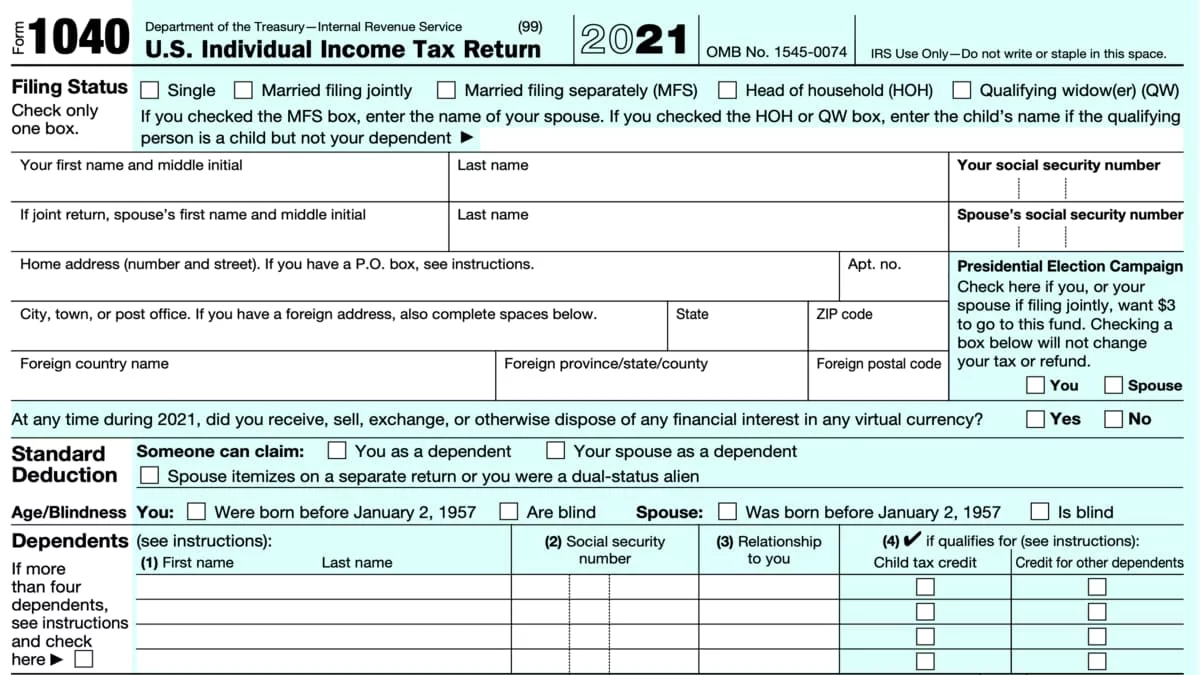

If you've recently returned a mattress, you may be wondering if you can deduct the cost from your taxes. After all, mattresses can be expensive and it would be nice to recoup some of that money. Unfortunately, the answer is not a simple yes or no. It depends on a few factors.Can you deduct a mattress return?

One option you may be considering is donating your returned mattress to charity. Not only does this help someone in need, but it may also provide a tax deduction. However, not all charities accept mattress donations and those that do may have specific guidelines and restrictions. It's important to do your research and make sure your mattress is in good enough condition to be donated.Can you donate a returned mattress?

If you are unable to donate your returned mattress, you may be wondering if you can still claim a tax deduction. The answer is generally no. A returned mattress is not considered a charitable donation and therefore cannot be claimed as a deduction on your taxes.Can you claim a tax deduction for a mattress return?

As mentioned, a returned mattress is not considered a charitable donation. However, there is one exception. If you are a business owner and the mattress was purchased for business use, you may be able to write off the return on your taxes as a business expense. This would require proper documentation and may only apply to certain types of businesses.Can you write off a mattress return on your taxes?

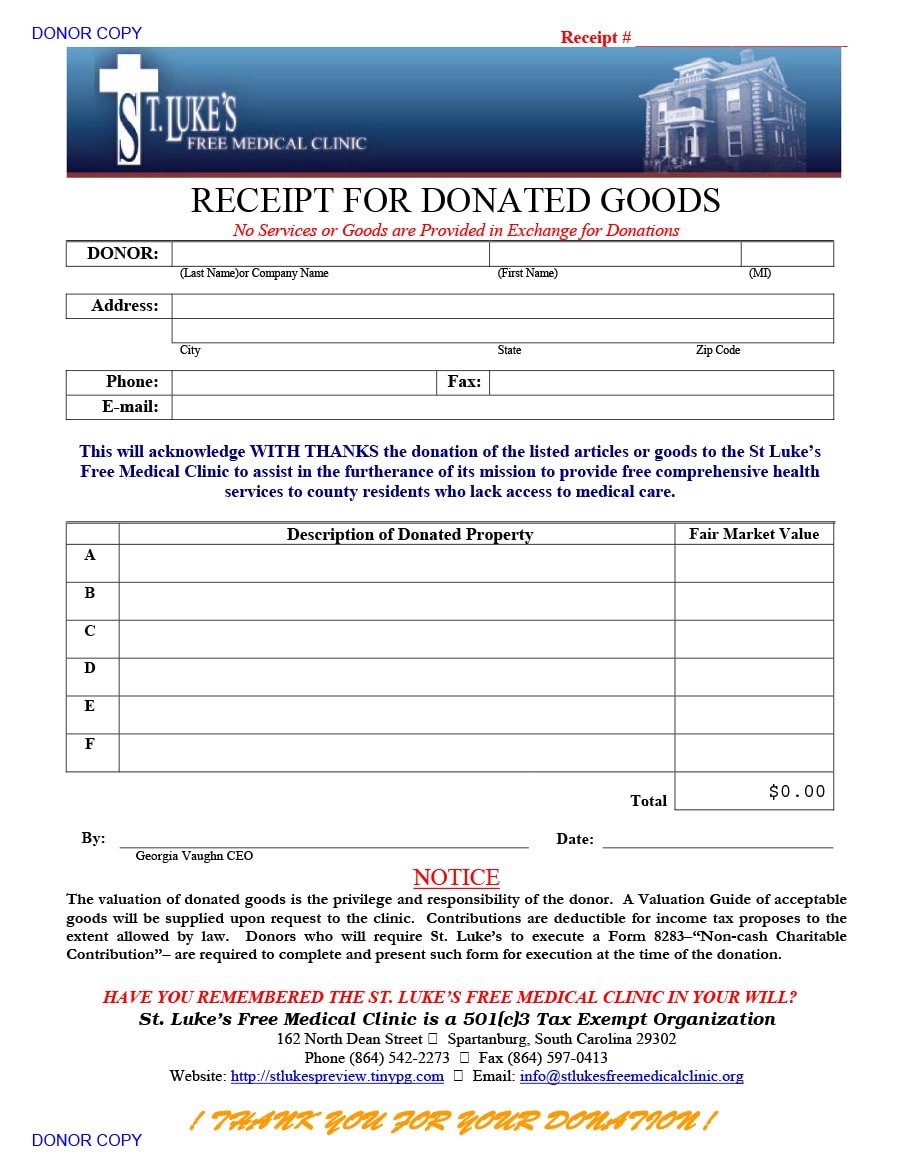

If you are able to donate your returned mattress to a qualified charity, you may be eligible for a tax deduction. The amount you can deduct will depend on the fair market value of the mattress at the time of donation. It's important to keep documentation of the donation and its value in case of an audit.Can you get a tax break for donating a returned mattress?

In general, mattress returns are not tax deductible. However, there are certain scenarios where you may be able to claim a deduction. This could include returning a mattress as a business expense or donating a returned mattress to a qualified charity. It's always best to consult with a tax professional to determine if your specific situation qualifies for a tax deduction.Are mattress returns tax deductible?

As mentioned, a returned mattress is not considered a charitable donation. Therefore, it cannot be deducted as such on your taxes. However, if you are able to donate the mattress, you may be able to deduct it as a non-cash charitable contribution.Can you deduct a mattress return as a charitable donation?

If you are able to donate your returned mattress to a qualified charity, you may be eligible for a tax deduction. However, the amount you can deduct will depend on the fair market value of the mattress at the time of donation. It's important to keep documentation of the donation and its value in case of an audit.Can you claim a tax deduction for donating a returned mattress?

As mentioned, a returned mattress is not considered a charitable donation and therefore cannot be claimed as a tax deduction. However, if you are able to donate the mattress to a qualified charity, you may be eligible for a tax deduction based on the fair market value of the mattress at the time of donation.Can you get a tax deduction for returning a mattress?

As a general rule, you cannot write off a mattress return as a charitable donation on your taxes. However, if you are able to donate the mattress to a qualified charity, you may be able to deduct it as a non-cash charitable contribution. It's always best to consult with a tax professional to determine the best course of action for your specific situation.Can you write off a mattress return as a charitable donation?

The Benefits of Donating Your Bear Mattress Return

Why Donate Your Bear Mattress Return?

When it comes to home design, every detail matters. From the color scheme to the furniture, every element plays a role in creating the perfect living space. But what about your mattress? While it may not be the first thing that comes to mind when designing your home, your mattress can greatly impact your overall well-being and comfort. That's why it's important to have a high-quality mattress that meets your needs. However, if you find that your recently purchased

Bear mattress

is not the right fit for you, you may be wondering what to do with it. The good news is, you can actually

deduct your Bear mattress return as a donation on your taxes

. Not only will you be able to save money on your taxes, but you'll also be doing a good deed by donating your mattress to those in need.

When it comes to home design, every detail matters. From the color scheme to the furniture, every element plays a role in creating the perfect living space. But what about your mattress? While it may not be the first thing that comes to mind when designing your home, your mattress can greatly impact your overall well-being and comfort. That's why it's important to have a high-quality mattress that meets your needs. However, if you find that your recently purchased

Bear mattress

is not the right fit for you, you may be wondering what to do with it. The good news is, you can actually

deduct your Bear mattress return as a donation on your taxes

. Not only will you be able to save money on your taxes, but you'll also be doing a good deed by donating your mattress to those in need.

The Tax Benefits of Donating Your Mattress

As a homeowner, you are probably familiar with the various tax deductions available to you. One of these deductions is for charitable donations, and this includes donating your

Bear mattress return

. The IRS allows you to deduct the fair market value of your donated goods, which includes mattresses. By donating your mattress to a qualified charitable organization, you can claim this deduction on your taxes and potentially save hundreds of dollars. This not only helps you financially, but it also helps the organization you are donating to.

As a homeowner, you are probably familiar with the various tax deductions available to you. One of these deductions is for charitable donations, and this includes donating your

Bear mattress return

. The IRS allows you to deduct the fair market value of your donated goods, which includes mattresses. By donating your mattress to a qualified charitable organization, you can claim this deduction on your taxes and potentially save hundreds of dollars. This not only helps you financially, but it also helps the organization you are donating to.

Make a Difference in Someone's Life

Aside from the tax benefits, donating your Bear mattress return allows you to make a positive impact in someone's life. Many charitable organizations accept mattress donations and distribute them to those in need, such as homeless shelters and low-income families. By donating your mattress, you are providing a comfortable and safe place for someone to sleep, which can greatly improve their overall well-being. Additionally, by donating to a charity, you are helping to support their cause and make a difference in your community.

Aside from the tax benefits, donating your Bear mattress return allows you to make a positive impact in someone's life. Many charitable organizations accept mattress donations and distribute them to those in need, such as homeless shelters and low-income families. By donating your mattress, you are providing a comfortable and safe place for someone to sleep, which can greatly improve their overall well-being. Additionally, by donating to a charity, you are helping to support their cause and make a difference in your community.

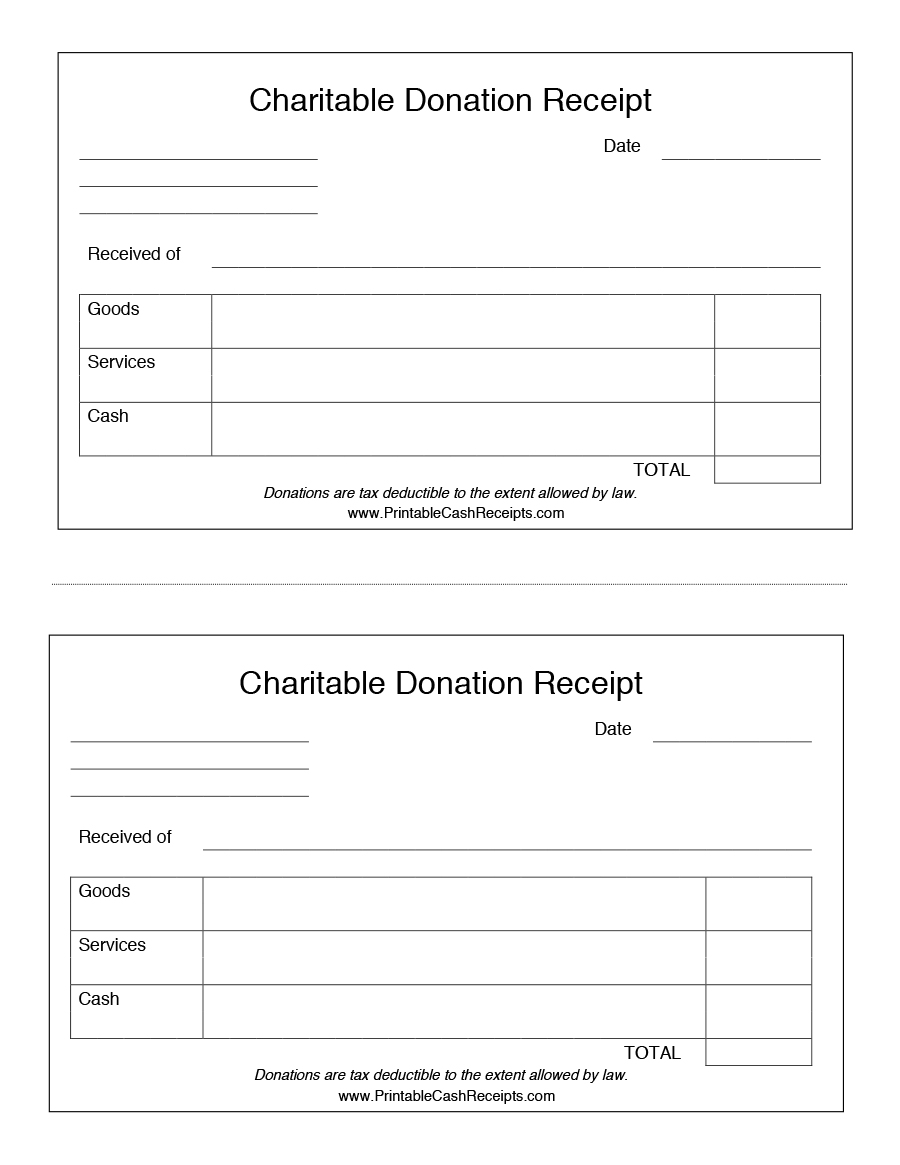

How to Donate Your Bear Mattress Return

To deduct your Bear mattress return as a donation, you must donate it to a qualified charitable organization. These organizations are typically non-profit and have a 501(c)(3) status. You can search for local charities in your area that accept mattress donations or reach out to organizations that specialize in mattress donations. Once you have found a charity, be sure to get a receipt for your donation, as this is essential for claiming the deduction on your taxes.

To deduct your Bear mattress return as a donation, you must donate it to a qualified charitable organization. These organizations are typically non-profit and have a 501(c)(3) status. You can search for local charities in your area that accept mattress donations or reach out to organizations that specialize in mattress donations. Once you have found a charity, be sure to get a receipt for your donation, as this is essential for claiming the deduction on your taxes.

In Conclusion

In addition to being environmentally friendly, donating your

Bear mattress return

can also benefit you financially and make a difference in someone's life. By taking advantage of the tax deduction for charitable donations, you can save money and help those in need. So, the next time you are considering what to do with your Bear mattress return, remember the positive impact you can make by donating it.

In addition to being environmentally friendly, donating your

Bear mattress return

can also benefit you financially and make a difference in someone's life. By taking advantage of the tax deduction for charitable donations, you can save money and help those in need. So, the next time you are considering what to do with your Bear mattress return, remember the positive impact you can make by donating it.