If you’re considering returning your Bear mattress, you may be wondering if you can deduct the return costs on your taxes. While there is no clear answer to this question, there are some factors to consider before making a decision. In this article, we’ll explore the potential deductions for bear mattress returns and provide some guidance on what you should do in this situation.Can you deduct bear mattress return?

Unfortunately, the IRS does not have specific guidelines for deducting returns on mattresses, so it’s not a straightforward answer. However, if you’re returning your Bear mattress due to a defect or warranty issue, you may be able to claim the return costs as a medical expense. This would fall under the category of “medical expenses for the diagnosis, cure, mitigation, treatment, or prevention of disease.” Be sure to consult with a tax professional for more specific advice on your situation.Can you deduct bear mattress return on taxes?

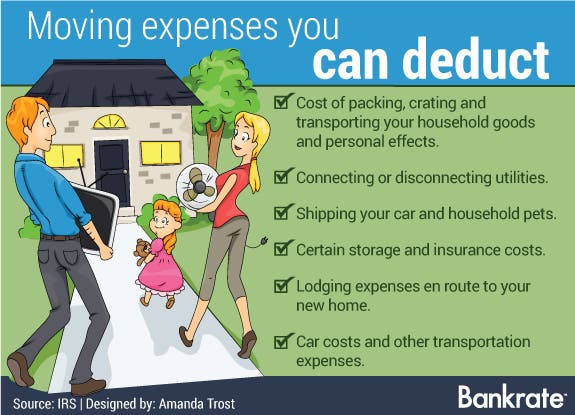

If you’re returning your Bear mattress for a reason other than a defect or warranty issue, you may still be able to deduct the return shipping costs. This would fall under the category of “miscellaneous itemized deductions,” which includes expenses related to the production of income, such as job search expenses, investment fees, and certain legal fees. However, these deductions are subject to certain limitations and thresholds, so be sure to consult with a tax professional for more information.Can you deduct bear mattress return shipping?

The return fee for your Bear mattress may also fall under the category of miscellaneous itemized deductions, depending on the reason for your return. If you’re returning the mattress due to a defect or warranty issue, it may be considered a medical expense. If you’re returning it for another reason, such as personal preference, it may be considered a production of income expense. Again, consult with a tax professional for more specific advice.Can you deduct bear mattress return fee?

The specific return policy for your Bear mattress may also impact your ability to deduct return costs on your taxes. If the policy states that returns are only accepted for defective or damaged products, then you may be able to deduct the costs as a medical expense. However, if the policy allows for returns due to personal preference, then the deductions would fall under miscellaneous itemized deductions.Can you deduct bear mattress return policy?

The overall cost of returning your Bear mattress may also affect your potential deductions. If the costs are significant, such as shipping fees and return fees, they may be more likely to be eligible for deductions. However, if the costs are minimal, they may not meet the threshold for miscellaneous itemized deductions. It’s important to keep track of all costs associated with the return and consult with a tax professional for advice.Can you deduct bear mattress return cost?

The return label provided by Bear for your mattress return may also be eligible for deductions. Depending on the reason for your return, it may fall under the categories of medical expenses or miscellaneous itemized deductions. Keep in mind that the return label may have its own cost, which could also be considered for deductions.Can you deduct bear mattress return label?

The cost of the return label provided by Bear may be eligible for deductions, depending on the reason for your return. If the label is necessary for a medical expense, such as returning a defective mattress, then it may be deductible. However, if the label is necessary for a production of income expense, such as returning the mattress for personal preference, then it may also be considered for deductions.Can you deduct bear mattress return label cost?

The return label fee may also be eligible for deductions, depending on the reason for your return. If the fee is necessary for a medical expense, it may be deductible. However, if it is necessary for a production of income expense, it may also be considered for deductions. Keep in mind that the fee may be subject to certain limitations and thresholds, so it’s important to consult with a tax professional for specific advice.Can you deduct bear mattress return label fee?

Finally, the shipping costs associated with the return label may also be eligible for deductions. Again, this will depend on the reason for your return and whether it falls under a medical expense or miscellaneous itemized deduction. It’s important to keep track of all costs and consult with a tax professional for specific advice on your situation.Can you deduct bear mattress return label shipping?

Can You Deduct Bear Mattress Returns?

The Basics of Tax Deductions for Homeowners

As a homeowner, there are a lot of expenses that you may be able to deduct on your taxes. From mortgage interest and property taxes to energy-efficient home improvements, there are many ways to save money on your taxes. But when it comes to

deducting the return of a Bear mattress

, things can get a little more complicated.

As a homeowner, there are a lot of expenses that you may be able to deduct on your taxes. From mortgage interest and property taxes to energy-efficient home improvements, there are many ways to save money on your taxes. But when it comes to

deducting the return of a Bear mattress

, things can get a little more complicated.

Understanding the Tax Benefits of Home Furnishings

Under normal circumstances, you can't deduct the cost of furniture and other home furnishings on your taxes. However, there are some exceptions to this rule. For example, if you use a room in your home as a home office, you may be able to deduct a portion of the cost of furnishing that room. Additionally, if you rent out a portion of your home, you may be able to deduct the cost of furnishing that space as a business expense.

Under normal circumstances, you can't deduct the cost of furniture and other home furnishings on your taxes. However, there are some exceptions to this rule. For example, if you use a room in your home as a home office, you may be able to deduct a portion of the cost of furnishing that room. Additionally, if you rent out a portion of your home, you may be able to deduct the cost of furnishing that space as a business expense.

The Grey Area of Mattress Returns

When it comes to returning a mattress, the tax implications can be a bit murky. The IRS considers furniture purchases to be personal expenses and therefore not tax-deductible. However, if you are able to successfully argue that your return was necessary for business purposes, you may be able to deduct the cost of the return.

So, what does this mean for Bear mattress returns?

If you are returning your mattress for personal reasons, such as discomfort or dissatisfaction with the product, you will not be able to deduct the cost of the return on your taxes. However, if you are returning the mattress due to a defect or other issue that affects your ability to use it for business purposes, you may be able to deduct the cost.

When it comes to returning a mattress, the tax implications can be a bit murky. The IRS considers furniture purchases to be personal expenses and therefore not tax-deductible. However, if you are able to successfully argue that your return was necessary for business purposes, you may be able to deduct the cost of the return.

So, what does this mean for Bear mattress returns?

If you are returning your mattress for personal reasons, such as discomfort or dissatisfaction with the product, you will not be able to deduct the cost of the return on your taxes. However, if you are returning the mattress due to a defect or other issue that affects your ability to use it for business purposes, you may be able to deduct the cost.

Seeking Professional Advice

With the complexities of tax deductions for homeowners, it's always best to consult with a tax professional before attempting to deduct any expenses on your taxes. They will be able to provide guidance specific to your situation and help you determine if you are eligible for any deductions related to your Bear mattress return.

In conclusion, while it may be tempting to try and deduct the cost of a Bear mattress return on your taxes, it's important to understand the rules and regulations surrounding deductions for home furnishings. Always seek professional advice and keep detailed records to support any deductions you claim.

With the complexities of tax deductions for homeowners, it's always best to consult with a tax professional before attempting to deduct any expenses on your taxes. They will be able to provide guidance specific to your situation and help you determine if you are eligible for any deductions related to your Bear mattress return.

In conclusion, while it may be tempting to try and deduct the cost of a Bear mattress return on your taxes, it's important to understand the rules and regulations surrounding deductions for home furnishings. Always seek professional advice and keep detailed records to support any deductions you claim.

/bear-mattress-56c642b53df78cfb37847804.jpg)