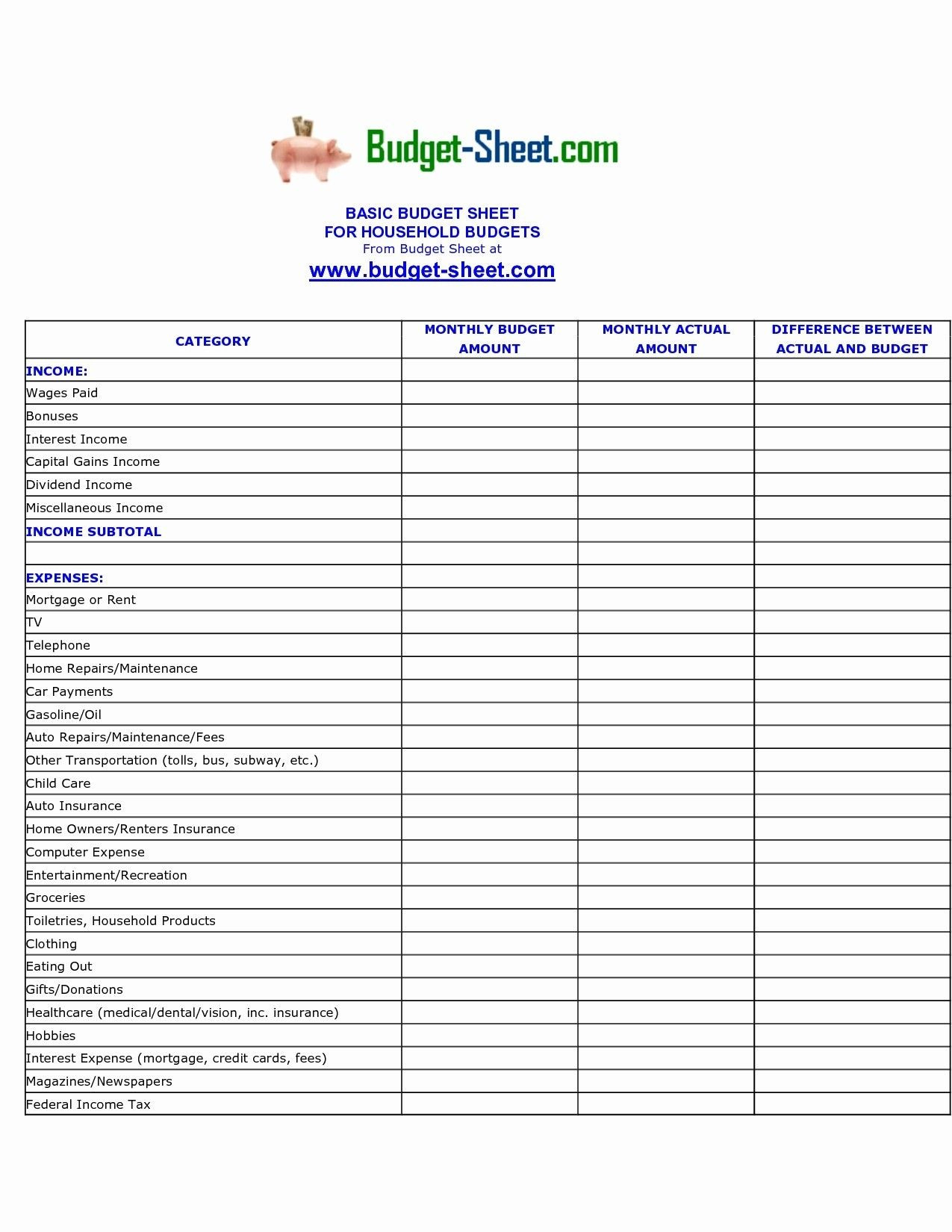

Renting out a living room can be a great way to earn extra income, but it's important to understand the potential for capital gains in this type of rental situation. Capital gains refer to the profit made when you sell a property or asset for more than its original purchase price. In the case of living room rentals, capital gains can come into play when you sell the property or when you receive income from the rental. Let's take a closer look at the top 10 main capital gain considerations for living room rentals.Capital Gain In Living Room Rental

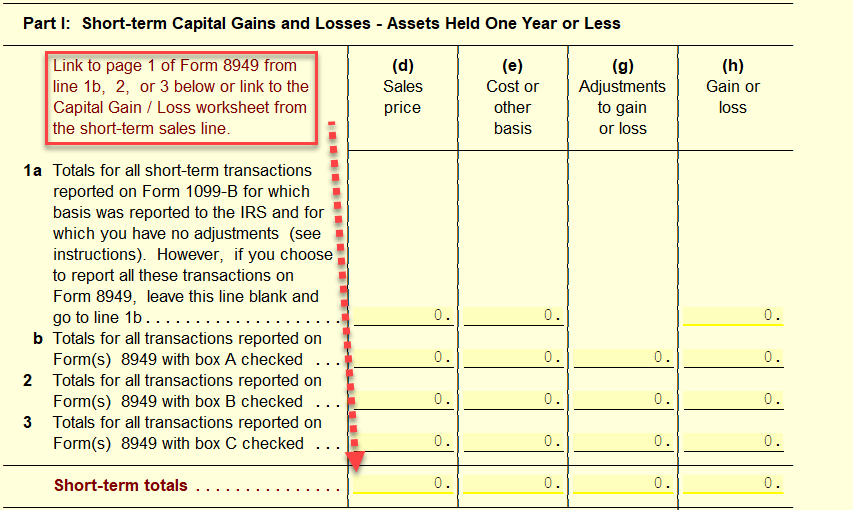

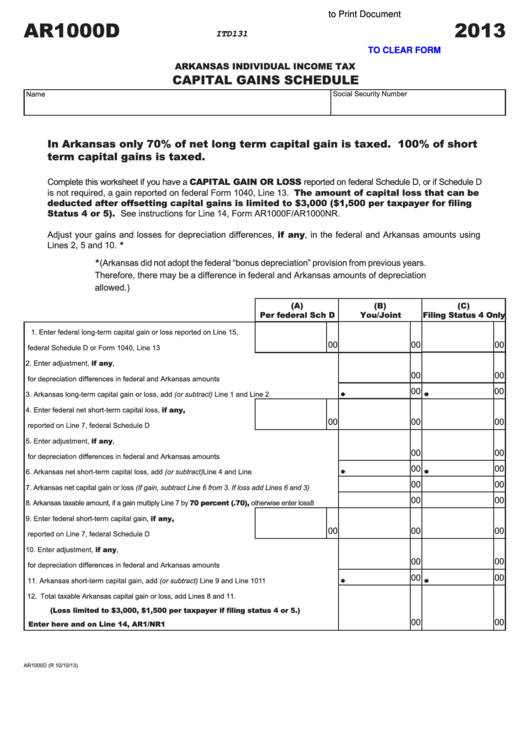

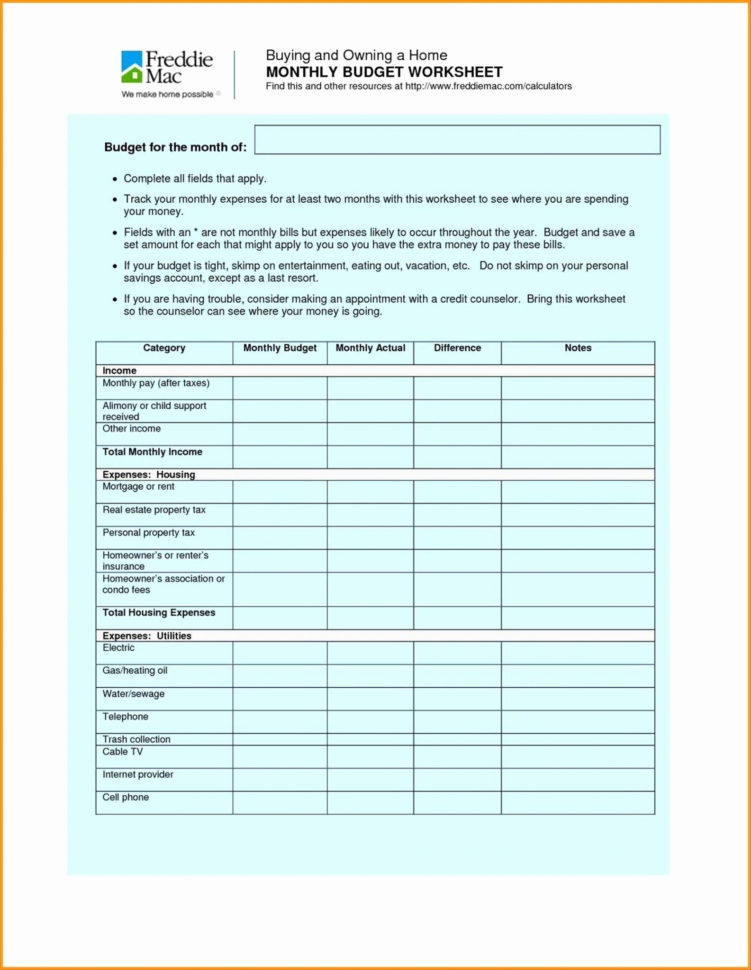

One of the most important things to consider when renting out a living room is the potential tax implications. Any income you receive from the rental is considered taxable and must be reported on your tax return. This includes both short-term and long-term rentals. Depending on your location and the specific details of your rental, you may be subject to federal, state, and local income taxes.Capital Gain In Living Room Rental Tax

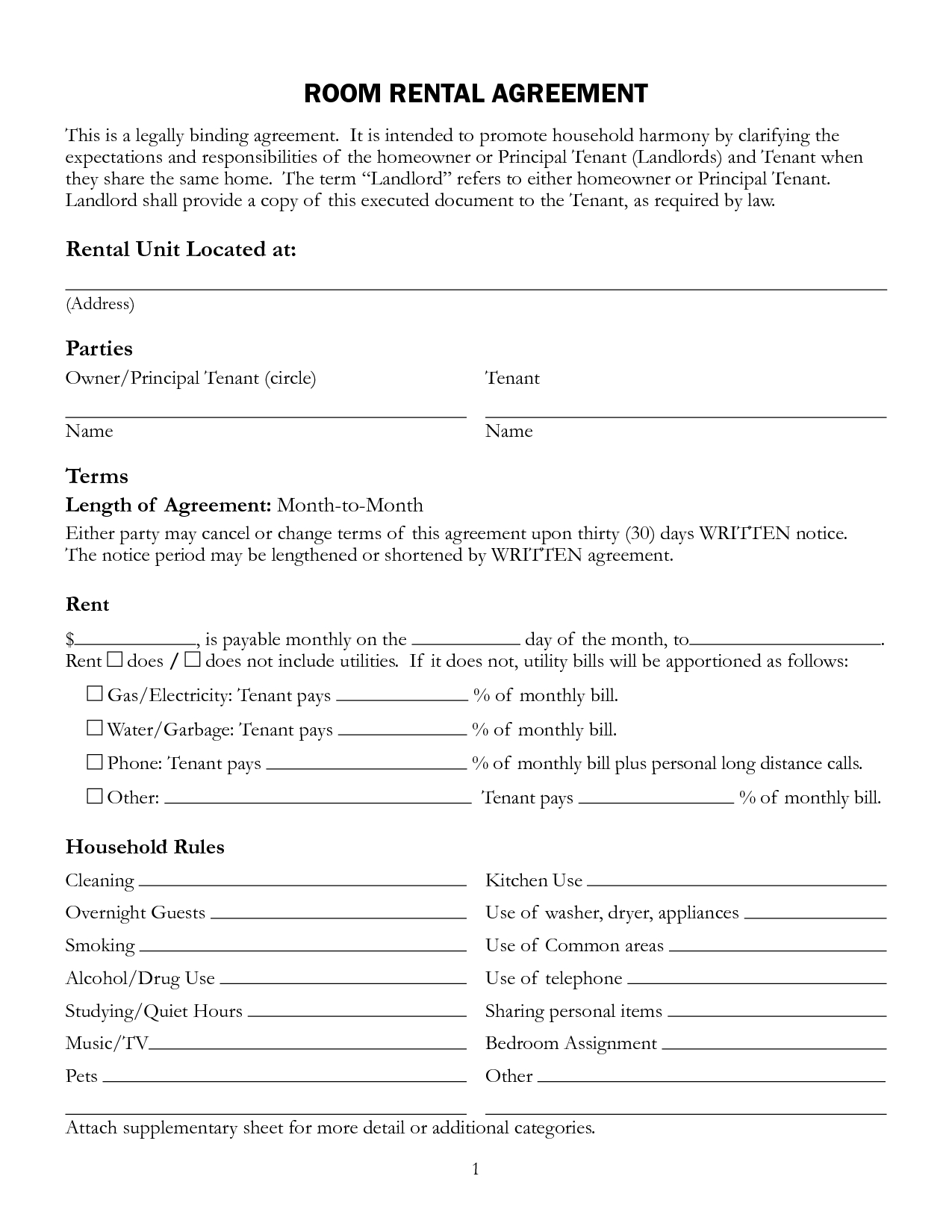

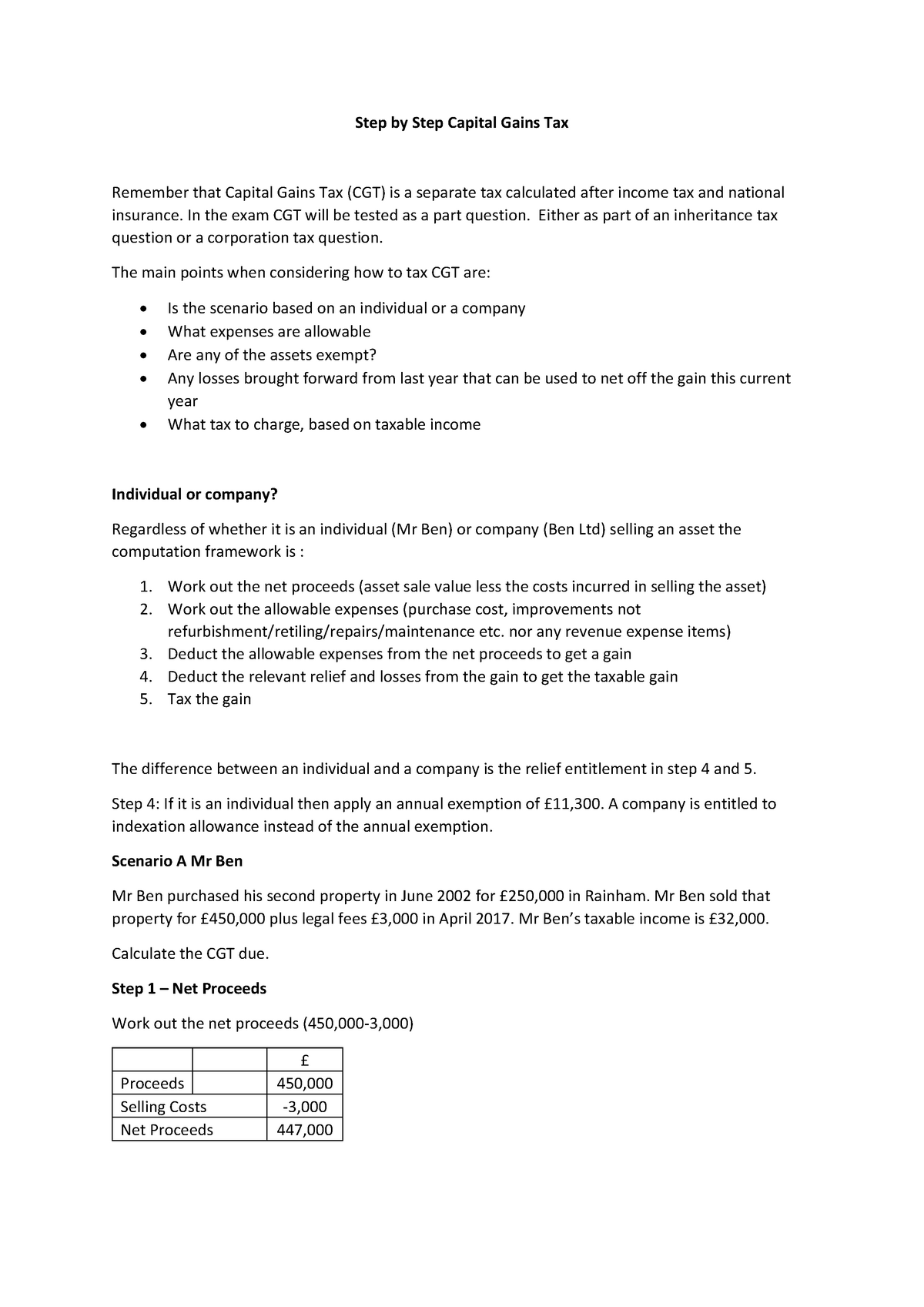

When you rent out a living room, you are essentially turning a portion of your primary residence into a rental property. This means that when you eventually sell your home, you may be subject to capital gains taxes on the portion that was used for rental purposes. It's important to keep track of any improvements or renovations made to the living room, as these can be used to decrease the amount of capital gains taxes owed.Living Room Rental Property Capital Gain

As mentioned earlier, any income received from a living room rental is considered taxable. This means that you will need to report it on your tax return and pay any applicable taxes. The exact tax rate will depend on your overall income and tax bracket, but it's important to budget for these taxes when planning to rent out your living room.Capital Gain Tax on Living Room Rental

Fortunately, there is a capital gains exemption that may apply to living room rentals. If you have lived in the property for at least two of the past five years and meet certain other requirements, you may be able to exclude up to $250,000 of capital gains if you're single, or up to $500,000 if you're married filing jointly. This can significantly decrease the amount of taxes owed when you sell the property.Living Room Rental Capital Gains Exemption

When it comes to capital gains, it's not just about the potential taxes owed when you sell the property. You may also be subject to capital gains taxes on the rental income itself. This is especially true if you have owned the property for a long time and the rental income has significantly increased over the years. Again, keeping track of any improvements or renovations made to the living room can help decrease the amount of capital gains taxes owed.Capital Gains on Living Room Rental Income

Calculating capital gains can be a complex process, especially when it comes to rental income. If you're unsure of how much you may owe in capital gains taxes, it's a good idea to use a capital gains calculator. This tool can help you estimate the potential taxes owed based on your specific situation and location.Living Room Rental Capital Gains Calculator

The capital gains tax rate for living room rentals will vary depending on your overall income and tax bracket. In general, the higher your income, the higher the capital gains tax rate will be. It's important to consult with a tax professional or use a capital gains calculator to determine your specific tax rate.Capital Gains Tax Rate for Living Room Rental

As mentioned earlier, there is a capital gains exclusion that may apply to living room rentals if you meet certain requirements. It's important to keep track of your residency in the property and any improvements made to the living room to ensure you qualify for this exclusion when you eventually sell the property.Living Room Rental Capital Gains Exclusion

Finally, it's important to consider the potential capital gains when you sell the property that has a living room rental. Depending on the length of time the living room was rented out and any changes in the property's value, you may owe capital gains taxes on the sale. It's important to keep track of all rental income and expenses to accurately determine the potential capital gains taxes owed on the sale of the property. In conclusion, renting out a living room can be a profitable venture, but it's important to understand the potential for capital gains and the tax implications that come with it. By keeping track of rental income and expenses and staying informed about tax laws and exemptions, you can ensure that your living room rental is a successful and financially beneficial experience.Capital Gains on Living Room Rental Property Sale

How to Maximize Your Capital Gain in Living Room Rental

Creating a Welcoming and Functional Living Room

When it comes to renting out your living room, it's important to remember that first impressions are everything. This is the first space that potential tenants will see and it sets the tone for the rest of the house. Therefore, it's essential to create a welcoming and functional living room that will not only attract tenants but also increase your capital gain.

Space Optimization:

One of the key elements of a successful living room rental is optimizing the space. This means making the most out of the available space without overcrowding it. Consider using multipurpose furniture such as a storage ottoman or a sofa bed to save space. This will not only make the room look bigger but also provide additional functionality for tenants.

Neutral Color Scheme:

When designing your living room, it's best to stick to a neutral color scheme. This creates a blank canvas for tenants to personalize the space with their own furniture and décor. Neutral colors also make the room feel more spacious and inviting. You can add pops of color through accessories such as pillows and rugs to add visual interest.

Functional Layout:

The layout of your living room should be both functional and aesthetically pleasing. Consider the flow of the room and make sure there is enough space for tenants to move around comfortably. Avoid blocking windows or doors and ensure that there is enough seating for the number of tenants your room can accommodate.

When it comes to renting out your living room, it's important to remember that first impressions are everything. This is the first space that potential tenants will see and it sets the tone for the rest of the house. Therefore, it's essential to create a welcoming and functional living room that will not only attract tenants but also increase your capital gain.

Space Optimization:

One of the key elements of a successful living room rental is optimizing the space. This means making the most out of the available space without overcrowding it. Consider using multipurpose furniture such as a storage ottoman or a sofa bed to save space. This will not only make the room look bigger but also provide additional functionality for tenants.

Neutral Color Scheme:

When designing your living room, it's best to stick to a neutral color scheme. This creates a blank canvas for tenants to personalize the space with their own furniture and décor. Neutral colors also make the room feel more spacious and inviting. You can add pops of color through accessories such as pillows and rugs to add visual interest.

Functional Layout:

The layout of your living room should be both functional and aesthetically pleasing. Consider the flow of the room and make sure there is enough space for tenants to move around comfortably. Avoid blocking windows or doors and ensure that there is enough seating for the number of tenants your room can accommodate.

Bringing in Natural Light

Natural light has the power to transform any space and make it feel more inviting. When designing your living room, try to incorporate as much natural light as possible. This not only makes the space look brighter and more spacious but also has numerous health benefits for tenants.

Window Treatments:

When choosing window treatments, opt for light and airy fabrics that allow natural light to pass through. You can also install blinds or curtains that can be easily opened and closed to control the amount of light coming in.

Mirrors:

Mirrors are a great way to reflect natural light and make a room feel bigger. Consider placing a large mirror opposite a window to maximize the amount of light in your living room.

Natural light has the power to transform any space and make it feel more inviting. When designing your living room, try to incorporate as much natural light as possible. This not only makes the space look brighter and more spacious but also has numerous health benefits for tenants.

Window Treatments:

When choosing window treatments, opt for light and airy fabrics that allow natural light to pass through. You can also install blinds or curtains that can be easily opened and closed to control the amount of light coming in.

Mirrors:

Mirrors are a great way to reflect natural light and make a room feel bigger. Consider placing a large mirror opposite a window to maximize the amount of light in your living room.

Adding a Touch of Personality

While keeping the living room design neutral is important, it's also essential to inject some personality into the space. This will make it stand out from other living room rentals and attract potential tenants.

Artwork and Décor:

Hang some artwork or add decorative pieces that reflect your personal style. This will add character to the living room and make it feel more like a home.

Plants:

Bringing in some greenery not only adds a pop of color but also purifies the air and creates a more inviting atmosphere. Consider low-maintenance plants such as succulents or snake plants that require minimal care.

In conclusion, by following these design tips, you can create a welcoming and functional living room that will not only attract tenants but also increase your capital gain. Remember to optimize the space, bring in natural light, and add a touch of personality to make your living room rental stand out.

While keeping the living room design neutral is important, it's also essential to inject some personality into the space. This will make it stand out from other living room rentals and attract potential tenants.

Artwork and Décor:

Hang some artwork or add decorative pieces that reflect your personal style. This will add character to the living room and make it feel more like a home.

Plants:

Bringing in some greenery not only adds a pop of color but also purifies the air and creates a more inviting atmosphere. Consider low-maintenance plants such as succulents or snake plants that require minimal care.

In conclusion, by following these design tips, you can create a welcoming and functional living room that will not only attract tenants but also increase your capital gain. Remember to optimize the space, bring in natural light, and add a touch of personality to make your living room rental stand out.

-min.png)