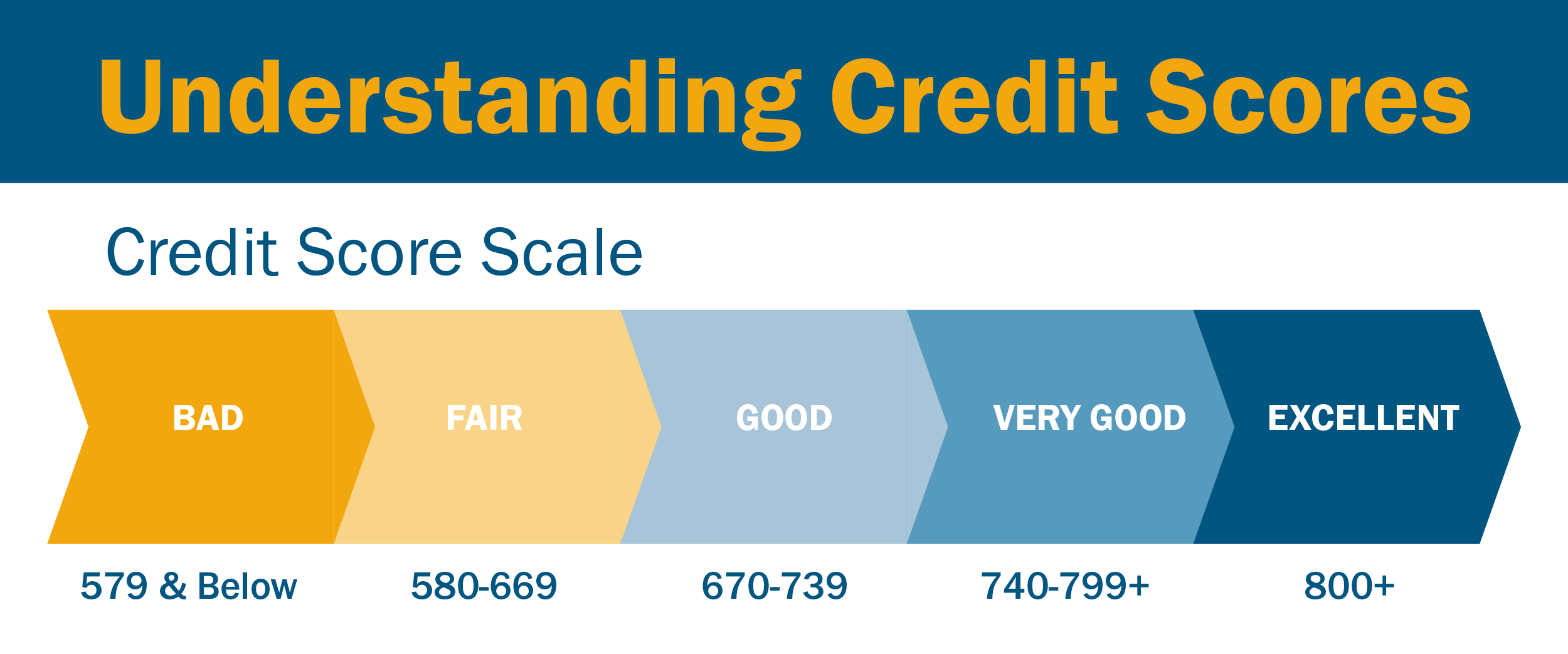

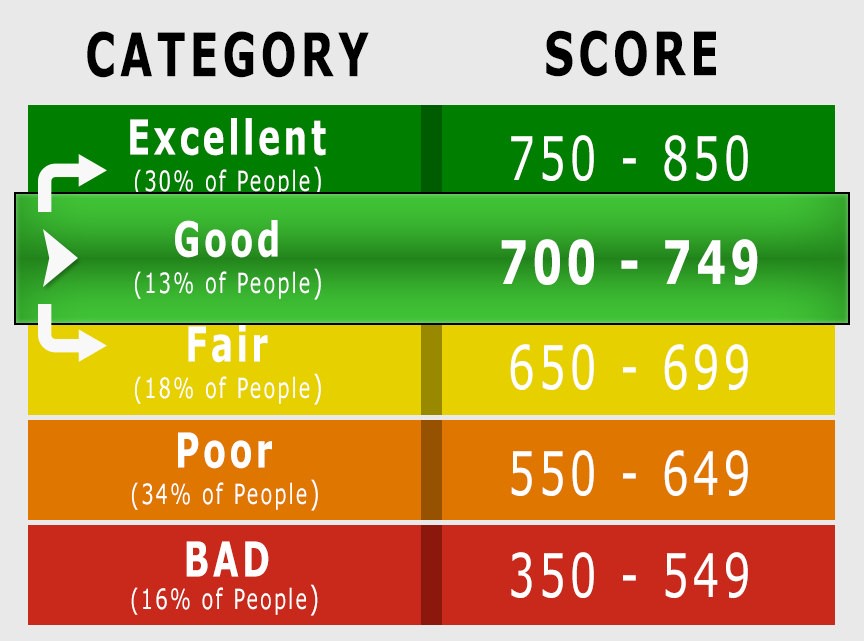

When you're in the market for a new mattress, you may be wondering what credit score is needed for financing. After all, mattresses can be a big investment, and not everyone has the funds to pay for one upfront. The good news is, there is no specific credit score required to buy a mattress. However, having a good credit score can make the financing process much easier. Credit score is a numerical representation of your creditworthiness, or how likely you are to pay back loans and credit. It ranges from 300 to 850, with a higher score indicating a lower risk for lenders. Different lenders may have different credit score requirements, but generally, a score of 700 or above is considered good, while 800 or above is excellent.What Credit Score Do You Need to Buy a Mattress?

If you have a good credit score, getting approved for mattress financing will likely be a breeze. However, if your credit score is lower, you may need to take some extra steps to improve it. One way to do this is by checking your credit report for any errors and disputing them. You can also try paying down any existing debt and making all of your payments on time. Another option for getting approved for mattress financing is to find a co-signer with a good credit score. This means that someone with a higher credit score will be responsible for the loan if you are unable to make payments. Just make sure your co-signer understands the responsibility and risks involved.How to Get Approved for Mattress Financing

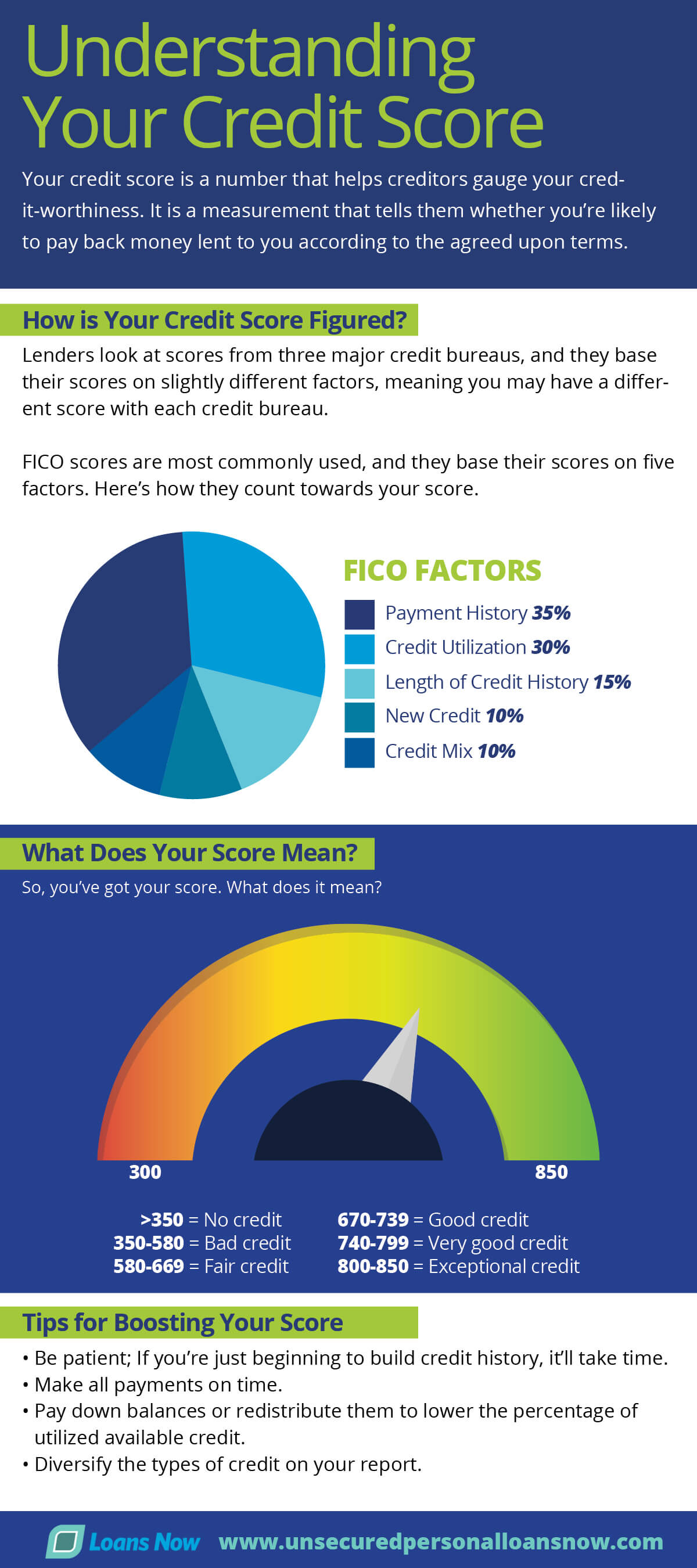

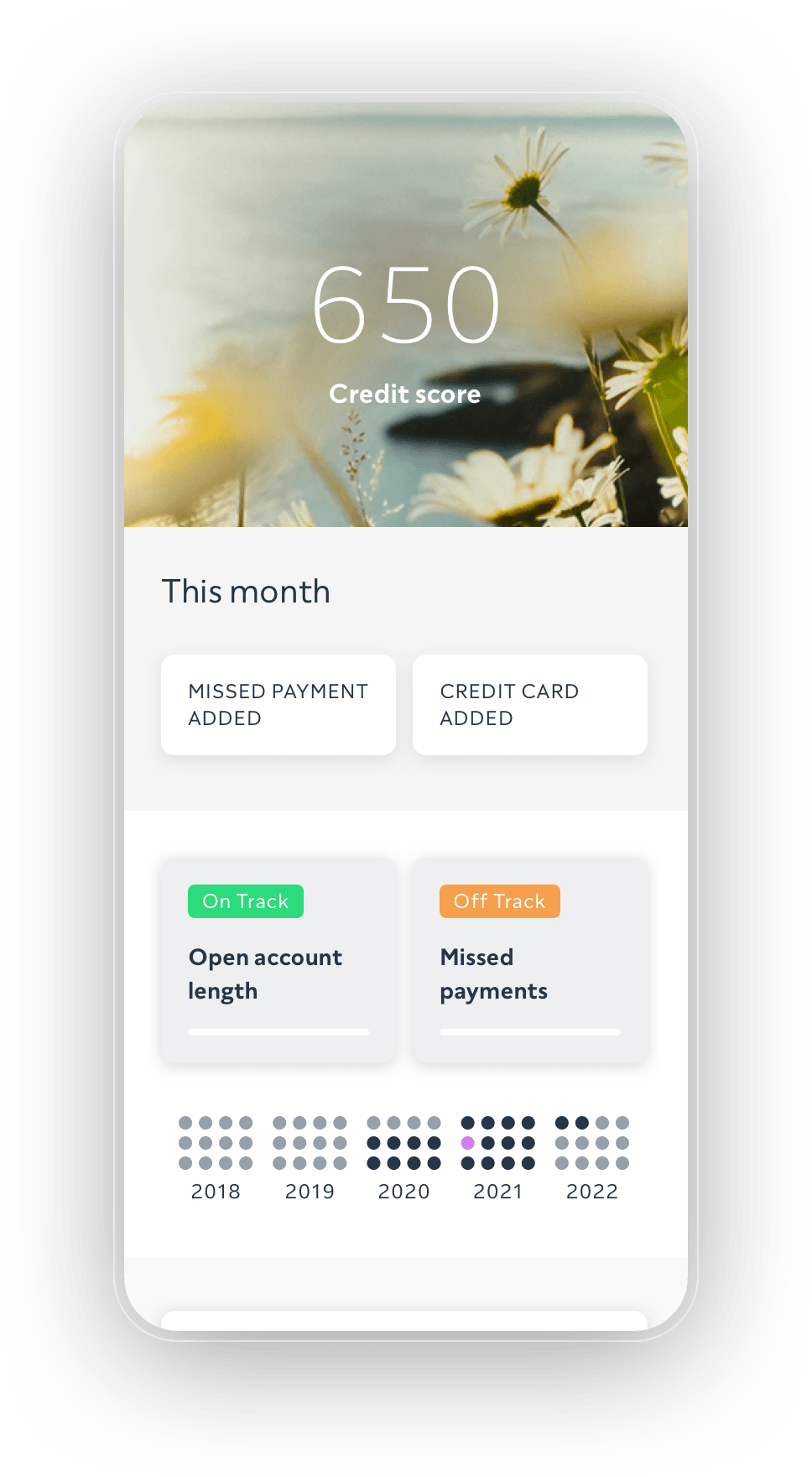

When it comes to mattress financing, credit scores play a significant role. Lenders use this important factor to determine your eligibility and interest rates for financing options. A higher credit score usually means a lower interest rate and better terms, while a lower credit score may result in higher interest rates and stricter terms. Credit scores are calculated based on several factors, including your payment history, credit utilization, length of credit history, and types of credit. Therefore, it's crucial to maintain good financial habits, such as making payments on time and keeping credit card balances low, to improve your credit score.Understanding Credit Scores and Mattress Financing

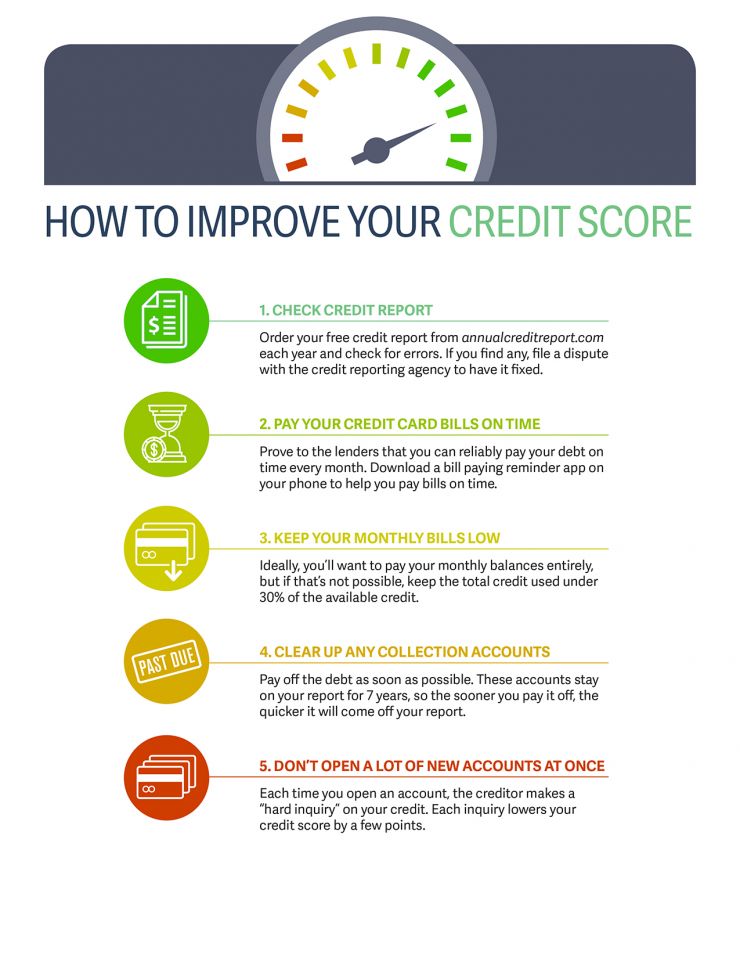

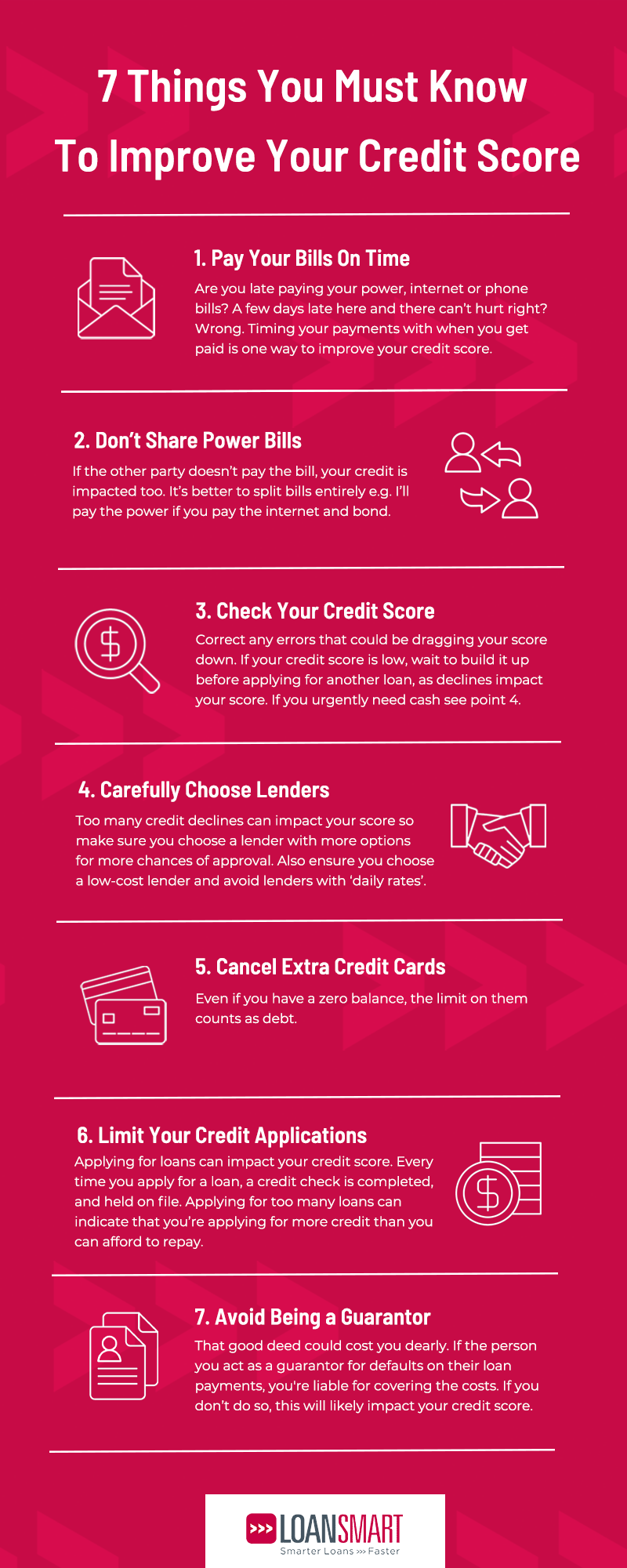

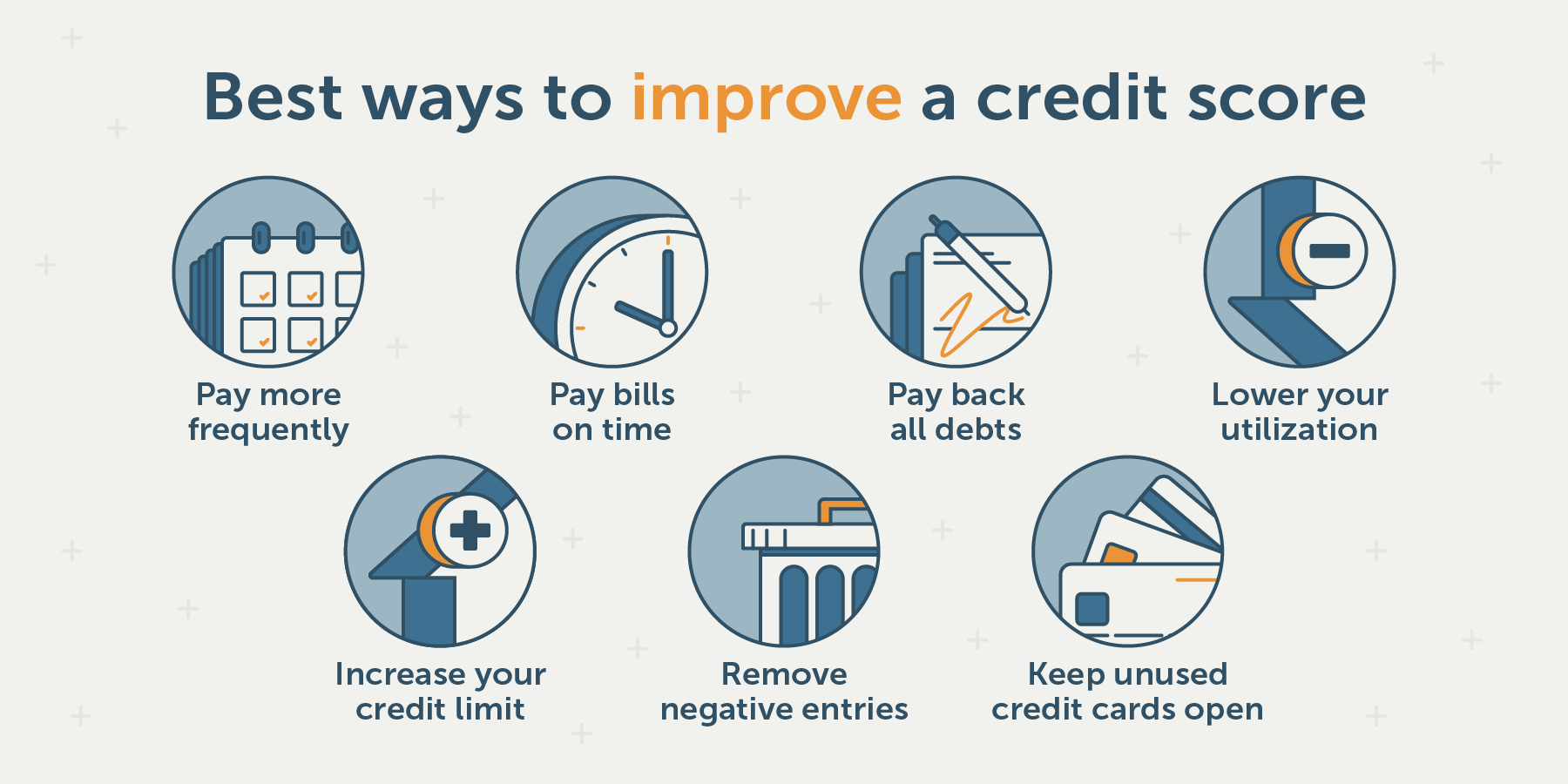

If your credit score needs some work, don't worry, there are steps you can take to improve it. One of the most important things you can do is to make all of your payments on time. Late payments can significantly lower your credit score and make it harder to get approved for financing. You can also try to pay down any existing debt, especially credit card debt, as credit utilization makes up a significant portion of your credit score. Additionally, try not to open new lines of credit unless absolutely necessary, as this can also temporarily lower your score.How to Improve Your Credit Score for Mattress Financing

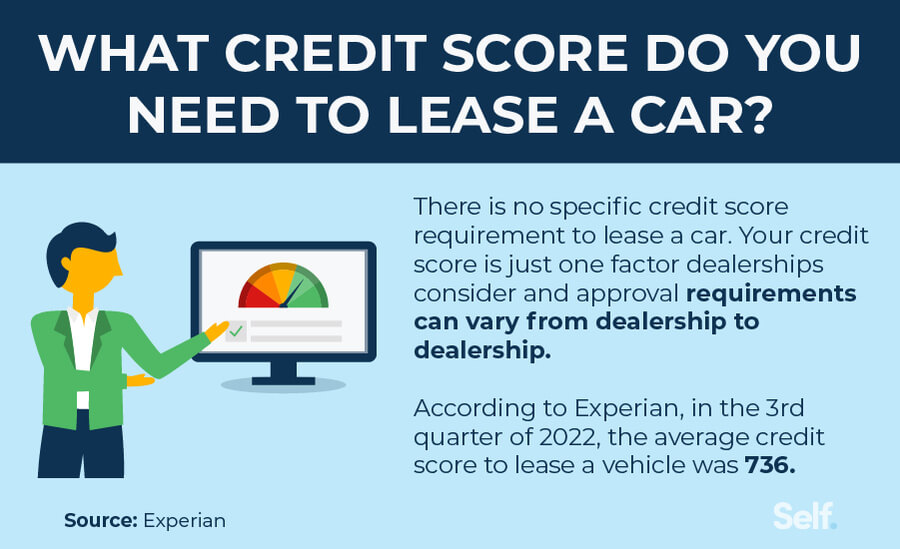

Many people wonder what credit score is needed for mattress financing at Mattress Firm specifically. While their requirements may vary, it's safe to assume that they will require a credit score of at least 600 for financing options. However, having a higher credit score can help you secure better financing terms and lower interest rates. If you're unsure about your credit score, you can always check it for free online or through a credit monitoring service. This will give you a better idea of where you stand and what you can do to improve your score.Mattress Firm Credit Score Requirements

As mentioned, there is no specific credit score required to buy a mattress. However, having a good credit score can make the financing process much easier. At Mattress Firm, a score of 600 or above is generally recommended for financing options. If your credit score is lower, don't worry, there are still options available to you. You can work on improving your credit score, or you can consider alternative financing options such as layaway or saving up to pay for your mattress in full.What Credit Score Do You Need for Mattress Firm Financing?

If you're unsure about your credit score, you can check it for free online or through a credit monitoring service. These services will provide you with a detailed breakdown of your credit score, as well as tips for improving it. It's always a good idea to check your credit score before applying for any type of financing, as it will give you a better idea of what to expect and how to prepare.How to Check Your Credit Score for Mattress Financing

If you have a low credit score, there are still ways to get approved for mattress financing. One option is to look for lenders that specialize in financing for those with bad credit. These lenders may have less strict credit score requirements and may be more willing to work with you. You can also consider offering a larger down payment or finding a co-signer with a good credit score to improve your chances of getting approved.Tips for Getting Approved for Mattress Financing with Bad Credit

At Mattress Firm, there are various financing options available for different credit scores. For those with good credit, you may qualify for 0% APR financing for a set period of time, while those with lower credit scores may be offered a higher interest rate and shorter financing terms. If you have a lower credit score, it's essential to carefully review the terms and interest rates before agreeing to any financing option. You may also want to consider alternative financing options, such as layaway or payment plans.Mattress Firm Financing Options for Different Credit Scores

If you're not in a rush to buy a mattress, you can work on building your credit score first. This will not only increase your chances of getting approved for financing, but it can also help you secure better terms and lower interest rates. To build your credit, make sure to make all of your payments on time, keep credit card balances low, and avoid opening new lines of credit unless necessary. Over time, these good financial habits will reflect positively on your credit score. In conclusion, there is no set credit score required to buy a mattress, but having a good credit score can make the financing process much easier. It's important to understand your credit score and take steps to improve it if needed. By doing so, you can secure better financing options and get the mattress of your dreams without breaking the bank.How to Build Credit for Mattress Financing Approval

The Importance of Credit Score for Mattress Firm Approval

What is a Credit Score?

Your credit score is a three-digit number that represents your creditworthiness and financial responsibility. It is based on your credit history and can range from 300 to 850. The higher your credit score, the more likely you are to be approved for loans, credit cards, and other forms of financing. A good credit score not only helps you secure better interest rates, but it also shows lenders that you are a responsible borrower.

Your credit score is a three-digit number that represents your creditworthiness and financial responsibility. It is based on your credit history and can range from 300 to 850. The higher your credit score, the more likely you are to be approved for loans, credit cards, and other forms of financing. A good credit score not only helps you secure better interest rates, but it also shows lenders that you are a responsible borrower.

The Role of Credit Score in Mattress Firm Approval

When it comes to purchasing a new mattress, you may not think that your credit score plays a role. However, many mattress firms require customers to fill out a credit application before approving them for financing options. This is because buying a mattress is considered a big-ticket purchase and lenders want to ensure that you are financially capable of making the payments.

A good credit score can greatly increase your chances of getting approved for financing at a mattress firm.

This is because it demonstrates to the lender that you have a history of managing credit responsibly and are likely to make your payments on time. On the other hand, a low credit score can result in a denial of financing or higher interest rates, making it more difficult for you to afford the mattress of your choice.

When it comes to purchasing a new mattress, you may not think that your credit score plays a role. However, many mattress firms require customers to fill out a credit application before approving them for financing options. This is because buying a mattress is considered a big-ticket purchase and lenders want to ensure that you are financially capable of making the payments.

A good credit score can greatly increase your chances of getting approved for financing at a mattress firm.

This is because it demonstrates to the lender that you have a history of managing credit responsibly and are likely to make your payments on time. On the other hand, a low credit score can result in a denial of financing or higher interest rates, making it more difficult for you to afford the mattress of your choice.

How to Improve Your Credit Score

If your credit score is not where you want it to be, there are steps you can take to improve it.

The first step is to check your credit report for any errors and dispute them if necessary.

You should also make sure to pay your bills on time, keep your credit card balances low, and avoid opening too many new credit accounts at once. Over time, these habits can help boost your credit score and make it easier for you to get approved for financing at a mattress firm.

In conclusion, your credit score plays a significant role in your ability to get approved for financing at a mattress firm. It is important to keep track of your credit score and take steps to improve it if needed. By doing so, you can increase your chances of getting approved for financing and ultimately, get the mattress of your dreams.

If your credit score is not where you want it to be, there are steps you can take to improve it.

The first step is to check your credit report for any errors and dispute them if necessary.

You should also make sure to pay your bills on time, keep your credit card balances low, and avoid opening too many new credit accounts at once. Over time, these habits can help boost your credit score and make it easier for you to get approved for financing at a mattress firm.

In conclusion, your credit score plays a significant role in your ability to get approved for financing at a mattress firm. It is important to keep track of your credit score and take steps to improve it if needed. By doing so, you can increase your chances of getting approved for financing and ultimately, get the mattress of your dreams.