Are you considering purchasing a Casper mattress? If so, you may be wondering about the sales tax implications. Sales tax can add a significant amount to the overall cost of a mattress, so it's important to understand how much you may need to pay. In this article, we'll break down everything you need to know about Casper mattress sales tax.1. Casper Mattress Sales Tax: What You Need to Know

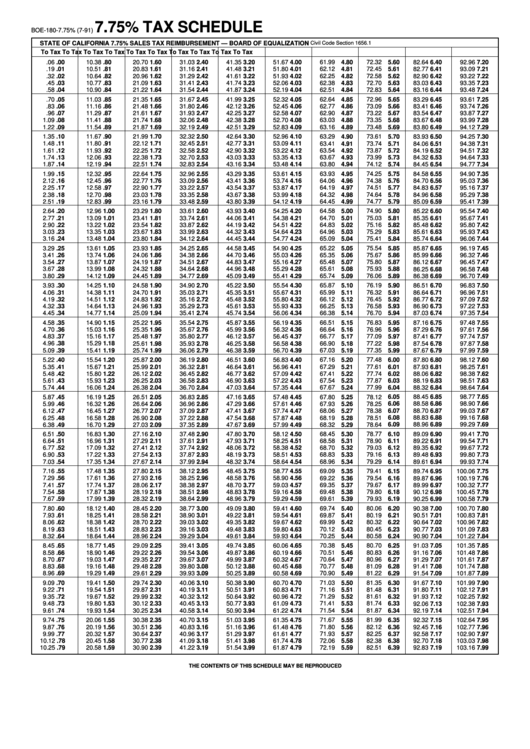

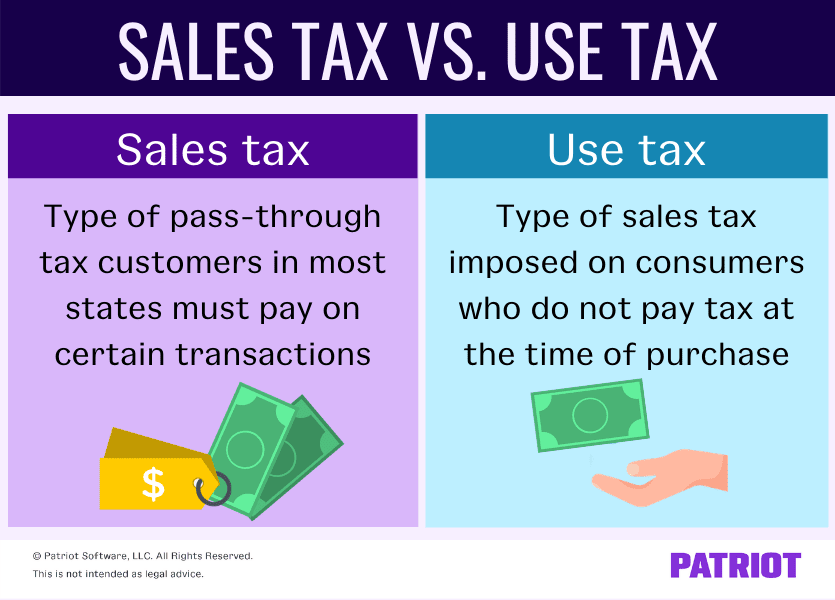

Sales tax is a tax imposed by state and local governments on the sale of goods and services. The tax rate varies depending on the location, and each state has its own set of rules and regulations. When it comes to purchasing a mattress, sales tax can range from a few dollars to a few hundred dollars, depending on the price of the mattress and the tax rate in your area.2. Understanding Sales Tax on Mattresses: A Guide for Consumers

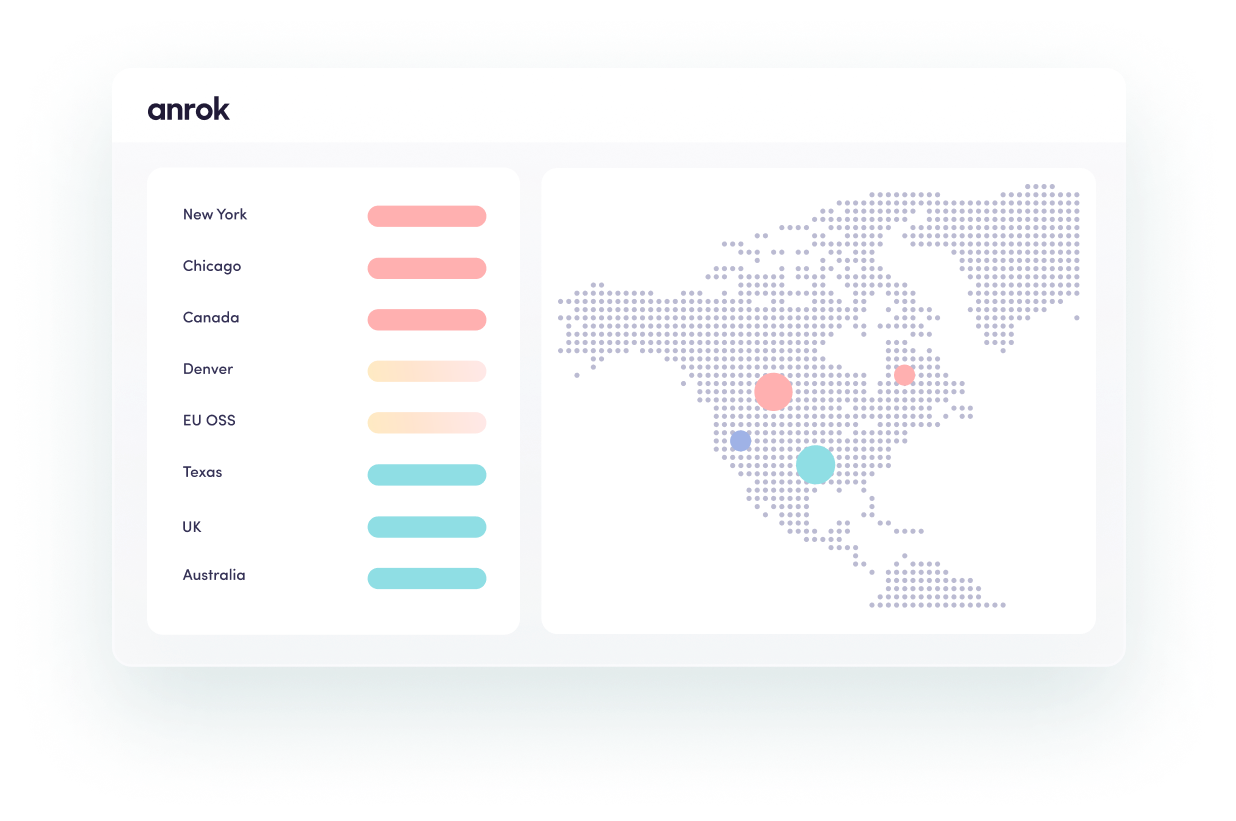

The amount of sales tax you'll pay on a Casper mattress depends on where you live. Casper is an online retailer, but they have showrooms in select cities where you can try out their mattresses before making a purchase. If you live in a state where Casper has a showroom, you may be subject to sales tax. However, if you live in a state without a showroom, you may be able to avoid paying sales tax.3. How Much is Sales Tax on a Casper Mattress?

Let's take a look at the sales tax rates for Casper mattresses in different states. Keep in mind that these rates are subject to change, so it's always best to double check with your local tax authority before making a purchase. California: California has a state sales tax rate of 7.25%. If you live in a city with a higher local tax rate, you may end up paying more for your Casper mattress. Texas: Texas has a state sales tax rate of 6.25%. However, some cities in Texas have additional local taxes, so you may end up paying more than the state rate. Florida: Florida has a state sales tax rate of 6%. However, like Texas, some cities in Florida have additional local taxes.4. Casper Mattress Sales Tax: State by State Breakdown

If you're looking to save some money on your Casper mattress purchase, you may be able to avoid paying sales tax by purchasing from a state without a Casper showroom. However, keep in mind that you may also have to pay for shipping, which can add to the overall cost. Another option is to wait for a sale or look for discounts or promo codes that can help offset the cost of sales tax.5. Tips for Saving Money on Your Casper Mattress Purchase

One of the main reasons people choose to purchase a Casper mattress is for the convenience of buying online. However, there are both pros and cons to this method of purchasing a mattress. On the plus side, you can avoid the hassle of visiting a showroom and dealing with pushy salespeople. You also have the option to return the mattress if you're not satisfied. However, you won't be able to try out the mattress before making a purchase, and you may have to pay for shipping and sales tax.6. The Pros and Cons of Buying a Casper Mattress Online

If you're curious about how much sales tax you'll need to pay on your Casper mattress, it's easy to calculate. Simply take the price of the mattress and multiply it by the sales tax rate in your area. For example, if you live in California and purchase a Casper mattress for $1,000, you'll need to pay $72.50 in sales tax (7.25% of $1,000).7. How to Calculate Sales Tax on a Casper Mattress

While Casper is a popular online mattress retailer, they are not the only one on the market. Other online mattress companies may have different sales tax rates depending on their business operations. It's always a good idea to compare prices and sales tax rates before making a purchase to ensure you're getting the best deal.8. Comparing Sales Tax Rates for Online Mattress Purchases

The laws surrounding sales tax for online retailers can be complex and vary from state to state. Some states require online retailers to collect sales tax if they have a physical presence, such as a showroom or warehouse, in the state. Other states have passed laws requiring online retailers to collect sales tax regardless of physical presence. It's important to stay updated on these laws to understand your tax obligations when purchasing a mattress online.9. Understanding the Sales Tax Laws for Online Mattress Retailers

If you're determined to avoid paying sales tax on your Casper mattress, there is one option available. Some states have a "use tax" for items purchased out of state and brought into the state for use. This means you may be required to report and pay sales tax on your Casper mattress when filing your state income tax return. However, not all states have a use tax, so be sure to check with your state tax authority for more information. Now that you have a better understanding of Casper mattress sales tax, you can make a more informed decision about your purchase. Keep in mind that sales tax rates and laws can change, so it's always best to do your research and consult with your local tax authority for the most up-to-date information. Happy mattress shopping!10. How to Avoid Paying Sales Tax on Your Casper Mattress Purchase

Why Sales Tax for Casper Mattresses Makes Sense for House Design

The Importance of a Good Mattress in House Design

When it comes to designing a house, many people tend to focus on the aesthetics and overall layout of the space. However, one crucial element that is often overlooked is the choice of mattress. A good mattress not only provides comfort and support for a good night's sleep, but it also plays a significant role in the overall design and functionality of a bedroom. This is why

Casper mattresses

have become a popular choice for those who prioritize both design and comfort in their homes.

When it comes to designing a house, many people tend to focus on the aesthetics and overall layout of the space. However, one crucial element that is often overlooked is the choice of mattress. A good mattress not only provides comfort and support for a good night's sleep, but it also plays a significant role in the overall design and functionality of a bedroom. This is why

Casper mattresses

have become a popular choice for those who prioritize both design and comfort in their homes.

The Benefits of Choosing a Casper Mattress

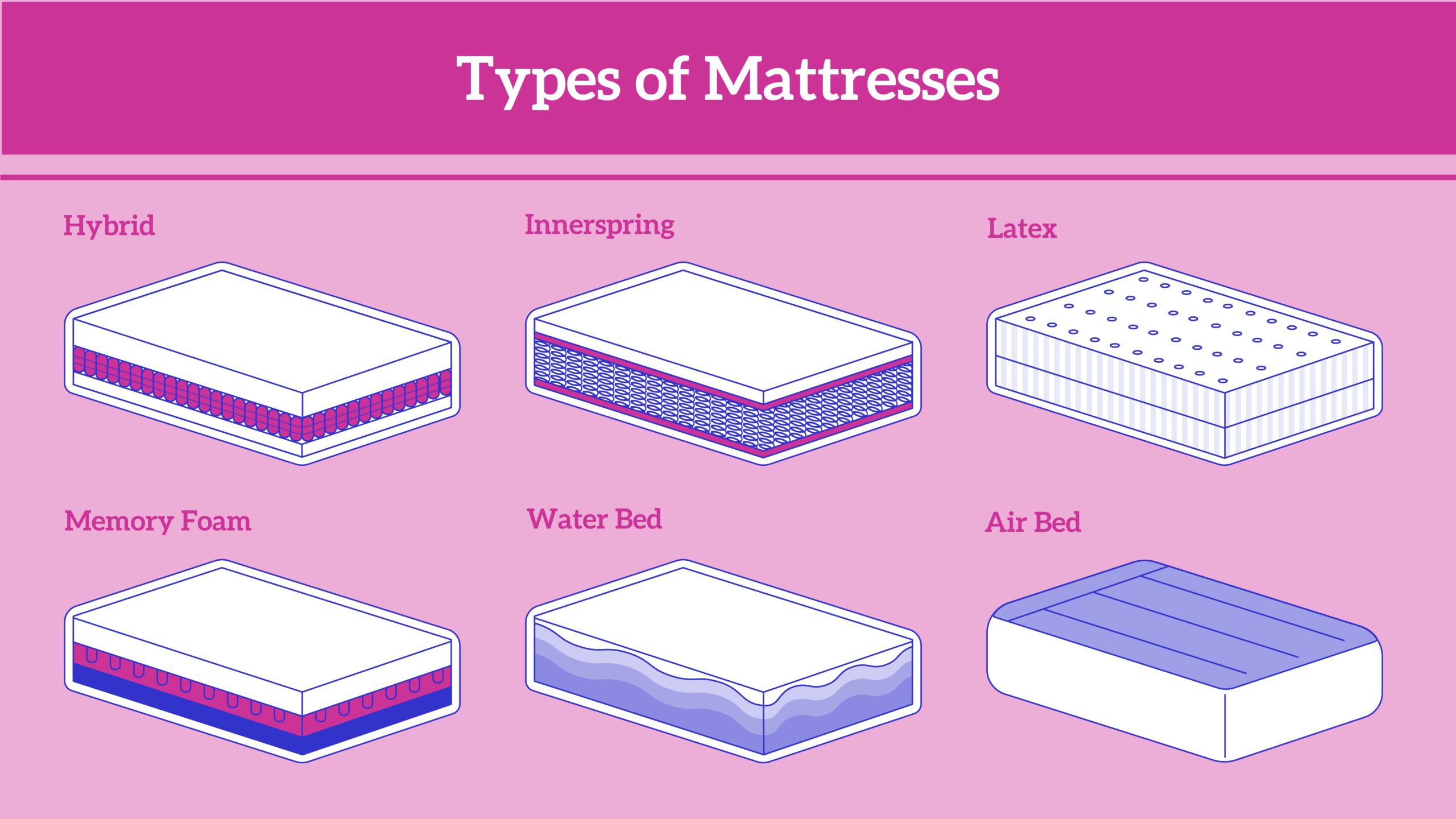

Casper mattresses are designed with both style and functionality in mind. The brand offers a variety of

innovative

mattresses that cater to different sleeping preferences and needs. Whether you prefer a firmer or softer mattress, Casper has got you covered. Not only that, but their mattresses also come in different sizes, making it easier to fit into any bedroom design.

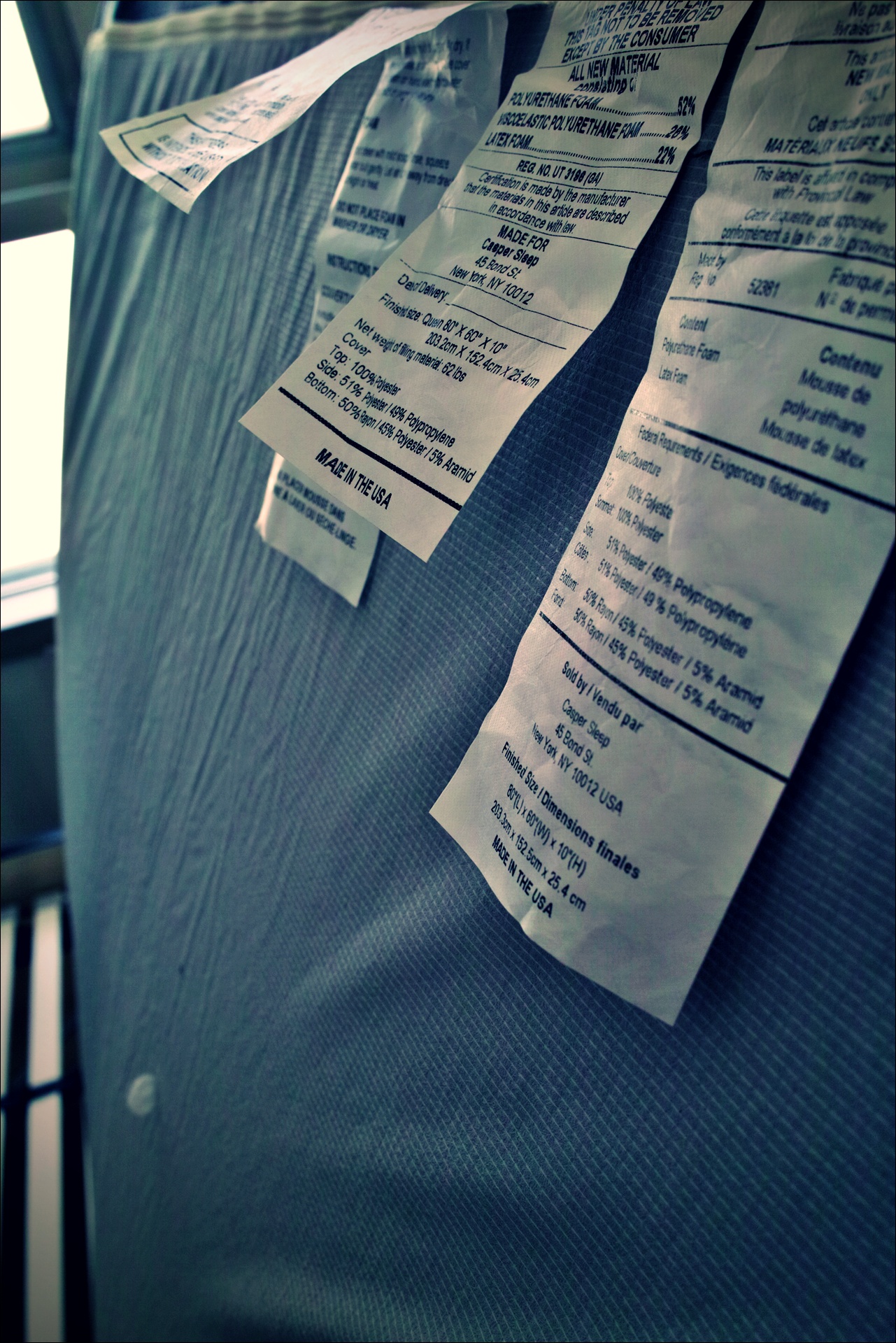

What sets Casper apart from other mattress brands is their use of

high-quality materials

that not only provide comfort but also ensure durability. With Casper, you can say goodbye to sagging mattresses and uncomfortable nights. Their mattresses are designed to provide the right amount of support and pressure relief, helping you wake up feeling refreshed and ready to take on the day.

Casper mattresses are designed with both style and functionality in mind. The brand offers a variety of

innovative

mattresses that cater to different sleeping preferences and needs. Whether you prefer a firmer or softer mattress, Casper has got you covered. Not only that, but their mattresses also come in different sizes, making it easier to fit into any bedroom design.

What sets Casper apart from other mattress brands is their use of

high-quality materials

that not only provide comfort but also ensure durability. With Casper, you can say goodbye to sagging mattresses and uncomfortable nights. Their mattresses are designed to provide the right amount of support and pressure relief, helping you wake up feeling refreshed and ready to take on the day.

The Importance of Paying Sales Tax for Casper Mattresses

Some may question why there is a need to pay sales tax for Casper mattresses when purchasing them. However, paying sales tax is not only a legal requirement, but it also has its benefits. By paying sales tax, you are supporting the local economy and contributing to the community. This, in turn, helps in the development and improvement of the area, making it a more desirable place to live in.

Moreover, paying sales tax for Casper mattresses also ensures that the brand can continue to provide high-quality products and services. It allows them to invest in research and development, leading to

innovative

and more advanced mattress designs that cater to the changing needs and preferences of consumers.

In conclusion, choosing a Casper mattress for your house design not only adds style and comfort to your bedroom, but it also supports the local economy and ensures the brand's continued ability to provide high-quality mattresses. So the next time you are in the market for a new mattress, don't forget the importance of paying sales tax for Casper mattresses. Your house design and the community will thank you for it.

Some may question why there is a need to pay sales tax for Casper mattresses when purchasing them. However, paying sales tax is not only a legal requirement, but it also has its benefits. By paying sales tax, you are supporting the local economy and contributing to the community. This, in turn, helps in the development and improvement of the area, making it a more desirable place to live in.

Moreover, paying sales tax for Casper mattresses also ensures that the brand can continue to provide high-quality products and services. It allows them to invest in research and development, leading to

innovative

and more advanced mattress designs that cater to the changing needs and preferences of consumers.

In conclusion, choosing a Casper mattress for your house design not only adds style and comfort to your bedroom, but it also supports the local economy and ensures the brand's continued ability to provide high-quality mattresses. So the next time you are in the market for a new mattress, don't forget the importance of paying sales tax for Casper mattresses. Your house design and the community will thank you for it.