractive to potential buyers in the future. It can also add to the overall square footage of your home, increasing its value even more.

Designing Your Dining Room for Dual Purposes

If you are concerned about the design and layout of your home, rest assured that a dedicated dining room for tax purposes does not have to be a hindrance. With some creative planning and design, you can easily create a dining room that can serve as a multipurpose space. Consider incorporating a desk or workspace into the design, or investing in furniture that can easily transform from a dining table to a conference table.

In conclusion, having a dedicated dining room for exclusive business deduction taxes not only has tax benefits but can also enhance the professional atmosphere of your home, increase its value, and serve as a functional space for both business and personal use. So next time you are designing your home, consider including a dedicated dining room for all your business needs.

If you are concerned about the design and layout of your home, rest assured that a dedicated dining room for tax purposes does not have to be a hindrance. With some creative planning and design, you can easily create a dining room that can serve as a multipurpose space. Consider incorporating a desk or workspace into the design, or investing in furniture that can easily transform from a dining table to a conference table.

In conclusion, having a dedicated dining room for exclusive business deduction taxes not only has tax benefits but can also enhance the professional atmosphere of your home, increase its value, and serve as a functional space for both business and personal use. So next time you are designing your home, consider including a dedicated dining room for all your business needs.

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)