Renting out a property can be a lucrative investment, but it also comes with its fair share of expenses. As a landlord, one of your responsibilities is to keep your rental property in good condition and make necessary repairs or replacements when needed. When it comes to rental kitchens, one of the most common areas that require maintenance is the cabinet and sink. However, did you know that these items have a depreciable life and can be written off as a tax deduction? Let’s take a closer look at the top 10 depreciable lives for rental kitchen cabinet and sink to help you maximize your tax savings.Depreciable Lives for Rental Kitchen Cabinet and Sink

Before we dive into the specific depreciable lives for rental kitchen cabinet and sink, it’s important to understand what depreciable life means. In simple terms, it refers to the estimated time period that an asset is expected to last and be used in your rental property. This can vary depending on the type and quality of the asset. For kitchen cabinets and sinks, the depreciable life can range from 5 to 20 years, depending on the material and condition.Depreciable Lives for Kitchen Cabinet and Sink

If your rental property has a kitchen cabinet made of wood, the depreciable life is typically 10 years. This means that you can claim a tax deduction for the cost of the cabinet spread out over a 10-year period. However, if the cabinet is made of a more durable material such as metal or stone, the depreciable life can be longer, up to 20 years.Depreciable Lives for Rental Kitchen Cabinet

Similar to kitchen cabinets, the depreciable life for a kitchen sink can also vary depending on the material. For a standard stainless steel sink, the depreciable life is typically 10 years. However, if you have a more expensive sink made of materials like granite or marble, the depreciable life can be longer, up to 20 years.Depreciable Lives for Kitchen Sink

When it comes to a rental property, the depreciable life for a kitchen sink is the same as that for a personal property. This means that if you replace the sink in your rental property, you can write off the cost over the depreciable life of the sink, which is typically 10 years.Depreciable Lives for Rental Kitchen Sink

As we’ve mentioned earlier, the depreciable life for a kitchen cabinet and sink can vary depending on the material and condition. However, if you have both a cabinet and sink that are made of the same material, you can claim the tax deduction for both items over the same depreciable life. This means that if you have a stainless steel cabinet and sink, the depreciable life for both items will be 10 years.Depreciable Lives for Cabinet and Sink

If you’re a landlord, it’s important to keep track of the depreciable lives of the assets in your rental property. As a rule of thumb, any item that has a depreciable life of less than a year is considered a repair and can be deducted in the year it was incurred. However, for items with a longer depreciable life such as a cabinet and sink, the cost can be deducted over the depreciable life of the item.Depreciable Lives for Rental Cabinet and Sink

Aside from the specific items in your rental kitchen, there are also depreciable lives for the kitchen as a whole. This includes the flooring, walls, and any built-in appliances. The depreciable life for a rental kitchen is typically 10 years, but it can be longer if there are high-end materials or appliances.Depreciable Lives for Rental Kitchen

For landlords, it’s important to understand the difference between a kitchen and a rental kitchen. A kitchen in your personal residence is not considered a rental property and is therefore not eligible for tax deductions. However, if you have a separate kitchen in your rental property, you can claim depreciable lives for the various assets in the kitchen.Depreciable Lives for Kitchen

If you only need to replace the sink in your rental property and not the entire kitchen, you can still claim a tax deduction for the cost of the sink. As mentioned earlier, the depreciable life for a sink is typically 10 years, so you can spread out the cost over a 10-year period.Depreciable Lives for Rental Sink

The Importance of Accurate Depreciable Lives for Rental Kitchen Cabinets and Sinks

Creating a Functional and Profitable Rental Property

When designing a rental property, careful consideration must be given to every aspect, including the kitchen. As one of the most frequently used areas of a rental unit, the kitchen must be functional, durable, and visually appealing. Kitchen cabinets and sinks are not only essential elements in a rental property's design, but they also have a significant impact on its overall value. Therefore, it is crucial to understand the concept of depreciable lives for rental kitchen cabinets and sinks to ensure a successful and profitable rental property.

The Concept of Depreciable Lives

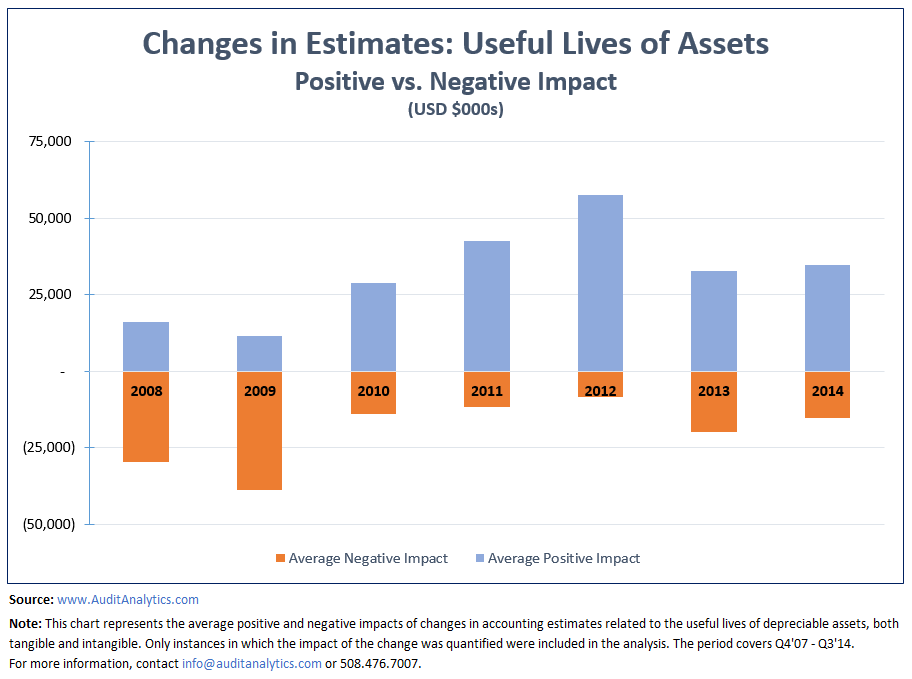

Depreciable lives refer to the estimated period of time that an asset, such as a kitchen cabinet or sink, will be used before it loses its value. This concept is crucial in rental property management as it affects the property's taxable income and overall value. It is essential to accurately estimate the depreciable lives of assets in a rental property to ensure proper tax deductions and to avoid over or underestimating the property's value.

Factors Affecting Depreciable Lives for Kitchen Cabinets and Sinks

Several factors can affect the depreciable lives of kitchen cabinets and sinks in a rental property. Quality of materials and construction is one of the primary factors. High-quality materials and proper construction can result in longer depreciable lives and lower maintenance costs. On the other hand, subpar materials and construction can result in shorter depreciable lives and higher maintenance costs, ultimately affecting the property's profitability.

Frequency of use is another factor that can impact the depreciable lives of kitchen cabinets and sinks. In a rental property, the kitchen is used frequently, and therefore, the cabinets and sinks are subject to wear and tear. This can result in a shorter depreciable life, and the need for more frequent repairs or replacements.

The Importance of Accurate Depreciable Lives

Accurately estimating the depreciable lives of kitchen cabinets and sinks in a rental property is vital for several reasons. First and foremost, it ensures proper tax deductions, which can significantly impact the property's financials. Secondly, it helps landlords and property managers plan for future repairs or replacements, avoiding any unexpected expenses. Lastly, an accurate estimation of depreciable lives can increase the property's overall value and appeal to potential tenants.

Conclusion

In conclusion, when designing a rental property, it is crucial to consider the depreciable lives of kitchen cabinets and sinks. Factors such as quality of materials, frequency of use, and accurate estimation can greatly impact the property's profitability and value. By understanding and carefully considering depreciable lives, landlords and property managers can create a functional and profitable rental property that tenants will love.